Yield-earn products are services that allow crypto holders to earn interest by lending their assets to other users or platforms. The exchanges that offer these products involve interest percentages that holders benefit from for passive earning.

Top 5 Crypto Exchange Earn Products Reviewed

In this review, we will analyze some of the cryptocurrency exchanges with the best yield-earning products based on the annual percentage yield (APY) they offer, supported assets, and security features.

- BTSE – 18.4% APY (AXS)

- OKX – 17.52% APY (TIA)

- WhiteBIT – 17.39% APY (BTC)

- Kucoin – 15% APY (HYDRA)

- Pionex – 10.43% (USDT)

| Exchange | Cryptos | Spot Fees | Future Fees | Max Leverage | Bonus | KYC | Top Product |

|---|---|---|---|---|---|---|---|

| 1. BTSE | 100+ | 0.09% / 0.09% | 0.02% / 0.06% | 100x | $4,163 | Yes | 22.5% APY AXS |

| 2. OKX | 317+ | 0.08% / 0.10% | 0.02% / 0.05% | 125x | $10 | Yes | 17.52% APY (TIA) |

| 3. WhiteBIT | 274+ | 0.10% / 0.10% | 0.00% / 0.00% | 100x | $10 | Yes | 17.39% APY (BTC) |

| 4. Kucoin | 800+ | 0.10% / 0.10% | 0.02% / 0.06% | 125x | $10,500 | Yes | 12% APY LUNA |

| 5. Pionex | 150+ | 0.05% / 0.05% | N/A | None | None | Yes | 10.43% APY (USDT) |

1. BTSE

When it comes to passive earning, BTSE is a major competitor in the cryptocurrency market. The exchange offers earn yields that are more promising compared to many of the top crypto exchanges.

BTSE offers 45 crypto tokens for users to select for their passive earnings. On BTSE, there are four major passive earning products to select from. These are:

- Staking

- Flexible savings

- Fixed savings

- Lending

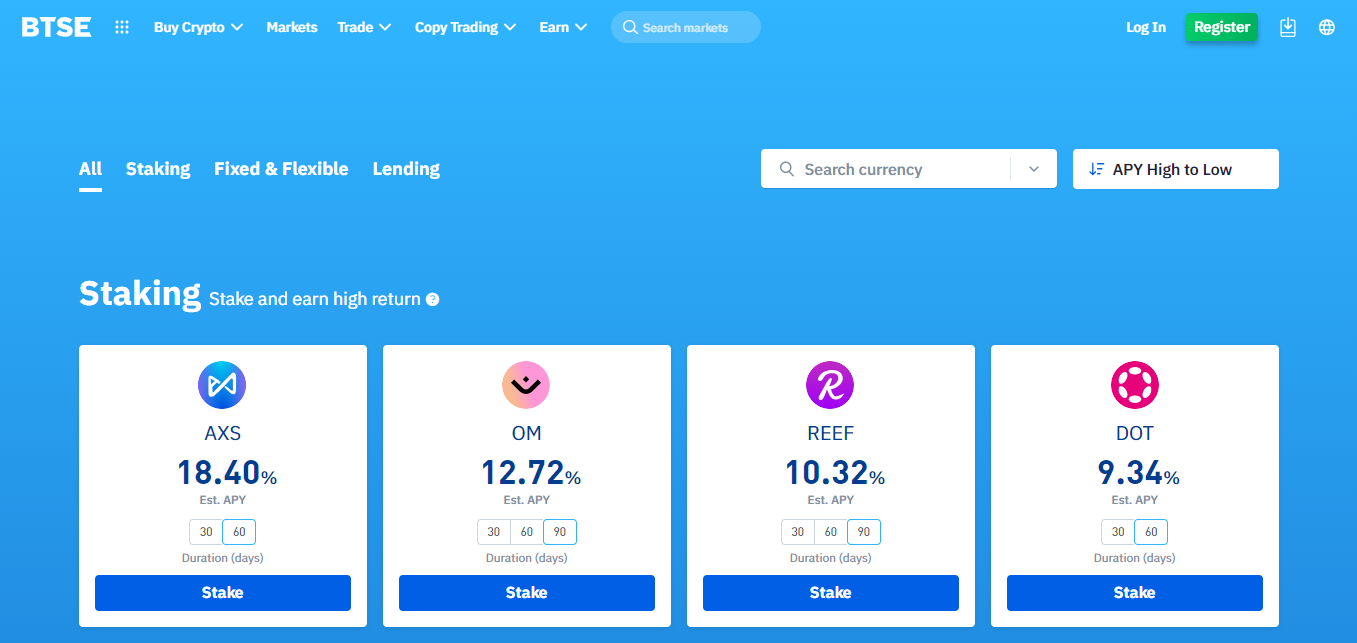

When staking on BTSE, you can earn significant interest on the assets listed. High-yielding assets include AXS, OM, REEF, and DOT. You also have access to quality projects already pre-vetted while sparing you all that work.

The highest-yielding product for BTSE is its staking platform, which yields up to 18.4% of AXS tokens, the highest that the exchange offers.

Based on the asset, users can expect a return on their investment between 30 to 60 days, but some like the fixed savings may extend to 90 days. Each asset also has its own APY is determined by the current state of the market and the liquidity of the asset.

Stablecoins and popular coins usually offer more stability and lower risks than less liquid and more volatile coins, but they tend to offer lower annualized yields (APY).

- Fixed: You can lock your funds for a fixed period and earn a guaranteed interest rate. The longer the duration, the higher the interest rate. You can choose from various coins, such as USDT, USDC, TUSD, BTC, and ETH.

- Flexible: You can deposit and withdraw your funds at any time and earn a variable interest rate that changes daily. You can also enable the Auto-Earn feature to automatically invest your idle assets into flexible savings products. You can choose from various coins, such as USDD, USDT, USDC, USDP, DAI, TUSD, BTC, and ETH.

- Lending: You can lend your funds to other traders who need margin for their positions and earn a competitive interest rate. You can choose from various coins, such as WHKD, WUSD, WSGD, BTSE, WGBP, and WEUR.

2. OKX

OKX is a leading crypto exchange that offers various yield-earning products, such as staking, savings, and lending. OKX claims to offer up to 300% APY on products like its seagull and dual investment under structured products, which is one of the highest in the industry.

However, the actual APY may vary depending on the market conditions, the demand and supply of the assets, and the duration of the investment. For example, for the seagull-earn product, a bullish placement for BTC will produce an APR of up to 116.43% while a bearish placement can produce up to 95.62% APR. This same applies to many other tokens and depends on which of the earned products the user engages with. OKX also provides a tool to calculate the estimated APY for different products and assets.

On the OKX earn platform, users are entitled to 100+ diverse tokens to hold and maximize profits with. These tokens include popular cryptocurrencies such as BTC and ETH, as well as stable coins like USDT and USDC.

There are three major products for earning on OKX. These are:

- Simple earn

- Structured products

- On-chain earn

Each of these products offers a different APY percentage on the tokens selected.

- Simple Earn: You can deposit your funds and earn interest. You can choose between flexible and fixed-term options, with fixed terms typically offering higher returns. You can choose from various coins, such as BTC, ETH, USDT, and others.

- Loan: You can lend your funds to other traders who need margin for their positions and earn a competitive interest rate. You can choose from various coins, such as USDT, USDC, USDK, and others.

- On-chain Earn: You can stake your funds to support the network security and governance of various blockchain projects and earn rewards in their native tokens. You can choose from a wide range of coins, such as ADA, AVAX, BNB, DOT, and others.

- Structured Products: You can invest in two scenarios at the same time and earn high-interest income before you successfully buy or sell crypto at your target price. You can choose from various products, such as Seagull, Dual Investment, Snowball, and Shark Fin.

Some of the factors that affect the APY on OKX:

- The type of product: OKX offers different types of yield earn products, such as fixed-term, flexible, and DeFi products. Each product has its terms and conditions, such as minimum and maximum amounts, lock-up periods, and withdrawal fees. Generally, fixed-term products offer higher APY than flexible products, but they also have longer lock-up periods and higher withdrawal fees. DeFi products are based on decentralized protocols that offer variable APY depending on the market dynamics and the risks involved.

- The type of asset: OKX supports over 100 crypto assets for its yield-earned products, such as BTC, ETH, USDT, OKB, and many others. Each asset has its own APY, which is determined by the demand and supply of the asset in the market, the liquidity of the asset, and the interest rate of the asset. Generally, stablecoins and popular coins offer lower APY than less liquid and more volatile coins, but they also have lower risks and higher stability.

- The duration of the investment: OKX allows users to choose the duration of their investment for some of its products, such as staking and savings. The longer the duration, the higher the APY, but also the lower the liquidity and flexibility. Users should consider their investment goals and risk appetite before choosing the duration of their investment.

3. WhiteBit

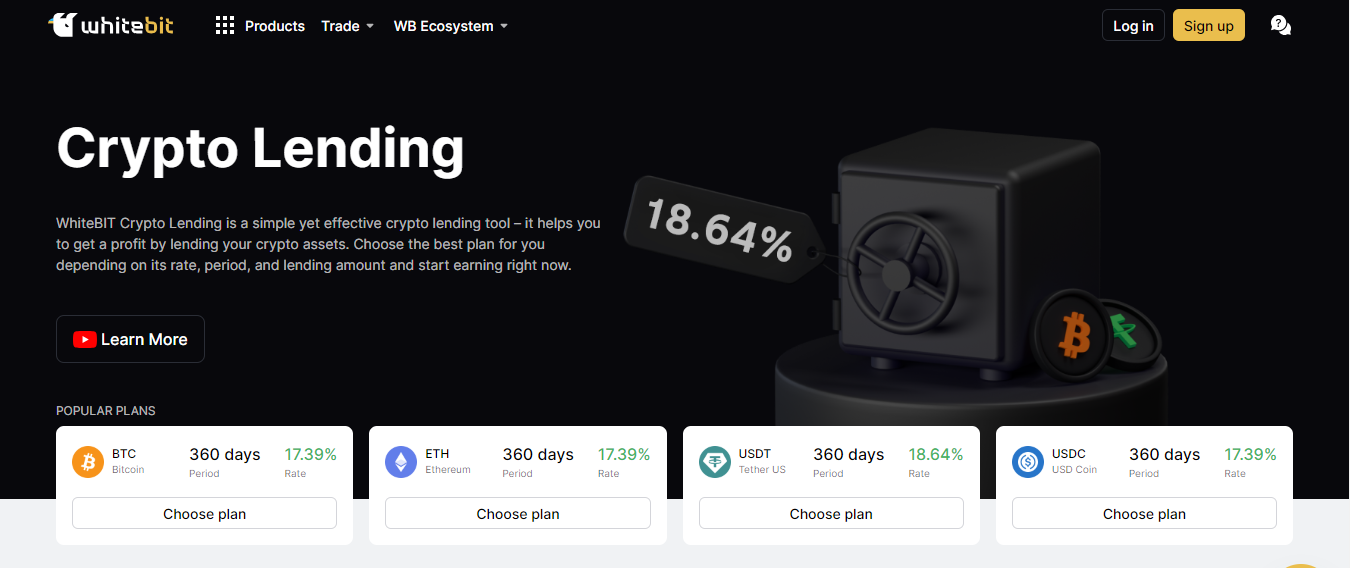

WhiteBIT is a cryptocurrency exchange offering various ways to earn passive income from digital assets. You can choose from different earn products, such as Crypto Lending and Staking, depending on your risk appetite, liquidity preference, and expected returns. Here is a brief overview of each product:

- Crypto Lending: You can lend your funds to the exchange for a fixed period and earn a guaranteed interest rate. The longer the duration, the higher the interest rate. You can choose from various coins, such as BTC, ETH, USDT, and others. Crypto Lending allows users to lend their digital assets to the exchange and gain a guaranteed reward in the same currency. Users can select from over 120 options with various interest rates, terms, and loan amounts. Interest rates range between 0.23% to 18.64% of income1. Users can earn 5.5% APY by lending Bitcoin for 30 days and 6.5% APY by lending Ethereum for 90 days.

- Staking: You can stake your funds to support the network security and governance of various blockchain projects and earn rewards in their native tokens. You can choose from a wide range of coins, such as ADA, AVAX, BNB, DOT, and others. Your funds become part of the Proof-of-Stake process, which means they verify and protect all transactions without the involvement of a bank or payment processor. This product, however, is not available to users yet.

4. Kucoin

Kucoin is a cryptocurrency exchange offering various ways to earn passive income from digital assets. You can choose from different earn products, such as:

- Savings: You can deposit your funds and earn interest. You can choose between flexible and fixed-term options, with fixed terms typically offering higher returns. You can choose from various coins, such as BTC, ETH, USDT, and others. You can also open multiple plans for the same asset but for different periods. The interest rate is accrued in the same currency as the loan.

- Staking: You can stake your funds to support the network security and governance of various blockchain projects and earn rewards in their native tokens. You can choose from a wide range of coins, such as ADA, AVAX, BNB, DOT, and others. You can also stake the Kucoin Token (KCS) to enjoy additional benefits.

- Promotions: These are fixed deposit products that provide higher returns compared to Savings and Staking but are made available for a limited time with limited subscription slots. They are available in flexible and fixed terms ranging from 7 days and up to 365 days, with the latter offering higher yields.

- ETH Staking: You can engage in Ethereum liquid staking on Kucoin Earn, earning rewards from the Ethereum blockchain.

- Advanced Products: These are products that have a fixed-term duration and offer higher potential gains with increased risks to your principal investment. They include Dual Investment, Snowball, and others.

5. Pionex

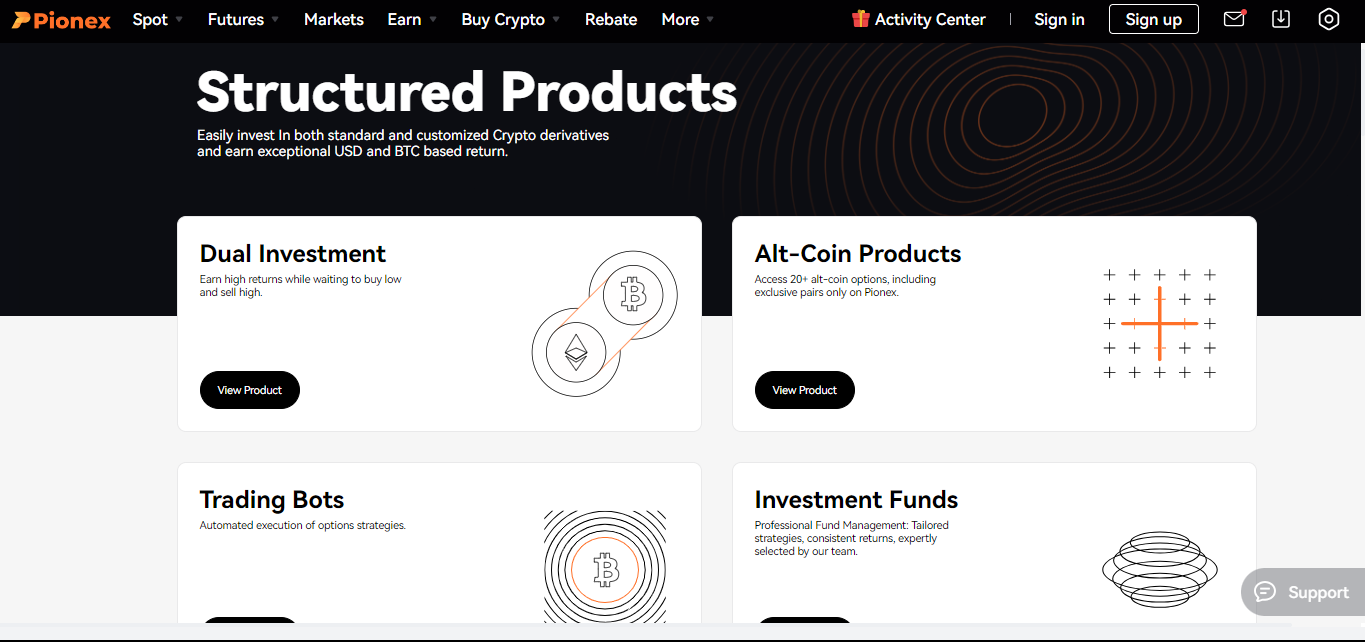

Pionex is a cryptocurrency exchange offering various ways to earn passive income from digital assets. You can choose from different earn products, such as:

- Structured Loan: You can borrow USDT at a low cost and high loan-to-value ratio (60%-80%) by using your crypto as collateral. You can also enjoy a built-in protection mechanism that reduces your liquidation risk and allows you to repay the loan in USDT or crypto.

- Dual Investment: You can invest in two scenarios at the same time and earn high-interest income before you successfully buy or sell crypto at your target price. The APY for Dual Investment can range from 10% to even around 300% depending on the target price and settlement date. You can choose from various products, such as Buy-the-Dip, Covered Gain, and Flying Wheel.

- ETH Staking: You can stake your ETH on Pionex and earn rewards from the Ethereum blockchain. You can choose from different durations, such as 30, 90, and 180 days, with different yield rates. The longer the duration, the higher the yield rate. The current yield rates are 3%, 3.25%, and 3.75% respectively.

- Easy Earn: You can deposit your crypto and earn interest. You can choose between flexible and fixed-term options, with fixed terms typically offering higher returns. You can choose from various coins, such as BTC, ETH, USDT, and others.

The highest-yielding product on Pionex is the Dual Investment, which can offer up to 300% APY depending on the market conditions and your target price.

Conclusion

Crypto exchanges are platforms that allow users to buy, sell, and trade cryptocurrencies. However, some crypto exchanges also offer various ways to earn passive income from your digital assets, such as lending, staking, and yield farming. These earned products can provide high returns for crypto holders who want to grow their holdings passively.

The best crypto exchanges with the highest yield earn products depend on several factors, such as the type of product, the supported coins, the fees, the risks, and the user experience. Some of the most popular and reputable crypto exchanges that offer high-yield earn products are:

- OKX: A crypto exchange that offers various earn products, such as simple earn, loan, on-chain earn, and structured products.

- BTSE: Especially known for its great staking returns and high yields of up to 18%. It also offers other products such as fixed and flexible savings, and lending.

- WhiteBit: Whitebit provides a good crypto lending platform and is currently preparing to launch its staking platform.

- Kucoin: A crypto exchange that offers various earn products, such as savings, staking, promotions, ETH staking, and advanced products.

- Pionex: A crypto exchange that offers various earn products, such as structured loans, dual investment, ETH staking, and easy earn.