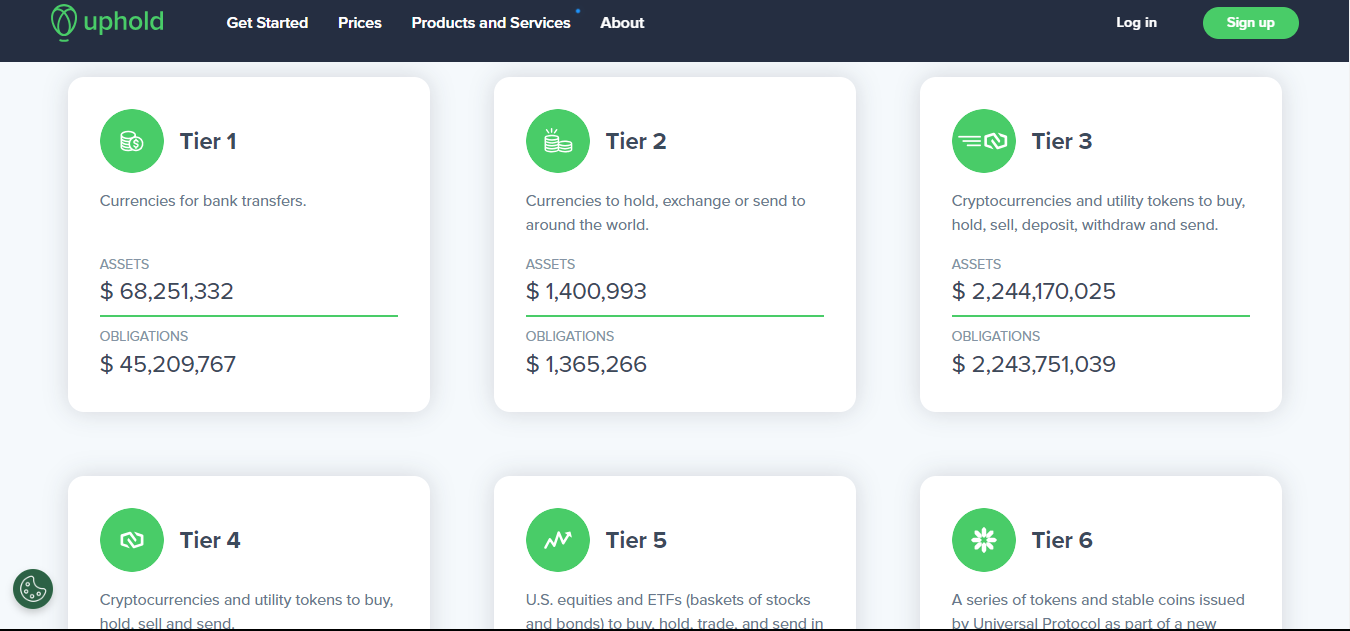

Uphold is a financial establishment that supports trades in digital currencies ( whether traditional or crypto) and commodities. It is a highly transparent and secure platform for customers to buy, sell, and store cryptocurrencies and other financial assets.

In this Uphold review, we will give you all the details you need, from the features to fees and products. After this review, you will be able to determine whether Uphold is the best platform for you to invest.

Uphold Overview

Uphold is a financial service platform offering a wide range of assets to a global community. It is a highly secure digital marketplace where potential users can enjoy various currencies and commodities.

Founded in 2015, Uphold was built on the foundation of proprietary technology and e-money apps. The exchange was established with a need to provide safe, fairer, affordable, and transparent financial services. Because of this, users are entitled to a transparency report presented by the platform to assure the safety of their funds.

Uphold offers services to 180+ countries with over 250 fiat currencies, cryptocurrencies, and commodities. Its high-class trading network allows a free flow for customers to trade ‘anything to anything’ without having to worry about asset classes. This makes it an easy place for investors to buy, sell, and swap assets.

There are currently over 40 equities available on the exchange, including metals like gold, silver, and platinum. You can also acquire up to 27 fiat currencies for trades. Cryptocurrencies on Uphold include the more popular ones like BTC, ETH, SOL, and many more. There are also several altcoins, newly listed and emerging tokens, and even stablecoins.

It is important to note that there are no spot or futures trading terminals available on Uphold, making it more suitable for investors and potential buyers. There are, however, a few products offered by the exchange. These services include its unique staking platform, a secure vault for storage, and access to funds for instant trading.

Additionally, you can also purchase cryptocurrency with your debit/credit card on Uphold. Based on market surveys conducted by the exchange, Uphold presents its users with competitive trading fees. It currently has a cumulative trading volume of $40 billion for all assets.

🌍 Free Uphold Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, Uphold does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Uphold country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

Pros and Cons

| 👍 Uphold Pros | 👎 Uphold Cons |

|---|---|

| ✅ Highly secure | ❌ Limited customer support |

| ✅ A wide range of cryptocurrencies | ❌ Lack of advanced trading tools |

| ✅ Allows trading of fiat currencies and commodities | ❌ Very high fees |

| ✅ Great user interface | ❌ No futures trading |

Uphold Signup and KYC

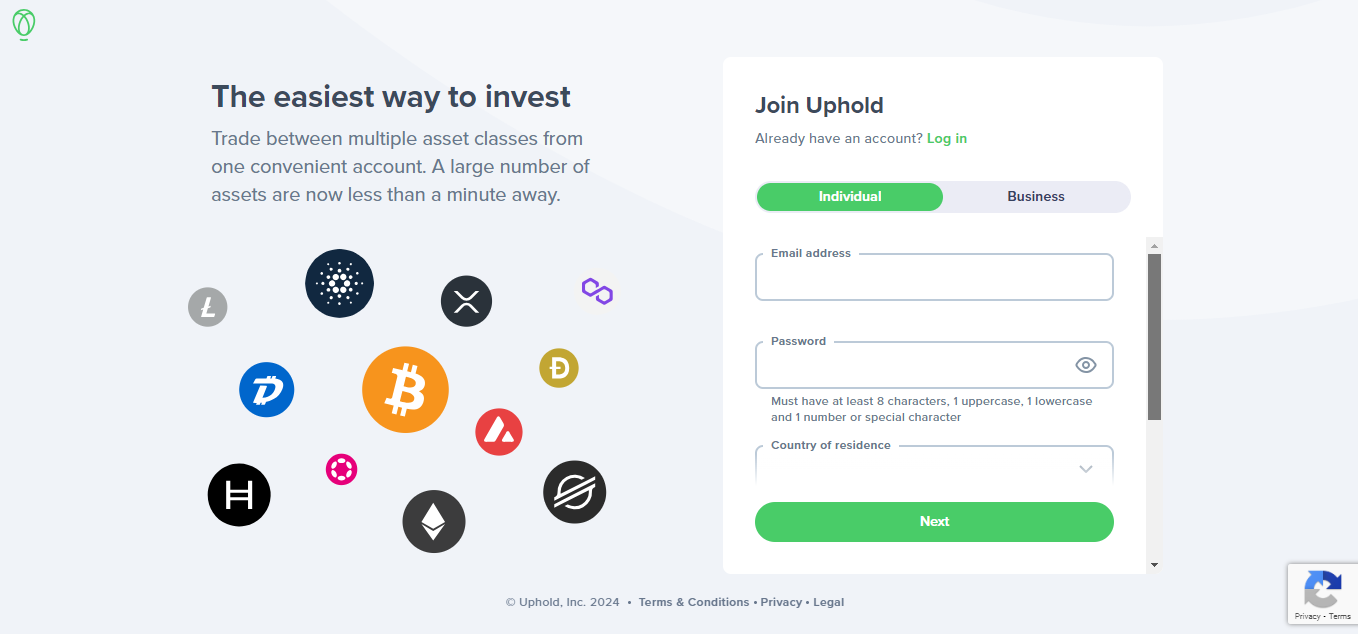

Signing up on Uphold is a straightforward process and will not even take you 10 minutes. However, due to the security standards of the financial company, you will have to be sure that you are not resident in any of the restricted countries.

To sign up, follow these easy steps:

- simply go to the Uphold web page or download the mobile app.

- Click on the signup icon which will redirect you to the Uphold signup page.

- Fill in your details under Individual(signing up for businesses is the same process).

- You may be asked questions like why you intend to use Uphold, your employment status, and your income based on your residential location.

- After signing up, you will be required to complete your KYC before you can begin trading. This is a quick process and only requires your government-issued ID.

- You’re good to go!

Uphold Trading

Trading on Uphold is unlike traditional crypto exchanges. Uphold does not offer spot or futures trading markets for crypto traders. Instead, trades are conducted between assets on the platform.

Trading on Uphold involves a very straightforward process. There are 5 easy steps for you to execute a trade. These are:

- Click on the ‘Trade’ icon at the top of the app.

- Select the fund source from which you wish to trade.

- Pick a destination to choose the asset to buy.

- Define the amount you wish to trade.

- Review the trade for your transaction breakdown.

There are several trading tools available on Uphold for users to boost their earnings. Similar to the normal trading interface, Uphold incorporates some basic trading tools to help you maximize profits on the exchange market. These tools include:

- Take profit – Uphold allows users to put a mark on their assets and watch them grow with a rise in the market. With the take-profit tool, you can take advantage of a market’s uptrend and boost your capital when your token rises. When you buy an asset for $40, immediately you will receive the suggestion to set up a take profit. When you do so, you will be given three percentage options to choose from. Once you make your pick, your take profit will be set up.

- Trailing Stop Order – Another tool used to prevent losses from amplifying during market downturns.

- Repeat Transactions – Users can set transactions to repeat daily.

- Limit Orders – Helps users prevent buying or selling assets above or below the prices they are seeking in the markets.

Uphold Fees

Fees are taken based on the asset that you are trading. Uphold fees are very high when compared with industry standards.

It is also not a suitable exchange for day trading. Its trading interface makes it more appealing to newbies in the crypto space who want to buy and hold crypto assets. This makes it a wrong choice for advanced traders.

Trading fees

When you trade on Uphold, a spread fee is charged on every cryptocurrency transaction. For users in the U.S, U.K., and Europe, fees are at:

- 0.25% for Stablecoins and market FX

- 1..4% – 1.6% for BTC, ETH

- 1.9% – 2.5% on altcoins

- 1.9% – 2.5% for precious metals

When trading Altcoins, the fee prices differ based on the token’s liquidity. Uphold charges higher fees for tokens with a smaller market cap or newbie tokens that are less liquid. Prices also increase on the exchange when markets are volatile.

Uphold does not charge additional fees for any transaction that has crossed the preview trade stage. Prices that you see during the preview trade are what you will pay after you have confirmed a trade.

Withdrawal fees (crypto)

For withdrawals of cryptocurrencies, fees are charged based on the network of the selected coin. For cryptocurrencies like ETH and ADA, a network fee is usually charged. BTC withdrawals attract a fee of 0.0006 BTC. Altcoins like SDC, DAG, BDG, SOLO, and others are withdrawn at a fee of $0.99.

Withdrawal fees (Fiat)

For withdrawals below $500, Uphold will charge a fee of $0.99. Fee structures differ among places of residence. There are also differences in withdrawal limits for each country in adherence to regulatory rules. For U.S. and UK residents, the price for withdrawals is 1.75% of the amount being withdrawn with a debit card.

To find out more about your country and the fees paid, you can visit the Uphold fees and limit page here.

Uphold Products and Services

Uphold offers its users a few amazing products that they can benefit from all year long. These products include:

Staking

One of the rich benefits of joining the Uphold community is the freedom to stake cryptocurrencies in its staking pool and generate yields up to 13% of your initial asset deposit.

APY differs among cryptocurrencies being staked on the platform. ETH, for instance, offers an estimated APY of 4.25%, while coins like SOL and ADA offer a 5.5% and 3% yield.

To begin staking on Uphold, simply sign up, head over to the staking pool, choose an asset that you wish to stake, and enjoy the benefit of weekly rewards.

Vault

Uphold provides users with a secure vault where they can take charge of their funds with an assisted key replacement protocol and access to instant trading.

How does this work?

Uphold provides three separate security keys. Two out of these three keys are for users to secure their funds, while Uphold safeguards one of them using vault-assisted self-custody key replacement.

Two of these keys are required to move assets. In any case, where a user loses any of the keys, Uphold Vault has got you covered with the recovery key replacement so that you never have to lose your funds.

Uphold Mobile App

Uphold has a unique mobile app for customers to perform all their trades outside of the web terminal. The mobile app is a secure, one-way ticket to enjoy all the potential benefits that the web portal offers.

Uphold mobile app is available on all Android and iOS devices. All you have to do is download the app, sign up or log in, and continue trading. You also get access to a multi-chain wallet, web3 access, and direct purchase of cryptocurrencies.

Uphold Wallet

The Uphold wallet is a multi-asset wallet that allows you to store all your digital currencies without the fear of having your wallet hacked and your assets lost. Uphold is also working to present users with a new UpHODL wallet, the new web3 wallet for Android and iOS devices.

With Uphold, users can store a wide range of assets all in one secure wallet.

Uphold Card

Uphold allows you to perform your transactions using the Uphold Mastercard. The Uphold card is currently only available to users in the U.K.

Uphold Security

When compared with standard security, Uphold takes the word ‘standard’ to another level with their high-infrastructure security program.

Uphold employs some very rigid measures Some of these measures include:

- Encryption of data and private keys for user safety.

- Regular security audits and penetration testing: Uphold conducts regular security audits and penetration testing of its systems, using both internal and external security professionals.

- Compliance with regulatory and anti-money laundering standards: Uphold complies with the regulatory and AML standards of the jurisdictions where it operates, such as the United States, the United Kingdom, and the European Union.

- 24/7 monitoring: Uphold monitors its systems and networks 24/7.

- Bug bounty program to reward security researchers: Uphold has a public bug bounty program, which is open to anyone who wants to help Uphold improve its security.

Uphold Customer Support

Uphold customer support is quite poor. It only provides users with a help center where all available requests can be submitted. Aside from that, there is a ‘FAQs & Support’ page where users have access to blog posts and guides to enjoy trading on the platform. The exchange has limited customer support. It lacks live chat support for users to ask questions relating to the platform and report difficulties.

The only available way for users to get the information they need is via the exchange’s blog, request page, or through mail.

Uphold Alternatives

Uphold is a beginner-friendly exchange with a focus on simplicity, but if you’re looking for alternatives, consider these:

- Coinbase: Coinbase is another user-friendly exchange with a wider range of features and educational resources.

- Bitvavo: Bitvavo is a good option for European users with a user-friendly interface and support for SEPA deposits.

- Kraken: Kraken is a well-established exchange with a strong reputation for security and a wide range of features.

| Feature | Uphold | Coinbase | Bitvavo | Kraken |

|---|---|---|---|---|

| Established | 2013 | 2012 | 2018 | 2011 |

| Spot Fees (Maker/Taker) | 1.40% / 1.60% | 0.40% / 0.60% | 0.15% / 0.25% | 0.16% / 0.26% |

| Futures Fees (Maker/Taker) | Not supported | 0.05% / 0.05% | Not supported | 0.02% / 0.05% |

| Max Leverage | None | 10x | None | 50x |

| KYC Required | Yes | Yes | Yes | Yes |

| Supported Cryptos (Spot) | 100+ | 250+ | 308+ | 323+ |

| Futures Contracts | None | None | None | 150+ |

| No KYC Withdrawal Limit | Not Allowed | 10+ | Not Allowed | 216+ |

| 24h Futures Volume | None | $0.81B | None | $0.42B |

| Trading Bonus | None | None | $10 | None |

| Key Features | • Regulated US exchange • Very beginner-friendly • Forex trading available |

• Largest user base (108M+) • Strong security • Public company |

• EU focused exchange • Low fees • iDEAL deposits |

• Longest track record • Advanced features • High security |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Conclusion

Uphold is a leading digital asset trading company that utilizes the best of both the cryptocurrency and Forex markets to present users with a wide array of options to trade. Its quality security, great interface, and affordable fees make it an exceptional platform to invest, store, and trade between currencies seamlessly.

FAQs

Is Uphold legit?

Uphold is a legitimate and fully licensed platform that operates in over 180 countries across the globe.

Where is Uphold located?

Uphold is located in New York, and has offices in London UK, Porto, and Braga, Portugal.

Is Uphold available in the U.S.?

Uphold is available to U.S. residents and complies with all the regulatory laws guiding financial exchanges.