What is Leverage in Crypto trading?

Leverage in Crypto trading can amplify one’s buying or selling power by using borrowed capital to make trades. In other words, it increases your buying or selling power and allows a trader to trade with more money than they actually have by borrowing it from the trading platform.

The amount of leverage you have is called a ratio. For example, 1:10 (10x) or 1:20 (20x). It represents the number of times your starting capital is multiplied. Hence, at a leverage ratio of 1:10, you would only need $1,000 to invest $10,000. The amount needed to be deposited is called collateral. The collateral needed is determined by the leverage used and the total value of the position you wish to open (margin). When you have a margin trading account, you can increase your trading leverage, especially if you use automated margin trading bots, to maximize your potential profits. As a result, even during a crypto bear market, it’s an excellent way to generate significant returns.

How does leverage trading work?

For example, if Joan wants to invest $5,000 in Bitcoin (BTC) with a leverage of 10x, the required margin is 1/10 of $5,000. In layman’s terms, this means that the required collateral or minimum deposit account is only $500. With a higher leverage such as 20x, the required margin would be smaller ($250) because it is equivalent to 1/20 of $5,000.

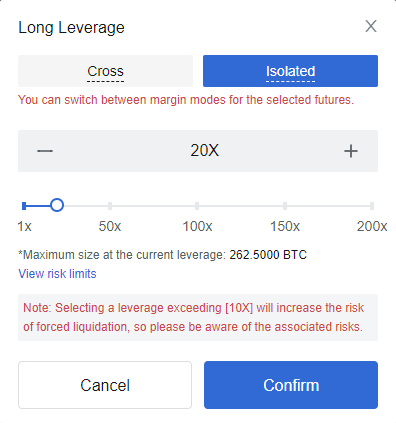

The futures and derivatives market is where you trade with leverage. When trading on the futures market with leverage, you don’t have to worry about borrowing and repaying. While you have to actively borrow and repay everything in spot margin trading, in leverage trading, the whole process is automated. This makes it a lot easier for traders to open and close positions. On the futures market, you just have to select the leverage amount, and then you can proceed to long or short the market. When you long the market, you bet on prices going up. When you short the market, you bet on prices going down.

A double-edged sword

It is a double-edged sword because it can increase one’s profit by up to 100 times their account balance, but due to market volatility, you can also get liquidated quickly. Hence, when there are higher rewards, there are also higher risks.

Advantages

The primary benefit of leverage trading is that it allows the trader to profit more. Compared to traditional trading, you can generate much larger returns with a much smaller investment when using binary options to make a lot of money by using less money to buy assets. Leverage trading is adaptable because it allows the trader to trade more frequently and perform more transactions in order to increase the return on his or her investment. Because of the flexibility of leverage trading, one can profit quickly from short-term price movements. Lastly, one can also maximize its potential by growing more assets through confident investments.

Disadvantages

Going back to higher rewards, there are also higher risks in Leverage trading. Leverage trading can be difficult for new traders. Mostly, only experienced traders are able to fully maximize the opportunities of Leverage trading. Hence, staking can be higher for new traders. Sometimes, new traders fall into a trap by frequently attempting to raise their position to recover their losses.

Where can I trade cryptos with leverage?

The most common way to trade cryptocurrencies with leverage is a centralized futures and derivatives exchange (CEX) such as MEXC, Binance, or ByBit. These exchanges offer you a platform where you can trade with a leverage ratio of up to 1:200 (200x). While this offers you great opportunities, it also brings a lot of risks with it. Trading with such a high leverage is not recommended at all. Even with a leverage of 1:10 (10x) you are exposed to high risks, as the crypto market is very volatile. Especially when you are just starting, we recommend going with lower leverage.

When looking for a cryptocurrency trading platform that offers leverage, it is crucial to know how high or low the fees are. As fees apply to the whole position, including the leveraged amount, they can quickly become costly and eventually eat up your profits. MEXC is the cheapest major centralized exchange with 0% maker, 0.06% taker fees, and a 10% fee cashback which you get into your account 24 hours after trading. Binance offers 0.02% maker and 0.04% taker fees, which is close to MEXC. ByBit offers 0.01% maker and 0.06% taker fees and is also a great option for leverage trading. As many cryptocurrency trading platforms are restricted in certain countries, we recommend you to go through the mentioned exchanges and see which one works for you.

Another way to trade with leverage is a decentralized exchange (DEX). You can check out our complete DEX guide here to learn more about decentralized exchanges here. Some exchanges like GMX or DYDX offer you to trade with leverage on their futures market. As decentralized exchanges are still new compared to centralized ones, they still need some features like advanced order types, liquidity, and volume. Compared to centralized exchanges, decentralized exchanges have relatively high fees, with an average of 0.1%.

Leverage Trading Pros & Cons

| 👍 Leverage Trading Pros | 👎 Leverage Trading Cons |

|---|---|

| ✅ Easy order execution on the futures market | ❌ Not accessible in all countries |

| ✅ Accelerate your profits with leverage | ❌ Risk of losing your capital in case of a liquidation |

| ✅ Simple to hedge the market by opening long and short positions simultaneously | ❌ Higher leverage means higher fees relative to your margin |

| ✅ You can long and short, which means you can make money when prices go up but also when prices go down | ❌ A higher barrier of entry as it is more complicated and riskier compared to spot trading |

MEXC futures and derivatives market

MEXC Long Leverage 1:20 (20x)

Tips and Tricks for leverage trading crypto

To avoid potentially costly mistakes, it is best to start small and take short positions to maintain equilibrium (hedge).

A stop-loss can also save your assets if the market goes against you. It is an effective way to protect yourself from damaging losses because it places a strict limit on how much you can lose. Position sizing must be planned out in order to avoid losing motivation during losses. For this, you can use our free position size calculator tool. If you want to simulate your trading strategy you can also try out our free win-rate and profit calculator tool.

Another tip is to never put more money at risk than you can afford to lose. A commonly used risk management approach is to never risk more than 1%-5% of your portfolio on any trade. That means when your stop loss gets hit, you know exactly what your maximum loss will be.

Lastly, remember to DYOR (Do Your Own Research), consider risks, and never use more money than you can afford to lose. Always remember that most traders lose money. Trading is not easy, it is very hard. It is a way to consistently make gains in the long run rather than getting rich overnight.

FAQs

What is leverage trading crypto?

Leverage trading allows traders to borrow funds to increase their buying power in a trade, amplifying potential gains but also increasing risk. A trader can open a position with a smaller amount of capital and borrow funds from a broker to increase the size of the trade. The trader is responsible for any losses incurred on the position.

Where can I leverage trade crypto?

MEXC allows its users to trade with leverage on their platform and it is overall a great choice for crypto trading.

What are the risks of leverage trading in cryptocurrency?

Leverage trading increases the risk of a trader losing their whole trading balance in case of a liquidation.

What is a liquidation?

A liquidation in crypto trading is when a trader’s open position is automatically closed by the broker due to a lack of sufficient funds (margin) to maintain the position. This occurs when the market moves against the trader’s position and their account balance falls below a certain level, triggering a margin call. The liquidation is executed to minimize the broker’s exposure to risk and to prevent the trader from incurring further losses.

Can i lose more money than I own when I leverage trade cryptocurrencies?

No, trading cryptocurrencies with leverage on the futures and derivatives market will not make you lose more than you own. You can only lose your own capital if the price moves against you. If the price moves against you too far, the crypto exchange is forced to close the position and take its capital back.

What are the costs of leverage trading crypto?

This varies a lot. Some trading platforms like MEXC allow you to trade with 0% maker fees on the futures market. That means the fees for limit orders are 0%. The industry average for the spot market fees is 0.02% maker and 0.06% taker, which means that MEXC is cheaper.

Crypto leverage trading in the USA?

As the USA strictly regulates crypto trading, it is hard to find a reliable crypto leverage trading platform. MEXC allows traders from the USA to trade with leverage on their platform and it is overall a great choice for crypto traders.