Both Polygon and Arbitrum are EVM-compatible blockchains, with Polygon offering zk-rollup technology and Arbitrum utilizing optimistic rollup. These two platforms are competing to be the top Ethereum Layer 2 solution. However, users might prefer one over the other, especially when looking to bridge their assets from Polygon to Arbitrum. In this guide, we will explore the available options for bridging assets from Polygon to Arbitrum.

Can I Bridge from Polygon to Arbitrum?

Yes, bridging from Polygon to Arbitrum is possible with the help of cross-chain bridges, which are designed to enhance interoperability between blockchains. In this guide, we will explore the Portal Bridge for transferring assets from Polygon to Arbitrum, and we will also look at Rango Exchange, a bridge aggregator, to provide a wider range of bridging options in case the Portal Bridge is ever down or congested.

Important: It’s important to note that phishing scams and fraud are common when using untrusted bridges or fake websites. Connecting your wallet to these can lead to bad actors wiping out your funds.

How to Bridge from Polygon to Arbitrum

Alright, let’s now look at the steps involved in bridging from Polygon to Arbitrum using both methods.

Using Cross Chain Bridge

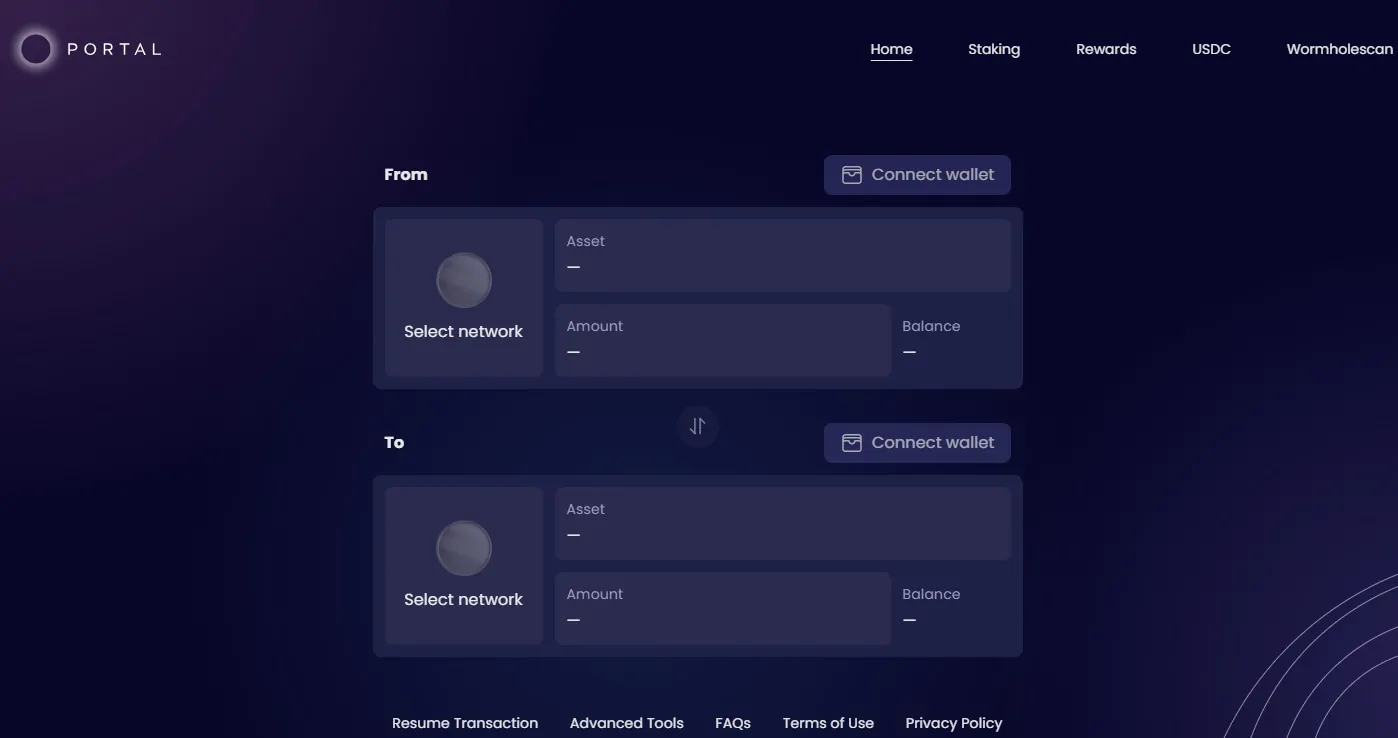

The first and most cost-effective method to bridge from Polygon to Arbitrum is by using a cross-chain bridge like the Portal Bridge. The key advantage of using a cross-chain bridge is that there are no intermediaries, which reduces fees and makes the process more affordable.

The Portal Bridge, built on the Wormhole network, locks your original tokens on the source chain and mints corresponding wrapped tokens on the target chain. You can then swap these wrapped tokens for native tokens on Arbitrum. The process is secured by Guardians, special validator nodes that validate transactions, ensuring a smooth transfer with minimal fees, typically around $0.0001 per transaction.

Here are the steps to follow to bridge from Polygon to Arbitrum using the Portal Bridge:

Step 1: Access the Portal Bridge by opening the website in your browser.

Step 2: Select the network you want to bridge from. In this case, choose “Polygon”.

Step 3: Connect your wallet by clicking on the “Connect Wallet” button.

Step 4: Choose the wallet where your funds are located on the Polygon network.

Step 5: A wallet extension will appear asking you to approve the connection request with the Portal Bridge. Approve the request to continue.

Step 6: From the list of available tokens on the Polygon network, select the token you want to bridge and enter the amount you wish to transfer.

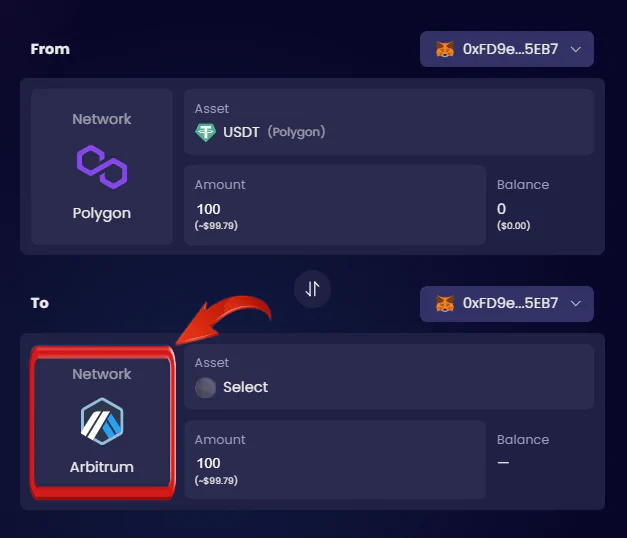

Step 7: Next, choose the destination blockchain by selecting “Arbitrum”.

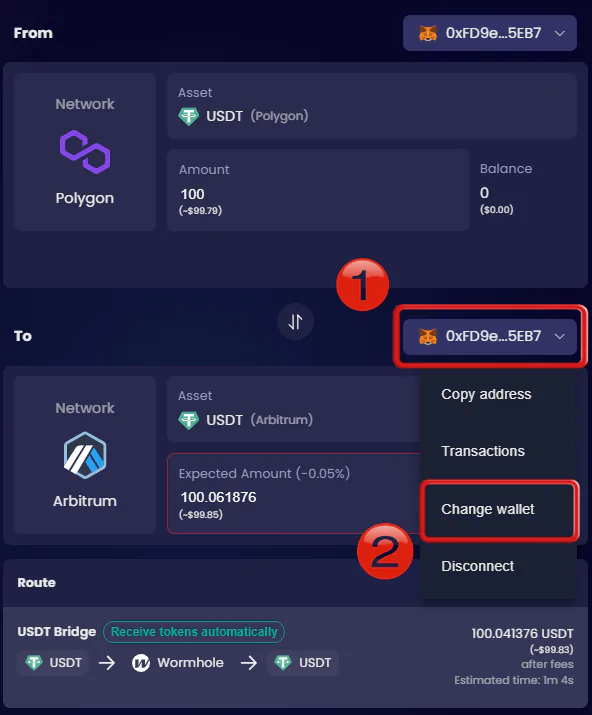

Step 8: In this example, we’re using MetaMask wallet, as it’s compatible with both blockchains. If you prefer to use a different wallet for Arbitrum, click on the “Wallet” button and then select “Change Wallet” to transfer your assets to a different wallet.

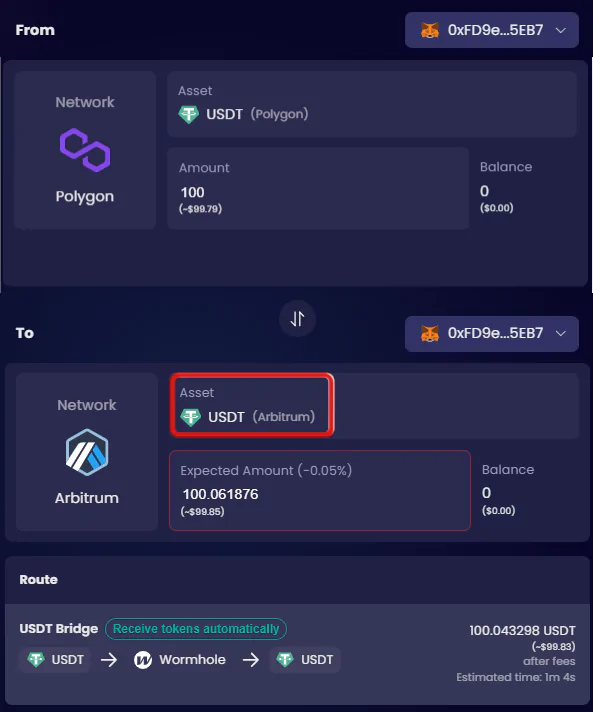

Step 9: After selecting the destination wallet, choose the token on the Arbitrum network that you want to receive once the bridging is complete.

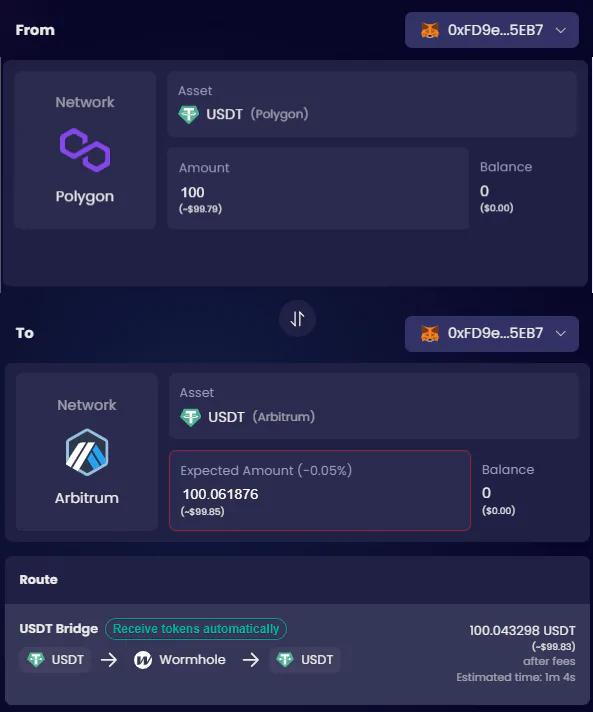

Step 10: The Portal Bridge will show the associated fees and the amount you will receive after the transfer is finalized.

Step 11: Review all the details and proceed with the transaction to complete the asset bridging from Polygon to Arbitrum.

Using the Portal Cross-Chain Bridge allows users to easily transfer their assets from Polygon to Arbitrum. A common issue with such transactions is finding compatible wallets, but since both Polygon and Arbitrum are EVM-compatible, they can both be added to MetaMask, allowing you to manage your assets from a single wallet.

Using Bridge Aggregator

Another great way to access a broader range of bridging protocols from a single platform is by using a bridge aggregator. These aggregators provide all possible routes between two chains, offering options that vary in cost and speed. They are particularly useful for exploring new options, as they incorporate emerging protocols as they become available.

Rango Exchange is an excellent example of a bridge aggregator. It offers a wide selection of tokens and bridging options, ensuring the most efficient transfer routes. Rango provides high security and reliability by connecting with over 100 DEXs and bridges, using smart routing for optimal fees, and offering high liquidity. It supports more than 67 chains, 68 DEXs, 18 bridges, and 25 wallets. With its user-friendly interface, Rango allows seamless asset transfers across over 60 chains without requiring KYC. We will use Rango Exchange to bridge from Polygon to Arbitrum.

Step 1: Go to the Rango Exchange website on your preferred browser.

Step 2: Click on the “Launch App” button to access the Rango bridge aggregator platform.

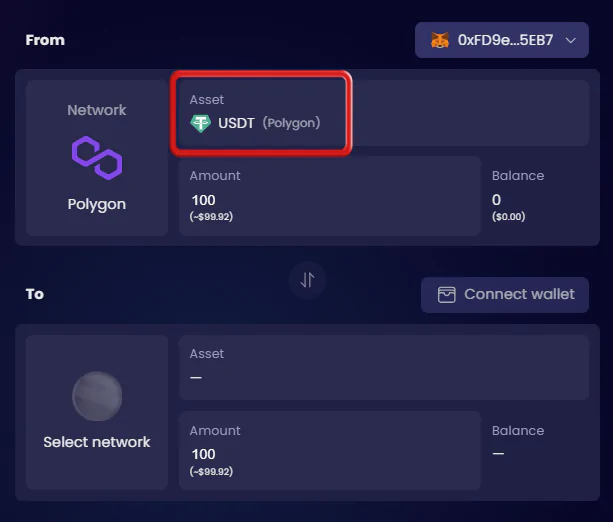

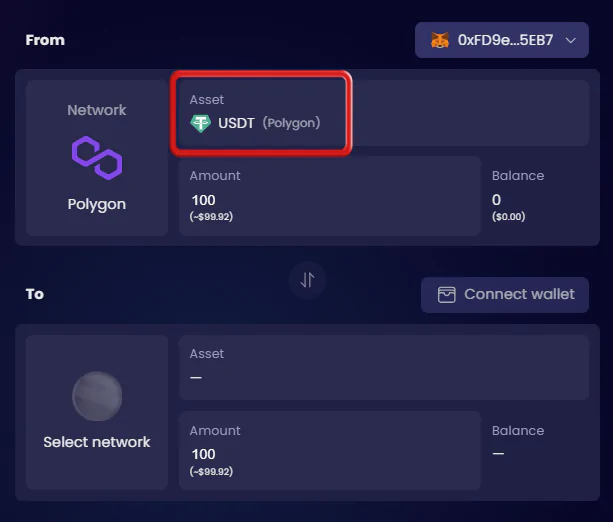

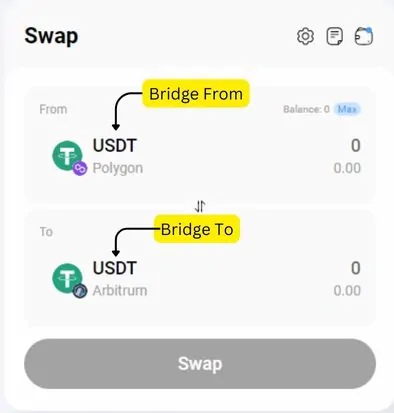

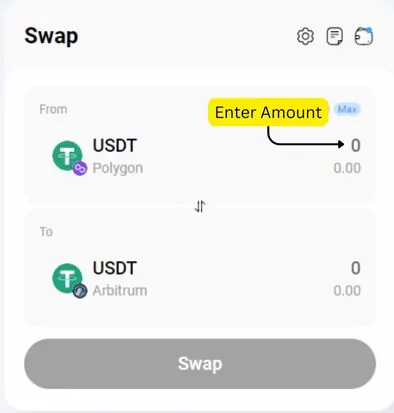

Step 3: Choose the blockchains and tokens you wish to bridge. For ease, select stablecoins on both Polygon and Arbitrum.

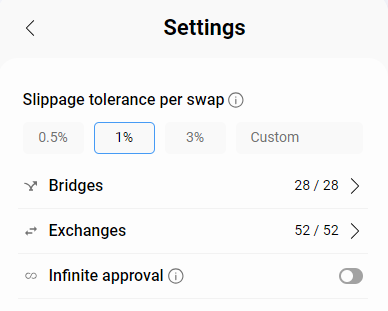

Step 4: Click the settings icon to adjust options like slippage and routing preferences.

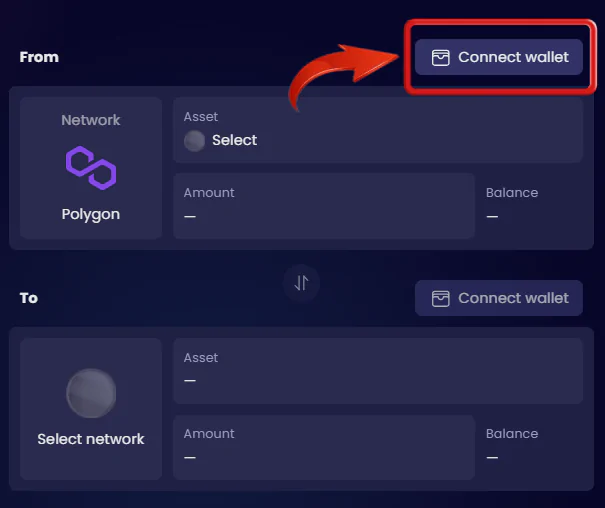

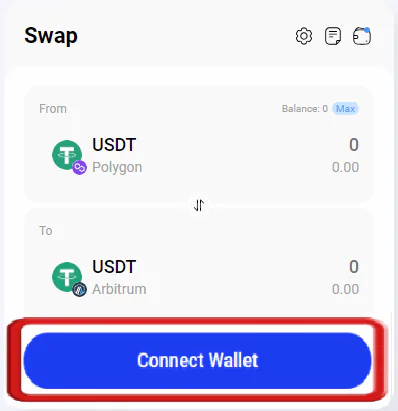

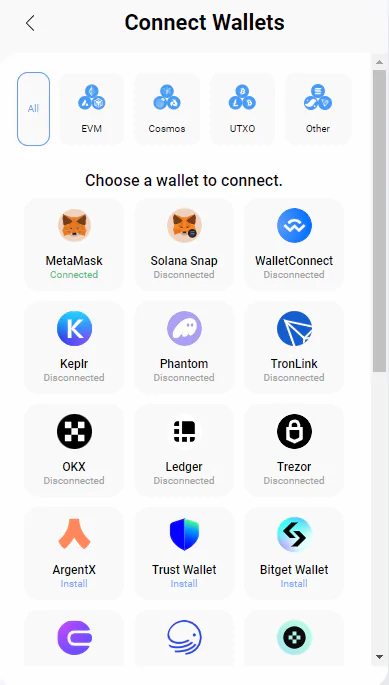

Step 5: After reviewing and adjusting your settings, click on the “Connect Wallet” button to continue.

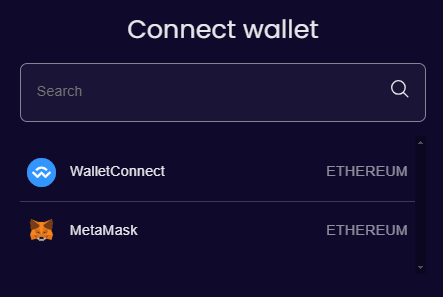

Step 6: Connect your wallets for the transaction. We will be using the MetaMask wallet since it is compatible with both Polygon and Arbitrum.

Step 7: Once your wallets are connected, return to the swap page and input the amount of assets you want to bridge from Polygon to Arbitrum.

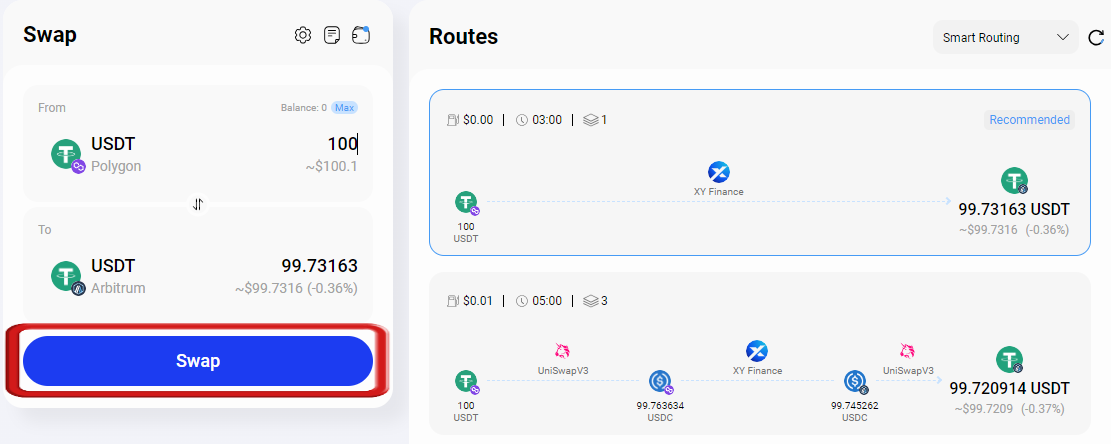

Step 8: Rango Swap will show various routes for transferring your assets. Choose the most suitable route and click “Swap” to finalize the transfer.

Bridge aggregators provide a variety of options for transferring assets across blockchains, but managing multiple wallets can introduce security risks and usability challenges. To streamline your experience, consider using decentralized exchanges (DEXs) like Binance and BingX. These platforms offer a simpler solution, enabling direct asset trades without the complexities of bridging or handling multiple wallets.

Bottomline

When your goal is to bridge Polygon to Arbitrum, the process can be simple with the right guidance. However, the method you choose ultimately depends on what matters most to you. Before exploring the bridging process, take a moment to consider your priorities—whether it’s security, cost, efficiency, or simplicity. Each method offers its own strengths, so understanding your needs will help you select the best approach for a smooth and successful transfer.

FAQs

1. What are the risks associated with wrapped tokens when bridging from Polygon to Arbitrum?

When bridging assets, you often receive wrapped versions of tokens on the destination chain. These wrapped tokens carry certain risks:

- Smart Contract Risks: The contracts governing wrapped tokens may have vulnerabilities.

- Centralization Risks: Some wrapped tokens rely on centralized custodians.

- Depeg Risk: Wrapped tokens may lose their 1:1 peg with the original asset.

- Liquidity Risk: There may be limited liquidity for certain wrapped tokens on the destination chain.

2. What are the best practices for securing assets during the bridging process from Polygon to Arbitrum?

To enhance security when bridging assets:

- Use hardware wallets when possible for both source and destination addresses.

- Double-check all addresses and transaction details before confirming.

- Start with a small test transaction before moving large amounts.

- Be cautious of phishing attempts and only use official bridge interfaces.

- Consider using multi-signature wallets for large transfers.

- Monitor the bridge transaction status and be prepared for potential delays.

- Keep records of all bridging transactions for security and tax purposes.

- Stay informed about the latest security practices and potential vulnerabilities in bridging protocols.

3. Are there any potential risks associated with using cross-chain bridges or bridge aggregators?

While cross-chain bridges offer convenience, they also introduce certain risks:

- Smart contract vulnerabilities: Bridges rely on smart contracts, which can be susceptible to vulnerabilities and attacks.

- Price slippage: The price of the token you’re bridging might fluctuate during the transaction, potentially affecting the amount you receive on the destination chain.

- Third-party risks: Using a bridge aggregator introduces an additional intermediary, which could potentially increase the risk of fraud or loss of funds.

4. What factors should I consider when choosing a cross-chain bridge or aggregator?

When selecting a bridge or aggregator, consider the following factors:

- Security: Prioritize bridges with a strong security track record and audited smart contracts.

- Fees: Compare the fees charged by different bridges to find the most cost-effective option.

- Speed: Consider the estimated time for the bridging process and the potential impact of network congestion.

- Reputation: Choose bridges or aggregators with a good reputation and positive user reviews.