- •OKX is a Seychelles-based cryptocurrency exchange founded in 2017, serving over 50 million users in 100+ countries.

- •Supports 349+ cryptocurrencies for spot trading and 290+ futures contracts with leverage up to 125x.

- •Offers spot, futures, options, P2P, staking, copy trading, bot trading, and a multi-chain Web3 wallet.

- •Competitive fees from 0.08% (spot) and 0.020% (futures), with up to 40% discounts for OKB token holders.

- •Security measures include 2FA, cold storage, anti-phishing codes, and on-chain Proof of Reserves.

The crypto market offers countless platforms, each catering to different needs and trading conditions. For some, access is shaped by local regulations that make direct purchases tricky, leading to reliance on peer-to-peer networks or alternative funding routes. Others may be searching for tools and markets beyond their usual exchange. In this OKX Review, we break down the platform’s features, fees, and practical considerations, giving you the details needed to decide if it fits your trading approach.

| Stats | OKX |

|---|---|

| 🚀 Founded | 2017 |

| 🌐 Headquarters | Seychelles |

| 🔎 Founder | Star Xu |

| 👤 Active Users | 50M+ |

| 🪙 Supported Coins | 349+ |

| 🔁 Spot Fees (maker/taker) | 0.08% / 0.10% |

| 🔁 Futures Fees (maker/taker) | 0.02% / 0.05% |

| 📈 Max Leverage | 125X |

| 🕵️ KYC Verification | Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.6/5 |

| 💰 Bonus | $10 (Claim Now) |

OKX Overview

Founded in 2017 by Star Xu and headquartered in Seychelles, OKX has grown into one of the largest crypto exchanges by trading volume. It serves more than 50 million users in over 100 countries, backed by a team of 2,000+ employees. The platform lists 349+ cryptocurrencies for spot trading and over 290+ futures contracts, with daily activity averaging around $3.84B+ in spot volume and $44.12B+ in futures. Liquidity is a core strength here, not just in the main markets but also in its peer-to-peer (P2P) platform, which supports multiple fiat currencies and maintains steady order flow.

OKX offers spot, futures, perpetual swaps, and options trading, with leverage up to 125x on derivatives. Users also have access to staking, copy trading, and bot trading. Its native token, OKB, provides fee discounts and other platform benefits. Fees start at 0.08% for spot makers and 0.02% for futures makers, with fiat funding supported in 45+ currencies through cards, bank transfers, SEPA, and third-party processors.

KYC verification is required, and access is restricted in certain jurisdictions. The exchange operates with a high safety index and offers 24/7 multilingual support via live chat and email.

OKX Pros and Cons

| 👍 OKX Pros | 👎 OKX Cons |

|---|---|

| ✅ Lower fees than many tier-1 platforms | ❌ Not Available to users in the United States |

| ✅ Multiple products: spot, futures, options, staking, bots, copy trading | ❌ KYC is mandatory. |

| ✅ High liquidity in spot, futures, and P2P markets | ❌ Complex for beginners |

| ✅ OKB token for fee discounts | |

| ✅ Trusted and reliable wallet | |

| ✅ Supports 45+ fiat currencies |

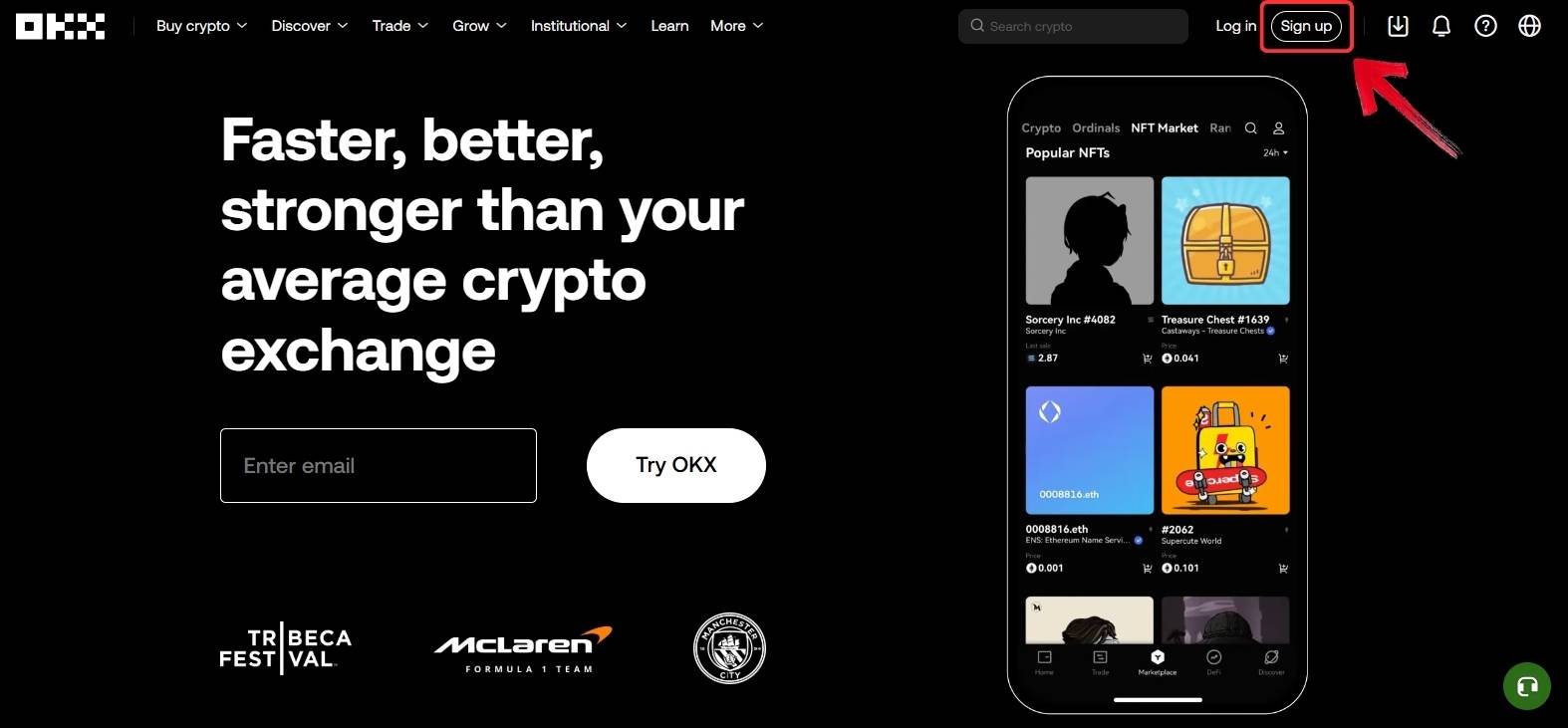

OKX KYC and Sign-up

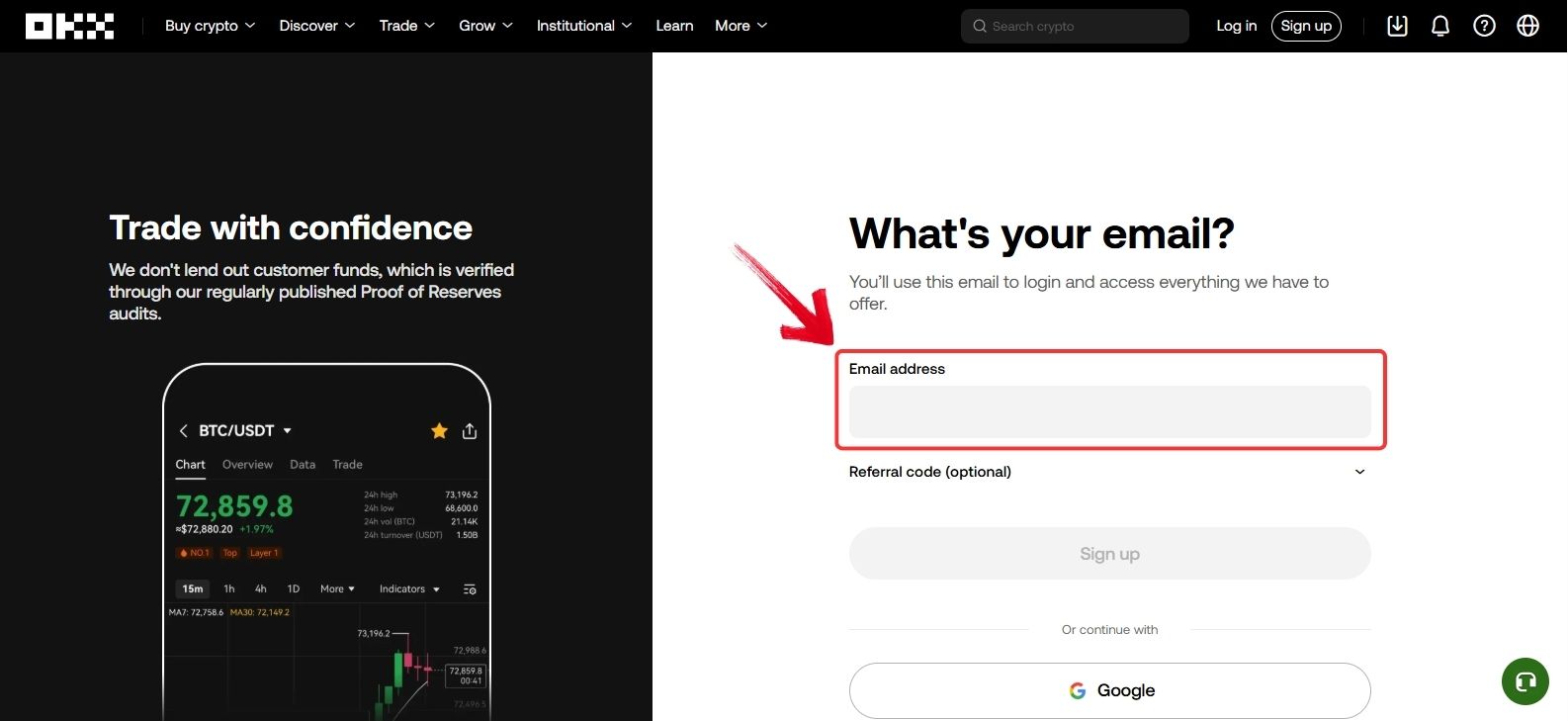

Creating an account on OKX is a simple process and works much like signing up on any other exchange. You can register using either your mobile number or an email address, and once your account is active, you’ll be guided through KYC verification. The first verification stage asks for some basic personal details and ID, giving you access to high withdrawal limits. If you choose to go a step further and submit additional documents, you can unlock the platform’s full range of features without restrictions.

Step 1: On your browser, navigate to the OKX website, where you can click on the “Sign Up” button to start your registration.

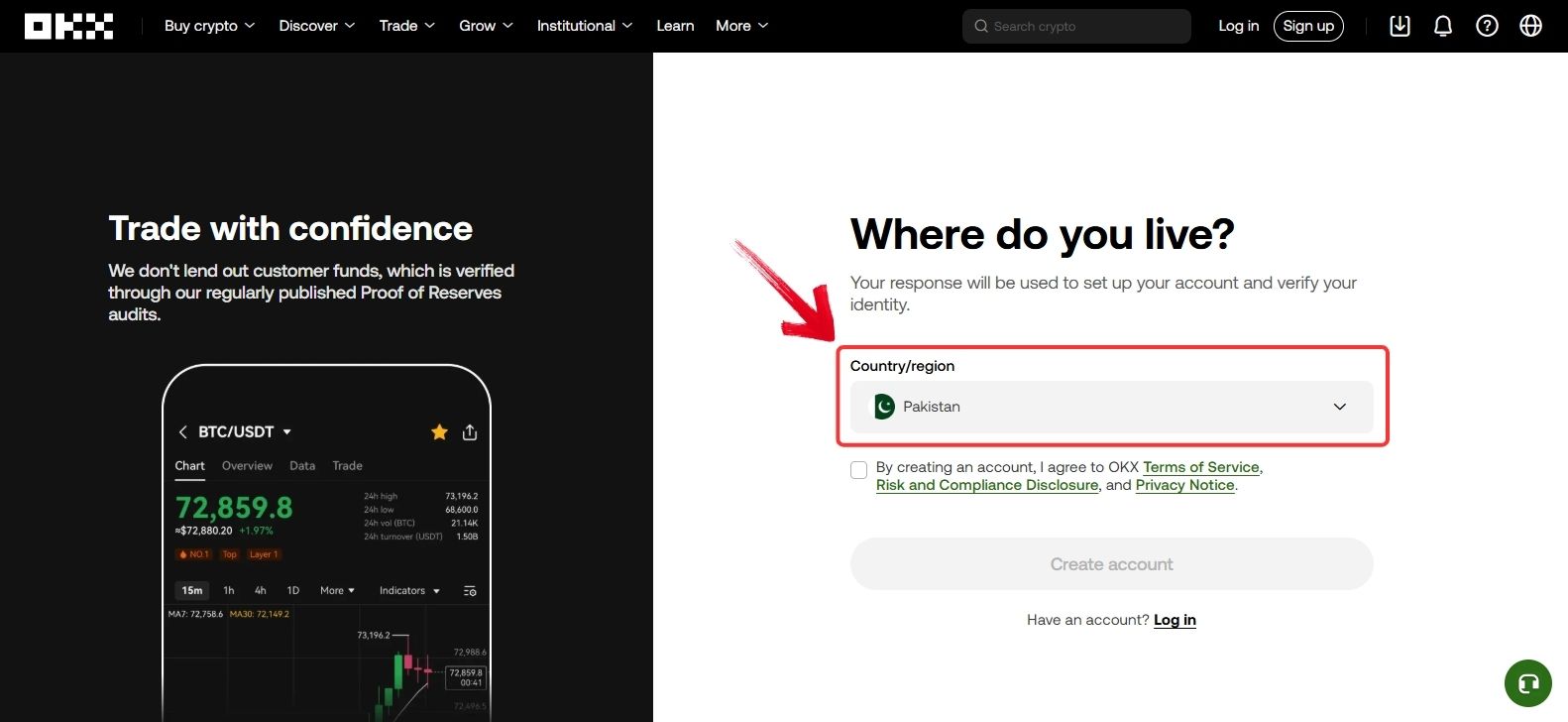

Step 2: You will be asked to select your region, then click on the “Terms and Conditions” checkbox to continue, and after that, click the “Create Account” button.

Step 3: Next, enter the email address you want to use for creating your OKX account, and then click the “Sign Up” button.

Step 4: You will receive a verification code in your email. Enter this code to verify your account.

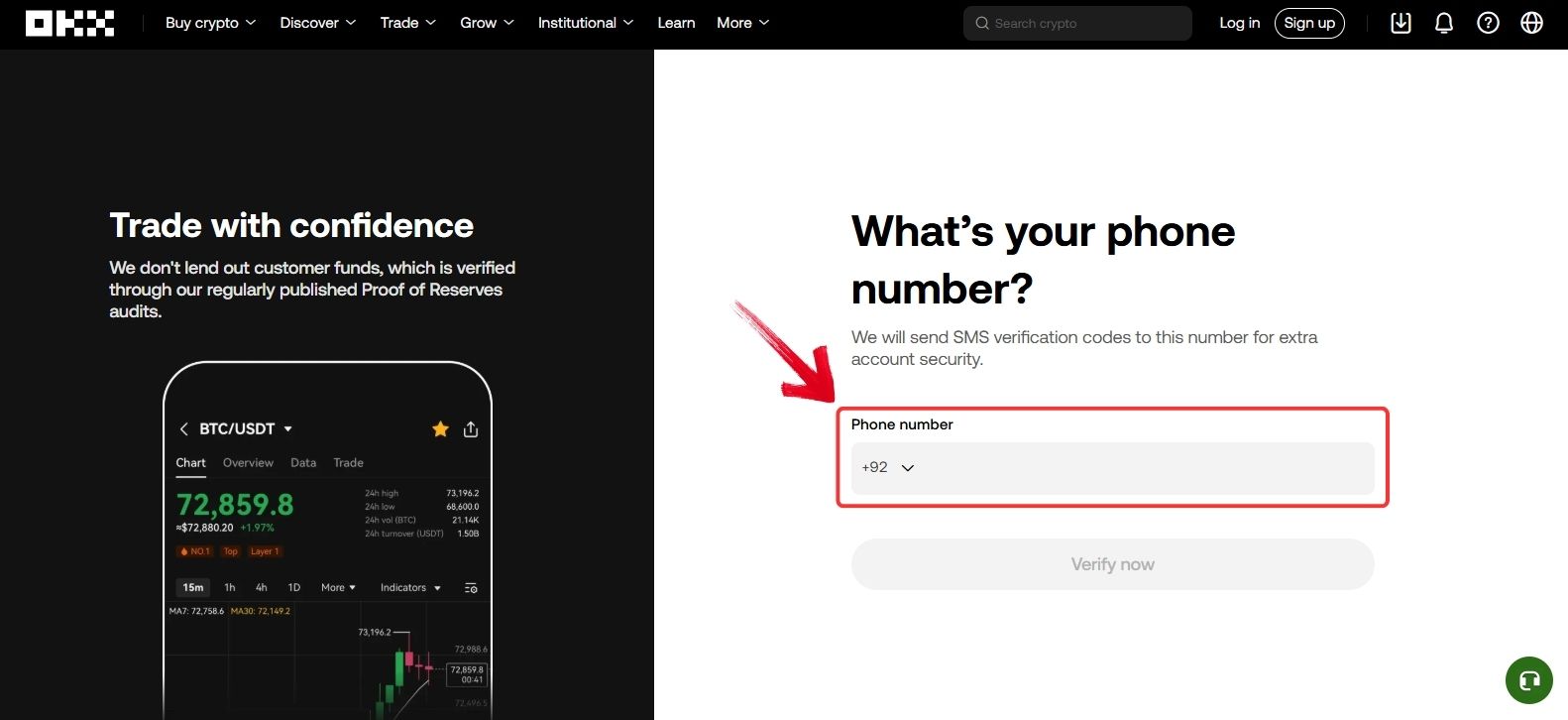

Step 5: You will then be asked to provide your phone number for additional verification, and once entered, click the “Verify” button.

Once these steps are complete, proceed with KYC by providing a valid national ID or driving license along with a live selfie. This grants Level 1 verification. Before starting, note that OKX is restricted in certain regions. You can use CryptoWinRate’s OKX Country Checker to confirm eligibility or explore other options if needed.

🌍 Free OKX Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, OKX does not support every country. To ensure that you are eligible to register on the exchange, you can use our free OKX country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

OKX Trading

Trading is the main reason most people use an exchange, but it’s the underlying features that determine how useful a platform really is. Things like available order types, market liquidity, fee structure, trading pairs, and leverage options all play a role in shaping the overall experience. Every trader has different priorities, so it’s worth looking at what OKX offers in these areas.

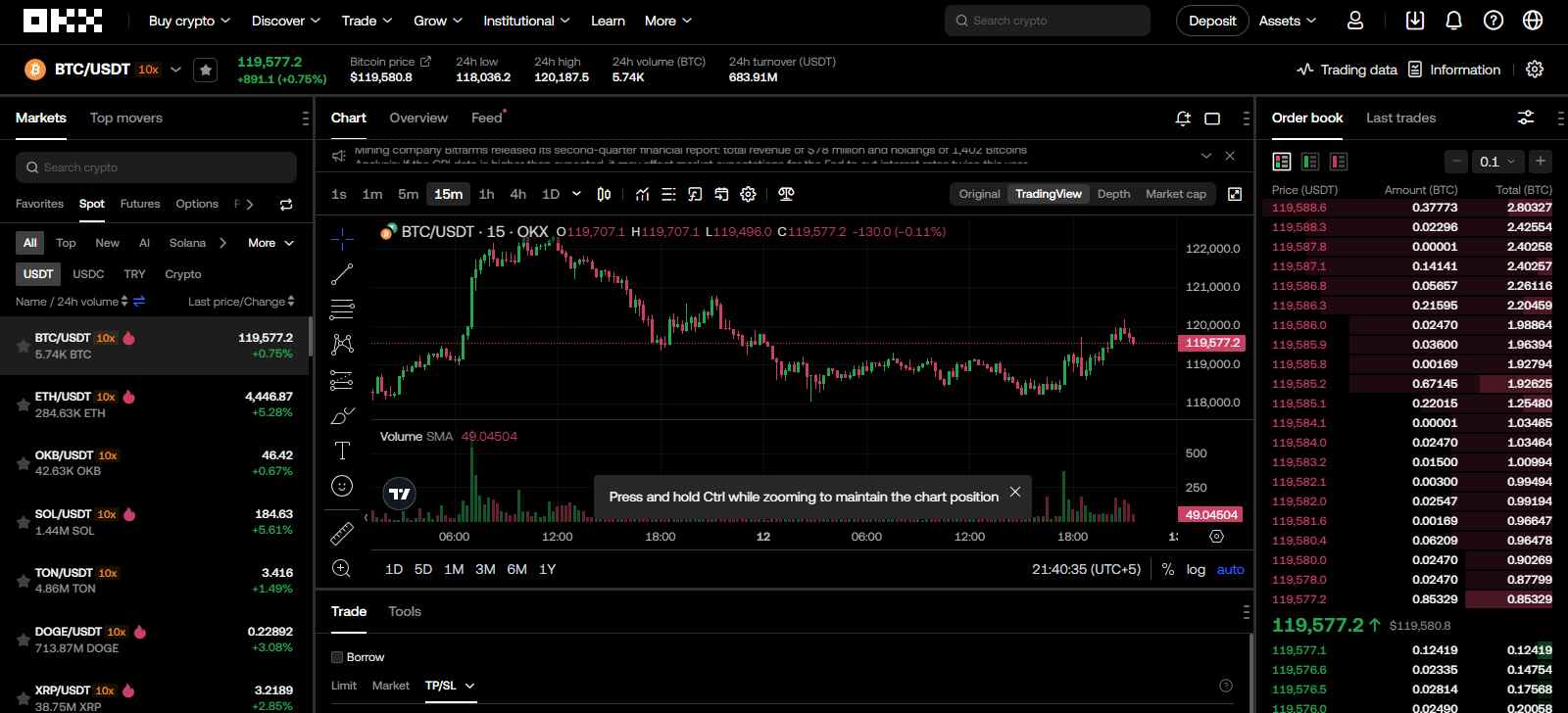

Spot Trading

OKX’s spot market has a clean and simple interface, making it accessible for both quick trades and longer analysis sessions. The exchange supports 349+ cryptocurrencies, covering everything from major assets like BTC, ETH, and SOL to a wide range of altcoins. Trading fees are competitive at 0.08% for makers and 0.10% for takers, with daily volumes averaging above $3.84 billion, enough to keep order books active and slippage low.

TradingView is built directly into the interface, giving users access to charting tools, multiple timeframes, and technical indicators. Order types are kept straightforward with Limit, Market, and OCO options. Users can also activate margin trading directly from the spot interface with leverage up to 10x, and there’s the option to run spot trading bots or follow other traders through copy trading.

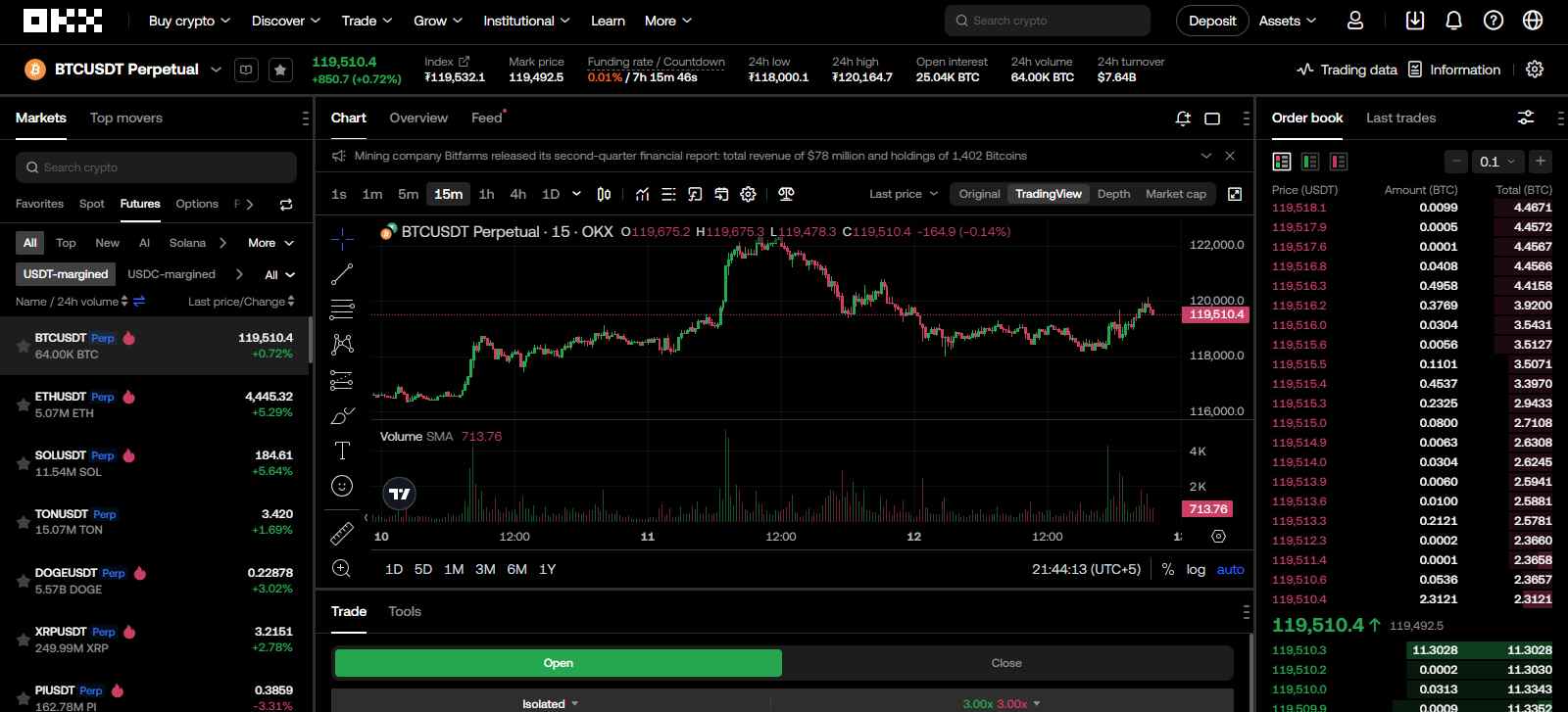

Futures Trading

The futures interface is designed to be familiar for spot traders, carrying over the same TradingView integration for charts and analysis. The product range includes perpetual and dated contracts, with leverage reaching up to 125x for those who want more exposure. Fees are lower than spot at 0.020% for makers and 0.050% for takers, appealing to high-volume traders.

Daily volume in the futures market often exceeds $44.12 billion, supported by deep liquidity that helps maintain smooth order execution even during volatile conditions. Order types match those in spot, keeping the learning curve minimal for traders moving between the two.

OKX Fees

Fees are an important factor when choosing an exchange because they directly affect your overall profits, especially for frequent traders. Even a small difference in rates can add up over time. OKX is known for having competitive fees, generally lower than most tier-1 exchanges, which makes it appealing for both spot and derivatives trading.

Trading Fees

OKX uses a tiered fee structure where costs decrease as a user’s VIP level increases. For regular traders, spot fees start at 0.08% for makers and 0.10% for takers, while futures fees begin at 0.020% and 0.050% respectively. As trading volume and VIP status grow, these rates drop significantly, at the highest tier, fees can go as low as -0.005% for makers and 0.015% for takers.

In addition, holding the platform’s native token, OKB, can reduce trading fees by up to 40%. This discount applies to both spot and derivatives markets, giving active traders another way to save on costs.

Spot Fees

0.08% Maker

0.10% Taker

Future Fees

0.02% Maker

0.05% Taker

Deposits and Withdrawals

For crypto transactions, OKX only charges the network fee, which varies depending on the blockchain being used. Deposits in cryptocurrencies are free apart from these network costs. When funding accounts through fiat, OKX itself does not charge a deposit fee, however, third-party payment providers (such as card processors or bank partners) may apply their own charges. Withdrawal fees also follow the same model, with only the applicable network fee being deducted.

OKX Products and Services

We will be looking at the different products and services offered by OKX to help you see what trading, investment, and earning options the platform provides.

OKX Trading

OKX delivers a broad trading environment designed to cater to different styles and strategies. The platform brings together spot, futures, options, and other advanced markets under one interface, supported by high liquidity and competitive fees. Traders can choose between manual execution, copy trading, and automated strategies through built-in trading bots.

A demo mode is available for testing ideas without committing real funds, while integrated TradingView charts provide the tools needed for market analysis. With various markets and trading methods in one place, OKX aims to accommodate both active traders and those seeking a more automated or experimental approach.

OKB Token

OKB is the native utility token of the OKX ecosystem. It plays a central role in reducing trading fees, with holders eligible for discounts of up to 40% on both spot and derivatives markets. Beyond fee reductions, OKB can be used to access exclusive token sales, participate in special promotions, and cover transaction fees within the OKX Web3 wallet.

The token also supports cross-chain transfers on multiple networks, improving its flexibility for both trading and DeFi activities. As part of its tokenomics, OKX periodically buys back and burns OKB from circulating supply, aiming to increase scarcity over time. This blend of exchange utility, market benefits, and deflationary mechanics has made OKB an integrated part of the platform’s overall trading and investment ecosystem.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

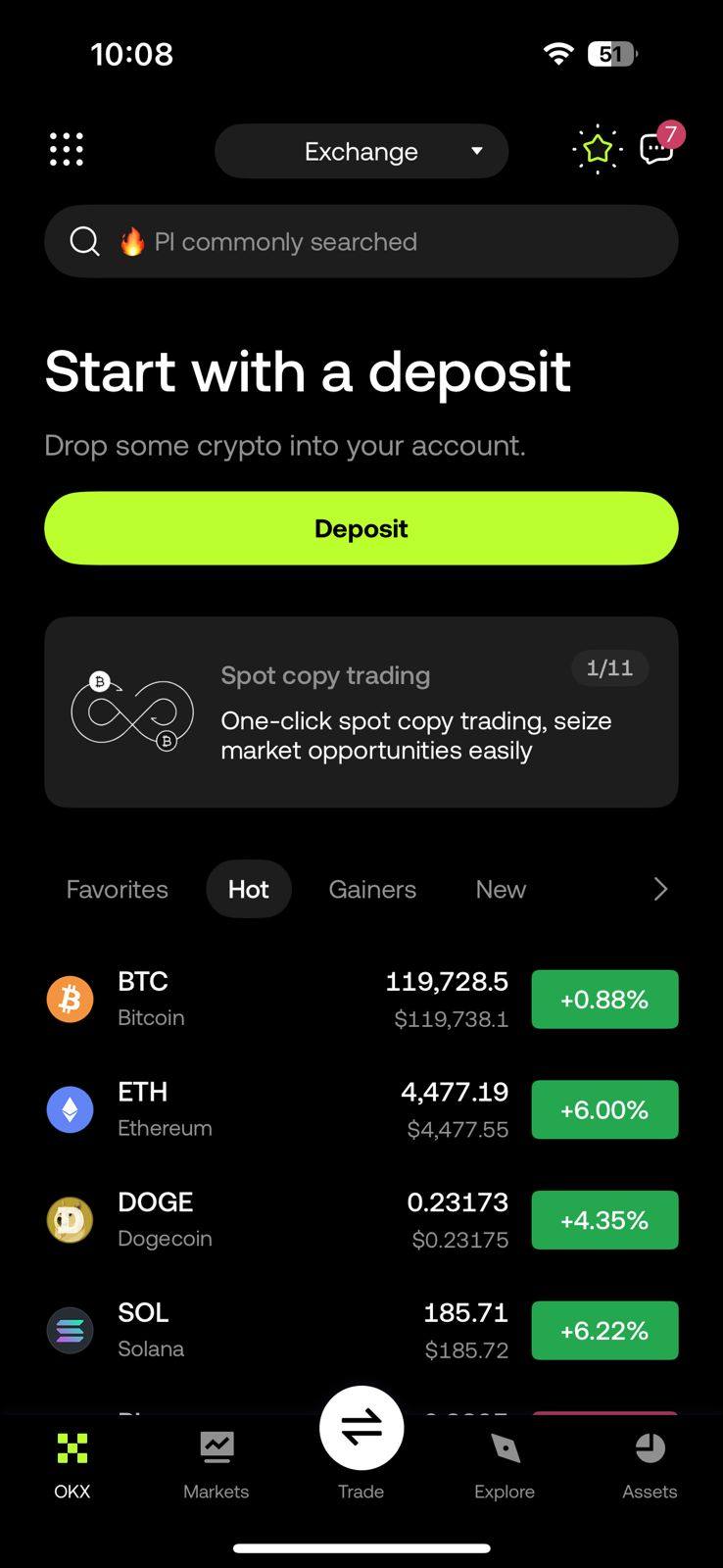

OKX Mobile App

The OKX mobile app is the platform’s mobile extension of the web terminal. Like the website, it offers various services, including spot and derivatives trading, NFT marketplace, and Web3 Wallet.

The app is designed to provide a seamless trading experience with a user-friendly interface. Users can also trade on the mobile app for spot and futures trading. For beginners, a Lite version of the app simplifies the process of buying, selling, and earning cryptocurrency.

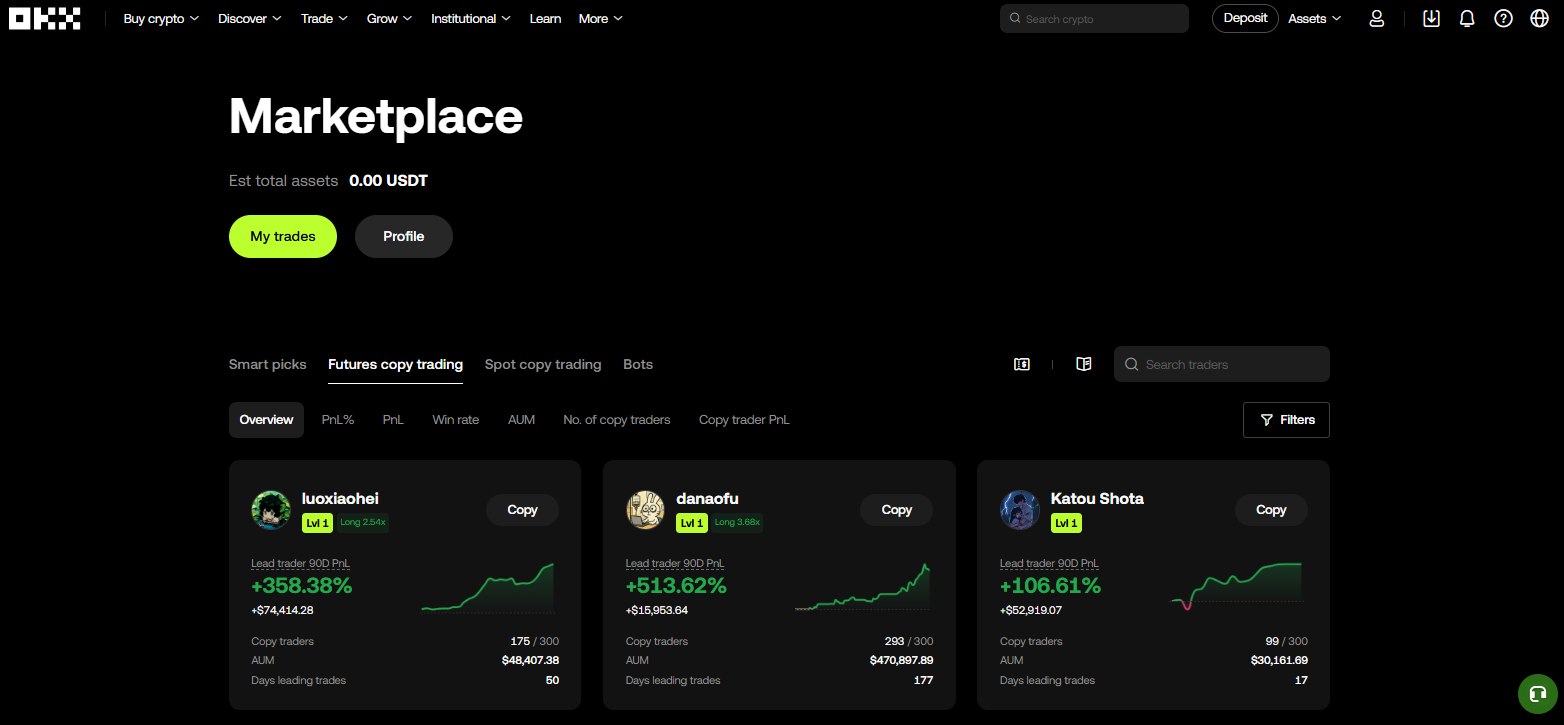

Copy Trading

OKX’s copy trading feature lets users follow top traders in both spot and futures markets. Once connected, trades are mirrored automatically, allowing participation without constant market monitoring. Bot copy trading is also available, replicating automated strategies instead of manual trades. This can serve as a passive trading approach, with the flexibility to adjust investment amounts, set risk limits, or stop copying at any time.

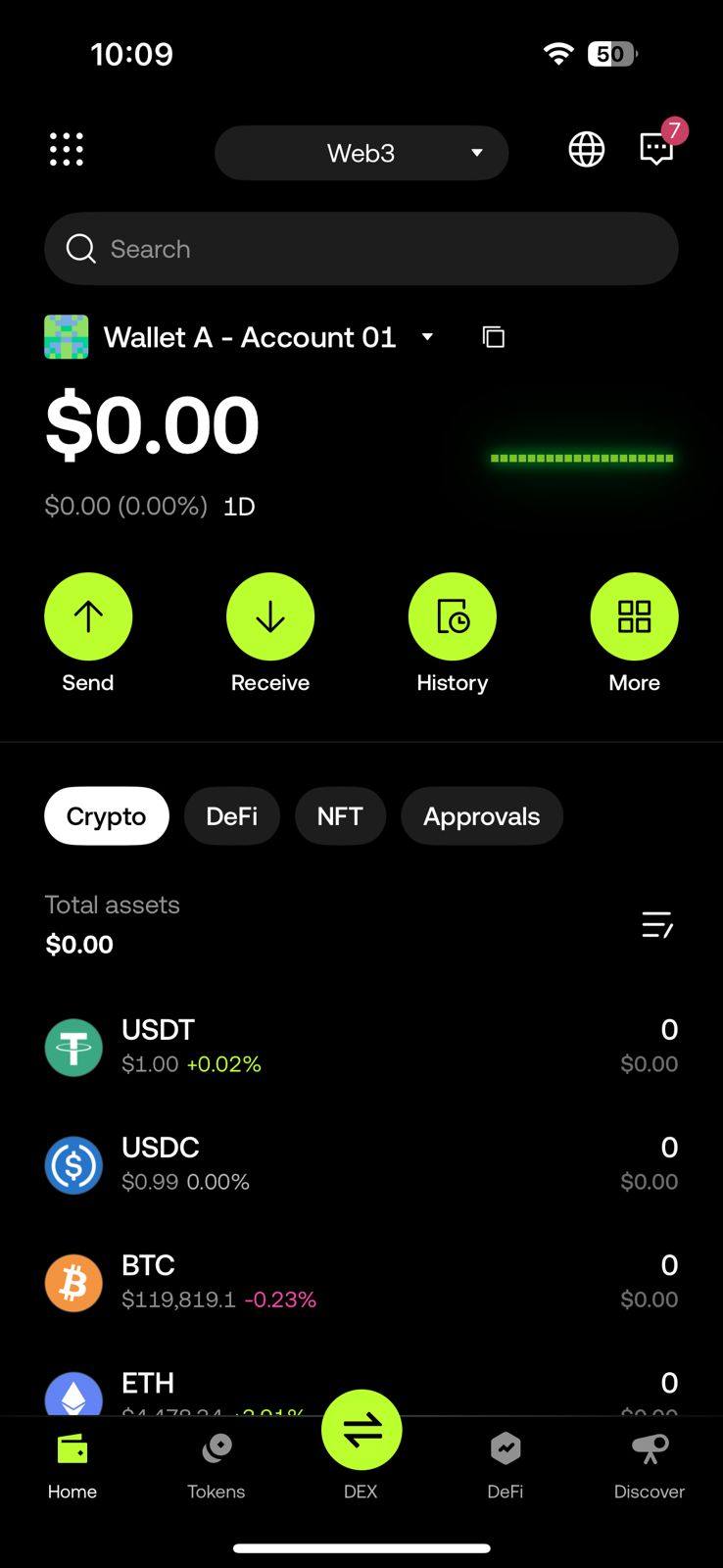

OKX Wallet

The OKX Web3 wallet gives you a way to store, trade, and interact with cryptocurrencies directly on-chain, while keeping full control of your private keys. It supports 31 different networks, covering major options like Ethereum, BNB Chain, Polygon, Solana, TON, Aptos, and more. With this multi-chain access, you can connect to dApps, explore DeFi platforms, swap tokens, or trade NFTs without leaving the wallet. It also links seamlessly with the OKX exchange, making it easy to move funds between centralised and decentralised accounts whenever needed.

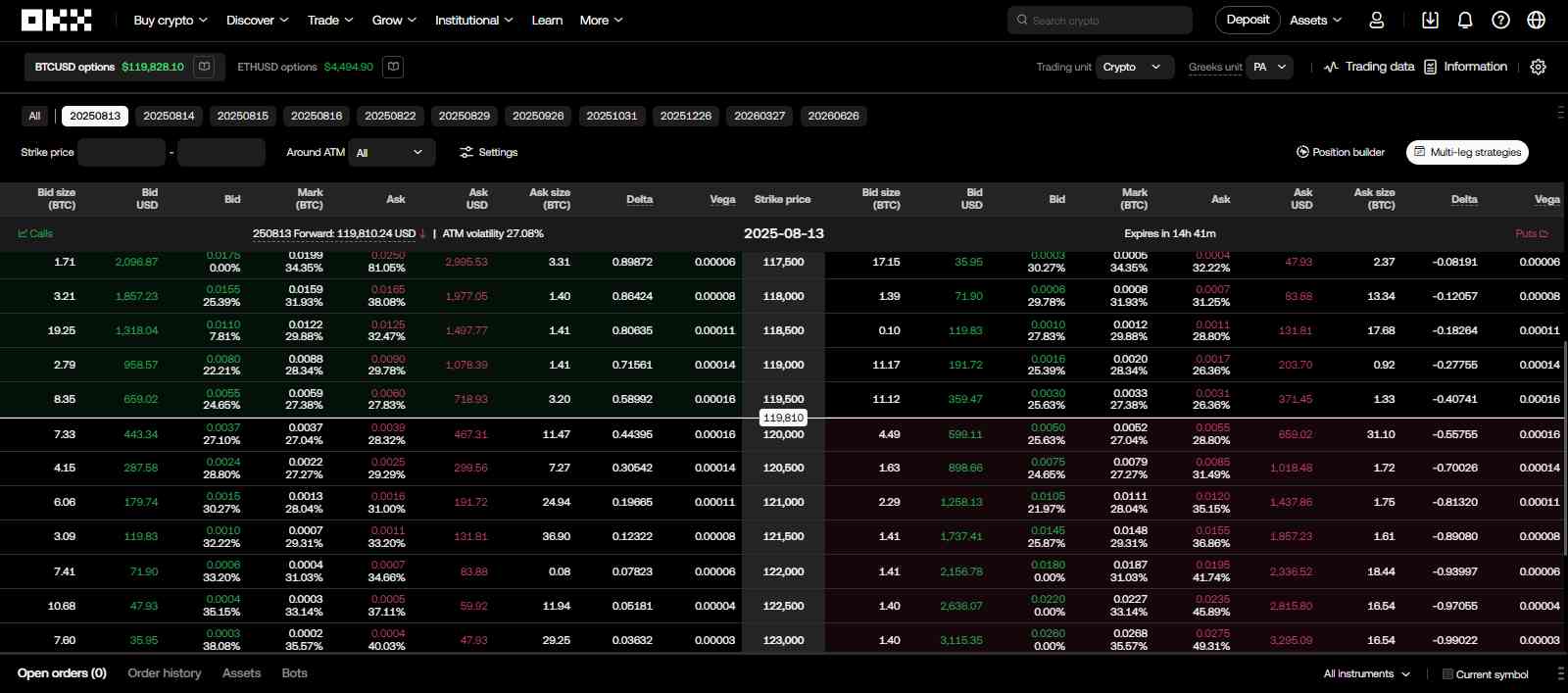

Options Trading

OKX offers cryptocurrency options trading for BTCUSD and ETHUSD pairs. The platform supports both call and put options, along with multi-leg strategies for building structured positions such as spreads, straddles, and strangles. Traders can customise strike prices, expiration dates, and contract sizes to suit their strategy.

Integrated TradingView charts make it easier to analyse market trends before executing trades. For those wanting more control, the RFQ (Request for Quote) builder lets users negotiate directly with counterparties to secure specific pricing for complex trades.

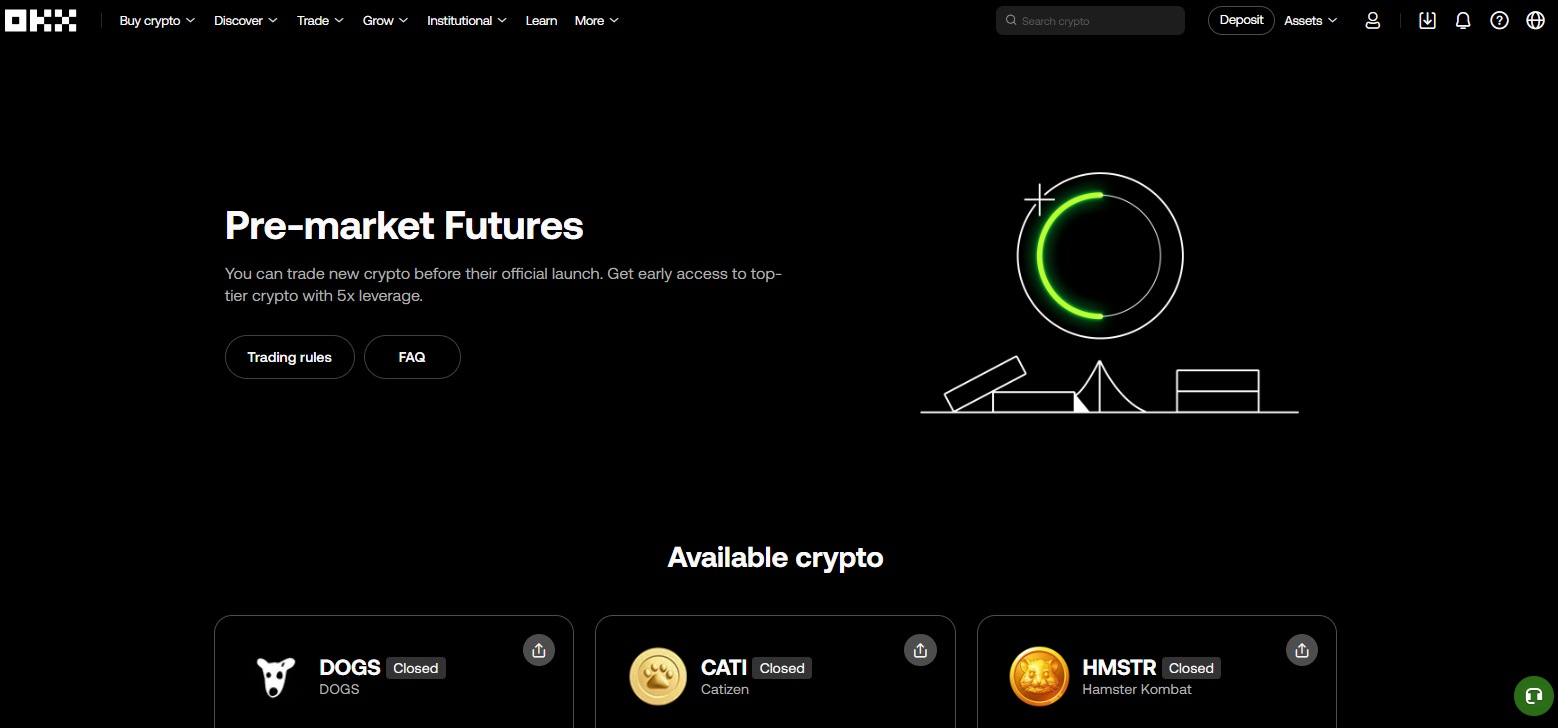

Pre-Market Futures

OKX’s Pre-Market Futures let traders speculate on tokens before they are officially listed on the exchange. This gives early access to potential price action and can be appealing for those following new project launches closely. Contracts can be opened long or short, depending on market expectations. While it offers the chance to enter early, pre-market trading also carries higher volatility and liquidity risks, making it more suitable for experienced traders who can manage rapid price swings.

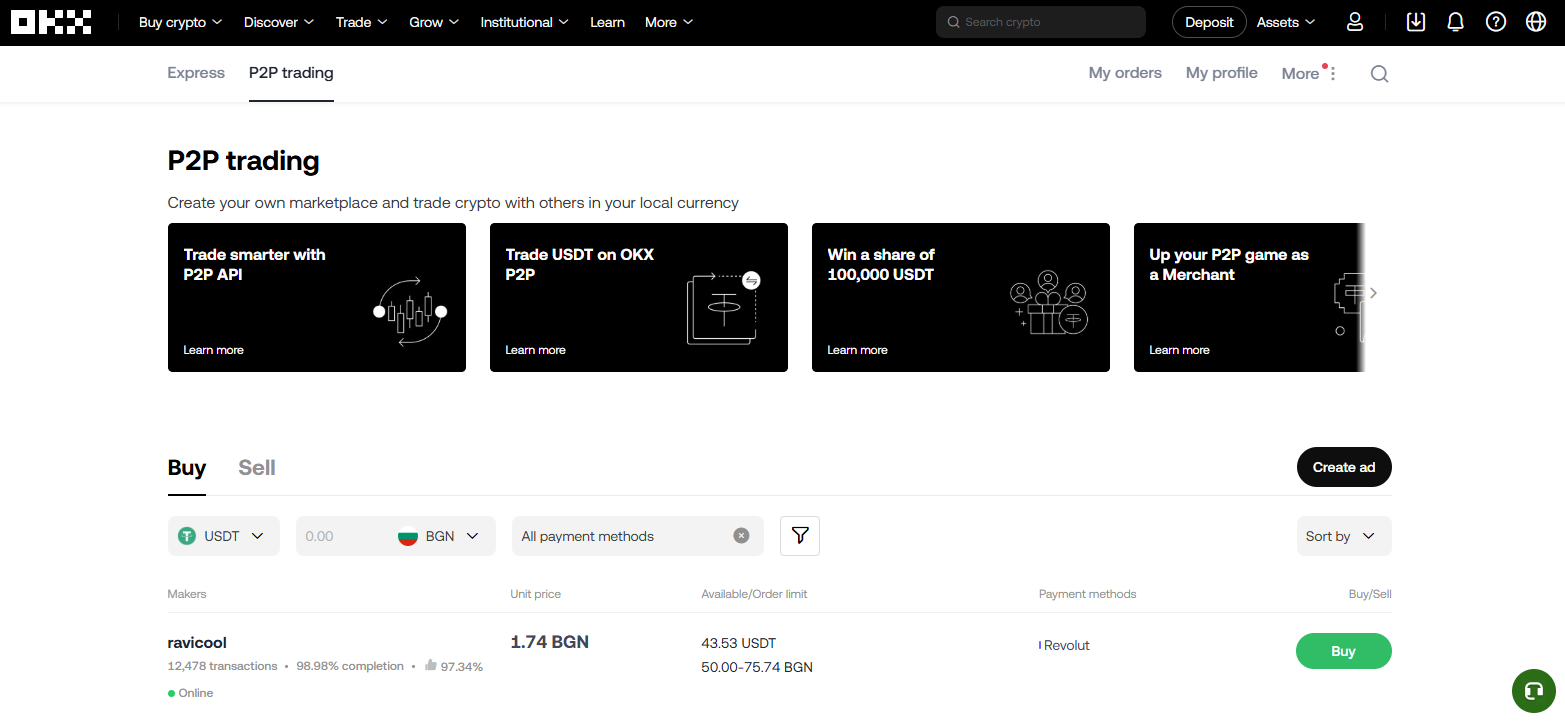

P2P Trading

P2P trading on OKX is designed for users in regions where direct crypto purchases through bank cards are limited. The platform offers good liquidity, responsive customer support, and supports four cryptocurrencies: USDT, USDC, ETH, and BTC. Users can transact directly with each other using local payment options. OKX provides an escrow system to secure transactions, ensuring that funds are only released once both parties have met the agreed terms.

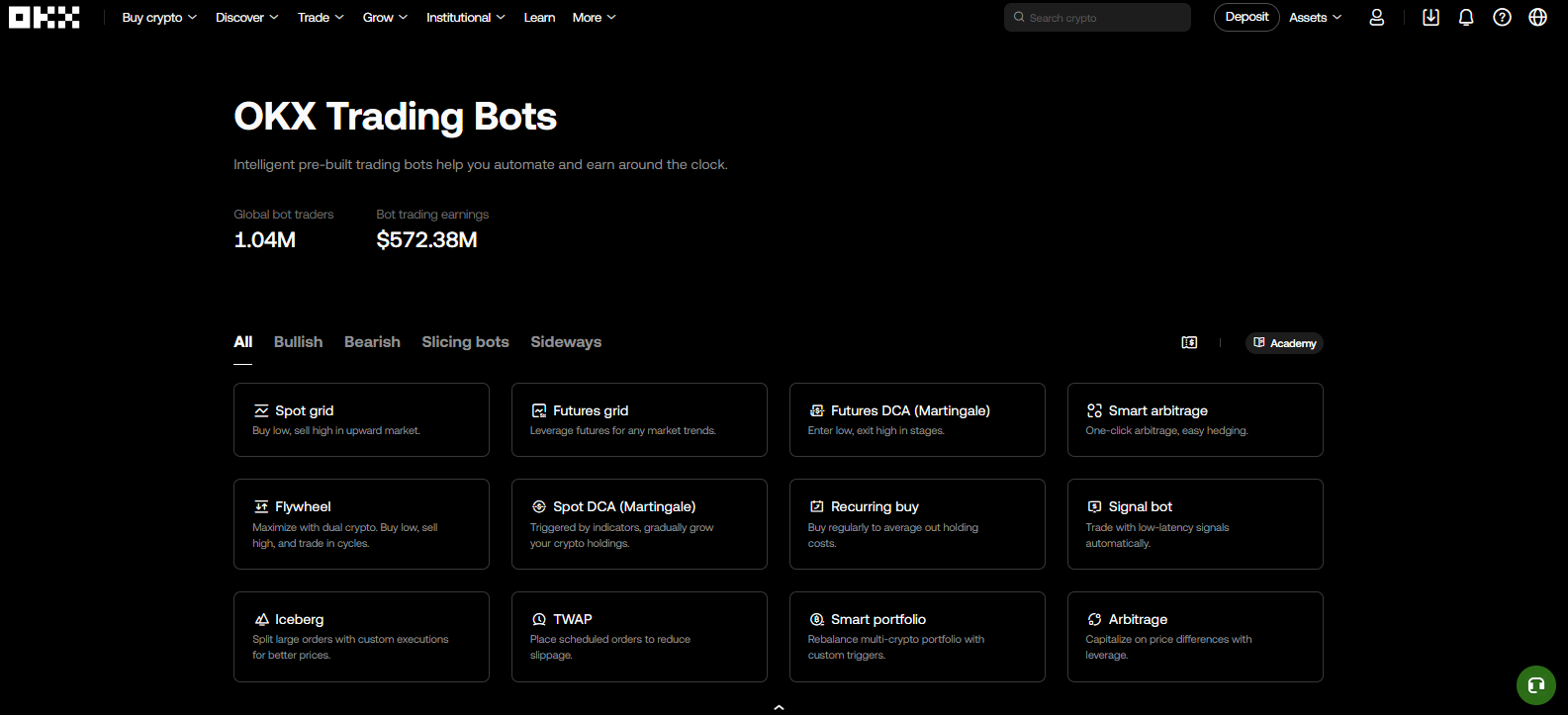

Trading Bots

OKX provides 12 pre-set trading bots tailored for different market conditions, including grid, DCA, and arbitrage strategies. These bots can be used on both spot and derivatives markets, allowing for automation of various trading styles. Users can customise parameters such as investment size, price range, and order frequency to suit their risk appetite. Bot trading helps reduce manual intervention while keeping strategies active around the clock.

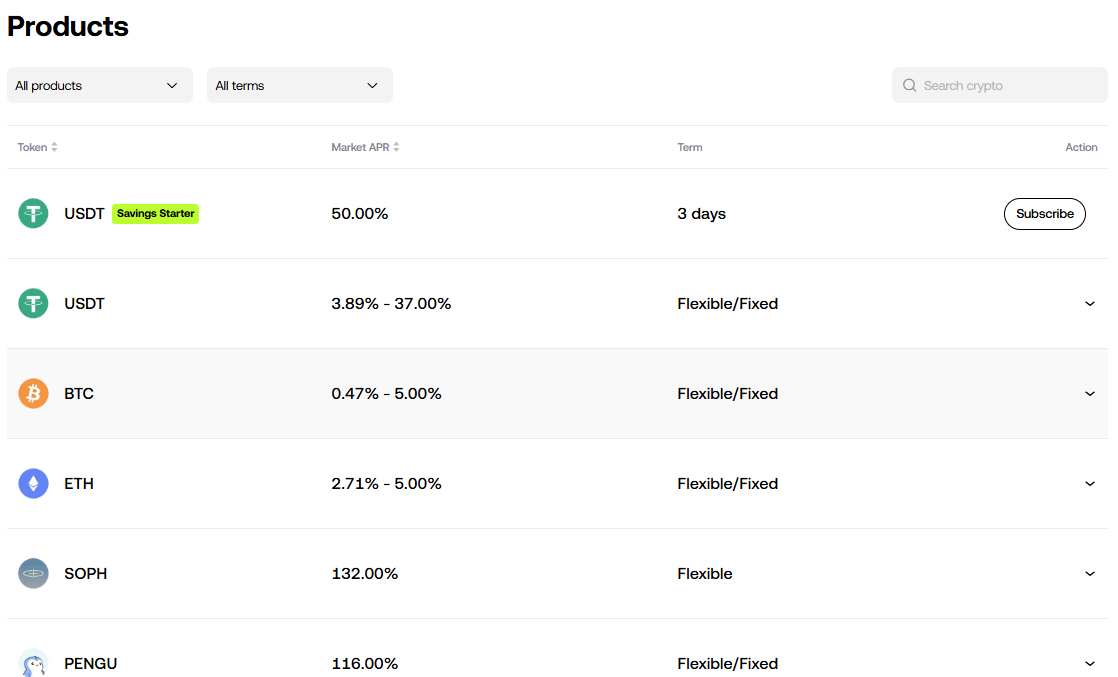

Earn

OKX Earn is aimed at investors who want to generate passive income from their crypto holdings. The platform offers staking, fixed and flexible savings, DeFi yield farming, and promotional high-yield products. Users can choose between locked terms for higher returns or flexible terms for easy withdrawals. Earn is suitable for long-term holders looking to maximise the value of their assets without active trading.

xBTC – Wrapped Bitcoin by OKX

xBTC is a wrapped Bitcoin token issued by OKX, maintaining a 1:1 reserve fully backed by native BTC and verified through on-chain Proof of Reserves. It allows Bitcoin holders to use their assets within the DeFi ecosystem while retaining the same security and value as BTC. With cross-chain support, xBTC can be moved across multiple networks such as Solana, Aptos, and Sui, enabling activities like lending, liquidity mining, and trading on integrated DeFi platforms. Converting between BTC and xBTC is straightforward: withdraw BTC from OKX to a supported blockchain to receive xBTC, or deposit xBTC back to OKX to redeem native BTC.

OKX Jumpstart

OKX Jumpstart is the platform’s token launch service, giving users early access to new cryptocurrency projects before they are widely listed. Participation often requires holding OKB tokens, with allocation based on the amount staked or committed. Projects are vetted by OKX, and token sales are conducted on a first-come, first-served or proportional basis. This feature allows users to support new ventures and potentially secure tokens at an early stage, though it carries the same risks as any early investment in a volatile market.

OKX Security

OKX combines multiple security measures to protect accounts and funds. Email and mobile verification are required for sensitive actions, while mandatory 2FA via Google Authenticator adds an extra layer. An anti-phishing code helps confirm genuine OKX communications, and withdrawal passwords secure fund transfers.

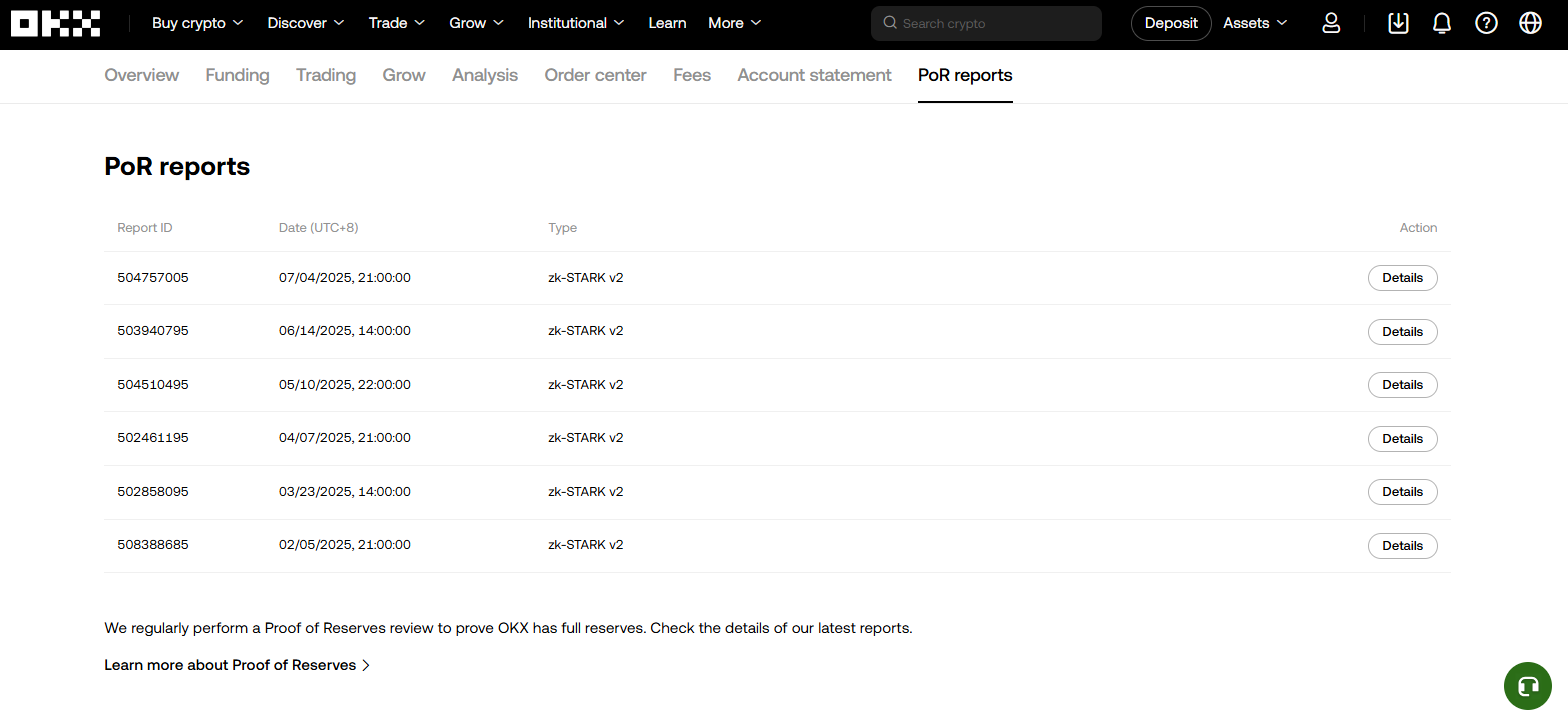

Strong encryption safeguards personal data, and assets are stored using a mix of secure online systems and multisignature cold storage with multiple backups. OKX also publishes an on-chain Proof of Reserves (PoR), allowing anyone to verify the backing of user assets through blockchain data. The OKX Risk Shield offers additional protection during extreme market events or user mistakes.

If you decide to leave the platform, OKX allows full account deletion, see our OKX account deletion guide for details.

OKX Customer Services

OKX customer service provides a comprehensive help center. They offer 24/7 support for various issues, including account management, deposits, withdrawals, etc. Users can contact them via their contact page or live chat for additional support. OKX is committed to ensuring a positive user experience and success. Their customer service is secured with bank-level SSL encryption and cold storage technology.

OKX Alternatives

OKX is a well-established exchange, but if you’re looking for alternatives, check these out:

- Bybit: Bybit has a similar range of features with deep liquidity and a large user base.

- BloFin: Blofin is a good choice if you need a no-KYC option with a wide selection of cryptocurrencies and competitive trading fees.

- Bitunix: Bitunix is another solid no-KYC option with high leverage and a user-friendly platform.

| Feature | OKX | Bybit | BloFin | Bitunix |

|---|---|---|---|---|

| Established | 2017 | 2018 | 2019 | 2022 |

| Spot Fees (Maker/Taker) | 0.08% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.020% / 0.050% | 0.020% / 0.055% | 0.020% / 0.060% | 0.020% / 0.060% |

| Max Leverage | 125x | 100x | 150x | 125x |

| KYC Required | Yes | Yes | No | No |

| Supported Cryptos (Spot) | 349+ | 726+ | 564+ | 541+ |

| Futures Contracts | 290+ | 578+ | 440+ | 400+ |

| No KYC Withdrawal Limit | Not Allowed | Not Allowed | $20,000 | $500,000 |

| 24h Futures Volume | $44.12B+ | $41.16B+ | $2.38B+ | $10.97B+ |

| Trading Bonus | $10 | $30,000 | $5,000 | $5,500 |

| Key Features | • Deep liquidity • Lowest spot maker fees • Multiple trading options |

• Most cryptocurrencies • Highest trading bonus • Advanced features |

• No KYC required • High leverage (150x) |

• No KYC required • User-friendly • Multiple fiat options |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

OKX delivers a broad mix of trading, earning, and wallet features, supported by competitive fees and strong liquidity. Its product range; from spot and futures to options, P2P, and trading bots, gives users multiple ways to trade and manage assets. Security is backed by on-chain Proof of Reserves, cold storage, and layered account protections.

However, mandatory KYC and restrictions in certain regions mean it’s not accessible to everyone, and its wide feature set can feel complex for beginners. For those able to use it, OKX offers a capable environment with transparent security practices and 24/7 support. The decision comes down to whether its tools, costs, and accessibility align with your priorities as a trader or investor.

FAQS

1. Is OKX legit?

OKX is a widely recognized crypto exchange. It is supported in over 200 countries worldwide, which makes it a legitimate platform.

2. Is OKX available in the United States?

OKX is not available to users in the United States due to some regulatory issues.

3. Where is OKX located?

OKX is a Seychelles-based crypto exchange that was founded in 2017.

4. Does OKX have a native token?

OKX has a native token, OKB, that users can also trade with.

5. Does OKX require KYC?

Yes, OKX requires KYC verification to trade and access all features, with higher verification levels unlocking increased withdrawal limits.