Staking is a crypto activity where users traditionally had to connect their wallets to external applications, often facing technical difficulties and sometimes losing some of their assets in the process. This is now a thing of the past, as MetaMask has introduced its own staking feature through the MetaMask portfolio. In this guide, we will learn how to stake crypto on MetaMask and explore additional staking opportunities within this popular wallet.

MetaMask And Staking

MetaMask has added one of the latest features to its extensive range of crypto services: crypto staking. Crypto is a relatively new technology, and like all technologies, it can sometimes be challenging for users to understand and get familiar with.

Many people only know about crypto through Bitcoin and its exponential growth as an asset. This is mainly because other opportunities in crypto, such as staking, DeFi, and NFTs, can be difficult for new users to grasp. MetaMask users can now easily stake their Ethereum directly through the MetaMask portfolio on this popular self-custodial wallet.

Can I Stake With MetaMask?

Yes, MetaMask can now be used to stake your Ethereum directly within the MetaMask portfolio. MetaMask provides its users with the unique opportunity of pooled and liquid staking alongside the traditional validator staking, where users had to stake a minimum of 32 ETH to earn something from their idle Ethereum tokens.

How to Stake Crypto Tokens on MetaMask

Let’s now get right into MetaMask and staking. Connecting wallets to different DeFi platforms to earn something from Ethereum assets is no longer the only option. With MetaMask, users can stake their Ethereum in different ways: Liquid, Pooled, and Validator Staking.

Let’s take a look at each of these staking opportunities provided by MetaMask:

Validator Staking

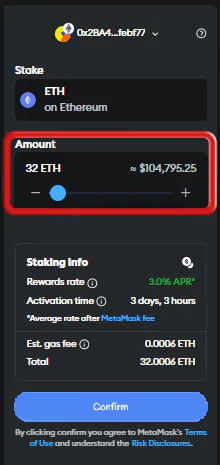

Ethereum’s legacy staking system allows you to stake your Ethereum as a validator to earn incentives while helping to secure the network. This requires users to stake a minimum of 32 ETH. Let’s take a look at how you can easily become a validator on the Ethereum blockchain through MetaMask:

Step 1: Open your MetaMask extension by clicking on the MetaMask icon in your Google extensions.

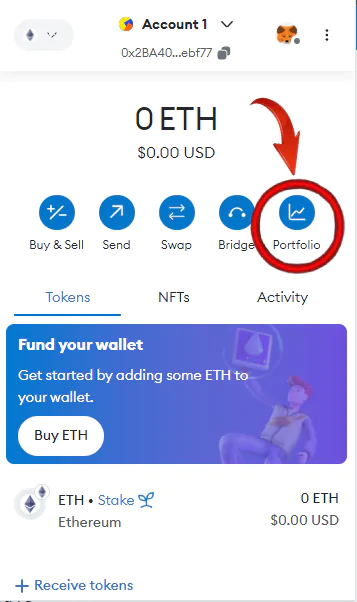

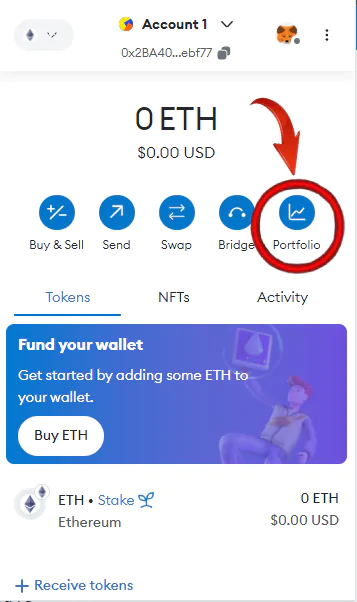

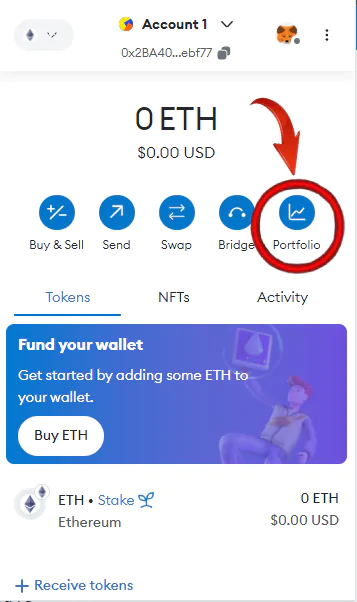

Step 2: Click on the “Portfolio” icon in your MetaMask wallet.

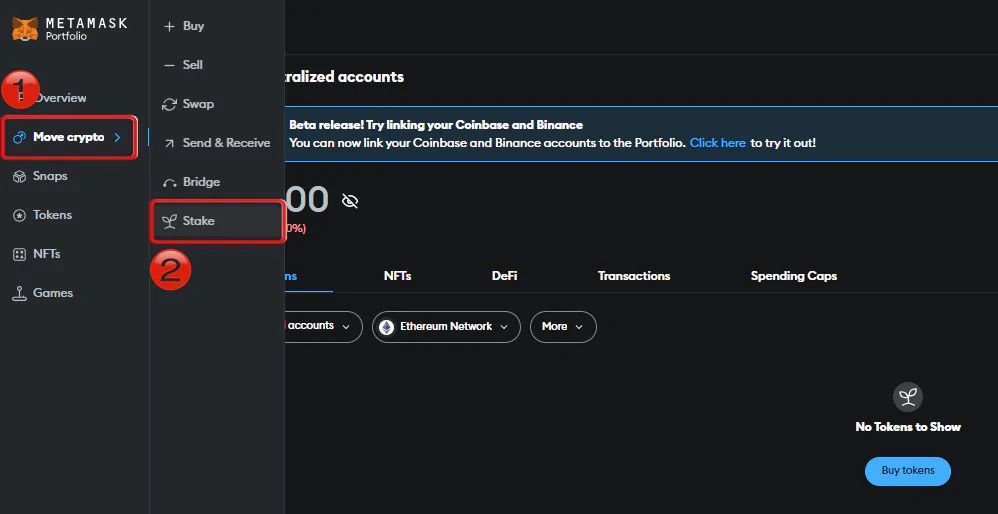

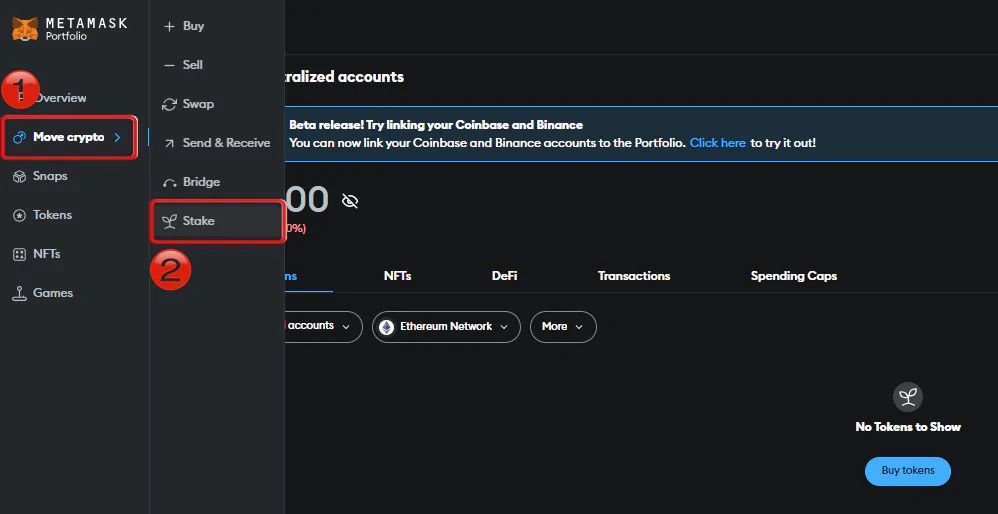

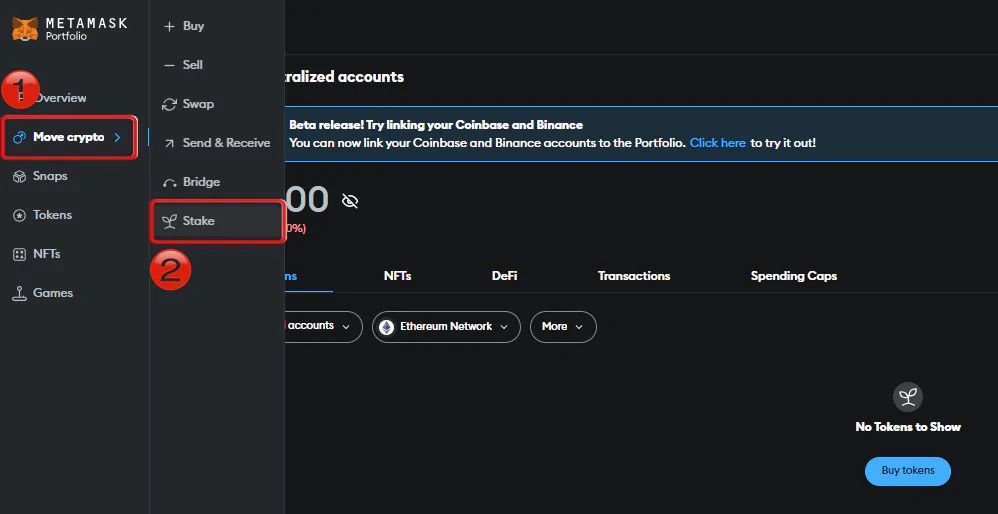

Step 3: The MetaMask Portfolio window will open. Here, click on the “Move Crypto” option in the left pane and then select “Stake” from the flyout menu.

Step 4: On the MetaMask staking webpage, click on “MetaMask Validators” to stake your Ethereum.

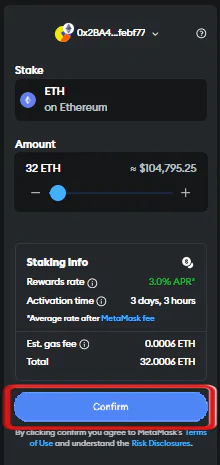

Step 5: For validator staking, the minimum amount required is 32 ETH. Enter the amount you wish to stake, and MetaMask will show all the necessary details, including APR, activation time, gas fees, and total.

Step 6: Next, click on the “Confirm” button after reviewing the details.

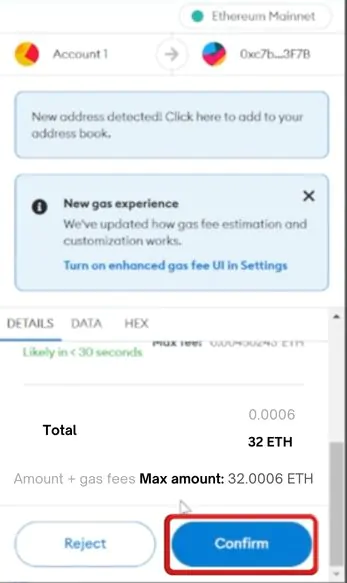

Step 7: You will then be prompted to sign the transaction on MetaMask. Click on “Continue” to approve the transaction.

Your Ethereum is now being used to secure the Ethereum blockchain as a validator. To check your holdings, visit your MetaMask portfolio to review your rewards and the current staked amount.

Pooled Staking

Becoming a validator on the Ethereum blockchain is not for everyone. With the price of Ethereum well over $3000, becoming a validator would require you to have Ethereum worth hundreds of thousands of dollars. However, since crypto is not just for the big players, smaller investors can take advantage of the pooled staking mechanism offered by MetaMask.

Here, users can allocate their Ethereum for staking to a pool of 32 Ethereum. This entire pool of investors can then collectively act as a validator on the Ethereum blockchain. Let’s take a look at the steps to stake your Ethereum in a pool using MetaMask.

Step 1: Access your MetaMask extension by clicking the MetaMask icon in your Google extensions.

Step 2: Select the “Portfolio” icon within your MetaMask wallet.

Step 3: In the MetaMask Portfolio window that appears, click on “Move Crypto” in the left pane and choose “Stake” from the flyout menu.

Step 4: On the MetaMask staking page, click on “MetaMask Pool” to start staking your Ethereum.

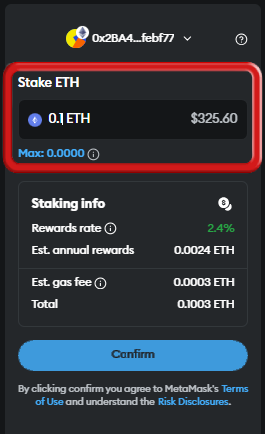

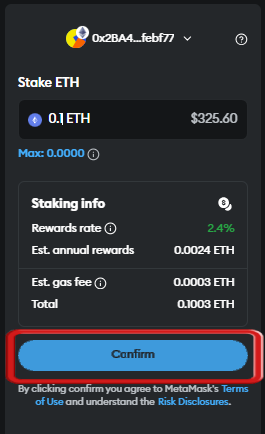

Step 5: Enter the amount of ETH you want to stake, and MetaMask will show you the estimated rewards, rate, and gas fees for the transaction.

Step 6: To confirm the transaction, click on “Confirm”. MetaMask will then prompt you to sign the transaction to approve it.

Once you have pooled your Ethereum, MetaMask will act as a validator on behalf of the entire pool, charging a small percentage as a fee. However, this fee is charged to provide an opportunity for small investors to become part of the blockchain, which would otherwise be impossible.

Liquid Staking

If you’re more into Liquid staking, MetaMask has that option available for you as well. For all new crypto investors, liquid staking is a mechanism through which users can stake their Ethereum on MetaMask and in return receive staked Ethereum (stETH), which can then be used as collateral.

For instance, a user might deposit ETH into the Lido staking pool to receive stETH tokens in return, which they can then deposit into Aave to earn interest. Currently, MetaMask offers two liquid staking platforms: Rocket Pool and Lido. Here are the steps to get into liquid staking with MetaMask:

Step 1: Open your MetaMask extension by clicking the MetaMask icon in your Google Chrome extensions.

Step 2: Tap on the “Portfolio” icon in your MetaMask wallet.

Step 3: When the MetaMask Portfolio window opens, click on “Move Crypto” in the left sidebar and then select “Stake” from the flyout menu.

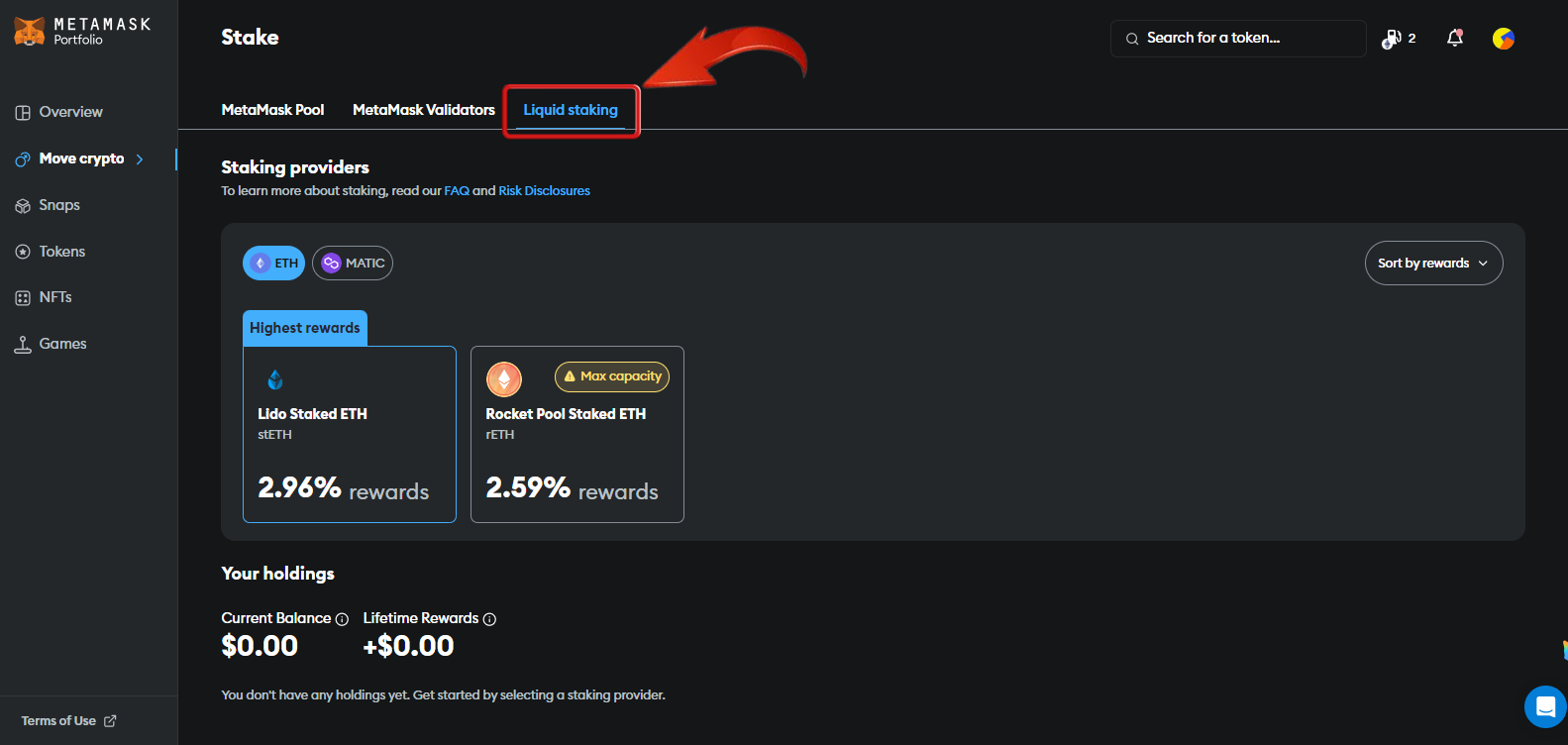

Step 4: In the MetaMask staking interface, select “Liquid Staking” to proceed with staking your Ethereum.

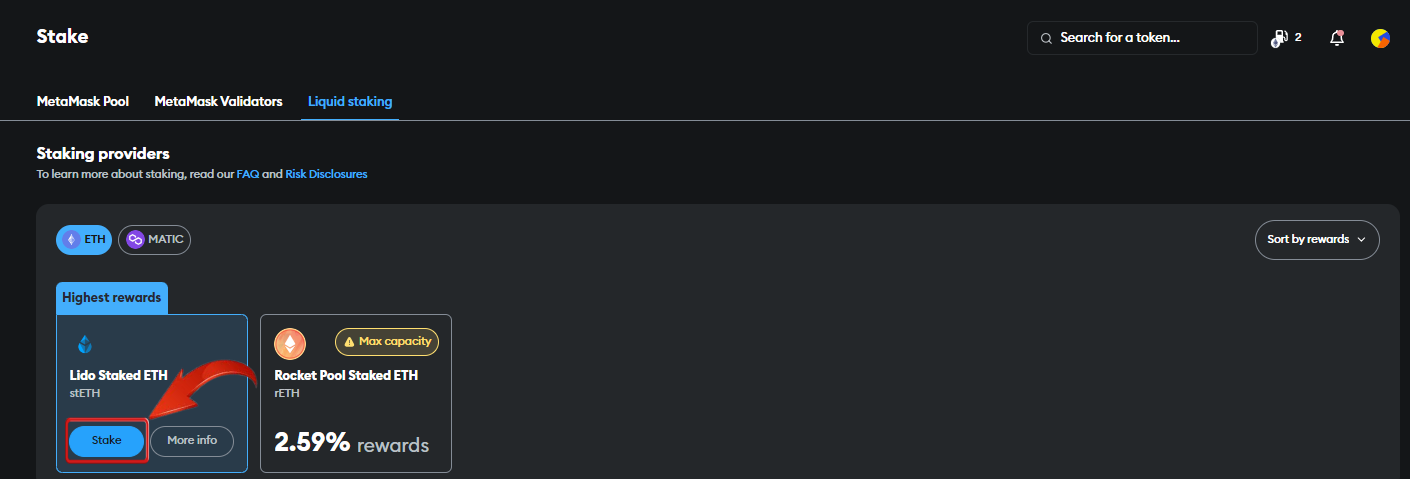

Step 5: In liquid staking, MetaMask users can stake both Ethereum and Matic tokens. To stake Ethereum, select one of the staking providers by hovering over it and clicking on “Stake”.

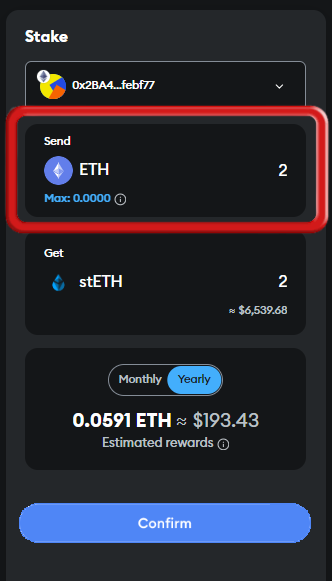

Step 6: On the next page, enter the amount of Ethereum you wish to stake. MetaMask will then show you the amount of staked Ethereum (stETH) you will receive, along with the APR and rewards.

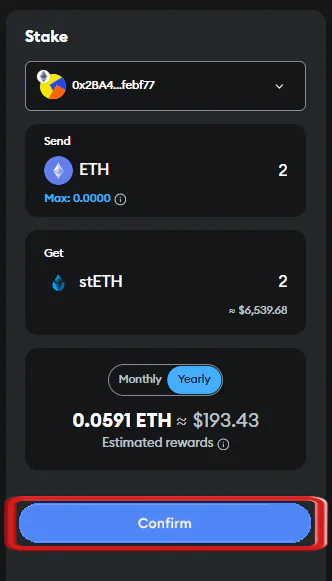

Step 7: Click on “Confirm” to proceed and then approve the transaction by signing the MetaMask transaction approval request.

Pro tip:

Gas fees are lower at certain times of the day. To save some money, you can check during off-peak times when gas fees are lower and stake your Ethereum then.

MetaMask users can now use stETH as collateral, sell it on exchanges like OKX or Bitget, or swap it within MetaMask.

How to Unstake From MetaMask Pooled Staking

If you’re looking to unstake your Ethereum, simply follow these steps:

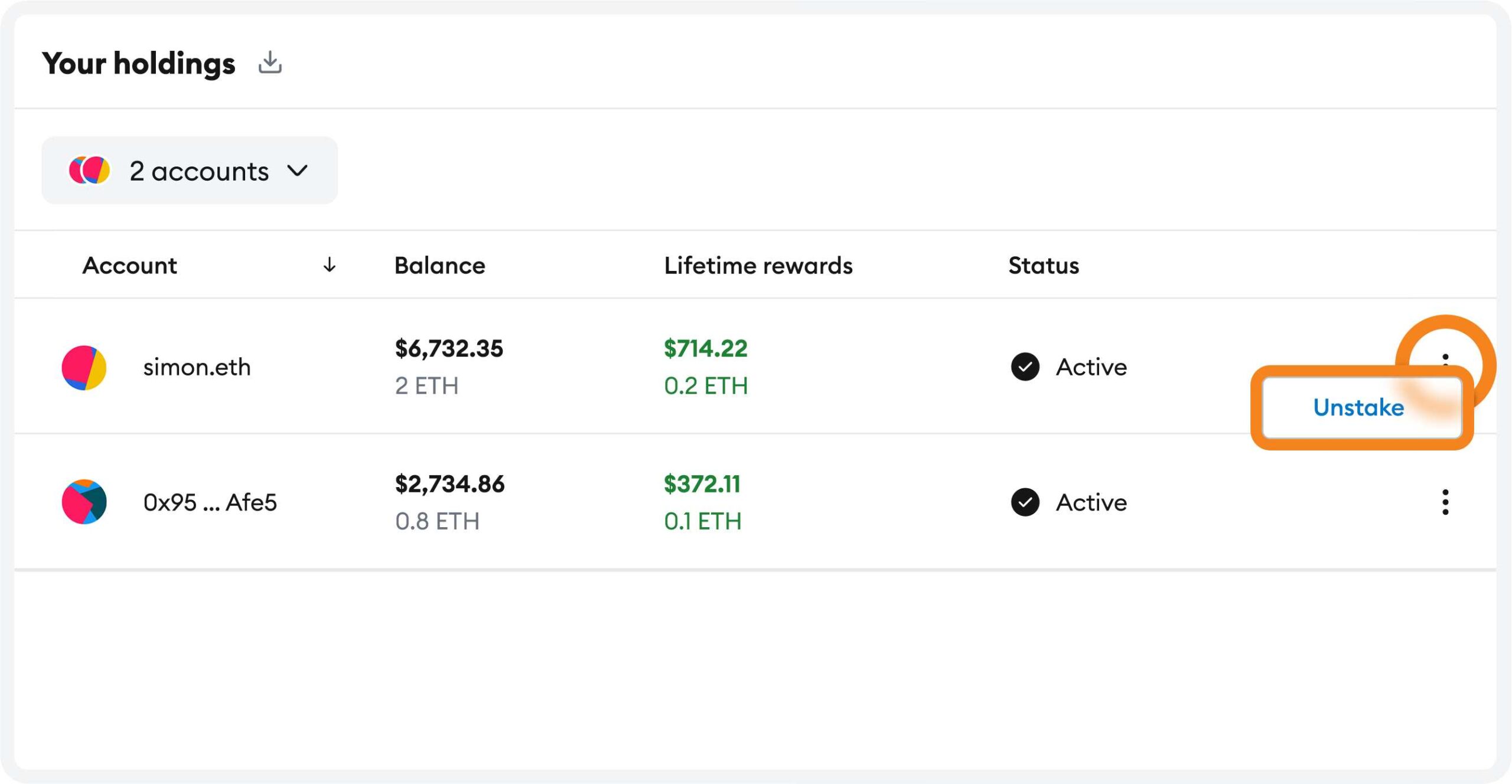

Step 1: On the MetaMask Pooled Staking homepage, locate the account from which you want to unstake. Click the three vertical dots on the right, then select “Unstake”.

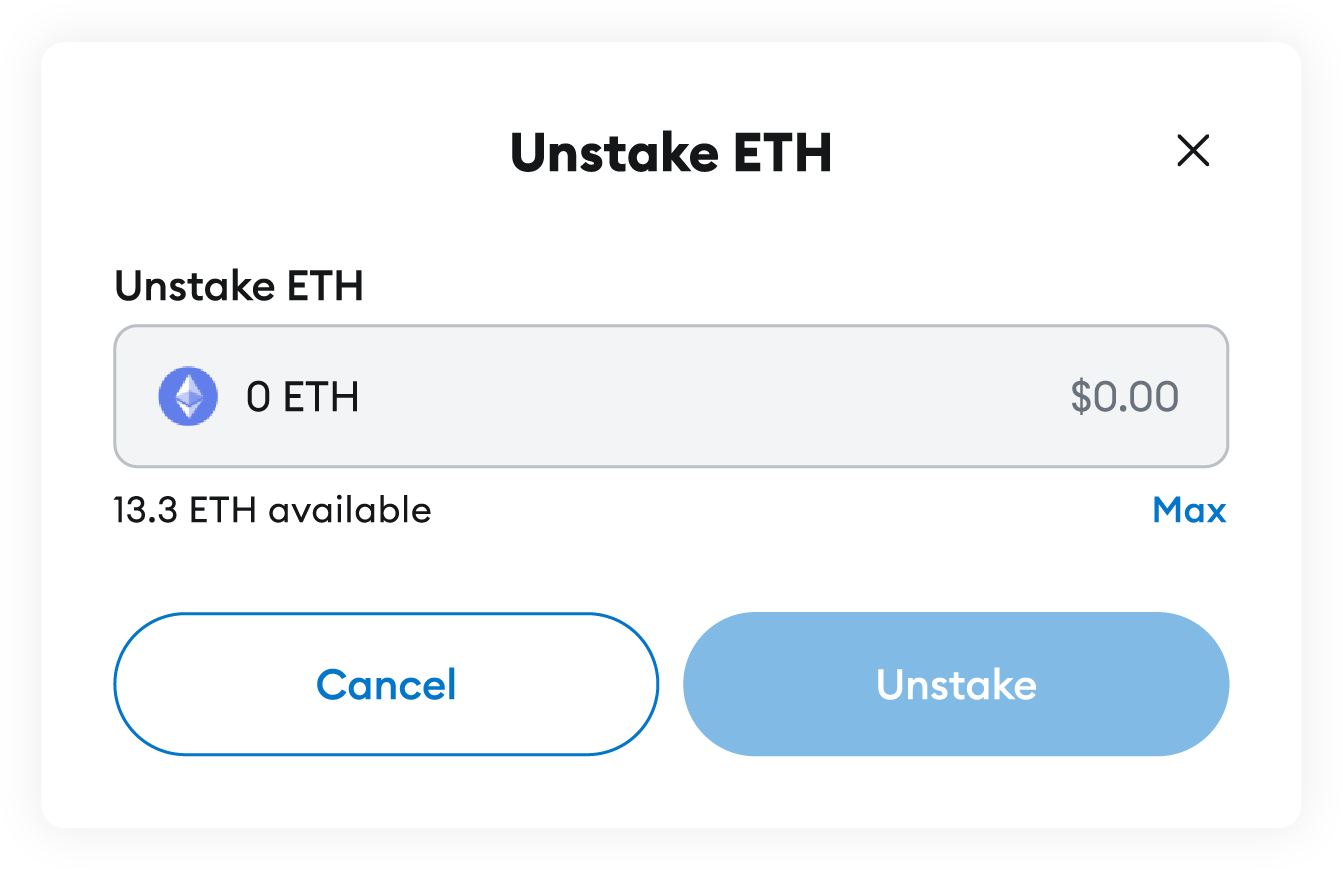

Step 2: Now simply enter the amount of ETH you wish to unstake. MetaMask will then display the details. If you agree with the unstaking details, click on “Unstake”.

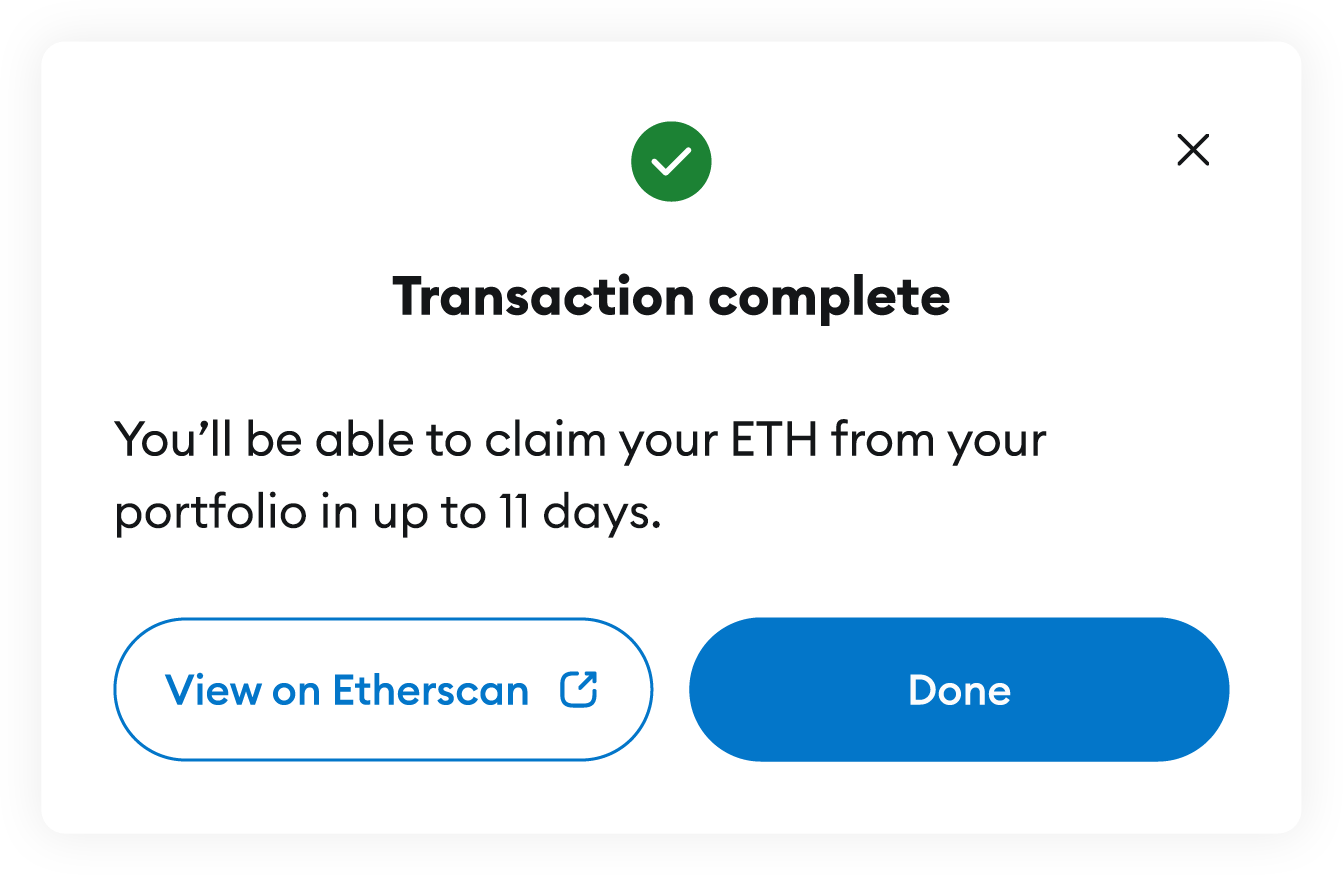

Step 3: After the transaction is confirmed, you will receive a “Transaction complete” message, indicating the duration before you can claim your unstaked ETH.

Benefits of Staking on MetaMask

Some of the major benefits of staking on MetaMask are as follows:

- MetaMask handles the staking process for you, including the setup and management of withdrawal addresses, making it easy to stake without needing to manage the technical details yourself.

- Your staked assets are held in a self-custodial setup, giving you control and responsibility over your funds. MetaMask recommends best practices to secure your assets, such as using hardware wallets and backing up your recovery phrase.

- MetaMask provides regular updates on your rewards, calculating them based on performance and fees, and adjusts your balance accordingly.

- You can manage your staking activities through the MetaMask Portfolio, simplifying the staking and reward tracking process.

Bottomline

So now, with the help of this guide, choose how you wish to stake your Ethereum and earn easily without any hassles. Staking through MetaMask is available to everyone, so be sure to take advantage of this opportunity!

FAQs

1. How can I be sure my stake won’t be slashed?

To minimize the risk of slashing, ensure your validators are operated by a reputable service with a strong track record. Consensys Staking, which manages MetaMask Staking validators, has never faced slashing penalties in over two years. Their validators are continuously monitored and supported by a robust infrastructure across global regions, enhancing resilience and reliability.

2. Why is my validator’s withdrawal address not my own?

When using MetaMask Staking, the withdrawal address is a unique smart contract set up by MetaMask. This contract ensures that fees are deducted and the bulk of the rewards are sent to your account. Although you don’t see your account as the withdrawal address, your rewards are still directed to your account, which is the only one with access to the smart contract.

3. How do you calculate rewards?

To calculate rewards:

- Predicted Rewards Rate: For new validators, it’s based on the average performance of similar validators over the past week.

- Actual Rewards Rate: For existing validators, it reflects your validator’s performance over its lifetime, minus a 10% MetaMask fee.

- Ethereum Protocol: Rewards are ‘swept’ from validator balances every nine days, affecting how rewards appear.

4. What happens if I lose access to the account I staked with?

If you lose access to the Secret Recovery Phrase (seed phrase) for the account you used to stake with MetaMask Staking, you lose access to your stake and rewards. As MetaMask Staking is self-custodial, you’re fully responsible for the security of your assets and accounts.

5. Does MetaMask charge a fee?

Yes, MetaMask charges a 10% fee on your rewards.