- •Hyperliquid paused withdrawals following a $30M POPCAT liquidation event, though no evidence currently suggests a hack or asset loss.

- •A trader withdrew $3M USDC from OKX, used 19 wallets to build leveraged POPCAT longs, and was liquidated within seconds after removing a large buy wall.

- •Hyperliquid’s liquidity vault (HLP) absorbed roughly $4.9M in losses, while deposits remain active and the Arbitrum bridge is still paused.

In a surprising turn of events, Hyperliquid withdrawals paused on Wednesday following a major liquidation involving the POPCAT memecoin. The issue appears to have started after a trader attempted to build an unusually large leveraged position, which triggered a series of losses for the platform’s liquidity vault.

While the situation caused widespread speculation, initial reports suggest there is no evidence of a hack or major exploit. Instead, the pause seems to be a temporary safeguard as the platform manages the aftermath of an aggressive trading move that unfolded earlier in the day.

The Sequence of Events

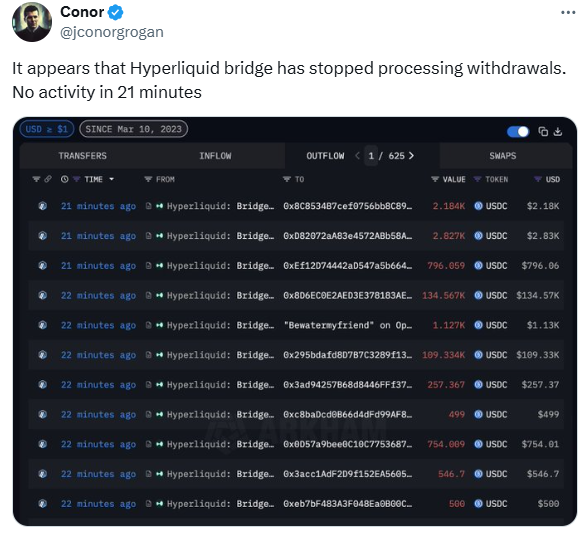

The first signs of trouble came when former Coinbase executive Conor Grogan noted on X that Hyperliquid’s bridge had stopped processing withdrawals. His post highlighted that there had been no bridge activity for over 20 minutes. However, he also clarified that the USDC bridge still held roughly $4.5 billion in assets, with deposits remaining active and no indication of mass fund outflows.

Around the same time, onchain analyst MLMabc shared a detailed thread outlining how the issue began. Roughly 13 hours earlier, a trader withdrew $3 million in USDC from the OKX exchange and distributed it across 19 wallets. By 14:45 CET, the trader began opening long positions on POPCAT, creating a massive $20 million buy wall at $0.21.

This position expanded to roughly $30 million in total across those wallets. Once the trader removed the buy wall, POPCAT’s price collapsed almost instantly. The liquidation of those leveraged positions was so severe that Hyperliquid’s liquidity provider (HLP) had to assume the losing side of the trade, resulting in an estimated $4.9 million loss for the protocol.

Related news: Hyperliquid Whale Linked to BitForex CEO

Platform Response and Speculation

Soon after, users noticed that Hyperliquid had paused both deposits and withdrawals. A screenshot shared by community members confirmed the suspension message on the exchange interface, citing “maintenance”.

An ArbiScan transaction later verified that deposits and withdrawals were indeed paused. Despite the sudden halt, there are no confirmed reports of a security breach. Grogan and other analysts described the move as a precautionary measure; a common step exchanges take during system stress or potential manipulation attempts.

Some observers suggested the pause might also be part of a clawback procedure to mitigate or reverse potential manipulation losses. However, this remains unconfirmed as the exchange has yet to issue an official public statement addressing the event.

The POPCAT Impact

The memecoin at the center of the situation, POPCAT, saw extreme volatility following the liquidation. According to market data, the token surged by nearly 40% before plunging over 50% within a single day, falling from $0.21 to roughly $0.13.

Benzinga reported that this rapid decline erased most of the day’s gains and triggered significant profit-taking among traders. Technical indicators also showed weakening demand, as POPCAT’s RSI dropped from overbought levels above 80 to around 35, confirming bearish pressure.

The event not only impacted POPCAT’s short-term outlook but also reignited broader discussions around leverage risks and market manipulation in decentralized perpetual exchanges.

Looking Ahead

At the time of writing, deposits on Hyperliquid appear to remain functional, while withdrawals through the Arbitrum bridge are still paused. The USDC bridge continues to hold billions in assets, suggesting that funds are secure and the situation is contained.

Whether the suspension will be lifted soon depends on the platform’s internal review of the POPCAT liquidation and its risk management protocols. If confirmed as a targeted manipulation attempt, it would mark the second such event this year, following the earlier incident involving the JELLYJELLY memecoin in March.

For now, Hyperliquid withdrawals paused remains one of the most closely watched developments in the DeFi space, with traders waiting for official clarification on when operations will resume.

- Conor Grogan (X) – Hyperliquid Bridge Activity Halt – (Nov 12, 2025)

- MLMabc (X) – Onchain Analysis of POPCAT Long Position and Liquidation – (Nov 12, 2025)

- The Block – Hyperliquid Pauses Deposits and Withdrawals Amid POPCAT Speculation – (Nov 12, 2025)

- U.Today – Breaking: Hyperliquid Withdrawals Paused – (Nov 12, 2025)