- Gas measures the computational work on Ethereum and is required for every on-chain action.

- Every action; from transactions to deploying smart contracts, uses gas, with fees paid in ETH (denominated in Gwei).

- Gas prices fluctuate based on network congestion, directly influencing transaction costs.

- The Dencun upgrade reduced gas fees by 95%, significantly lowering costs even as ETH’s price also declined.

- Gas fees on Ethereum are the costs required to process transactions on the network.

Gas fees on Ethereum are the costs required to process transactions on the network. But why are these fees necessary, and why do they constantly fluctuate? This article will help clear up any doubts by explaining the basics of Ethereum gas, how fees are determined, and what factors influence their variability.

What is Ethereum Gas?

Gas fees are essential to the Ethereum network, and their role varies depending on your perspective. As a trader, you might see these fees as an extra cost on each transaction. However, if you’re a validator, they serve as a reward for your efforts in securing the blockchain.

So, why does Ethereum have gas fees? Simply put, gas is the amount of ETH required to process a transaction on the network, and this cost fluctuates based on how busy the network is. The variable fee structure ensures that validators are incentivized to participate in the validation process whenever transactions enter the mempool, receiving a portion of the gas fees as compensation.

Key Components of Gas Fees

When you dig deeper into transactions, you’ll encounter several key terms that help you understand and optimize the fees you pay. Here’s what you need to know:

Gwei

Gas fees on Ethereum are usually expressed in gwei rather than in whole ETH. Gwei represents one billionth of an ETH, making it a more manageable unit for everyday calculations. For example, a fee might be shown as 0.000000054 ETH, which is equivalent to 54 gwei or 54,000,000,000 wei. This practical unit is why most gas fee trackers and calculators use gwei.

Base Fees

Base fees are a mandatory component set by the Ethereum protocol. They automatically adjust based on network congestion and are burned once paid, meaning they’re permanently removed from circulation.

Priority Fees

Priority fees are optional and serve as an extra incentive to validators, ensuring that your transaction gets processed faster. Think of it as a little bribe to prioritize your transaction, especially useful when network demand spikes, like during a highly anticipated NFT mint.

Max Fees

The max fee is the upper limit you’re willing to pay for a transaction, ensuring that your costs remain predictable. If the actual fee (the sum of the base fee and the priority fee) ends up being lower than your max fee, you get the difference refunded.

Mempool

The Mempool is essentially a waiting area for transactions. When you submit a transaction, it enters the Mempool; also known as the transaction pool or transaction queue, where it stays until validators pick it up for inclusion in the next block.

How Is the Price of Gas Set?

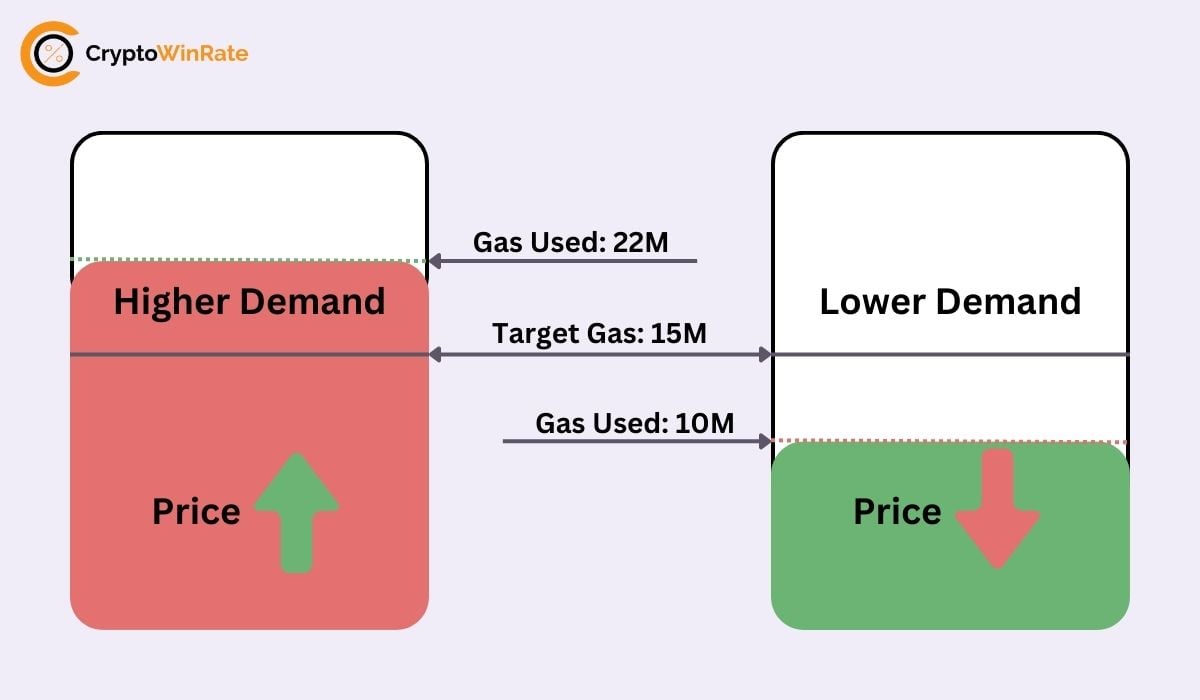

When you’re trying to understand how gas prices are determined, it helps to start with the concept of block capacity. Each Ethereum block can use up to 30 million gas in total, but there’s a target of 15 million gas. This target serves as a baseline for measuring demand in each block.

The network begins by setting a base fee, ideally resulting in blocks that use around 15 million gas; no more, no less. In practice, blocks can exceed or fall below this target. If a block ends up using more than 15 million gas (like 22 million), the base fee is automatically increased for the next block. This higher cost discourages excessive transactions, bringing demand back down. Conversely, if a block uses less than 15 million gas (like 10 million), the base fee is lowered to encourage more transactions.

By examining how “full” the previous blocks were, you can get a pretty good idea of where gas prices are heading. This mechanism helps you avoid paying unnecessarily high gas fees, since you can better predict future prices and set your transaction costs accordingly.

Reducing Ethereum Gas Fees: Best Practices

Even though Layer-2 solutions are poised to make Ethereum transactions more affordable, there are still plenty of ways you can minimize costs right now. Here are some practical strategies:

Use Off-Peak Hours

Ethereum network activity isn’t constant; it fluctuates throughout the day. By timing your transactions during periods of lower demand, you can often pay less in gas fees. Tools like the Ethereum Gas Price Tracker help you spot these quieter windows. If you’re not in a rush, waiting for an off-peak period can save you a substantial amount on fees.

Optimize Transaction Timing

Before you hit “confirm”, it’s wise to get a clear estimate of how much your transaction will cost. Several tools, such as Tenderly, let you simulate transactions to see the estimated fees. Many wallets, like MetaMask, also display gas estimates when connected to a dApp. By double-checking these figures, you’ll avoid paying more than necessary.

Layer 2 Solutions

Layer-2 (L2) networks, such as Arbitrum and Optimism, exist on top of Ethereum and help process transactions more efficiently. While not every dApp supports L2s yet, they can significantly reduce fees when they do. If your favorite platform or service is available on an L2, consider moving your activity there to cut down on gas costs.

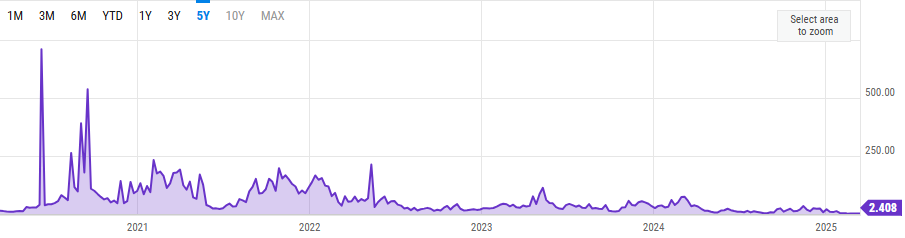

Dencun Upgrade: Lower Fees, Shifting Market

After the Dencun upgrade went live on March 13, 2024, we’ve seen gas fees drop dramatically; by about 95% in just one year. This means average fees have fallen from 72 gwei to roughly 2.7 gwei according to the YCharts Ethereum Average Gas Price indicator, making everyday transactions like token swaps and NFT sales much more affordable.

However, there’s a trade-off: while fees have plummeted, ETH’s price has declined by 53%, from over $4,070 to around $1,891. These changes, driven by a series of EIPs aimed at boosting scalability and cutting costs, have reshaped the Ethereum landscape—lowering your transaction costs even as market dynamics continue to shift.

Bottom Line

Learning the basics of Ethereum gas fees empowers you to manage your costs effectively. By understanding key elements like gwei, base fees, and the mempool, you can optimize your transaction strategy, whether by using off-peak hours, simulation tools, or exploring Layer-2 solutions. Moreover, the Dencun upgrade has dramatically reduced gas fees by 95%, even as ETH’s price has experienced a significant dip. In short, staying informed and adapting your approach is essential for thriving in Ethereum’s ever-evolving landscape.

FAQs

1. Why is gas shown in gwei?

Gas is shown in gwei because it’s a practical unit for measuring tiny amounts of ETH, making it easier for you to understand and calculate transaction fees.

2. What is the Ethereum transaction gas limit?

The transaction gas limit is the maximum amount of gas you’re willing to spend on a single transaction, ensuring you control your cost exposure.

3. Is gas refunded for failed transactions on Ethereum?

No, even if your transaction fails, the gas consumed up to that point isn’t refunded, so you still bear the cost for the computational work attempted.