Cryptocurrency enthusiasts and investors are no strangers to the popularity of Gemini and Coinbase, two renowned exchange platforms that have reshaped the landscape of digital asset trading.

As the crypto market continues to gain momentum, the rivalry between these platforms has intensified, leaving traders with the question: which platform is the ultimate choice?

Both exchanges offer a user-friendly interface, extensive asset offerings, and robust security measures, making them top contenders for crypto enthusiasts worldwide. However, when it comes to key aspects like fees, supported cryptocurrencies, advanced trading options, and regulatory compliance, the distinctions become apparent.

Now let’s go ahead and explore these differences below in detail.

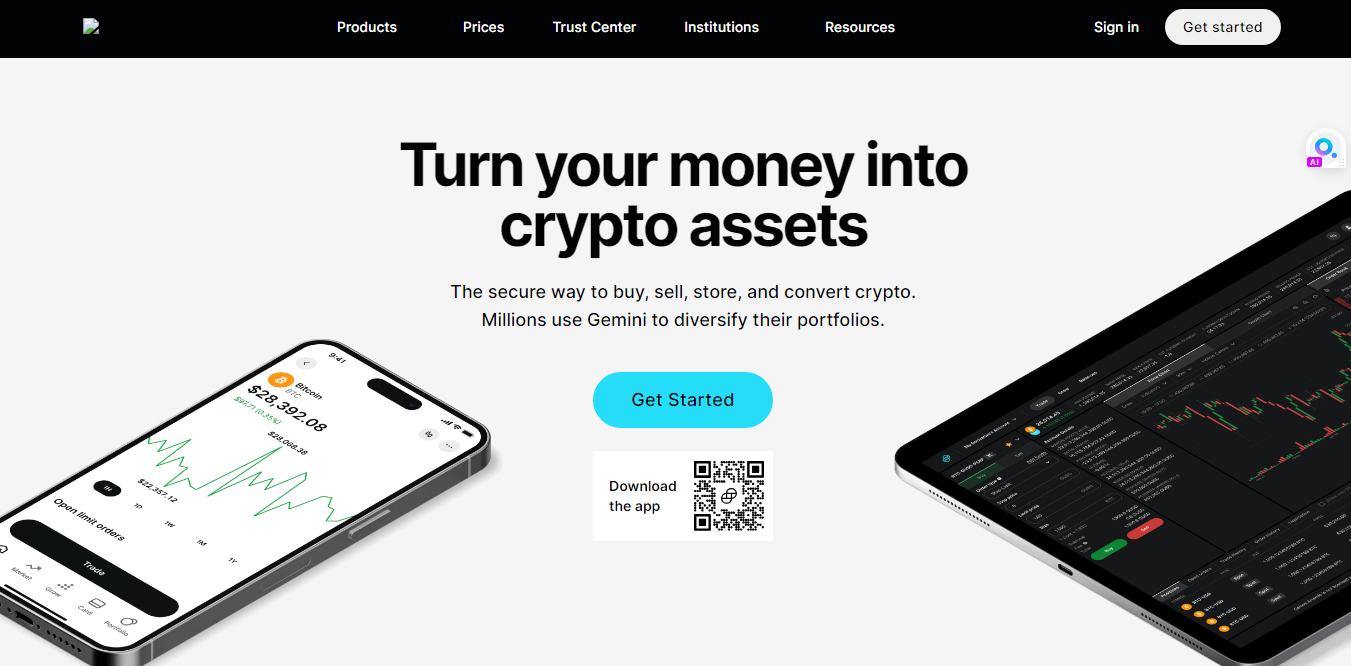

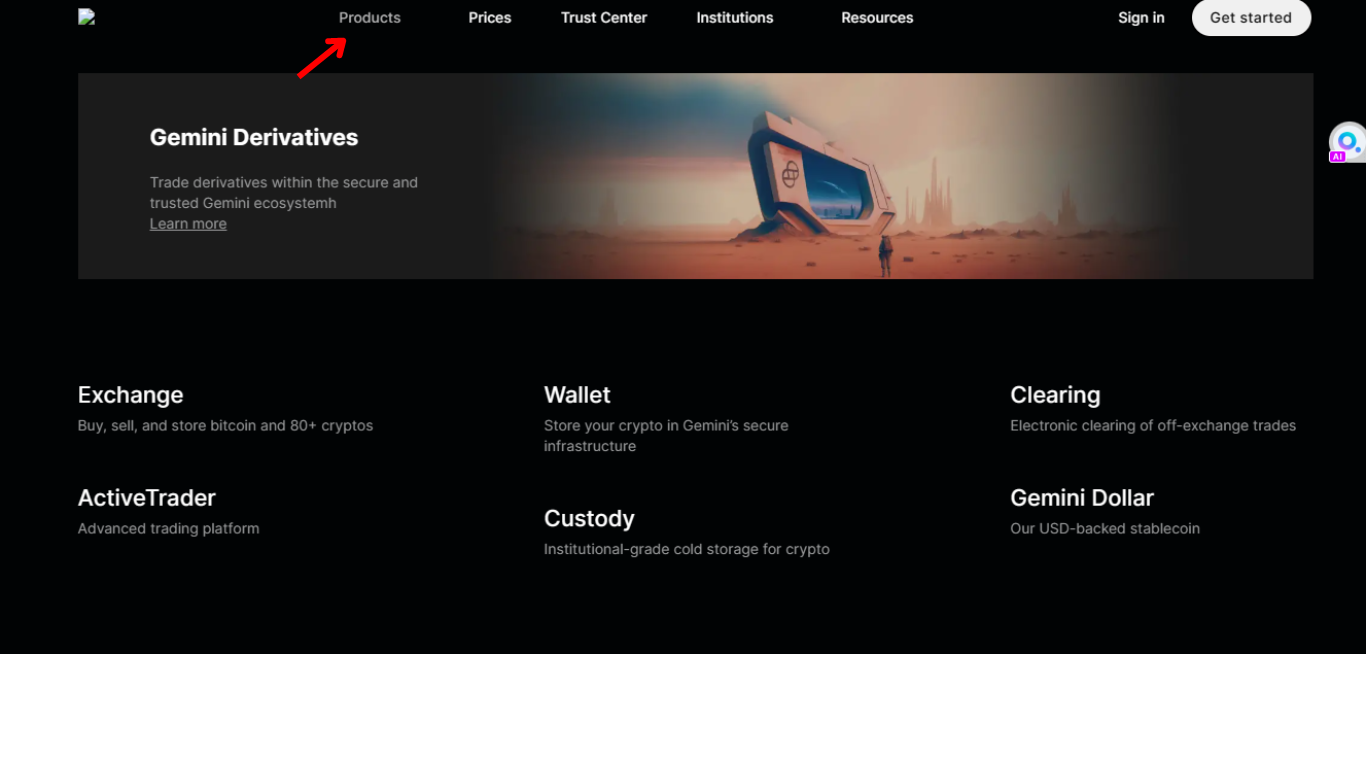

Overview of Gemini

Gemini, founded by the Winklevoss twins in 2014, is a New York-based exchange. Regulated by the New York State Department of Financial Services, Gemini is known for its strong commitment to security and compliance.

With over 100 cryptocurrencies available, including Bitcoin, Ethereum, Solana, and Polkadot, Gemini caters to a wide range of trading preferences. Traders can rely on Gemini’s dedication to security and adherence to regulations, making it a trusted and reliable platform for engaging in the world of cryptocurrencies.

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ All USD balances are 100% insured by FDIC | ❌ Limited choices in cryptocurrency |

| ✅ Variety of yield-earning products | ❌ Requires extensive private information from users |

| ✅ Available in all U.S. states | |

| ✅ Strong compliance and security |

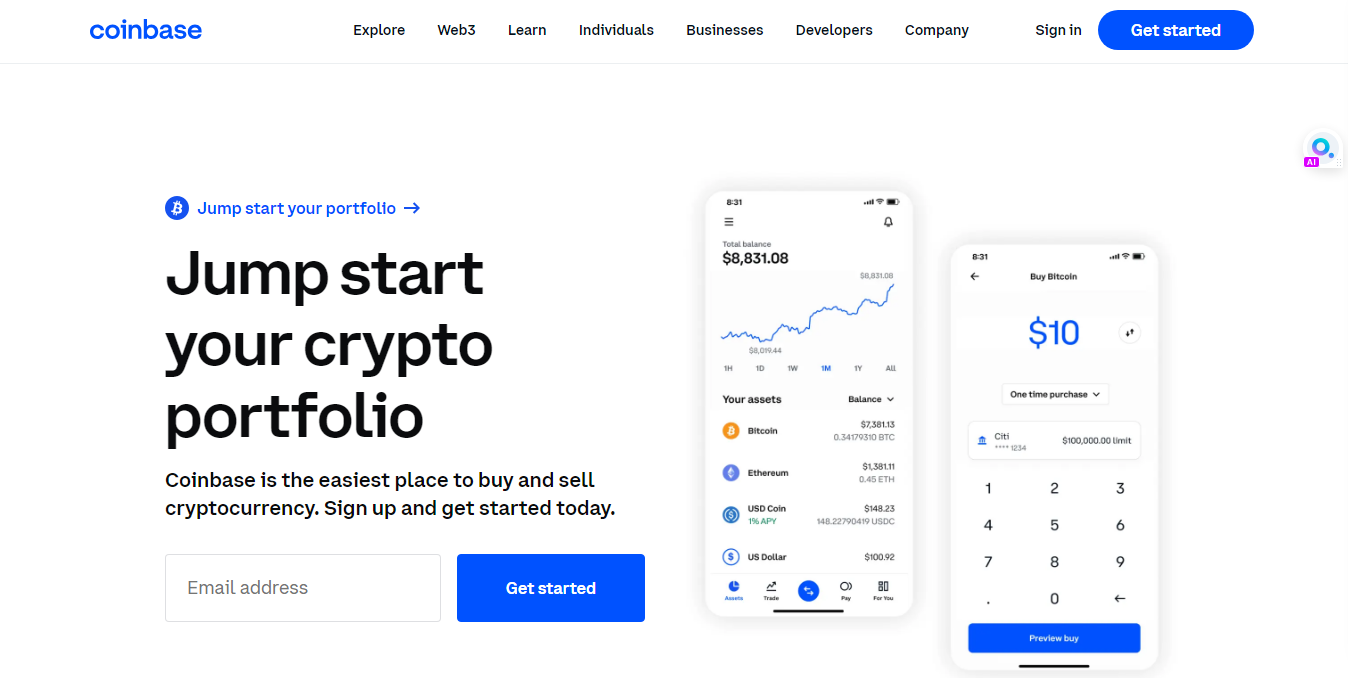

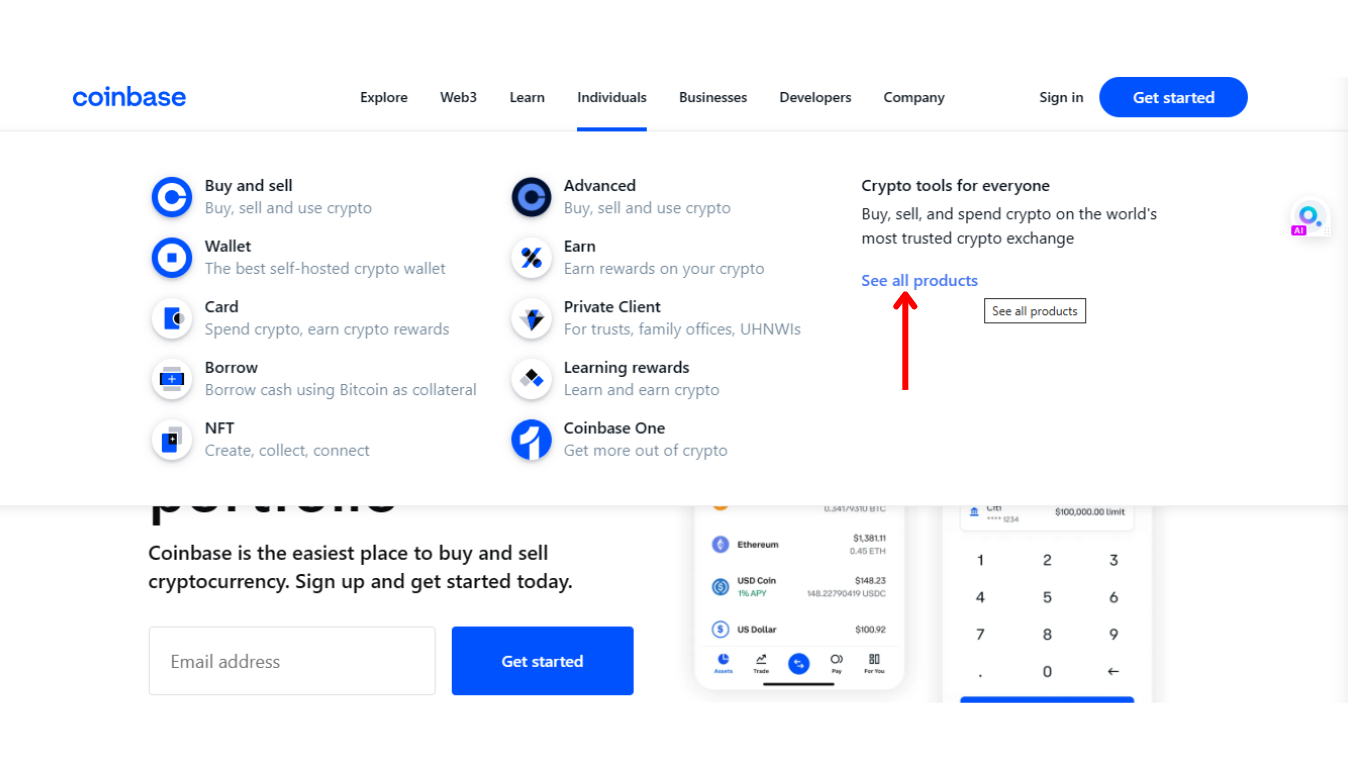

Coinbase

Coinbase, founded in 2012 in the United States, operates under the regulatory oversight of FinCEN. As a public company, Coinbase undergoes rigorous scrutiny, making it highly monitored globally.

With over 200 cryptocurrencies available, Coinbase offers a user-friendly platform catering to beginners. It provides spot trading, NFT engagement, interest earning, recurring buys, and educational resources through its “learn and earn” program.

What makes this crypto exchange a prominent player in the industry is its comprehensive services and commitment to accessibility.

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Accepts fiat currency | ❌ Complex trading fees |

| ✅ Enables trading of various popular cryptocurrencies | ❌ Does not support some lesser-known coins |

| ✅ All your digital assets are insured | |

| ✅ Provides a seamless user experience | |

| ✅ Offers solid educational materials for beginners |

Key Features of Gemini vs Coinbase

While both Gemini and Coinbase are popular names in the crypto world, there still are significant differences that set them apart from one another. Some such key differences include:

1. Supported Cryptocurrencies

Coinbase offers a wider range of cryptocurrencies compared to Gemini. With over 200 options, Coinbase takes the lead, while Gemini supports trading for over 100 cryptocurrencies.

Now both platforms include popular cryptocurrencies like Bitcoin and Ethereum, along with numerous smaller digital assets. However, it’s important to note that Gemini lacks some significant cryptocurrencies available on Coinbase, such as Cardano (ADA) and Stellar (XLM).

Yet, Gemini does have its exclusive cryptocurrencies, but they are usually less popular and often ranked outside the top 100. One exception is Fantom (FTM), a relatively sizable cryptocurrency available on Gemini but not on Coinbase.

2. Speed

The speed of deposit and withdrawal methods is another significant factor that differentiates both platforms. Precisely, Gemini allows quick money transfers into your cryptocurrency exchange account, particularly through instant ACH deposits.

Yet, these instant deposits have a daily limit of $2,500. On the other hand, Coinbase enables instant Bitcoin purchases from your bank account or debit card but with higher fees than Gemini.

Similarly, Gemini facilitates instant deposits to your ActiveTrader-enabled account, resulting in crypto trade fees starting at 0.35%. But Coinbase charges a 1.5% fee for instant purchases from your bank account and a 4% fee for instant purchases using a debit or credit card. These fee variations significantly add to the differences when considering the two exchanges.

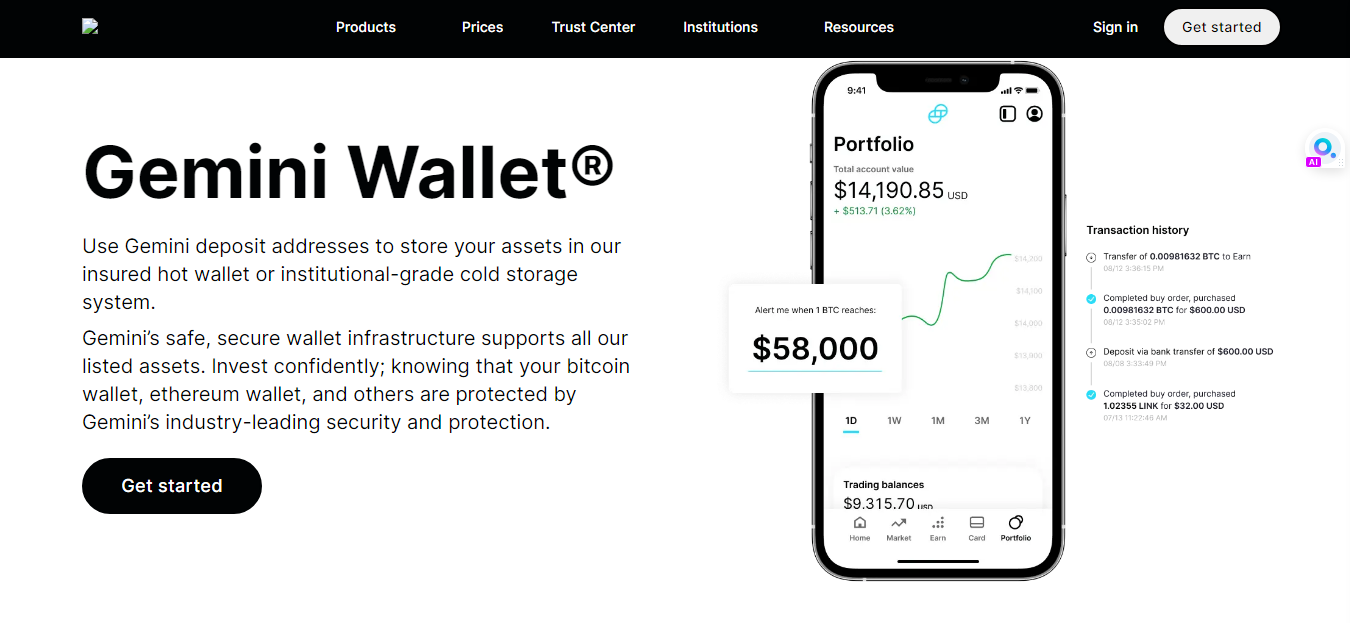

3. Crypto Wallet

In terms of offering smart crypto wallet solutions, Gemini Wallet is a custodial wallet, which is managed and controlled by Gemini as a third-party provider.

Consequently, any cryptocurrency funds stored in the Gemini Wallet are technically under the control of Gemini. Moreover, this wallet is exclusively available to users of the exchange.

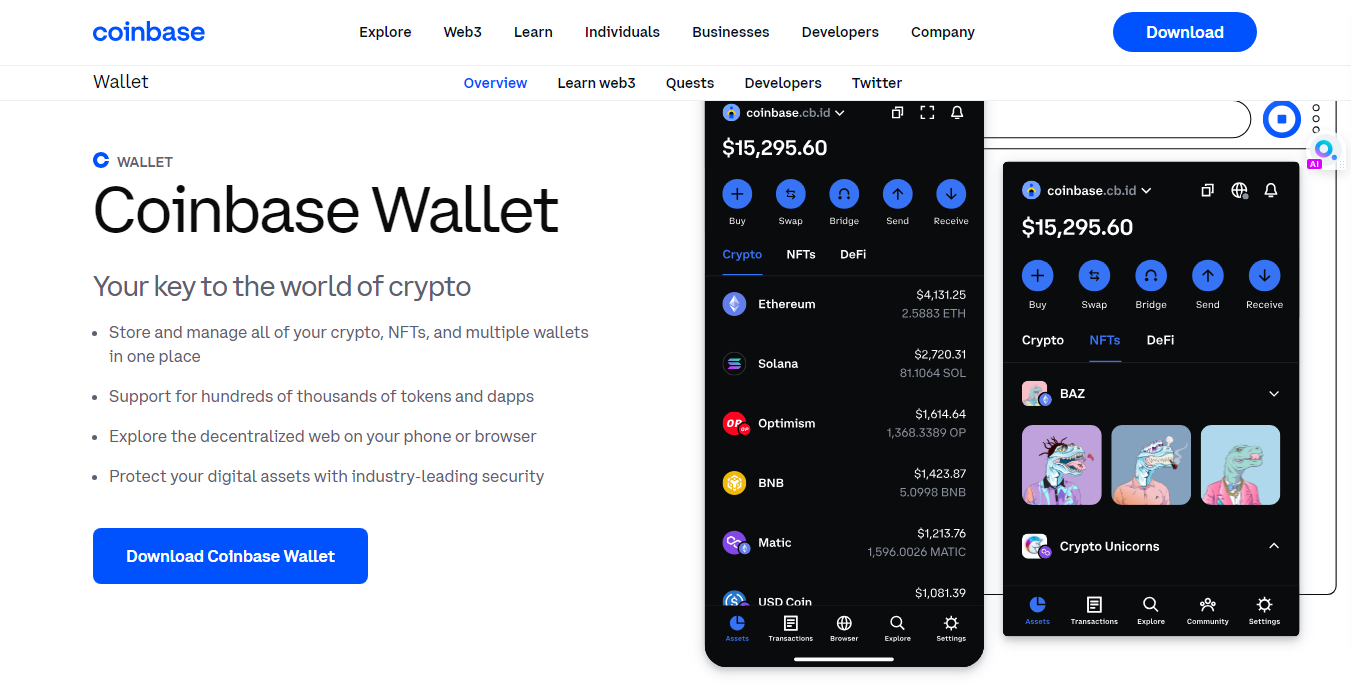

In contrast, Coinbase Wallet is a non-custodial option, granting users complete control over their stored funds. What sets it apart is that you don’t need to be a Coinbase client to utilize this wallet.

It is accessible to anyone, free of charge, regardless of whether they hold a Coinbase account or not. This gives users the freedom and flexibility to manage their crypto assets independently and securely.

4. Withdrawal Methods

When you’re ready to withdraw fiat currency from your Gemini account, you can easily withdraw USD, EUR, and GBP through bank transfers (ACH/Wire Transfer), and the great news is that these withdrawals won’t cost you a penny.

Meanwhile, Coinbase offers a wider range of fiat withdrawal options. You can withdraw funds via ACH, Wire, SEPA (for European customers), and Swift. ACH withdrawals on Coinbase are free of charge. However, it’s worth noting that wire withdrawals come with a $25 USD fee, SEPA withdrawals have a 0.15 EUR fee, and Swift withdrawals incur a 1 GBP fee.

5. Additional Features

Gemini and Coinbase both cater to different user needs with their distinct products and services. Simply put, Gemini provides spot trading, wallet and custody services, Gemini dollar, and over-the-counter (OTC) trading.

Furthermore, although it’s a beginner-friendly exchange, Gemini has a modest average 24-hour spot trading volume of around $15 million.

On the other hand, Coinbase offers a wider range of features. Users can buy/sell cryptocurrencies, engage in lending/borrowing, use the Web 3.0 wallet, access Coinbase cards, explore NFTs, and benefit from recurring buys. While occasional connectivity issues occur, Coinbase delivers a great user experience.

In terms of spot trading volume, Coinbase leads with an impressive daily average of approximately $1 billion, reflecting its popularity and significant trading activity.

Exchange Fees

Varying on the trading and non-trading activities supported by these exchange platforms, Gemini and Coinbase both have different fee structures. Below is a table that demonstrates this fee structure:

Trading Fees

| Fee | Coinbase | Gemini |

| Maximum Maker | 0.5% | 0.25% |

| Maximum Taker | 0.5% | 0.25% |

| Minimum Maker | 0.04% | 0.35% |

| Minimum Taker | 0% | 0.35% |

| Debit/Credit Card Purchase Fee | 3.99% | 3.49% |

Non-Trading Fees

| Fee | Coinbase | Gemini |

| Account Fee | 0% | 0% |

| Deposit Fee | 0% | 0% |

| Bank Transfer Withdrawal Fee | 1.49% | 1.49% |

| Debit/Credit Card Withdrawal Fee | 3.99% | 3.49% |

| Inactivity Fee | 0% | 0% |

Security

Gemini and Coinbase are popular exchanges backed by J.P. Morgan, with all USD balances on these platforms insured by the FDIC, providing protection of up to $250,000 per individual.

However, in terms of fund storage, Coinbase takes extra precautions by storing most of its customers’ funds offline, away from the internet. This “cold storage” method reduces the risk of hacking attempts. Coinbase also has additional security measures like two-factor authentication and risk management protocols to safeguard user accounts.

In contrast, while Gemini also stores most customer funds offline, this exchange strengthens its security model with insurance coverage. This insurance helps guard Gemini users’ digital assets against losses caused by cyber-attacks or third-party hacks.

Customer Support

Regarding customer service, Gemini stands out with its wider range of contact options and round-the-clock availability. This exchange goes the extra mile by providing additional channels like social media and 24/7 phone support.

Furthermore, Gemini has introduced a new platform called Cryptopedia, offering valuable information on different aspects of cryptocurrency trading.

Conversely, Coinbase only offers phone-based customer service specifically for fraud or account-locking matters. They do provide a chat button and contact form for general inquiries, though.

Summing Up

While Gemini and Coinbase are both stellar choices for your crypto trading needs, the best among the two can only be determined as per your usage needs.

So if you crave a wide range of cryptocurrencies, Coinbase is the go-to exchange for you. With an extensive selection, it’s the ideal platform for exploring diverse digital assets. On the other hand, Gemini comes to the rescue for trading enthusiasts looking to save on fees. Especially if you’re an ActiveTrader user, those savings can really add up.

With both exchanges having their fair share of strengths and weaknesses, it is now up to you to determine which one meets your usage needs perfectly.

FAQs

Is Gemini or Coinbase safe?

Both Gemini and Coinbase are top-notch in terms of safety. With advanced security features, secure storage options, and strong account protections, your crypto is in good hands, no matter which platform you choose.

Which crypto wallet is best for beginners?

For beginners, we recommend Coinbase Wallet. It is intuitive, highly secure, and backed by a well-known exchange. Even if you have little to no experience with crypto, Coinbase Wallet is a great option.

Does it matter which crypto wallet you use?

Yes, it matters which crypto wallet you use. With different types of wallets available, i.e., hot and cold crypto wallets, picking a wallet that fulfils your crypto storage and management needs is crucial. Hence, for maximum safety, it is better to go for a non-custodial cold hardware wallet. Likewise, it’s better to use a hot wallet for everyday funds while you keep most of your crypto in cold storage.