Cryptocurrency exchanges are easily accessible for retail traders in 2023 due to the rapid growth of the crypto space. There are hundreds of trading platforms, specializing in cryptocurrencies, but which is the best choice for you? There are a couple of key factors to consider when signing up to a crypto exchange, such as security, fees, liquidity, area restrictions, regulations, features, and more.

While there is no right or wrong for choosing a crypto exchange, you should carefully pick the crypto exchange that you are trading on. The last thing you want to happen is your money being stuck due to regulations or your money being drained by high fees. Furthermore, you should make sure that the platform is secure and properly audited.

In this guide, we will go over the key factors for choosing a crypto exchange for buying and trading.

13 Key Factors For Choosing A Crypto Exchange

- Regulations

- Security

- Insurance

- Proof of reserves

- Reputation and History

- Available Products

- Ease of Use

- Interface, languages, responsive

- Supported assets

- Liquidity

- Fees

- Reliability

- Page speed

- Order execution

- Deposits and Withdrawals

- Customer support

1. Regulations and Jurisdictions

First things first, you must make sure that the exchange you plan to trade on is actually available in your region. Cryptocurrency is a highly controversial topic. Some governments support it while others try everything to ban it and others are very unclear about the regulatory standings.

A great example of unclear regulatory standings is the United States. Unfortunately, the US made it very hard for most cryptocurrency trading platforms to operate in the country. That’s why Binance had to make a completely separate service, called “BinanceUS” which is exclusively for US citizens and the platform differs a lot from the global version of Binance.

Be very careful with non-KYC exchanges. While you can access them via VPN, even when being in a restricted region, your capital will be at risk in case the exchange makes KYC mandatory in the future. Restricted areas will not be able to verify their identity and the money will end up being stuck.

So always make sure that the exchange you want to trade on is available in your region.

2. Security

Hacks and bugs are not a rare thing in the crypto space. Each year billions of dollars are lost or stolen. Make sure that the crypto exchange you want to trade on has updated security certificates.

Furthermore, you should check where the crypto exchange is holding the cryptos of the customers. In the best case, the cryptos will be stored in an offline wallet, a so-called “cold storage”. This is not hackable and is the most secure type of custody. Furthermore, you should check if it is a multi-signature wallet. Multisig wallets require signatures from separate entities, which means no person can steal the funds alone as it always requires the signature of additional custodians.

3. Insurance

Check if an exchange has some sort of insurance for its customers. Luckily, many exchanges started collecting a certain amount of trading fees to their security funds. Binance has the SAFU fund (Secure Asset Fund for Users) worth over $1 billion. OKX and Bitget each have a customer security fund too with $800 million and $340 million which will be used in the case of funds being stolen.

It is just important to note that crypto exchanges are not like banks. When an exchange goes bankrupt (e.g. FTX), you will be lucky to even receive a portion back of your holdings. We never recommend holding any cryptos on the exchange if you are not trading with. It is always safest to store your cryptos in a personal wallet.

4. Proof of Reserves

After FTXs downfall due to illegally lending customers funds, many crypto exchanges came forward and provided full proof of reserves. By doing so, customers can see if their assets are backed. Most exchanges are fully transparent and share their proof of reserves with customer funds being backed by more than 1:1.

Most exchanges update their proof of reserves each month but you can also track it manually with their wallet addresses.

The largest exchanges that provide full proof of reserves with a ratio of 1:1 or more are: Binance, MEXC, Bitget, OKX, Phemex, Kucoin, Kraken, Bybit, Bitfinex, Gate.io, Huobi

5. Reputation and History

Have you ever heard the term “people don’t change”? While this sounds a bit negative at first, it is absolutely crucial to be skeptical in the crypto space. If an exchange was fraudulent in the past, there is no reason to trust them now. Research if exchanges are practicing wash trading or liquidation hunts against their customers.

Also, check if the exchange got hacked and if the customers were fully refunded or just partially. You can also go a step further and research if the CEO was involved in shady crypto projects, such as one of the many ICO scams in 2017.

You can also go and check out their social media accounts. What do people say on their Twitter posts? Do they complain or are they positive?

6. Available Products

Now that you don’t have the boring part about regulations, security, and history, you must make sure that the exchange supports the products you plan to use.

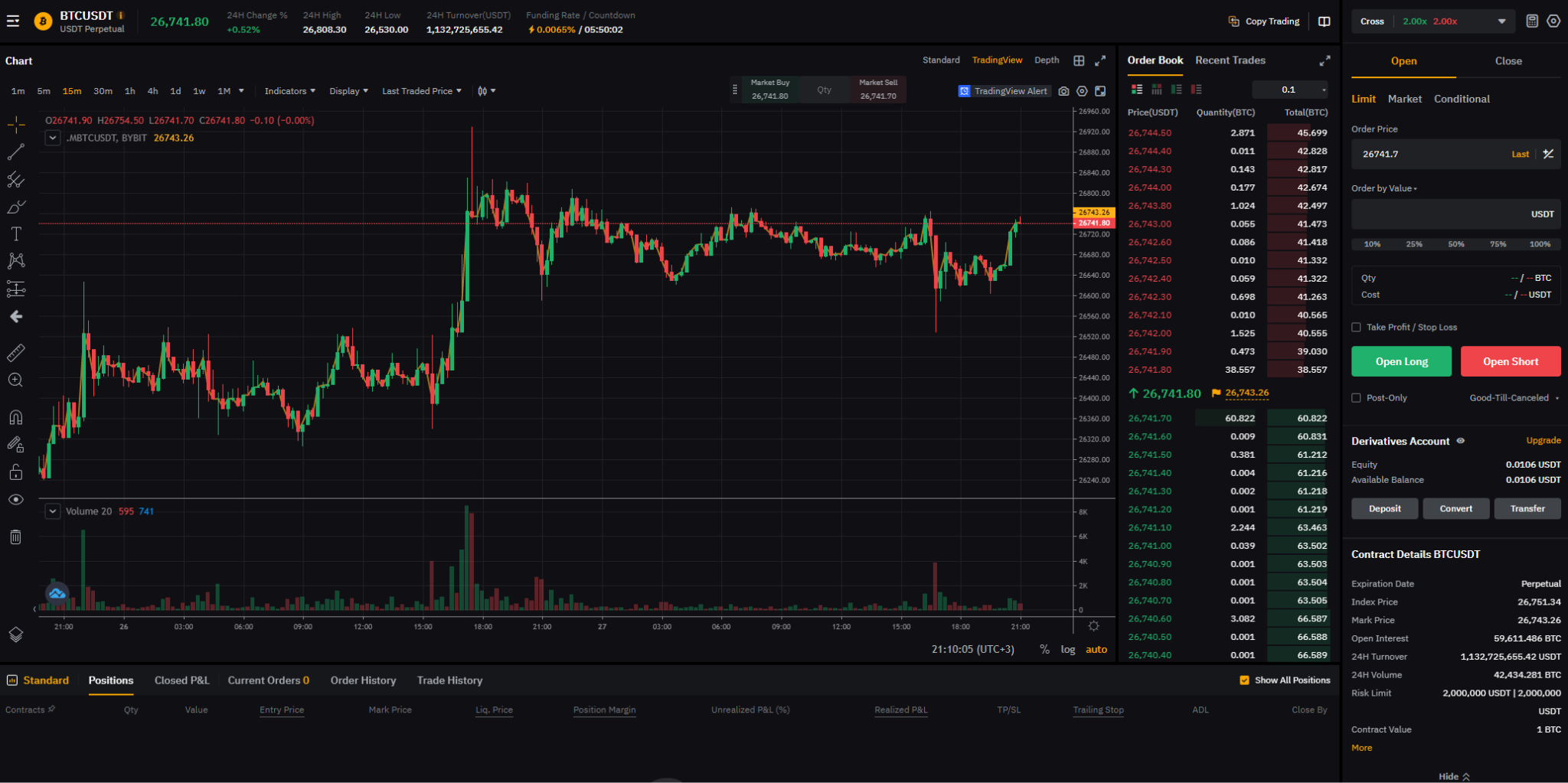

The most popular products on crypto exchanges are the spot market and the perpetual futures (derivatives) market. On the spot market, you are buying the asset which you can then send to your wallet. On the futures market, you are trading a contract (usually with leverage of up to 100x), representing the underlying asset.

Other popular products are staking, copy trading, bot trading, or crypto debit cards.

Most tier 1 exchanges offer all of these products, but it is still best to manually check if the exchange you would like to choose supports what you are looking for.

And if you are mostly trading on your phone, you should make sure that the exchange has a comprehensive and reliable mobile app. Most tier 1 exchanges do have iOS, Android, and Windows mobile phone applications. However, some apps are not as fast as they should be. Some of the best mobile applications are from Bybit and MEXC.

7. Supported Coins

An exchange is worthless if it does not support the cryptocurrency coins you are planning to buy or trade. If you want to learn more about this, we made a guide about the exchanges with the most coins and trading pairs.

If you want to buy and hold a cryptocurrency for the long term, make sure that the coin is supported on the spot market so that you can send it to your own wallet. If you want to use margin, you should check if margin is supported for this asset. And when you want to trade a coin, you must make sure that it is available on the futures market.

8. Ease of Use

Cryptocurrency exchanges can be very confusing, especially when they are very comprehensive and have many features. While offering many features can be a great thing, it will be a lot harder to adapt for new traders that don’t have much experience with trading platforms yet.

Look for a crypto exchange with a simple user interface that is easy to understand and navigate while being stable. For this, it is best to just sign up for the exchange and give it a try. Some of the tier 1 exchanges with the best interfaces are Bybit, MEXC, and Bitget.

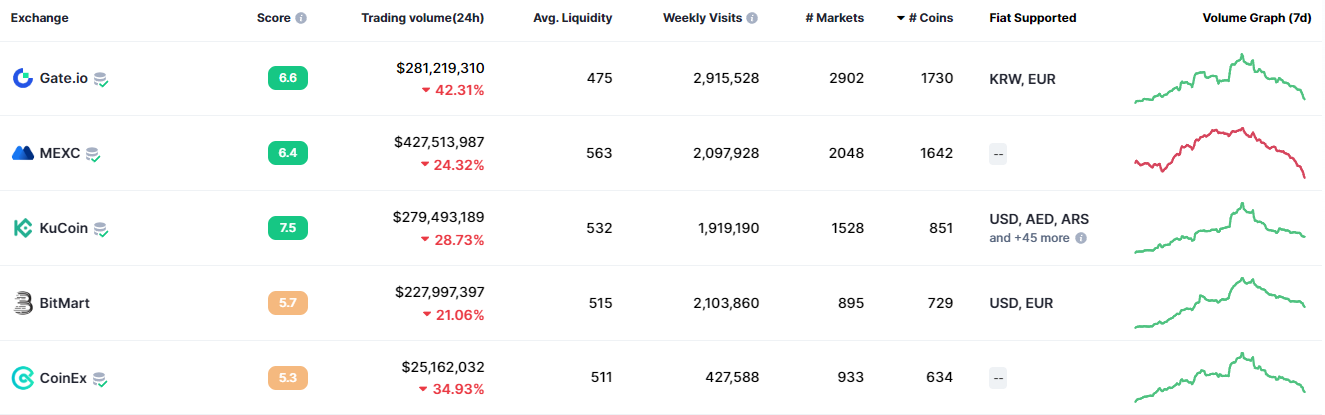

9. Liquidity and Volume

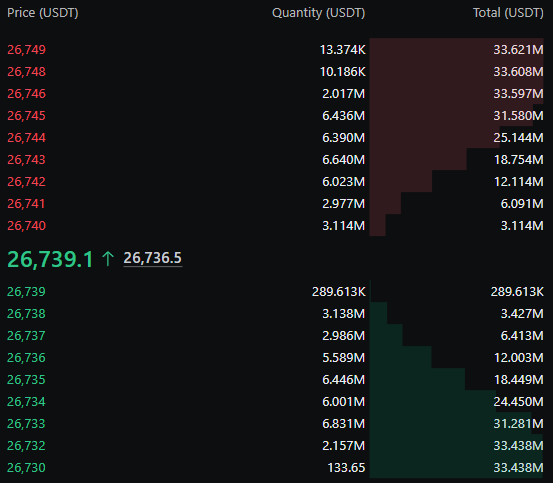

Liquidity is an often overlooked part. Liquidity is provided by market makers through limit orders in the order book. If there were no market makers providing liquidity, you could not trade or even buy and sell any assets. Below you will find the order book of MEXC, which has some of the best liquidity in the crypto space.

You can see that in order to move the price of Bitcoin by only $9, you would have to buy $33 million dollars worth of Bitcoin (this would be a move of barely 0.03%). That means that even larger orders do not move prices too heavily.

High liquidity supports healthy and natural price movements and ensures the market stays efficient. When researching, we found MEXC and OKX to have the best liquidity in the crypto space, followed by Binance and Bybit.

In terms of volume, you should look for platforms with at least $500 million dollars transacted per day, otherwise, the price movements are not reliable and the market would look “dead” with no trades happening for minutes or hours. You can check the crypto exchanges with the most trading volume on coinmarketcap.

10. Fees

An often overlooked factor (especially by newbies) is trading fees. A great example of this is Coinbase: One of the most user-friendly crypto exchanges, yet every advanced trader hates them. A key part of this is their fee structure which is ridiculously expensive.

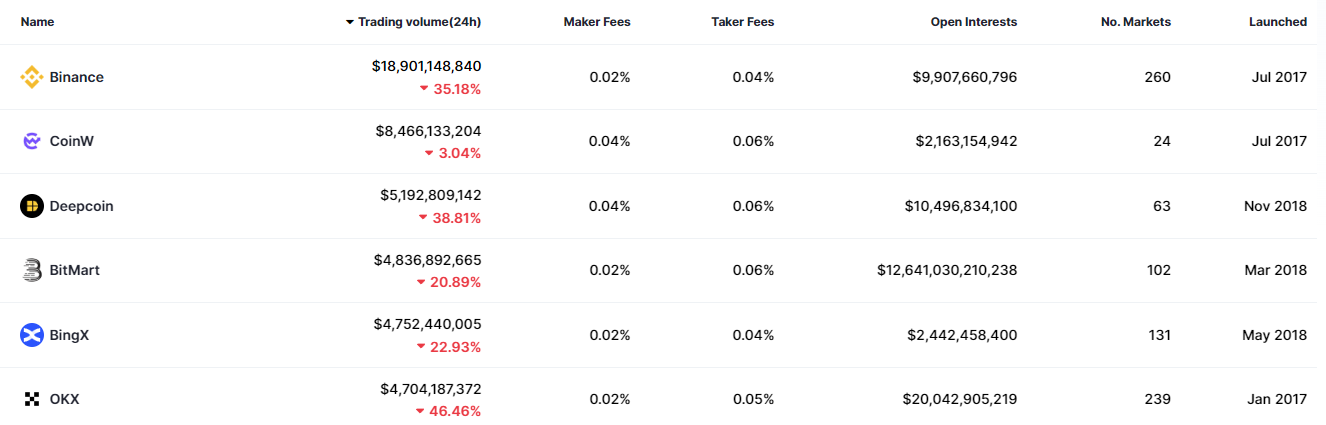

While Coinbase charges 0.4% maker and 0.6% taker fees on the futures market, the industry standard is at 0.02% maker and 0.06% taker. This makes Coinbase fees more than 10x times higher. So make sure that the exchange offers fair fees. Anything below 0.02% maker and 0.06% taker on the futures market is great.

On the spot market, the industry standard is 0.1% for makers and takers.

High trading fees will eat up a large portion of your profits in the long run. You can test this with our free profit and trade simulator.

11. Reliability

This is an important factor, especially for day traders. If you want to trade on an exchange, you must make sure that the uptime is 24/7 and that there are no lags, bugs, or other network issues.

Some exchanges are heavily limited in times of high volatility because their system is fully occupied. When you are day trading cryptos, often a difference of just a few milliseconds can have a massive impact on your order price. In the worst case, your order won’t go through at all because the platform experienced a bug.

12. Deposits and Withdrawals

Crypto deposits and withdrawals

Before sending any cryptos to an exchange, make sure that the platform supports deposits and withdrawals for said crypto. Some (shady) exchanges accept deposits but no withdrawals for certain coins. An example of this is HitBTC which accepts DOGE deposits but no DOGE withdrawals (I fell for an arbitrage trap…). You will mostly experience this on smaller exchanges. This should never happen on tier 1 exchange.

FIAT deposits and withdrawals

Aside from crypto transactions, you should also care about FIAT ($, €, £, etc .) deposit and withdrawal rules on a crypto exchange. While most crypto exchanges support FIAT deposits through credit cards and bank transfers, not every exchange offers FIAT withdrawals.

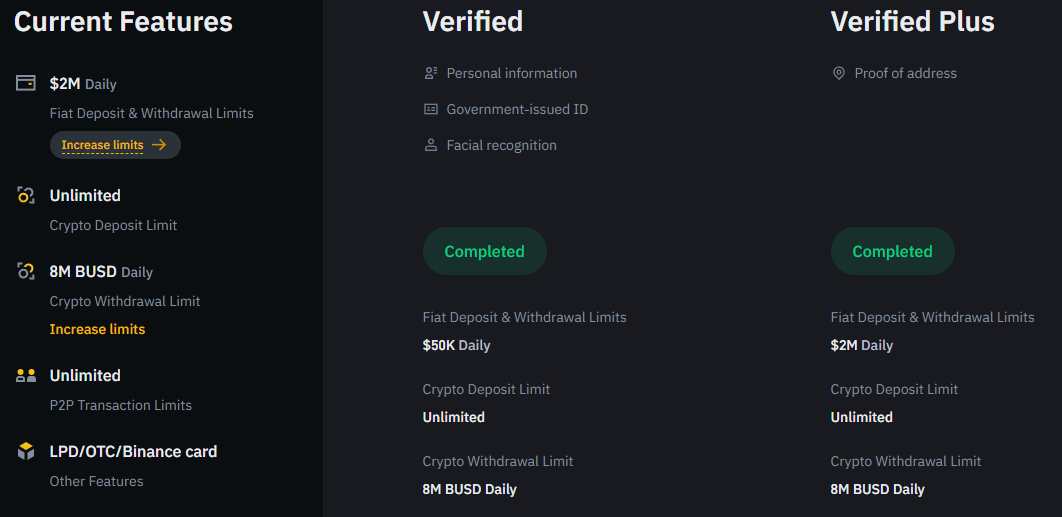

Furthermore, you should check the daily and monthly withdrawal limit on the exchange. Some exchanges have really low withdrawal limits for users without KYC.

13. Customer Support

Last but not least you should make sure that the customer support of the exchange you want to choose is solid. Most tier 1 cryptocurrency trading platforms offer multilingual 24/7 live chat support which is directly integrated into their platform. This is the industry standard.

Other than that you can try reaching out to them via email or social media channels such as Twitter or Instagram. Just be careful of fake customer support accounts on social media. Customer support staff will never ask you to send cryptos nor will they ask you for your seed phrase.

Some of the exchanges with the best customer support are Bybit and Binance.

Conclusion

Selecting the right crypto exchange can take time, especially as a beginner, but it will be worth doing the research and trying thigns out. At the end of the day, you should feel safe and happy with the crypto exchange you registered on. Also, you don’t just have to stick to one single crypto platform. Sending cryptos is very cheap and does not take a lot of time, so whenever you want to use a service on another platform, you can simply send your funds over.

Also, it is important to really understand what you need and which features your needs require. If you just want to buy and hold cryptos, you must look for the best exchange for the spot market that supports the asset you desire.

If you want to day trade, you should look for the exchange that suits your needs on the futures market. Key factors for day traders are fees, liquidity, volume, reliability, and supported assets.

If you want to learn more about the best cryptocurrency exchanges for day trading, you can read our comprehensive guide here.