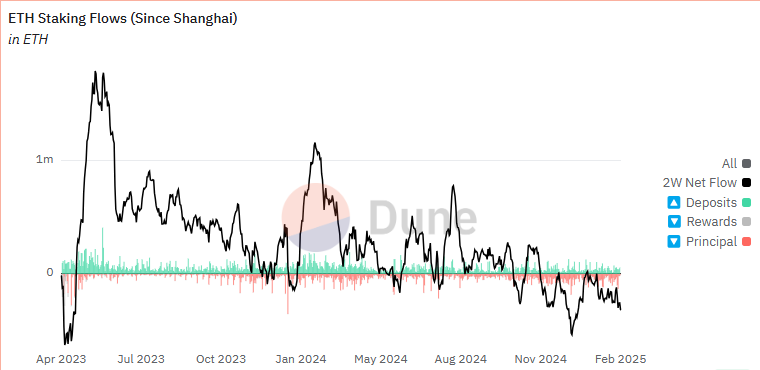

The cryptocurrency ecosystem continues to evolve, and the latest data from January to February 2025 reveals significant shifts in Ethereum staking trends. In this article, we examine the key patterns driving staking activity, validator interest, and liquidity preferences among participants. By focusing on user behavior and market signals, we offer a concise overview of the current Ethereum staking landscape.

Top 5 Trends

Below are the top five trends observed from the most recent data. We focus on deposit and withdrawal flows, validator participation, and the rise of liquidity-focused solutions, providing readers with clear insights into current market dynamics.

Trend 1: Negative ETH Staking Flows & Coinbase Withdrawal Surge

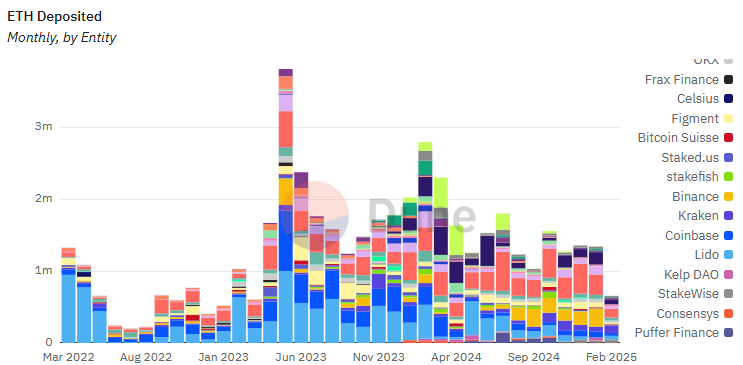

Recent data shows that ETH staking flows have remained negative since the start of the year, with deposit activity steadily declining—especially since early February 2025. Notably, Coinbase recorded the largest volume of withdrawals, indicating that many users are choosing to reallocate their staked assets amid market uncertainty.

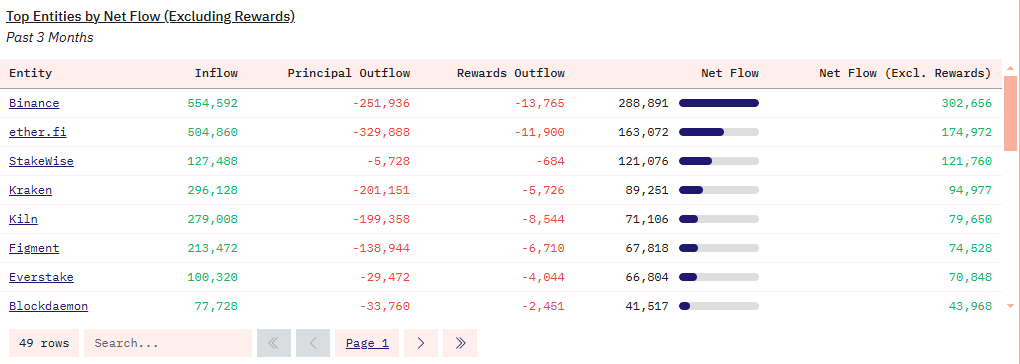

Trend 2: Positive Net Flows on Binance, Followed by Ether.fi and StakeWise

Amid the overall negative flow, certain platforms are performing differently. Binance leads with the most positive net inflow, closely followed by Ether.fi and StakeWise. This trend suggests that users are selectively moving their assets toward platforms that offer higher yield opportunities and more efficient staking experiences.

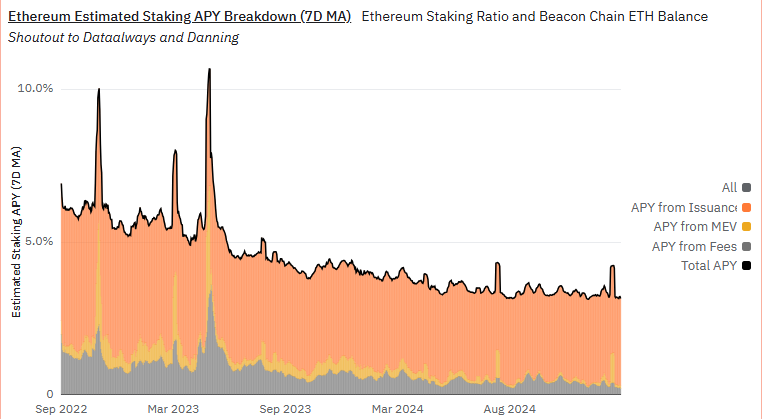

Trend 3: Declining Ethereum Staking APY

From January to February 2025, the overall Ethereum staking APY has continued to steadily decrease, driven mainly by diminishing returns from fees and MEV (Maximal Extractable Value). While the portion of APY from issuance remains relatively stable, the reduced transaction-based rewards reflect a shifting incentive structure for validators.

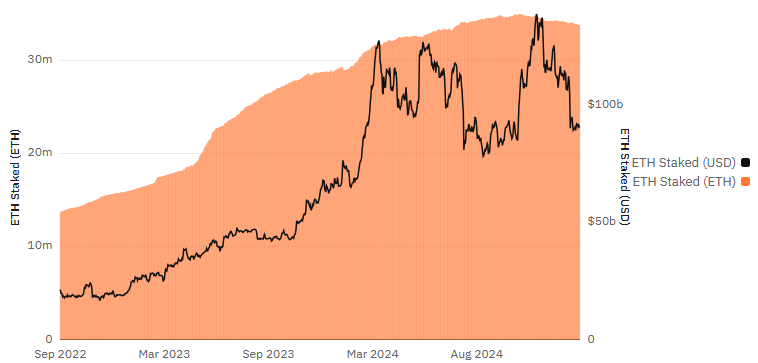

Trend 4: Overall Decline in Total ETH Staked

Recent figures reveal a modest drop in the total ETH staked—from 34M ETH in January to 33.8M ETH in February 2025. This decrease appears linked to sustained negative deposit flows and significant withdrawal volumes, suggesting a cautious approach by many market participants.

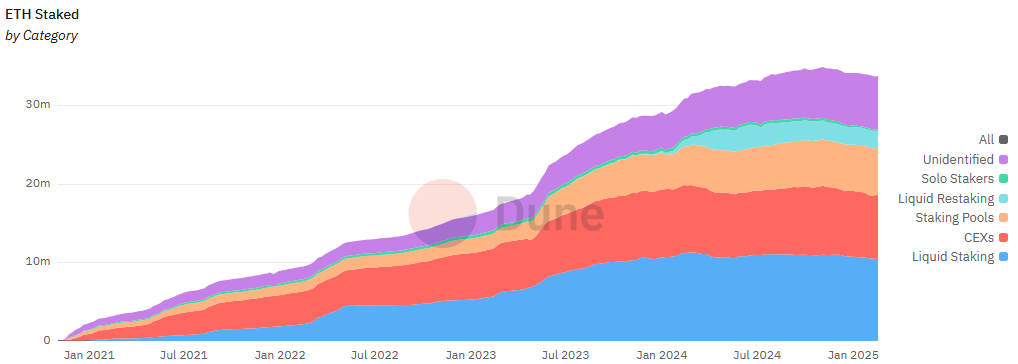

Trend 5: Rise of Liquid Staking & Restaking Solutions

Liquidity remains a top priority for stakers. Lido continues to lead the liquid staking sector, while Ether.fi has emerged as the frontrunner in liquid restaking. In addition, Kiln has established itself as the top staking pool. These developments indicate a growing market preference for solutions that balance yield generation with asset flexibility.

ETH Staking Insights:

Recent market reports and data insights further illuminate these trends:

- Withdrawal Dynamics: Coinbase’s significant withdrawal volume highlights a cautious sentiment among users.

- Platform-Specific Trends: While Binance enjoys positive net inflows, other platforms face substantial outflows, reflecting varying user experiences.

- Validator Onboarding: Kraken’s 13.0% increase in stakers underscores improvements in validator onboarding and growing confidence in network security.

- Liquidity Solutions: The continued dominance of Lido, along with Ether.fi’s leadership in restaking and Kiln’s success as a staking pool, signals a clear market shift toward flexible staking options.

- Withdrawal-to-Deposit Ratio Increase: The additional data reveals that withdrawals have consistently outpaced deposits. This rising ratio underscores a cautious sentiment among stakers, with many opting to withdraw rather than commit new deposits.

- Lido’s Market Dominance: Lido remains the leading platform in terms of total staked assets, holding a market dominance of over 27.7%—a clear testament to its widespread adoption among liquid staking users.

- Sharp Drop in Deposits: Ethereum deposits for staking have seen a significant decline, falling from 1.29M ETH in January to just 102k ETH in February. This steep drop in new deposits underscores the cautious sentiment among stakers.

Bottom Line

Market sentiment remains cautious yet adaptive. While negative staking flows and high withdrawal volumes persist, selective platform performance and increased validator participation indicate a measured confidence in Ethereum’s staking future.