- Decentralized Trading Platform

- Low Trading Fees

- Zero Gas Fees for trades

- Dedicated Layer 1 Blockchain

- 149 Futures Contracts with up to 50x Leverage

- No KYC or Signup

- Fully On-Chain Order Book

- One-Click Trading

- Copy Trading through Hyperliquid Vaults

Cryptocurrency—a term that instantly brings decentralization to mind. Yet, when it comes to trading, decentralization was a challenge. However, perpetual DEXs like Hyperliquid, through innovation, have transformed the landscape of DEX trading. In this Hyperliquid Review, we’ll explore its features, fees, trading options, and overall experience. Additionally, we’ll examine alternatives to help you decide if it’s the right Perp DEX for you.

| Stats | Hyperliquid |

|---|---|

| 🚀 Founded | 2024 |

| 🔎 Founder | Jeff Yan |

| 👤 Active Users | 306K+ |

| 🪙 Spot Cryptos | 11+ |

| 🪙 Futures Contracts | 149+ |

| 🔁 Spot Fees (maker/taker) | 0.0350% / 0.0100% |

| 🔁 Futures Fees (maker/taker) | 0.0350% / 0.0100% |

| 📈 Max Leverage | 50X |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | No |

| ⭐ Rating | 4.7/5 |

HyperLiquid Overview

Hyperliquid is a high-performance Layer 1 blockchain (L1) optimized from the ground up for decentralized finance (DeFi) applications. It aims to create a fully on-chain, open financial system where user-built applications seamlessly integrate with native components, delivering exceptional performance without compromising the user experience. Powered by a custom consensus algorithm, HyperBFT, which draws inspiration from Hotstuff and its successors, the network is designed to handle over 100,000 orders per second with block latencies of less than one second.

At the core of Hyperliquid’s ecosystem is its flagship native application: the fully on-chain Hyperliquid DEX, a perpetual decentralized exchange featuring an order book model. This model helps Hyperliquid address the common issue of slippage in crypto trading, where the price of an asset can change between placing and executing a trade. By utilizing a decentralized order book solution, Hyperliquid offers traders the benefits of high liquidity and fast execution, while maintaining the privacy and control that decentralized platforms are known for.

Additional offerings include support for spot trading, permissionless liquidity, and a native token standard. Hyperliquid provides key features such as zero gas fees, low trading fees, up to 50x leverage, and fast transactions with no wallet approvals required for trading. This makes trading efficient and highly transparent, as every order, cancellation, trade, and liquidation is processed on-chain.

With over 306,000 users, Hyperliquid has already achieved significant milestones, including a $523M+ spot trading volume, $2.61 billion in futures trading volume, and a total value locked (TVL) of $2.49 billion. The platform supports 11+ spot coins and 149+ futures contracts, offering leverage of up to 50x. Its advantages include high liquidity, fast transactions, low slippage (up to 10% for TP/SL orders), and no KYC requirements, making it highly appealing to traders.

However, it has some limitations, such as fewer spot trading options, limited chain support, and relatively high trading fees compared to other perpetual DEXs. Hyperliquid stands out as the only Layer 1 blockchain specifically dedicated to DeFi perpetual DEXs, offering a groundbreaking solution for decentralized financial applications.

Hyperliquid Pros and Cons

| 👍 Hyperliquid Pros | 👎 Hyperliquid Cons |

|---|---|

| ✅ High liquidity | ❌ Limited chains supported |

| ✅ Low slippage | ❌ Fewer spot trading options |

| ✅ Fully decentralized | ❌ No fiat support |

| ✅ No KYC requirements | |

| ✅ Self custody (DEX) |

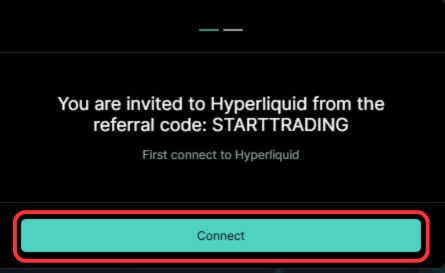

Hyperliquid Signup

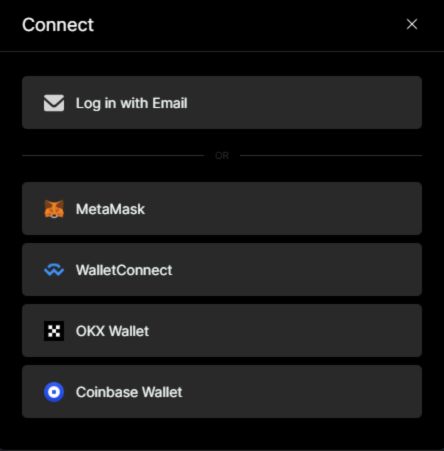

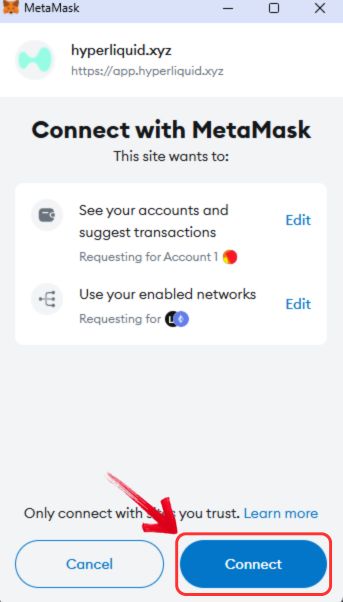

Hyperliquid is a platform that requires no sign-up or KYC process. (You can optionally use your email ID as well.) With just a single click, you’ll be taken directly to their trading interface, where you can jump into trading futures or spot markets. All you need to do is connect your Web3 wallet, such as MetaMask. The process is incredibly simple:

Step 1: Hyperliquid is currently only available as a web-based trading platform. Open your browser and visit the Hyperliquid website.

Step 2: Once on the website, you’ll be prompted to connect your wallet. Click on the “Connect” button to continue.

Step 3: From the list of supported wallets, select the wallet you want to connect to the Hyperliquid platform.

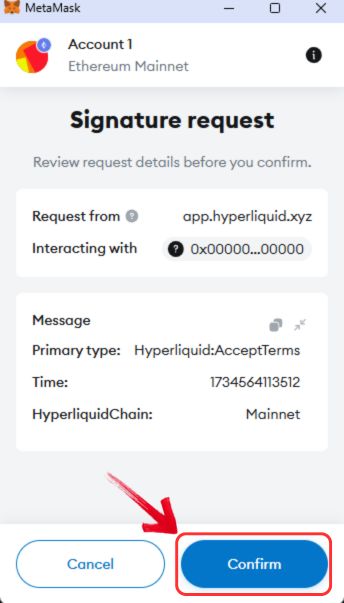

Step 4: Your wallet extension will prompt you for confirmation. Click on “Connect” within your wallet extension to proceed.

Step 5: Tick the terms and conditions checkbox, then click on “Accept” to move forward.

Step 6: Your wallet extension will open again for a signature request. Click on “Confirm,” and you’re all set to start trading on Hyperliquid.

Since Hyperliquid is a no-KYC platform, you can begin trading immediately without worrying about any regional or identity restrictions.

Hyperliquid Trading

Hyperliquid provides both spot and futures trading for its users, with no need for sign-up or KYC. As long as you have a Web3 wallet, you’re ready to start trading. Let’s take a closer look at what you can expect when trading spot or futures on Hyperliquid.

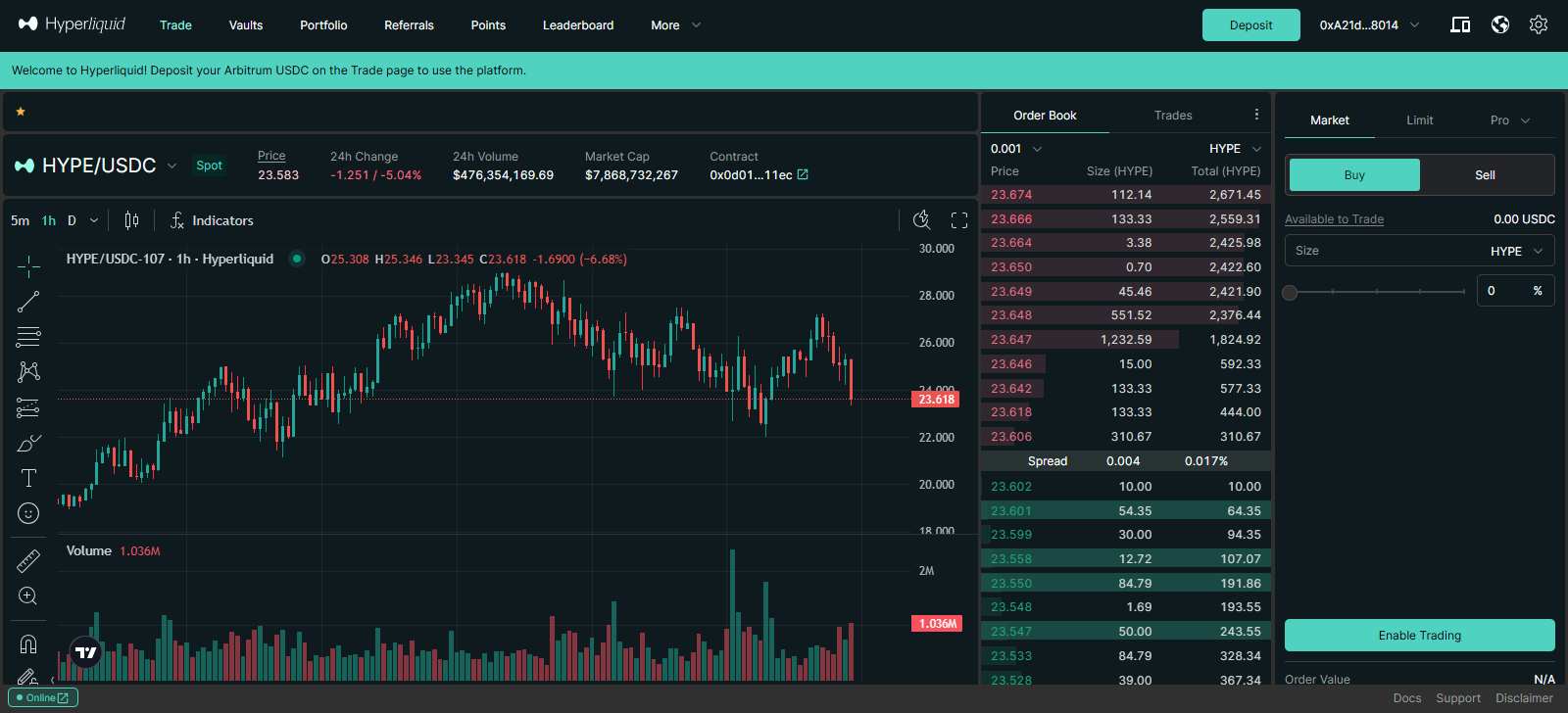

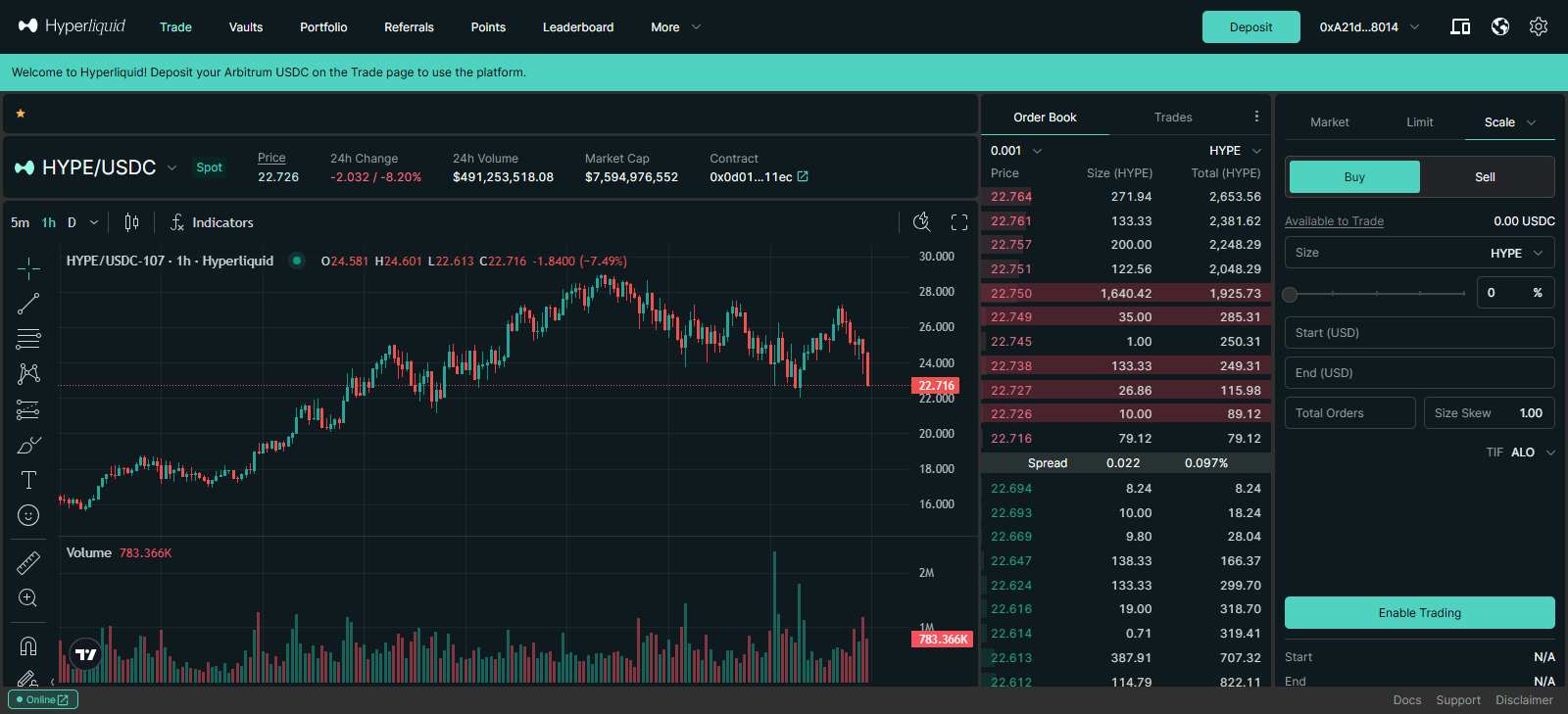

Spot Trading

Hyperliquid’s spot trading interface delivers a fresh and modern experience, combining all the essential trading tools in one place. With TradingView integrated directly into the platform, traders can utilize a wide range of strategies and advanced charting tools like Fibonacci retracements and scaling to analyze markets effectively. The platform supports over 11 spot coins, including its native token, HYPE, offering ample opportunities for diverse trading strategies.

Getting started is straightforward—simply connect your Web3 wallet, such as MetaMask or OKX Wallet, and you’re ready to trade. Hyperliquid supports basic order types like market and limit orders, along with advanced options such as Scale and TWAP, catering to both beginners and experienced traders. The user interface is smooth, intuitive, and closely resembles the spot trading experience found on centralized exchanges like Binance or Coinbase, making it accessible yet highly functional.

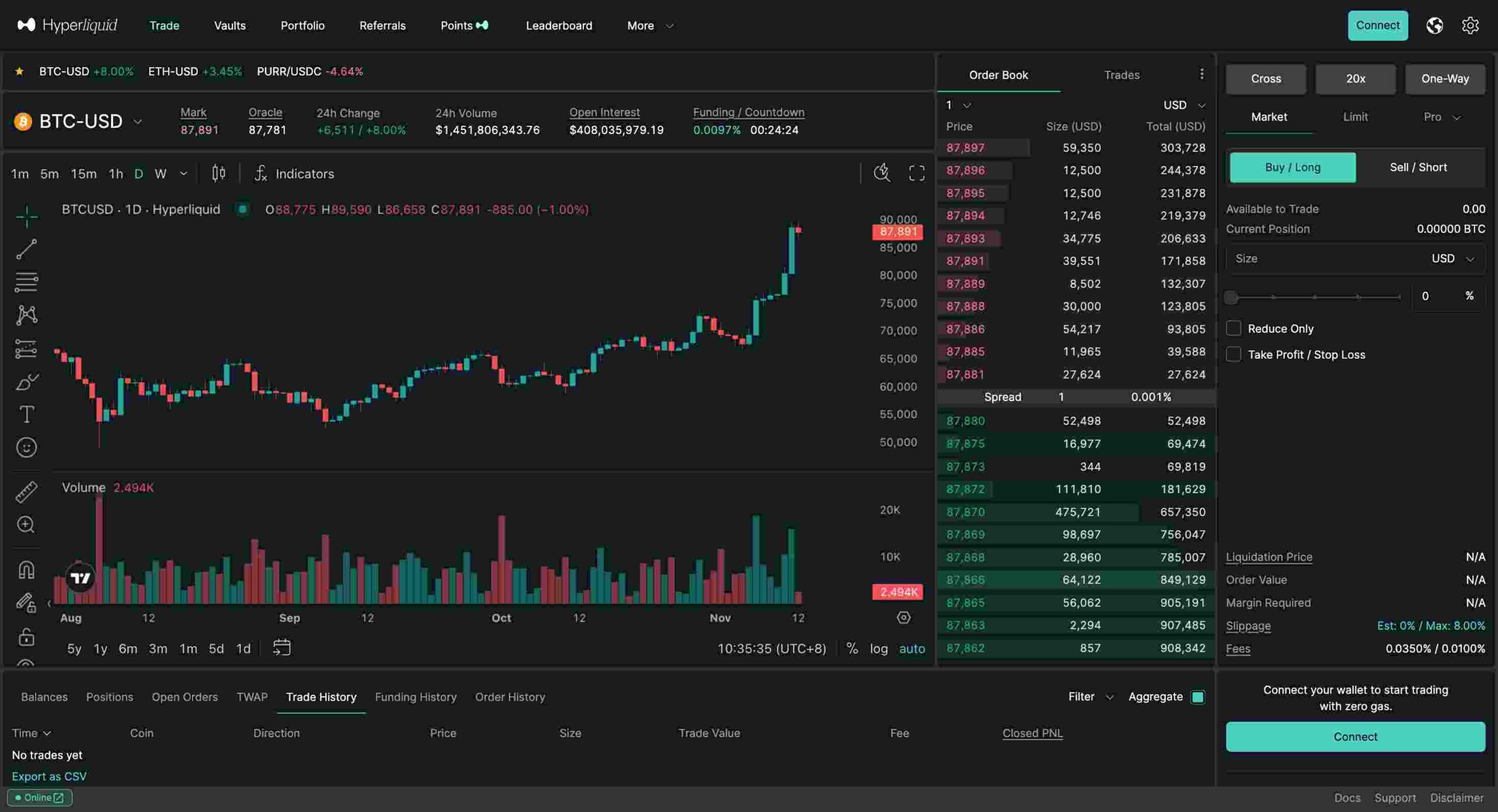

Futures Trading

Hyperliquid’s futures trading offers many of the same features as its spot trading, but with the added advantage of leverage and a wider selection of trading options. The platform provides access to over 149+ futures contracts, allowing traders to take positions with leverage of up to 50X. This makes it suitable for those looking to maximize their capital efficiency in the market.

The interface is smooth and highly responsive, delivering a trading experience comparable to top centralized exchanges. Integrated with TradingView, the platform offers powerful charting tools to support technical analysis. The order types available mirror those in spot trading, including market, limit, Scale, and TWAP orders, ensuring flexibility for all levels of traders.

For a detailed walkthrough on how to start trading on Hyperliquid, check out our full tutorial.

Hyperliquid Fees

Deposit and Withdrawals

Hyperliquid does not support direct bank deposits. However, you can deposit funds via cryptocurrencies, specifically USDC on the Arbitrum network. Currently, Hyperliquid only supports the Arbitrum chain, and all trading pairs are based on USDC. To start trading, you need to transfer USDC to the Hyperliquid L1 chain. The network fee for transferring USDC from your MetaMask wallet or any other compatible wallet to the Hyperliquid L1 chain is just $0.01. Watch our full deposit tutorial to begin trading on Hyperliquid.

Withdrawals follow a similar process. You can transfer USDC from the Hyperliquid L1 chain back to your MetaMask wallet, with a withdrawal fee set at $1. Watch our full tutorial to learn how to withdraw from Hyperliquid.

Trading Fees

Hyperliquid charges a standard trading fee of 0.0100% for makers and 0.025% for takers on both spot and futures trades. However, with its tier-based system, fees can drop as low as 0.00% for makers and 0.019% for takers, depending on your daily trading volume.

Spot Fees

0.010% Maker

0.035% Taker

Future Fees

0.010%% Maker

0.035% Taker

Hyperliquid Products and Services

Being a decentralized Perp DEX, Hyperliquid’s choice of products and services is somewhat limited. However, it does offer the essentials. Let’s go through them one by one.

Trading Platform

Hyperliquid offers both spot and futures trading, making it a versatile platform for different types of traders. The platform makes it easy to find coins, with dedicated columns such as L1, L2, and AI DeFi for better organization.

The order book has a tight spread, ensuring high liquidity, which is crucial for smooth and efficient trading. Thanks to its Layer 1 blockchain, all trades are processed on-chain, resulting in faster and more responsive execution compared to other perpetual DEXs.

Another standout feature is the easy swapping of coins between the perp and spot markets, offering flexibility for users who wish to transition seamlessly between different types of trades.

$HYPE Token

HYPE is the native token of Hyperliquid, serving as both the gas token for the network and a utility token for trading. It enables fast, secure, and transparent transactions within the Hyperliquid ecosystem.

In addition to facilitating transactions, HYPE offers several premium features for users, including trading fee discounts, staking opportunities, and a burn mechanism designed to help maintain price stability. The token functions within the HyperEVM (Hyperliquid’s execution environment), enhancing the platform’s overall efficiency and user experience.

You can easily acquire the $HYPE token directly on the Hyperliquid platform, or if you prefer to purchase it from a centralized exchange, you can find it on BingX.

Hyperliquid

New TokenToken Symbol

HYPE

All-Time High

-

Current Price

Loading...

Market Cap

Loading...

Total Supply

Loading...

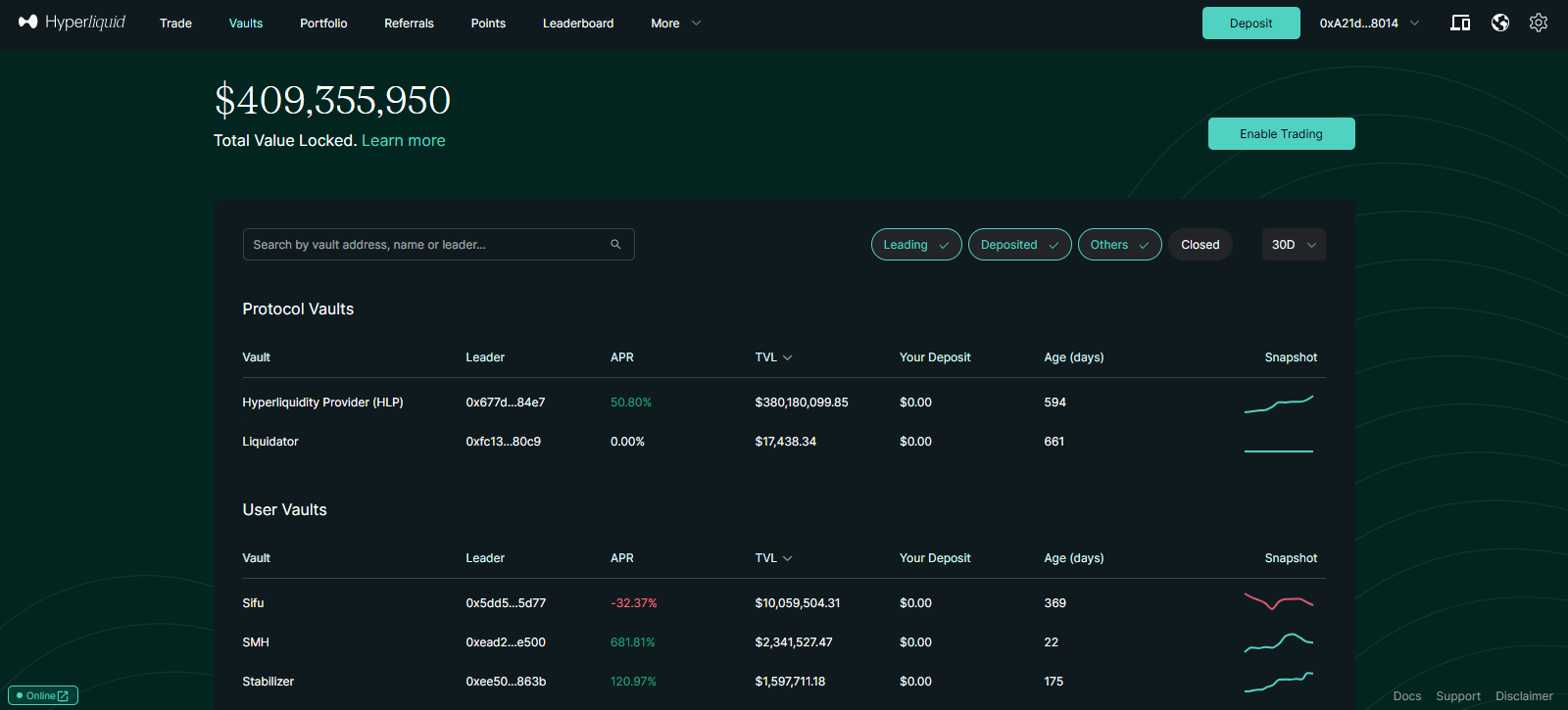

Vault

Vaults on Hyperliquid function similarly to traditional copy trading on centralized exchanges. A vault leader manages the trades, deciding when to open and close positions, while users can deposit funds into these vaults to mirror the leader’s strategies and potentially share in the profits. Vault owners receive 10% of the total profits as a reward for their management, creating an incentive for skilled traders to set up vaults and share their expertise. The deposit lock-up period lasts for 4 days, meaning funds can only be withdrawn 4 days after the latest deposit, and there may be some slippage when withdrawing or closing positions.

Additionally, Hyperliquid offers an HLP (Hyperliquid Protocol Liquidity) vault, designed for market making and liquidations, fully owned by the community without profit-sharing fees.

Learn how to copy trade on the Hyperliquid platform by watching this full video tutorial.

Hyperliquid Airdrop

On November 29, 2024, Hyperliquid completed its Genesis Event, distributing 310 million HYPE tokens to over 90,000 users, making it one of the largest airdrops in DeFi history.

There may be future airdrop events, with 38.8% of the remaining HYPE supply allocated for future emissions and community rewards. To participate, users can interact with their testnet by adding it to MetaMask and engaging with the platform.

Hyperliquid Security

Hyperliquid’s Layer 1 blockchain ensures strong security with native multi-sig support, allowing multiple private keys to control a single account. All trades are processed on-chain via smart contracts, providing high security. However, there are risks, including potential vulnerabilities in the Arbitrum bridge smart contracts, which could result in the loss of user funds. Hyperliquid’s L1 is also less tested than established blockchains, risking downtime or consensus issues.

Market liquidity risk could lead to price slippage, especially in the early stages. Additionally, compromised price oracles could trigger incorrect liquidations. To mitigate these risks, Hyperliquid implements open interest caps and prevents orders from being placed too far from the oracle price.

Hyperliquid Customer Support

Hyperliquid currently does not offer online customer support. However, users can reach out via email by clicking the “Support” button at the bottom right of the Hyperliquid app page. While there is an FAQ section, it is not very comprehensive at the moment, containing only one question.

Hyperliquid Alternatives

If Hyperliquid is considered the best perp DEX, why explore alternatives? The answer lies in specific features. Alternatives may provide higher leverage, support for a preferred blockchain, or a broader selection of coins for trading. For traders seeking these advantages, here are three of the best alternatives for decentralized trading:

1. dYdX: Built on its own application-specific blockchain, dYdX is an open-source platform designed for decentralized perpetual trading. It boasts the largest selection of cryptocurrencies among all decentralized exchanges, making it a top choice for traders seeking variety.

2. Vertex: Vertex offers a next-generation decentralized trading experience by blending the speed and precision of centralized exchanges with the transparency and security of on-chain settlement. With some of the lowest fees in the market, it stands out as a cost-effective alternative.

3. APX Finance: APX Finance is a leading decentralized exchange for crypto derivatives, operating on major blockchains like BNB Chain and Arbitrum. Its most prominent feature is its unmatched leverage of up to 1001x, catering to traders looking for extreme risk-reward opportunities.

| Feature | Hyperliquid | dYdX | Vertex | APX Finance |

|---|---|---|---|---|

| Cryptocurrencies | 149+ | 179+ | 58+ | 97+ |

| Trading Fees | 0.010% / 0.035% | 0.020% / 0.050% | 0.00% / 0.020% | 0.020% / 0.070% |

| Trading Volume | $523M+ | $745.96M+ | $50M+ | $61.26M |

| Max Leverage | 50x | 50x | 20x | 1001x |

| No. of Supported Chains | 1 | 5 | 4 | 7 |

| Key Feature | Highest Volume | Most number of coins | Lowest fees | Highest leverage |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottomline

To wrap up this review, Hyperliquid proves to be a game-changing decentralized trading platform, delivering faster and more transparent trading experiences, thanks to its high-performance Layer 1 blockchain. Features like a fully on-chain order book, zero gas fees, low trading fees, and up to 50x leverage make it a strong alternative to traditional centralized exchanges.

Additionally, Hyperliquid Vaults provide users with an opportunity to store assets and earn from others’ trading activities, creating a collaborative ecosystem. With the recent launch of its native token and the success of the largest DeFi airdrop to date, Hyperliquid’s potential for growth is undeniable.

Overall, it’s an excellent choice for traders looking for a decentralized platform with advanced features and easy accessibility.

FAQs

1. How does Hyperliquid work?

Hyperliquid is a decentralized exchange (DEX) optimized for perpetual contracts. It employs a custom-built high-performance blockchain to ensure ultra-low latency and fast transaction finality, providing a trading experience that rivals centralized exchanges. It also features a central order book model, enabling deep liquidity and efficient trade matching.

2. What chain does Hyperliquid use?

Hyperliquid operates on its own blockchain infrastructure, which is specifically designed for speed, scalability, and low latency to handle high-frequency trading effectively.

3. Does Hyperliquid have a token?

Yes, Hyperliquid recently conducted an airdrop event for its native token, $HYPE. If you missed the opportunity, you can still purchase $HYPE on the Hyperliquid platform or through centralized exchanges like Bitget.

4. What is Hyperliquid Vault?

Hyperliquid Vault is a feature that allows users to passively earn yields by depositing funds into a liquidity pool. These funds are utilized to provide liquidity for traders on the platform, and in return, the liquidity providers earn fees generated from trades executed on the platform.

5. Is Hyperliquid free to use?

No, trading on Hyperliquid incurs a fee of 0.010% for makers and 0.0350% for takers.

6. What does zero gas fees mean?

On Hyperliquid, all transactions are processed on-chain. Typically, on-chain transactions require users to pay gas fees for network operations. However, Hyperliquid eliminates gas fees for its users, unlike other perpetual DEXs where gas fees depend on the chain used for trading. This makes transactions more cost-effective for traders.