BYDFi is a digital platform where you can easily buy, sell, and trade more than 250 types of cryptocurrencies. It’s well-known for offering various services, following stringent regulations, and having proper licenses. This makes it a trustworthy choice for trading.

Whether new to crypto or experienced, remember that trading involves risks, especially futures. With that said, let’s talk about how to start trading futures on the BYDFi platform.

If you want to learn more about the exchange, check out our full BYDFi review.

Opening a BYDFi Futures Account

Registering a new account on BYDFi is a straightforward process. To register, visit the official website and locate the registration button at the top right.

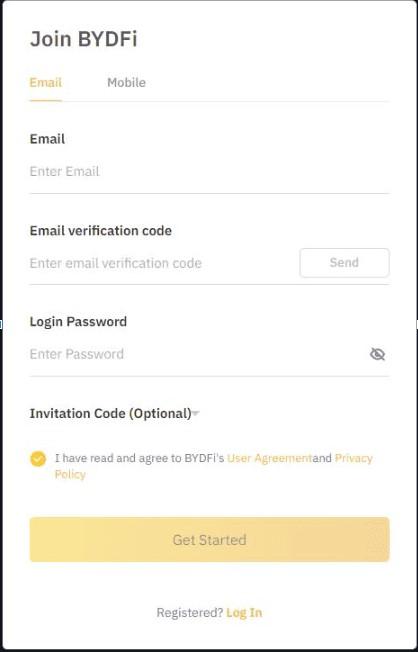

Here is the official registration screen you will encounter:

When registering, be sure to provide a valid email address, as you’ll need to verify your account with a code sent immediately to your email to complete the registration process. Sometimes, it takes a few minutes to receive the code. If you don’t get the email on the first attempt, you can request a new code after a minute.

After successfully creating your account, prioritizing the safety of your account comes next. To do this, go to the Account Security tab and click the Manage button under the security center.

Follow through with all the steps, which include:

- Email verification (which you must have done)

- Phone number verification

- Trading password

- Google Authenticator and more

For extra security, you have the option to create a withdrawal address whitelist. With this, you only use specified addresses when withdrawing funds from your BYDFi account.

BYDFi KYC Verification

Technically, you can use the exchange without undergoing the Know Your Customer (KYC) procedure, but this comes with certain limitations. You must complete the identity verification process to lift these restrictions, which is a standard requirement for most legitimate exchanges.

The process is simple, involving just a few straightforward steps. Once these are successfully completed, you’re all set to make the most of the platform. Now, let’s delve into the process of depositing funds.

Funding your BYDFi Futures Account

Whether you are familiar with how crypto deposits work or not, funding your BYDFi futures account should be a breeze.

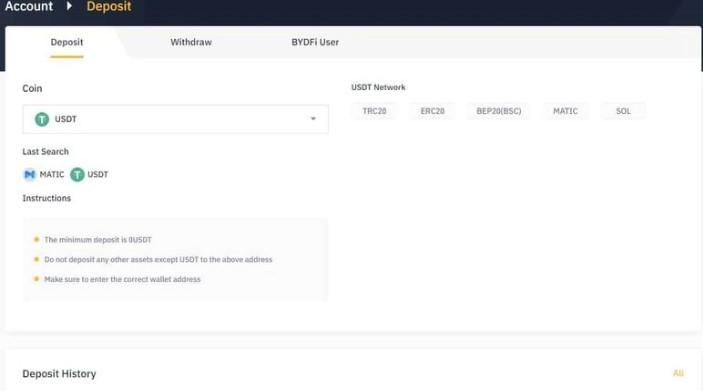

To start this process, go to the top navigation menu. Look for the Assets tab, and click the Deposit button in the dropdown menu that appears when you hover over it. You’ll be directed to this screen:

Next, simply choose the network you want to use. Once you click on it, the platform will generate a specific deposit address for you to use when sending funds.

Verifying the network and address before you complete any transactions is crucial. Sending funds through the wrong network or address can result in an irreversible loss.

Notice that there’s no minimum deposit required, but remember that network fees apply. After depositing funds, you should transfer them to your specific sub-accounts based on whether you plan to use the spot exchange, the derivatives exchange, or other products. Once this is done, you’re ready to begin trading.

For a full step-by-step process, check out our in-depth BYDFi deposit guide.

Trading BYDFi Futures

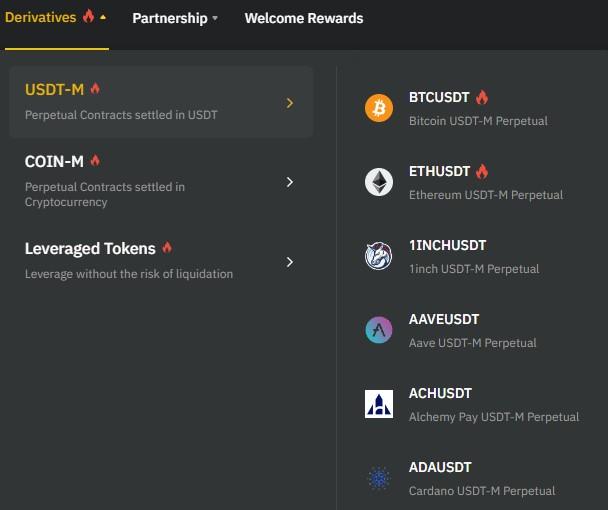

The Derivatives button opens you to the world of futures trading. On the main navigation menu, you will find this Derivatives button, which, once hovered over, you’ll see several options:

There are different options for trading on BYDFi. USDT-M allows trading perpetual contracts using USDT. COIN-M offers perpetual contracts settled in cryptocurrencies. Lastly, leveraged tokens present additional opportunities. In this guide, we’ll concentrate on the USDT-M option.

It’s important to know that a perpetual contract lacks a fixed expiration or settlement date. This flexibility allows users to buy and sell it anytime, adding a high level of versatility to this financial instrument.

Derivatives trading introduces the use of leverage, elevating the overall risk significantly. With a substantial potential for capital loss, it’s a domain best navigated by experienced users. Engaging in leverage above 5x is particularly precarious and should be cautiously approached.

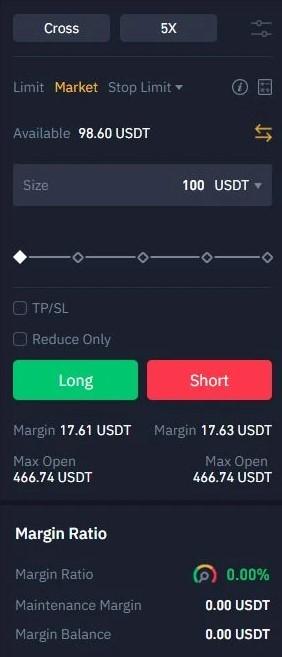

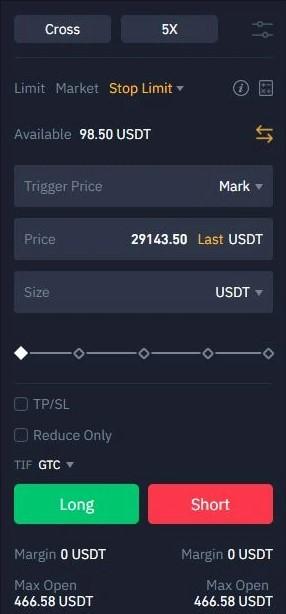

Now, let’s take a glimpse at the derivatives trading interface:

Upon closer inspection, you’ll notice some distinctions, especially on the right side of the screen, offering expanded options for order types and leverage adjustments. In the case of the BTC trading pair, BYDFi provides the choice of up to 150x leverage. However, sticking to a conservative 5x is advisable, as elaborated earlier.

Leverage works by magnifying your position size based on the chosen leverage factor. With 5x leverage, you can open a position five times larger using the same initial capital. For instance, $10 allows you to initiate a $50 position.

However, there’s a snag. You face liquidation if the price moves unfavorably, leading to a loss equivalent to your initial capital.

Opening a Position

For explanation purposes, we use a simple market order to open a position:

Following the image, the goal is to buy BTC valued at 100 USDT. However, we will be sacrificing 17.61 USDT as collateral due to the leverage employed. A single click on the Long button executes the purchase.

It’s important to recognize that you can also speculate on the price decreasing with derivatives. To do this, click the red Short button, and your position will become profitable if the price falls.

Closing a Position

There’s a tab below the chart where you can oversee and control your positions. In this section, you can keep track of your position size, margin mode, entry price, liquidation price, margin ratio, and Profit and Loss.

To close your position, you can either use the market button on the side or set a limit order with your preferred exit price.

Take Profit/Stop Loss Orders

In addition to the options mentioned earlier, you can use take-profit or stop-loss orders, eliminating the need to close your position manually. Simply click the stop limit button and choose the order type.

Bottom Line

Trading futures on the BYDFi trading platform is a simple process. With several repetitions, you will get the hang of it in no time. If you want to know more about the BYDFi trading platform, you can refer to our full BYDFi review for an in-depth evaluation.

We are obligated to tell you that futures trading is a high-risk, high-reward endeavor. Be cautious and stick to your trading strategies. Happy Trading!