Trading cryptocurrencies can be a great way to invest in digital assets and potentially earn a profit. However, one of the biggest challenges that traders face is the high fees associated with buying and selling cryptocurrencies. In this article, we will explore how to trade cryptocurrencies with 0% fees.

The importance of low fees in crypto trading

Low fees are of paramount importance in crypto trading as they can greatly impact the profitability of your trades. High fees can eat into your profits, making it difficult to earn a significant return on your investment. When trading cryptocurrencies, every dollar counts, and high fees can significantly decrease the returns on your investment.

Fees can come in various forms, such as trading fees, withdrawal fees, deposit fees, and network fees. Each of these fees can add up quickly, eating into your profits. For example, if you are trading a cryptocurrency that has a high trading fee, you may have to pay a significant amount of money every time you make a trade. Similarly, if you are withdrawing your profits, you may have to pay a high withdrawal fee, which can greatly decrease the amount of money you are taking home.

Moreover, low fees in crypto trading can also provide an opportunity for small traders or investors to participate in the market. High fees can be a barrier to entry for new traders as they might be scared that the trading fees will eat up their profit – and their thoughts are well justified. In the cryptocurrency market, there are many exchanges charging way too much when it comes to fees. This can limit the number of participants in the market and limit liquidity. Even fee differences of as little as 0.01% will make a huge difference in the long run.

In addition, low fees can also attract more traders to the market, increasing liquidity and providing more opportunities for traders to buy and sell at favorable prices. This can lead to a more efficient market, where prices reflect the true value of the underlying assets.

In conclusion, low fees in crypto trading are essential for maximizing profits, attracting a larger number of traders, and providing an opportunity for small traders and investors to participate in the market. By using the right exchange, traders can avoid the high fees associated with buying and selling cryptocurrencies on the open market, increase their profitability, and finally earn a higher return on investments.

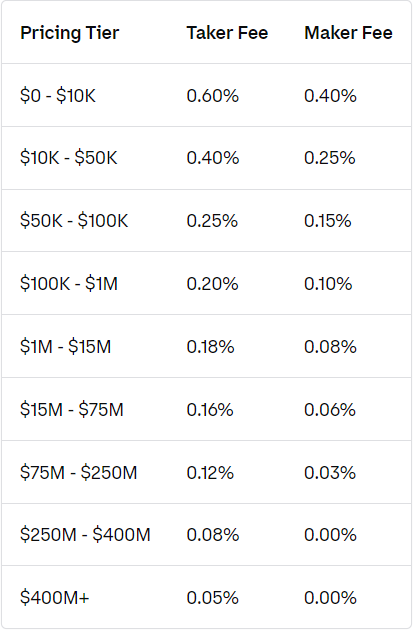

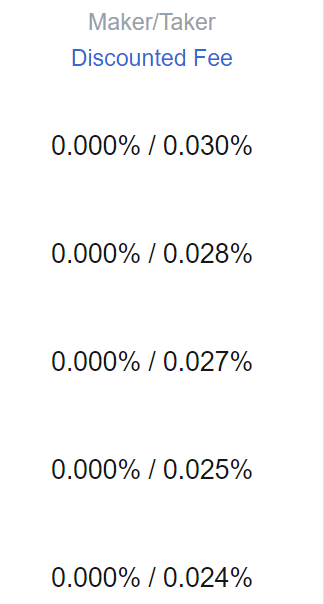

Above you can see the fees of Coinbase on the left, and MEXC on the right. Coinbase charges over 10 times more fees than MEXC, which makes it a bad environment for serious traders.

How do cryptocurrency exchange/trading platforms function?

Cryptocurrency trading platforms function as a marketplace where traders can buy and sell cryptocurrencies. These platforms connect buyers and sellers, allowing them to trade cryptocurrencies at prices that are determined by market demand and supply.

The process of trading on a cryptocurrency platform begins by creating an account and completing the necessary verification process. Once an account is created, traders can deposit funds into their account using various methods such as bank transfer, credit card, or cryptocurrency. Once funds are deposited, traders can then buy and sell different cryptocurrencies offered by the platform.

The trading platform typically shows the current market price of each cryptocurrency, as well as the bid and ask prices. The bid price is the highest price that a buyer is willing to pay for a particular cryptocurrency, while the asking price is the lowest price that a seller is willing to accept. The difference between the bid and ask price is known as the spread, which is the profit margin for the platform.

Most trading platforms also offer advanced trading tools such as order books, stop-loss orders, and margin trading, which allow traders to have more control over their trades and manage their risk. Some also offer a mobile app and APIs to access the platform and to operate trades on the go.

The trading platform also acts as a custodian for the cryptocurrency held on the platform, and thus it is responsible for the safekeeping of the crypto assets. Therefore, it is important to select a reputable and reliable trading platform that follows security best practices and has a proven track record of protecting customer assets.

In other words, cryptocurrency trading platforms are an essential part of the digital currency market, providing a marketplace for traders to buy and sell cryptocurrencies. They offer various tools and features that allow traders to manage their trades and risk and also serve as a custodian for the cryptocurrency held on the platform. It is important to select a reputable and reliable trading platform for the safekeeping of assets and the best trading experience.

Cryptocurrency trading platforms make money through various revenue streams, including:

• Trading fees: One of the most common ways trading platforms make money is by charging a fee for each trade that is executed on the platform. These fees can be a percentage of the total trade value or a flat fee per trade.

• Withdrawal fees: Some trading platforms charge a fee for withdrawing funds from the platform to an external wallet or bank account.

• Deposit fees: Some platforms also charge a fee for depositing funds into the platform, which can be a percentage of the deposit amount or a flat fee.

• Listing fees: Some trading platforms charge projects or tokens a fee to list their cryptocurrency on the platform.

• Interest on margin trading: Trading platforms that offer margin trading allow traders to borrow money to trade with. The platform earns interest on the money that is borrowed.

• Advertising: Some trading platforms earn revenue by displaying ads on their platform.

• Affiliate program: Some platforms offer an affiliate program where they pay users a commission for referring new users to the platform.

• Custodial Services: Some platforms charge a fee for providing custody services for the assets held on the platform.

In other words, cryptocurrency trading platforms have multiple ways to make money. Traders need to be aware of these different revenue streams and the associated fees when selecting a trading platform. It’s also important to note that not all trading platforms are the same; some may have lower fees or different revenue streams, so it’s important to do your own research to find the best platform for your needs.

How to trade cryptocurrencies with 0% fees?

Trading cryptocurrencies with 0% fees is possible if you use the right platforms. By using a cryptocurrency trading platform like MEXC, you can avoid the high fees associated with buying and selling cryptocurrencies and potentially earn a profit.

What value does MEXC bring to the table?

In November 2022, the crypto trading platform MEXC announced that it will launch Zero % Maker Fees for all futures trading pairs. MEXC exchange offers zero maker fees for spot trading, which means that users who place limit orders that are not immediately matched with a corresponding taker order will not be charged a fee. This is in contrast to taker fees, which are charged to users who place orders that are immediately matched with existing orders on the order book.

When a user places a limit order on the MEXC exchange, the order is added to the order book and is visible to other users. If another user places a market order that matches the limit order, the trade is executed, and the taker fee is charged to the user who placed the market order. However, if no one places a market order that matches the limit order, the order remains on the order book and the user who placed it is not charged a fee. Also, the taker fees are only 0.03% which is way below the industry standard of 0.06%.

The reason for this is that the MEXC exchange is incentivizing users to provide liquidity to the exchange by not charging them for placing limit orders. This helps to ensure that there are always a sufficient number of orders on the order book, which in turn helps to improve the trading experience for all users.

The zero maker fees also help new and small traders to access the market without incurring heavy fees; this way they can learn the market and trade without incurring losses due to fees.

How much are the fees on MEXC?

- Deposit Fees: MEXC does not charge its clients when they deposit cryptocurrency. Fiat deposits are not embraced, but users use fiat to buy cryptocurrency. The charge is somewhere around 1-3%, based on what third-party vendors end up deciding to incur.

- Trading Fee: In order to provide the best trading experience possible, MEXC strives to bring you the lowest fees in the crypto market. MEXC charges 0% for makers and 0.02% for takers for futures trading.

- Crypto Withdrawal Fees: MEXC charges a varying fee for each investment when withdrawing cryptocurrencies. Some cryptos are completely free to withdraw, while others necessitate a service charge to be paid to withdraw them. The MEXC fee page contains a cryptocurrency withdrawal fee checklist, as well as the withdrawal fees for each coin. Some of the cheaper coins to withdraw are USDT via TRC-20 with a $1 fee or via BSC (BEP-20) with a $0.5 fee.

Conclusion

MEXC is a no KYC worldwide cryptocurrency exchange that functions in almost every major nation, such as the United States, United Kingdom and Germany. MEXC draws a significant number of both investors and traders because of the accessibility of more than 1,520 cryptocurrencies. As MEXC stands for a fair trading environment, they introduced 0% maker fee trading as well as incredibly low taker fee trading with 0.03%. With a great user interface and a highly responsive website, MEXC offers all the tools for trading that you need. If this sounds interesting to you, you can create your account on MEXC here.