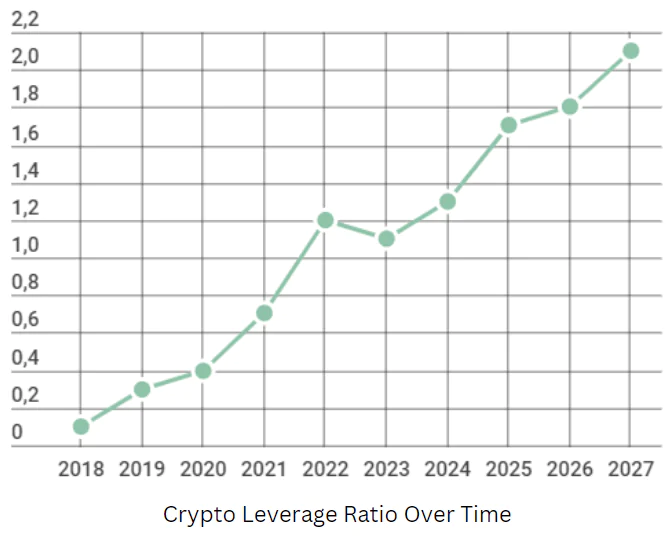

The leverage ratio in the crypto trading world has more than tripled from 2019 until 2025. This significant growth leads back to crypto exchanges offering more advanced derivatives products with lower fees and, of course, higher leverage. As investors want to use their capital in the most efficient way, leverage is a powerful tool to get the most out of your money.

As the leverage ratio is projected to double until 2027 and reach an effective leverage of 2.1x in the cryptocurrency market, it is time to look out for the crypto exchanges with the highest leverage.

With hundreds of crypto exchanges out there, it can be tricky to find the best crypto exchanges with the highest leverage. This list does not aim to provide the best overall exchanges, as in this guide, you will learn about the crypto exchanges with the highest leverage. We only focus on the crypto exchanges with the highest leverage for futures trading.

Highest Leverage Crypto Exchanges Reviewed

This guide is all about the highest-leverage crypto trading platform. We have analyzed over 100 leverage trading platforms to present you with the top 7 options sorted from highest leverage to lowest.

- Zoomex – 1000x leverage

- BTCC – 500x leverage

- MEXC – 300x leverage

- WEEX – 200x leverage

- BYDFi – 200x leverage

- Tapbit – 150x leverage

- Bitget – 125x leverage

- Binance – 125x leverage

| Exchange | Futures Contracts | Futures Fees | Max Leverage | Bonus | KYC Requirement |

|---|---|---|---|---|---|

| 1. Zoomex | 439+ | Maker: 0.020% Taker: 0.060% |

1000x | $200 | No KYC |

| 2. BTCC | 309+ | Maker: 0.045% Taker: 0.045% |

500x | $11,000 | No KYC |

| 3. MEXC | 600+ | Maker: 0.010% Taker: 0.040% |

300x | $8,000 | Required |

| 4. WEEX | 478+ | Maker: 0.020% Taker: 0.080% |

200x | $20,000 | No KYC |

| 5. BYDFi | 187+ | Maker: 0.020% Taker: 0.060% |

200x | $300 | No KYC |

| 6. Tapbit | 111+ | Maker: 0.020% Taker: 0.060% |

150x | 1% | No KYC |

| 7. Bitget | 246+ | Maker: 0.020% Taker: 0.060% |

125x | $6,200 | Required |

| 8. Binance | 352+ | Maker: 0.020% Taker: 0.050% |

125x | $100 | Required |

1. Zoomex – 1000x

Zoomex offers two types of derivatives platforms for its users: a traditional derivatives platform and Arena Trader Pro. For those seeking high-leverage trading on a secure platform, Arena Trader Pro provides up to 1000x leverage on 12 select pairs, with a trading fee of 0.04% for both maker and taker orders.

Users can always switch back to the standard Zoomex Derivatives platform, which gives them access to a broader range of futures contracts; a total of 439, though leverage is capped at 150x. This platform provides enhanced trading tools and operates under a separate fee structure of 0.02% for makers and 0.06% for takers.

What sets Zoomex apart is its hybrid structure, allowing users to choose between a centralized (CEX) and decentralized (DEX) trading experience. With the DEX option, users can trade on-chain using their Web3 wallets, accessing 150x leverage on the Ethereum network.

For a detailed analysis, check out our complete Zoomex review.

Zoomex Pros & Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Flexible trading options with CEX and DEX. | ❌ No fiat withdrawals available. |

| ✅ Focused on derivatives with USDT and Inverse Perpetual contracts | ❌ Market exposure risks with Inverse Perpetual Contracts. |

| ✅ Offers 24/7 customer support in various languages. | ❌ Relatively low number of spot coins |

| ✅ Low trading fees | |

| ✅ Maintains high liquidity for smooth trading experiences | |

| ✅ Strong security | |

| ✅ Arena Trader Pro offers 1000x leverage on 12 USDT pairs |

2. BTCC – 500x

BTCC is a well-established crypto exchange platform that facilitates leverage trading up to 500x on crypto futures. Their platform is user-friendly and provides an easy-to-navigate trading environment for both novice and experienced traders. While BTCC ranks number 3 sorted by highest leverage, we consider BTCC to be the best overall choice for high-leverage crypto traders.

When it comes to trading fees, BTCC has a competitive structure. They charge a taker and maker fee of 0.045%, which is a very low rate. It’s worth noting that BTCC claims to have some of the lowest fees in the market, which can be particularly attractive for traders keen on maximizing their returns.

With over $7 billion in daily trading volume, BTCC is one of the largest crypto derivatives exchanges in the world. With 250 supported digital assets for contract trading, crypto traders will find all major currencies, such as Bitcoin, Ethereum, Ripple, and more, with a maximum leverage of 500x.

Lastly, BTCC has been in operation since 2011, which speaks volumes about its reliability and the trust it has garnered over the years in the crypto trading community. The long operational history and the provision of advanced trading features such as margin trading and API access make BTCC a viable option for traders interested in leverage trading.

If you want to learn more about the exchange, you can read our full BTCC review.

BTCC Pros & Cons

| 👍 BTCC Pros | 👎 BTCC Cons |

|---|---|

| ✅ 500x leverage | ❌ Only 80 spot coins |

| ✅ Very low fees | ❌ No fiat withdrawals |

| ✅ High liquidity | ❌ Too advanced for beginners |

| ✅ Free demo account |

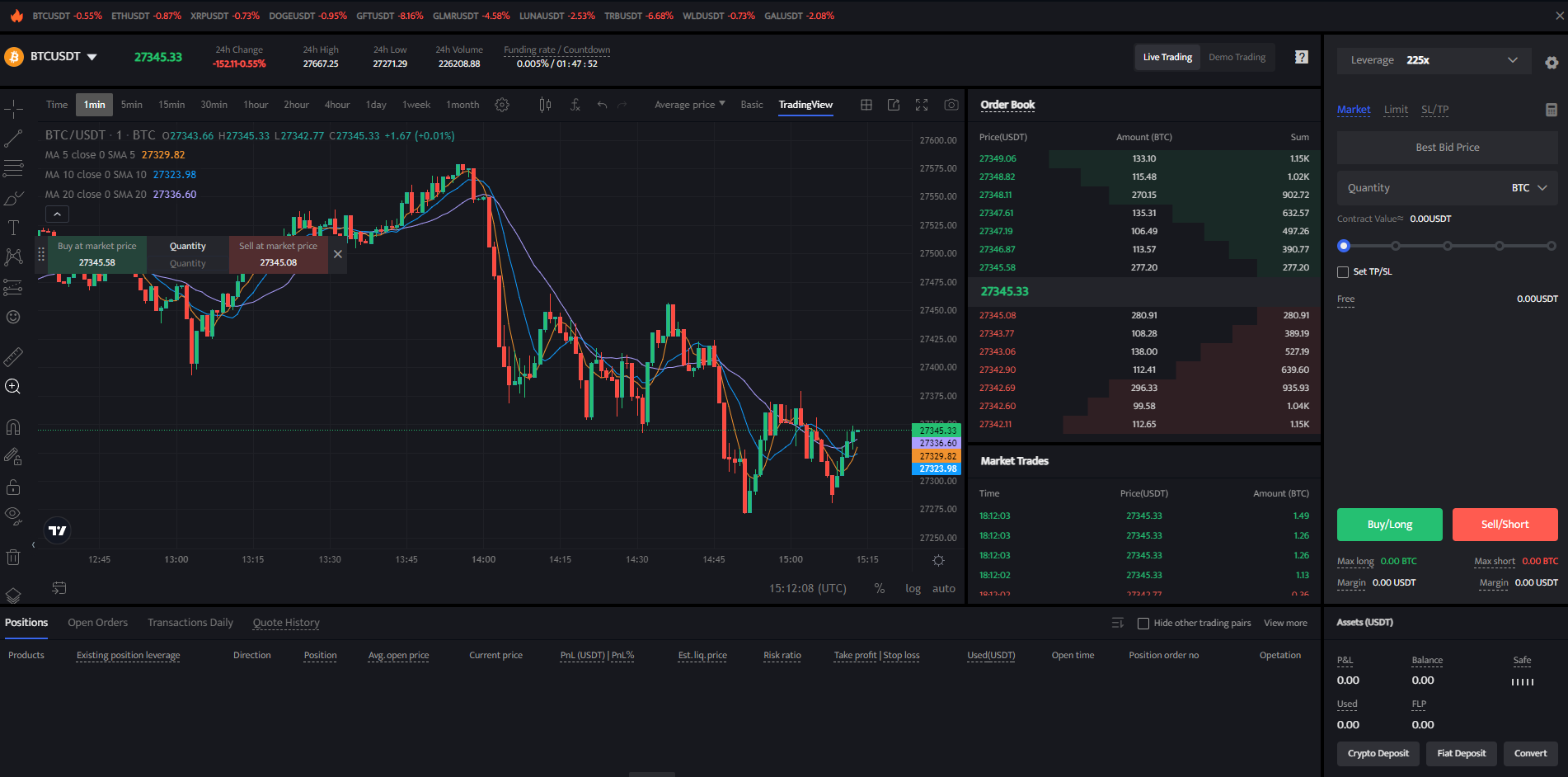

3. MEXC – 300x

MEXC has just introduced a leverage upgrade on BTC and ETH futures contracts. The previous maximum leverage of 200x is now increased to 300x. With a maximum leverage of 300x, MEXC is one of the highest leverage crypto exchanges in the indsutry right now.

Aside from offering incredibly high leverage, MEXC stands out with its wide range of tradable cryptocurrencies, covering over 3000 coins on the spot market and 660 coins on the futures market. This makes MEXC the number one exchange sorted by most cryptocurrencies.

In terms of fees, MEXC is unfortunately rather complicated. The exchange charges different fees based on your location. European traders pay 0.01% maker and 0.04% taker fees, while other users pay 0% maker and 0.02% taker fees. Additionally, MEXC regularly changes their fees, so make sure you check if there have been any recent updates.

Without any hacks or exploits, MEXC has a clean track record when it comes to customer funds and security. Additionally, MEXC stores most assets in cold storage and even provides full proof of reserves.

If you want to learn more about the exchange, you can read our full MEXC review.

MEXC Pros & Cons

| 👍 MEXC Pros | 👎 MEXC Cons |

|---|---|

| ✅ 3000+ Cryptos | ❌ No NFT market |

| ✅ Up to 300x Leverage | ❌ Lacks passive income products |

| ✅ Copy Trading | ❌ Lacks fiat Deposits/Withdrawals |

| ✅ Free Demo Account | ❌ Constantly changes fee structure |

| ✅ 24/7 Live Chat Support | ❌ European users pay much higher fees |

| ✅ Very User Friendly |

4. WEEX – 200x

WEEX is known as one of the best no-KYC crypto exchanges with high leverage. The professional crypto trading platform offers leverage of up to 200x on selected assets such as BTC, ETH, XRP, and more.

What makes WEEX special is its no KYC policy and high number of supported assets to trade. Over 600 cryptos are available for trading on WEEX, and 380 contracts are available for futures trading with high leverage of up to 200x.

The WEEX trading interface is well-designed, making it simple to navigate through the platform. Aside from offering high leverage and an amazing trading platform, WEEX also charges low fees. The futures fees start at only 0.02% maker and 0.08% taker fees. This places WEEX as great crypto futures exchanges while offering some of the highest leverage in the game.

As WEEX requires no KYC, you can deposit your cryptos to get started right away while staying anonymous. With deep liquidity, some of the lowest leverage trading fees, and very low spreads, WEEX is one of the best crypto exchanges for crypto traders seeking high leverage.

If you want to learn more about WEEX, we highly recommend you check out our comprehensive WEEX review.

WEEX Pros & Cons

| 👍 WEEX Pros | 👎 WEEX Cons |

|---|---|

| ✅ Access to over 603 cryptocurrencies | ❌ No fiat currency deposit or withdrawal options |

| ✅ High leverage up to 200x | ❌ OTC trading is for Chinese users only |

| ✅ No mandatory KYC | ❌ WXT token offers limited benefits |

| ✅ 1,000 BTC protection fund for additional security | ❌ Unregulated platform |

| ✅ Free internal transfers between WEEX accounts |

5. BYDFi – 200x

BYDFi (formerly BitYard) is a licensed crypto exchange operating in over 150 countries, including the United States. The exchange puts its focus on delivering high-quality leverage trading. With an impressive leverage of 200x, it is safe to say that BYDFi has secured a spot in the list of crypto exchanges with the highest leverage.

The fast-growing crypto exchange has one of the best and highest-leverage trading platforms in the world. Over 180 derivatives contracts are available for leverage trading on BYDFi. While popular cryptos such as BTC, ETH, or XRP support the highest leverage of 200x, smaller cryptos and meme coins have lower leverage between 10x to 175x.

Overall, BYDFi is a top choice for traders looking for the highest leverage trading platforms with fair fees of 0.02% maker and 0.06% taker.

If you want to learn more about the platform, you can read our full BYDFi review.

BYDFi Pros & Cons

| 👍 BYDFi Pros | 👎 BYDFi Cons |

|---|---|

| ✅ 200x leverage | ❌ Average fees |

| ✅ Licensed in US | ❌ Lacks fiat support |

| ✅ High liquidity | ❌ Only major coins support 200x leverage |

| ✅ Very beginner friendly |

6. Tapbit – 150x

Tapbit is a relatively new crypto exchange that was founded in 2021. However, the platform quickly rose to the top of crypto exchanges and now ranks in the top 10 crypto exchanges on CoinMarketCap based on liquidity. With up to 150x leverage, 150 futures contracts, and low trading fees, Tapbit is the perfect option for high-leverage crypto derivatives traders.

The derivatives trading dashboard is well-designed and very user-friendly.

The Tapbit futures fees start at 0.02% maker and 0.06% taker, making it an affordable option. Aside from self-trading, Tapbit also offers passive trading options such as automated grid trading and copy trading with up to 150x leverage.

Lastly, Tapbit not only offers crypto trading with some of the highest leverage but even forex trading with up to 200x leverage.

Overall, Tapbit is an excellent crypto exchange for traders seeking the highest leverage platforms.

7. Binance – 125x

Binance is the largest crypto exchange in the world, with over 120 million registered users. With a wide variety of products, Binance also has an excellent derivatives product for leverage traders. The maximum leverage on Binance is 125x for selected assets such as BTC and ETH.

For high-leverage futures traders, Binance offers a well-designed interface. However, it is important to note that Binance is designed for advanced and experienced traders, making it hard for newbies to navigate through the platform due to all the available information and order types. At the same time, this is exactly what professional crypto traders need.

For futures trading, Binance charges maker fees of 0.02% and taker fees of 0.04%. This makes Binance one of the cheaper crypto leverage trading platforms.

Aside from futures trading products, Binance also offers spot, options, NFT, and bot trading.

If you want to learn more about the exchange, you can read our full Binance review.

Binance Pros & Cons

| 👍 Binance Pros | 👎 Binance Cons |

|---|---|

| ✅ 125x leverage | ❌ Not beginner friendly |

| ✅ Best reputation | ❌ Not available in US |

| ✅ High liquidity | ❌ Only major coins support 125x leverage |

| ✅ Low fees |

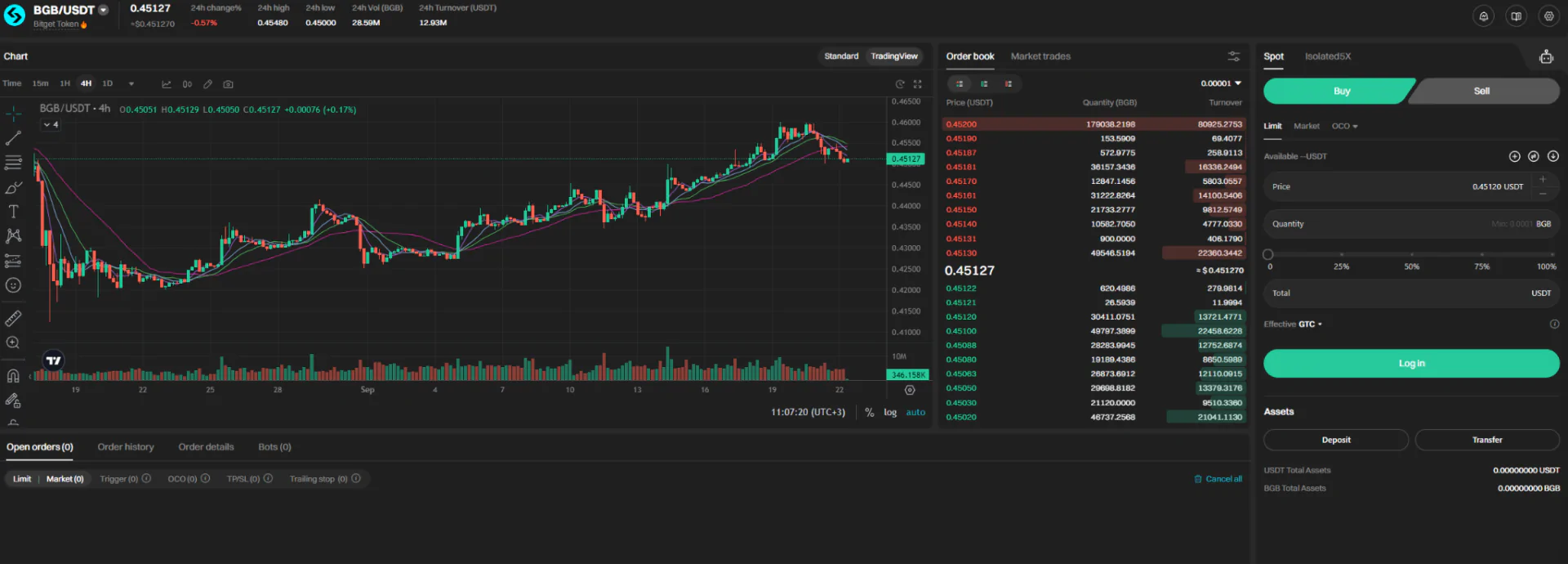

8. Bitget – 125x

Bitget is a relatively new crypto exchange that should not be underestimated. With a high leverage of 125x, Bitget caters to serious traders. While Bitget offers many advanced tools and options, the exchange is still very well-designed and beginner-friendly.

Where Bitget stands out most is its extensive number of supported coins. 600 cryptos are available for spot trading, and 320 cryptos are available for futures trading with leverage.

The trading fees on the futures market are 0.02% maker and 0.06% taker, which is the industry standard.

For passive income, Bitget offers excellent futures copy trading where you can easily follow professional traders to earn money from their performance.

If you want to learn more about the exchange, you can read our full Bitget review.

Bitget Pros & Cons

| 👍 Bitget Pros | 👎 Bitget Cons |

|---|---|

| ✅ 125x leverage | ❌ Average fees |

| ✅ Very beginner friendly | ❌ Not available in US |

| ✅ Many coins |

Advantages of High Leverage Crypto Trading

Many professional crypto traders utilize leverage to accelerate their gains and to use their portfolio balance in the most efficient way possible. By using leverage, a trader does not have to keep all of their balance on one exchange just to reach the desired position size. This lowers the capital exposure risk on crypto exchanges. We always recommend keeping as little as possible on centralized exchanges. Therefore, leverage is a powerful tool to effectively use your capital.