Are you new to trading, and wondering what maker orders and taker orders are? Or maybe you’re a seasoned trader who wants to brush up on the basics. Whatever your level of expertise, understanding these two order types is crucial for successful trading. In this blog post, we’ll explain the differences between maker orders and taker orders, when to use each one, and give some examples to help you make informed decisions about your trades.

On trading platforms, you will usually find two order types right away. Limit orders and market orders. These are basically just different words for maker orders and taker orders.

- Maker orders = limit orders

- Taker orders = market orders

Maker orders explained

Maker orders are a type of limit order used in trading. They are placed by market participants who want to sell or buy an asset at a specific price, known as the “limit price.” These orders add liquidity to the market because they sit on the order book until another participant is willing to take them.

When you place a maker order, you’re essentially making an offer to the market that other traders can accept. Maker orders are usually cheaper than taker orders. Some trading platforms, such as MEXC, even offer free maker orders with 0% fees. As maker orders never move a market, they are also called “passive market participants”

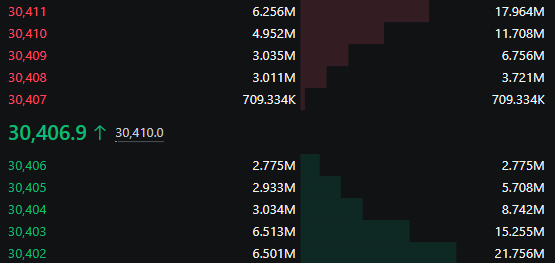

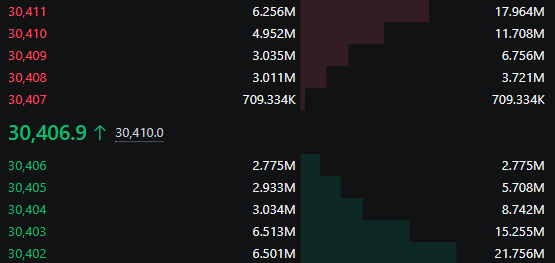

The image above displays an order book for Bitcoin. Let’s say you want to purchase $1 million worth of Bitcoin at a price of $30,404. By placing a limit order, your order will be added into the order book in the row of $30,404. Maker orders are filled by taker orders (also known as market orders). In this case, the order book needs over $8.7 million worth of Bitcoin to be market sold (taker order) to fill your order.

Maker orders allow traders to keep control over their trades while adding liquidity and depth into markets while enjoying lower fees. Furthermore, maker orders do not affect the market price and are considered passive market participants. Only taker orders (market orders) can move the market.

Taker orders explained

Taker orders are a common type of order in trading, but what exactly does it mean to be “taker”? In simple terms, taker orders refer to trades that are executed immediately at the current market price, also known as “market orders”.

Essentially, if you place a taker order, you’re willing to pay the going rate for whatever asset or security you’re interested in.

Every time you execute a market order (taker order), you fill the bids or asks in the order book. Remember, as explained in the maker order section: Maker orders provide liquidity to the market and are displayed in the order book. Taker orders on the other hand take liquidity out of the market and therefore move the price. The price movement due to market orders is also known as “slippage”.

As taker orders move the market price, they are also known as active market participants.

Let’s use the order book example from above. If you want to buy $4 million worth of Bitcoin instantly, you would move the market up by at least $3 as the order books displays $3.62 million worth of Bitcoin on the sell side. Only when a taker order, worth over $4 million is executed, the Bitcoin price will reach $30,409.

One key aspect of taker orders is that they typically come with higher fees than maker orders. This is because you are executing your trade right away. Despite the higher fees, many traders prefer using taker orders due to their speed and convenience.

If you need to enter or exit a position quickly, using a taker order can help ensure that your trade goes through as soon as possible.

Then, while there are certainly pros and cons when it comes to using taker versus maker orders in trading, it ultimately depends on individual preferences and needs as well as market factors at any given time.

When should I use maker orders or taker orders?

When it comes to trading, using the right order type is crucial. Maker orders and taker orders are two of the most common types used in trading platforms today. But when should you use each one?

Maker orders are typically used by traders who want to receive a specific entry price. This means that they want their order to sit on the order book until someone else takes action on it. Furthermore, by trading with taker orders, traders can reduce their fees.

On the other hand, taker orders are used by traders who want to take advantage of existing liquidity within a market. Takers execute their trades immediately at the current market price without waiting for someone else’s action on their order. You will find scalp, intraday, and day traders using taker orders most of the time as they want to quickly enter and exit the market without having to wait for a specific price.

Lastly, some cryptocurrencies have very low liquidity in the order book. That means even small taker orders can move the price a lot. Luckily, crypto exchanges have a public limit order book where you can check if the trading pair has sufficient liquidity for your desired market order.

So when should you choose maker orders or taker orders? It ultimately depends on your trading strategy and goals. If you’re looking for additional incentives like rebates and reduced fees, then maker orders might be more beneficial for you. However, if speed and immediate execution are important, then taker orders may be more suitable.

Maker vs Taker Order Examples

When it comes to trading, there are several order types that traders can use depending on their goals and strategies. The most common type of order is the market order (taker order), which is executed at the current market price and guarantees instant execution but not at the exact price. This type of order is often used by takers who want to enter or exit a trade quickly. Furthremore, most order types on trading platforms are taker orders.

Stop-loss orders are designed to minimize potential losses by automatically executing when an asset’s value drops below a predetermined level. Stop-loss limits can be set at any point below an asset’s purchase price are always taker orders, so they are executed as market orders.

Trailing stop orders work similarly to stop-loss orders but they move with the market price instead of remaining static. As such, trailing stops can help lock in profits as well as minimize losses, though they are always executed as taker orders.

Take-profit orders are also often set to taker orders by default. That means as soon as your target price is reached, your order will be closed instantly with a market order. This can lead to slippage and leave you with a worse price than what your actual target was, based on how good the liquidity is. If you want your take-profit orders to be executed as a taker order to save fees, you should check if your trading platform supports this feature.

TWAP orders, also known as time-weighted average price, are executed throughout an upfront configured amount of time with a pre-set interval. TWAP orders are also executed as taker orders.

Understanding different types of orders and how they function can make you more confident in executing trades that align with your strategy and goals.

Now you know the difference between maker (limit) and taker (market) orders. Make sure to check which order types your trading platform supports. If you are looking for a reliable cryptocurrency trading platform, check out our guide for the top 10 crypto exchanges fo day trading!

Maker vs Taker Orders FAQ

What are maker orders?

Maker orders are also known as limit orders. These orders are placed in the order book and provide liquidity to the market. Maker orders are cheaper than taker orders and they also guarantee a specific entry/exit price.

What are taker orders?

Taker orders are also known as market orders. These orders are executed instantly at the best possible price. Taker orders are more expensive than maker orders.

When should I use taker orders?

Taker orders, or so-called market orders, are best for day traders as they need to quickly enter and exit the market. With market orders, you are instantly in and out of the market.

When should I use maker orders?

Maker orders are best for swing traders. Also, you should use maker orders if you want to receive a specific price while also paying fewer fees compared to taker orders. Furthermore, large traders usually use limit orders so that they do not impact the price.