Akash Network is one of the world’s leading decentralized GPU marketplace offering cost-effective, secure, and scalable cloud computing resources. It is a fully open-source platform that sets itself apart from other public clouds through its commitment to transparency and community-driven development. Plus, its cost-effectiveness makes it a popular choice for developers and businesses.

With its permissionless deployment and an active community of contributors, Akash Network positions itself as one of the most promising blockchain projects in the crypto space. Akash’s support for AI/DeFi apps makes it a strong player in the AI and Web3 marketplaces. Its native token, $AKT, plays a central role in its ecosystem. If you’re interested in buying the Akash token but don’t know where to start, you’ve come to the right place. This guide will teach you how to buy Akash Network Tokens ($AKT), choose the right platform, and secure your tokens by transferring them to a hot wallet.

Where to Buy Akash Network

The success of Akash, thanks to its censorship-resistant app deployment and GPU marketplace, has positioned $AKT as a valuable digital asset with growing potential. You can get your hands on $AKT via any major crypto exchange. However, it’s not a simple decision. Make sure you consider factors such as KYC and AML compliance, security, liquidity, platform fees, and benefits such as staking rewards and signup bonuses before making your final choice.

Following are some of the best exchanges to buy Akash Network, listed alongside their unique benefits:

How to Buy $AKT on Phemex

In this guide, we will buy the $AKT tokens using the Phemex exchange. Phemex is home to over 5 million active users, known for its user-friendly interface, excellent customer support, and powerful security features. It is a KYC-compliant exchange with a high safety index and competitive platform fees of 0.10% for both maker and taker orders. It supports 350+ cryptocurrencies, and new users get a sign-up bonus of up to $8,800. Users can earn additional discounts by holding the platform’s native token, $PT.

Apart from that, Phemex supports popular bot trading strategies like Grid and Martingale, allowing users to easily optimize their trading performance without micro-managing their accounts. Plus, it is great for futures trading, offering up to 100x leverage for users with greater risk tolerance.

Below are the steps for buying $AKT on Phemex:

Step 1: Open your browser and go to the official website of Phemex. Here, you’ll need to sign up for an account before you can start trading.

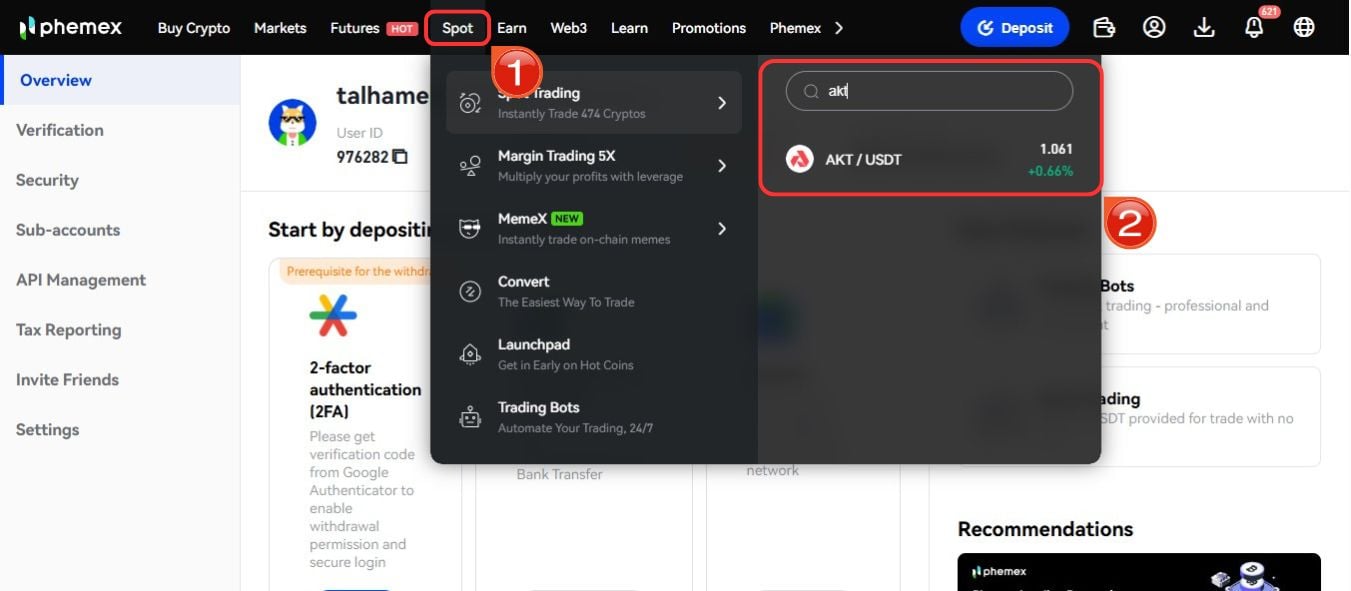

Step 2: Once you’ve completed the sign-up process, navigate to the Phemex homepage. Hover over the “Trade” tab in the toolbar, two dropdown menus will open.

Step 3: On the right dropdown menu, use the search bar to search “AKT” and choose “AKT/USDT”.

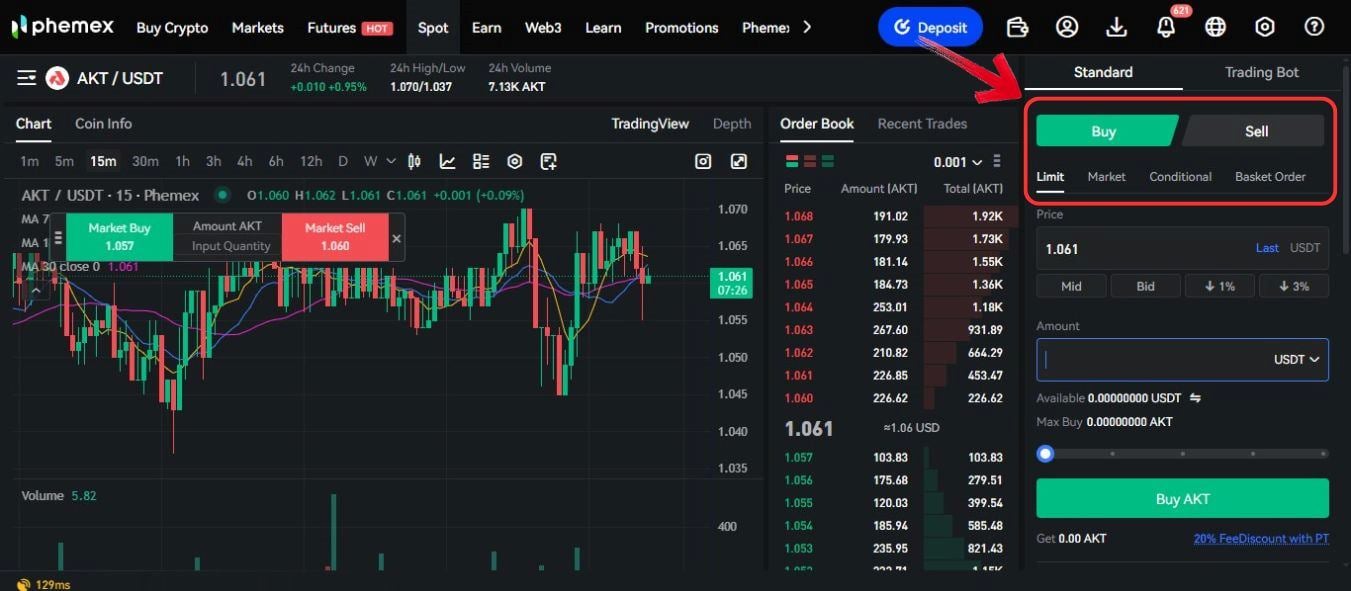

Step 4: Locate the Buy/Sell panel on the right-hand side, where you can opt to place either a “Market” or “Limit” order.

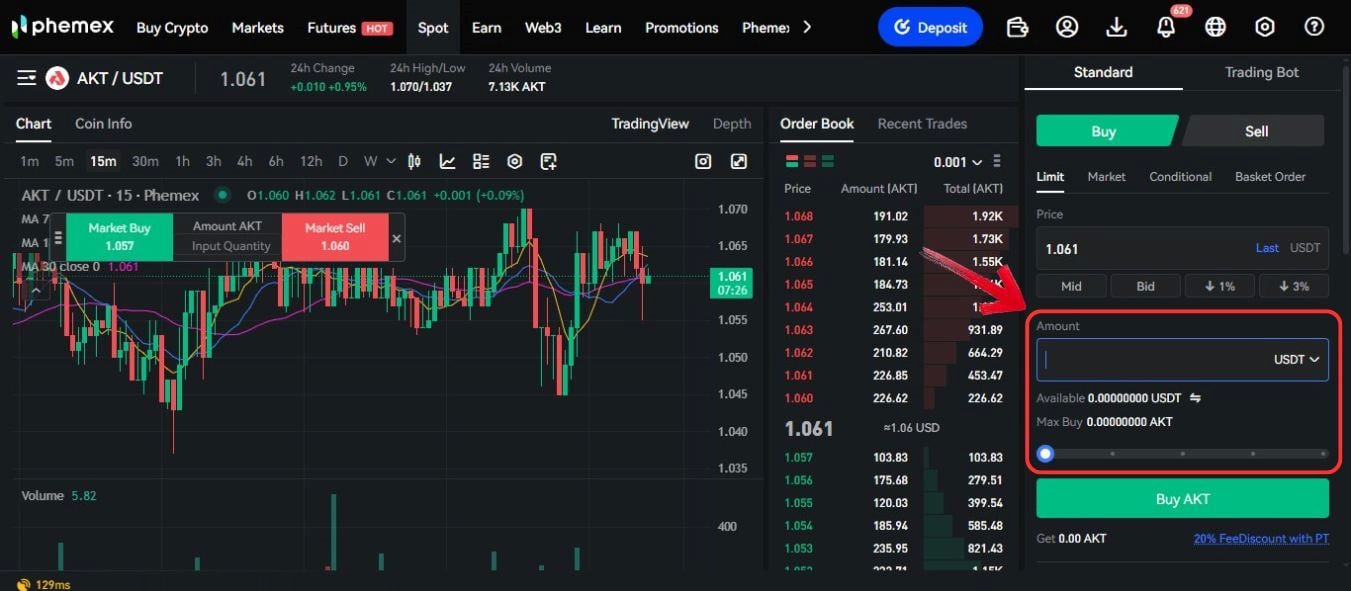

Step 5: In the “Amount” field, you can enter how much USDT you want to spend. For quick adjustments, feel free to use the slider as well.

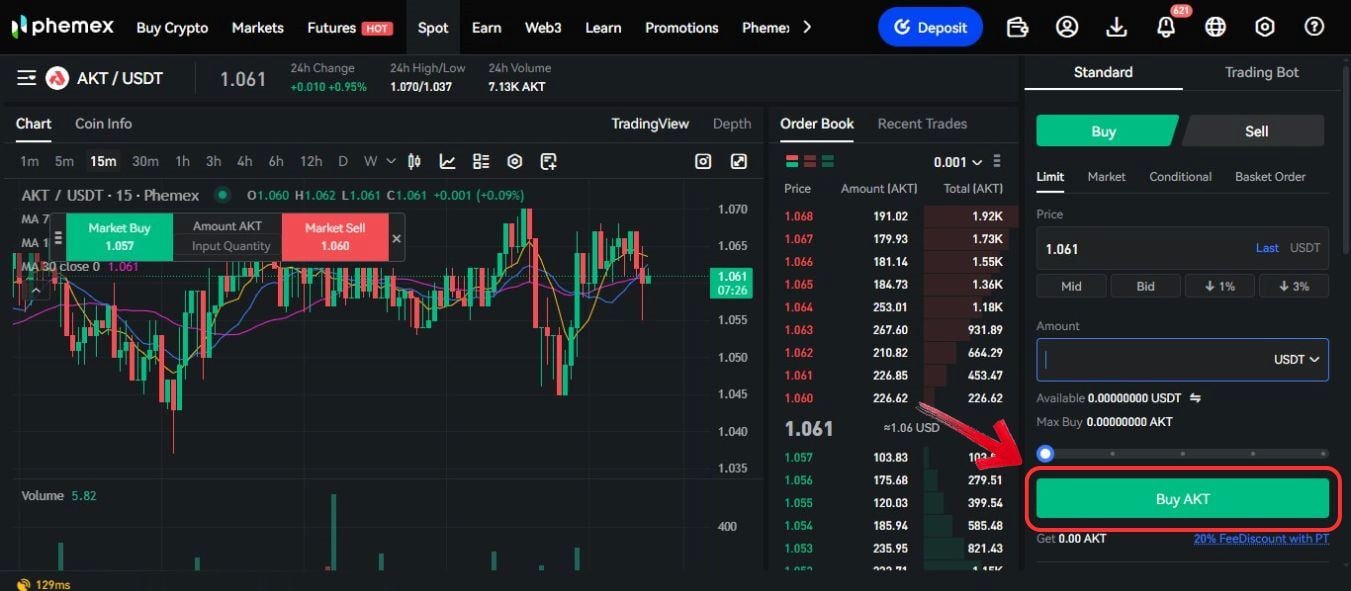

Step 8: Once your order details are set, review the transaction information carefully. Then, click on “Buy AKT” to finalize your Market or Limit order.

Fees when buying Akash on Phemex

Phemex offers a competitive trading fee of 0.10% for both maker and taker orders. For example, if you buy $100 worth of Solana ($AKT), you’ll pay a $0.10 fee, leaving you with $99.90 in AKT. However, if you hold Phemex’s native token (PT), you can receive a 20% discount, reducing the fee to 0.080%, meaning you’d only pay $0.080 in fees on a $100 trade.

Akash Network (AKT)

New TokenToken Symbol

AKT

Current Price

Loading...

Daily Change

Loading...

All-Time High

Loading...

Daily Low

Loading...

Daily High

Loading...

24h Volume

Loading...

Market Cap

Loading...

FDV

Loading...

Total Supply

Loading...

Max Supply

Loading...

How to transfer $AKT to a Web3 Wallet (Leap Cosmos Wallet)

Purchasing $AKT tokens is often just the beginning. Many users transfer their $AKT tokens to a Web3 wallet to maintain complete control over their assets or to interact with the Akash Network dApp. Because a single mistake during a transfer can cause permanent loss of funds, it’s essential to understand how token transfers work.

Start by choosing a wallet that supports the Akash Network; AKT is built on Akash Network, and Leap Cosmos Wallet is the preferred option thanks to its intuitive design, seamless Akash Network DApp integration and strong security safeguards. Once your wallet is ready, simply share its address to receive $AKT tokens from a centralized exchange via the Akash Network, keeping your funds safe and fully under your control.

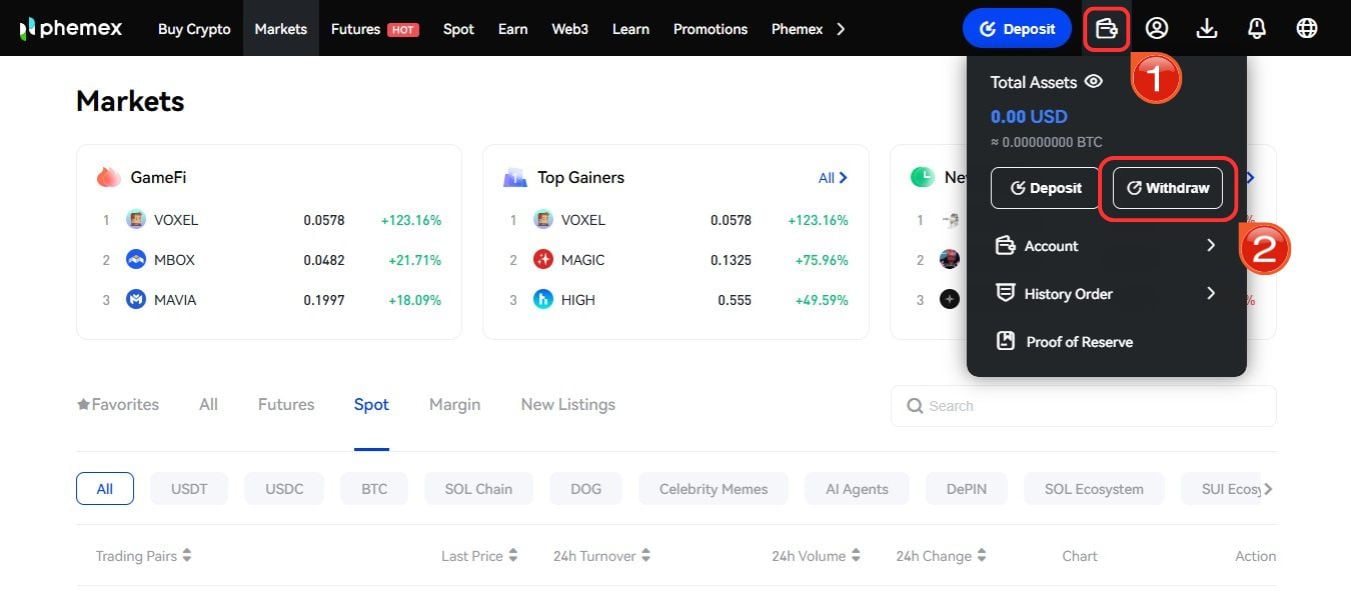

Step 1: Click on the “Assets” icon (wallet symbol) to access your account balances, then from the dropdown menu, click on “Withdrawal”.

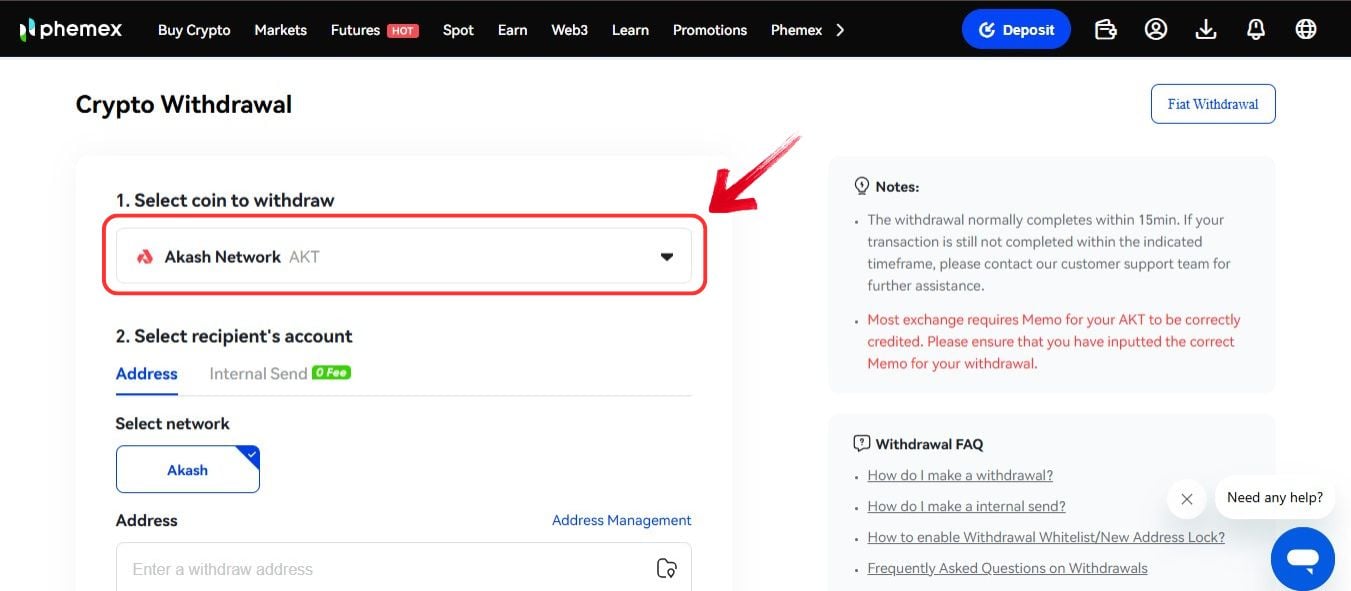

Step 2: In the section of “Select a coin to withdraw”, select “AKT” by searching for it in the search bar. The network will be automatically set as “Akash”.

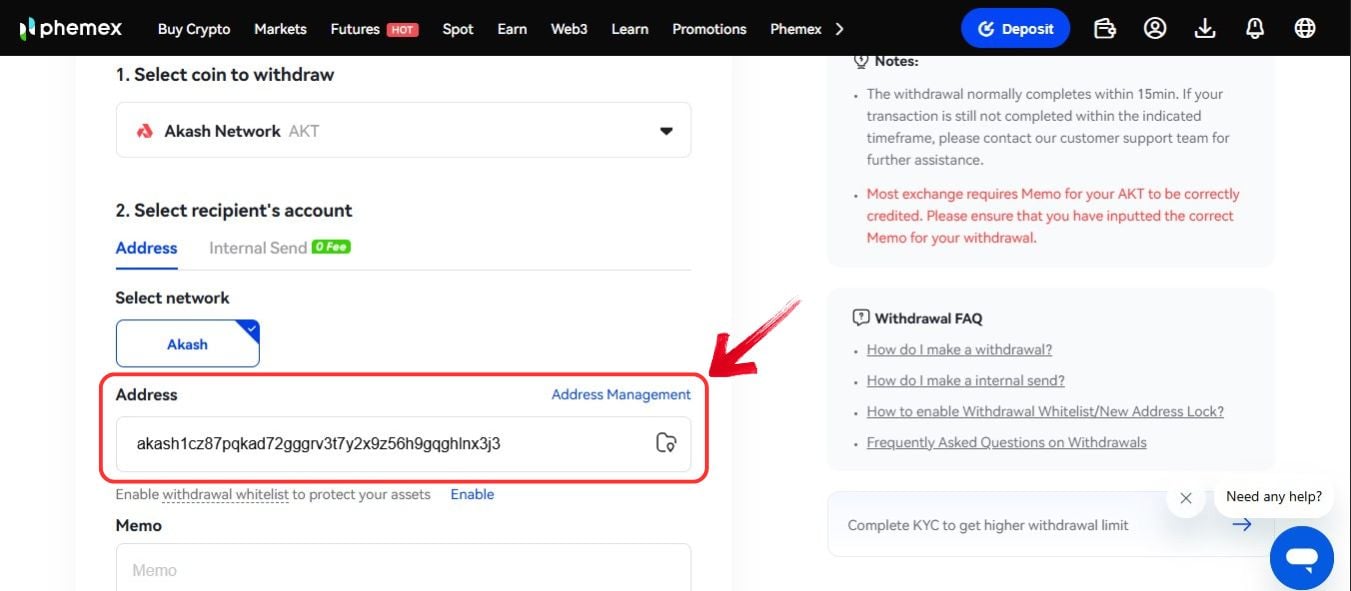

Step 3: In the recipient’s “Address” field, open your AKT-compatible wallet, copy your AKT receive address, and paste it here.

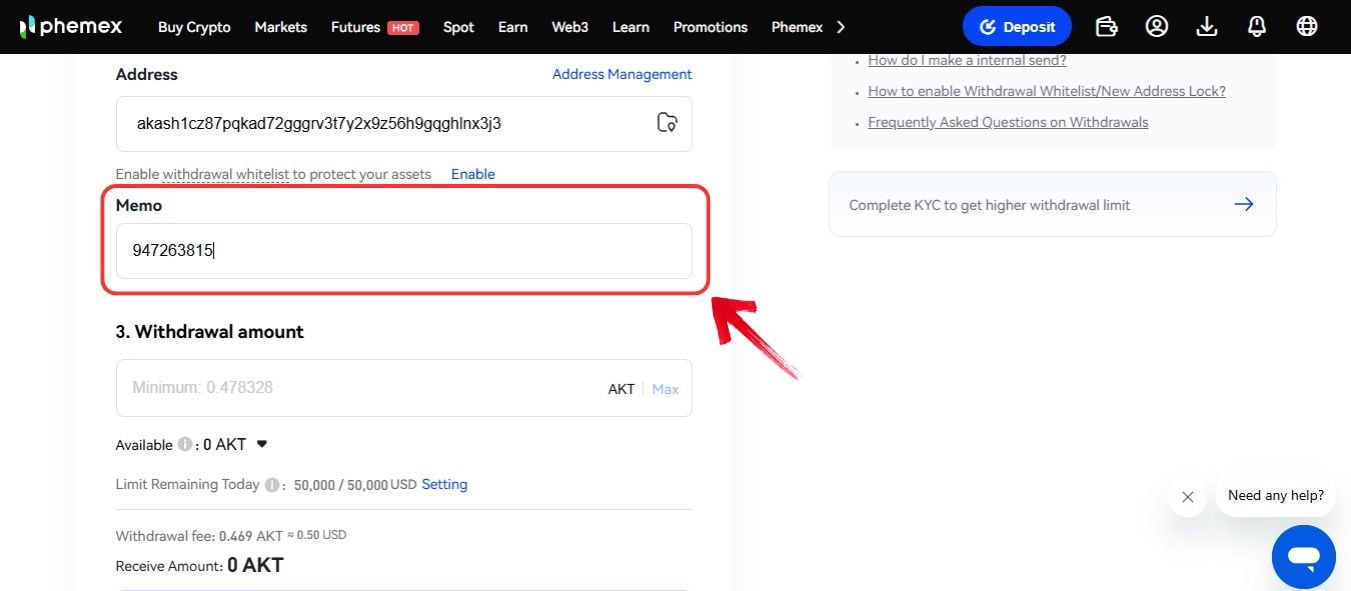

Step 4: If you’re withdrawing AKT to an exchange wallet, enter the required “Memo” in the designated field. You can find this Memo on the deposit page of the receiving exchange, usually displayed next to the wallet address.

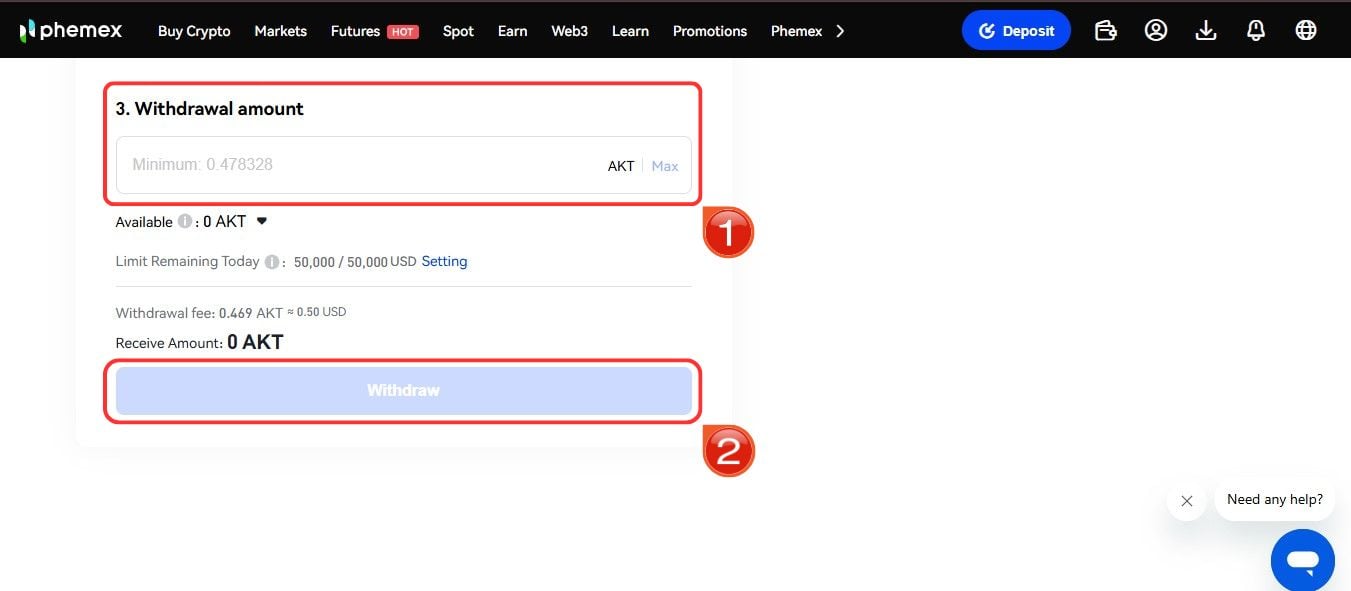

Step 6: Scroll down, enter the amount you want to withdraw in the “Withdrawable Amount” field, then click on “Withdraw” to proceed.

You can track the transaction using the TXN ID on Atomscan. Once it’s confirmed, your $AKT tokens will appear in your Web3 wallet.

Akash Explained

Akash Network (AKT) is a decentralized, open-source cloud computing platform designed to make deploying applications faster and more accessible, especially in growing sectors like blockchain and machine learning, and AI. Instead of depending on traditional cloud providers, Akash connects users directly with server owners through its marketplace, where computing resources can be bought and sold. This peer-to-peer approach offers more flexibility and cost efficiency. The platform is powered by its native token, AKT, which is used for pricing services, settling leases, and securing the network through staking.

Akash is built on a Tendermint based blockchain using the Cosmos SDK and operates on a Delegated Proof-of-Stake (DPoS) consensus mechanism. Validators play a key role by producing blocks and handling transactions, and they must meet hardware requirements and stake AKT to participate. This structure ensures a secure, scalable, and truly decentralized cloud computing ecosystem.

Bottom line

Akash Network offers a decentralized, cost-effective, and flexible alternative to traditional cloud computing providers. Built on the Cosmos ecosystem and powered by a Delegated Proof-of-Stake (DPoS) consensus mechanism, Akash ensures high performance, security, and scalability. Its native token, AKT, is used for payments, staking, and earning rewards within the ecosystem. Ideal for Web3, AI, and DeFi projects, Akash empowers developers to deploy and manage applications without relying on centralized cloud providers.

FAQs

1. Is the Akash blockchain secure?

Yes, it uses a Delegated Proof-of-Stake (DPoS) consensus and is built with the Cosmos SDK, with validators ensuring transaction integrity and network performance.

2. How does staking AKT benefit me?

Staking AKT allows you to earn passive income while supporting network security. You can delegate your tokens to validators and receive staking rewards in return.

3. What can I do with AKT tokens once I buy them?

You can stake AKT to help secure the network and earn rewards, or use it to pay for cloud computing resources within the Akash Marketplace.

4. Can I stake AKT without being a validator?

Absolutely. You can delegate your AKT to existing validators and still earn a share of the rewards without running a node yourself.

5. What are the risks of buying AKT?

As with any crypto investment, prices can be volatile. It’s also important to research staking, validator performance, and market trends before investing.