Real-World Assets, as the name suggests, refer to anything that holds intrinsic value. But why has this term become such a buzz in the crypto space? In this article, we will explore what Real-World Assets are, their connection to blockchain, and examine some examples and use cases.

What Are Real-World Assets (RWAs)?

Real-World Assets (RWAs) are physical assets like real estate, precious metals, or rare art that hold significant value in the traditional world. Historically, investing in these assets has been challenging—requiring substantial capital and access to exclusive markets. However, tokenization has changed the game. By dividing ownership into shares, RWAs are now accessible to a broader audience. Imagine owning a fraction of a valuable property or priceless art piece, which was once reserved for a select few.

The rise of decentralized finance (DeFi) has only amplified the appeal of RWAs, enabling the integration of tangible assets into the blockchain ecosystem. This creates opportunities for a more inclusive financial system that bridges the gap between traditional finance and crypto.

In fact, as DeFiLlama highlights, the total value locked (TVL) in RWAs has skyrocketed, increasing nearly 10X from $757.16M at the start of 2023 to a whopping $7.9B+ today. Even major industry figures, like BlackRock CEO Larry Fink, are taking notice, predicting that tokenization will shape the future of markets—offering faster settlements, lower fees, and a transformative shift in how we invest.

Types of Real-World Assets That Can Be Tokenized

In theory, you can tokenize any real-world asset, anything that holds intrinsic value and is of interest to others. Some common examples of real-world asset tokenizations include:

- Real Estate

- Art and Collectibles

- Intellectual Property

- Books and Music

- Precious Metals (Gold, Silver, etc.)

- Commodities (Oil, Gas, etc.)

- Venture Capital Shares

- Luxury Goods (Watches, Jewelry)

- Antiques

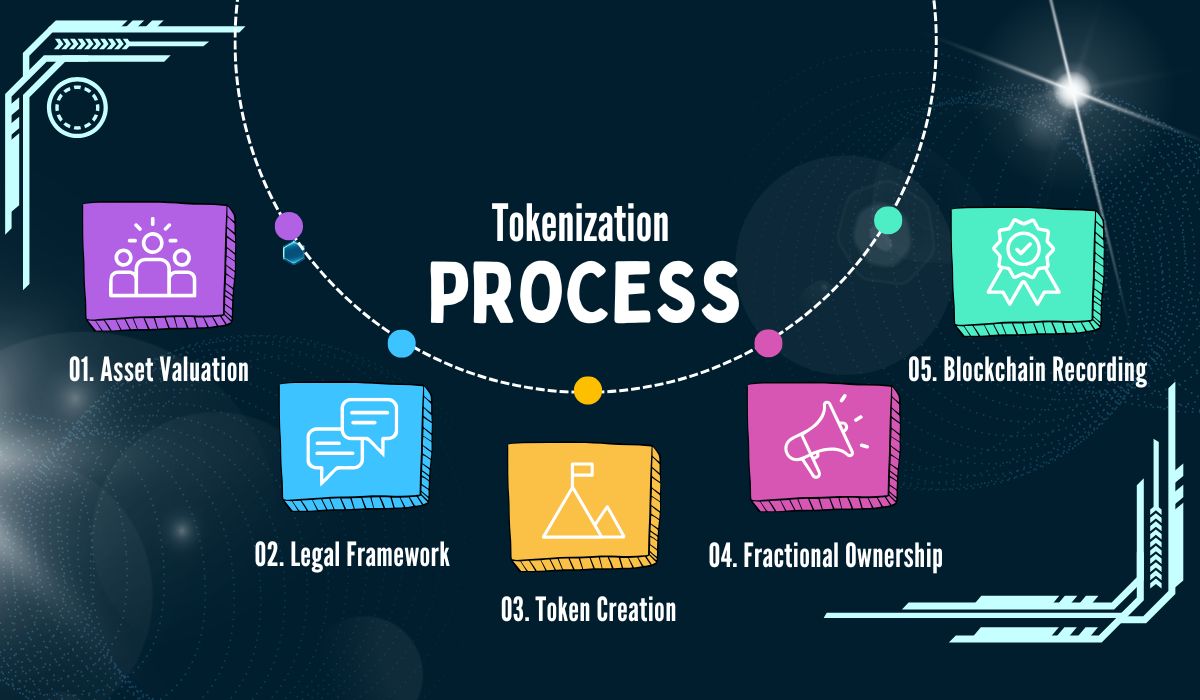

How Does the Tokenization Process Work?

Now that we understand what RWAs are, let’s dive into how the tokenization process works. It’s actually quite straightforward:

1. Asset Valuation: First, the asset is appraised to determine its market value. This step ensures we know what we’re investing in.

2. Legal Framework: Next, a legal structure is created to make sure that our tokenized ownership is clear and compliant with regulations.

3. Token Creation: Digital tokens representing shares of the physical asset are created on a blockchain. Each token reflects our ownership stake.

4. Fractional Ownership: The asset is divided into smaller, tradable units. This means multiple investors can own fractions of it—making it much more affordable for us.

5. Blockchain Recording: Finally, every transaction and change in ownership is securely recorded on the blockchain. This ensures transparency and that our rights as owners are protected.

Example of Real-World Asset (RWA) Tokenization

If we tokenize a piece of real estate together, we would first need to assess the actual value of the property, address the legal considerations, and then proceed to tokenize the asset. Tokenization could involve creating 100 tokens to represent a share in the real estate or just 10 tokens, with the property equally divided among each share. Ownership would then lie with the individuals who own any of the tokens. For example, if there are 10 tokens and a person owns 5 of those tokens, they would effectively own 50% of the real estate. These transactions would be recorded on the blockchain for transparency and security.

5 Examples of RWA Projects

When it comes to RWA projects, some act as shared technologies providing critical infrastructure. For example, Chainlink, an oracle platform, connects blockchain networks to real-world data, ensuring accurate asset valuation and seamless transaction verification. Similarly, layer-1 blockchains like Solana and Avalanche offer the scalability needed to host RWA platforms efficiently.

On the other hand, some projects focus solely on tokenizing specific commodities or assets, making traditionally exclusive investments accessible to a broader audience. Let’s take a quick look at some notable RWA projects!

1. Polymesh

Polymesh is a blockchain designed for security tokens and regulated assets. Built with institutions in mind, it simplifies outdated processes and creates opportunities for new financial tools. It addresses key issues like governance, identity verification, compliance, confidentiality, and settlement.

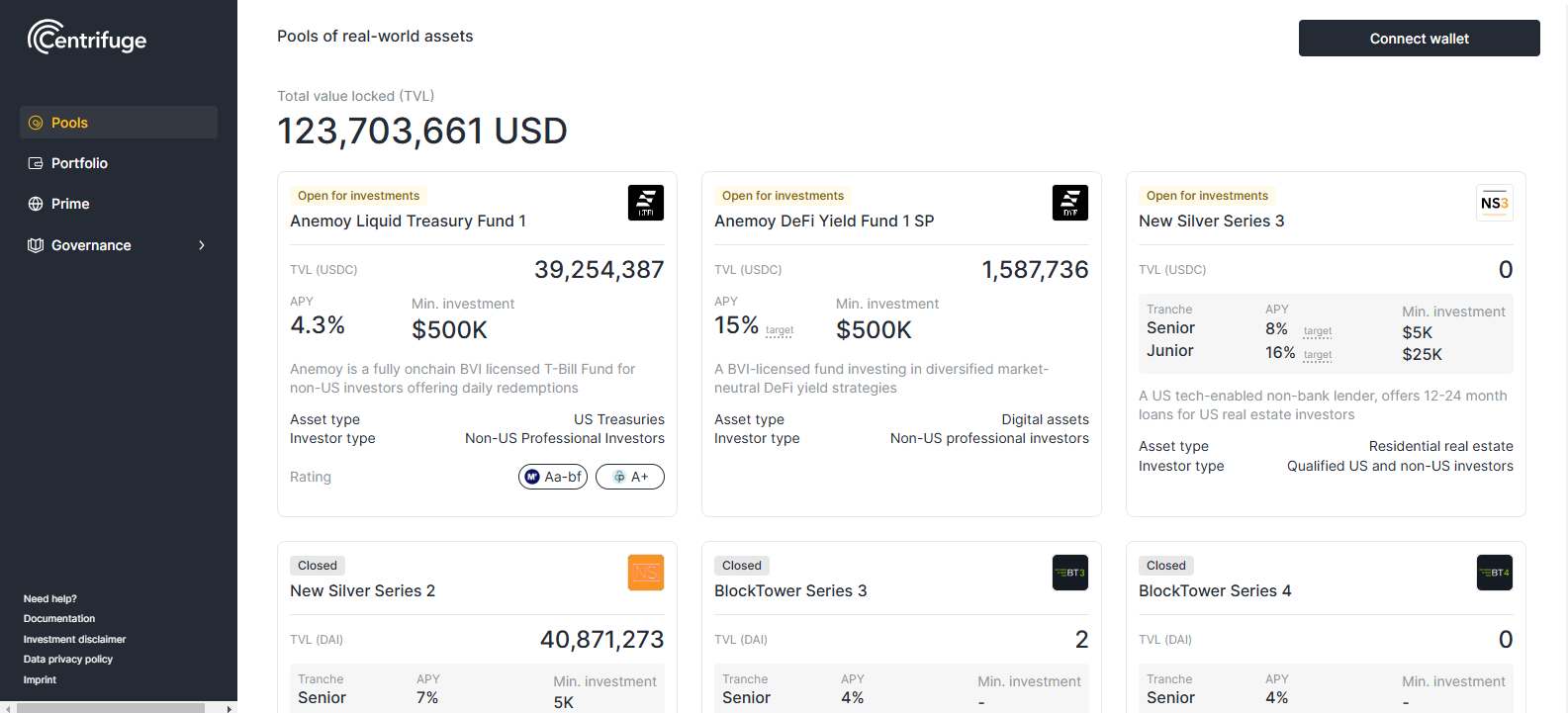

2. Centrifuge

Centrifuge is a platform that connects RWA token issuers with investors through its unique Centrifuge Pools. These pools enable issuers to tokenize and finance real-world assets such as real estate, structured credit, carbon credits, U.S. treasuries, and more.

3. Realio Network

The Realio Network is a layer-1 Web3 platform that supports creating and managing both digital and real-world assets. It works across different blockchains, including EVM-compatible and non-EVM chains.

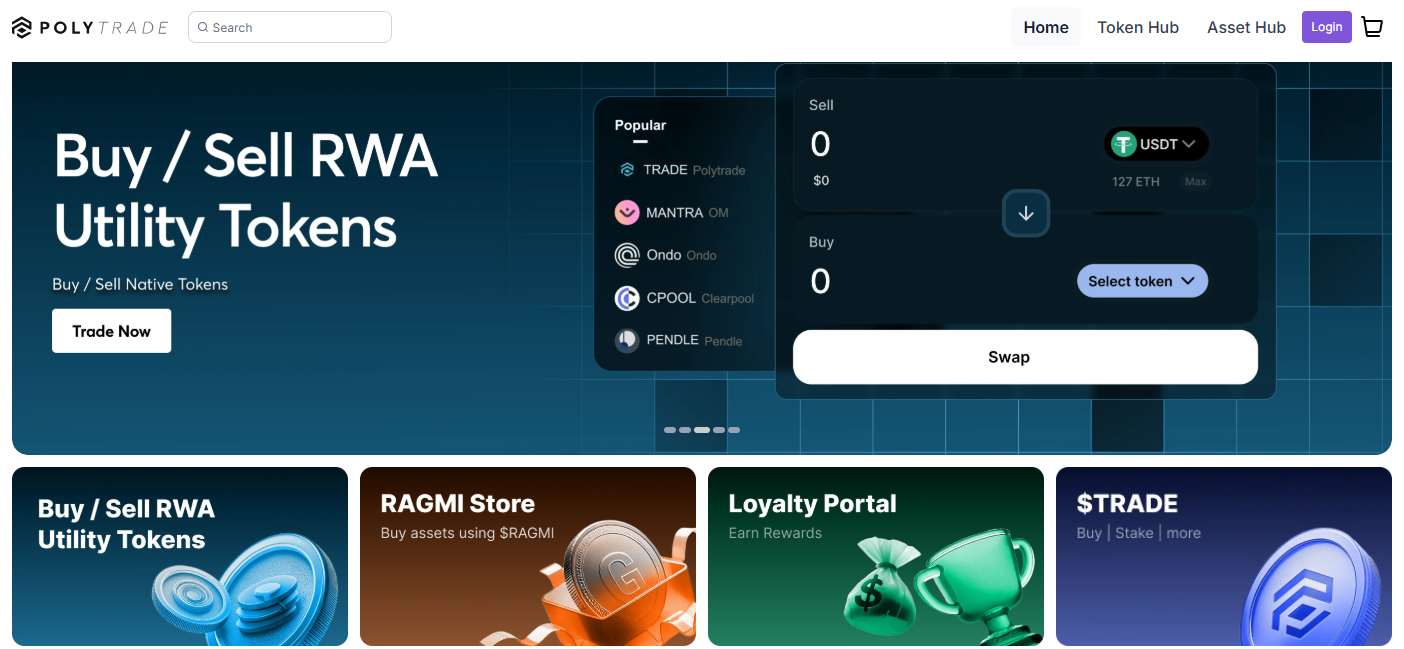

4. Polytrade

Polytrade (TRADE) is a decentralized blockchain protocol revolutionizing receivables financing by connecting buyers, sellers, insurers, and investors. Focused on tokenized real-world assets (RWAs) like T-bills, credits, and real estate, it uses its native token, TRADE, for utility and governance. The platform bridges traditional finance and decentralized tech, enabling trading and fractional ownership of RWAs.

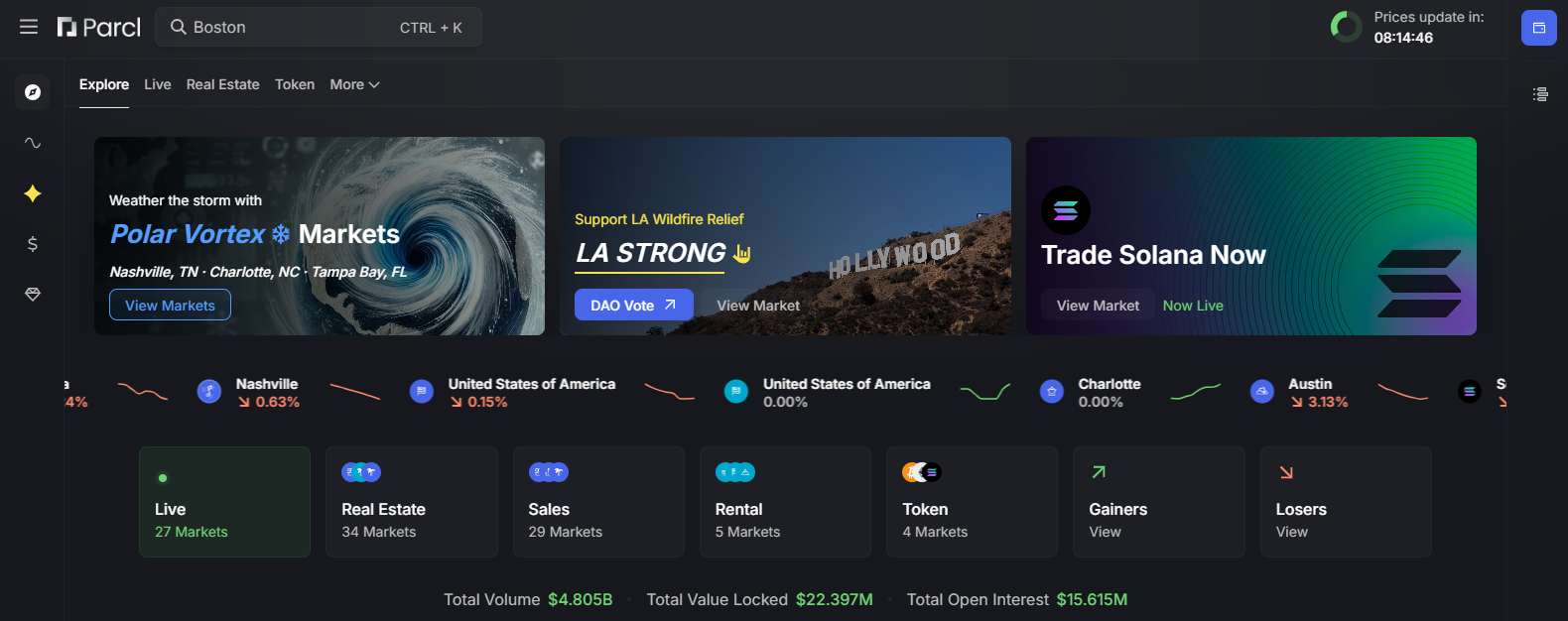

5. Parcl

Parcl is a platform for trading perpetual contracts tied to real estate synthetic assets. It enables cross-margined trading across various real estate markets. Liquidity providers (LPs) supply funds to a single pool per exchange, assuming trader gains and losses while earning fees from trading activities.

Bottom Line

RWAs are not just transforming the DeFi landscape, they are creating a more inclusive financial system. By tokenizing real-world assets like real estate, gold, and art, we’re seeing greater access and liquidity in markets once dominated by the elite. While adoption in traditional finance is still growing, the potential for RWAs to reshape global economies is undeniable. As technology evolves, so too will the ways we interact with physical assets, paving the way for a more interconnected and democratized financial future.

FAQs

1. Are the tokens created Fungible Tokens or Non-Fungible Tokens (NFTs)?

The tokens created are Fungible Tokens because each token holds the same value. For example, if each token is worth $100, their value remains identical across all tokens. On the other hand, NFTs (Non-Fungible Tokens) are unique, with each token having distinct attributes and varying prices. For instance, in the Bored Ape Yacht Club collection, the tokens belong to the same collection, but each one has a different price due to its uniqueness.

2. What are real world assets in Web3?

Real-World Assets (RWAs) in Web3 refer to physical or financial assets, such as real estate and commodities, that are tokenized and integrated into blockchain systems. By bringing RWAs into decentralized finance, Web3 enables increased liquidity, fractional ownership, and easier access to global investment opportunities.

3. What is RWA tokenization?

RWA tokenization involves turning real-world assets, such as real estate, gold, and machinery, into digital tokens on a blockchain. This process makes both tangible and intangible assets, like physical properties and financial contracts, tradable and accessible in the digital world.