If you have ever tried to work in any financial sector, may it be banking, investing, or trading, you should be very familiar with the term KYC, or Know Your Customer. KYC verification is a crucial process that businesses and financial institutions require, in order to verify their customers’ legitimacy. By requiring customers to verify their identity, the risk of serving illegal activities, such as money laundering or financing criminal organizations, should be minimized.

In this article, we cover everything you need to know about the KYC verification and we will also answer the question: Is using non-KYC platforms illegal?

What is KYC?

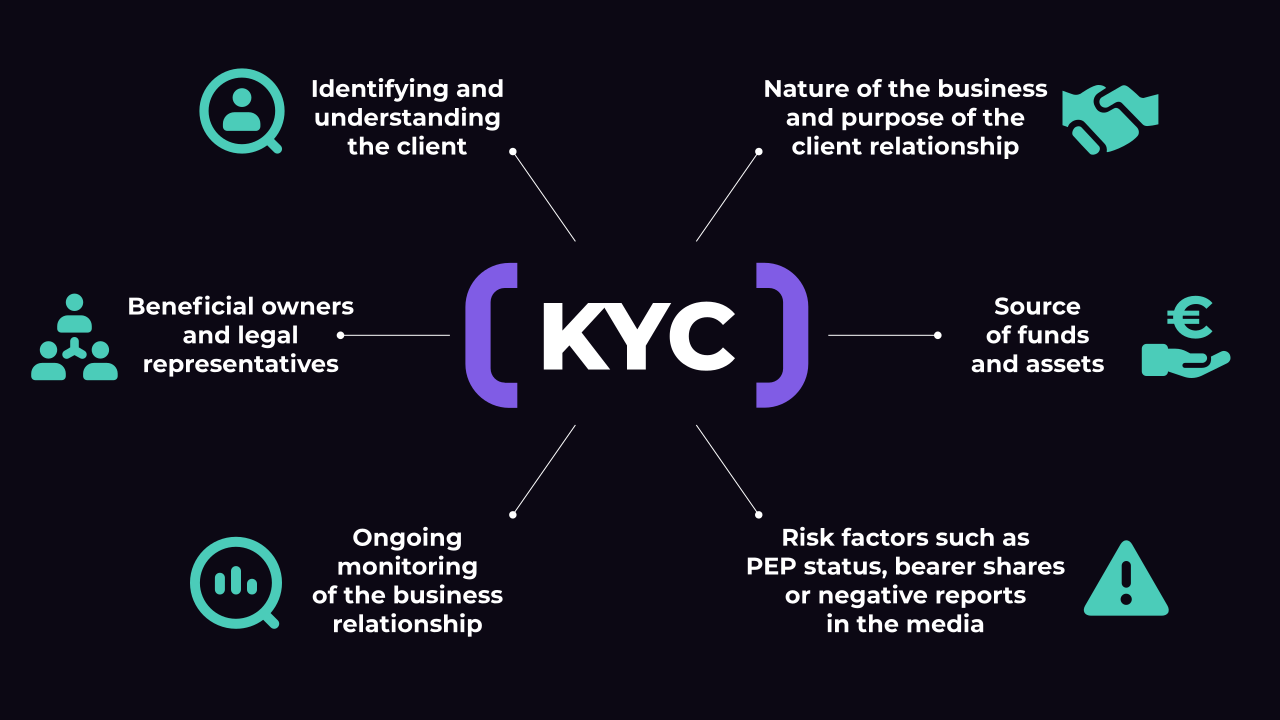

KYC, also called “Know Your Customer” is a verification process, customers must undergo before being able to use certain products. Especially in the finance industry, such as forex, stocks, or cryptocurrency trading, KYC is a very common practice. In most cases, it’s even required by lawmakers.

Aside from avoiding illegal activities, KYC helps understand institutions what their customers are up to and qualifies their source of funds.

Who requires KYC?

Verifying the identity of customers is not an uncommon practice. Especially in the banking sector, customers are screened thoroughly before getting access to financial products and services.

In summary, any organization that offers financial products or services is required to verify the identity of its customers. As covered earlier, this is absolutely crucial to avoid illegal activities, primarily money laundering, tax fraud and even financing terror organizations.

Furthermore, other industries such as telecommunication or health care require some sort of identity and customer verification before onboarding them.

Which information is required for KYC?

The information organizations ask for in order to verify your identity may differ. In most cases, you can verify your identity with the following documents:

- ID

- Passport

- Drivers License

Sometimes this is not enough and you must provide further information, such as proof of address. Here you can usually provide the following documents:

- Recent Utility bills (up to 3 months)

- Rental agreement

- Bank statements with your address

When using financial services such as stock, forex, or cryptocurrency trading platforms, you often have to provide information such as the source of funds and disclose your income. This is also a common case when applying for credits, loans, or any other banking-related service.

Is non-KYC illegal?

If you want to stay anonymous, you must use a platform withou KYC verification. Using non-KYC platforms is not necessarily illegal. However, many non-KYC platforms are unregulated and can carry risks when using them.

Before using a platform without KYC, you should definitely do your due diligence to assure that the platform or service you are planning to use is safe and legit. Especially in the cryptocurrency and forex trading space, there are many non-KYC exchanges that are unregulated in some areas or may even be restricted in other countries.

A great example of this is the crypto trading platform Bitunix. While Bitunix has a good reputation in the crypto space and is a well-respected name, it is restricted in some regions. However, many traders use the non-KYC feature of Bitunix and access the trading platform with a VPN while residing in a restricted area. That means you can still trade on Bitunix without having to verify your identity.

Conclusion

KYC is an important process to ensure the legitimacy of the potential customer. Especially in the financial, telecommunication, and healthcare sectors, KYC is a required practice. KYC also ensures better protection against threats such as financing criminal organizations.

At the end of the day, it is important to understand that any fully regulated and legitimate platform, in any financial sector will require you to verify your identity with some sort of KYC procedure.

As discussed earlier, the required information may vary depending on the service you use. If you wish to remain anonymous while accessing financial services, you have to access unregulated, non-KYC platforms.