Imagine a world where borrowing and lending money requires no banks, credit checks, or paperwork—just instant, borderless transactions. Welcome to DeFi lending, a transformative financial model that is reshaping how we interact with money. In this article, we will explore the technicalities of DeFi, starting with the basics, then moving on to how it works, and finally examining some real-world use cases.

What Is Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) is a financial system built on blockchain technology that enables peer-to-peer transactions without relying on traditional banks or financial institutions. By integrating blockchain with smart contracts, DeFi allows users to engage in lending, borrowing, trading, and earning interest without intermediaries.

A key principle of DeFi is transparency—every transaction is recorded on a public blockchain ledger, ensuring accessibility and verifiability. This system grants users full control over their assets while maintaining security and trust, as it operates without central authority oversight.

How Decentralized Finance (DeFi) Works

DeFi uses blockchain networks especially Ethereum to execute transactions through automated smart contracts that protect financial operations. Smart contracts represent autonomous agreements which perform automatic operations after predefined circumstances become true.

Users within DeFi platforms can add their cryptocurrencies to lending protocols. These decentralized pools receive contributions of assets from lenders and enable borrowers to obtain funds through collateral provision.

These are the essential procedure steps which need to be followed:

- Lenders who place cryptocurrency within lending pools can gain earning interest directly from their crypto deposits.

- Borrowers need to give another cryptocurrency as collateral when securing loans through lending protocols.

- The execution of loans through smart contracts starts when borrowers place collateral because the system processing these transactions will activate the loan approval instantly.

- Lenders receive earnings through accrued interest from the capital deposits made to loan services.

- The system performs Collateral Liquidation as a necessary step when collateral value reaches below the specified threshold.

Benefits and Risks of DeFi Lending

| Benefits of DeFi Lending | Risks of DeFi Lending |

|---|---|

| Eliminates middlemen, reducing costs and delays. | Smart contract vulnerabilities may lead to financial losses. |

| Provides global access to crypto loans without restrictions. | Collateral value may drop due to market volatility, triggering liquidation. |

| Offers higher interest rates compared to traditional savings accounts. | Lack of regulatory oversight increases the risk of fraud and platform failures. |

| Ensures transparency and security through real-time blockchain verification. | Liquidity issues on some DeFi platforms may restrict fund access. |

Use Cases of Decentralized Finance (DeFi)

DeFi was initially designed to provide financial services to individuals without access to traditional banking. Over time, it has expanded into a broader ecosystem, offering various financial applications powered by blockchain technology. Below are some of the most prominent use cases of DeFi, along with real-world examples of decentralized applications (dApps) operating in these areas.

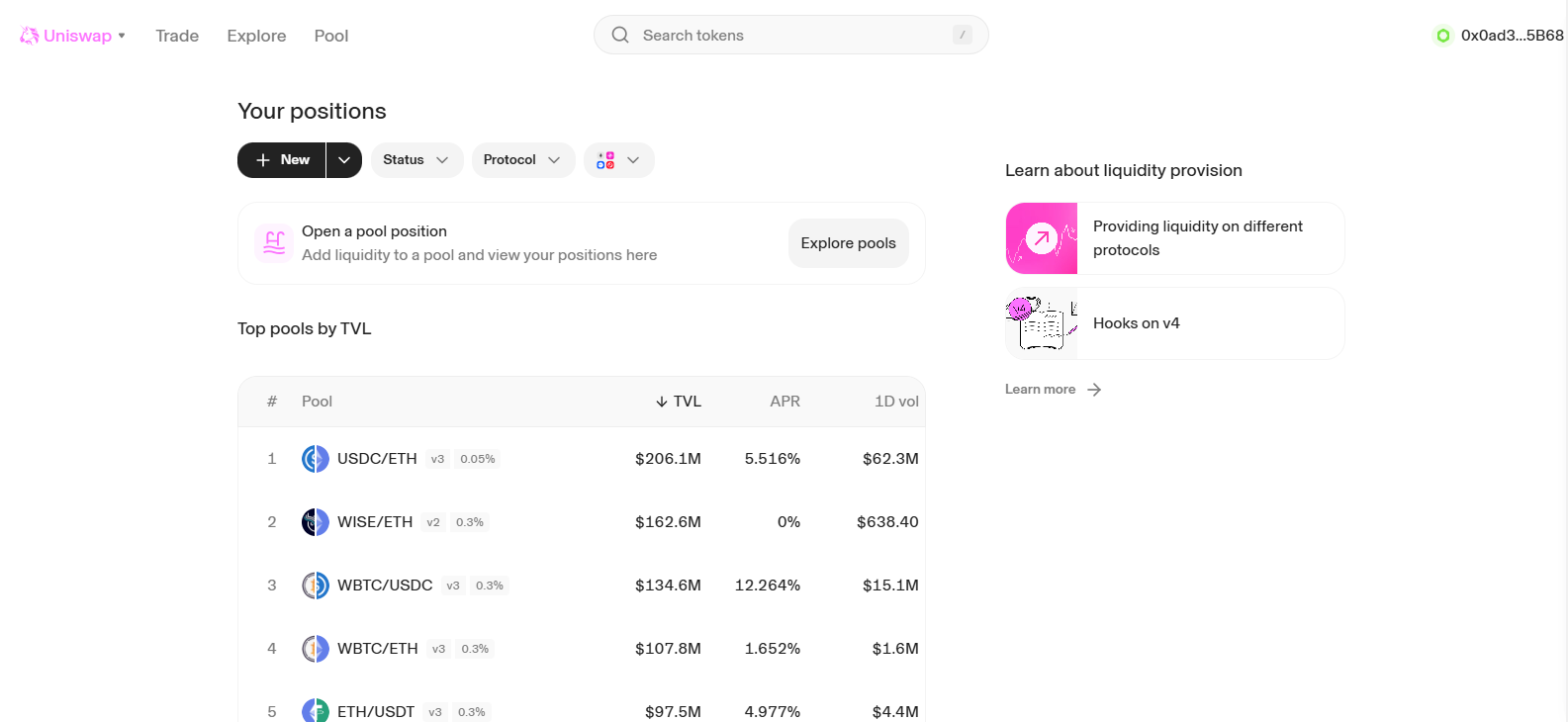

1. Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) allow users to trade cryptocurrencies directly with one another without depending on a central authority. Unlike traditional exchanges that require users to deposit funds into a platform, DEXs facilitate direct wallet-to-wallet transactions. This not only enhances security but also ensures users retain full control over their assets. A key example in this category is Uniswap, one of the largest DEXs, known for its automated liquidity pools and permissionless trading.

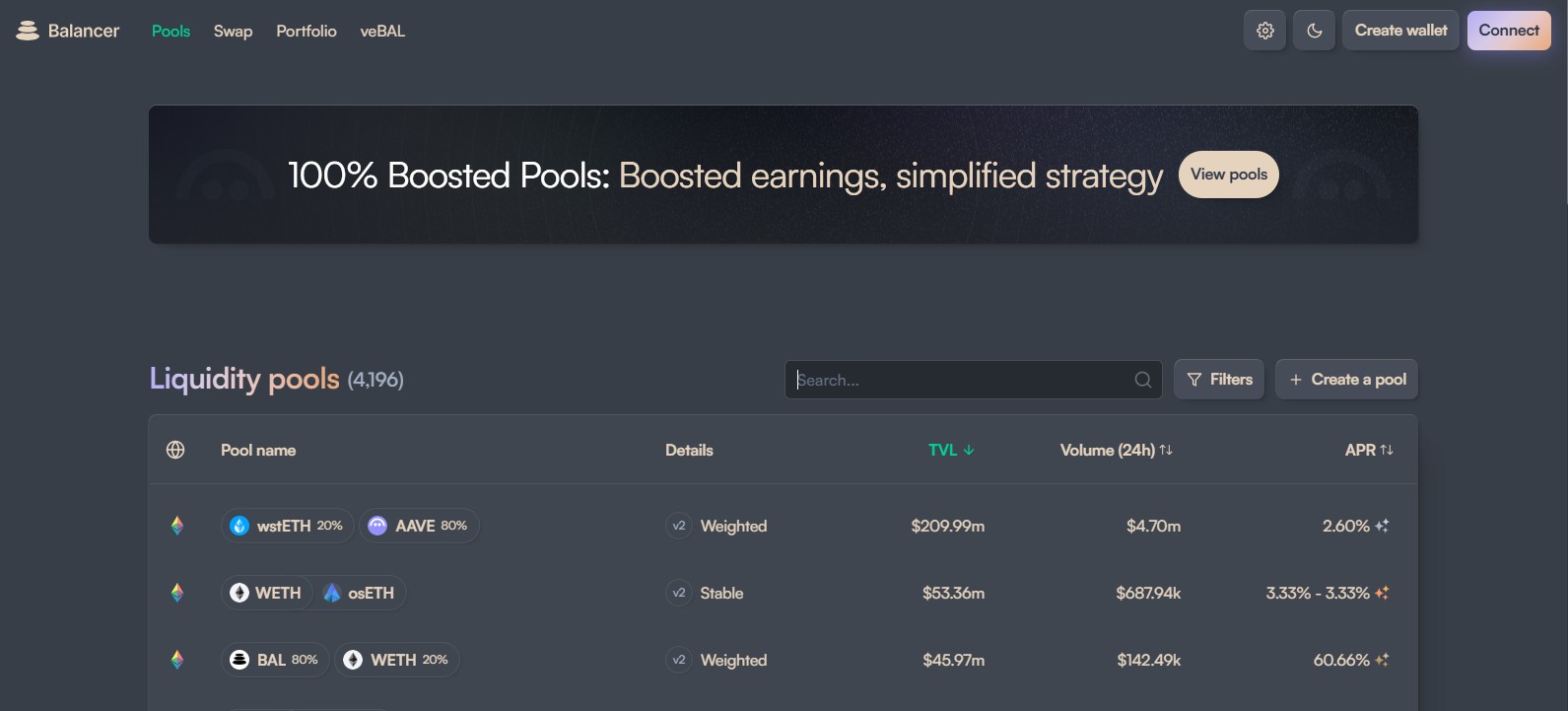

2. Liquidity Provision & Automated Market Makers (AMMs)

Liquidity is crucial for the efficient operation of DeFi markets. Liquidity providers (LPs) deposit funds into pools that facilitate seamless trading, minimizing price slippage and enhancing market efficiency. In return, LPs earn transaction fees and rewards. A notable platform in this space is Balancer, a decentralized portfolio manager and trading platform that rewards LPs for contributing liquidity.

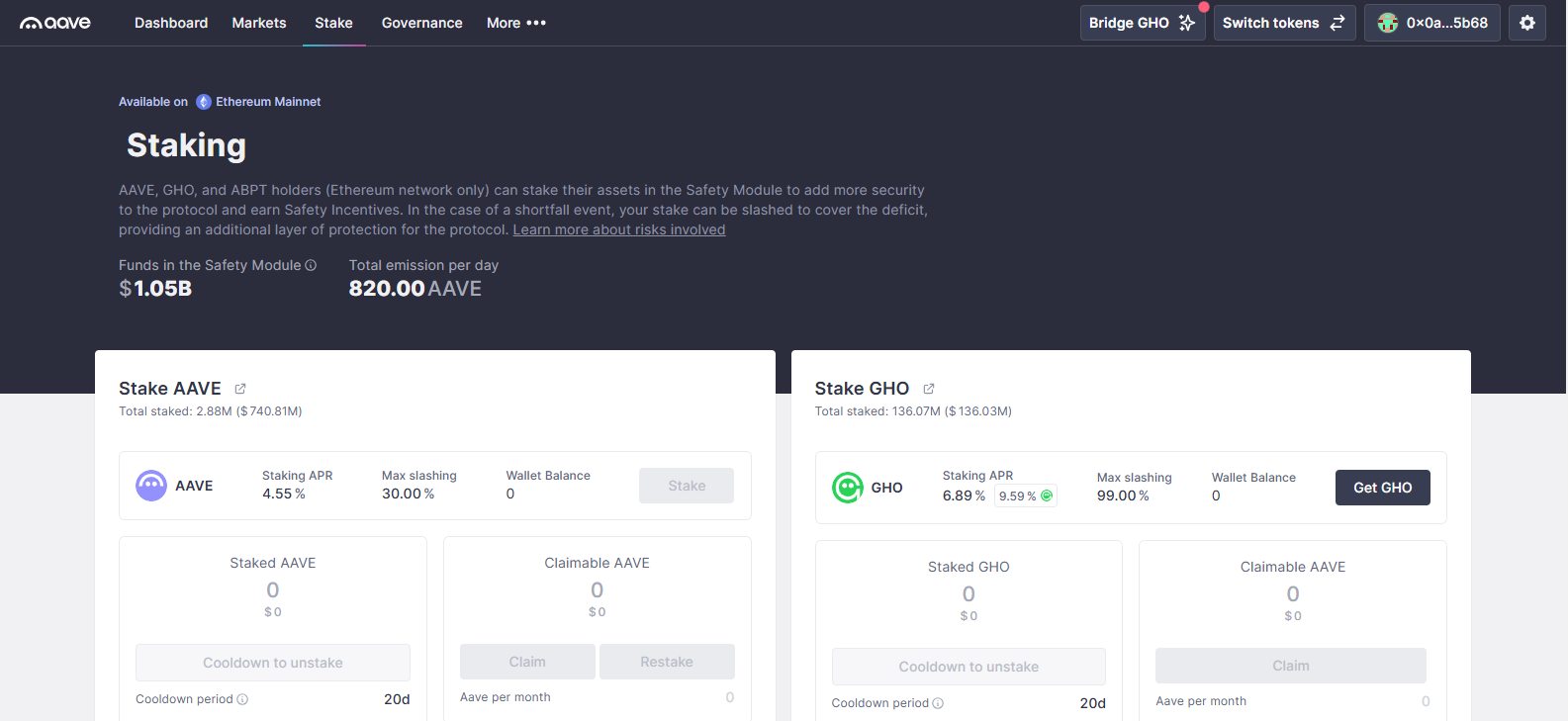

3. DeFi Lending & Yield Farming

DeFi lending platforms enable users to lend their crypto assets in exchange for interest. Borrowers can secure funds by providing collateral, while lenders earn passive income. Yield farming, a strategy within DeFi lending, allows users to lock their assets in lending protocols to optimize returns. Aave is a prominent lending protocol that provides overcollateralized loans and flash loans, which require no upfront collateral.

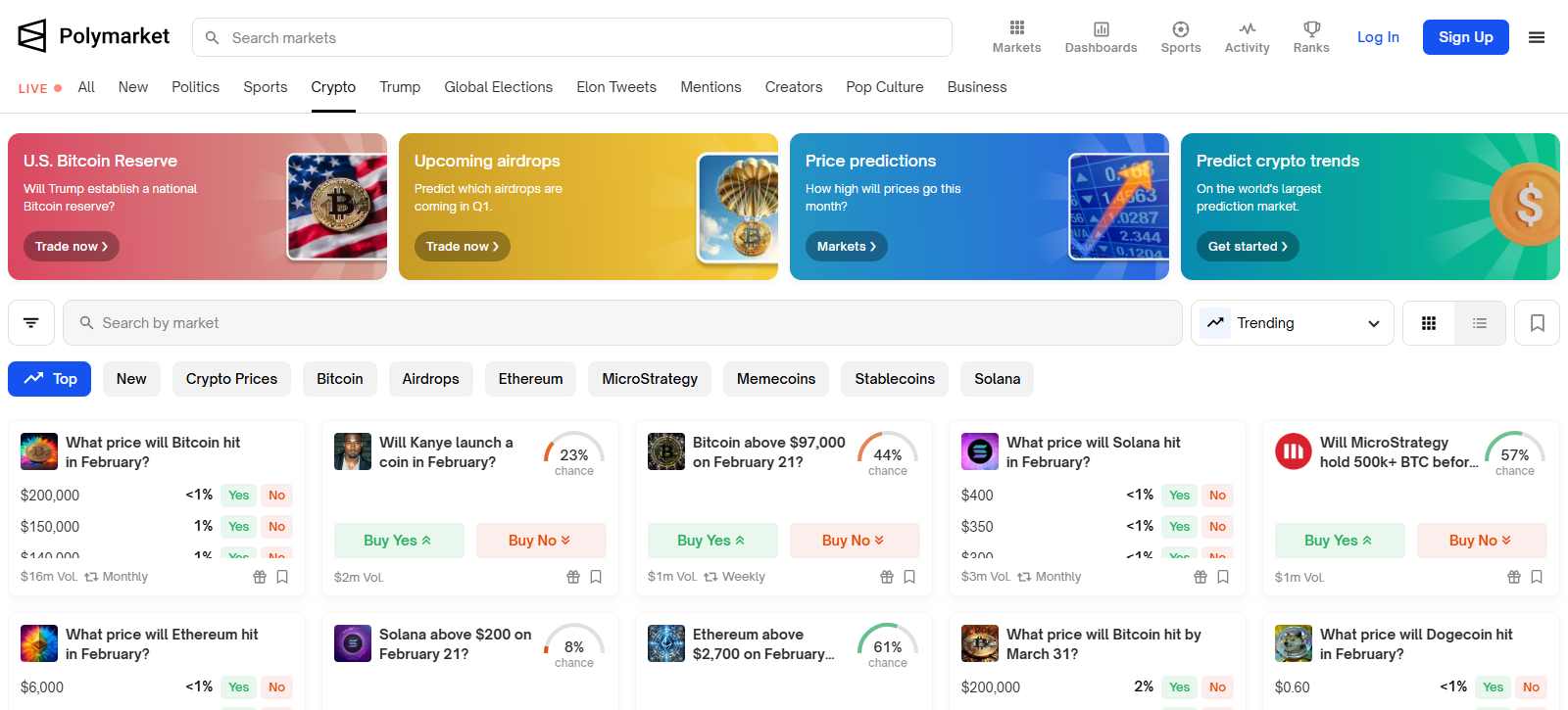

4. Prediction Markets & Decentralized Gambling

Prediction markets enable users to wager on event outcomes, from elections to sports, without intermediaries. This ensures fair and transparent betting. DeFi has also driven the growth of decentralized gambling platforms, allowing users to engage in various games using cryptocurrency. Polymarket is a leading decentralized prediction market where users can bet on real-world events.

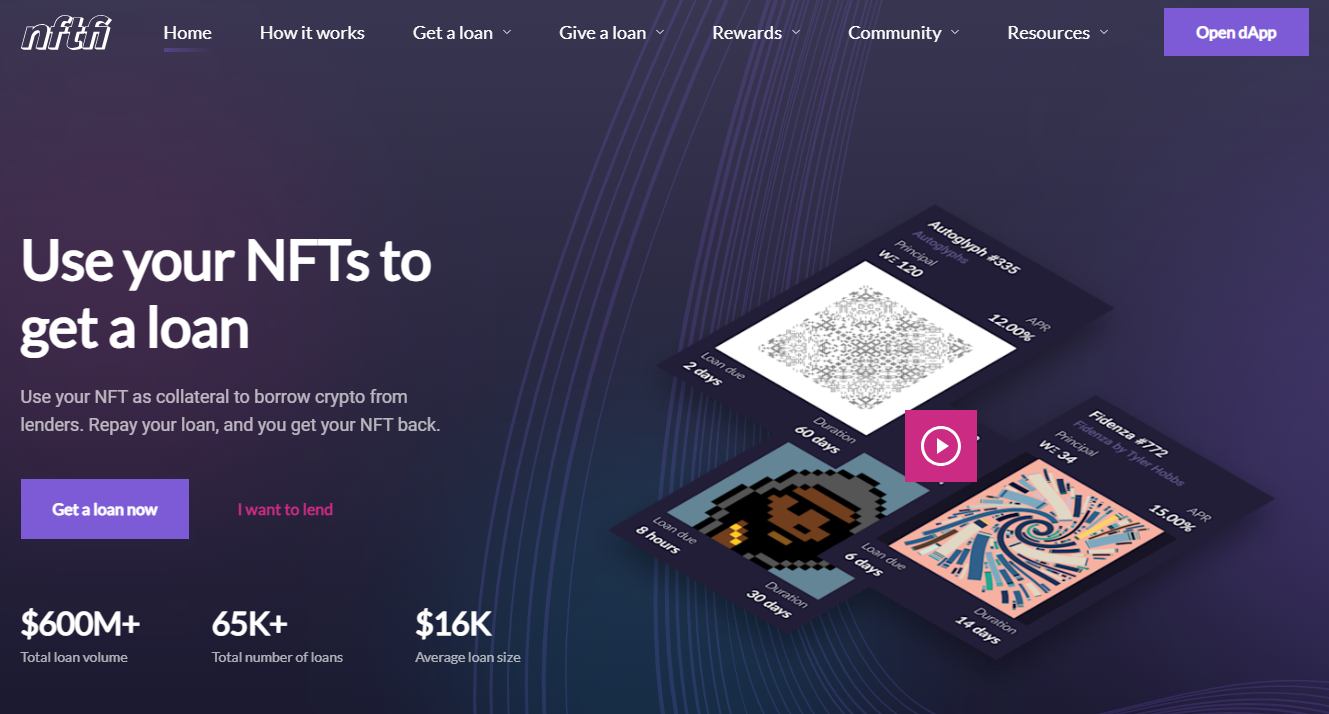

5. Non-Fungible Tokens (NFTs) & DeFi Integration

NFTs have brought digital ownership and collectibles into DeFi. Some platforms now offer NFT-backed lending, enabling users to use NFTs as collateral for loans. NFTfi is one such protocol that facilitates borrowing against NFT assets.

Traditional vs. Decentralized Lending

DeFi can be seen as a direct competitor to traditional financial institutions, leveraging blockchain technology to eliminate intermediaries and automate processes through smart contracts. The key advantage of DeFi is its ability to reduce human errors, minimize delays, and lower costs. However, since the technology is still evolving, certain risks remain, including security vulnerabilities and regulatory uncertainty.

The table below highlights the key differences between traditional lending and DeFi lending:

| Feature | Traditional Lending | DeFi Lending |

|---|---|---|

| Intermediaries | Banks & Institutions | No intermediaries, only smart contracts |

| Accessibility | Requires credit checks, documents | Open to anyone with internet & crypto |

| Interest Rates | Fixed by banks & lenders | Market-driven, based on supply and demand |

| Speed | Days to weeks | Near-instant transactions |

| Security | Government-backed | Secured by blockchain, but smart contract risks exist |

| Transparency | Limited information on transactions | Fully transparent on blockchain |

| Availability | Restricted by location and regulations | 24/7 global access |

Bottom Line

DeFi lending is reshaping the financial landscape by offering users an open and flexible alternative to traditional banking. While it provides opportunities for high returns and greater financial inclusion, users must navigate smart contract vulnerabilities and market volatility. As the DeFi ecosystem continues to evolve, it is set to redefine borrowing and lending through decentralized and accessible solutions.

Success in DeFi lending depends on understanding the risks, using reliable platforms, and staying informed about ongoing developments. For lenders seeking higher yields and borrowers looking for accessible credit, DeFi presents compelling opportunities in the future of finance.

FAQs

1. How is money made in DeFi?

Unlike traditional finance, which depends on banks and other intermediaries, DeFi operates on blockchain technology to provide financial services like lending, borrowing, and trading. Users can earn passive income through methods such as staking, yield farming, and lending, where they receive rewards in the form of interest or transaction fees.

2. How to earn on DeFi?

Step 1: Select a DeFi protocol that supports yield farming, such as Aave or Compound.

Step 2: Deposit your tokens into a high-yield liquidity pool.

Step 3: The protocol utilizes your tokens for lending or trading.

Step 4: You earn rewards through interest or transaction fees generated by the pool.

3. Is DeFi a safe investment?

Like any financial decision, investing in DeFi requires caution. Many financial experts consider DeFi speculative and recommend allocating only 3-5% of your net worth to crypto. Since there is no central authority, users are responsible for managing their own risks, including potential security vulnerabilities and market volatility.