Chainlink ($LINK) is considered a fundamental part of the blockchain ecosystem, acting as a decentralized oracle network that connects smart contracts with real-world data. By delivering reliable and tamper-proof information, Chainlink allows blockchain applications to integrate off-chain data like price feeds, weather reports, and external APIs. With many analysts viewing $LINK as significantly undervalued, investors are increasingly looking for ways to buy Chainlink (LINK) and add it to their crypto portfolios. This guide will highlight the best platforms to purchase $LINK and the steps to securely store it.

Where to Buy $LINK

With $LINK now widely available on major exchanges, selecting the right platform comes down to factors like security, liquidity, trading fees, and staking opportunities. Here are some of the top exchanges where you can buy Chainlink (LINK), each offering its own unique advantages:

| Exchange | Fees | Liquidity | Yield | Bonus | Security | KYC |

|---|---|---|---|---|---|---|

| Binance | 0.10% maker, 0.10% taker | $10B+ | 0.12% | $100 | Very High | Yes |

| Bybit | 0.10% maker, 0.10% taker | $3.64B+ | 1.06% | $30,000 | Very High | Yes |

| Kraken | 0.16% maker, 0.26% taker | $608.49M+ | None | None | Very High | Yes |

| BingX | 0.10% maker, 0.10% taker | $252.47M+ | 10.00% | $5,000 | Very High | No |

| BYDFi | 0.00% maker, 0.10% taker | $163.71M+ | None | $300 | Above Average | No |

| Bitget | 0.10% maker, 0.10% taker | $252.47M+ | 0.36% | $20,000 | Very High | Yes |

How to Buy $LINK on BingX

The exchange we’ll be using to buy LINK is BingX, a non-KYC exchange established in 2018 with over 5 million users. If we talk about BingX in general, it offers a competitive fee structure; 0.10% maker and 0.10% taker fees, similar to other top exchanges. Another similarity is that it also offers LINK within its futures trading platform.

However, the standout feature that made BingX the top choice for buying LINK is its staking returns, offering up to 10% savings with no minimum lock-up requirements. This means you can redeem your staked LINK at any time, giving you full flexibility. Additionally, new users can receive a welcome bonus of up to $5,000, making it an even more attractive choice.

With its competitive fees, staking rewards, and no KYC requirements, BingX is a great choice to buy Chainlink (LINK). Follow these steps to get started:

Step 1: Open your browser and go to BingX. Here, you’ll need to sign up for an account before you can start trading. No KYC is required.

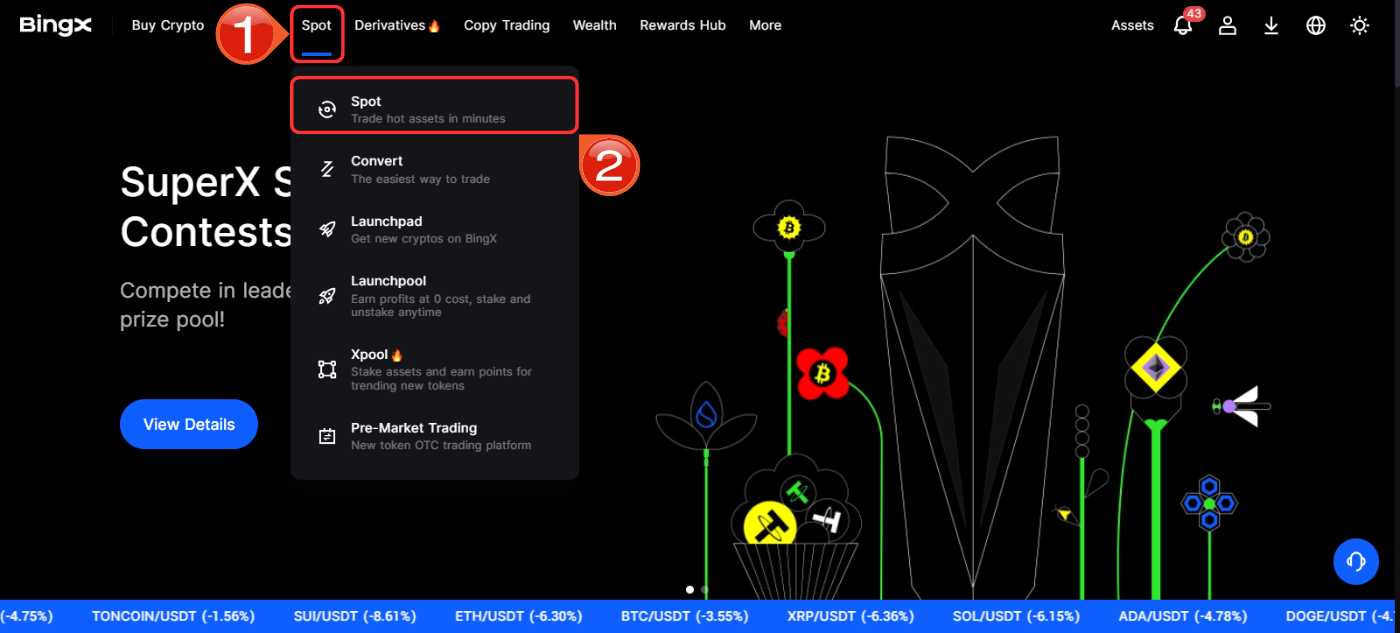

Step 2: Once you’ve completed the sign-up process, navigate to the BingX homepage. Hover over the “Spot” tab in the toolbar, then click on “Spot” from the dropdown menu.

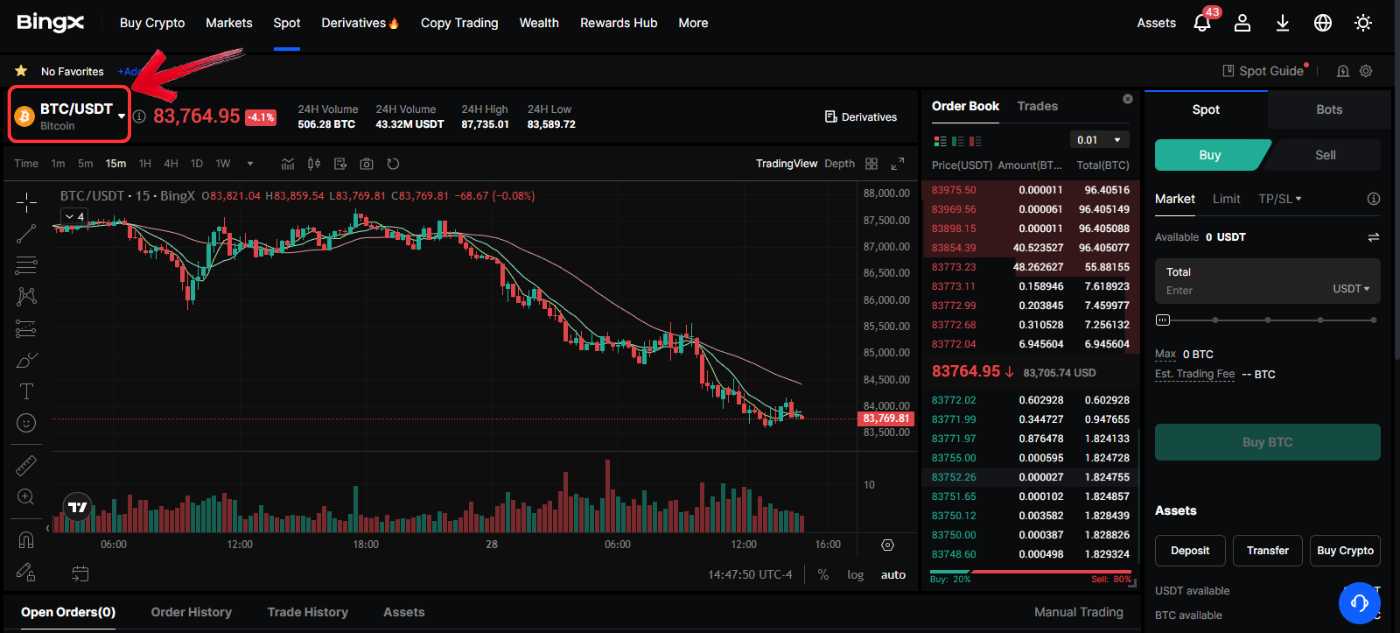

Step 3: You’ll now be taken to the BingX Spot trading platform. Click on the “Asset” dropdown to view the list of cryptocurrencies available for trading on BingX.

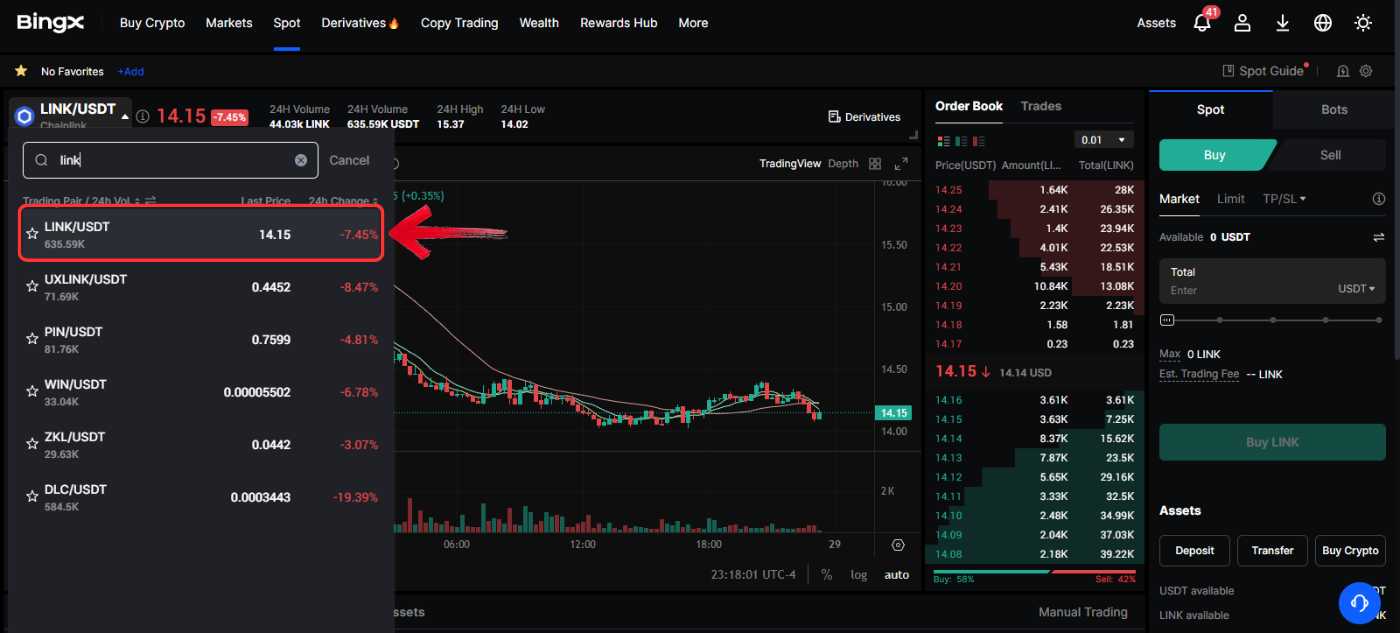

Step 4: Use the search bar to look up “LINK”, then select the “LINK/USDT” pair to buy Chainlink (LINK) on BingX Spot.

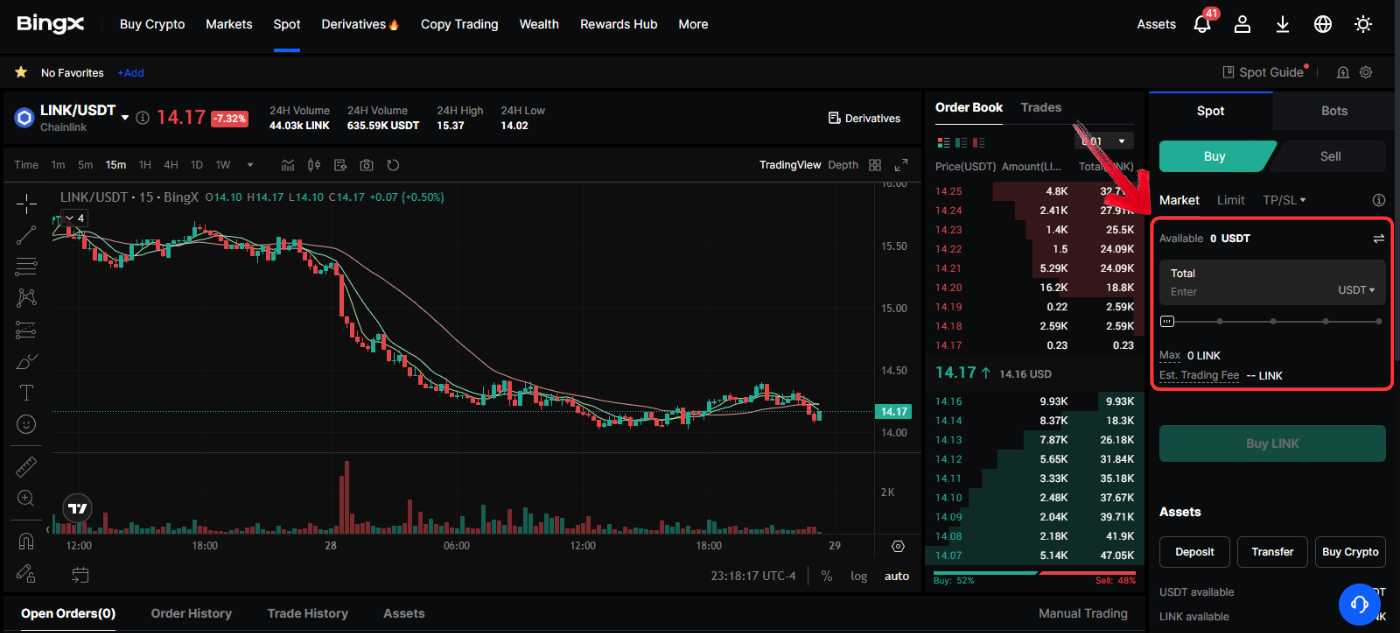

Step 5: The trading screen will now display all relevant Chainlink details, including price charts, order books, and Buy/Sell tools.

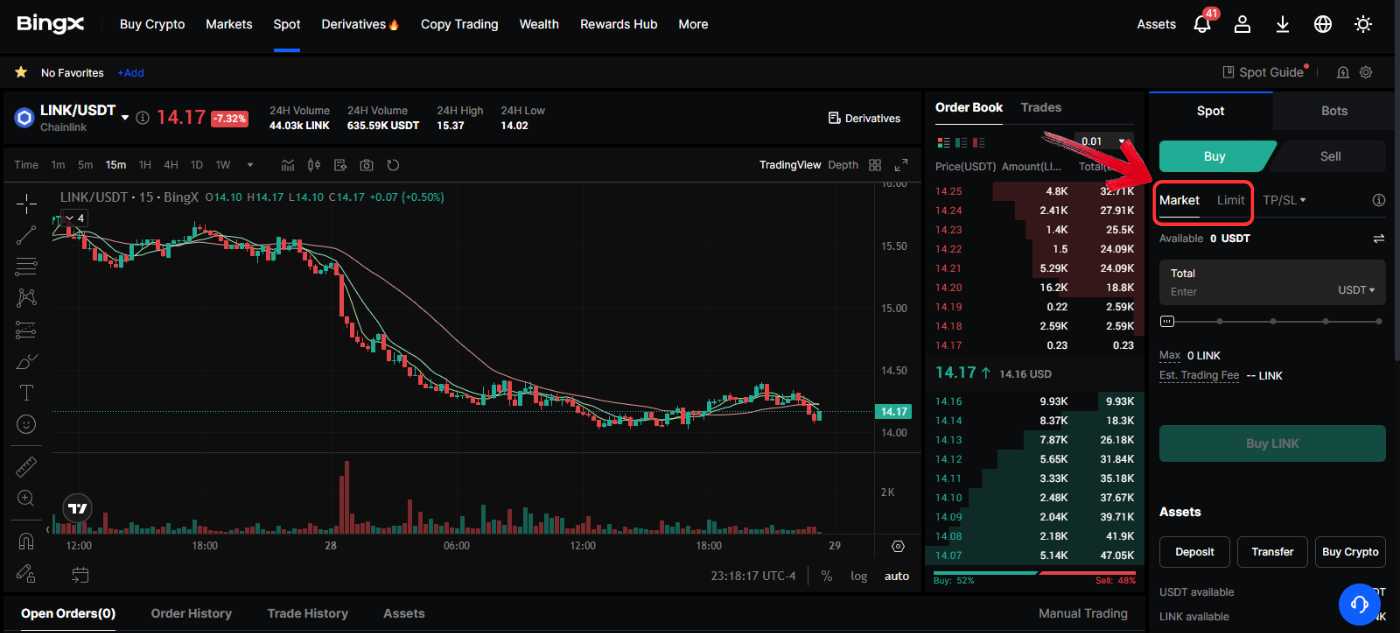

Step 6: You’ll find the Buy/Sell panel on the right side, where you can choose to place a Market or Limit order.

Step 7: In the “Total” field, enter the amount of LINK you want to buy. You can either type in the USDT value manually or use the slider to allocate a percentage of your USDT balance to purchase LINK.

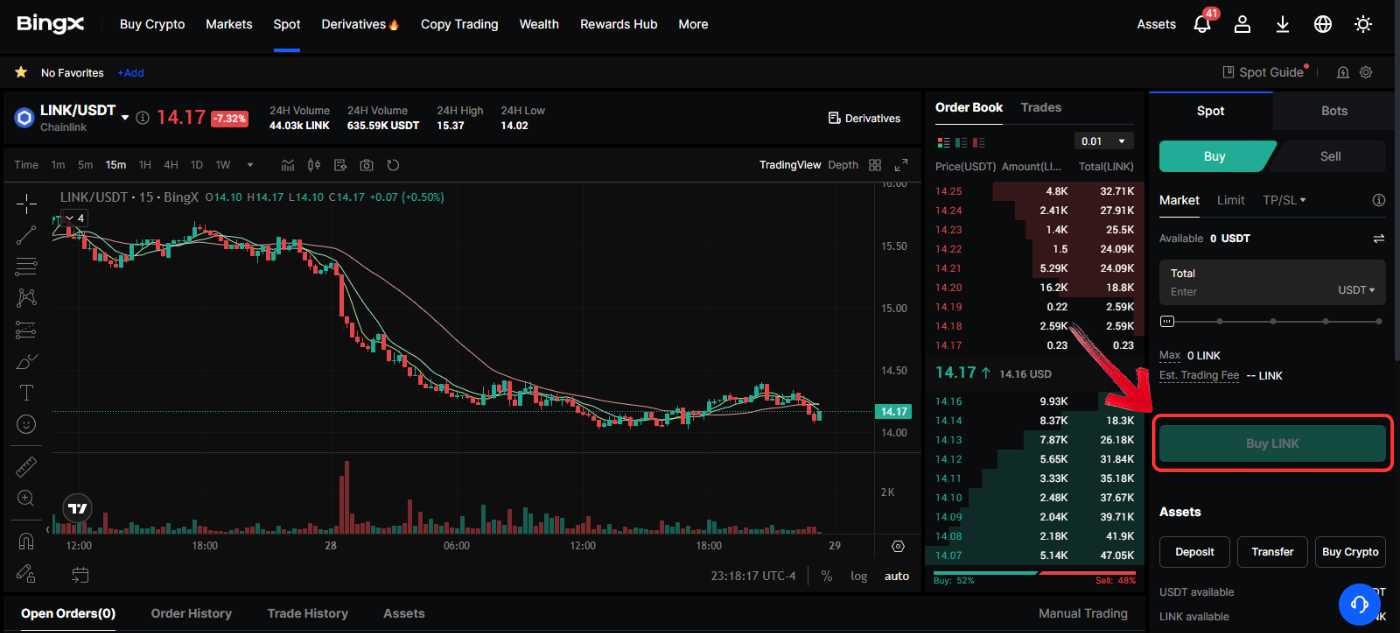

Step 8: Once your order details are set, review the transaction information carefully. Then, click on “Buy LINK” to finalize your Market or Limit order.

Fees When Buying Chainlink on BingX

BingX provides cost-effective trading fees, ensuring affordability while staying aligned with major exchanges. A 0.1% fee is charged for both maker and taker orders. If you decide to buy $100 worth of LINK, the platform will deduct $0.10 in fees, allowing you to receive $99.90 worth of LINK.

Chainlink (LINK)

New TokenToken Symbol

LINK

Current Price

Loading...

Daily Change

Loading...

All-Time High

Loading...

Daily Low

Loading...

Daily High

Loading...

24h Volume

Loading...

Market Cap

Loading...

FDV

Loading...

Total Supply

Loading...

Max Supply

Loading...

How to Transfer $LINK to a Web3 Wallet (MetaMask)

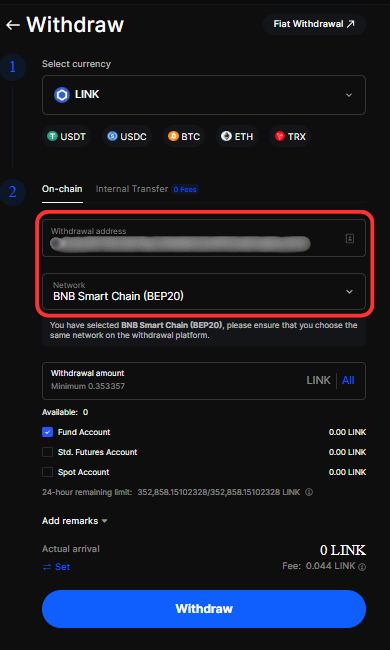

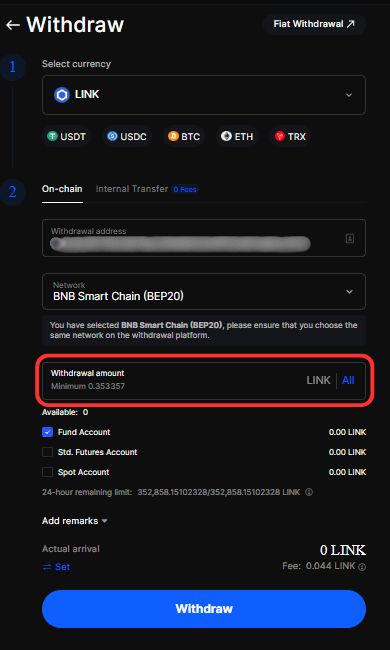

Transferring tokens to a Web3 wallet requires some understanding of on-chain transactions, as even a small mistake can result in a loss of funds. If you’re planning to transfer $LINK to a Web3 wallet, the first step is identifying the correct network, as Chainlink ($LINK) is available on both Ethereum and Binance Smart Chain (BSC). For this guide, we’ll use Binance Smart Chain, as it offers significantly lower transaction fees. Sending $LINK on Ethereum costs around 0.49 LINK, whereas on BSC, the fee is only about 0.044 LINK, making it 10 times cheaper.

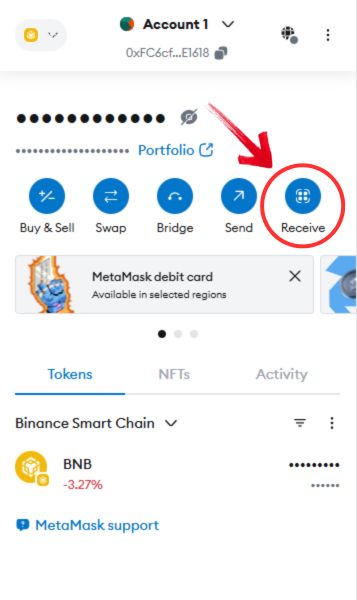

Before proceeding, ensure that Binance Smart Chain (BSC) is added to your Web3 wallet. The most commonly used Web3 wallet is MetaMask, but you can use any EVM-compatible wallet that supports BSC.

Once the network is set up, you can proceed with transferring $LINK to your Web3 wallet from BingX by following these steps:

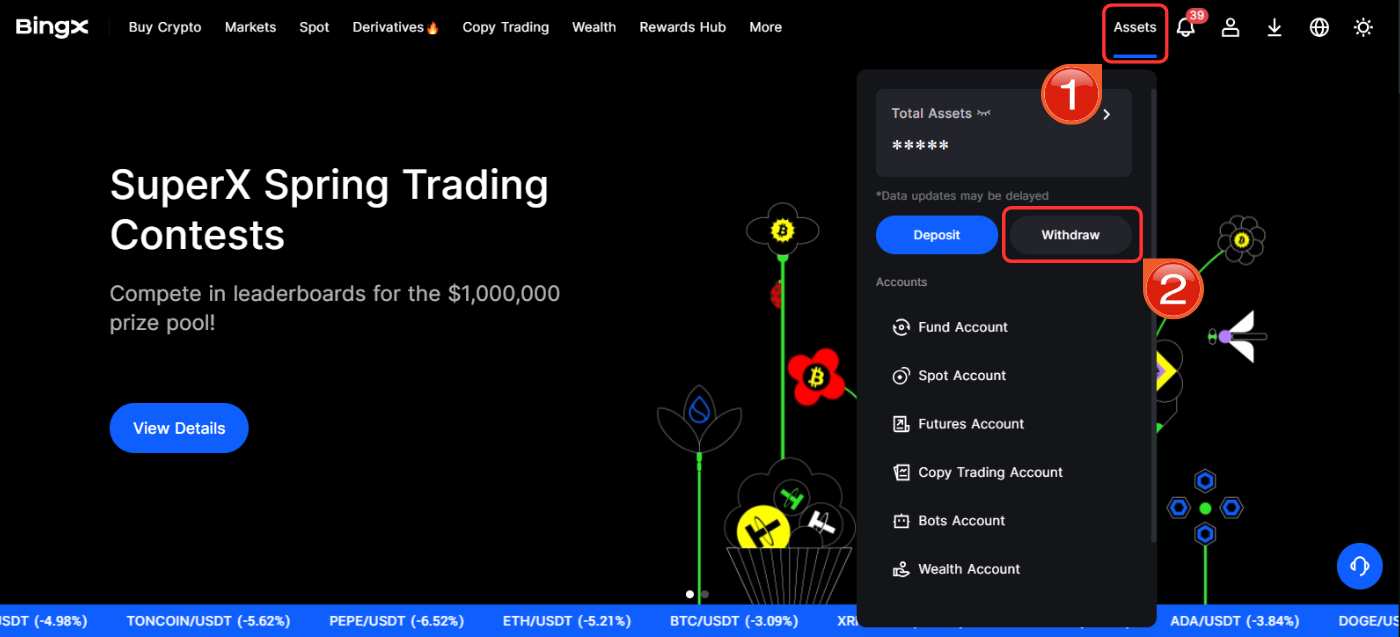

Step 1: Hover over the “Asset” icon and select “Withdraw” from the dropdown menu.

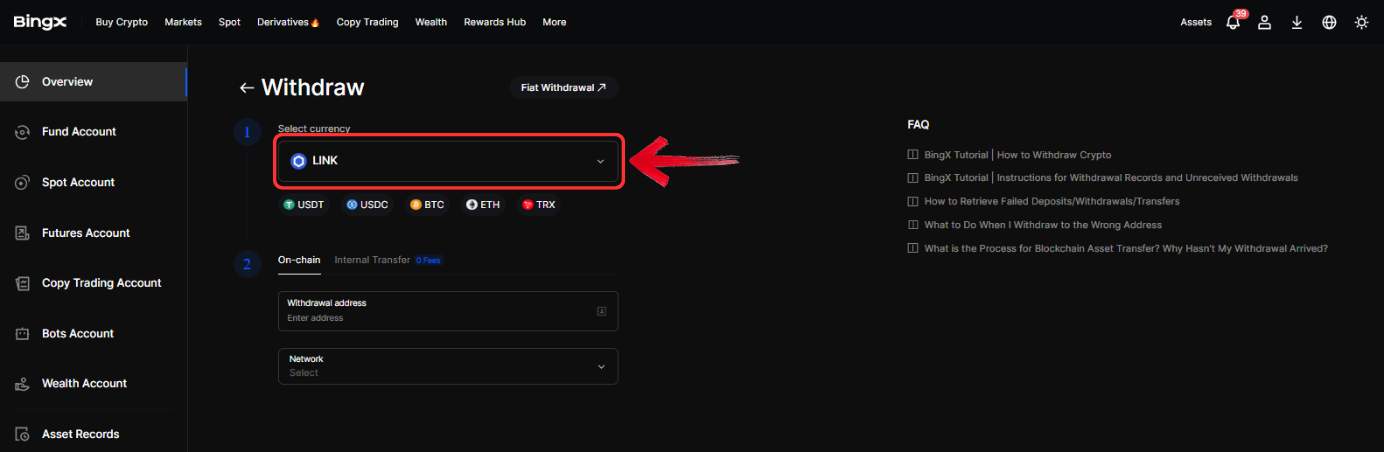

Step 2: You will be directed to the withdrawal page. Here, select “LINK” in the “Select Currency” field.

Step 3: In the “Withdrawal Address” field, open your Web3 wallet, copy your BNB Smart Chain (BEP-20) “Receive” Address, and paste it here.

Step 4: Choose “BNB Smart Chain (BEP-20)” as the network in the “Network” field.

Step 5: Enter the amount of $LINK you want to withdraw in the “Withdrawal Amount” field.

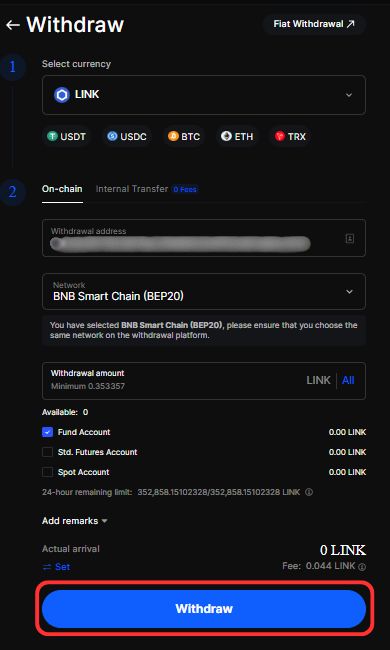

Step 6: Carefully review all transaction details, including the amount you will receive and any applicable network fees. If everything is correct, click “Withdraw” to proceed.

If you’re using a different Web3 wallet, the process remains the same. Just make sure to add the Binance Smart Chain Network RPC details to ensure compatibility with the network. Once the transaction is submitted, you’ll receive a confirmation message along with a transaction hash (TXN Hash). To check the status of your transaction, copy the TXN Hash and verify it on BSCscan.

Understanding Chainlink

Chainlink is a decentralized oracle network that bridges blockchains with off-chain data, enabling hybrid smart contracts that integrate on-chain logic with external information. Built on Ethereum using a proof-of-stake mechanism, it effectively resolves the blockchain oracle problem by securely relaying data between disparate systems. The network’s native token, LINK, plays a crucial role in compensating node operators for retrieving, verifying, and processing external data, ensuring the system’s reliability and security.

Chainlink supports various functions, including decentralized data feeds, verifiable randomness, and cross-chain interoperability, which are essential for modern DeFi applications, NFTs, gaming, and more. Its open-source framework has attracted a vibrant global community of developers and spurred the creation of thousands of projects leveraging its technology.

As one of the top U.S.-developed cryptocurrencies, LINK has established itself as a key asset in the blockchain ecosystem. By decentralizing data access and computations, Chainlink enhances the trustworthiness of smart contracts and blockchain interactions, making it a strong investment choice in the evolving digital economy.

Bottom Line

Chainlink plays a key role in the blockchain ecosystem by enabling smart contracts to access real-world data securely. Its decentralized oracle network supports various applications, including DeFi and gaming. With widespread adoption, it remains an important asset within blockchain infrastructure. Buying LINK is a simple process, with major exchanges like BingX offering multiple options. As blockchain technology advances, Chainlink continues to facilitate reliable data integration across networks.

FAQs

1. How does Chainlink improve trust in smart contracts?

Chainlink’s decentralized oracle network aggregates data from multiple independent sources, which reduces the risk of relying on a single data provider. This diversity helps ensure that smart contracts execute with accurate, tamper-proof information.

2. What makes Chainlink different from other oracle solutions?

Chainlink stands out thanks to its extensive network of node operators, robust security measures, and long-standing reputation. Its architecture is designed to handle a wide variety of data inputs, making it a preferred choice for integrating off-chain information.

3. How can developers benefit from integrating Chainlink into their projects?

By using Chainlink, developers can easily access reliable external data—whether for price feeds, random number generation, or event triggers—without building complex infrastructure from scratch. This accelerates development and enhances application security.

4. What are some innovative use cases for Chainlink beyond DeFi?

Beyond traditional financial applications, Chainlink is used in areas like insurance, gaming (for fair randomness), supply chain tracking, and even in environmental monitoring systems where real-time data is crucial.

5. How does the decentralized nature of Chainlink mitigate risks associated with single points of failure?

Because Chainlink pulls data from multiple independent nodes, it minimizes the risk of data manipulation or outages. This redundancy ensures that even if one node fails or is compromised, the network as a whole remains secure and reliable.