- Traditional staking at 3.95% APR would yield 1.2641 ETH per year.

- Liquid staking returns vary, but at 2% APR, you earn 0.64 ETH, while at 5% APR, you earn 1.6 ETH.

- Liquid staking tokens (LSTs) like stETH or rETH can be used in DeFi to increase earnings, which is not possible in traditional staking.

- The flexibility of liquid staking allows users to unlock additional yield-generating opportunities, making it a viable alternative despite potential fluctuations in LST value.

Many people are estimated to have poured billions into staking, lured by the promise of earning passive income while contributing to blockchain security. On the surface, it seems almost too good to be true; lock up your assets, help maintain the network, and watch the rewards roll in. It’s no wonder staking has become one of the cornerstones of the crypto world, especially with the rise of Proof-of-Stake (PoS) systems that offer a more energy-efficient alternative to traditional mining. In this article, we’ll pull back the curtain on liquid staking, exploring how it works, why it matters, and what it could mean for the future of crypto.

What is Liquid Staking and How Does It Work?

Liquid staking is a modern twist on the traditional staking model, designed to solve one of its biggest limitations: locked-up assets. To understand how it works, let’s start with the basics.

The Foundation: Traditional Staking

Staking has been a cornerstone of blockchain networks since the introduction of Proof-of-Stake (PoS) systems. In traditional staking, users lock up their tokens to help validate transactions and secure the network. In return, they earn rewards, which is a passive income stream that has attracted millions of users. However, this comes with a catch: once staked, those assets are locked and cannot be used elsewhere.

The Evolution: Liquid Staking

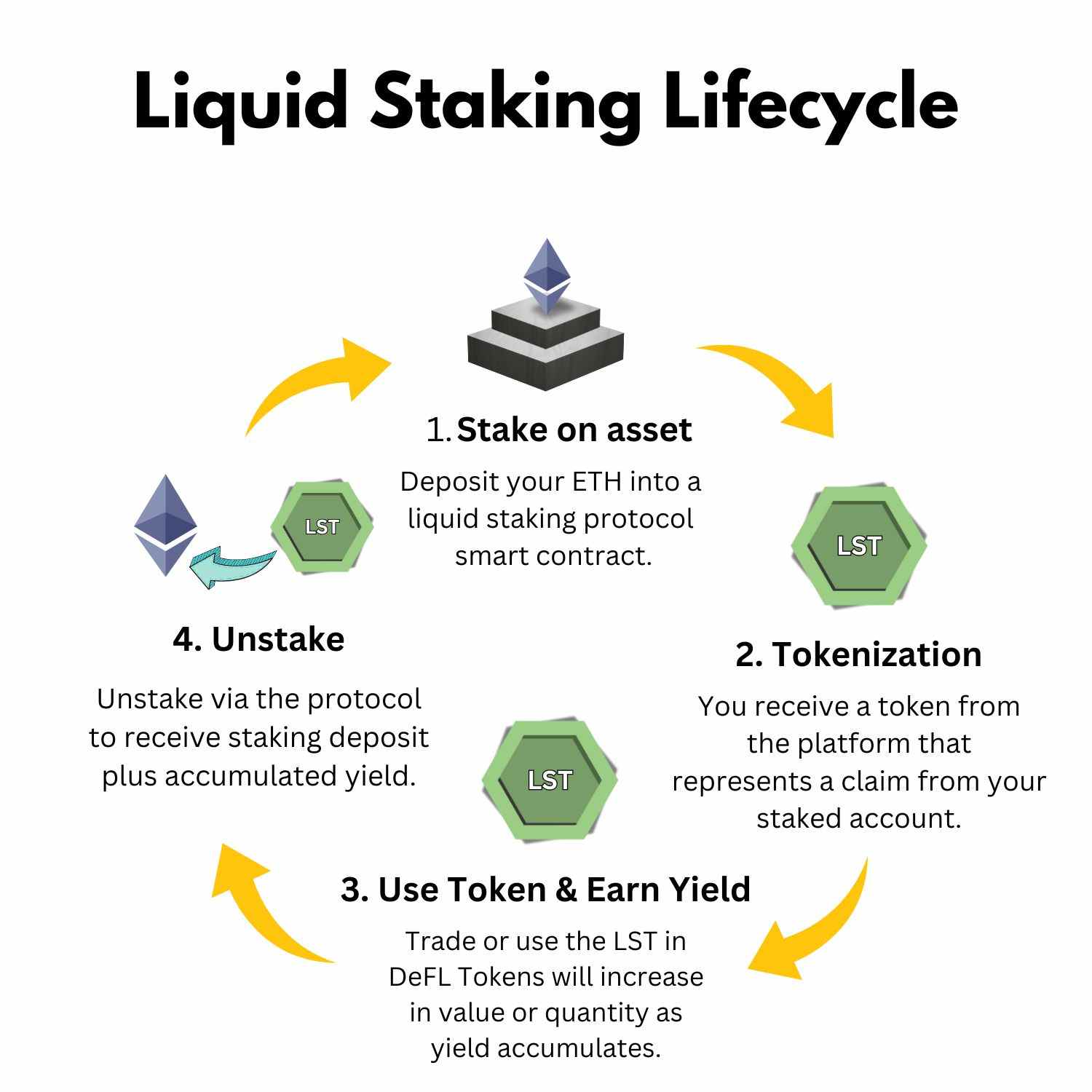

Liquid staking changes the game by unlocking the value of staked assets. Here’s how it works:

- Stake Your Tokens: Users deposit their tokens (like ETH) into a liquid staking protocol.

- Receive Liquid Staking Tokens (LSTs): In exchange, users receive LSTs, which represent their staked assets and the rewards they’ll earn.

- Use LSTs Freely: Unlike traditional staking, LSTs are not locked. They can be traded, used as collateral in DeFi protocols, or even sold on exchanges.

This means users can earn staking rewards and keep their assets liquid, opening up a world of opportunities in decentralized finance (DeFi).

The Mechanics Behind LSTs and LSDs

Liquid Staking Tokens (LSTs) represent a claim on your original staked assets along with their accrued rewards. For instance, when you stake ETH, you might receive stETH, which not only reflects your contribution to the network but also continually earns staking rewards.

On the other hand, Liquid Staking Derivatives (LSDs) are tokenized versions of these staked assets, designed to unlock additional yield opportunities through decentralized finance activities like trading, borrowing, or leveraging. This setup allows investors to enjoy the benefits of staking while still retaining liquidity and access to diverse DeFi strategies.

Why It Matters

Liquid staking tackles two primary challenges inherent in traditional staking. First, it enhances liquidity; users no longer need to sacrifice access to their funds in exchange for staking rewards. For example, when an investor stakes ETH and receives stETH, they continue earning rewards while maintaining the ability to use stETH in various DeFi protocols.

Second, it offers flexibility; liquid staking tokens can be integrated across decentralized finance platforms, allowing investors to boost their earnings through activities such as lending or trading. This dual advantage empowers users to simultaneously earn staking rewards and explore diverse yield-enhancing strategies without being locked out of their assets.

Liquid Staking vs. Traditional Staking

| Feature | Traditional Staking | Liquid Staking |

|---|---|---|

| Liquidity | Tokens are locked and cannot be traded or used as collateral. | Unlocks inherent value; tokens can be traded or used as collateral in DeFi protocols. |

| DeFi Composability | Limited integration within the DeFi ecosystem. | Tokens serve as receipts for staked assets and can be used across various DeFi platforms. |

| Reward Opportunities | Earn rewards solely from verifying transactions. | Earn staking rewards while also accessing additional yield through DeFi strategies. |

| Infrastructure Requirements | Requires complex infrastructure and often a high minimum deposit (e.g., 32 ETH). | Outsources technical needs, allowing participation without a high minimum deposit. |

Liquid Staking Platforms

Liquid staking platforms can be broadly grouped into decentralized and centralized providers. Decentralized platforms enable users to retain control of their assets via smart contracts, while centralized platforms simplify the process by managing staking and custody on your behalf.

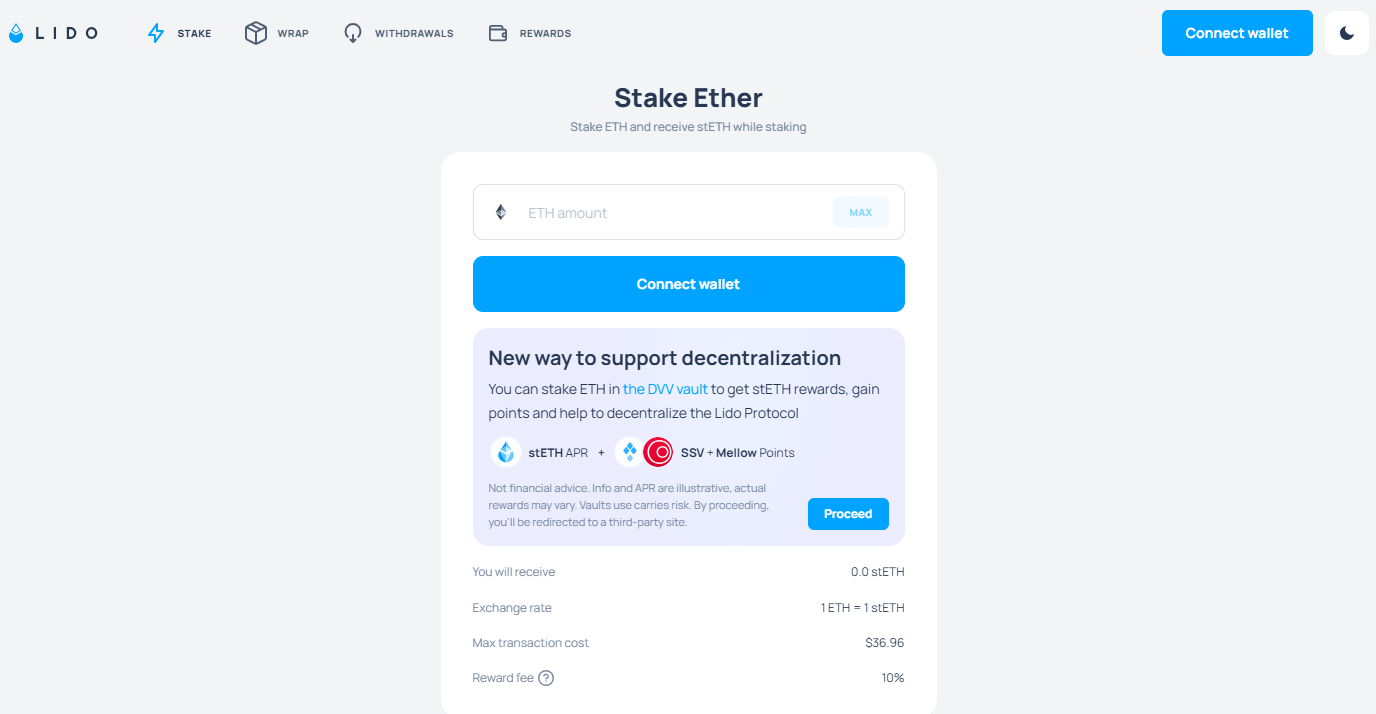

Lido:

A leader in Ethereum staking, Lido offers a 3.2% APR with over $21.3B TVL. Users stake ETH and receive stETH, allowing them to earn daily rewards and maintain liquidity without managing their own infrastructure.

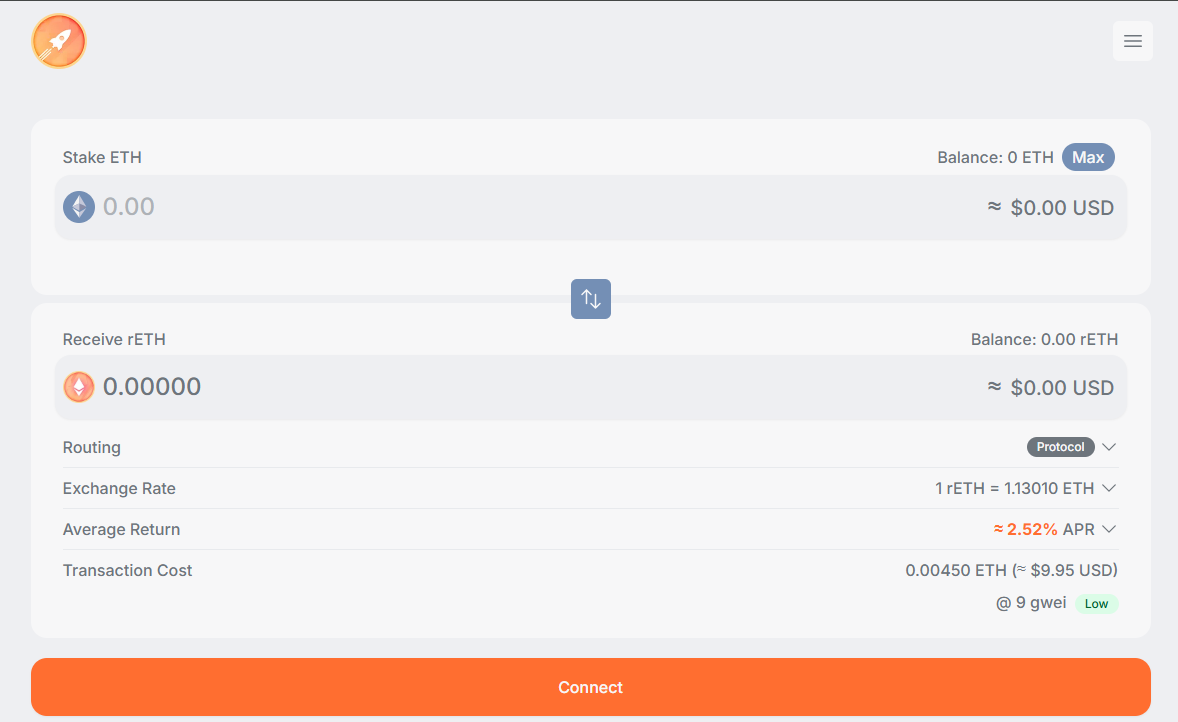

Rocketpool:

Rocketpool provides a flexible APR ranging from 2% to 4%. With no minimum staking requirement and 0% protocol fees (charging only 10% from staking rewards), users receive rETH tokens—making it an accessible and efficient option for Ethereum staking.

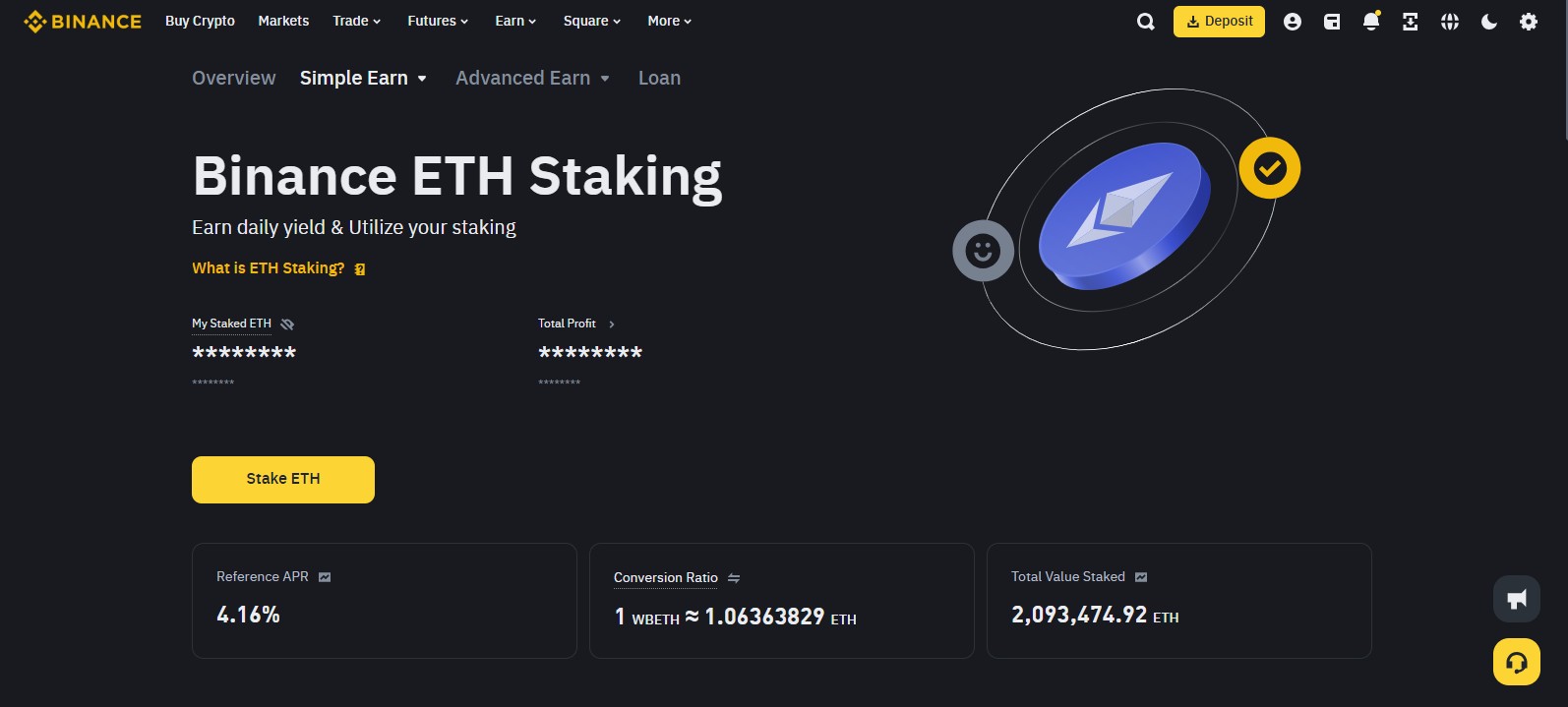

Binance:

As a centralized platform, Binance offers liquid staking with an APR of about 4-5%. Users receive WBETH tokens, which can be traded directly on the exchange, and the option to unstake at any time. With robust security measures, over 2M ETH is currently staked on Binance.

Risks and Considerations

Liquid staking brings the benefits of continuous rewards and liquidity, yet it also carries its own set of risks. One concern is that synthetic tokens may not always mirror the exact value of the underlying staked assets, especially during periods of high volatility or market stress. This misalignment can result from smart contract bugs, liquidity mismatches, or unforeseen market dynamics.

Additionally, the platform’s security is paramount; if the underlying protocol or its smart contracts are compromised, the value of your liquid staking tokens could be adversely affected. To mitigate these risks, it’s crucial to perform comprehensive due diligence on the platform’s security measures, review historical performance, and stay informed about any protocol updates.

Bottom Line

Liquid staking offers a practical way for Ethereum holders to earn passive income while helping secure the network. It removes the 32 ETH barrier of traditional staking, making it easier for new market entrants to participate without locking up their assets.

FAQs

1. What are the benefits of liquid staking compared to traditional staking?

Liquid staking removes the need to lock up your assets completely, allowing you to earn rewards while still maintaining flexibility. It also reduces the barrier to entry—such as the 32 ETH minimum—making it accessible to a broader range of users.

2. Is liquid staking taxable?

Yes, liquid staking is generally taxable. In many jurisdictions, when you receive rewards from liquid staking, they are treated as taxable income based on their value at the time of receipt. Additionally, if you later sell or exchange your liquid staking tokens, any gains (or losses) could be subject to capital gains tax. Tax laws vary significantly by region, so it’s essential to consult with a tax professional to understand your specific obligations.

3. How much can you earn by staking 32 ETH?

Staking 32 ETH traditionally at an estimated 3.95% APR yields around 1.2641 ETH per year. In contrast, liquid staking offers 2% to 5% APR, meaning rewards range from 0.64 ETH to 1.6 ETH annually. While traditional staking provides a fixed return, liquid staking allows users to earn rewards while using their LSTs (stETH, rETH, etc.) in DeFi for additional earnings, making it a more flexible alternative.