- Berachain is a DeFi-focused Layer 1 blockchain with full EVM equivalence, making it easy for developers to migrate Ethereum-based applications without modification.

- Its unique Proof-of-Liquidity consensus model restructures incentives, ensuring liquidity remains active while securing the network, unlike traditional staking mechanisms.

- Berachain’s ecosystem is centered on DeFi, but it is gradually expanding into gaming, SocialFi, and NFT marketplaces as the network grows.

Technology evolves, and with innovation, industries expand. The blockchain space is no exception. One of the latest developments is Berachain; a bear-themed Layer 1 blockchain that originally started as an NFT project called “Bong Bears”. Over time, it has transformed into a DeFi-focused blockchain with an execution layer identical to the Ethereum Virtual Machine (EVM). What sets Berachain apart is its unique Proof-of-Liquidity consensus mechanism, designed to address incentive misalignment in traditional consensus models.

This Berachain guide explores Berachain blockchain in detail, covering its design, key principles, potential use cases, and what to expect from its ecosystem.

What’s Berachain?

At first glance, Berachain might sound like just another meme-inspired project, but it is a fully functional, high-performance Layer 1 blockchain. Designed to be EVM-equivalent, it features a unique Proof-of-Liquidity (PoL) consensus mechanism that integrates liquidity and security within its network. By embedding liquidity solutions directly into its governance model, Berachain aims to tackle challenges faced by other blockchains and establish itself as a major player in the Layer 1 space.

Traditional Proof-of-Stake (PoS) blockchains require users to lock up their assets to participate in network security and earn staking rewards. However, this creates an incentive misalignment; while blockchain projects rely on active participation and trading volume, staking mechanisms encourage asset lockup instead. As a result, users are more likely to stake their assets for lower-risk returns rather than engage with DeFi applications built on the blockchain.

Berachain addresses this issue through its Proof-of-Liquidity (PoL) consensus mechanism. PoL builds upon PoS but restructures incentives to prioritize DeFi activity over asset lockup. This approach enhances network security and decentralization while ensuring that liquidity remains active within the ecosystem.

Berachain started in August 2021 as an NFT project called Smoking Bears before evolving into a DeFi-focused blockchain. It launched its Artio testnet in January 2023, followed by a second iteration in 2024. The project gained significant traction through one of the largest airdrops in blockchain history; distributing 79 million BERA tokens, valued at $1.1 billion, before launching its mainnet.

With its strong focus on DeFi, Berachain aims to become the go-to blockchain for DeFi developers, offering the following key features:

Read More: How to Buy $BERA

EVM-Identical for Seamless Compatibility

Berachain isn’t just EVM-compatible; it’s EVM-identical. This means it operates exactly like Ethereum, allowing developers to use the same tools, wallets, and smart contracts without modification. Any upgrades to Ethereum can instantly be applied to Berachain, keeping it up to date with the latest innovations. By using Ethereum execution clients like Geth, Erigon, and Nethermind, Berachain ensures a familiar and efficient environment for developers and users.

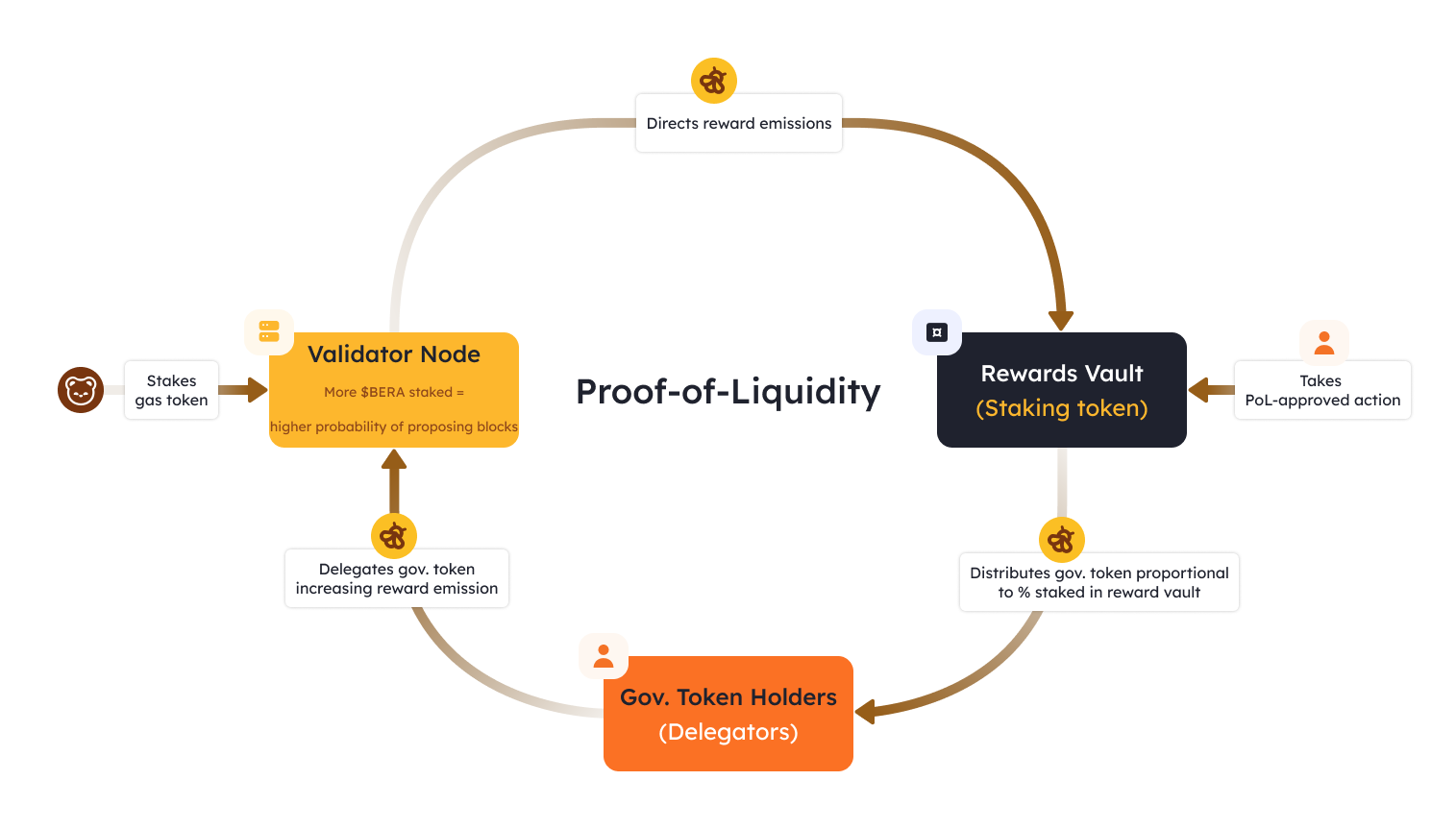

Proof of Liquidity: A New Consensus Mechanism

Most blockchains rely on staking, where users lock up their tokens to help secure the network. Berachain changes this with Proof of Liquidity (PoL). Instead of keeping tokens idle, users put them to work in liquidity pools, earning rewards while still contributing to network security. This approach boosts economic activity, keeps assets flowing, and makes the blockchain more attractive for DeFi projects. Validators secure the network by acquiring a special governance token, BGT, which is earned by providing liquidity rather than simple staking.

Source: Berachain Docs

BeaconKit Framework: Modularity for Expansion

Berachain introduces BeaconKit, a framework designed to improve blockchain flexibility. This toolkit lets developers customize how Berachain operates, making it easier to add Layer 2 rollups, custom block builders, and advanced data solutions. Built using the Cosmos SDK, BeaconKit ensures Berachain can integrate new technologies while maintaining its EVM-equivalent environment. It also includes CometBFT, a Byzantine fault-tolerant consensus engine that enhances security and reliability.

![]()

Source: Berachain Docs

Berachain Tokenomics: The Tri-Token Model

Berachain’s token system is built to keep the network running efficiently while rewarding active participants. Instead of relying on a single token for everything, it separates responsibilities across three distinct assets.

BERA: The Gas Token

BERA is the main token used for transactions on Berachain. Every time you send tokens or use a smart contract, you pay a small fee in BERA. It also plays a role in staking, where validators use it to help secure the network. The total supply started at 500 million BERA, and more tokens are added over time through inflation (10% per year, adjustable by governance). To prevent large sell-offs, BERA tokens given to the team and investors unlock slowly over three years.

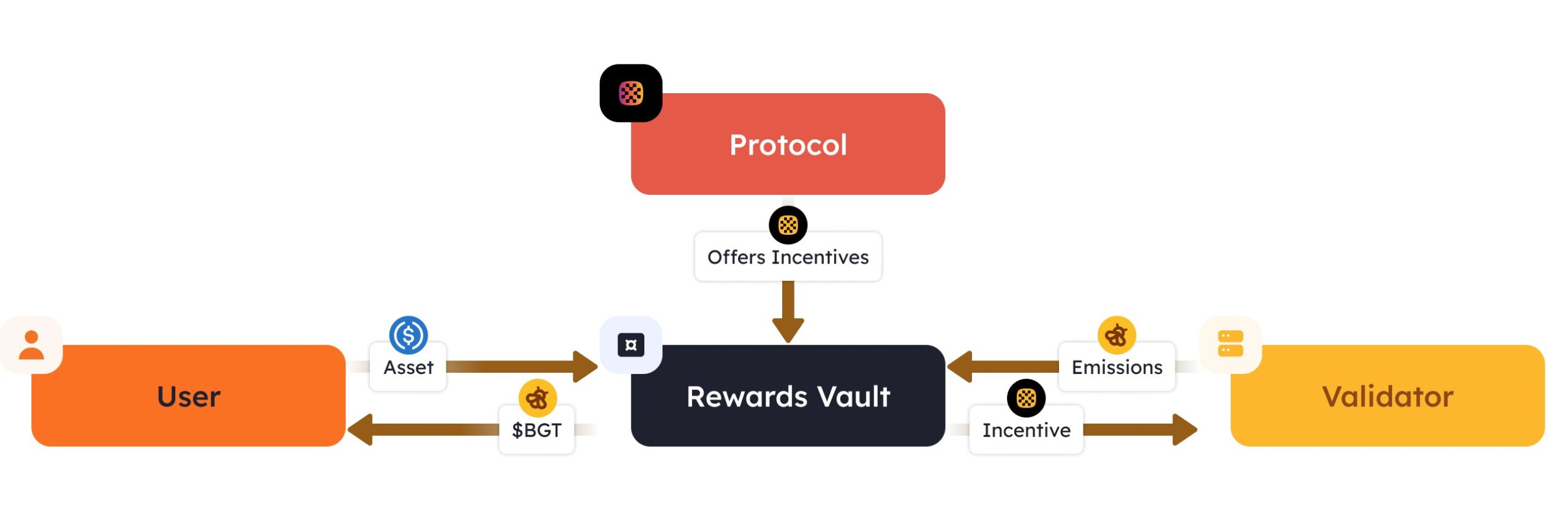

BGT: The Governance Token

BGT (Berachain Governance Token) lets users vote on important decisions, like how rewards are distributed or whether to upgrade the system. Unlike BERA, you can’t buy, sell, or trade BGT; it can only be earned by providing liquidity on Berachain’s platforms. This ensures that only active participants influence the network. Users can gain BGT by adding liquidity on BEX (Berachain’s exchange), borrowing HONEY on Bend (its lending platform), or depositing HONEY into bHONEY vaults for leveraged trading.

Source: Berachain Docs

HONEY: The Stablecoin

HONEY is Berachain’s stablecoin, meaning its value is designed to stay at $1 USD. Unlike regular tokens, it is backed by a mix of crypto assets. Users mint HONEY by depositing approved tokens into a vault, ensuring that every HONEY in circulation is fully backed. It’s widely used for lending, trading, and payments across Berachain’s ecosystem, making it a key part of decentralized finance (DeFi) on the network.

Berachain’s 3 Key Principles

Berachain follows three key principles that shape its vision for the DeFi space. These principles focus on improving liquidity, supporting developers, and making blockchain technology more accessible.

Unifying Liquidity Across the Network

Right now, DeFi liquidity is scattered across different blockchains and projects, making it harder for individual platforms to offer deep liquidity for trading and lending. Berachain solves this by integrating essential DeFi components; like exchanges and lending protocols, directly into its blockchain. This reduces competition for liquidity, making transactions smoother and improving efficiency for users and developers.

Turbocharging Applications

Most blockchains reward validators or miners for maintaining the network, but Berachain believes developers deserve incentives too. Its Proof-of-Liquidity (PoL) system directs blockchain rewards toward applications and builders, encouraging innovation. By financially supporting developers who build on Berachain, it helps create a stronger, more dynamic DeFi ecosystem.

Lowering Barriers for Adoption

Ethereum dominates DeFi, but its high fees and congestion make it difficult for new projects to thrive. Berachain is designed to be EVM-compatible, meaning developers can easily move their existing Ethereum-based applications onto its network without making major changes. This lowers the barrier to entry, making it easier for projects to expand and take advantage of Berachain’s unique features.

Berachain Ecosystem

Most of Berachain’s applications focus on DeFi, with many projects already live on the mainnet. These include decentralized exchanges, lending platforms, and liquidity protocols that take advantage of Berachain’s unique PoL consensus. Since the blockchain is built with DeFi in mind, it offers native support for trading, borrowing, and liquidity management, making it an attractive option for developers in this space.

Beyond DeFi, the ecosystem is slowly expanding into other sectors. Projects like Narra bring gaming to Berachain, allowing users to train, interact with, and trade AI-powered agents. Other applications are emerging in areas like SocialFi and NFT marketplaces, though they are currently fewer in number. As the network grows, it will be interesting to see how these non-DeFi projects evolve alongside its core financial infrastructure.

Read more: Top Berachain Ecosystem Projects

Final Thoughts

Berachain introduces a fresh approach to blockchain liquidity and security through its Proof-of-Liquidity consensus. With a strong focus on DeFi, it streamlines development while maintaining Ethereum compatibility. Its tri-token model balances governance, transactions, and stability, shaping a distinct ecosystem. While mostly DeFi-driven, projects in gaming and SocialFi are emerging, hinting at broader use cases. As it evolves, its impact on blockchain infrastructure will be worth watching.

FAQs

1. What is the origin of Berachain?

Berachain originated from the Bong Bears NFT collection, created by its pseudonymous founders, Papa and Smokey. The project gained traction with its unique rebase mechanism, rewarding holders with additional NFTs. As the community grew, attracting top DeFi and NFT enthusiasts, the idea of Berachain emerged; a blockchain designed to integrate liquidity directly into its consensus model.

2. Where is Berachain headquarters?

Berachain is based in George Town, Cayman Islands, a well-known hub for blockchain and fintech projects.

3. Is Berachain an L1?

Yes, Berachain is a high-performance EVM-identical Layer 1 blockchain that uses Proof-of-Liquidity (PoL) for consensus. It is built on the BeaconKit framework, enabling modular and efficient blockchain development.

4. What does Berachain do?

Berachain is a Layer 1 blockchain built for DeFi, using Proof-of-Liquidity (PoL) to secure the network while keeping liquidity active. It features a three-token model; BERA (gas), BGT (governance), and HONEY (stablecoin), to optimize governance and DeFi efficiency.

5. Why build on Berachain?

Berachain solves the liquidity lockup issue in PoS systems by ensuring staked assets remain usable. Its PoL model creates a secure, liquidity-rich environment for DeFi development.