- Users must complete identity verification to access the platform.

- Coinbase is available in over 100 countries, but some features may be restricted in certain areas.

- Offers trading fees based on a maker-taker model, ranging from 0.00% to 0.40%.

- Supports fiat deposits and withdrawals, with various options for transactions.

- New users can benefit from promotional rewards.

- Over 150 cryptocurrencies are available for trading.

- Low liquidity and relatively high fees.

- Coinbase is the only publicly listed cryptocurrency exchange.

- Fully regulated, enhancing trust and security for users.

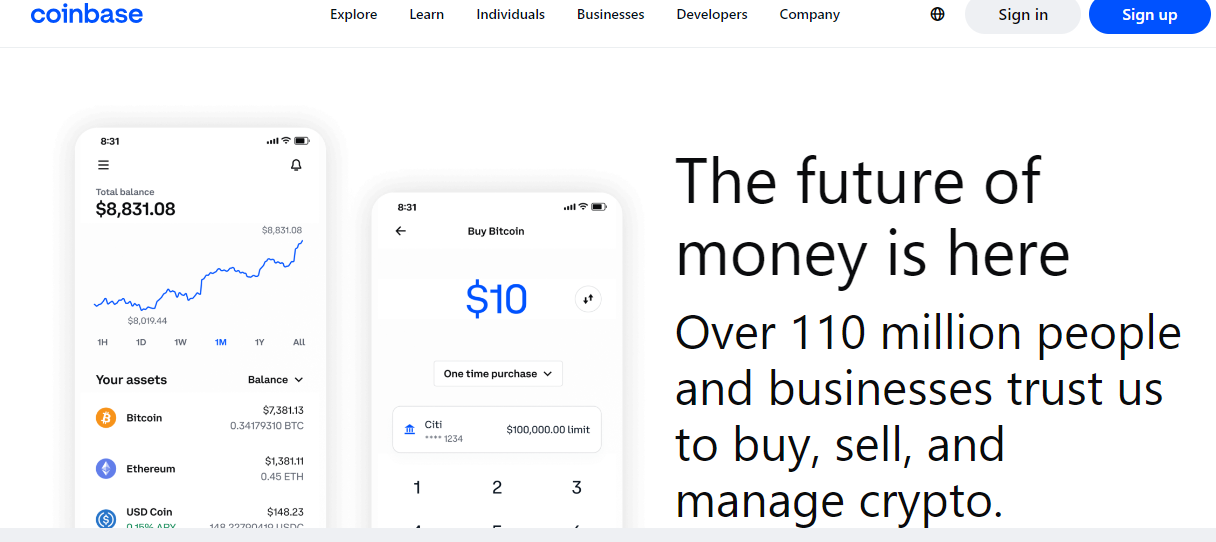

Coinbase has grown from a simple platform for buying and selling select cryptocurrencies into one of the world’s largest and most influential crypto exchanges. Providing solutions to beginners, advanced traders, and even institutions, Coinbase stands as a market leader. Some even say, if you want to spot the peak of a bull run, just check where Coinbase ranks in the App Store.

So, what makes Coinbase stand out? In this review, you’ll explore the exchange’s unique features, its competitive markets and fees, as well as its wide array of products and services. By the end, you’ll have the information you need to decide if Coinbase is the ideal platform for your crypto journey—especially if you’re a U.S. user looking for one of the best exchanges in the country.

Coinbase Overview

Coinbase is a leading cryptocurrency exchange based in the United States, founded in 2012, and is regarded amongst the best platforms for buying, selling, and storing cryptocurrencies, including major assets like Bitcoin, Ethereum, and Litecoin. With over 43 million active traders and total assets exceeding $90 billion, Coinbase operates in more than 100 countries, making it a significant player in the cryptocurrency market.

Coinbase currently has a daily trading volume of over $800 million, and as the only publicly listed cryptocurrency exchange, it is fully regulated, providing an added layer of trust. You can trade 250+ different assets and explore 589 trading pairs, giving you plenty of options to diversify your portfolio.

Accessible via both a web interface and mobile apps for iOS and Android, Coinbase makes it easy to trade on the go. Security is a top priority, with most user assets stored offline and FDIC insurance for USD balances up to $250,000. Additionally, you can take advantage of a free e-wallet and a virtual card for seamless transactions.

Coinbase Sign Up and KYC

To start your cryptocurrency journey with Coinbase, you will need to complete identity verification, known as Know Your Customer (KYC). While signing up is straightforward, KYC is an essential step that ensures security and compliance.

- Create an account on the Coinbase website or download the mobile app.

- During the sign-up process, you’ll be asked to provide your legal full name, email address, password, and state of residence.

- After providing this information, you’ll need to verify your email address by clicking the verification link sent to your registered email.

- Once you registered your account, you must fully verify your identity using a government issued ID or Passport. Additional information such as proof of residence may also be requested, based on your region.

This multi-step verification requires you to submit a valid form of identification, such as a state-issued ID or passport, and may also involve answering some regulatory questions. By completing this step, you gain access to a variety of features and services that enhance your cryptocurrency trading experience on Coinbase.

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform. Due to regulations, Coinbase does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Coinbase country checker.🌍 Free Coinbase Country Checker

Simply type in your country and see if you can use the platform or if your country is restricted.

Coinbase Pros & Cons

| 👍 Coinbase Pros | 👎 Coinbase Cons |

|---|---|

| ✅ User-Friendly Interface | ❌ Very high fees |

| ✅ Wide Range of Cryptocurrencies | ❌ Poor liquidity |

| ✅ NFT trading | ❌ KYC required |

| ✅ Supports fiat deposits (USD, EUR, GBP) | ❌ Limited Passive Earning Options |

| ✅ Established and regulated | ❌ Only for beginners |

Coinbase Trading

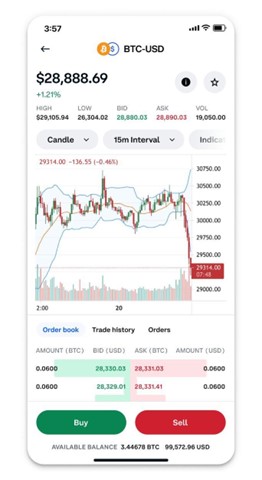

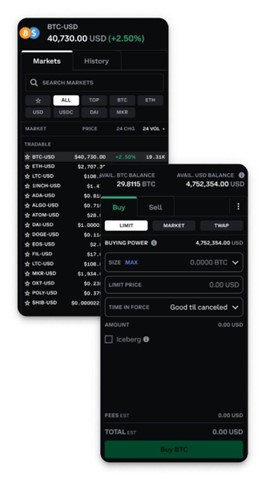

Coinbase offers a versatile trading experience and the platform features two main trading terminals: the standard exchange for simple trading and the advanced trading terminal, known as Coinbase Advanced Trade, which is designed for more experienced traders.

This advanced terminal provides a range of sophisticated tools, such as interactive charts powered by TradingView, advanced order types, and real-time order books, enabling you to execute trades with precision.

Spot trading

In spot trading, you can choose from a wide selection of 250+ supported cryptocurrency, with fees ranging from 0% to 0.40% for makers and 0.05% to 0.60% for takers, depending on your trading volume. This tiered fee structure rewards higher trading volumes with lower costs.

Futures trading

When trading perpetual futures, you can access leverage of up to 5X, enabling you to open positions with less upfront capital. The trading fees for perpetual futures are competitive, with a low introductory fees of 0% for maker and 0.03% for taker, available to qualified traders in select non-U.S. jurisdictions.

Coinbase Trading Fees

Coinbase charges fees based on order type. Maker fees apply for limit orders, while taker fees apply for market orders.

Spot trading fees on Coinbase are relatively high. With default spot fees starting at 0.4% for makers and 0.6% for takers, Coinbase is one of the most expensive crypto exchanges when it comes to spot trading. This is one tradeoff users seeking a fully regulated and beginner-friendly crypto exchange have to make. The more beginner-friendly a platform is, generally speaking, the more expensive the trading fees are.

Futures trading fees, on the other hand, are very low and affordable. Coinbase charges a 0.02% maker and 0.05% taker fee for users on their leverage trading platform. Compared to other exchanges, this is cheaper than the industry standard in terms of futures fees.

Aside from trading fees you also pay spread and slippage (when using taker orders), which always varies based on current market conditions and the available liquidity in the Coinbase limit order book.

Note: Coinbase has a separate fee structure for spot stablepairs (e.g. USDC). For Stablepairs, the fees start at 0.1% for takers. Maker fees are not listed.

Coinbase Spot Fees

0.40% Maker

0.60% Taker

Coinbase Future Fees

0.02% Maker

0.05% Taker

Additional Fee Discounts

What we like about Coinbase is its generous fee discount. While default spot trading fees are incredibly expensive, you can quickly lower your fees based on your monthly trading volume. If you are an active spot trader, you can lower your fees down to 0.18% for maker and 0.08% for taker orders. This only requires a monthly trading volume of $1 million.

You can learn more about Coinbase fee discounts here.

Coinbase Products & Services

Coinbase offers a diverse range of products and services tailored for individuals, developers, and companies, making it a comprehensive platform for all your cryptocurrency needs. Here’s a closer look at some of these offerings:

Coinbase Wallet

The Coinbase Wallet is your gateway to the web3 world, allowing you to store and manage cryptocurrencies, NFTs, and multiple wallets in one place. It supports assets like Bitcoin, Ethereum, Solana, and Dogecoin, and all Ethereum-compatible networks. With the Coinbase Wallet, you can explore thousands of tokens and dApps from your phone or browser.

As a self-custody wallet, it gives you full control over your crypto, keys, and data. Safely store your digital assets and NFTs while engaging with decentralized finance (DeFi), participating in liquidity pools, swapping assets, and joining DAOs to influence web3 projects.

We think that the Coinbase wallet will play a fundamental role in the coming years due to the simple onchain onboarding process. Your Coinbase wallet is direclty connected to your Coinbase account, which lowers the barrier of entry. You instantly have direct access to major chains such as ETH and Coinbase native BASE chain.

Pre-Market Trading

Coinbase also features pre-launch markets, allowing you to trade new tokens before they officially launch. This gives you the chance to participate in the price discovery of upcoming projects. However, these markets are available only to users in eligible jurisdictions outside the U.S., UK, and Canada, and come with unique risks such as lower liquidity and higher volatility.

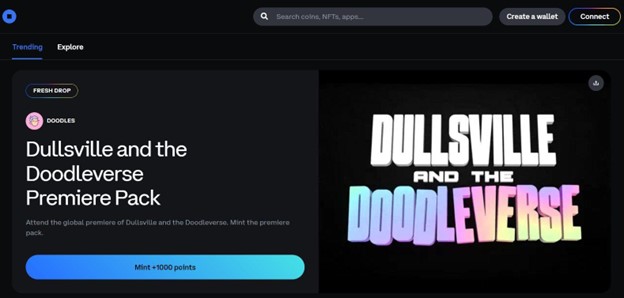

Coinbase NFT

In addition to the wallet, Coinbase also offers Coinbase NFT, a web3 marketplace where you can discover and buy NFTs with the simplicity, safety, and security that Coinbase is known for. Here, you can find the best prices from multiple marketplaces, making it easy to grow your NFT collection.

API Trading

For those looking to automate their trading strategies, Coinbase Advanced offers an API that allows you to execute trades programmatically. This feature is ideal for traders who want to maximize their trading efficiency and take advantage of market opportunities quickly.

Coinbase Card

The Coinbase Card is a Visa® debit card that allows you to turn your everyday purchases into crypto rewards. With this card, you can earn crypto back on every purchase, making it easy to stack rewards from your daily spending. You can use your Coinbase Card anywhere Visa® debit cards are accepted, which includes over 40 million merchants worldwide.

Institutional Trading

If you’re an institutional investor, Coinbase Prime is designed specifically for you. It connects you to many of the largest and most liquid exchanges and trading venues worldwide through an advanced smart order router and trading platform, simplifying the execution of your trading strategies.

Coinbase Advanced trading

Coinbase Advanced is designed for traders seeking low fees and powerful trading capabilities. With over 500 spot pairs available, you can enjoy maker fees as low as 0.0%. The platform features advanced charting powered by TradingView, allowing you to customize your trading pages to suit your style and preferences.

You can execute fast trades across 552 markets, including 237 new USDC trading pairs and free trading on 22 stable pairs. To manage risk in volatile markets, you have the option to use limit orders and stop-limit orders. The platform also provides real-time order books and live trade history, ensuring you have the data you need for efficient trading.

Coinbase Advanced includes a suite of advanced tools that experienced traders will appreciate. You can access over 50 technical indicators to analyze market trends, and with high throughput APIs, you can unlock real-time market data for even more control over your trading strategies.

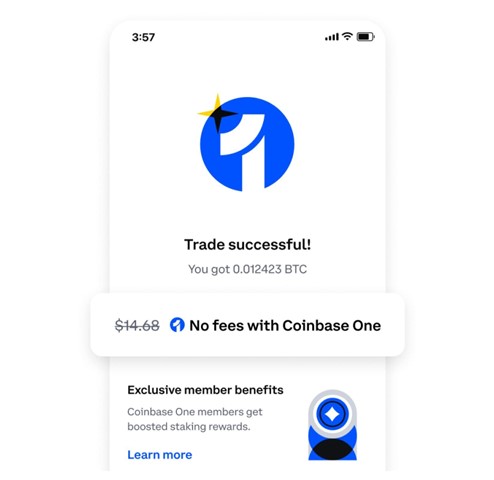

Coinbase One

With Coinbase One, you can enhance your crypto experience through a single membership. This service offers zero trading fees (up to $10,000 trading volume), boosted staking rewards, $10 BASE onchain gas balance, and priority support, giving you more value from your transactions.

One major criquite point we have for the Coinbase One program is its advertised feature “No fees with Coinbase One”. It is very misleading and leads to the assumption that you wont pay any trading fees at all, since the “No fees” only apply for the first $10,000 traded each month. Lets break down the numbers below.

The price of Coinbase One is $29.99 per month. When trading $10,000 per month with market orders (0.6% taker fees apply), you would pay $60 in fees. That means you would have saved $30. But here is the twist: If you primarily trade with limit orders (0% maker fees apply), you would pay $40, meaning you only saved $10. Overall, Coinbase One is only worth it if you trade cryptos worth between $8,000 and $10,000. If you are an inactive trader or a very active trader, it is not worth joining Coinbase for trading purposes.

However, the overall value (if fully made use of) is great: You can save $10-$30 in trading fees, receive a $10 monthly gas fee for BASE chain, small staking rewards, and you get a 24/7 customer support line.

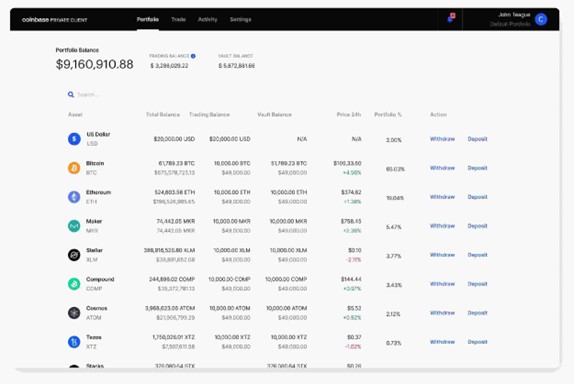

Coinbase Private Client

For sophisticated clients who have significant investments but are new to the world of crypto, Coinbase offers the Private Client service. This service provides you with a high-touch team of experts dedicated to navigating the complexities of cryptocurrency. You’ll have a dedicated account manager and direct access to onboarding and account support, along with a coverage desk that delivers institutional research and insights tailored to your needs.

Coinbase Prime

Coinbase Prime is a full-service prime brokerage platform designed specifically for institutions. It offers everything you need to execute trades and custody assets at scale. You can customize your Coinbase Prime experience to suit your trading strategies, whether you require full trading functionality or a secure custody-only solution that includes secure storage, staking, and governance options.

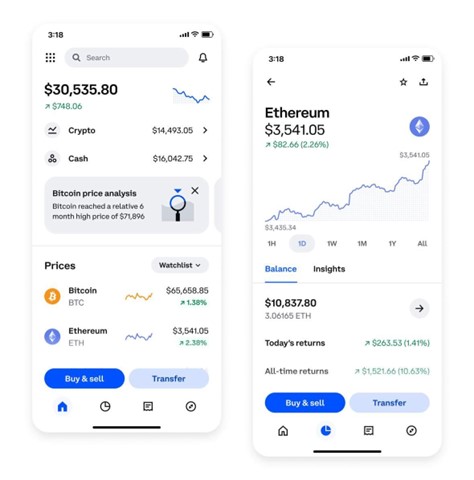

Coinbase Mobile App

The Coinbase Wallet is your gateway to the web3 world, allowing you to store and manage cryptocurrencies, NFTs, and multiple wallets in one place. It supports assets like Bitcoin, Ethereum, Solana, and Dogecoin, and all Ethereum-compatible networks. With the Coinbase Wallet, you can explore thousands of tokens and dApps from your phone or browser.

As a self-custody wallet, it gives you full control over your crypto, keys, and data. Safely store your digital assets and NFTs while engaging with decentralized finance (DeFi), participating in liquidity pools, swapping assets, and joining DAOs to influence web3 projects.

Fiat and Cryptocurrency Deposit/Withdrawal Fees on Coinbase

When it comes to depositing and withdrawing funds from Coinbase, you’ll find that the fees vary based on the method you choose for both fiat and cryptocurrency transactions.

Fiat Deposit and Withdrawal Fees

For fiat deposits and withdrawals, Coinbase offers several options:

Fiat Deposit Fees

ACH: Free

Wire (USD): $10 USD

SEPA (EUR): €0.15 EUR

Swift (GBP): Free

Fiat Withdrawal Fees

ACH: Free

Wire (USD): $25 USD

SEPA (EUR): Free

Swift (GBP): £1 GBP

Using ACH for deposits and withdrawals is a great way to avoid fees altogether, although it may take 1 to 3 business days for the funds to arrive in your bank account.

Cryptocurrency Deposit/Withdrawal Fees

When withdrawing cryptocurrencies, Coinbase does not impose a direct deposit and withdrawal fee. Instead, you will incur a standard network fee that fluctuates based on the current market conditions of the specific cryptocurrency network.

For example, if you decide to withdraw Bitcoin, you’ll only pay the network fee, which varies depending on the congestion of the Bitcoin network at the time of your transaction. This fee is necessary to incentivize miners to process your withdrawal.

It’s important to keep in mind that while there are no direct fees for withdrawing crypto, the network fee can still add up depending on the asset and market conditions. Always check the estimated fee before finalizing your withdrawal to ensure you’re aware of the costs involved.

Coinbase Security

Coinbase is known for its robust security measures, making it one of the most trusted platforms for trading cryptocurrencies. As a public company, it operates with financial transparency, publishing financial statements quarterly and undergoing annual audits by independent third parties.

Coinbase ensures that your crypto remains your own, as it does not lend or act with your assets without your permission. The platform employs secure and multifaceted risk management programs to protect customers’ assets.

To safeguard your account, Coinbase provides a variety of security tools, including:

- Auto-Enrolled Two-Factor Authentication: This feature adds an extra layer of security by requiring a second form of verification when logging in.

- Password Protection: Your passwords are stored using the bcrypt algorithm, which irreversibly hashes them, ensuring that they cannot be read or decrypted, even by Coinbase.

- Multi-Approval Withdrawals in Coinbase Vault: This feature requires multiple approvals for withdrawals, adding an additional layer of security.

Coinbase Customer service

Coinbase provides comprehensive customer service experience to assist you with your cryptocurrency needs. Their website has a dedicated “Help” section where you can find articles on trading, funding, privacy, security, and more. This section also includes trending articles and product-specific help, making it easier for you to find the information you need.

For more specific inquiries or issues, Coinbase offers live customer support. If you are in certain countries, including the US, UK, Ireland, Germany, and Japan, you can access phone and messaging support options for various crypto-related questions. This allows you to get accurate information directly from the support team regarding Coinbase products and services.

Coinbase Alternatives

Coinbase is great for beginners, but if you need more advanced features or lower fees, here are some alternatives:

- BYDFi: BYDFi offers high leverage and no KYC requirements.

- Kraken: Kraken is a well-established exchange with a wider range of cryptocurrencies and more competitive fees.

- Bitvavo: Bitvavo is a good option for European users with a user-friendly interface and support for SEPA deposits.

| Feature | Coinbase | BYDFi | Kraken | Bitvavo |

|---|---|---|---|---|

| Established | 2012 | 2019 | 2011 | 2018 |

| Spot Fees (Maker/Taker) | 0.40% / 0.60% | 0.00% / 0.10% | 0.16% / 0.26% | 0.15% / 0.25% |

| Futures Fees (Maker/Taker) | 0.050% / 0.050% | 0.020% / 0.060% | 0.020% / 0.050% | N/A |

| Max Leverage | 10x | 200x | 50x | None |

| KYC Required | Yes | No | Yes | Yes |

| Supported Cryptos (Spot) | 250+ | 418+ | 323+ | 308+ |

| 24h Spot Volume | $1.09B | $163.71M | $608.49M | $158.87M |

| 24h Futures Volume | $0.81B | $5.6B | $0.42B | N/A |

| Trading Bonus | None | $300 | None | None |

| Key Features | • Most trusted US exchange • Easy to use interface • Strong regulatory compliance |

• No KYC required • High leverage (200x) • Zero-fee spot trading |

• Established since 2011 • Strong security • Advanced trading features |

• EU regulated exchange • SEPA transfers • Beginner friendly |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottomline

Coinbase stands out as a leading cryptocurrency exchange platform due to the wide range of services it offers and its robust security measures. Its user-friendly interface makes it suitable for both beginners and experienced traders. You’ll find various products available, including options for buying, selling, and managing cryptocurrencies, a self-custody wallet, advanced trading, and much more.

However, it’s important to note that while Coinbase offers a wide range of services and features, it may not be the best fit for everyone. Factors such as fees, supported countries, and your personal preferences can influence your choice of a cryptocurrency exchange.

Coinbase’s commitment to security, user experience, and continuous innovation makes it a strong contender in the cryptocurrency exchanges landscape, providing you with the tools you need to navigate the world of digital assets confidently.

FAQS

Is Coinbase legit?

Coinbase is a legitimate crypto exchange platform supported in over 100 countries, including the United States.

What are Coinbase fees?

Coinbase fees average 0% to 0.40% maker and 0.05% to 0.60% taker. Stable pairs have a default fee of 0% for makers and 0.001% for takers.

Is Coinbase available in the US?

Coinbase is a leading exchange based in the United States and fully regulated by the US government. Coinbase is available in the US.

Where is Coinbase located?

Coinbase is located in San Francisco, Florida, USA.

Does Coinbase have a native token?

Coinbase does not have a native token.