Many people are entering the crypto market, driven by factors like Donald Trump’s recent election victory, expected rate cuts, and the common belief in a four-year bull cycle—often unaware of external market risks like rug pulls. This guide explains what crypto rug pulls are, highlights notable past cases, and provides key strategies to identify and avoid them.

What are Crypto Rug Pulls?

A rug pull is a scam in the cryptocurrency world where developers create a project, attract investors by selling tokens, and then abruptly abandon it—taking all the funds and leaving investors with worthless assets. These scams are especially common in decentralized finance (DeFi), where anyone can launch a token and list it on a decentralized exchange (DEX) without strict regulations.

Rug pulls have been on the rise according to Solidus Labs Rug Pull report, with fraudsters creating over 212,000 scam tokens between September 2020 and January 1st, 2022. In 2021 alone, more than 83,000 scam tokens emerged, and the number surged to 125,000 in 2022. Scammers often use deceptive tactics like promising high returns, leveraging social media hype, and enlisting influencers to gain trust before disappearing with investors’ money.

Imagine a new crypto project called MoonGold promising investors 1,000% returns. The developers use flashy marketing, pay influencers to promote it, and create a website full of buzzwords. Investors rush in, buying MoonGold tokens, believing it’s the next big thing. But one day, the developers disappear, the website goes offline, and all the liquidity is gone—leaving investors with worthless tokens. That’s a rug pull.

How Rug Pull Works in Cryptocurrency

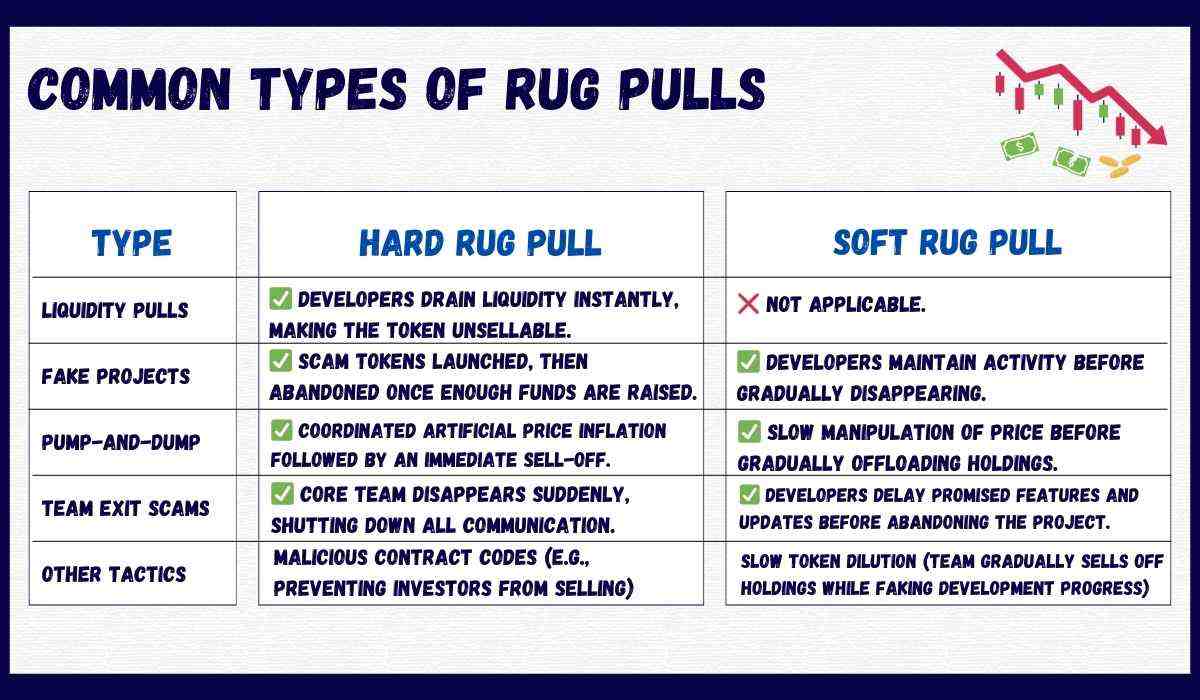

To stay cautious of rug pulls in crypto, it’s important to understand the types that exist. These scams generally fall into two categories: hard rug pulls and soft rug pulls, each differing in execution and impact.

1. Hard Rug Pulls

This is the most abrupt type of scam, where developers withdraw all liquidity at once, transferring funds to their wallets. Since decentralized exchanges rely on liquidity pools for trading, the sudden removal of funds causes the token’s value to collapse instantly, leaving investors with nothing.

2. Soft Rug Pulls:

Unlike hard rug pulls, these happen gradually. Developers may continue providing updates and engaging with the community to maintain trust while slowly siphoning funds. Over time, they reduce project activity, delay promised features, and eventually abandon the token, leaving investors trapped with worthless assets.

Common Types of Rug Pulls

1. Liquidity Pulls: Developers remove liquidity from a token’s trading pool, making it impossible to sell, which causes its price to drop to zero.

2. Fake Projects: Scammers launch a token with a polished website, roadmap, and social media presence to appear legitimate, only to vanish after raising funds.

3. Pump-and-Dump Schemes: Fraudsters artificially inflate the token’s price through hype and coordinated buying, then sell their holdings at the peak, causing a market crash.

4. Team Exit Scams: The project’s founders or developers suddenly disappear, shutting down all communication channels and leaving investors stranded.

Understanding these tactics can help investors recognize warning signs before getting caught in a rug pull. Staying informed about deceptive practices, including other fraudulent schemes in the crypto space, is essential for protecting investments.

How to Identify & Avoid Rug Pulls

While there is no single answer to how you can identify if a project is a scam, there are several ways to secure your investments by being extra cautious about where you put your money:

Do Your Own Research (DYOR)

Before investing, research the project yourself. Check the team’s credentials, the project’s whitepaper, and tokenomics. Understand what the project is building and the problem it solves. Be confident in your investments to avoid unnecessary stress.

Security Audits

Reputable projects undergo third-party security audits. Check for audits on platforms like CoinMarketCap or the project’s official website to ensure the code is secure. Always prioritize projects that have undergone third-party security audits. These audits ensure the project’s code is secure and free from malicious functions.

Community Engagement

Great projects often have strong communities, and this is a good indicator of their potential. Examples like Ripple (XRP) and Cardano (ADA) demonstrate how a solid community can contribute to a project’s success. For newer projects, take the time to explore their social media presence, including platforms like Telegram and X (formerly Twitter). Engaging with the community will give you a better understanding of the project’s strengths and weaknesses, providing valuable insights from both supporters and critics.

Use Reputable Exchanges

Exchanges like Binance and Coinbase have a strict vetting process, listing only projects that are legitimate and sound, not scams. It’s similar to having a team of financial advisors doing extensive research on your behalf, selecting the best projects for you.

Warning Signs to Watch For

- Unrealistic Returns: If the promised returns sound too good to be true, they probably are. Be cautious of projects offering sky-high rewards with little risk.

- Over-the-Top Marketing and Urgency: If you’re being pressured to invest quickly or bombarded with excessive promotion, take a step back. Genuine projects don’t rely on urgency to attract investors.

- Trust Your Instincts: If something feels off, don’t ignore it. Avoid the temptation to follow the crowd out of fear of missing out (FOMO).

Examples of Crypto Rug Pull

Learning from past incidents can be a valuable source of insight into how rug pulls have occurred, taking billions of dollars in liquidity out of the market. Let’s take a look at some of the biggest scams that have happened over the years:

1. OneCoin

OneCoin, co-founded by Ruja Ignatova in 2014, was marketed as a revolutionary cryptocurrency. In reality, it was a Ponzi scheme that defrauded investors of over $4.4 billion. Ignatova disappeared in 2017, and her whereabouts remain unknown, making OneCoin one of the biggest crypto scams in history.

2. Squid Game Token

Inspired by the Netflix series Squid Game, the Squid Game Token launched in 2021, offering an exclusive token for a play-and-earn game. The token’s value skyrocketed, but the developers cashed out and disappeared, leaving investors with losses as the token’s price crashed to almost nothing. The total value defrauded was over $3 million.

3. AnubisDAO

AnubisDAO, a decentralized autonomous organization (DAO), promised high returns and raised nearly $60 million within hours of its launch in 2021. The developers then drained the liquidity pool and vanished, leaving investors with nothing.

4. Thodex

In 2021, Thodex, a Turkish cryptocurrency exchange, was hacked, and over $2 billion worth of crypto was stolen. The exchange’s founder, Faruk Özer, disappeared, and was later arrested in Albania in 2022 after the rug pull was revealed.

5. Uranium Finance

Uranium Finance, a DeFi project claiming to provide exposure to uranium mining, was another crypto rug pull. The developers drained the liquidity pool, causing millions in losses for investors.

Bottom Line

Crypto investors are eagerly waiting for the bull run, preparing their portfolios with projects offering high returns. In times like these, it’s always best to ensure your investments are safe by taking precautions against crypto rug pulls, phishing attempts, and other scams that are widely known within the crypto space.

FAQs

1. Are crypto rug pulls illegal?

Yes, crypto rug pulls are illegal. They involve fraudulent activities, where the creators of a crypto project intentionally deceive investors by withdrawing all funds from the liquidity pool or project wallet, often leaving the investors with worthless tokens.

2. Can you get your money back from a rug pull?

In most cases, getting your money back from a rug pull is extremely difficult, if not impossible. Rug pulls are designed to be fraudulent, with developers often disappearing with the funds or hiding behind anonymous identities, leaving little recourse for victims.

3. How do rug pulls impact the overall crypto market?

Rug pulls create distrust in the crypto market, making investors hesitant to explore new projects. They can also trigger regulatory crackdowns, affecting legitimate DeFi and token projects.

4. Are meme coins more vulnerable to rug pulls than utility tokens?

Meme coins, especially those with anonymous teams and no real-world use case, are more susceptible to rug pulls since they rely heavily on hype rather than sustainable utility or development.