Overview

In a nutshell, dYdX is a decentralized exchange (DEX) that allows users to trade cryptocurrencies and other digital assets in a decentralized manner. This means that users have full control over their assets and are not reliant on a central authority or intermediary to facilitate trades. This article will go over everything you need to know about this exchange.

Without any further ado, let’s dive right in!

How to Use dYdX

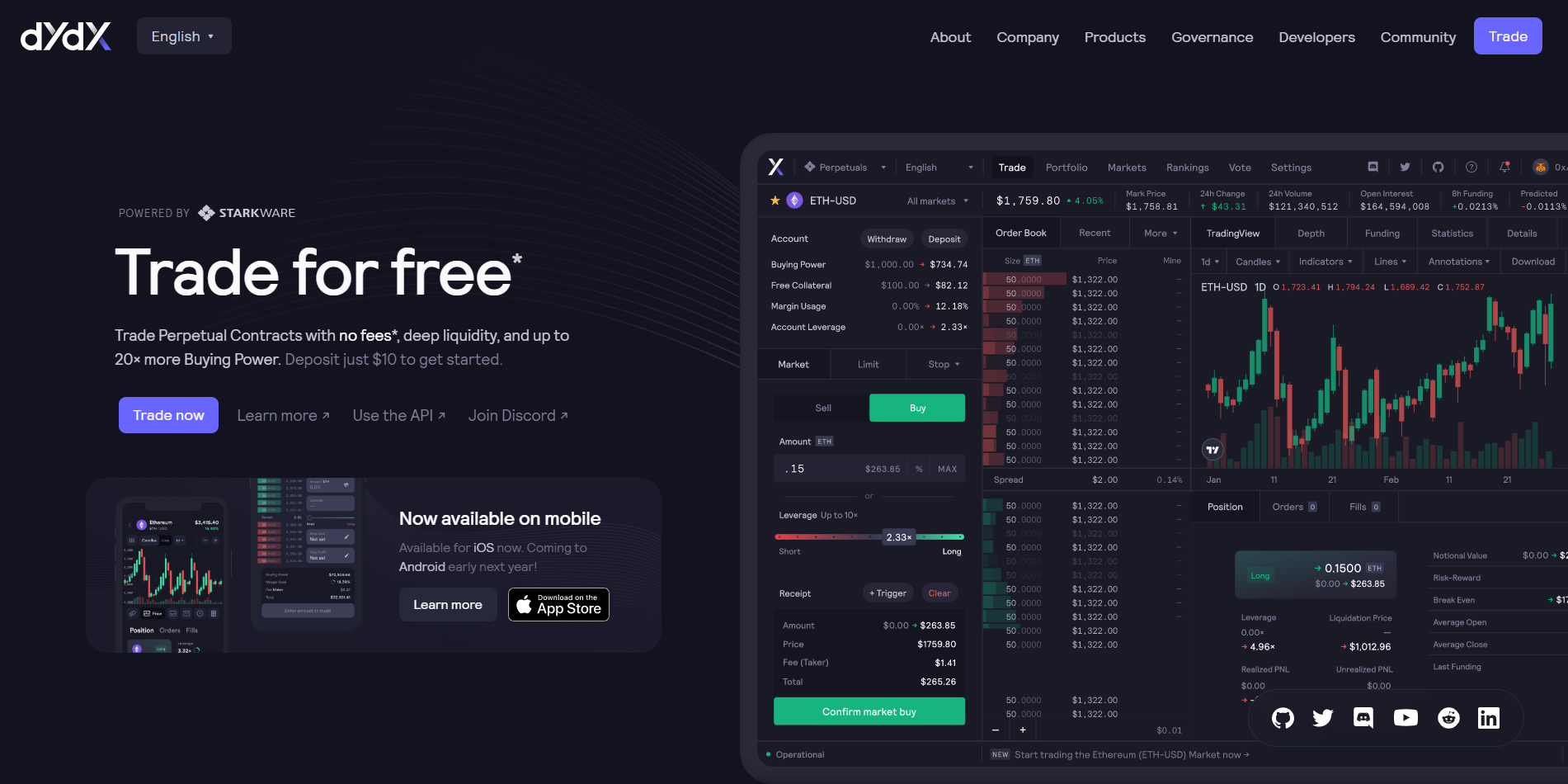

dYdX offers a simple and user-friendly interface that allows users to easily navigate the platform and find the assets they wish to trade. Users can also use the platform to track their portfolio and view their transaction history.

Here’s a step-by-step process on how to use the dYdX exchange:

- Connect a web3-enabled wallet to the platform. This can be done using a browser extension like MetaMask or by connecting a hardware wallet like Ledger or Trezor.

- Deposit your crypto assets into the platform by sending them to the unique address generated by your connected wallet.

- Once your assets are in the platform, you can begin trading by selecting a trading pair and placing a limit or market order.

- To borrow or lend assets, navigate to the lending and borrowing section of the platform and select the asset you wish to borrow or lend.

- To borrow, select the amount of the asset you wish to borrow and the duration of the loan. Your borrowed assets will be added to your account balance and can be used for trading or other purposes.

- To lend, select the amount of the asset you wish to lend and the duration of the loan. You can earn interest on your lent assets while they are being borrowed by other users.

- To close a borrowed position, return the borrowed assets to the lending pool before the loan’s expiration date.

- To close a lending position, simply wait for the loan to expire and the lent assets will be returned to your account balance.

- After trading or lending, you can withdraw your assets from the platform by sending them to an external wallet address.

It’s important to note that dYdX is a decentralized platform, meaning that you are in full control of your own funds and private keys, and there is no central point of failure or control. Additionally, dYdX is built on the Ethereum blockchain, making it resistant to censorship, hacking and other types of attacks.

Pros and Cons of dYdX

One of the main advantages of dYdX is the decentralization aspect. As a DEX, dYdX allows users to have full control over their assets, without the need for a central authority or intermediary. This means that users are not at risk of losing their assets due to a hack or other security breach.

Another advantage of dYdX is the transparency and security provided by the Ethereum blockchain. All transactions are recorded on the blockchain, providing a permanent and immutable record of all trades.

However, there are also some drawbacks to using dYdX. One of the main issues is the lack of liquidity compared to centralized exchanges. This can make it difficult to find buyers or sellers for certain assets and can lead to wider bid-ask spreads. Additionally, the platform is still in its early stages and is not yet available in many countries.

Security and Regulations

dYdX places a strong emphasis on security, utilizing smart contracts to ensure the integrity of all trades. Additionally, the use of MetaMask wallets allows users to have full control over their private keys, providing an added layer of security.

Furthermore, dYdX is a decentralized exchange (DEX), meaning it’s built on a decentralized infrastructure and does not rely on a central point of control or authority. This architecture provides a number of security advantages over centralized exchanges, such as resistance to censorship, hacking, and other types of attacks.

One of the key security features of dYdX is that it is non-custodial, meaning that users are in full control of their own funds and private keys at all times. This eliminates the risk of funds being lost or stolen as a result of a hack or other security breach.

Another security feature of dYdX is that it is built on the Ethereum blockchain, which is considered to be one of the most secure and decentralized blockchain networks in existence. The platform’s smart contracts are also audited by third-party security firms, which helps to ensure that they are free of vulnerabilities and bugs.

In terms of regulations, dYdX operates in a regulatory-compliant manner. The platform adheres to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which helps to prevent illegal activities such as money laundering and terrorist financing. dYdX also monitors the platform and transactions in real-time to detect and prevent any suspicious activities.

dYdX Fees

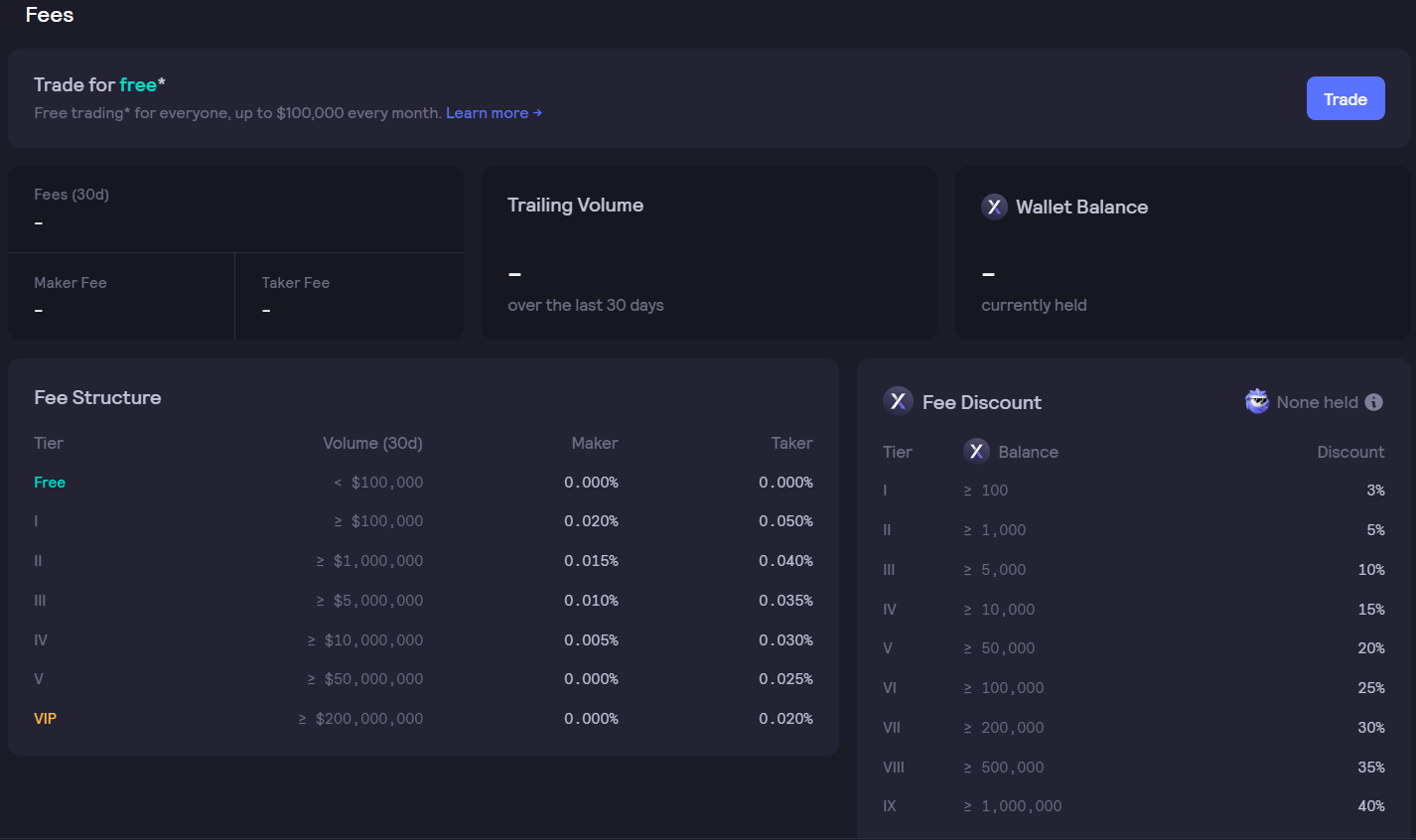

The fees on dYdX are generally lower than those on centralized exchanges, due to the absence of intermediaries and the decentralized nature of the platform. That being said, here’s a list of all the fees involved in the dYdX exchange:

- Trading fees: Users are charged a small fee for each trade they make on the platform. The fee is calculated as a percentage of the total value of the trade. Accounts with over $100,000 are charged a maker fee of 0.02% and a taker fee of 0.05%. The maker fee is charged to users who add liquidity to the order book by placing a limit order below the current market price for a buy, or above the current market price for a sell. The taker fee is charged to users who remove liquidity from the order book by placing a market order or a limit order.

- Deposit and withdrawal fees: Users may be charged fees for depositing or withdrawing assets from the platform. These fees vary depending on the asset being deposited or withdrawn.

- Gas fees: dYdX is built on the Ethereum blockchain, so users will need to pay gas fees to the Ethereum network in order to make trades or perform other actions on the platform.

- Margin fees: Users who trade with leverage on dYdX will also be charged margin fees. These fees vary depending on the amount of leverage being used.

- Inactivity fee: If a user has no activity on their account for a certain period of time, they may be charged an inactivity fee.

It’s important to note that fees may change over time and vary depending on the specific action being taken on the platform. Users should check the dYdX’s website or consult with the platform’s customer support team for the most up-to-date information about fees

dYdX Trading Features

dYdX offers a variety of trading features, among which the following are the most noteworthy:

- Leveraged trading: Users can trade with leverage on dYdX, allowing them to increase their potential returns. Leverage can be applied to both long and short positions.

- Short selling: Users can also short sell assets on dYdX. This allows them to profit from a decrease in the price of an asset.

- Margin trading: Margin trading is a feature that allows users to trade with borrowed funds, which can amplify their potential returns.

- Tokenized assets: dYdX offers trading of tokenized assets, which are digital representations of real-world assets.

- Advanced order types: dYdX offers various advanced order types such as limit orders, stop-limit orders and post-only limit orders.

- Trading view charts: dYdX offers trading view charts which provide users with advanced technical analysis tools.

- Mobile App: dYdX also has a mobile app that allows users to trade on the go.

It’s important to note that the platform is still in development and some features may not be available yet. You should check the dYdX website or consult with the platform’s customer support team for the most up-to-date information about features.

Wrapping Up

We hope this guide has answered all your questions about the dYdX exchange. You should now have a good idea whether this exchange is the right one for you to carry out your trading transactions. While you’re considering which trading platform is best suited for your needs, take a look at our top ranked decentralized exchanges—these rankings are crafted by a team of blockchain specialists who have dedicated countless hours of research to it.

In case you still have a query about this topic, leave a comment below and we will answer it as soon as possible.

DYDX FAQs

Here are answers to the most frequently asked questions about the dYdX exchange

1. Is dYdX a centralized exchange?

No, dYdX is a decentralized exchange (DEX) that utilizes the Ethereum blockchain to facilitate trades.

2. Can I trade on dYdX from any country?

dYdX is currently only available to users in certain countries. However, the platform is still in its early stages and may expand to more countries. To find out whether you can use dYdX from your area of residence, we recommend getting in touch with their customer support as they’re the ones most up-to-date with their policies and regulations.

3. What are the fees involved in using dYdX?

The fees involved in using the dYdX exchange include trading fees, deposit and withdrawal fees, gas fees, margin fees and inactivity fee. However, it is important to note that fees may change over time and vary depending on the specific action being taken on the platform.

4. How does short selling work on dYdX?

It works the same way as it does in every other platform. Short selling allows users to profit from a decrease in the price of an asset. When a user opens a short position, they are borrowing an asset from the platform and selling it on the market. If the price of the asset drops, the user can buy the asset back at a lower price, return it to the platform, and keep the difference as profit.

5. How do I deposit or withdraw assets on dYdX?

Depositing and withdrawing assets on dYdX is done through the platform’s smart contract. Users can deposit assets by sending them to the platform’s smart contract address, and withdraw assets by sending a request to the smart contract.

6. How does dYdX ensure the security of my assets?

dYdX uses smart contract technology to ensure that user’s assets are safe and secure. The platform also uses various security measures such as two-factor authentication and hardware wallets to protect user assets.

7. Is dYdX available on mobile?

Yes, dYdX also has a mobile app that allows users to trade on the go. Users can download the app from the App Store or Google Play.