Starting the copy trading journey with OKX is a rewarding experience that begins with the crucial step of understanding how to copy Trade on OKX, one of the world’s leading crypto exchanges with over 50 million users.

In this blog post, we’ll walk you through the seamless process of setting up and executing successful copy trades. Follow our comprehensive guide to unlock the full potential of copy trading on OKX. So let’s get started.

OKX Overview

Established by Chinese investor Minxing “Star” Xu, it joined OK Group in 2013, initially named OKEx until its 2022 rebranding as OKX. Presently the 6th largest global crypto exchange by Coinmarketcap’s trading volume ranking.

Providing spot and futures trading with user-friendly interfaces, OKX imposes low fees on transactions and withdrawals. The platform lists over 350 cryptocurrencies and 500+ trading pairs.

On top of standard offerings, OKX offers 150 USDT pairs for trading perpetually and margin, crypto loans, and NFT. Geared towards advanced traders, its interface may appear more detailed for beginners.

Diversifying its offerings, OKX caters to users with staking, copy trading, trading bots, DeFi, and more. Its extensive user base exceeds 50 million globally, and it operates a native blockchain, OK chain, featuring the OKB token. Read out our comprehensive OKX review if you want detailed insights into its features, security measures, and overall performance.

OKX Copy Trading Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Successful transactions result in actual profits for participants | ❌ Investors may face losses if the strategies of copied traders prove unsuccessful |

| ✅ Observe and learn from professional traders, gaining insights into their techniques | ❌ Trading errors can magnify losses, constraining deposit flexibility |

| ✅ Engage in copy trading with minimal or no prior experience in the financial markets | ❌ The primary challenge lies in market risk, posing a substantial threat to traders |

| ✅ Experience minimal losses, often confined to temporary deposit shortfalls | ❌ Your success is dependent on the performance of chosen traders, leading to potential uncertainties |

| ✅ Benefit from a diverse range of trading strategies by copying multiple traders simultaneously |

How is Copy Trading on OKX Different?

OKX differentiates itself in copy trading through a user-friendly platform, offering a diverse range of traders with transparent performance data. Investors can thoroughly research and select traders based on historical results and risk management strategies.

OKX’s robust system emphasizes data-driven decision-making, enhancing the copy trading experience. Okx allows you to analyze a traders performance in-depth before copying them.

OKX Copy Trading Market

OKX Copy Trading, a component within the OKX Social Trading framework, introduces a transformative trading experience. Enabling users to seamlessly exchange trading strategies offers access to multiple trading pairs from skilled global traders.

With easy setup for automated copy trades, users can effortlessly follow experienced traders, diversify their portfolios, and benefit from a diverse range of trading pairs. Whether tailing favourite traders or discovering emerging talents on the leaderboard, OKX Copy Trading enhances accessibility and simplifies profit potential. It facilitates the acquisition of analytical skills necessary for evolving into a proficient trader.

Types of OKX Copy Trading

1: Futures Copy Trading

Futures trading, known for leverage and margins, involves predicting price movements for potential profits.OKX facilitates copy trading for futures, allowing users to imitate the strategies of experienced traders in the futures market.

Investors can benefit from the insights of skilled futures traders, leveraging their expertise to navigate the complexities of derivative trading.

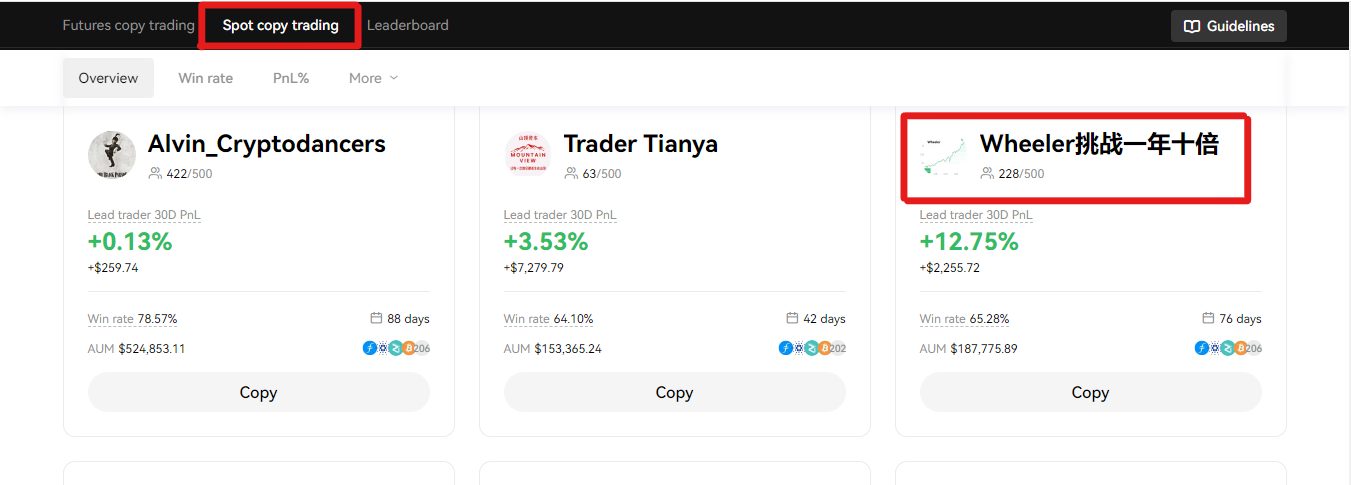

2: Spot Copy Trading

Spot trading, a widely considered trading format, can be challenging for beginners to analyze market trends accurately. OKX Spot Copy Trading addresses this by allowing novices to identify successful traders based on performance metrics like PnL, or followers.

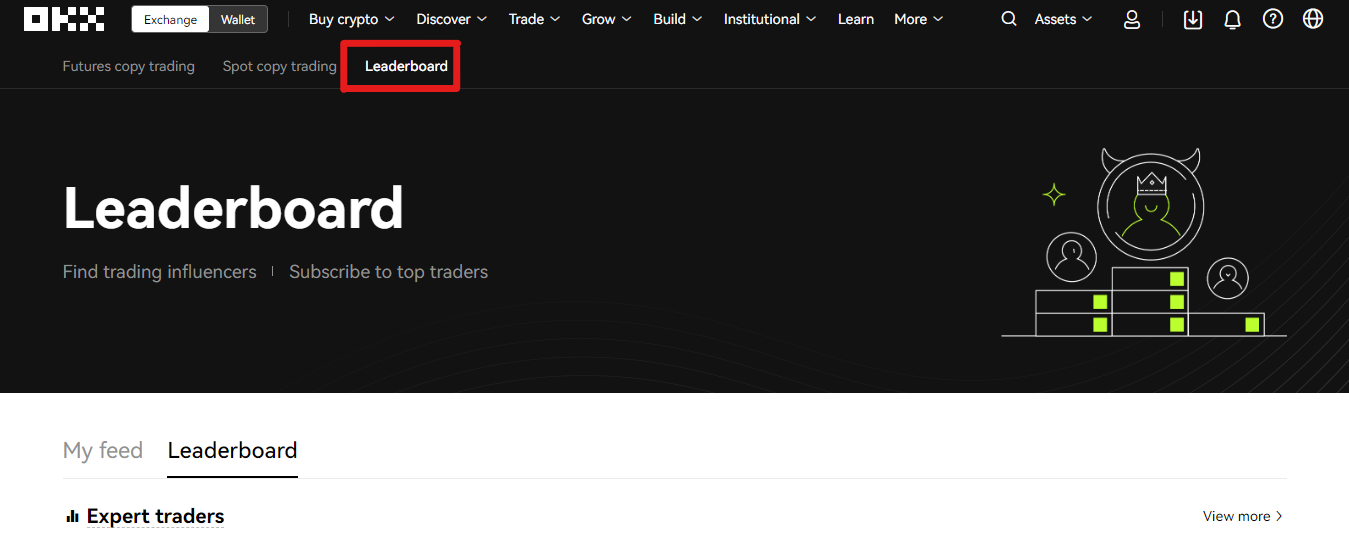

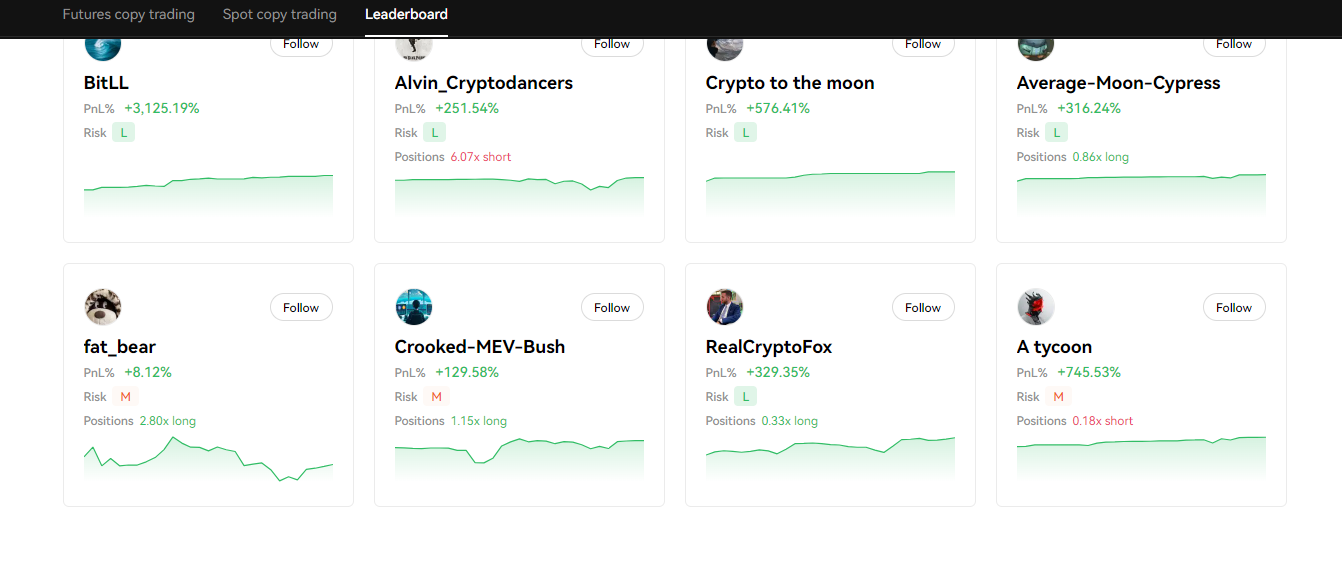

3: Leaderboard Copy Trading

The Leaderboard feature on OKX Copy Trading serves as a showcase of top-performing traders within the community. It allows users to identify and follow lead traders based on their historical performance and success rates.

OKX Copy Trading Fees

On OKX, the trading fees remain consistent with your regular trading tier, for instance for spot trading the fees are 0.080% maker and 0.100% taker fees, for futures trading OKX has 0.020% maker fees and 0.050% as taker fees.There are no additional transaction fees aside from the profit share distributed to the lead trader which vary between 8% to 13%.

Traders vs Followers

Followers mimic expert traders’ patterns and strategies with a simple click, benefiting from automated processes that replicate trades. They have the flexibility to customize parameters for precise operations. Followers can continue autonomously, and select a new trader to imitate.Both followers and traders establish a permanent nickname and profile picture, which is crucial for identity representation on the copy trading page.

Set up Copy Trading on OKX

Here is a step-by-step guide to begin copy trading on OKX.

Futures Copy Trading Guide

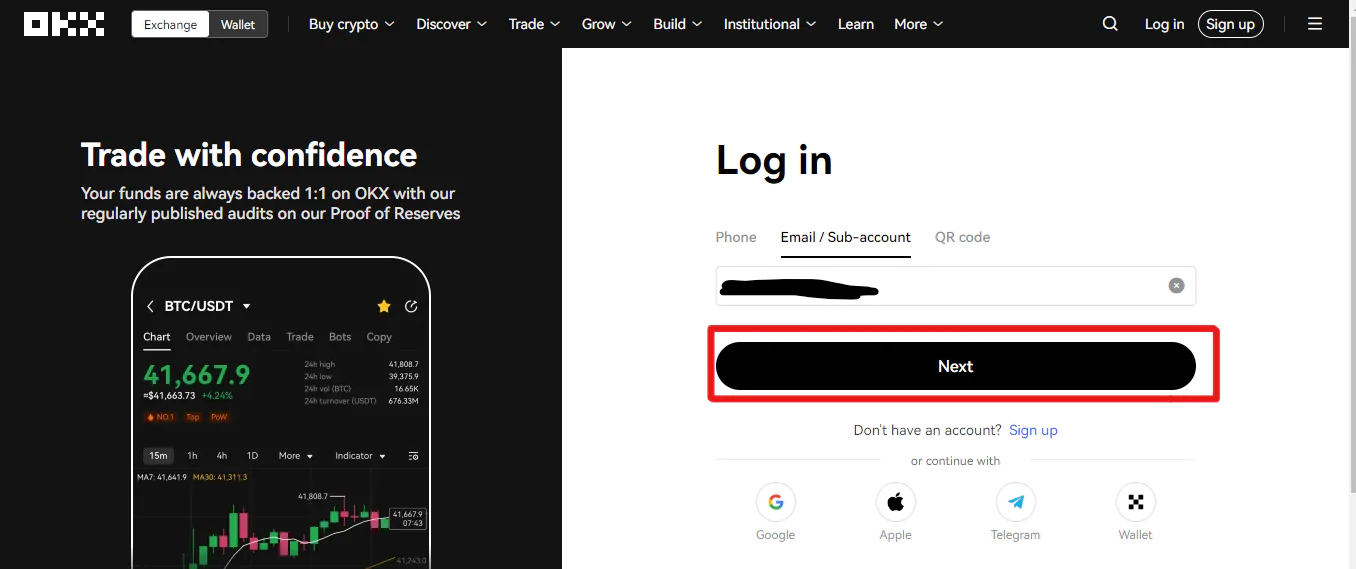

Step 1: Logging into your OKX account

Access your OKX account by visiting the official OKX website or using the OKX mobile app. Enter your login credentials, including your username and password.

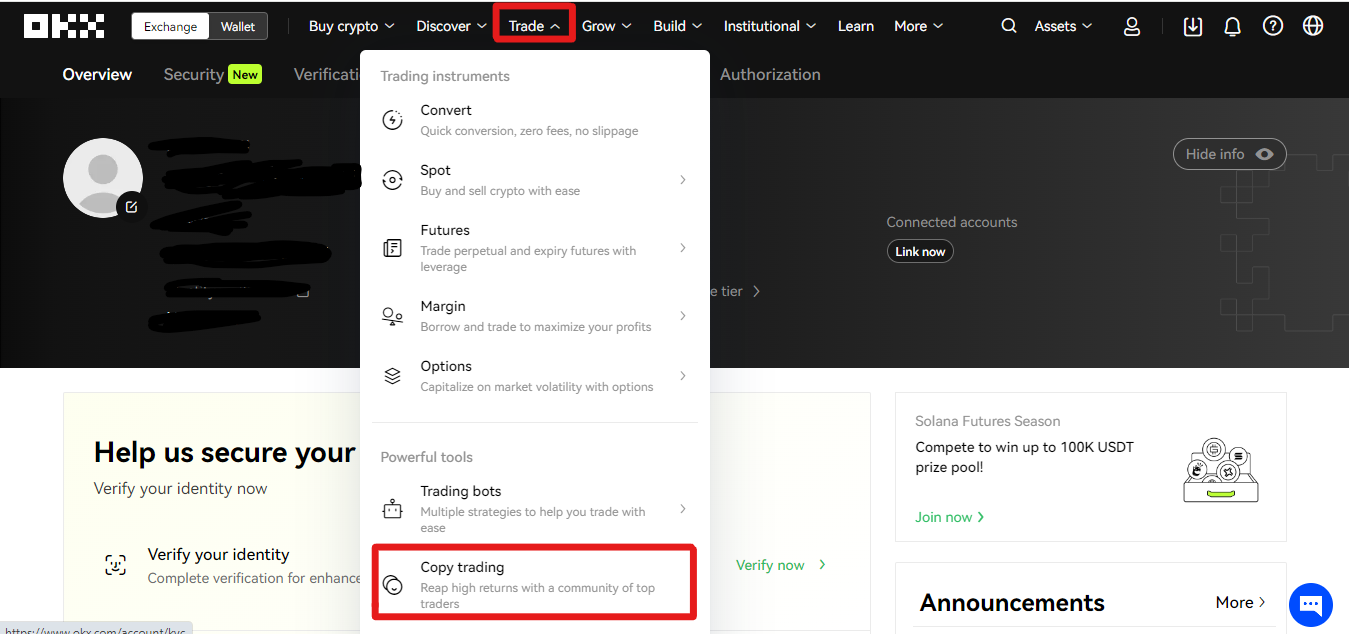

Step 2: Click on Trade Option and Select Copy Trading

Once logged in, navigate to the Trade section located on the platform’s main menu. Within the Trade section, locate and choose the option labelled “Copy Trading” to gain access to a list of lead trader profiles.

Step 3: Access Copy Trading Page

Open the Copy Trading page and specifically choose “Futures Copy Trading.”

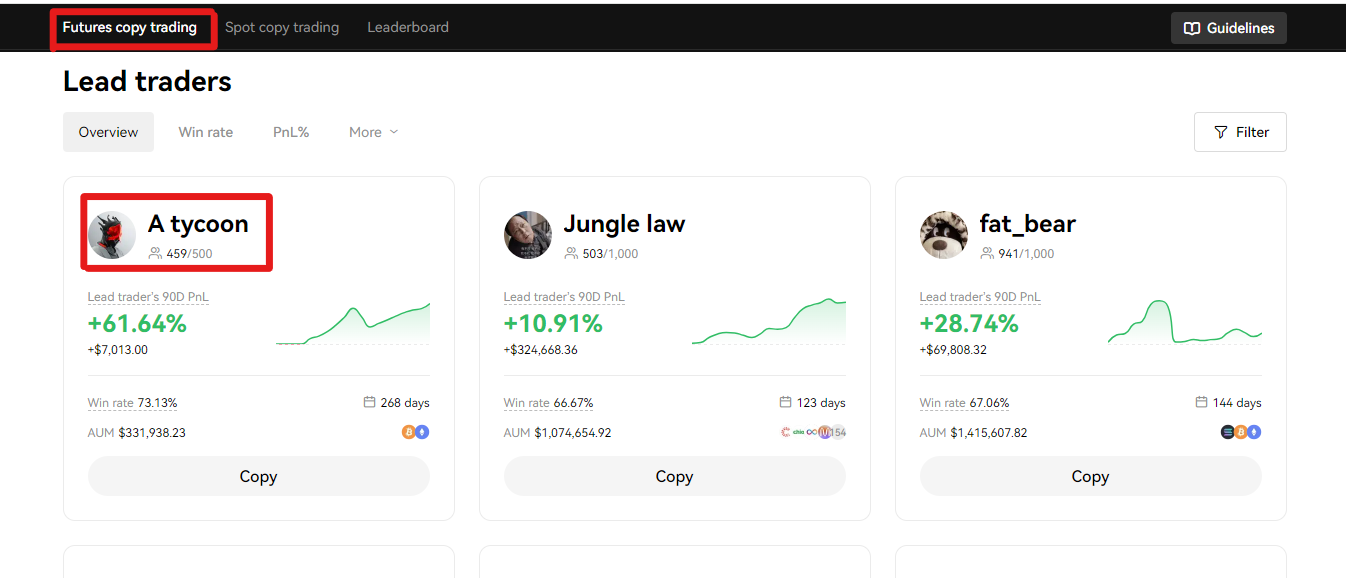

Step 4: Scroll Down and Select a Trader

Review the profiles of various lead traders to understand their trading statistics and performance. Choose a lead trader that aligns with your preferences.

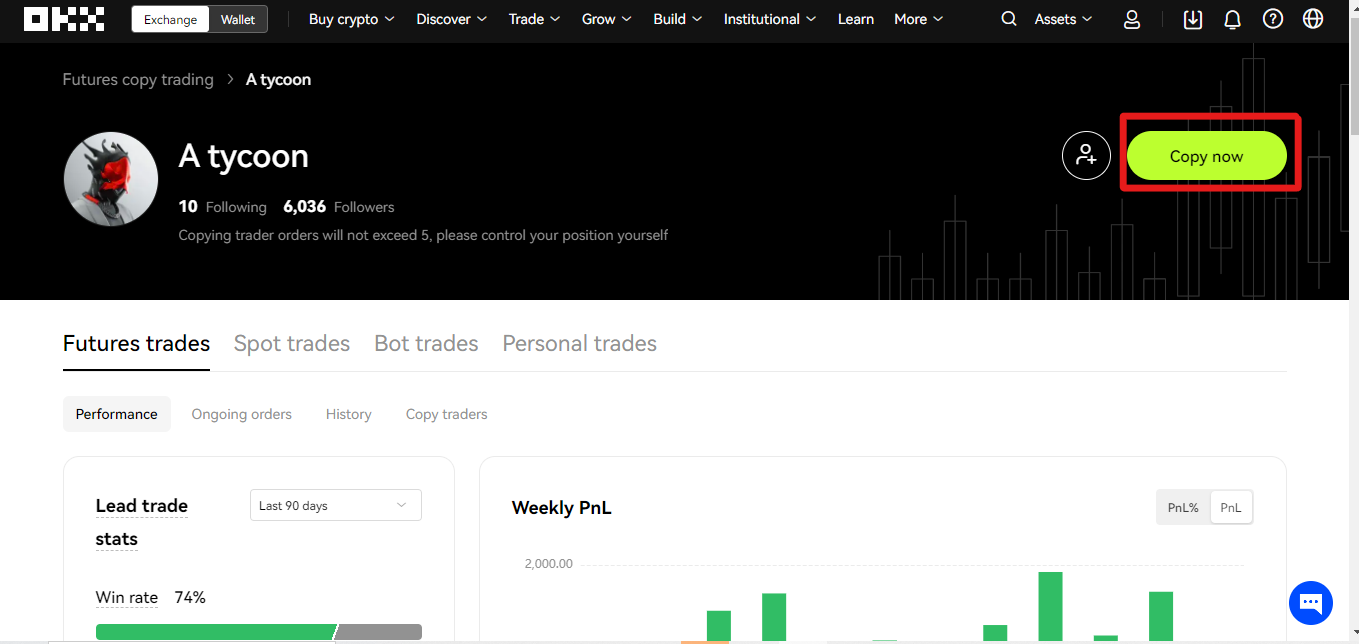

Step 5: Click on Prefered Trader Profile

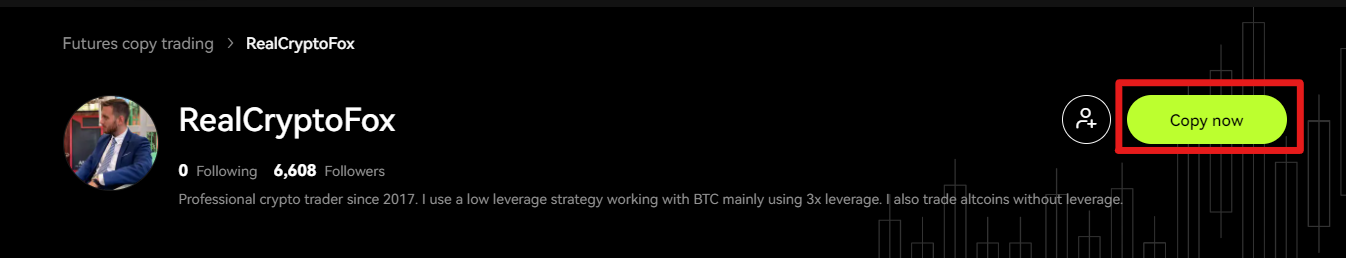

Click on your preferred lead trader’s profile to examine their details to gain insights into their trading strategy.

Step 6: Scroll Down and Read Their Details

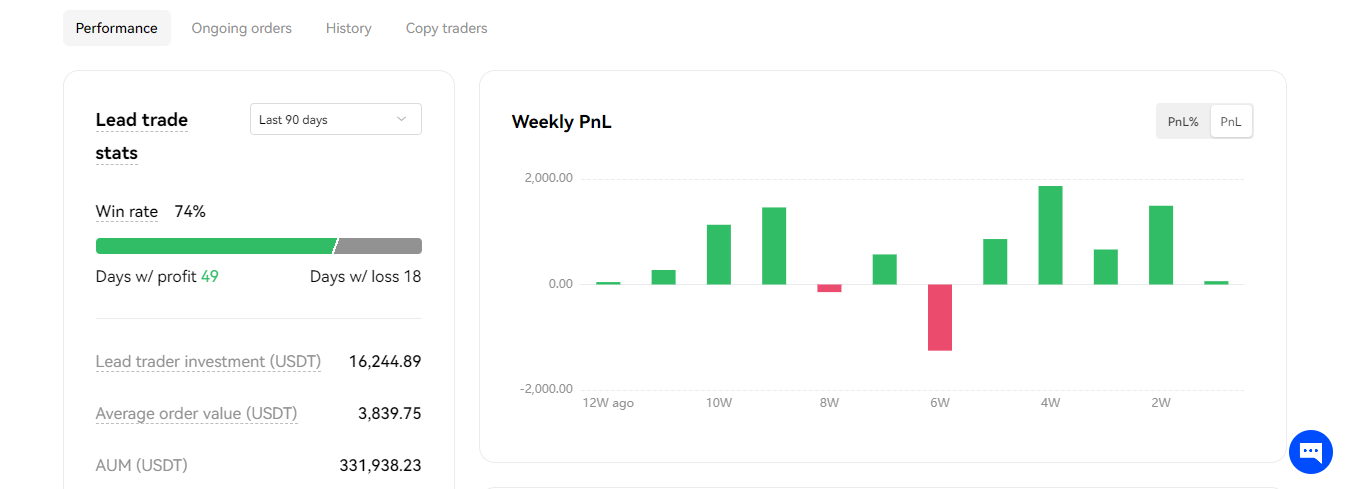

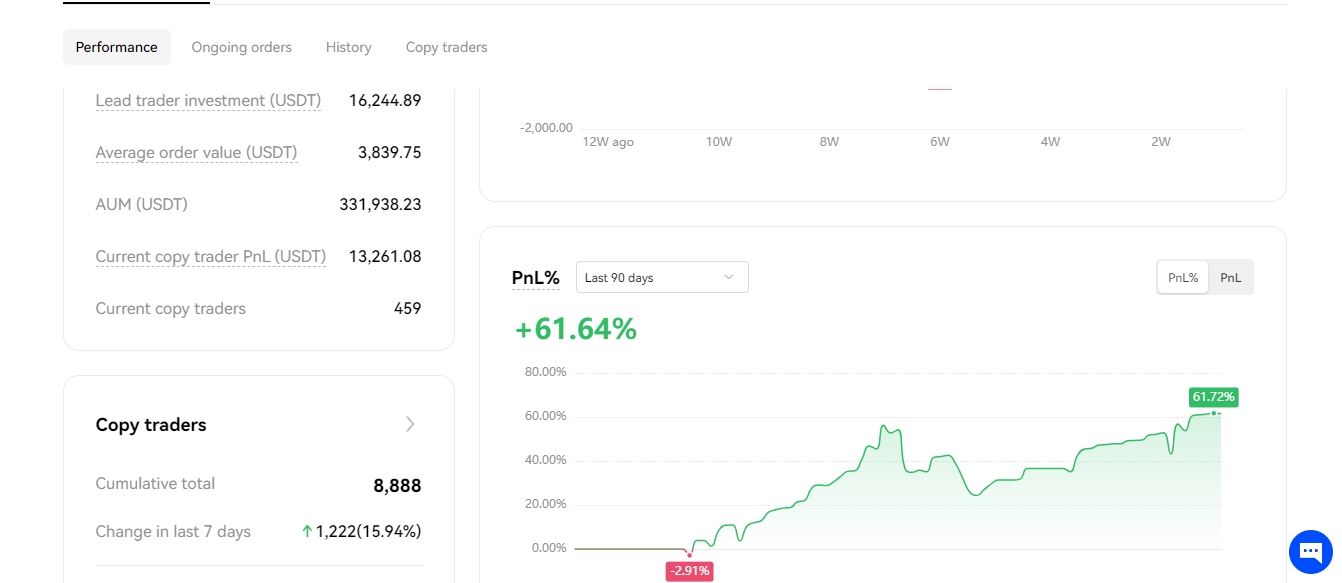

Explore lead trader details to inform your copy trading decision. Analyze performance, strategies, and statistics for a well-informed choice. For example, this trader has a sin rate of 74% and $331.938 as the amount of management which is pretty decent.

Step 7: Click on Copy

Select the “Copy” option to begin copying your chosen lead trader’s orders and strategy.

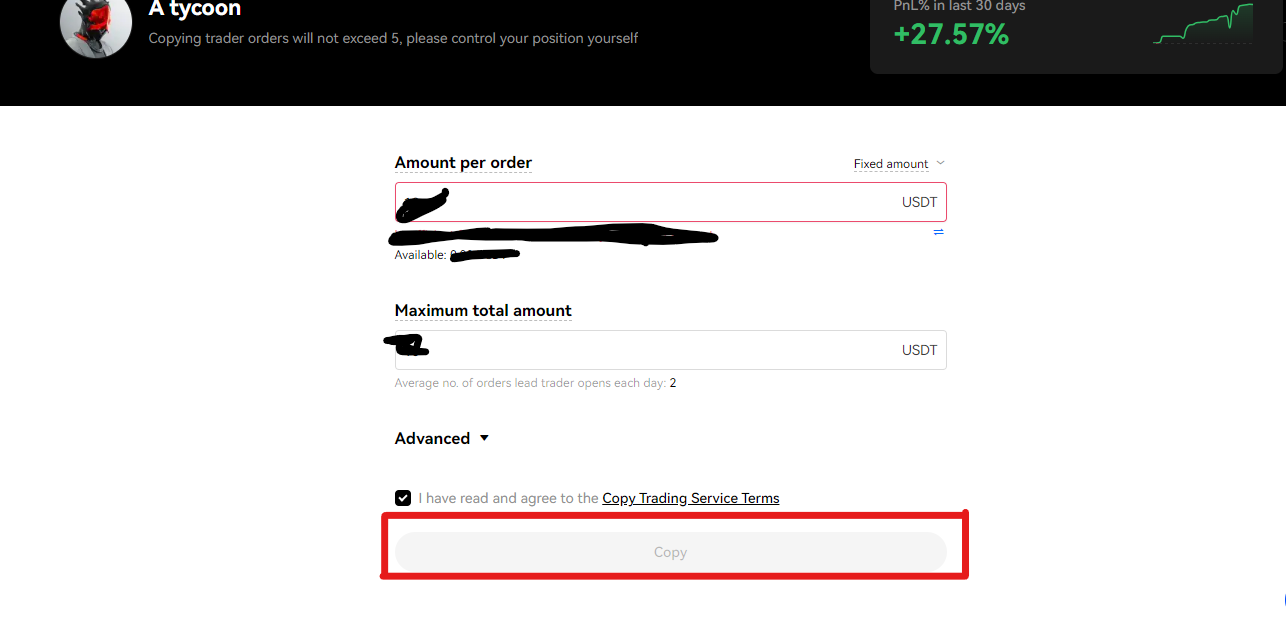

Step 8: Choose Between Fixed Amount and Proportional Amount

Decide between “Fixed amount” and “Proportional amount” based on your preference. This determines how much you’ll invest in each trade.

Note:

- Fixed Amount: Specify a constant margin for each copy trade order. For instance, entering 10 USDT means consistently investing 10 USDT as the margin for your trades.

- Proportional Amount: Multiply your lead trader’s orders (e.g., 0.1x) for flexible investments aligned with their strategy.

Step 9: Set Amount and Maximum Total

Insert your preferred amount per order (minimum 10 USDT) and specify the maximum total amount you want to copy from the lead trader.

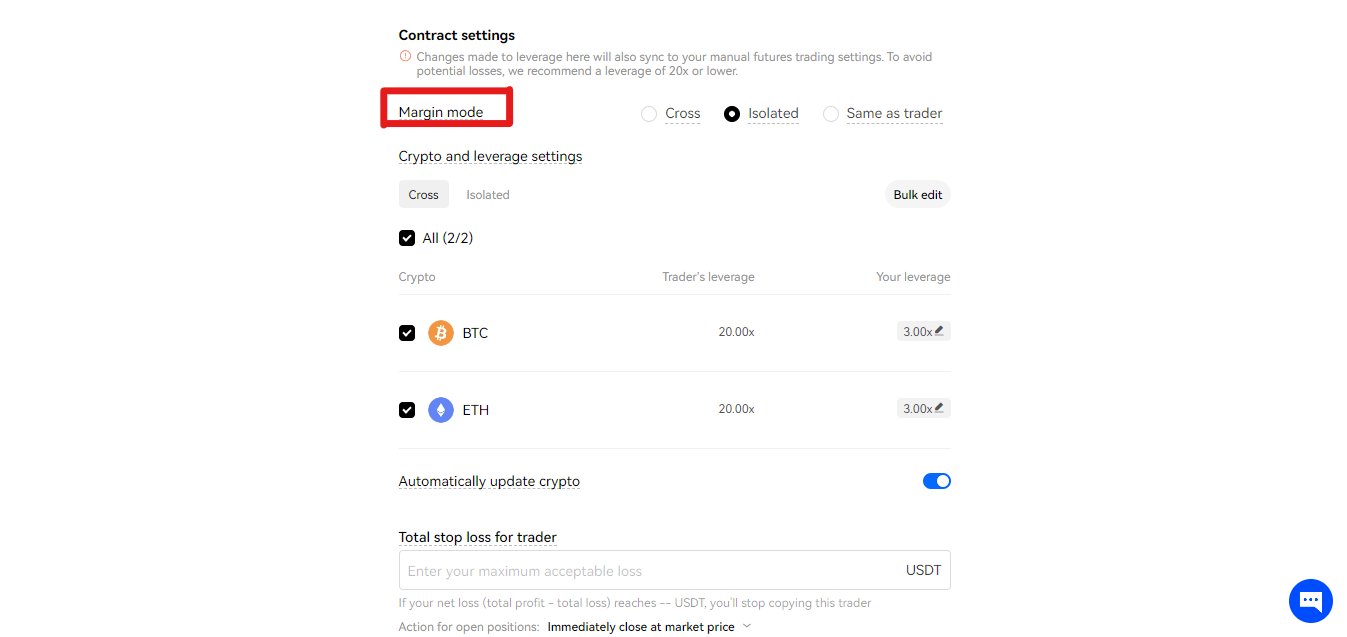

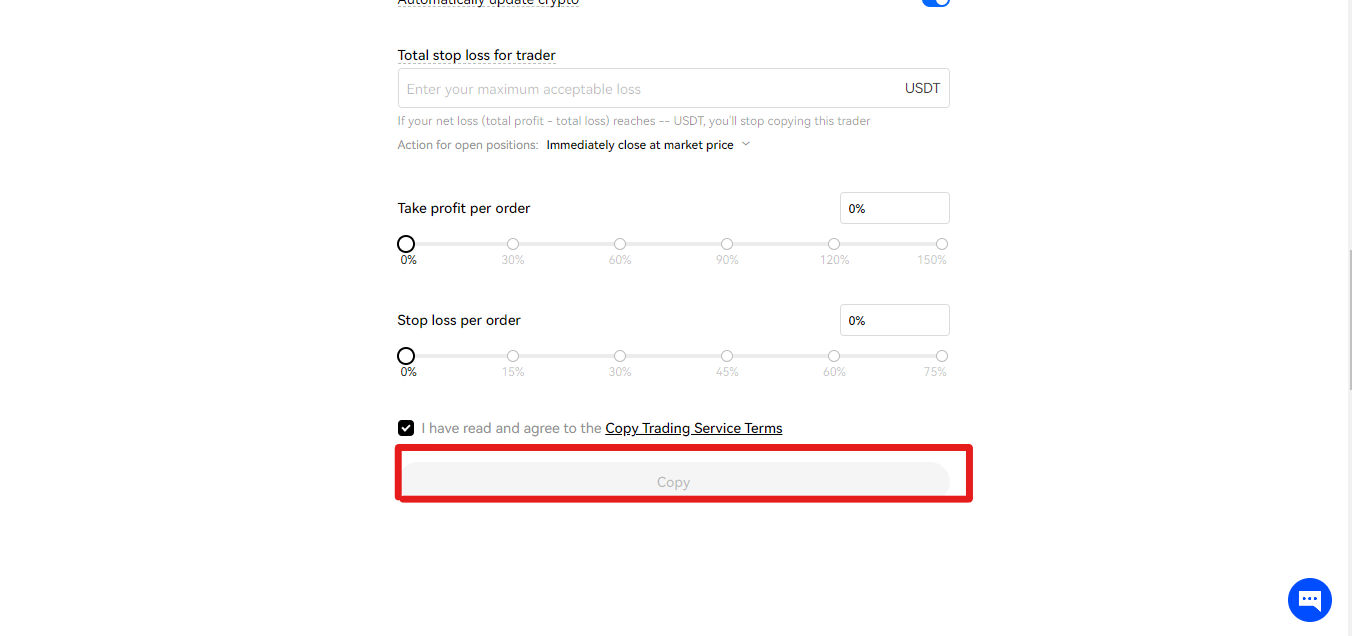

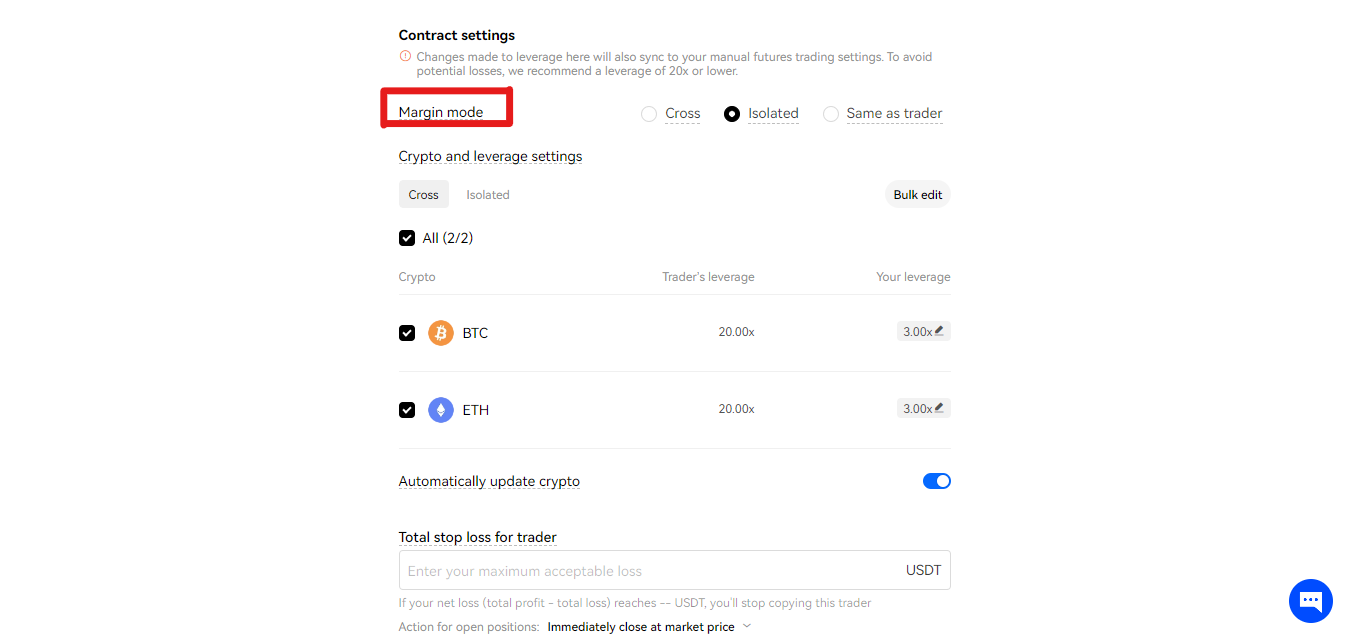

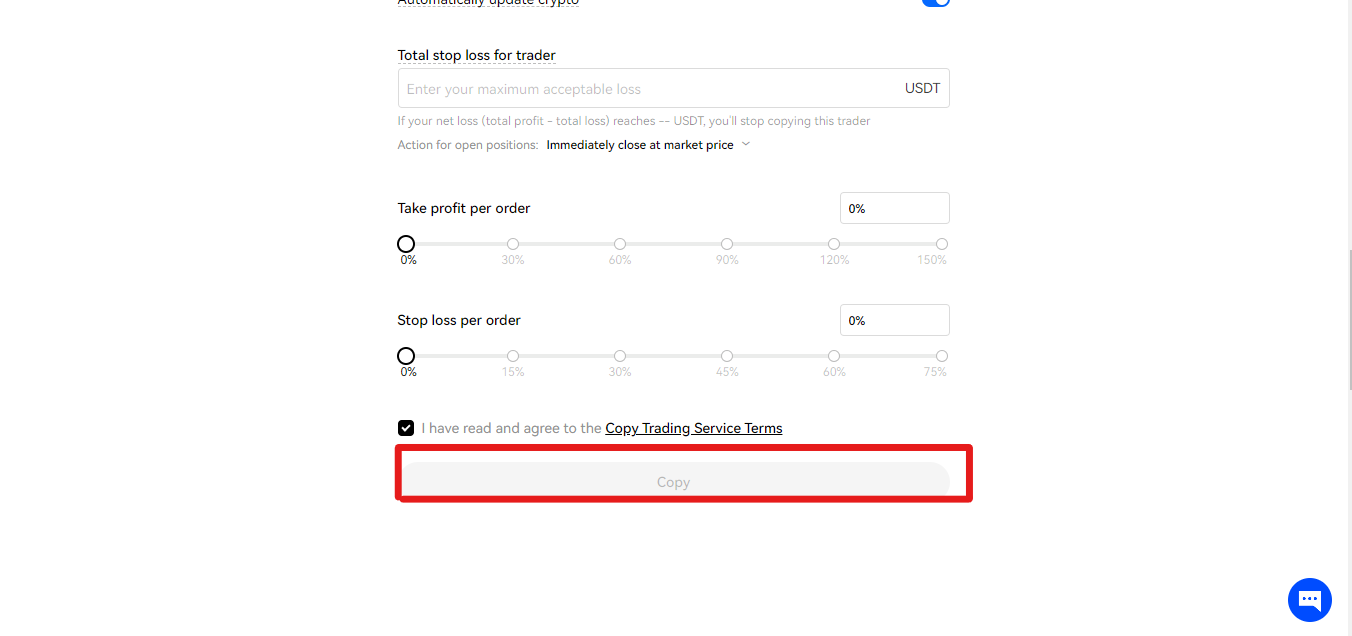

Step 10: Configure Advanced Settings

You can customise your contract type, margin mode, leverage, total stop loss, take profit, and stop loss per order according to your preferences.

Step 11: Review and Confirm

Select “Copy” after configuring your preferences.Review the order summary displayed to ensure accuracy.

Spot Copy Trading Guide

Step 1: Access Copy Trading Page and Select Spot Copy Trading

After entering the Copy Trading section, specifically opt for Spot Copy Trading as it involves the trading of actual cryptocurrencies rather than derivatives.

Step 2: Scroll Down and Choose a Trader

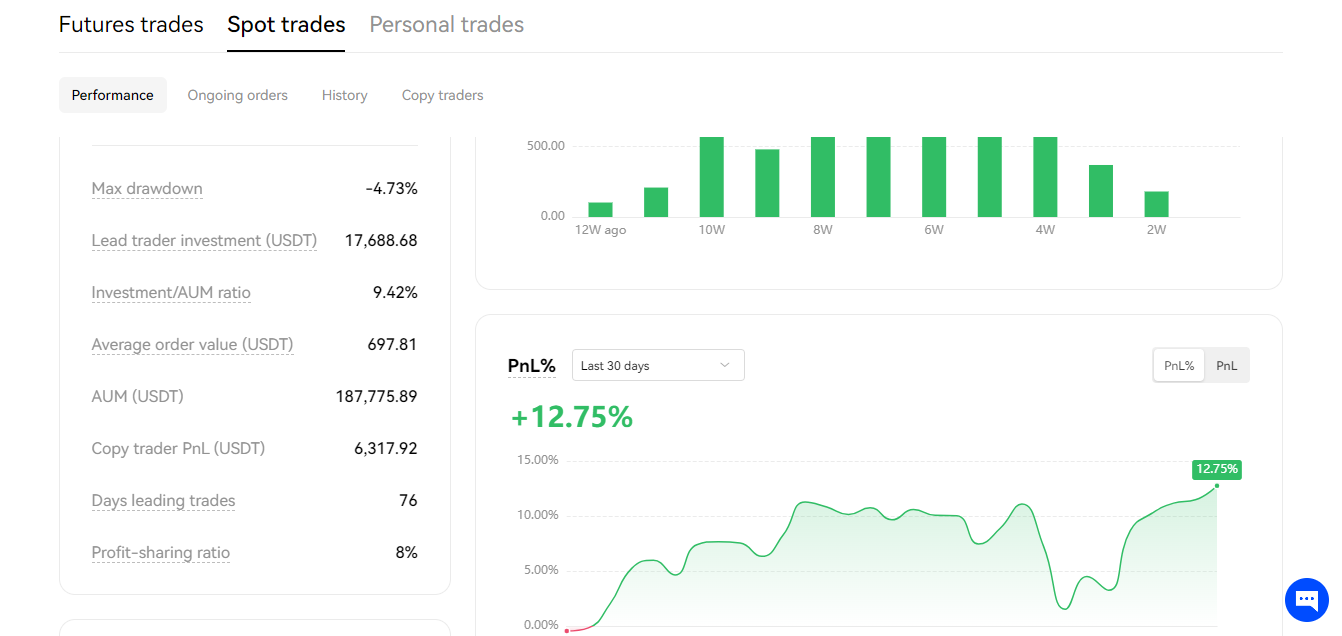

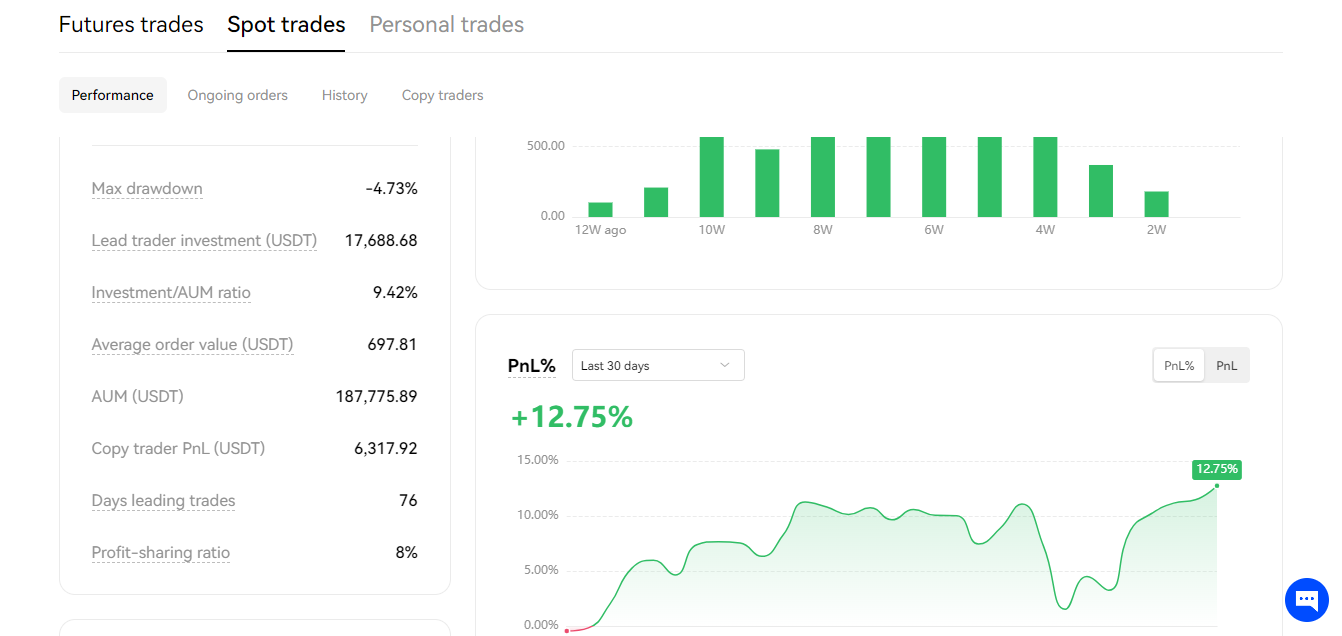

Within the Spot Copy Trading section, take the time to thoroughly review lead trader profiles.Assess key trading statistics such as past performance, risk factors, and consistency.

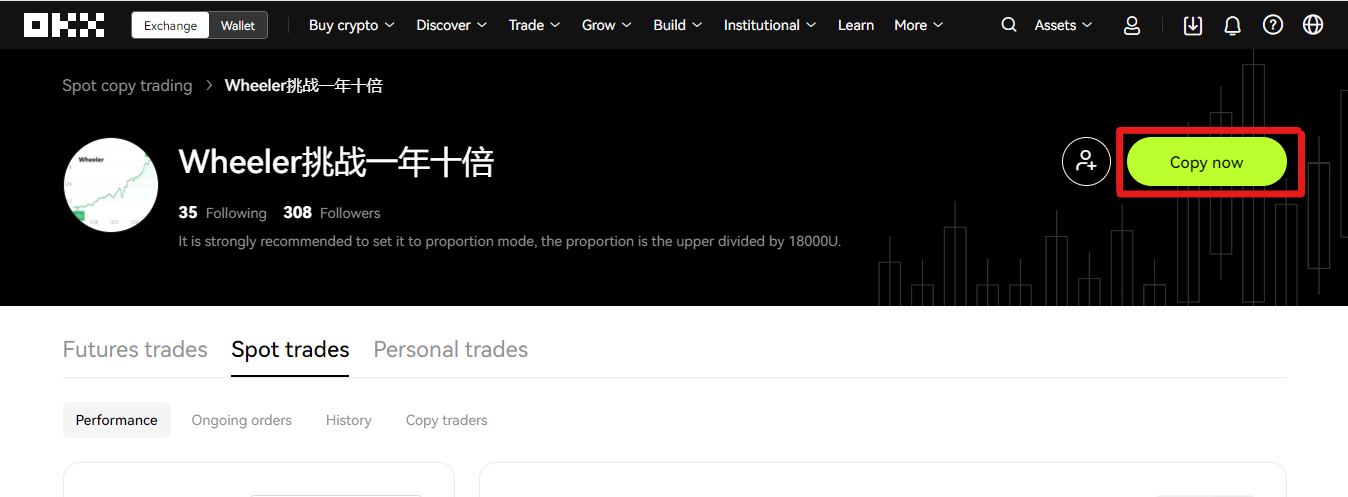

Step 3: Open Prefered Trader Profile

Click on the profile of the lead trader you find most suitable for your copy trading strategy.This will open a detailed view of the chosen trader’s profile, providing insights into their trading history and strategies.

Step 4: Review Their Details

Investigate the trader’s profile details, including trading strategies employed, risk management practices.Consider factors such as trading frequency, preferred assets, and overall market approach.

Step 5: Initiate Copy Process

Once satisfied with your chosen lead trader, select the “Copy” button to initiate the copy trading process.This action will link your account to the selected lead trader, allowing you to mirror their trading activitie.

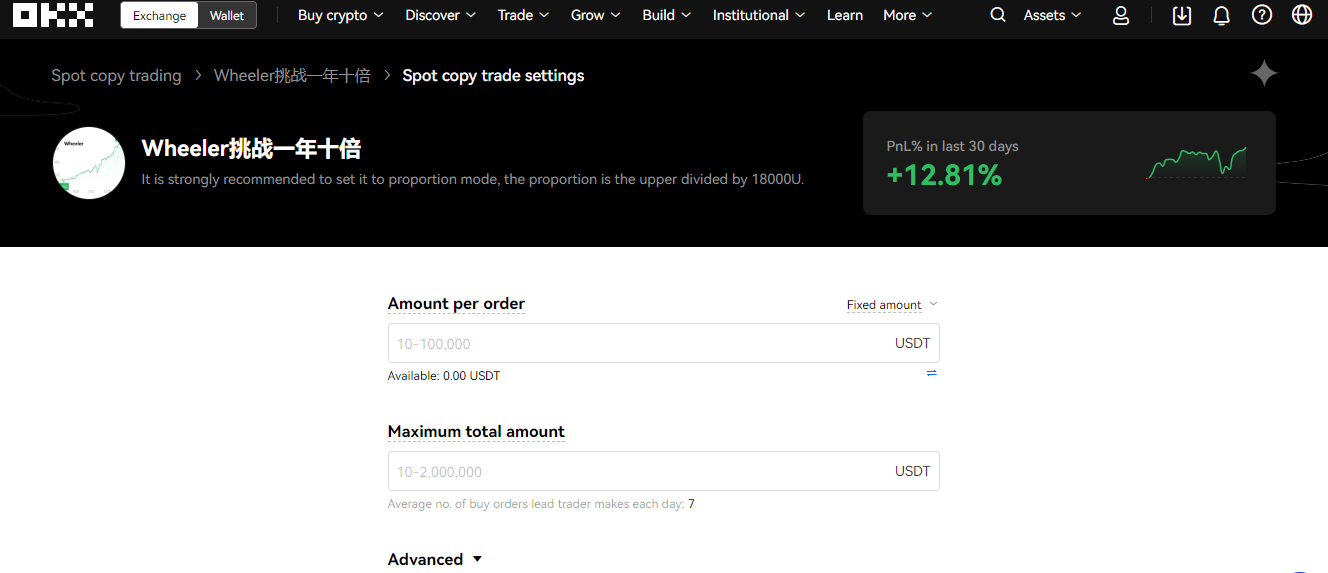

Step 6: Decide Between Fixed Amount and Propotional Amount

From the top right corner of the Copy Trading interface, choose between “Fixed amount” or “Proportional amount” based on your preferred copying strategy.

Step 7: Set Amount and Maximum Total

Input a minimum of 10 USDT in the “Amount per order” field, which represents the minimum margin for each copied trade. Specify the “Maximum total amount” you wish to allocate for copying trades from your preferred lead trader.

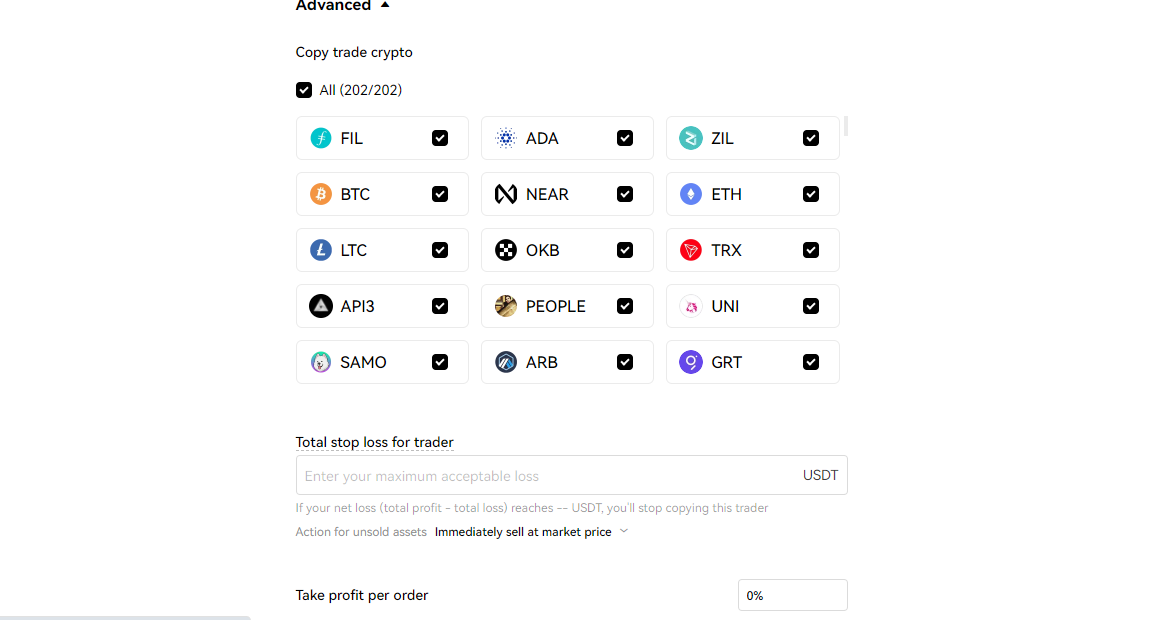

Step 8: Configure Advanced Settings

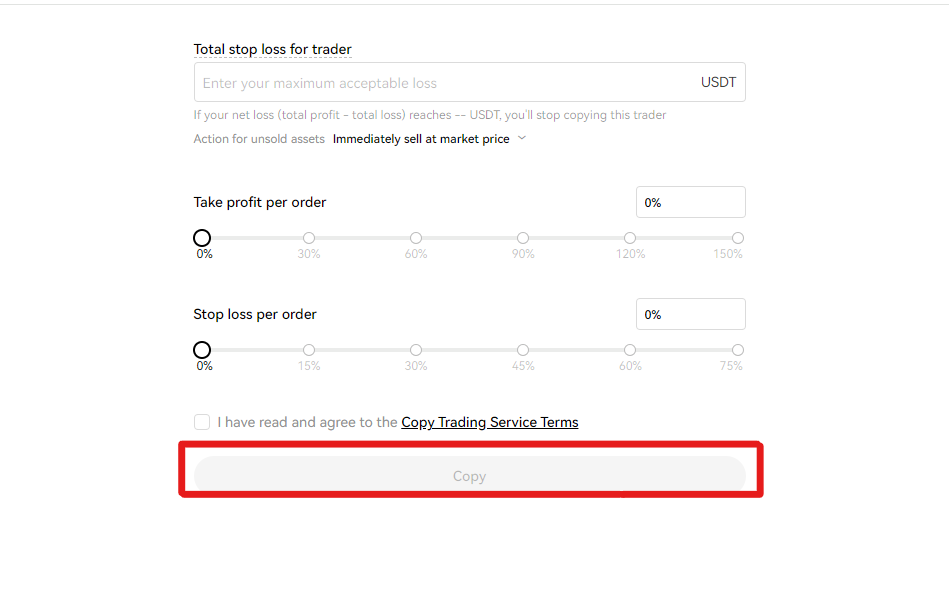

In the advanced settings section, customize contract settings by choosing the contract type, margin mode, and leverage.Set a “Total Stop Loss” for all trades to manage risk effectively.Establish “Stop Loss” values per order to automate profit-taking and limit potential losses.

Step 9: Review and Confirm

Click the “Copy” button after configuring all settings to confirm and finalize the copy order

LeaderBoard Copy Trading Guide

Step 1: Access Copy Trading Page

on the Copy Trading page click on LeaderBoard Option.

Step 2: Scroll Down and Choose a Trader

Review each lead trader’s profile to assess their trading statistics and performance, aiding you in finding a suitable lead trader.

Step 3: View Prefered Trader Profile Open the profile of the lead trader you prefer.

Examine Details look into the details of the selected lead trader to understand their trading strategy.

Step 4: Initiate Copy Process

Select the “Copy” option to copy your preferred lead trader’s trading strategy.

Step 5: Choose Order Amount Type

From the top right corner, select either Fixed amount or Proportional amount based on your preferences.

Step 6: Set Amounts

Insert your preferred amount per order (minimum 10 USDT) and the maximum total amount you wish to copy from the lead trader.

Step 7: Customize Advanced Settings

Customize contract type, margin mode, leverage, total stop loss, take profit, and stop loss based on your preferences and the lead trader’s suggestions.

Step 8: Finalize and Confirm

If satisfied, select “Copy” to complete the order, and the system will display an order summary for your reference.

OKX Copy Trading Checklist

Discover our OKC Copy Trading Checklist crafted to assess the compatibility of a trader for your investment journey.

- Followers: Evaluate the number of followers a trader has. Higher followers may indicate a trusted and experienced trader, but ensure they have a diverse follower base.

- PNL Rates (Profit and Loss): Examine the trader’s historical PNL rates. Consistent profits over time are crucial, and be cautious of excessively high returns that may involve higher risks.

- Actual Account: Confirm that the trader is trading with a real account, not a demo account. Real accounts reflect actual market conditions and the trader’s genuine capabilities.

- Amount Under Management: Check the total assets under the trader’s management. A balanced approach is essential; excessively high or low amounts may impact risk management strategies.

- Risk Management: Assess the trader’s risk management practices. Look for a clear strategy to limit losses, set stop-loss orders, and manage drawdowns effectively

Tips for Success in Copy Trading

- Diversify Your Portfolio:Spread your investment across multiple traders on OKX to reduce risk. Diversification helps mitigate the impact of poor performance from any single trader. Consider copying traders with different strategies for a well-balanced portfolio.

- Thoroughly Research Traders: Before copying a trader, conduct in-depth research. Examine their trading history, risk management practices, and overall performance.

- Regularly Review and Adjust: Keep a close eye on your copied traders’ performance. Regularly review their results and assess if they still align with your expectations. If a trader’s performance falters or their strategy changes, consider adjusting your portfolio accordingly.

- Set Realistic Expectations:Establish realistic expectations for returns and understand the inherent risks involved in copy trading on OKX. Markets fluctuate, and past performance does not guarantee future result.

- Do Not Fear Losses: Losses are an inherent part of trading. Instead of fearing them, view losses as opportunities to learn and refine your strategy.

Final Verdict

Exploring copy trading on OKX means discovering various investment strategies. This guide helps users easily start their copy trading adventure, tapping into the expertise of experienced traders. Stay alert to risks and be cautious with investments. Stay informed, adapt to market changes, and make smart decisions for a fulfilling copy trading journey on OKX.

OKX Copy Trading FAQs

1 – Are there any specific requirements or qualifications for participating in OKX Copy Trading?

To participate in OKX Copy Trading, users typically need to have a verified OKX account. While specific requirements may vary, having a basic understanding of cryptocurrency trading and risk management is advisable.

2 – Are there any risk management strategies integrated into OKX Copy Trading?

Yes, OKX Copy Trading incorporates risk management strategies to enhance investor protection. The platform employs features like stop-loss mechanisms and risk level customization, allowing users to manage their exposure effectively.

3 – Are there any fees associated with using OKX Copy Trading, and if so, how are they structured?

Yes, OKX Copy Trading may involve fees. The fee structure typically includes a portion of profits earned through copy trading. Additionally, some platforms may charge a management fee or performance fee.