Costs & Fees involved in Crypto Trading

If you want to start trading cryptocurrencies, you should know exactly what you will be charged. Trading is not free and never will be free. If you don’t pay with fees or commissions, you will be charged in another way. This guide aims to expose all costs, fees, and charges involved in crypto trading.

Trading Fees

The most obvious costs involved in crypto trading are trading fees. These will be applied for opening and closing positions. However, there are quite a few factors to consider.

For trading fees, you must be aware of the difference between maker and taker orders. Maker fees are applied on orders that provide liquidity for the limit order book. They are also known as “limit orders.” Taker orders, on the other hand, are executed immediately at the current market price and take liquidity out of the limit order book. Taker orders are also referred to as “market orders.” If you want to learn more about this, check out our maker vs taker guide.

First and foremost, we have to distinguish between spot and futures trading fees.

Spot Trading Fees

Spot trading fees are generally the highest trading fees. The crypto industry standard fee for spot trading is 0.1% maker and 0.1% taker. Exchanges like Binance, Bitget, Bybit, and Kucoin have implemented this fee structure too.

Spot Margin Fees

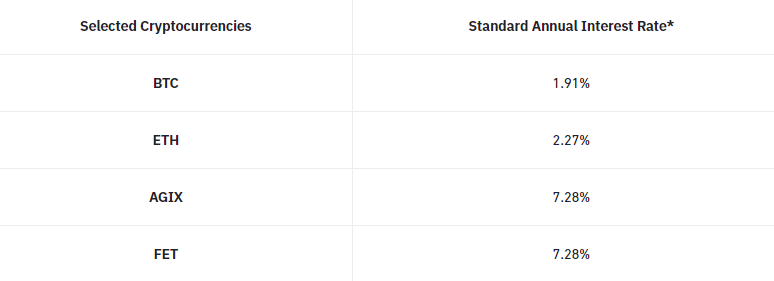

If you are a spot trader and you wish to use margin, you can borrow cryptos from exchanges such as Binance or Bybit. The borrowed amount is subject to an interest rate. Most crypto exchanges offer margin trading with up to 10x your capital. The margin fees are different for every exchange and every cryptocurrency. Below, you can see the margin interest rates for popular cryptos on Binance, such as BTC, ETH, or AGIX.

Futures Trading Fees

Crypto futures are derivative products. They represent an underlying asset in the form of a contract. If you trade on the futures market, you don’t actually own any coins. You just bought a contract representing the price of the coin or asset.

Futures trading fees are much cheaper compared to spot trading. This is due to the use of leverage. Therefore, crypto day traders and scalpers should consider trading on the futures market.

The industry standard for crypto futures trading fees is at 0.02% maker and 0.06% taker. While this is not necessarily expensive, it is not cheap either. Most crypto exchanges actually started decreasing their taker fees.

Futures Funding Fees

The funding fee is exchanged between long (buy) and short (sell) positions on active futures positions. A funding fee was implemented for futures trading to even out the futures contract price to the spot price. If Bitcoin is cheaper on the spot market and more expensive on the futures market, the funding fee will be negative and act as an incentive to close long positions or open short positions. Funding fees are usually between -0.01% and +0.01%. However, during extreme market conditions, the funding fees can fluctuate.

- When the funding fee is positive, long positions will pay short positions.

- When the funding fee is negative, short positions will pay long positions.

Spread

The spread between bid and ask price is an often overlooked factor when it comes to costs involved in cryptocurrency trading.

In crypto trading, the “bid” represents the highest price a buyer is willing to pay, while the “ask” is the lowest price a seller is willing to accept. The difference between the two is known as the “spread.”

Market makers aim to profit by buying at the bid price and selling at the ask price. This is also known as liquidity providing.

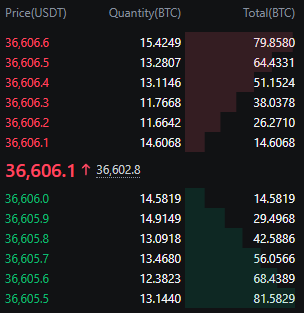

Let’s go over an example. Below, you can see the Bitcoin futures order book of MEXC. The red price marks the asking price, while the green price marks the bid price. We can see that the Bitcoin ask is at $36,606.1 while the Bitcoin bid is at $36,606.0. The difference between these two numbers is the spread, which is 10 cents. That means for every Bitcoin contract that you buy, you pay a $0.10 markup. While this is a very low number, other crypto exchanges have much higher spreads. Always check the order book of the crypto exchange you want to trade on.

Slippage

Slippage can occur when opening or closing a trade with a market order. Based on the liquidity, in other words, the amount of limit orders resting in the order book, the slippage changes. The more limited orders are in the order book, the better the liquidity; therefore, the lower the slippage.

Let’s also go over a concrete example here. We will use the same order book screenshot from before, but this time, we will focus on the sell side liquidity as we want to buy Bitcoin.

In the screenshot, we can see that there is a total of 64.4331 BTC resting at a price of $36,606.5. At the current market price of Bitcoin, 64 Bitcoins are worth around $2,358,638. That means if we execute a market buy order of over $2.4 million, we will push the Bitcoin price up by 50 cents. This is called slippage, as we change the Bitcoin price due to the size of our order.

The good news is that slippage is usually just an issue for crypto whales with millions of dollars.

Bottom Line

Knowing all costs, fees, and charges involved in crypto trading is crucial. High fees can easily eat up your profits, and switching to a more affordable crypto exchange can increase traders’ profitability.

The most important fees are certainly spot and futures trading fees. These are applied when opening and closing a position. Additionally, crypto day traders must choose a crypto exchange with low spreads and good liquidity so they can open and close trades without impacting the market.

Our recommended crypto exchanges that tick all of these boxes are MEXC and OKX. They are advanced derivatives crypto exchanges with low fees and deep liquidity.

MEXC is the exchange with the lowest fees and lowest spreads. The futures fees are 0% maker and 0.02% taker, making MEXC the most affordable crypto exchange.

OKX, on the other hand, has the deepest liquidity, which ensures flawless trade execution for large orders.