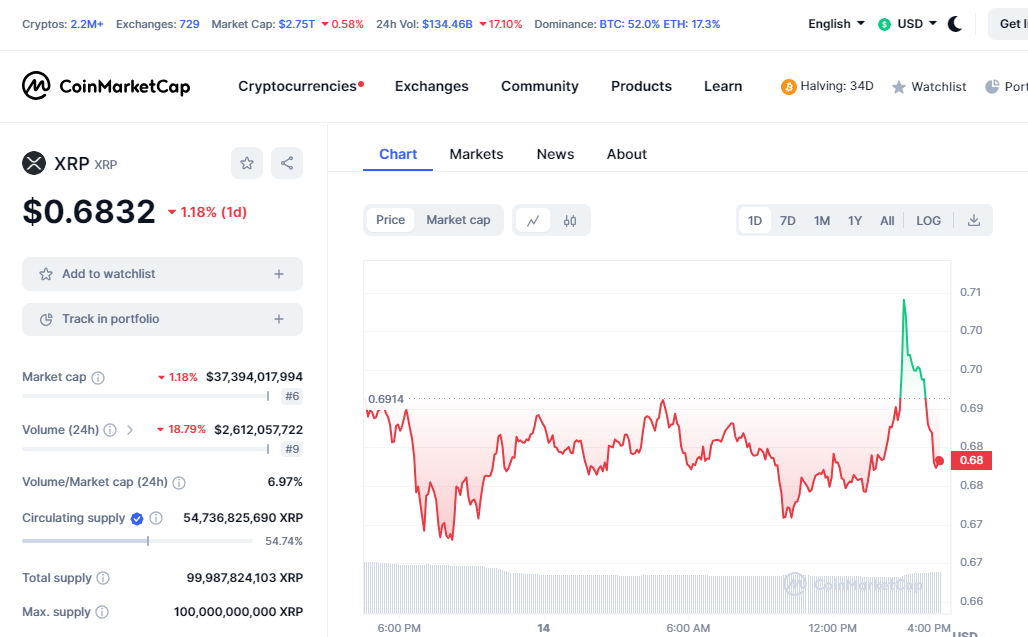

Ripple (XRP) stands out as a prominent cryptocurrency with a market cap of over $37 billion in facilitating seamless cross-border transactions. Amidst its rising popularity, one burning question persists: How many individuals actually own Ripple? As of 2024, over 5 million wallets hold at least 1 XRP.

This guide looks into the details of Ripple ownership, exploring various methodologies and insights to shed light on the figures. Join us as we solve the mysteries behind Ripple’s user base and gain valuable insights into the decentralized currencies holders. Let’s start exploring.

Research-Driven Facts About How Many People Own Ripple

Specifying the precise count of Ripple (XRP) owners presents challenges owing to the decentralized and constantly developing nature of the cryptocurrency.

While explorers like Binance offer glimpses into the number of addresses, still these unique individuals remain inaccessible, complicating the task of accurately quantifying XRP owners. Nonetheless, two dependable methodologies exist for approximating the Ripple user base, which you will find below.

Method 1: Ripple Wallets Analysis

Ripple’s growth, as indicated by research studies, reveals a remarkable surge in community interest and engagement. Its transition within a two-year period from 4 million to over 5 million active accounts signifies a renewal of enthusiasm within the XRP network.

The expansion of active XRP addresses, currently totaling 5,000,315, showcases a significant milestone for Ripple. This surge is accompanied by a collective holding of 99.98 billion XRP, valued at $56.41 billion, underscoring Ripple’s market dominance. Varied ownership, with 1,520,402 addresses holding below 20 XRP, highlights the broad accessibility and appeal of Ripple.

In addition, the latest update on XRP ownership as of October 27, 2023, reveals that approximately 4.82 million wallet addresses hold at least 1 XRP, reflecting a substantial growth trend.

Despite the challenge of precisely determining the number of individuals owning XRP due to the pseudonymous nature of the XRP Ledger, there’s a consistent increase in ownership, with an average of 438,180 new addresses added annually over the past 11 years.

Notably, the concentration of ownership among the top 10 addresses, primarily held by Ripple and exchanges, further illustrates Ripple’s market position and dominance.

Method 2: Ripple Transactional Activity

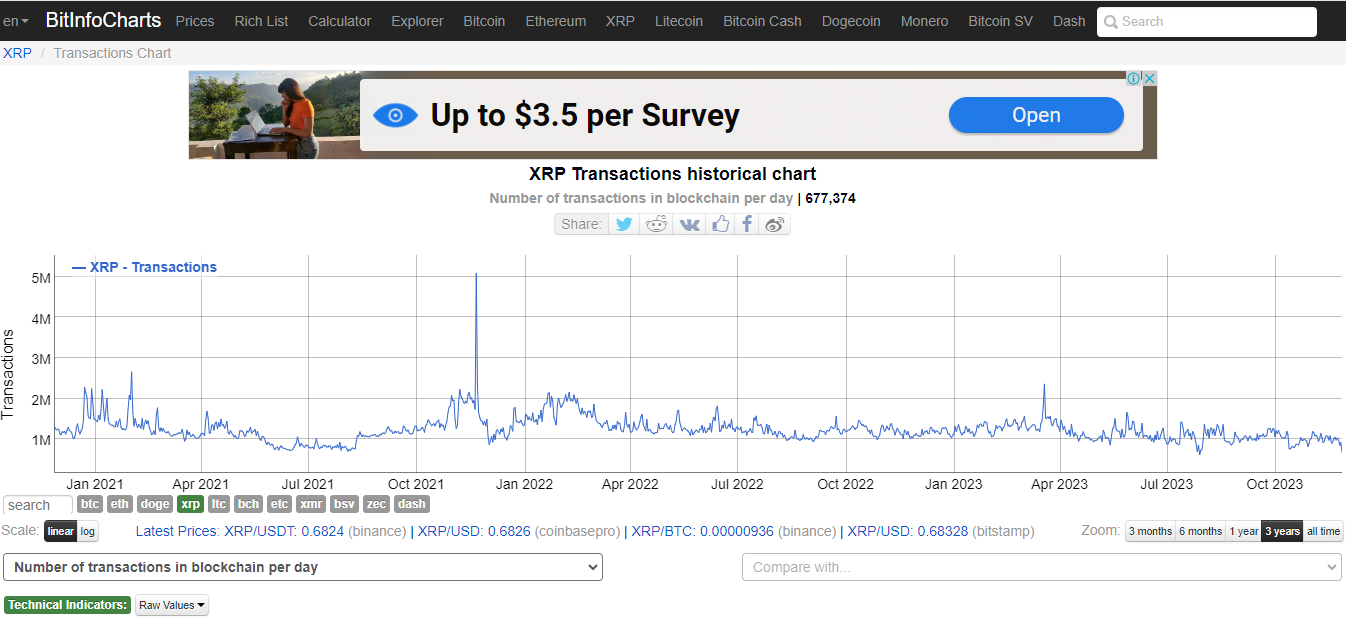

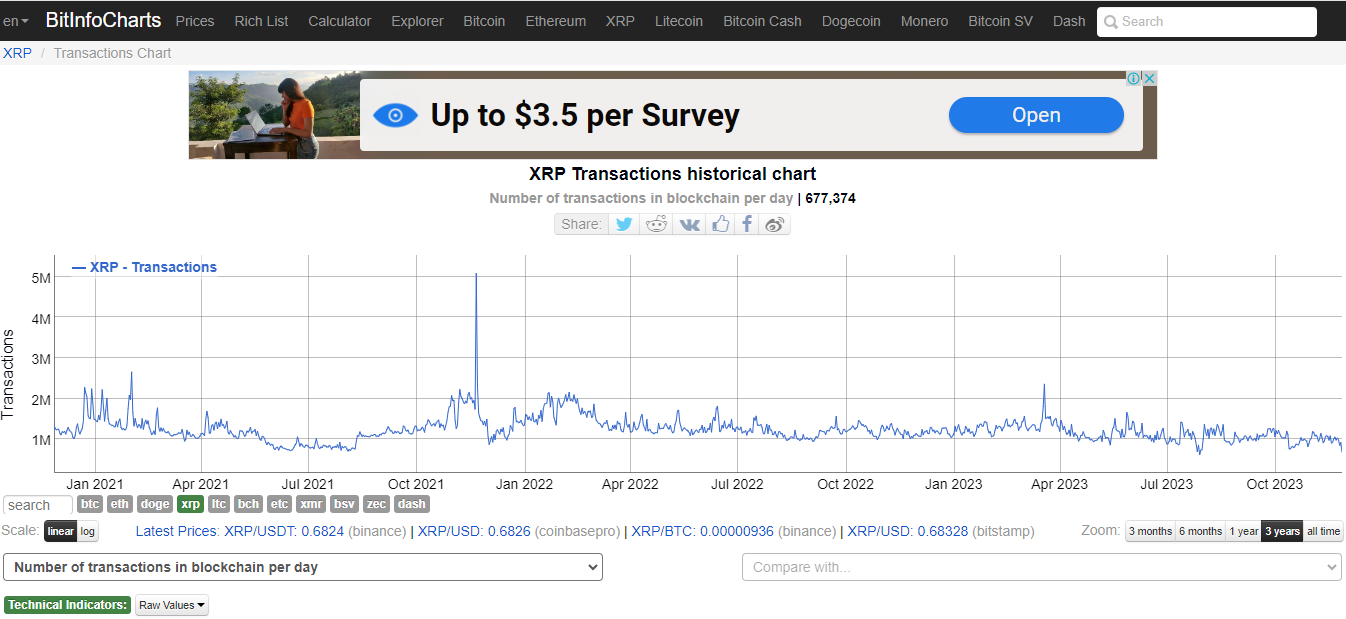

Ripple’s transactional activity on the Ethereum blockchain provides additional insights into its financial prowess and market standing. As of Statista reports of February 11, 2023, Ripple (XRP) displayed a significant surge in daily transaction volume, surpassing 2.5 million blockchain transactions.

This surge marks a significant increase from previous months and underscores Ripple’s prominence in the cryptocurrency domain. Notably, Ripple’s transaction volume outpaced that of Bitcoin during this period, highlighting its competitive edge and utility in facilitating efficient cross-border payments.

According to Bitinfocharts, Ripple (XRP) shows promising signs with its strong transaction activity, as seen in its historical chart, averaging 677,374 transactions per day. This surge underscores sustained interest and utility in the platform, reflecting its importance and relevance in the digital asset ecosystem.

Despite its modest market share compared to other cryptocurrencies, Ripple’s high transaction volume reflects its status as a prominent player in financial instruments and investments within the blockchain domain.

The sustained interest and engagement in Ripple’s platform suggest a promising future, supported by its utility in facilitating swift and efficient transactions globally. This continued growth in transactional activity underscores Ripple’s stability and potential to further disrupt the traditional financial industry.

Who Owns the Most Ripple?

According to Coincodex, Ripple’s ownership structure reveals insights into the distribution of XRP among major entities. Notably, Ripple itself holds the two largest addresses, emphasizing its significant stake in the cryptocurrency. The table below outlines the top 10 holders, showcasing their respective XRP amounts, percentage of circulating supply, and blockchain addresses.

| Owner | XRP Amount | % Of Circ. Supply | Blockchain Address |

|---|---|---|---|

| Ripple account 1 | 1,960,027,032 | 3.60% | rMQ98K56yXJbDGv49ZSmW51sLn94Xe1mu1 |

| Ripple account 2 | 1,541,294,080 | 2.83% | rKveEyR1SrkWbJX214xcfH43ZsoGMb3PEv |

| Binance | 1,477,168,712 | 2.71% | rEy8TFcrAPvhpKrwyrscNYyqBGUkE9hKaJ |

| Uphold | 1,372,766,274 | 2.52% | rBEc94rUFfLfTDwwGN7rQGBHc883c2QHhx |

| Binance | 931,894,888 | 1.71% | rs8ZPbYqgecRcDzQpJYAMhSxSi5htsjnza |

| Upbit | 911,346,890 | 1.67% | rDxJNbV23mu9xsWoQHoBqZQvc77YcbJXwb |

| Uphold | 837,891,325 | 1.54% | rsX8cp4aj9grKVD9V1K2ouUBXgYsjgUtBL |

| Kraken | 740,000,042 | 1.36% | rUeDDFNp2q7Ymvyv75hFGC8DAcygVyJbNF |

| Unknown | 685,476,580 | 1.26% | rwgvfze315jjAAxT2TyyDqAPzL68HpAp6v |

| Bitbank | 651,660,620 | 1.20% | rUeDDFNp2q7Ymvyv75hFGC8DAcygVyJbNF |

This table shows Ripple’s internal addresses that hold the lion’s share, reflecting its influence on XRP’s distribution.

Our Key Findings About Ripple Usage

This table shows our key findings about Ripple(XRP) ownership.

| Key Findings | Values |

|---|---|

| XRP Addresses Holding ≥ 1 XRP | Approximately 4.82 million |

| XRP Ledger Market Cap Growth in 2023 | $12 billion (73% increase) |

| Top 10 Addresses Share of Total XRP Supply | Over 11%, valued at $3.24 billion |

| Average New XRP Addresses Annually (11 years) | Around 438,180 |

| XRP Population Equivalent to Kabul, Afghanistan | Roughly 4.6 million |

| Total XRP Holdings by Population | Approximately $29.48 billion in value |

The Future of Ripple

The future of Ripple (XRP) appears promising, as evidenced by its strong transaction activity, with a remarkable historical chart averaging 677,374 transactions per day. This surge reflects sustained interest and utility in the platform, showcasing its importance and relevance in the digital asset ecosystem. With 4.82 million addresses holding at least 1 XRP, the network demonstrates widespread adoption.

Ripple continues to prove its utility in facilitating swift and efficient cross-border payments. Additionally, with a price of $0.6822 and a market cap of over $37 billion, Ripple remains a significant player in the cryptocurrency market, further showing its promising outlook.

Despite facing legal challenges with the SEC, Ripple maintains popularity. The ongoing lawsuit concerning XRP’s classification hasn’t significantly affected users, reflecting confidence in its utility. Ripple’s focus on real-world applications and partnerships positions it well for further growth.

The ongoing development of Ripple’s ecosystem and its commitment to addressing global payment challenges suggest a positive trajectory for XRP. As blockchain technology gains widespread acceptance, Ripple’s emphasis on facilitating swift, secure transactions positions it favorably for sustained growth, potentially solidifying its role as a key player in the changing domain of digital finance.

What Affects the Ripple User Base?

Let’s look into key metrics that can affect the value of Ripple, thereby influencing its user base volume in the future.

- Regulatory Policies: Political policies and regulatory decisions significantly impact Ripple’s user base. Clarity or uncertainty in regulations can influence investor confidence and adoption.

- Interest and Awareness: Ripple’s user base is affected by public interest and awareness. Media coverage, educational initiatives, and community engagement play vital roles in shaping perceptions and attracting users.

- Market Volatility: Ripple’s user base is sensitive to market volatility. Fluctuations in XRP’s value can impact investor sentiment, affecting both adoption and usage patterns.

- Economic Stability: Economic conditions influence Ripple users. During periods of economic uncertainty, individuals may seek alternative assets like XRP for financial security, affecting user numbers.

- Security Concerns: The security of the Ripple network and its technology is crucial. Any vulnerabilities or concerns regarding the safety of transactions can deter potential users.

- Partnerships and Collaborations: Ripple’s strategic partnerships impact its user base. Collaborations with financial institutions or other industries can enhance credibility and attract more users.

- Technological Developments: Advancements in blockchain technology and updates to Ripple’s protocol influence user satisfaction and retention. Users are more likely to stay engaged with a platform that embraces innovation.

- Global Economic Trends: Ripple’s user base is affected by broader global economic trends. Changes in international trade, monetary policies, or financial stability can indirectly impact the adoption and usage of Ripple.

Ultimately, the impact of economic events on Ripple’s long-term value remains uncertain. While significant news may prompt short-term market reactions, Ripple’s price fluctuations are primarily influenced by broader market trends rather than isolated events. Understanding these larger trends is crucial for assessing Ripple’s value over time.

In a Nutshell

While the exact number of Ripple (XRP) owners remains elusive due to the cryptocurrency’s decentralized nature, insights from various sources shed light on its widespread adoption and utility. Through reliable methodologies and data analysis, we gain valuable insights into the vibrant ecosystem of XRP ownership.

With millions of active addresses and a growing user base, Ripple continues to demonstrate its utility in facilitating efficient cross-border transactions. As the cryptocurrency field changes, Ripple’s innovative solutions will play a significant role in shaping the future of finance.

FAQs

1 – Who is the originator of Ripple?

Ripple, the cryptocurrency and payment protocol, was created by Chris Larsen and Jed McCaleb. Founded in 2012, Ripple Labs developed the XRP digital currency to facilitate faster and more cost-effective cross-border transactions. While both Larsen and McCaleb were instrumental in its creation, they have since pursued separate ventures within the broader blockchain and cryptocurrency space.

2 – Is the use of Ripple considered legal?

Yes, the use of Ripple (XRP) is generally considered legal. Ripple operates within legal frameworks in various jurisdictions, but regulatory perspectives may vary. It’s crucial for users to comply with local regulations and stay informed about the changing legal domain in the cryptocurrency space. Seeking professional advice can help ensure responsible and legal use of Ripple.

3 – How transparent is Ripple ownership distribution?

Ripple’s ownership distribution is relatively transparent due to its public blockchain ledger. However, specific details about individual holders may not be readily available. Transparency stems from the decentralized nature of blockchain technology, enabling users to track transactions. Nonetheless, complete visibility into the identities of Ripple holders might be limited to maintain privacy and security.

4 – What factors contribute to the adoption or disuse of Ripple among cryptocurrency enthusiasts?

The adoption or disuse of Ripple among cryptocurrency enthusiasts is influenced by various factors. Key considerations include its technological features, regulatory environment, market trends, partnerships, and community sentiment. Security, scalability, and transaction speed also play pivotal roles. Shifts in the global financial field and developing perceptions of digital assets contribute to the nature of Ripple’s adoption within the crypto community.

5 – Are there any recent developments or events influencing the ownership and usage patterns of Ripple?

Yes, recent events, such as regulatory changes, partnerships with financial institutions, and technological advancements, have significantly impacted Ripple’s ownership and usage patterns. These developments contribute to shifts in investor sentiment, adoption by businesses, and overall market nature, shaping the domain for Ripple users and stakeholders