Cryptocurrency isn’t just about trading—it’s a financial instrument where people invest for gains. And while they do that, they can also earn passively by staking their tokens. Sonic, recently rebranded from Fantom, is a high-performance EVM Layer 1 combining speed, strong incentives, and solid infrastructure. It’s compatible with the Ethereum Virtual Machine, enabling low-cost, fast transactions across DeFi, NFTs, and GameFi applications.

The native token, S, has multiple functions including governance, staking, and paying transaction fees. In this guide, we’ll explore how to stake S tokens to earn passive income while holding for long-term capital gains.

What is Sonic Staking

Sonic is a high-performance, EVM-compatible Layer 1 blockchain designed to empower developers and deliver seamless user experiences. It boasts an impressive capacity of 400,000 transactions per second with sub-second finality, making it one of the fastest networks in the space. Sonic’s architecture is built with developers in mind, offering innovative incentive programs, such as Fee Monetization, which lets developers earn up to 90% of the fees generated by their apps, along with an Innovator Fund and an Airdrop program to spur ecosystem growth.

The native S token plays a central role by covering transaction fees, enabling staking, running validators, and powering governance. With a 1:1 migration from FTM, Sonic ensures a smooth transition for users while expanding its reach. Additionally, the Sonic Gateway provides secure, seamless access to Ethereum liquidity, setting the stage for a dynamic, interconnected blockchain landscape.

Overall, Sonic redefines the blockchain space by combining cutting-edge technology with a developer-first model, paving the way for scalable, high-quality applications.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

Ways to Earn with S Tokens

Sonic is quickly establishing itself as one of the most dynamic and scalable blockchain platforms, with its TVL now exceeding $1.05B and climbing steadily. For holders of S tokens who want to earn passive income, there are two key approaches. One option is to stake via Binance; a straightforward, user-friendly solution, while the other is to stake directly on the blockchain through Sonic Labs, which offers enhanced liquidity and the potential for greater rewards.

Staking on CEX

For users looking for an effortless start, Binance’s Simple Earn product makes staking S tokens both secure and straightforward. With APYs of up to 3.5% and no lockup period for flexible options, it’s designed to help you start earning passive income quickly. Follow these steps to stake your S tokens on Binance:

Step 1: Access Binance on your desktop and log in to your account. New users will need to create an account first.

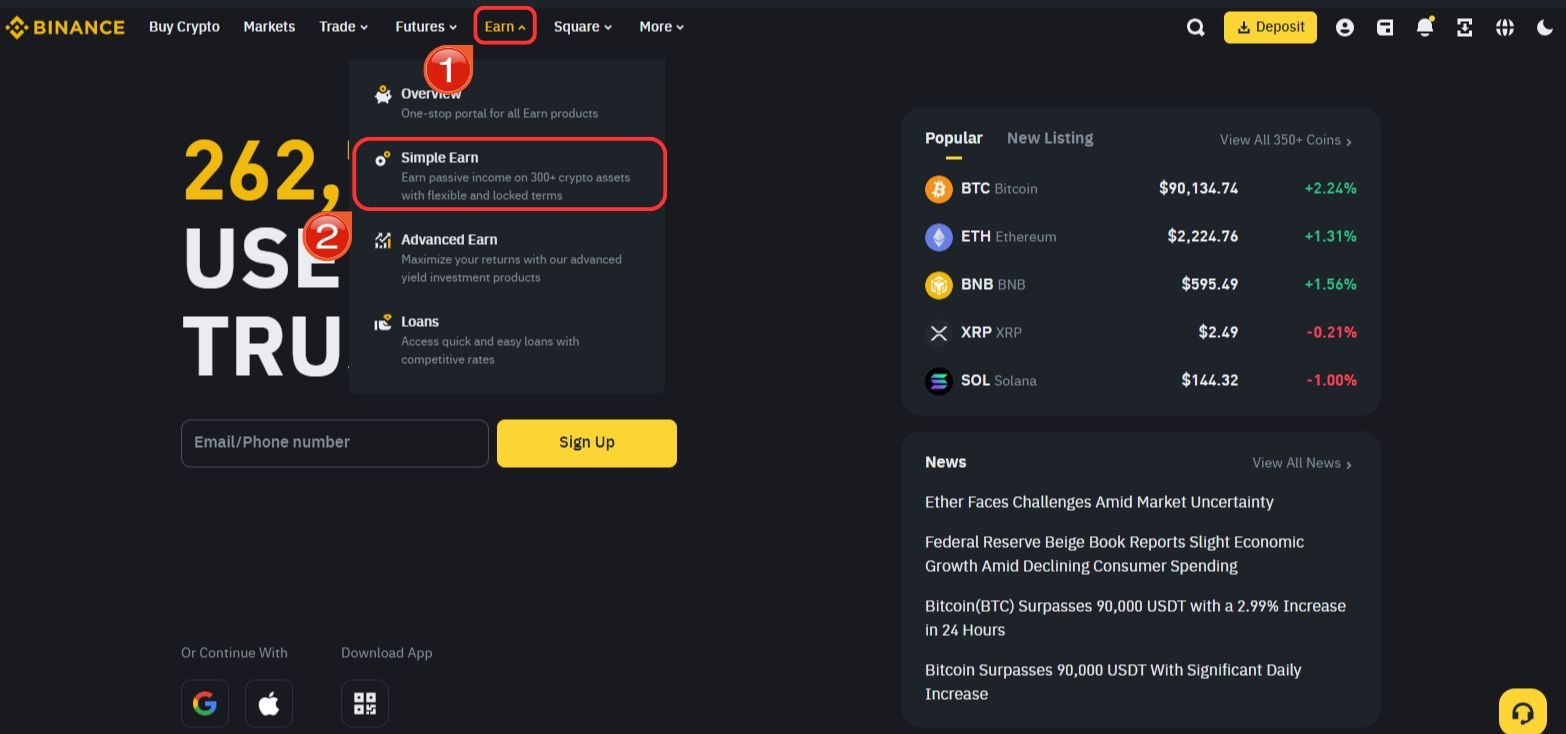

Step 2: Hover over the “Earn” tab on the Binance homepage and select “Simple Earn” to see the available staking options.

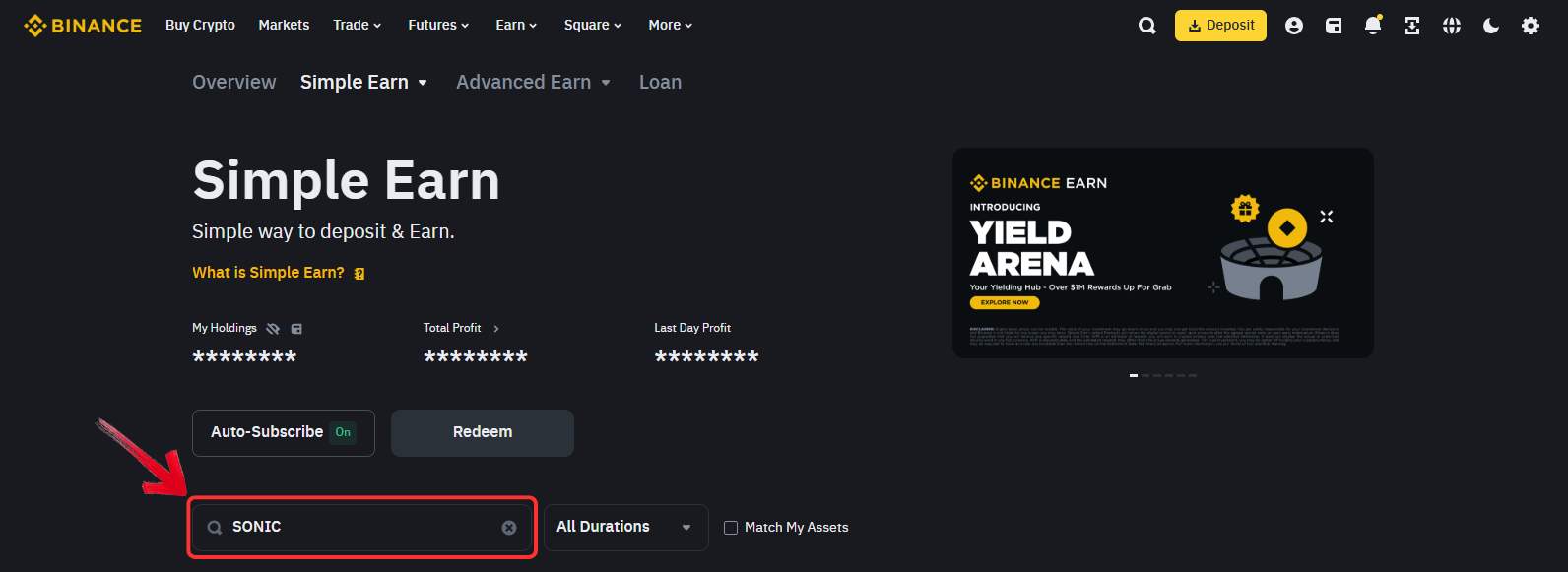

Step 3: On the Simple Earn page, use the search bar to type “S” or “Sonic” and locate the Sonic token in the list of available products.

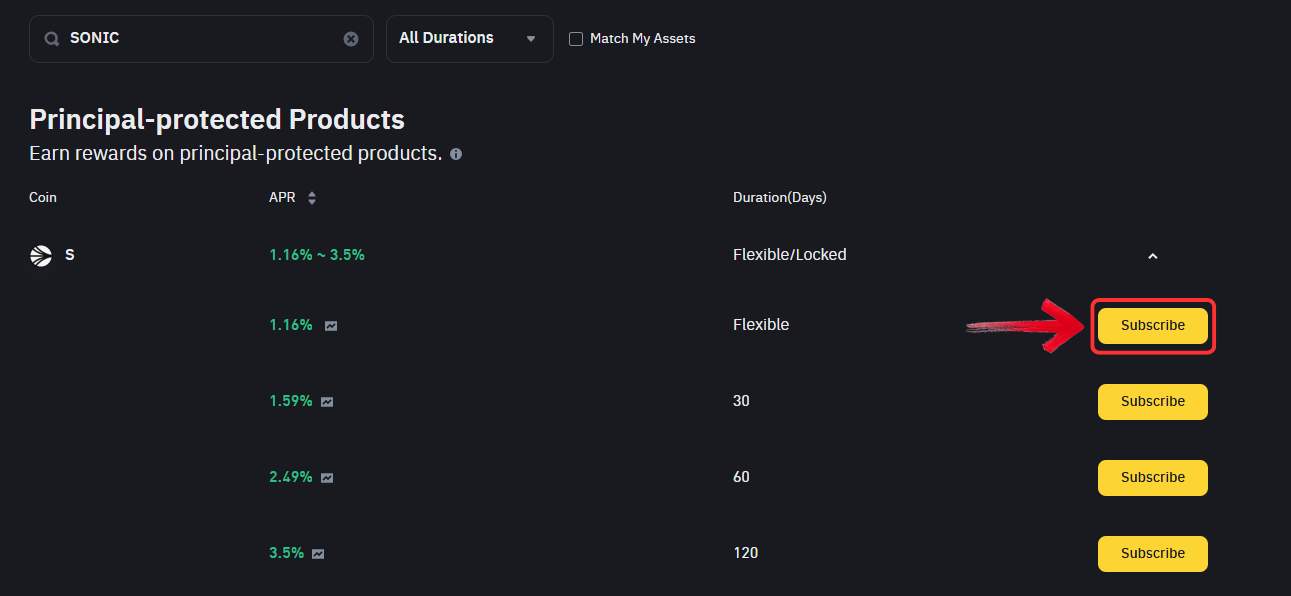

Step 4: From the search results, click on the Sonic token to expand its options. Choose the staking product you prefer; flexible or locked, and click the “Subscribe” button to proceed.

Note: Binance offers both flexible and locked staking for Sonic. You can subscribe to either based on your preference for liquidity or higher yields.

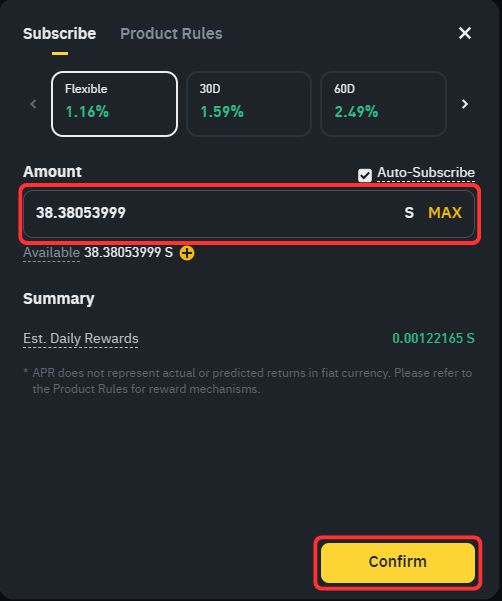

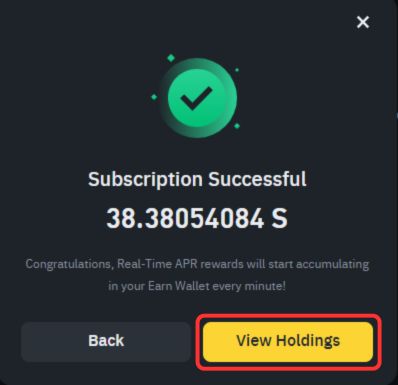

Step 5: In the staking window that appears, enter the amount of $S tokens you want to stake and click the “Confirm” button.

Step 6: You will receive a confirmation notification for your successful staking. Click “View Holdings” to monitor your staked tokens and accrued rewards.

Staking On-Chain on Sonic Labs

Beyond the convenience of Binance, Sonic Labs serves as the official platform for staking S tokens directly on the Sonic network. With APYs reaching up to 4.92%, this option not only offers higher yields and improved liquidity but also provides a closer connection to the ecosystem. Although the process involves a few extra steps, it’s perfect for users eager to actively support Sonic’s long-term growth.

To get started on Sonic Labs, make sure your S tokens are stored in a compatible Web3 wallet; MetaMask is a popular choice due to its user-friendly interface and seamless integration with the Sonic network. Additionally, engaging in various activities on Sonic Labs may also make you eligible for exclusive airdrops, further enhancing your rewards.

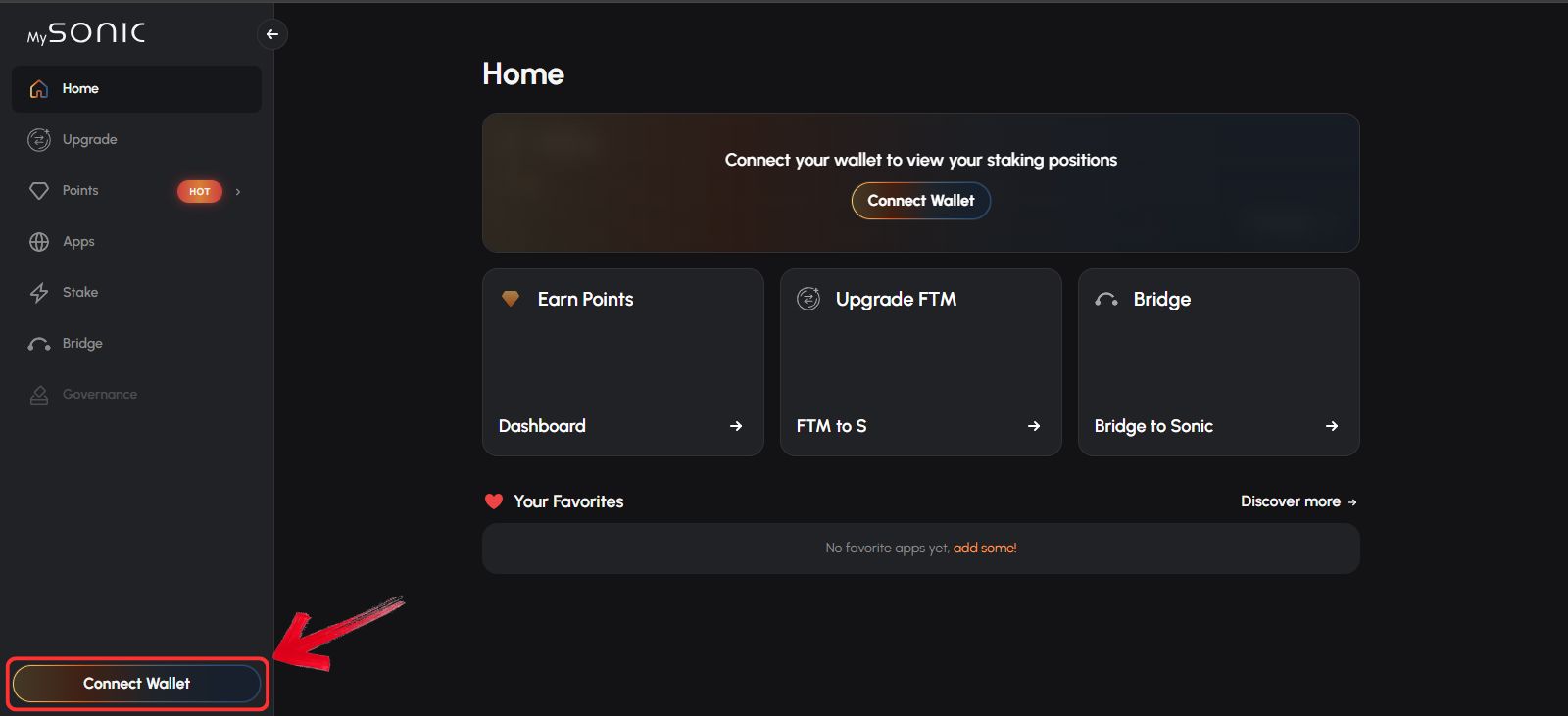

Step 1: First, open My Sonic Labs in your browser. Click on the “Connect Wallet” button located at the bottom left to connect the wallet that holds your S tokens.

Note: If the Sonic network isn’t added, connecting your wallet will by default add the Fantom network. However, you won’t be able to stake on the platform using the Fantom network.

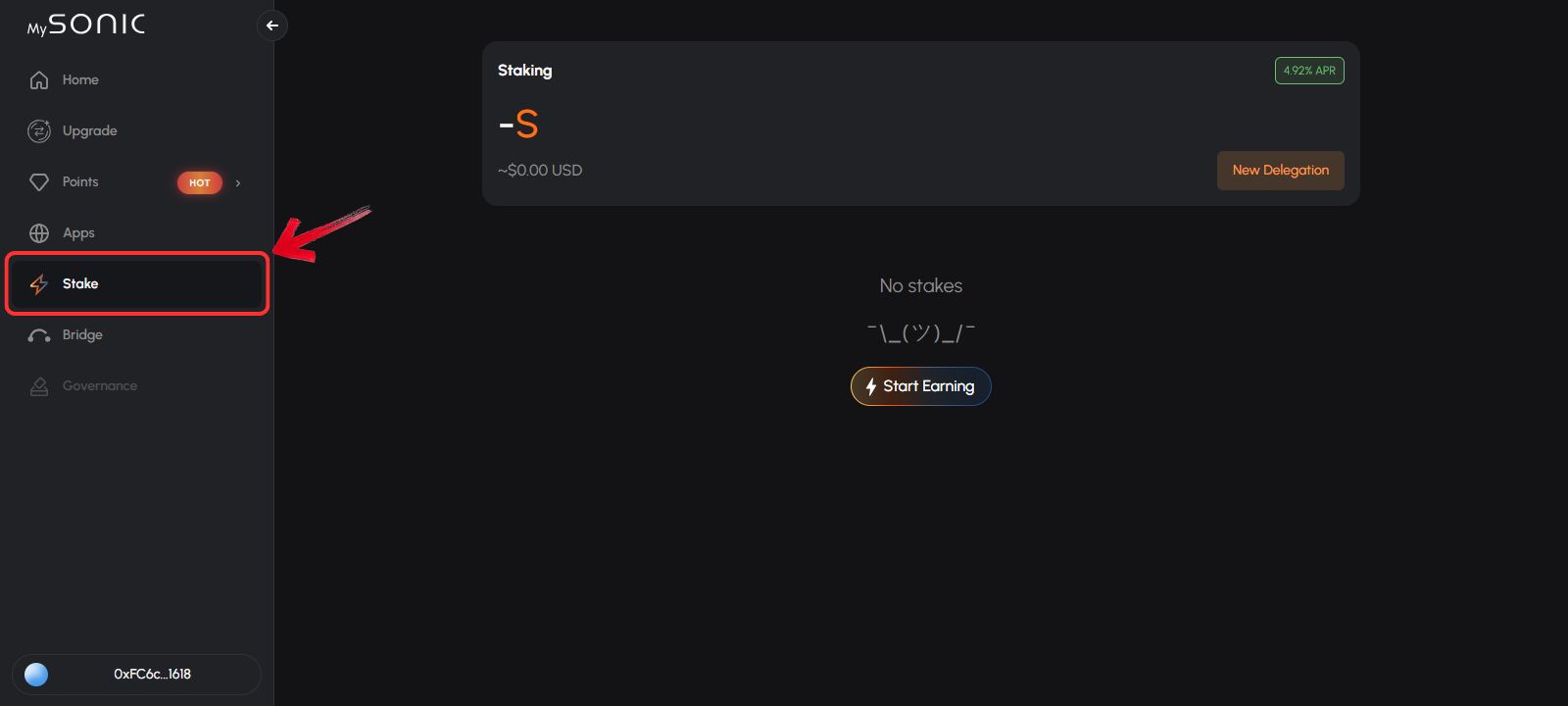

Step 2: Once your wallet is connected, click on the “Stake” tab on the left pane.

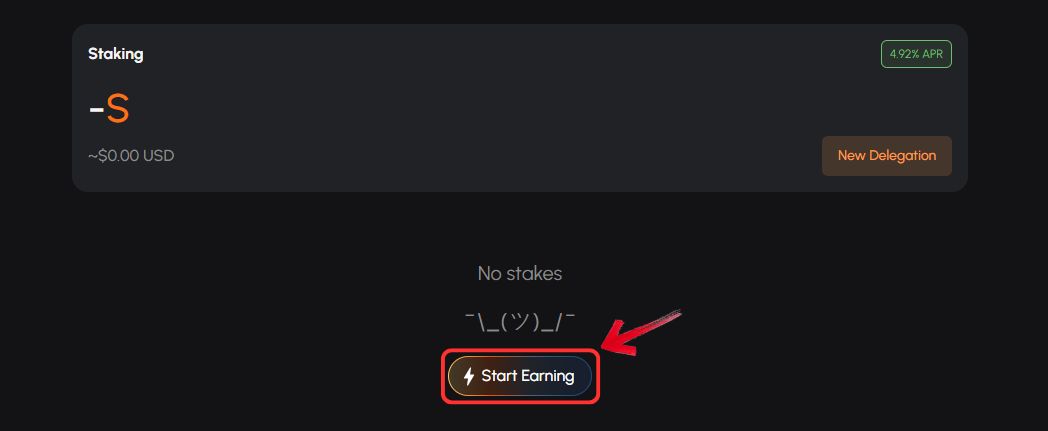

Step 3: On the Staking screen, you have the option to start a new delegation or add to an existing stake. To begin, click on the “Start Earning” button.

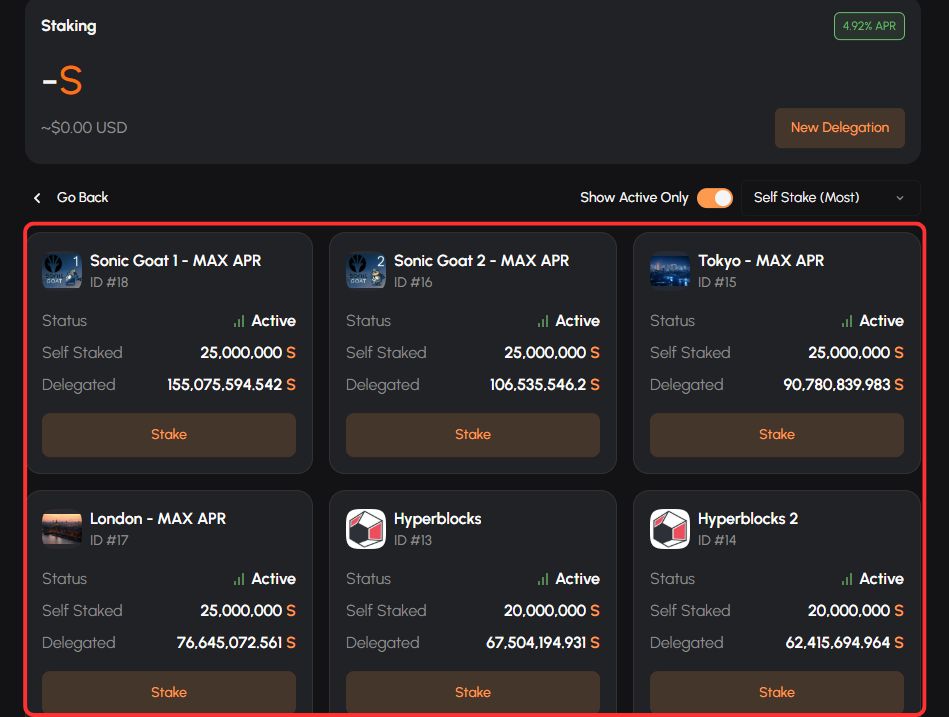

Step 4: Scroll through the existing delegations and click on the “Stake” button to open the specific delegation you want to use.

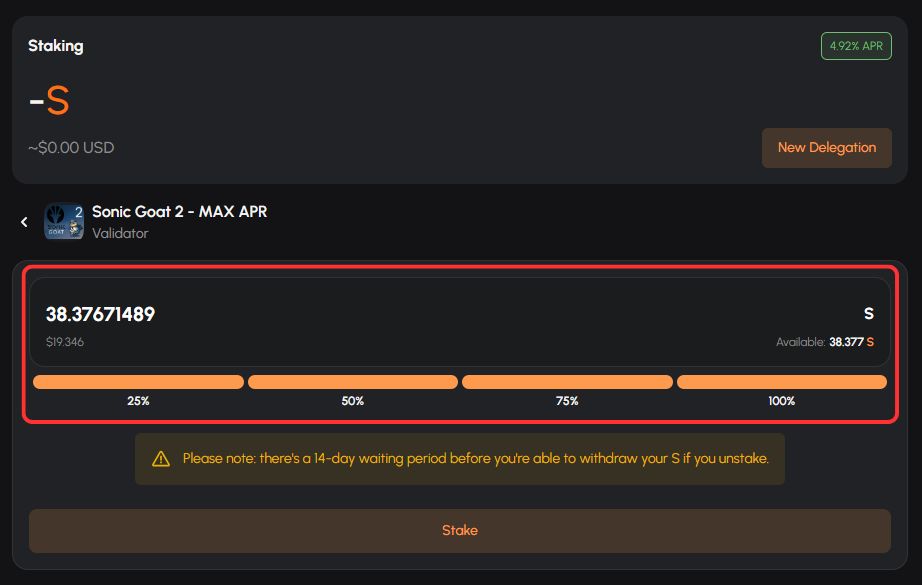

Step 5: Enter the amount of S tokens you wish to stake or use the percentage buttons to allocate a specific portion of your Sonic holdings.

Note: Ensure you leave at least 0.004 S tokens in your wallet to cover gas fees.

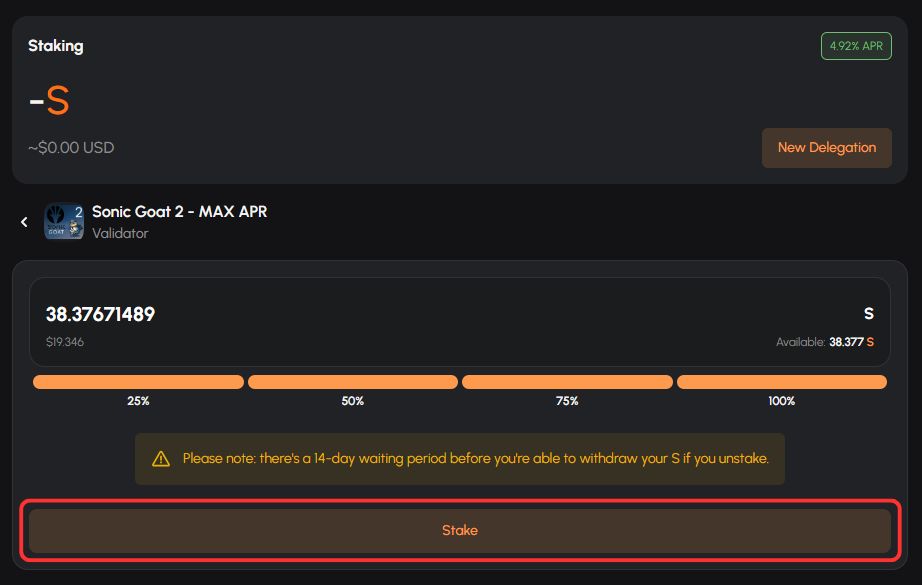

Step 6: Finally, click on the “Stake” button to confirm your staking, and then approve the transaction in your wallet.

Sonic Token Staking Guidelines

On Binance, you have the choice between flexible and locked staking options. For example, with a 30-day locked staking option, redeeming your tokens before the lockup period ends will forfeit any staking rewards.

In contrast, staking on My Sonic Labs requires a minimum period of 14 days, during which you won’t be able to unstake your S tokens. This guideline ensures network stability and rewards commitment over a defined timeframe.

Sonic Staking Fees

When staking S tokens, whether on a centralized exchange like Binance or directly via My Sonic Labs, there are no additional staking fees. However, you’ll need to cover gas fees when transferring your tokens from an exchange to your Web3 wallet. Typically, this fee is around 0.004 S, which translates to only a few pennies at the current Sonic price.

Final Thoughts

Sonic continues to show promise, building on the solid foundation of Fantom while introducing innovative improvements. Whether you choose to stake through Binance or directly on Sonic Labs, you have a secure way to earn passive rewards while holding your S tokens. Just ensure your Web3 wallet is secure, and consider diversifying your strategy based on your risk tolerance and desired returns.

FAQs

1. What do I need to migrate from Fantom to Sonic?

To migrate, undelegate your FTM tokens from the Fantom wallet. After a 24-hour unlock period, you can use the official Sonic Upgrade tool to convert your FTM tokens to S tokens on a 1:1 basis.

2. What is Sonic, and why is it replacing Fantom?

Sonic is a next-generation Layer 1 blockchain designed to improve on Fantom’s infrastructure. While Fantom will continue to exist, its staking APR has been reduced to 0%, encouraging users to migrate to Sonic for better rewards, lower fees, and enhanced performance.

3. Is there a minimum amount required to stake on Sonic?

Yes, the minimum amount required to stake on Sonic is 1 S token.

4. What is the unbonding period for staking on Sonic?

Once you choose to unstake your tokens, they will enter a 14-day unbonding period. During this time, your tokens remain locked and cannot be used or transferred. After the period ends, they become fully accessible.

5. What is happening with Fantom tokens now?

Fantom tokens (FTM) are still active and usable, but their staking rewards have been discontinued. Users are being encouraged to migrate to Sonic, which offers better staking incentives and a more efficient ecosystem.