People seek new routes beyond trading to earn passive income in the crypto industry. Beyond the complexity of buying and selling crypto coins, new ways of earning passively like bot trading and crypto lending have emerged as realistic choices, offering huge profits with no effort.

Therefore, this article highlights the eight best ways to earn passive income with crypto, presenting a detailed analysis that transcends beyond standard trading practices.

From studying bot trading technicalities to learning the basic principles of passive income, this article is focused on arming readers with the knowledge to manage the complexity of generating passive income in the ever-growing arena of cryptocurrencies.

What is Passive Income with Crypto?

Passive income, in the crypto wilderness, is like a mystical downpour that descends on your digital wallet without requiring you to labor perpetually. Picture it as money that comes in effortlessly, a financial airflow grazing against your crypto holdings. Unlike the arduous toil of active income, where you trade time for money, passive income invites you into a more leisurely tango with your assets.

It’s the art of making your money work for you, a kind of financial alchemy where your crypto mysteriously generates returns while you drink your favored beverage. This can happen through various straightforward methods, like pledging your crypto in platforms that reimburse you for holding onto it or entering liquidity pools, where your coins float in the market, garnering a share of transaction fees.

In essence, passive income in the crypto sphere is a low-effort, high-perplexity strategy where your currencies take on a life of their own, silently growing. At the same time, you embrace the simplicity of a financial siesta. It’s an explosion of financial refreshment, a means to let crypto assets breathe and flourish in the intriguing world of digital finance.

8 Best Ways to Earn Passive Income with Crypto

1. Copy Trading

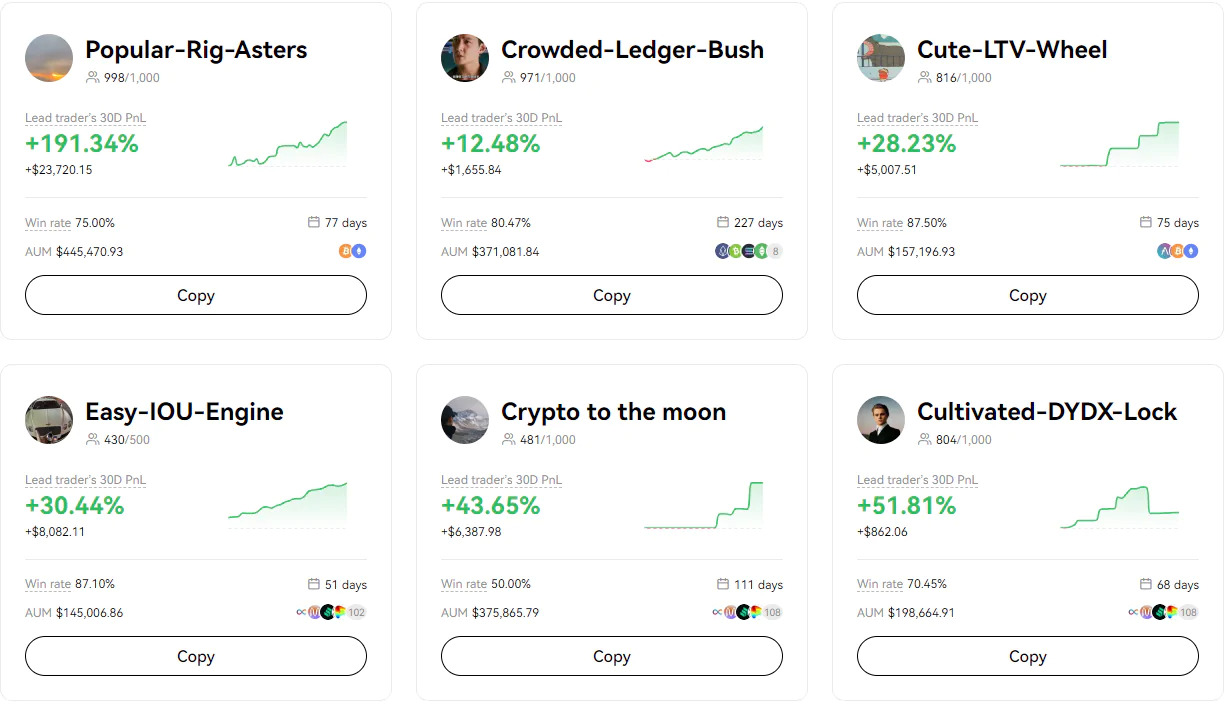

Crypto copy trading emerges as one of the best ways to earn passive income very quickly without feeling like you’re deciphering a rocket science manual. Imagine this: you can mimic the moves of astute speculators without requiring a Ph.D. in financial expertise. Platforms like eToro and Binance offer this exciting feature. It’s like having a financial companion – you observe, they trade.

Here’s how it dances: when a trader you’re imitating makes a move, your crypto does the same routine. If they find gold, so do you; if not, it’s a shared voyage. It’s like navigating the crypto swells without fretting about sliding off the board because you’ve got a competent surfer guiding the way.

Now, it has its quirks. Like any exercise, copy trading has dangers. But it’s an exhilarating option for those not set on doing the crypto cha-cha alone. So, if letting someone else lead while you enjoy the financial cadence appeals to you, copy trading might be your crypto tango to passive income glory.

If you want to get started with copy trading, check out our comprehensive guide of the 8 best crypto copy trading platforms.

2. Staking

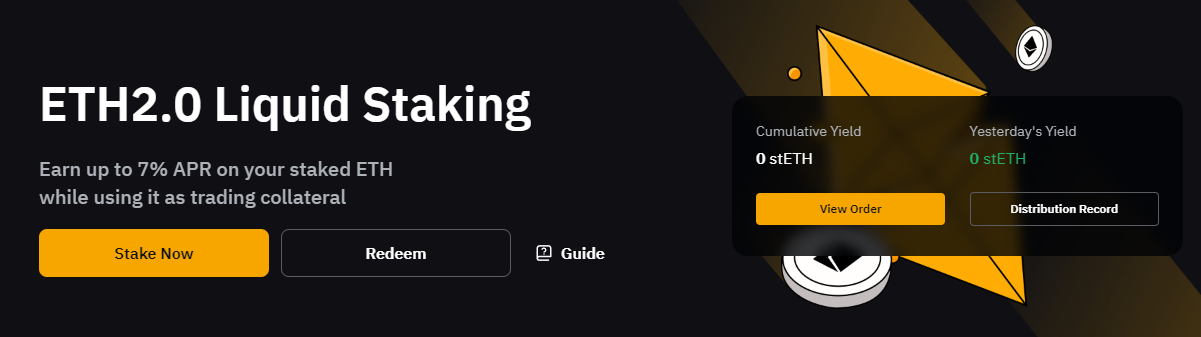

You can also earn passively with staking. This clever method of earning passive income is like allowing your digital currencies to do a laid-back dance routine. Staking is when you place your crypto in a unique platform, and in return, you get rewarded. Think of it as putting your money to work without heavy labor.

Now, these platforms, like Ethereum 2.0 or Binance, urge you to seal up your tokens. It’s not a vault with a massive door but a digital one where your currencies hang out for a while. In this mystical realm, your coins assist in operating the blockchain, and for this, you receive additional coins as a thanks-for-helping-out gift.

But here’s where it gets a tad difficult – the longer your coins stay placed, the more you get. It’s like a crypto savings account but with a hint of enigma. And imagine what? Some platforms even let you imitate the actions of successful crypto speculators. It’s like having a crypto-savvy acquaintance who leads the way, and you follow their dance steps to earn some extra coins without breaking a digital sweat.

In addition, staking is a simple yet confounding way to let your coins take center stage, growing and increasing in this ever-spinning world of digital finance.

If you want to start crypto staking, check out our complete guide about the best platforms.

3. Bot Trading

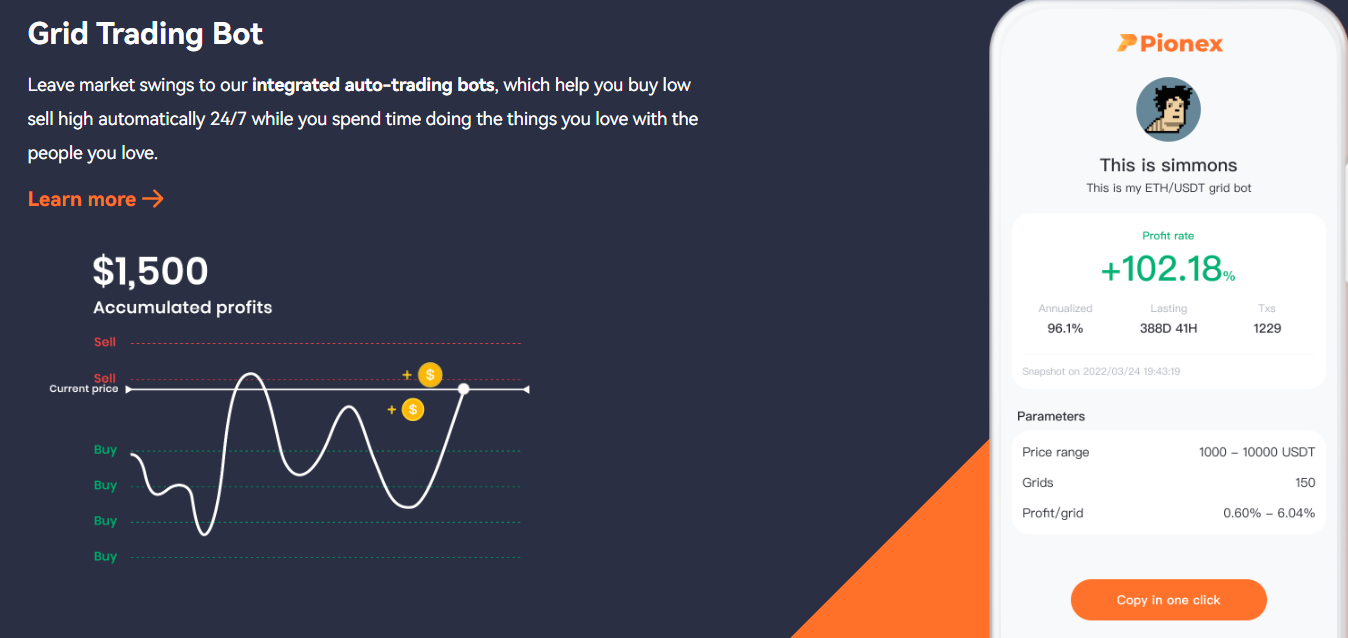

Bot trading emerges as a clever ballet of automation, offering a surge of potential passive income. Picture it like a digital assistant – a program that can buy and sell crypto for you. This is like having a tireless associate working 24/7 in the crypto marketplace, responding to market movements with the speed of a hummingbird.

Here’s the deal: locate an expert trader on these platforms, and your program replicates their movements. It’s like learning to dance by following the lead of a seasoned performer. So, while you rest, your program replicates the transactions, potentially enhancing your crypto stash without you breaking a sweat. Remember, while bot trading can be an exhilarating crypto ballet, it’s wise to proceed cautiously and comprehend the fundamentals before plunging in.

If you want to get started with automated trading, check out our guide for the best crypto bot trading platforms.

4. Liquidity Farming

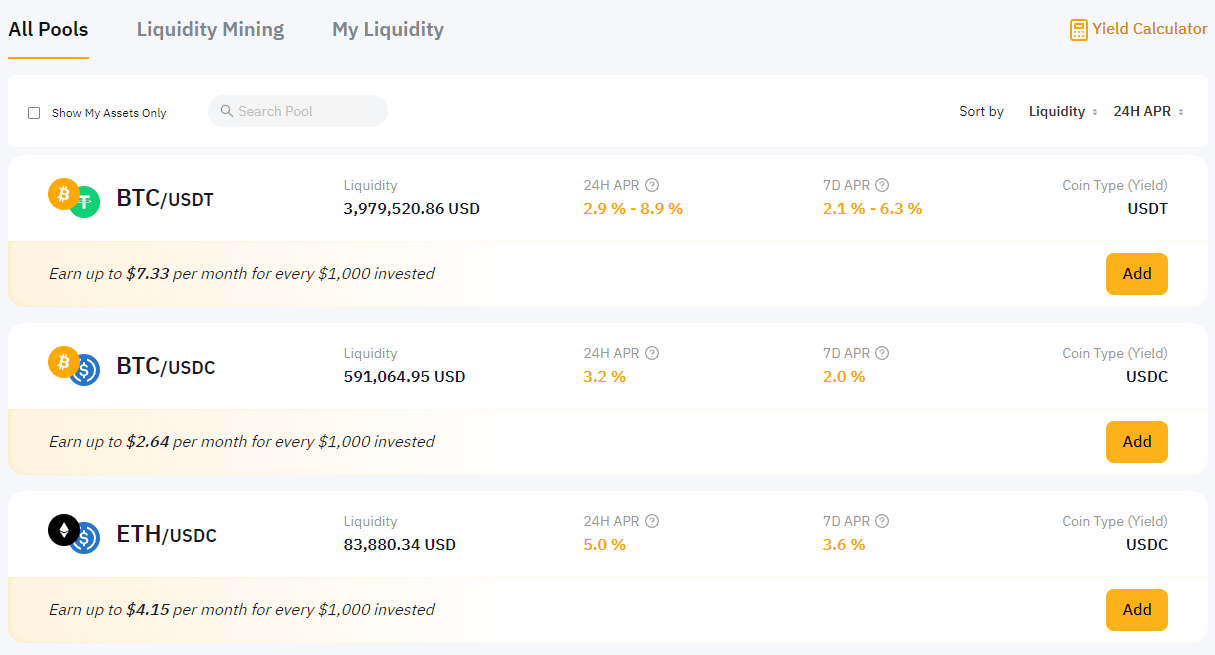

Liquidity is one of the cunning methods to earn passive income without breaking a sweat. Imagine your crypto coins taking a refreshing dip in a digital pool, mingling with others. Platforms like Uniswap or PancakeSwap are platforms where you can do this. When people trade in this pool, you get a portion of the pie – transaction fees become your financial ephemera.

To simplify, you couple up your crypto, like ETH and USDT, and send them into the liquidity pool. In return, you get LP tokens your golden tickets to the passive income carnival. As your crypto collaborators, the platforms automatically do the complex arithmetic for you.

So, liquidity providing? It’s like hosting a crypto soirée where your currencies mingle, and you, the host, collect the rewards without losing sleep.

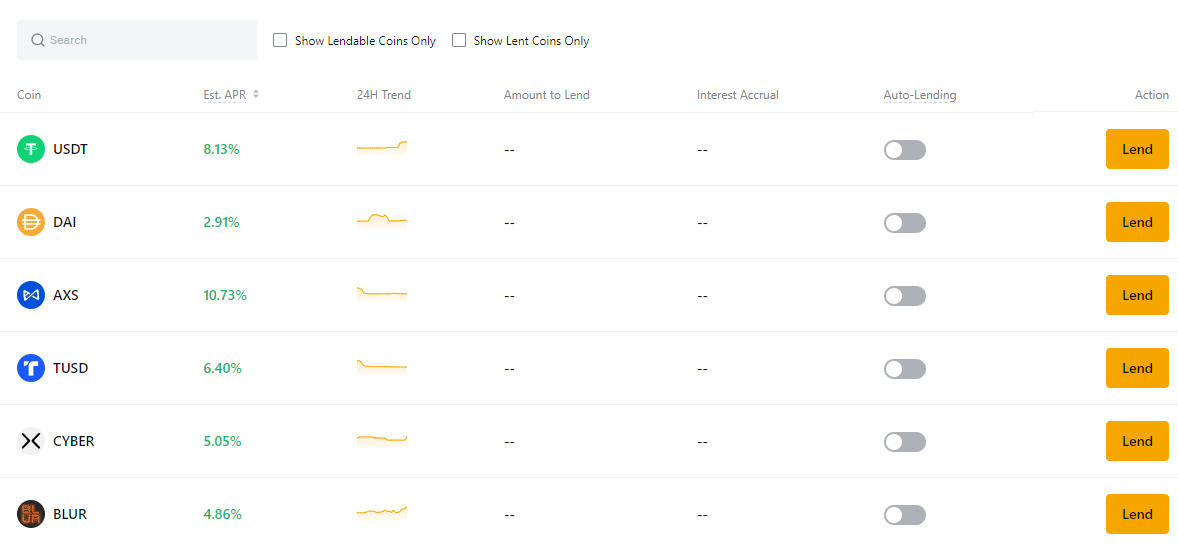

5. Crypto Lending

In the intricate landscape of crypto, engaging in crypto lending emerges as a simple yet perplexing avenue for passive income. It’s like lending an acquaintance your crypto but with a wrinkle. You give over your coins to a platform; in return, they pay you interest. It’s like depositing a seed that develops into a financial tree.

By lending your crypto on crypto lending platforms, you let others borrow it, and you earn interest in exchange. It’s like allowing someone to borrow your lawn mower and getting something extra for your trouble. The burstiness of this strategy lies in the continuous flow of interest. At the same time, you sit back and watch your crypto work for you, a straightforward act with complex financial ramifications in the crypto lending sphere.

6. Crypto Mining

Crypto mining is like searching for digital treasure in the extensive landscape of digital currencies. It’s a process where you use powerful computers to solve complex puzzles and validate transactions on the blockchain. You’re rewarded with new cryptocurrencies in repayment for your computational efforts. Think of it as the crypto world saying, “Hey, thanks for keeping things secure and running smoothly!”

To enter into this crypto mining endeavor, you’ll need specialized hardware, like a mining setup, and software to connect to the blockchain network. Examples of crypto mining platforms include NiceHash and Genesis Mining, which let you participate without requiring an extensive degree in computer science.

Remember, though, that mining requires energy and is not always a burst of profit. It’s like a gradual and constant race, and success depends on factors like utility costs and the current state of the crypto market. So, crypto mining is a systematic voyage, like ministering to a digital garden where you can cultivate a passive income stream in the vast crypto landscape with patience and the right tools.

7. Crypto Savings Account

Diving into the crypto seas for passive income, a Crypto Savings Account stands as a robust lifeboat in this digital ocean. It’s like placing your crypto on a comfortable bed that also happens to grow over time. Consider depositing your digital currencies into a platform, and they start accruing interest, like a money garden that flourishes on its own.

By merely depositing your crypto there, you can earn interest regularly. It’s an uncomplicated procedure – deposit your coins, let them rest, and watch your cache grow discreetly. There are no elaborate trading maneuvers, just a serene savings approach in the crypto universe.

Copy Trading, a fascinating innovation, enables you to automatically follow the movements of seasoned crypto traders. It’s like having a financial expert imparting advice to your investments. Platforms like eToro offer this feature, allowing you to replicate the transactions of successful participants in the crypto game without requiring a PhD in digital finance.

A Crypto Savings Account is a passive income sanctuary in the crypto desert, where your digital currencies rest, flourish, and invite a few friends for the financial feast. It’s the serenity in the crypto storm, offering a straightforward yet effective method to let your crypto work for you.

8. Revenue Share Crypto Tokens

Venturing into the perplexing domain of passive income in the crypto sphere, revenue share crypto tokens stand out as a promising avenue. Imagine these tokens as your discreet financial companions, offering a portion of the share when the crypto ecosystem prospers. Platforms like Phemex and Unibot provide spaces where the burstiness of your investment can be shared, creating a community-driven flow of earnings.

With revenue share tokens, it’s like having a stake in the success of a broader crypto landscape without delving into the intricacies of Active Trading. These tokens often represent a piece of a project or platform, entitling holders to a portion of the revenue generated by the enterprise.

The simplicity resides in solely holding onto these tokens, allowing the passive income to flow as the crypto tide rises. It’s a means to partake in the crypto voyage without the complexity of direct market involvement. So, consider revenue share crypto tokens as a straightforward yet enigmatic mechanism, where your crypto assets discreetly collaborate with the broader market, converting your holding game into a mild stream of earnings.

Is Passive Income the Best Way to Earn from Crypto?

It is up to each person if passive income is the best approach to profit from cryptocurrencies. That depends on your specific tastes, risk tolerance, and financial objectives. There are several ways to generate passive income in cryptocurrency, such as by operating crypto nodes and using the strategies outlined above. Over time, they may provide consistent profits. Moreover, none of them need as much participation as Trading.

Passive income is lucrative for long-term holders who want to keep their cryptocurrency long. While they wait for the prices to rise, they may make extra money using any of the above-discussed strategies. All of these tactics do, however, carry some risk. Examples include temporary loss, regulatory changes, and market volatility. Because of this, it is imperative that all cryptocurrency users understand what they are doing and the associated dangers.

Bottom Line

Exploring revenue-sharing cryptocurrency tokens for passive income is a silently exciting adventure. Exchanges such as Phemex and Kucoin give cryptocurrency holders an easy way to profit from the success of the larger market. Other great options are copy trading on Bitget where you automatically follow the trades of experienced crypto traders.

Like financial allies, these tokens provide a portion of profits without the hassles of active Trading. Your cryptocurrency assets will silently but confusingly dance with the currents of the market, turning idle holdings into a reliable source of passive income.

FAQs

Is Crypto Passive Income Safe?

Although using cryptocurrencies to generate passive income might be advantageous, hazards are involved. Considerations include the cryptocurrency market’s volatility, possible security risks, and unclear regulations. Choosing safe and reliable platforms and diversifying your assets is critical.

What Crypto Generates Passive Income?

A lot of cryptocurrencies provide some passive income. This is the focus of the DeFi industry, and DeFi is available on any blockchain with smart contracts. Though other networks are comparable, Ethereum is the best example.

Are Crypto Nodes Taxable?

Taxes apply to any earnings from the cryptocurrency sector. Although nodes by themselves are tax-free, you may still make cryptocurrency by verifying transactions. Taxes may apply to this cryptocurrency, or you may only be required to pay at the time of conversion. Additionally, a lot may rely on the rules of your nation.