Real crypto enthusiasts appreciate the benefits of ETH staking on the Ethereum blockchain. However, choosing the best ETH-compatible staking platform can be challenging since several platforms that help maximize profits now exist. We’ve identified the top 5 Ethereum staking platforms for 2025, which we’ll discuss in this post. This guide highlights their unique benefits and staking policies to help you choose the best fit for your needs.

What is Ethereum Staking?

Ethereum staking involves locking up a certain amount of Ether (ETH) to participate in the network’s Proof-of-Stake (PoS) consensus mechanism. By staking, participants (validators) help secure the blockchain, validate transactions, and earn rewards in ETH. Unlike the energy-intensive Proof-of-Work system, PoS is more energy-efficient and decentralized.

Traditionally, staking required a minimum of 32 ETH to run a validator node, making it expensive for many users. However, new alternatives like liquid staking, restaking, and staking pools have emerged, allowing users to stake smaller amounts of ETH without needing to manage a node. These options also provide greater flexibility, as they avoid long lock-up periods and reduce the risk of slashing.

Best Ethereum Staking Platforms

Below, you will find the top 5 Ethereum staking platforms available in 2025:

- Binance – Competitive rewards and comprehensive ecosystem.

- Bybit – User-friendly interface and high APY

- Lido – Leading liquid staking solution

- Kiln – Robust infrastructure and API solutions.

- Coinbase – Supports ETH staking with competitive rewards.

1. Binance

Binance, one of the largest centralized exchanges, makes Ethereum staking easy with its Binance ETH Staking platform. With just a single click, you can stake your ETH and receive Wrapped Beacon ETH (WBETH) in return. WBETH is fully tradeable and can also be used in DeFi protocols to generate additional yield.

A notable aspect of this platform is its flexibility. There’s no minimum requirement, so you can stake any amount of ETH. Plus, Binance doesn’t charge any staking fees, allowing you to keep all the rewards.

One key benefit of Binance’s staking platform is its strong security measures. In the unlikely event of slashing penalties, Binance covers the costs, ensuring your staked assets remain protected. That said, while withdrawals are typically instant, they might occasionally take longer during periods of high redemption activity.

With an APR of 4-5% and over 2 million ETH already staked, Binance ETH Staking offers a secure and beginner-friendly way to earn passive income on your Ethereum holdings.

2. Bybit

Bybit is one of the top crypto platforms that supports Ethereum 2.0 staking and provides validators with several tools to optimize their rewards for staking ETH. Bybit simplifies the staking process by eliminating technical requirements and making it accessible to beginners and experienced users.

One of Bybit’s standout features is zero gas fees for staking and unstacking ETH. Unlike other platforms with massive staking commissions, users can maximize their profits from ETH staking without worrying about expensive gas fees.

Users receive staking derivative tokens for their staked ETH, which allows them to maintain liquidity by trading or using those tokens as collateral within the platform. You can earn up to 5.28% APR for staking ETH depending on your chosen liquid staking token (stETH or mETH), but average yields hover around 3.22%.

As for Bybit unstaking times, this platform takes around 8-18 days to unstake your ETH. Validators swap their ETH for stETH to earn rewards, which vary depending on your stETH volume and the total generated from Bybit’s ETH 2.0 staking pool.

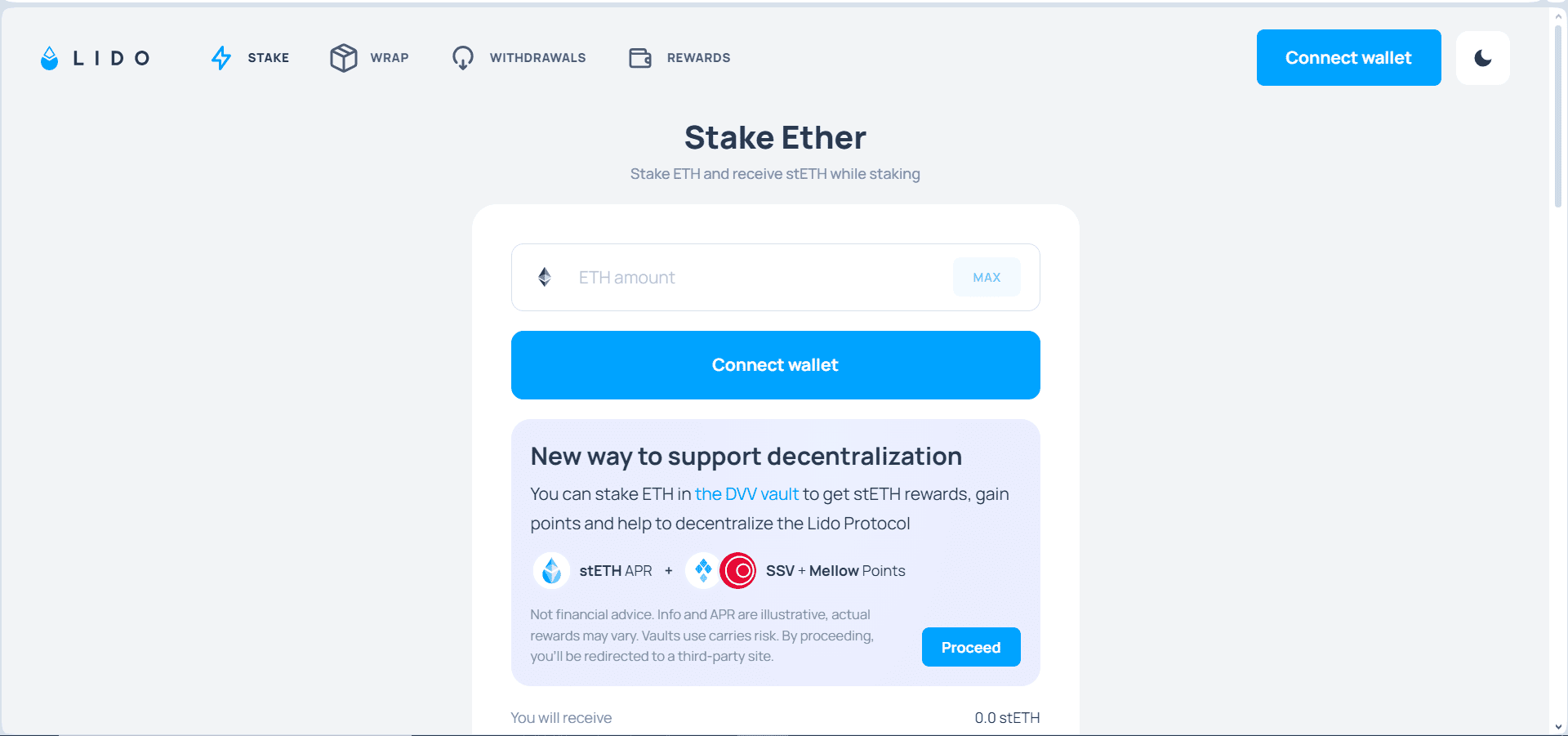

3. Lido

Lido is a leading liquid ETH staking platform known for its user-friendly interface and focus on decentralization. Also, Lido holds a high percentage of the liquid staking market share of about 69%, attracting half a million stakers, with over $20B+ TVL.

Users can stake any amount of ETH on Lido and receive stETH, a liquid token representing their staked ETH. The stETH reward is at an APY of around 3.5% in 30 days, which can be used in DeFi protocols.

One of Lido’s key strengths is its decentralized governance. The platform is managed by the Lido DAO, which ensures community-driven decision-making and transparency. Due to its audited smart contracts and rigorous security measures, Lido also has a high safety index.

While Lido offers competitive staking rewards, it’s important to note that a 10% fee is applied to these rewards, which is split between node operators and the DAO treasury. Lido’s focus on security and community governance makes it a trusted choice for ETH staking.

4. Kiln

Established in 2018 before Ethereum staking became a thing, Kiln is a leading enterprise-grade platform known for its robust infrastructure and focus on institutional clients. Unlike platforms catering to individual stakers, Kiln is the best option for businesses and institutions seeking a detailed staking solution.

Kiln provides secure and scalable infrastructure, along with comprehensive APIs, to facilitate large-scale staking operations. This makes it ideal for clients like Bitvavo, Bitget, and many more who want to participate in Proof-of-Stake networks earn about 3.58% APY without the technical complexities of managing their validator nodes.

Kiln emphasizes security and reliability with enterprise-grade measures and high uptime. The platform offers transparency through dedicated account management and reports on staking performance and rewards. Kiln charges an 8% fixed staking fee and provides institutional clients with extensive technical support.

Kiln primarily caters to large-scale clients, which may not suit individual stakers with limited resources. However, its institutional-grade staking infrastructure and security make it a trusted partner for businesses looking to maximize staking returns. Users can request an exit to join the queue, which takes 1-4 days for the ETH to be set for withdrawal.

5. Coinbase

Founded by crypto guru Brian Armstrong, Coinbase is a well-established and highly regulated cryptocurrency exchange. The platform is ideal for users who prioritize security and compliance when trading or staking tokens like ETH.

Coinbase lets users stake Ethereum or wrap their staked ETH tokens to attain cbETH (Coinbase ETH). Many consider the platform the best for beginners, thanks to its structured UI, despite playing host to a wide array of advanced staking and trading tools.

Coinbase also supports liquid staking, allowing users to trade cbETH like regular ETH or use it across DeFi platforms. Despite its well-structured staking solution and simple user interface, Coinbase’s 25% staking commission is usually frowned upon.

We should also mention that the platform’s staking yield is 2.41%, which is relatively lower than several decentralized options. However, Coinbase’s reputation as a trusted exchange makes it a solid choice for those who prioritize safety and simplicity.

How to Get Started With Ethereum Staking

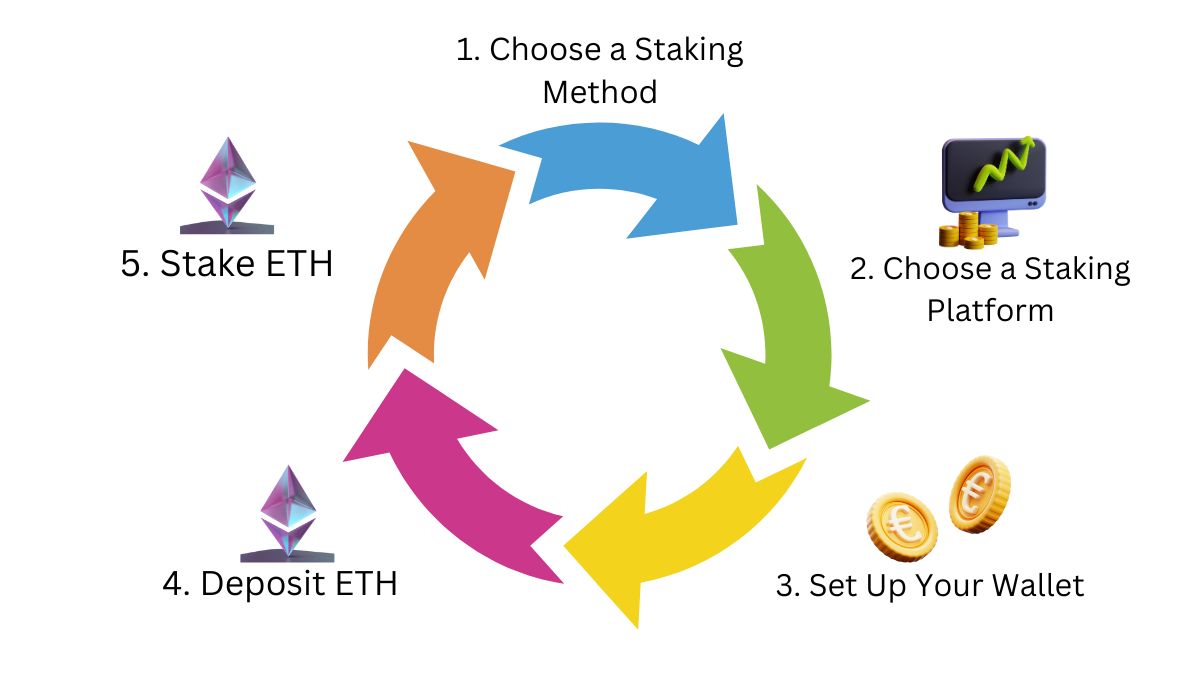

Ethereum staking, like all activities in the crypto space, is risky. So, before diving in, familiarize yourself with the concepts, regulations, and platforms involved in Ethereum staking. Luckily, we have clarified all of that for you in this post, so now you should be ready for actual ETH staking. The following steps provide a general idea about how to get started with Ethereum staking:

Step 1: Choose a Staking Method

You can choose between solo, service, or pooled staking methods to pledge your Ether tokens. Solo staking offers complete control of your validator node but requires a deposit of 32 ETH and technical expertise. Service/exchange staking uses third-party solutions to run nodes on your behalf. While pooled staking is ideal for users with less than 32 ETH, it allows multiple users to combine their ETH to meet the minimum requirement, using DEXs or CEXs.

Step 2: Choose a Staking Platform

Based on your preferred staking method, select a platform that offers Ethereum staking services at rates that suit your needs.

Step 3: Set Up Your Wallet

Ensure you have an Ethereum wallet to store your tokens. Your selected platform may have specific wallet recommendations, so verify compatibility before proceeding.

Step 4: Deposit ETH

Send the ETH tokens you want to stake into your selected exchange or wallet. Your minimum ETH deposit depends on your staking method or the platform’s policy. So, once again, consider your ETH balance when selecting a platform for staking.

Step 5: Stake ETH

Complete the staking process using the platform’s staking service section, reviewing the displayed transaction details to ensure the fees and other information fit your preferences.

Regularly check your staked Ethereum tokens, checking their progress and rewards earned. Some platforms like Kiln allow users to unstake anytime they want to, while others like Binance have a predetermined minimum staking duration.

Final Thoughts

Ethereum staking has always been a passive source of income, but new platforms offer more innovative solutions. Hence, every ETH owner wants the best platform to make profits while simultaneously strengthening the blockchain. You must, however, select the ideal platform based on your preferred staking method and the total amount of ETH you wish to stake. The article introduced you to the top 5 Ethereum staking platforms in 2025 for maximum staking experience. Once you sort that out, follow the highlighted steps to stake Ethereum and earn more ETH rewards successfully.

FAQs

1. What is the difference between solo staking and pooled staking?

Solo staking requires running a validator node with 32 ETH, while pooled staking allows multiple users to contribute smaller amounts.

2. Is staking ETH risky?

Yes, risks include slashing penalties, lock-up periods, and potential losses if the staking provider is hacked or mismanaged funds.

3. Do I need special hardware to stake ETH?

You’ll need dedicated ETH staking hardware to earn rewards if you opt for solo staking. In contrast, exchange and pooled staking can be done with a crypto wallet or CEX/DEX protocols.

4. What is the staking reward rate for ETH?

ETH staking rewards range between 3% to 7% APY, depending on network conditions and the staking platform used.

5. Can I stake ETH without having the minimum 32 ETH?

Yes, you can leverage staking pools or centralized exchanges to stake ETH tokens less than the standard 32 ETH stake tokens.