Different Types Of Cryptocurrency Exchanges

In the cryptocurrency space, there are three major types of crypto exchanges and trading platforms. The most prevalent type of crypto exchange is a centralized exchange. But in recent years, new types of exchanges gained a lot of popularity, including decentralized exchanges as well as hybrid exchanges. In this guide, we will explain exactly how each of these crypto exchanges function and we will expose the pros and the cons.

1. Centralized Exchanges

A centralized crypto exchange, also called a CEX is a crypto exchange functioning in a similar manner to forex and stock exchanges. You send your funds to the exchange and trade on it. It is called a centralized exchange because it is run by one entity. That also means that the cryptos you send to an exchange are held and managed by the platform in one single place.

Centralized exchanges offer the most comprehensive experience for crypto traders and as of 2023, CEXs still keep over 90% of the crypto market share. They are easier to use than decentralized or hybrid exchanges, making them the better option for beginners.

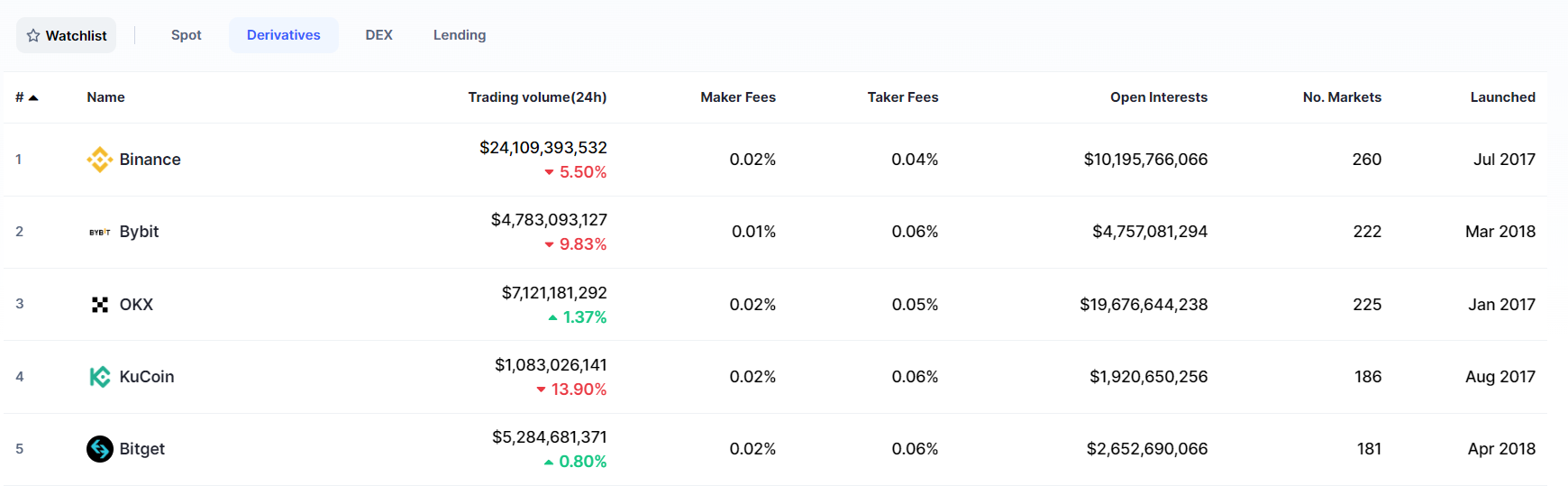

The main activities on centralized exchanges are spot and futures trading where traders can participate in the crypto market. One big upside of centralized exchanges is the amount of trading volume and liquidity provided on the platform, making them very efficient and reliable. Additionally, due to the high trading volume on centralized exchanges, they can offer fairly low fees making trading more profitable.

As centralized exchanges are the oldest type of cryptocurrency exchanges, they also are the most advanced ones with the most features and products.

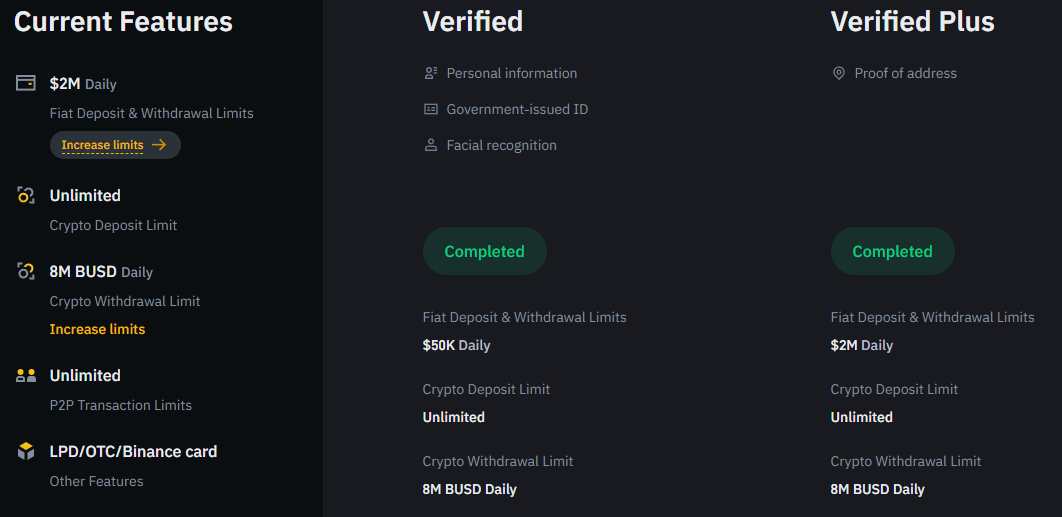

Aside from trading on centralized exchanges, you can enjoy other features such as staking, copy trading, FIAT deposits and withdrawals, P2P trading, and in some cases even crypto debit cards. So if you are interested in features aside from trading, such as passive income products, centralized exchanges are for you.

The FIAT features should not be overlooked. Most centralized exchanges offer FIAT onramps as well as FIAT offramps, meaning you can pay out your profits to your bank account.

Lastly, centralized exchanges offer dedicated customer support. In the CEX space, 24/7 customer live chat support is the industry standard.

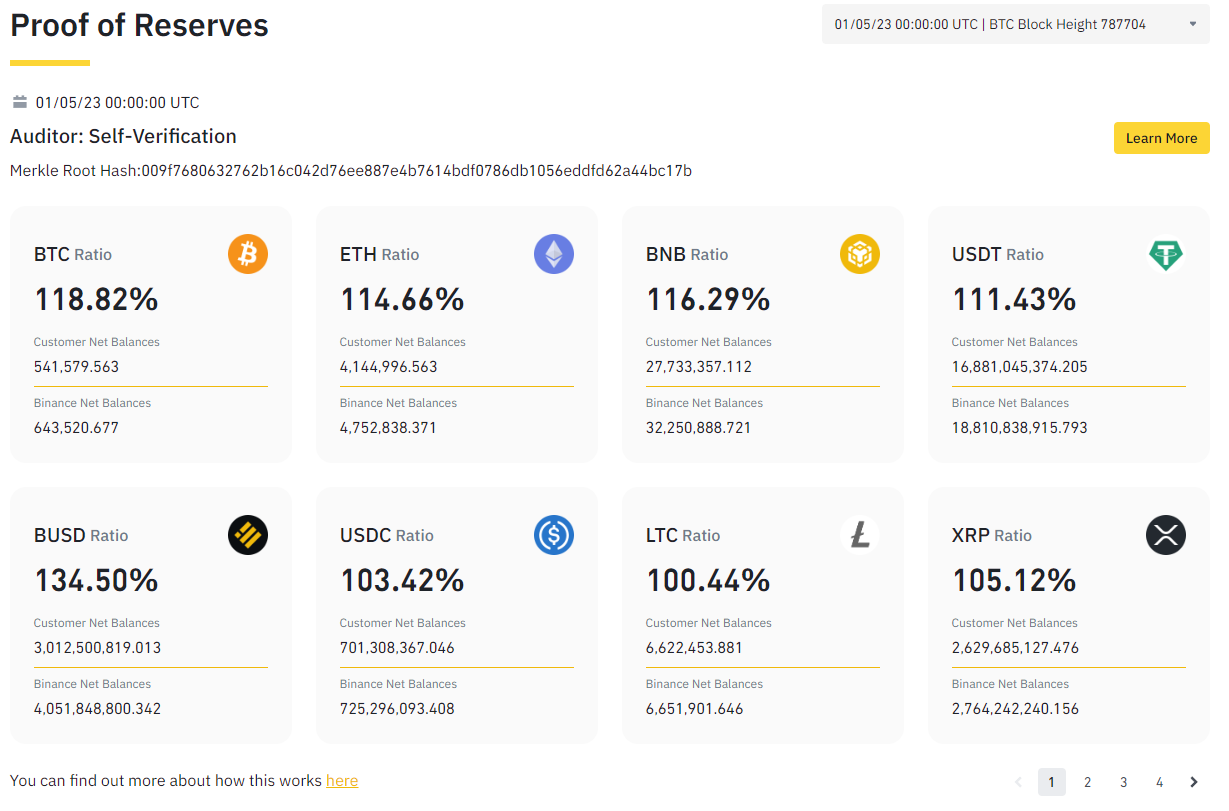

A major downside of centralized exchanges is how customers’ funds are managed. While most centralized exchanges keep customer funds in cold storage, which is an offline wallet, your funds are still at risk. If the exchange goes bankrupt, you will lose your money and you will be lucky to even get a portion of it back. Crypto exchanges do not work like banks where the customers’ funds are insured to a certain amount. We never recommend keeping more money on an exchange than what you are trading with. And when you are done with your trading session, simply send your funds back to your personal wallet.

Pros of Centralized Exchanges

- Simple to use

- More volume and best liquidity

- Lowest trading fees

- FIAT deposits and withdrawals supported

- Most advanced products and features

- Most reliable

Cons of Centralized Exchanges

- Not your keys, not your crypto

- The centralized exchange holds your funds. If the exchange gets hacked or goes bankrupt, you will lose your money

- Often require KYC, meaning you can’t stay anonymous

As of 2023, some of the best centralized cryptocurrency exchanges are Binance, MEXC, and Bybit. Binance and Bybit require KYC while MEXC is a non-KYC exchange, offering anonymous crypto trading. In terms of features, these exchanges are very advanced and you will get to enjoy the most comprehensive CEX service.

2. Decentralized Exchanges

A decentralized exchange, also called DEX, is a type of crypto exchange where you connect your own wallet to trade on the platform. Especially in recent years, decentralized crypto exchanges started becoming more popular due to concerns about using centralized exchanges. A great example of this is FTX, which mismanaged the funds of customers, leading to its insolvency. Now the customers are left standing with empty hands and uncertain if they will ever see their money again. This can not happen on decentralized exchanges as you don’t have to send your funds to another platform.

When looking at decentralized exchanges, it is important to differentiate between DEXs that focus on proper trading (called an orderbook DEX), similar to CEXs with an order book, liquidity, etc, and DEXs that focus on P2P trading or so-called “swaps”.

Overall, decentralized crypto exchanges focus on orderbook trading and swaps. They do not support other features such as staking or copy trading.

Orderbook DEX

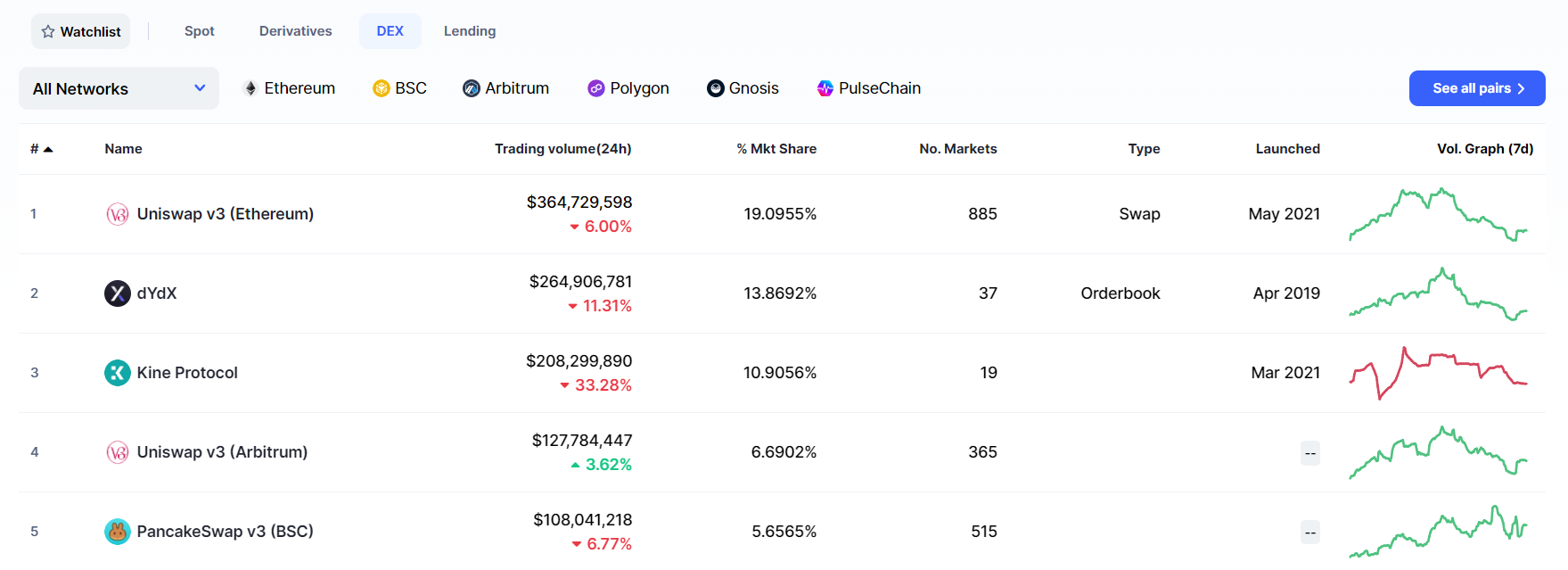

Decentralized orderbook exchanges that focus on day trading are very similar to centralized exchanges when it comes to the derivatives market. The interface is similar and you also have an order book, as well as liquidity. You also get access to leverage, just like on centralized derivative markets. However, most decentralized exchanges have relatively low volume and low liquidity compared to centralized exchanges and on top of that they have higher fees.

Some of the most popular decentralized orderbook exchanges are GMX, DYDX, and ApeX.

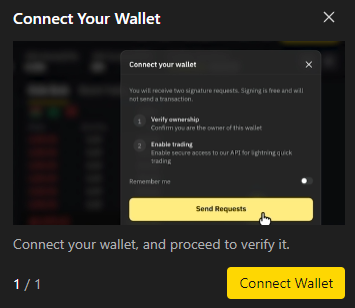

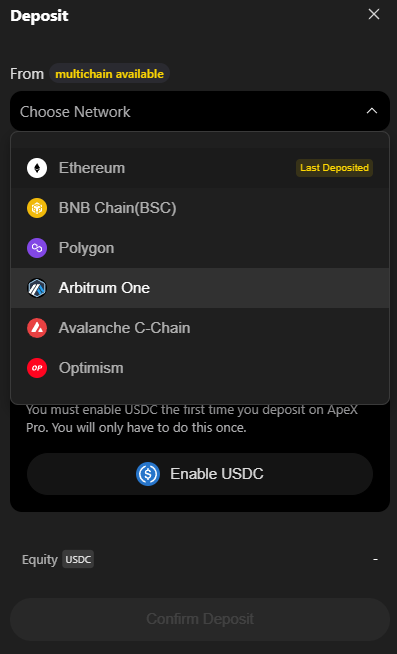

When launching a DEX, you will be asked to connect your wallet so you can start trading.

After that, you must select the network you want to trade on. As you can see, the process of setting up an account on a decentralized exchange is a lot more complicated than signing up on a centralized one. That’s why many newbies stay away from decentralized exchanges.

Swap DEX

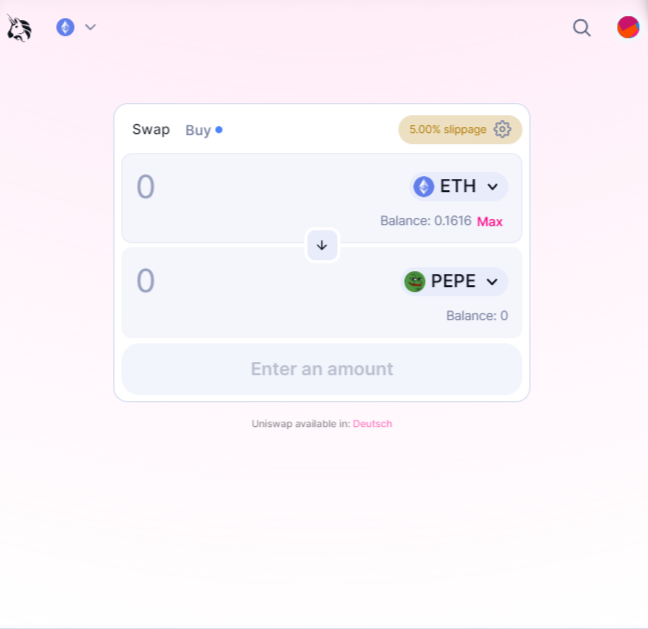

Decentralized exchanges focusing on swaps facilitate trades on-chain through so-called smart contracts. Like on every DEX, you must connect your wallet if you want to make transactions on decentralized swap exchanges. One thing that is important to note is that there is no order book and also no leverage.

They are generally simpler to use than decentralized orderbook platforms. Above you see the interface of Uniswap. You basically exchange one token for another. Most trades happen on the Ethereum network. In this case, we send ETH into the liquidity pool of PEPE and receive PEPE coins in exchange.

One of the biggest downsides of these swap platforms is the high gas fees that apply to each transaction on the ETH network. In times of low network usage, the fees are low and just a few dollars. But when many people use the network, one transaction can cost hundreds to thousands of dollars.

Decentralized Exchange Pros:

- Fully anonymous trading

- Work around jurisdictions as you are not governed by an entity

- Self-custody of your cryptos as you don’t have to keep them on another platform

- Still in the early phases and we expect massive improvements in the coming years

Decentralized Exchange Cons

- Complicated to use

- Less advanced features

- Less available products

- High transaction and gas fees (depending on the chain)

- Low trading volume and liquidity, lead to inefficient price delivery

- Lacks customer support

3. Hybrid Crypto Exchanges

Hybrid crypto exchanges are a mix of DEX and CEX and combine the power of the two major types of exchanges. The goal is to secure the privacy of a DEX and add the power of a CEX. You also get to keep your funds in your own wallet, so losing funds due to the bankruptcy of the exchange is not possible. At the same time, a hybrid exchange tries to provide liquidity, just like centralized exchanges. The whole concept of hybrid exchanges is still fairly new and we are excited to see the developments in the future

Pros of Hybrid Exchanges

- Combines strengths of CEXs with the strengths of DEXs

Cons of Hybrid Exchanges

- New concept and not properly executed yet

Which Type Of Crypto Exchange You Should Pick

First of all, there is no right or wrong. Choosing the right crypto exchange can take some time and is very individual. If you want to trade with ease of use in mind, centralized crypto exchanges are great for you. Some of the best centralized exchanges for day trading are Binance, Bybit, and MEXC.

If you don’t want to keep cryptos on an exchange and self-custody your funds, you can utilize decentralized exchanges. If you want to day trade, the best decentralized orderbook exchanges as of 2023 are DYDX, GMX, and ApeX. If you want to swap tokens, the most popular options are Uniswap and Pancakeswap.

FAQ

What does CEX stand for?

CEX stands for centralized exchange.

What does DEX stand for?

DEX stands for decentralized exchange.

What is a Hybrid crypto exchange?

What is a hybrid crypto exchange

What are the three types of crypto exchanges?

There are centralized, decentralized and hybrid crypto exchanges.

What is the best type of crypto exchange?

The best crypto exchange is whatever suits your needs. As of 2023, the best centralized exchanges of 2023 are Binance and MEXC. The best decentralized exchanges are GMX, DYDX and ApeX Network.