The recent airdrop conducted by Hyperliquid, worth over $3 billion, has drawn significant attention, with many users turning to the Hyperliquid platform to explore its features as a perpetual decentralized exchange (Perp DEX). A key step to get started is to bridge to Hyperliquid, enabling users to trade seamlessly on the platform or access other features like Hyperliquid Vaults.

In this guide, we’ll discuss how to bridge to Hyperliquid, explore available solutions, and clarify common misconceptions, ensuring you’re ready to navigate decentralized trading with confidence.

Key Takeaways: Bridging to Hyperliquid

Here’s what you need to know about bridging to Hyperliquid:

- You’ll need an EVM-compatible wallet with your Arbitrum wallet added.

- The Hyperliquid platform is different from the Hyperliquid blockchain. The platform currently supports only the Arbitrum network, so you’ll need to bridge to Arbitrum to start trading.

- Hyperliquid currently supports only USDC trading pairs, so ensure you bridge USDC to the platform.

Can I Bridge to Hyperliquid?

Yes, you can bridge funds to the Hyperliquid platform to begin trading. However, it’s important to note that the Hyperliquid platform and the Hyperliquid Layer 1 blockchain are two separate entities.

Currently, the Hyperliquid platform supports the Arbitrum network, allowing users to use cross-chain bridges to transfer tokens from any network to Arbitrum. However, the Hyperliquid blockchain’s mainnet is not yet live, and no cross-chain bridges support the Hyperliquid network at this time. If you’re interested in interacting with the Hyperliquid blockchain, possibly to qualify for future airdrops (if announced), you can refer to our guide on how to add Hyperliquid to MetaMask.

What Do You Need to Bridge to Hyperliquid?

For now, here’s what you need to bridge to Hyperliquid and start trading on the platform:

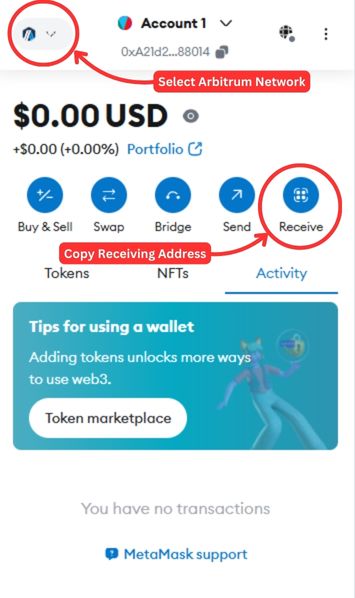

- An EVM-compatible wallet: This is essential because the platform currently supports only the Arbitrum network. An EVM-compatible wallet such as MetaMask or Coinbase Wallet is required. If you use MetaMask, make sure to add the Arbitrum network to create your Arbitrum wallet.

- USDC: All trading pairs on the Hyperliquid platform are USDC pairs. Therefore, you’ll need to bridge USDC to the platform to get started.

How to Bridge to Hyperliquid?

There are many cross-chain bridge solutions that support the Arbitrum network. Your choice of bridge will depend on the network from which you want to transfer USDC to Arbitrum.

Hybridge

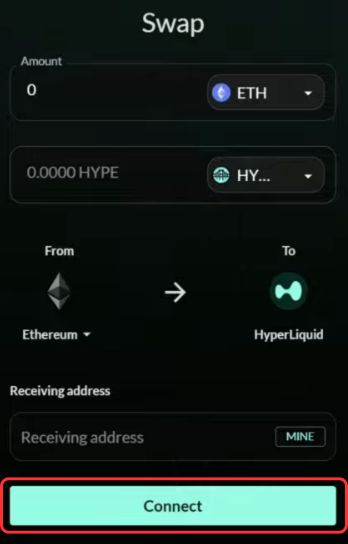

HyBridge is a native cross-chain bridging solution for the Hyperliquid blockchain, designed to simplify asset transfers into the Hyperliquid ecosystem. It supports smooth token movement across seven blockchains, including both EVM-compatible networks and non-EVM blockchains like Solana.

Step 1: HyBridge can be accessed via a browser. Launch your browser and navigate to the HyBridge website.

Step 2: The first step is to connect your wallet by clicking on the “Connect” button.

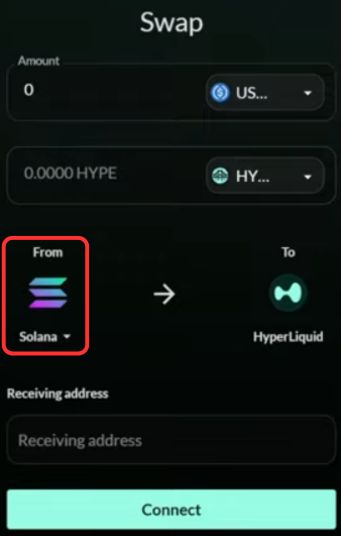

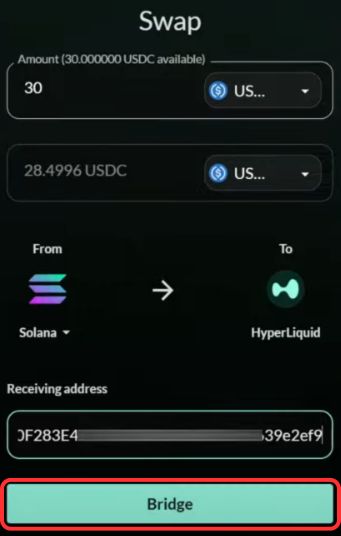

Step 3: Once your wallet is connected, go to the “From” field and select the network you want to bridge from, e.g., Solana.

Step 4: You will have the Hyperliquid network selected by default.

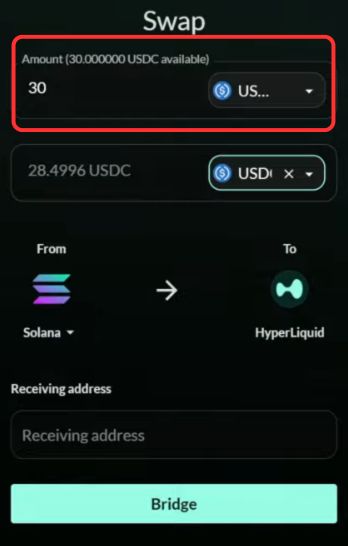

Step 5: In the “Amount” field, select “USDC” as the token you wish to bridge.

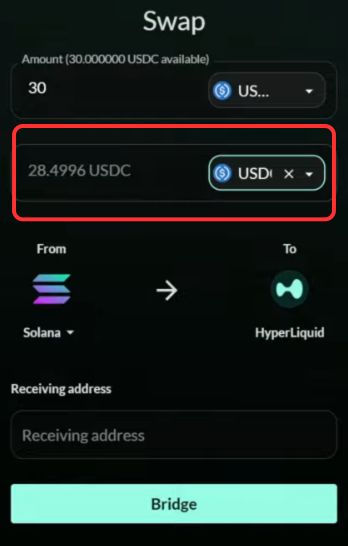

Step 6: Choose “USDC” as the token to receive on the Arbitrum network.

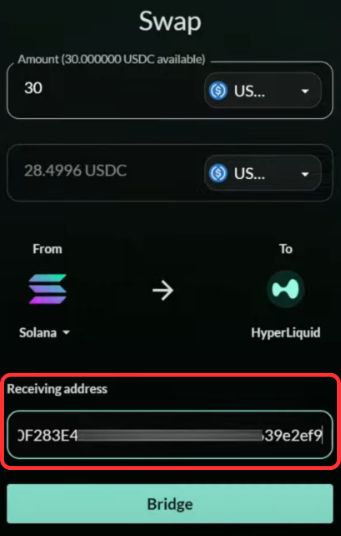

Step 7: Once all transaction details are complete, go to the “Receiving Address” field and paste your Arbitrum “Receive” address.

Step 8: The Arbitrum wallet address will be available on your MetaMask wallet or any compatible wallet with the Arbitrum network added.

Step 9: With the receiving address entered, click on the “Bridge” button. In just a few seconds, your USDC will be successfully bridged to the Hyperliquid platform!

Bridging with HyBridge is straightforward. By setting the network to Hyperliquid, it simplifies the process, removing confusion and making it accessible even for non-technical users. For a complete step-by-step guide on how to bridge Solana to Hyperliquid using HyBridge, check out our tutorial.

But what if the network you want to bridge isn’t supported by HyBridge? That’s where alternatives like Squid come in.

Squid

Squid supports over 70+ EVM chains, Cosmos chains, and even some non-EVM chains like Solana, offering a reliable alternative when your preferred network isn’t available on HyBridge.

With Squid Boost, you can complete cross-chain actions in under 20 seconds, saving users significant time. Squid has already saved over five years of user time collectively and is trusted by leading platforms. Whether you need cross-chain staking, minting, payments, or other functions, Squid’s versatile tools, integrated via the Squid SDK, ensure a smooth and efficient experience.

Step 1: Open your browser and navigate to the Squid app.

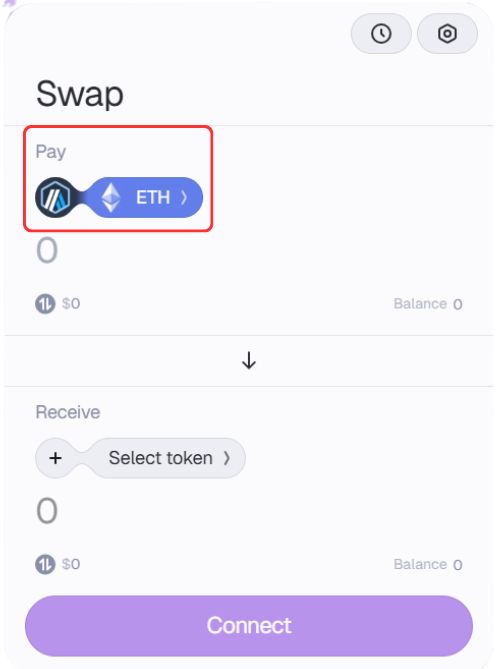

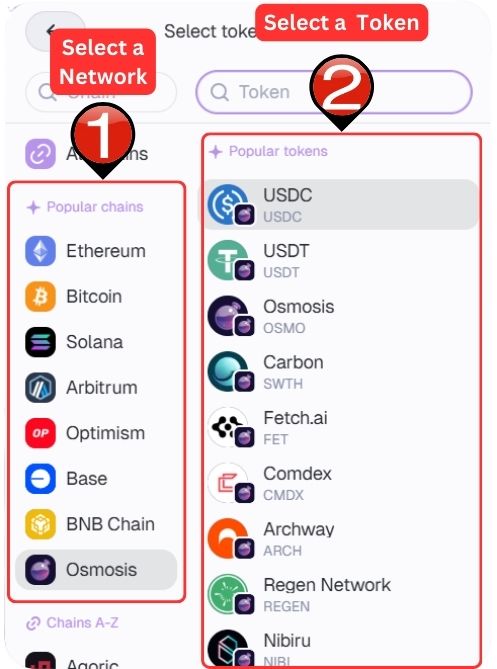

Step 2: Go to the “Pay” field, then click on the “Network” button to select the network you want to bridge from.

Step 3: On the left pane, you’ll see a list of networks and tokens to choose from. Select the desired network and token for the transaction.

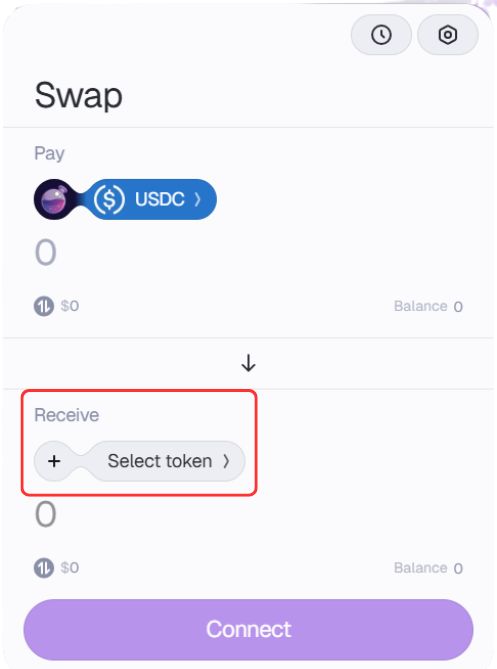

Step 4: Now move to the “Receive” field. Click on the network option, and similar to the previous step, select “Arbitrum” as the network. Make sure to select USDC as the receiving token.

<div style=”background-color: #f5f8fc; border-left: 4px solid #0078D4; padding: 15px; border-radius: 4px; font-family: Arial, sans-serif; margin: 10px 0; color: #000000;”><span style=”color: #d83b01; font-weight: bold;”>Remember:</span> Hyperliquid supports Arbitrum and only has USDC trading pairs.</div>

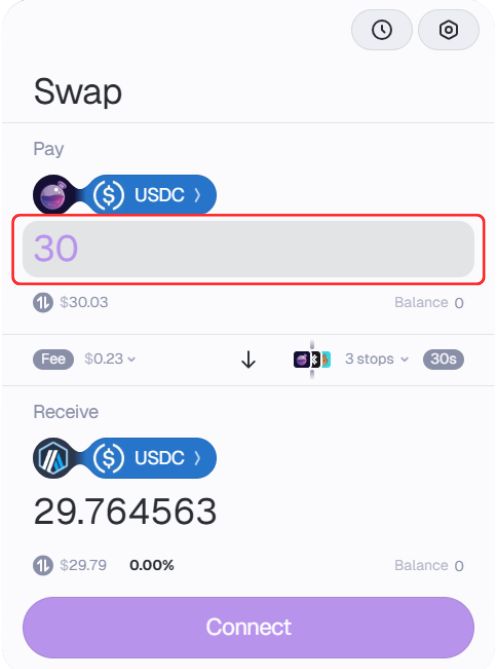

Step 5: Enter the amount of tokens you want to send to the Arbitrum network.

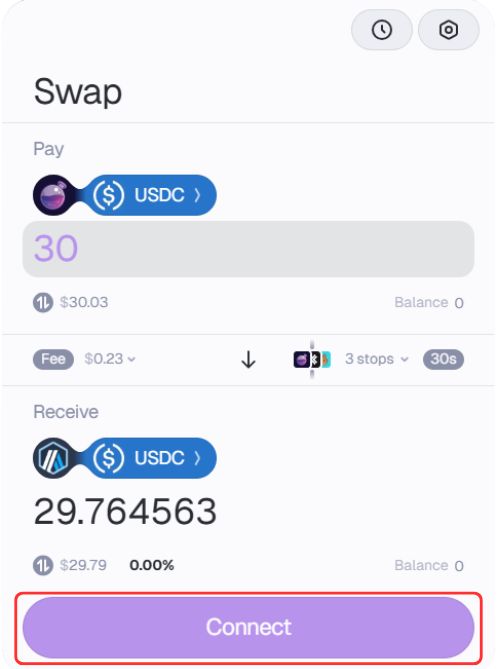

Step 6: You won’t see real-time updates until your wallet is connected. Click on the “Connect” button and connect your wallets for the transaction.

Step 7: Once your wallets are connected, real-time quotes will be displayed. Review the details, then click on “Swap” to proceed.

Bonus: Quick Alternatives to Bridge to Hyperliquid

1. MetaMask Bridge:

MetaMask users can use the MetaMask bridge for quick swaps between different EVM networks to bridge USDC to Hyperliquid.

2. Centralized Exchange (CEX):

If you prefer not to bridge, you can use a centralized exchange like BloFin that supports the Arbitrum network. Simply purchase USDC on the exchange and transfer it to your Arbitrum wallet using the Arbitrum network.

3. Gas Fees:

Ensure you have enough tokens to cover gas fees, which depend on the networks involved:

- If bridging from Solana, have some $SOL for gas.

- For EVM networks (like Arbitrum), $ETH is widely used for Layer 2 solutions.

About Hyperliquid

Hyperliquid is a decentralized perpetual exchange (DEX) built on its own Layer 1 (L1) blockchain, offering high-speed trading with a fully on-chain order book for real-time transactions and lower costs. Unlike traditional DEXs that use automated market makers (AMMs), Hyperliquid addresses inefficiencies in decentralized finance (DeFi) by enabling transparent and efficient order matching.

On November 29, 2024, Hyperliquid completed its Genesis Event, distributing 310 million HYPE tokens to over 90,000 users in one of DeFi’s largest airdrops. With no venture capital funding, Hyperliquid thrives on a community-driven growth model, empowering its users to help shape the platform’s future.

Supporting over 149 perpetual contracts with up to 50x leverage and 11+ spot cryptocurrencies, Hyperliquid offers zero gas fees and block latencies under one second. Its ability to process 100,000 orders per second ensures smooth and scalable trading. With $523M+ in daily spot trading volume and a lifetime trading volume nearing $560.01B to date, Hyperliquid is quickly becoming a leader in decentralized trading.

The recent launch of the native $HYPE token has further propelled the platform’s growth, not only with the largest airdrop but also by making history as the first dApp-specific chain to enter the top 10 in TVL rankings. Within just a few days, the token’s market cap exceeded $8B, a clear indicator of its growing momentum. As Hyperliquid continues its weekly updates, the platform and its ecosystem are poised for sustained growth and innovation, making it an exciting project in the decentralized finance space.

Hyperliquid

New TokenToken Symbol

HYPE

All-Time High

-

Current Price

Loading...

Market Cap

Loading...

Total Supply

Loading...

Key Advantages of Hyperliquid

- High Throughput and Low Latency: Hyperliquid processes up to 100,000 orders per second, rivaling centralized exchanges in performance.

- Decentralized Oracle System: The platform uses decentralized oracles for accurate price feeds, ensuring trade and margin integrity.

- One-Click Trading: Hyperliquid allows one-click trading, eliminating the need for a signature every time you enter a trade.

Hyperliquid Bridging Fees

On most decentralized exchanges, each trade incurs gas fees that can vary depending on network conditions. However, Hyperliquid stands out with its gas-free trading platform, thanks to its dedicated blockchain. While there are no gas fees for trading, you will still incur fees for deposits and withdrawals. Deposit fees can fluctuate based on network congestion, but they are typically low, usually just a few cents. Withdrawal fees are fixed at $1 per transaction.

Bottom Line

Bridging to Hyperliquid can be very lucrative. The platform not only offers a decentralized environment for safe asset trading but is also easy to use. However, it’s important to understand the difference between bridging to the Hyperliquid platform and to the Hyperliquid blockchain. The blockchain is still under development, while the platform currently only supports the Arbitrum network. Therefore, users will need to bridge to the Hyperliquid platform, which means bridging to Arbitrum, in order to begin trading.

FAQs

1. Is Hyperliquid legit?

Hyperliquid has been growing rapidly and has captured the attention of many. While the platform is fairly new, it offers a well-designed decentralized trading experience that mimics a centralized finance (CeFi)-like approach. Currently ranked #22 by market cap, Hyperliquid has garnered strong community support, with users praising it as a reliable hub for crypto trading.

2. Can I use Hyperliquid without bridging USDC to Arbitrum?

No, all trading pairs on the Hyperliquid platform are in USDC. You must bridge USDC to Arbitrum to start trading. Alternatively, you can use a centralized exchange to deposit USDC directly into your Arbitrum wallet.

3. Why does Hyperliquid rely on an order book instead of AMMs?

Hyperliquid uses an on-chain order book to improve trading efficiency and transparency. Unlike AMMs, order books allow for real-time matching of buy and sell orders, reducing slippage and offering better price discovery for traders.

4. Do I need to bridge directly to the Hyperliquid blockchain?

No, the Hyperliquid blockchain’s mainnet is not live, and no cross-chain bridges currently support it. When bridging to Hyperliquid, you are transferring funds to the Arbitrum network to trade on the Hyperliquid platform.