As Muslims, we often hear elders say things like, “Crypto is haram”, or even, “It involves interest (riba)”. Such remarks often lead practicing Muslims, especially the elderly, to avoid cryptocurrencies altogether. However, not everything we see or hear online is entirely accurate. In fact, many scholars consider digital currencies halal under certain conditions.

To address these concerns, Bybit has introduced a new product: the Bybit Islamic Account. This account is specifically designed for the Muslim community, providing peace of mind by aligning crypto trading with Islamic principles. In this guide, we’ll address common doubts about whether crypto is halal, explain how the Bybit Islamic Account works, and explore how it adheres to the principles of Islamic finance.

What is a Bybit Islamic Account?

Cryptocurrencies have often been labeled as “haram” within the Muslim community, primarily due to misinformation. The Islamic finance system is based on the principles of Shariah, or Islamic law, which prohibits paying or charging interest (riba) and emphasizes ethical and equitable financial transactions.

Islamic finance is built on the principle of profit-and-loss sharing, where borrowers and lenders jointly bear the risks, profits, and losses instead of relying on interest. Bybit has adopted this framework by integrating Islamic finance principles into the cryptocurrency domain. The Bybit Islamic Account complies with Shariah guidelines, ensuring that all transactions are free from interest (riba) and avoid excessive uncertainty (gharar).

Rather than simply claiming to provide a riba-free and fully Islamic environment, Bybit worked closely with ZICO Shariah Advisory Services to develop a crypto trading account that complies with all Shariah laws. They also formalized this effort with the Wakalah Agreement to further solidify the account’s compliance.

In addition, Bybit collaborated with CryptoHalal to carefully vet the cryptocurrencies available for trading through the Islamic account. This vetting process involved analyzing the projects and their tokens—for example, Bitcoin—and reviewing the operations of each project. If a project involved haram activities, such as lending and borrowing with interest (riba) in DeFi, it was deemed non-compliant and excluded. Currently, the Bybit Islamic Account offers access to 76 Shariah-compliant cryptocurrencies.

Create a Bybit Islamic Account!

Key Features of the Bybit Islamic Account

- Shariah-Compliant Options: Trade 76 verified Shariah-compliant tokens through spot trading, with additional tools like Dollar-Cost Averaging (DCA) and Spot Grid Bots to support strategic investment plans.

- Worldwide Availability: Open to users globally, excluding regions with specific legal limitations.

- Certified Compliance: Thoroughly reviewed and approved by CryptoHalal Certification and ZICO Holdings to guarantee adherence to Islamic principles.

- Riba-Free Transactions: Bybit’s Islamic Account eliminates all forms of interest, enabling Muslim traders to participate in financial activities that align with their ethical and faith-based principles.

How to Create a Bybit Islamic Account

The process of creating a Bybit Islamic Account is straightforward and simple. Just follow these steps to set up your Bybit Islamic Account.

Step 1: To get started, you first need to create a Bybit account to set up your Islamic account. Visit the Bybit website on your browser and sign up using your email or mobile number.

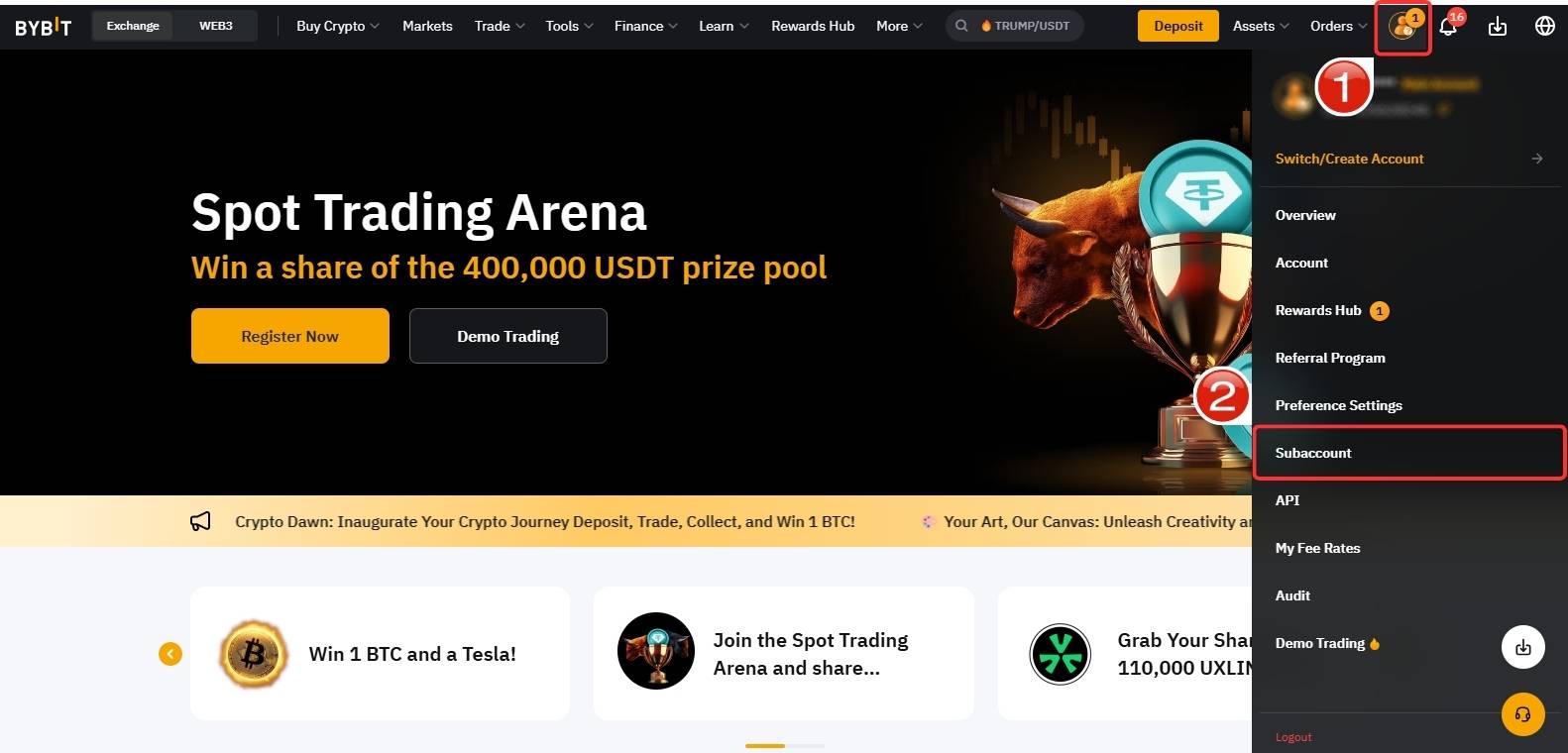

Step 2: Once your account is set up, go to the “Accounts” icon located at the top right of the toolbar, and select the “Subaccount” option.

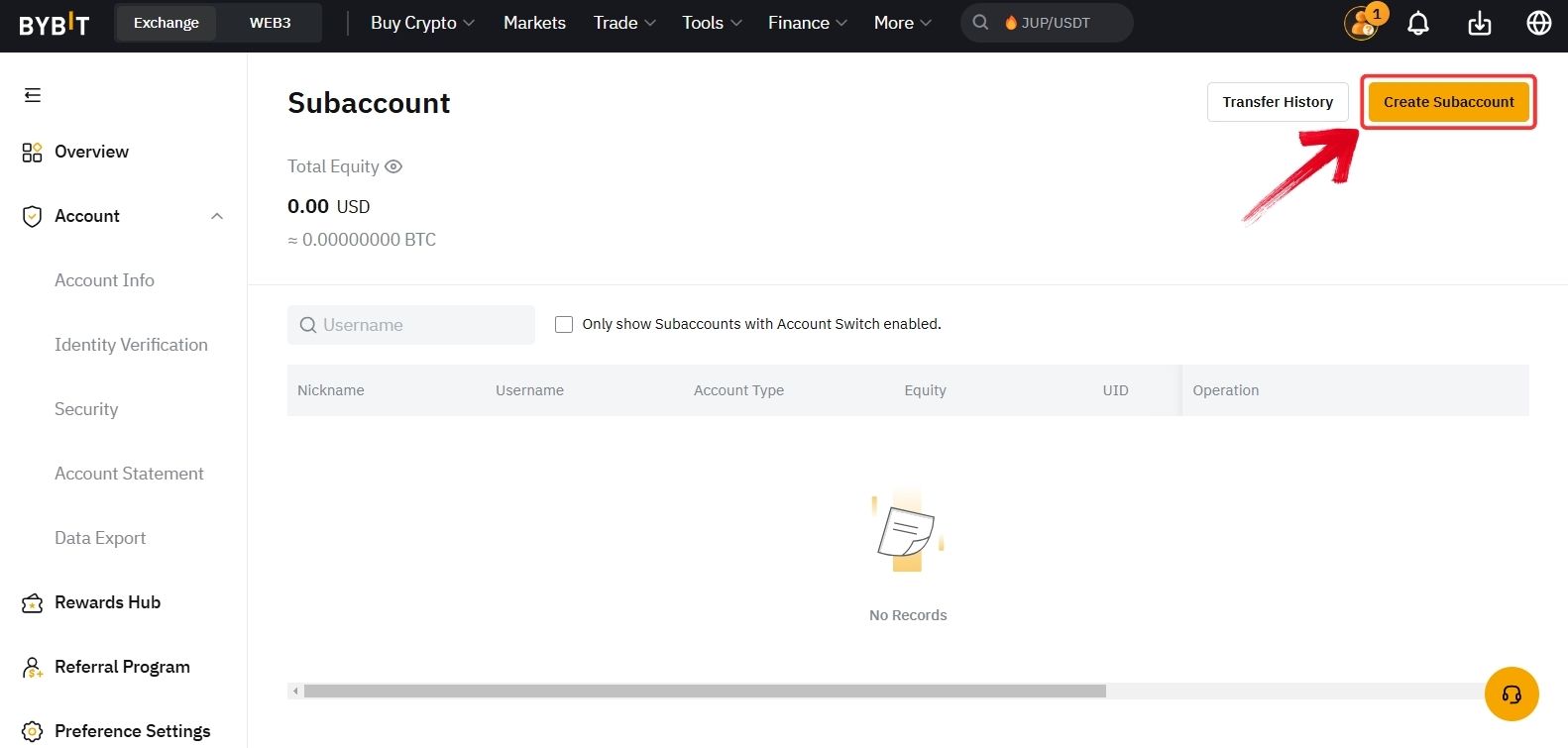

Step 3: You will now be redirected to the Subaccounts section, where you can manage or create subaccounts. Click on the “Create Subaccount” button at the top right of the screen.

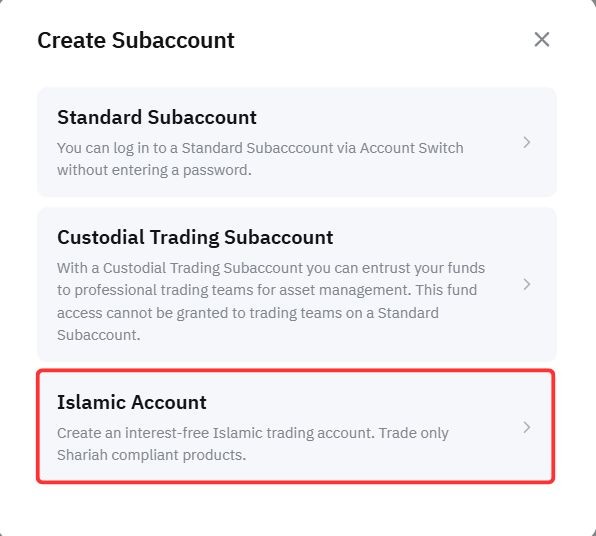

Step 4: A small Create Subaccount window will appear. Select “Islamic Account” from the options to proceed.

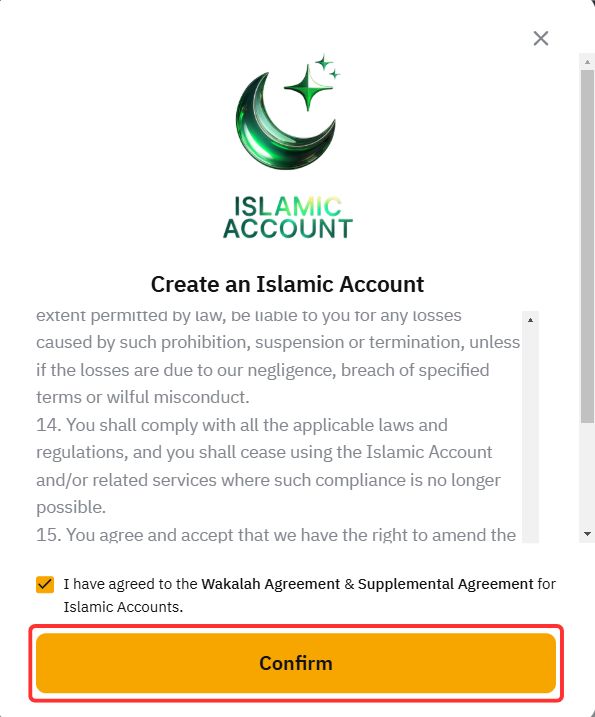

Step 5: The Bybit Islamic Account operates under a Wakalah Agreement. Make sure to review the Wakalah Agreement thoroughly to understand all the steps taken to ensure the crypto transactions are Shariah-compliant. After reading, click on “Continue”.

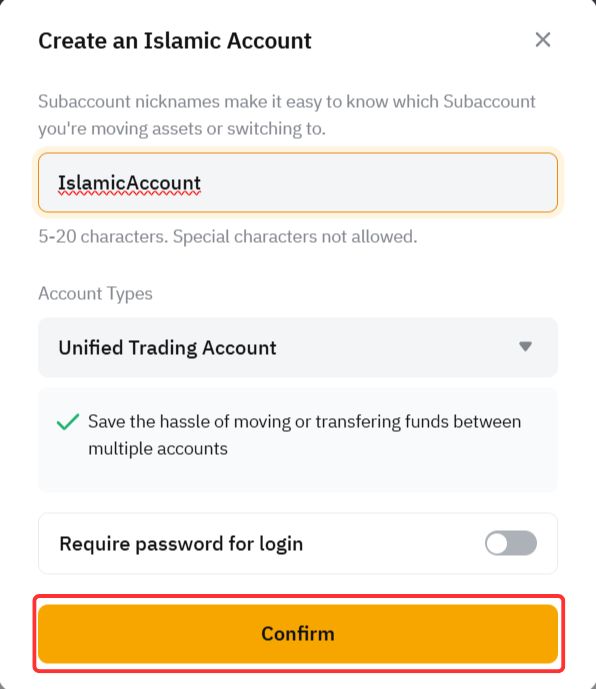

Step 6: Next, set up a nickname for your subaccount in the “Nickname” field and define the password requirements for your Islamic account. Once done, click on “Confirm”.

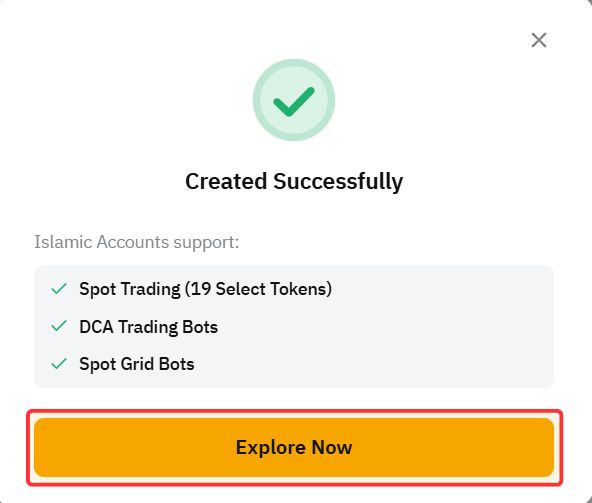

Step 7: Your Bybit Islamic Account has now been successfully created. To explore the features of the Bybit Islamic account, click on the “Explore Now” button.

With this, your Bybit Shariah-compliant Islamic account is ready. Simply switch to your Islamic account and head to the “Markets” tab on the toolbar to start buying, selling, or investing in 76 halal cryptocurrencies, carefully vetted by CryptoHalal.

Create a Bybit Islamic Account!

How Does the Bybit Islamic Account Work?

So, with your account now created, you might be wondering how the Shariah-compliant crypto services work and what you should expect once the account is set up. Let’s take a closer look at these:

- Spot Trading: Traders can purchase and sell digital assets with instant ownership transfer. The Bybit Islamic Account offers 19 Shariah-compliant tokens, all carefully vetted to align with Islamic finance principles.

- DCA Trading Bot: Dollar-cost averaging (DCA) is a strategy that divides investments over time. The DCA trading bot enables Islamic Account holders to invest in digital assets while adhering to Shariah principles, avoiding excessive uncertainty.

- Spot Grid Bot: This automated tool helps traders buy and sell assets within a specified price range, offering a consistent and Shariah-compliant trading approach that reduces risk.

- Islamic Account Interface: The interface of the Bybit Islamic Account is designed to exclude any products or services that violate Islamic principles, such as futures trading, which involves paying interest (riba). You won’t find any of these services in the Islamic account, ensuring that you are never tempted or at risk of engaging in activities that go against Shariah rules.

Bybit Islamic Account Fees

When engaging in spot trading, users utilize their Islamic account funds to purchase digital assets, with Bybit facilitating the process according to the chosen trading strategies. Upon the completion of each trade, Bybit, as the Wakeel (agent), collects an ujrah (fee) based on the agreed-upon amount outlined in the Wakalah contract. Users can check the fee rates they’ll be charged before confirming the agreement by visiting the Fee Rates page for clarity.

Bottom Line

Muslims often face challenges when determining if cryptocurrencies align with Islamic principles. However, with the launch of the Bybit Islamic Account, progress is being made, making crypto more accessible to the Muslim community. While doubts remain, which are understandable, the growing interest from one of the world’s largest crypto exchanges is a significant step forward.

As interest in crypto Islamic accounts grows, other exchanges may follow suit, potentially introducing enhanced projects backed by more comprehensive research and due diligence. Overall, this initiative is a positive development for both the Muslim community and crypto enthusiasts, as it paves the way for greater crypto adoption.

Create a Bybit Islamic Account!

FAQs

1. Are cryptocurrencies halal

Bybit has recently listed only those cryptocurrencies in their Islamic Account that have been certified as halal by CryptoHalal. The projects and their tokens undergo a thorough review process, where their operations are carefully analyzed to ensure they align with Islamic principles. Only after this detailed assessment is a ruling issued to confirm their legitimacy under Shariah law.

2. How does Bybit ensure the 76 cryptocurrencies listed are Shariah-compliant?

Bybit collaborates with CryptoHalal to vet cryptocurrencies. The evaluation process includes analyzing each project’s operations, ensuring they don’t involve haram activities like interest-based lending, gambling, or unethical practices. Non-compliant projects are excluded.

3. What is the Wakalah Agreement, and why is it important for the Bybit Islamic Account?

The Wakalah Agreement is a formal arrangement between Bybit and its Islamic account holders, where Bybit acts as an agent (Wakeel) to facilitate trades on the user’s behalf. This agreement ensures all transactions comply with Shariah principles, such as avoiding interest (riba) and uncertainty (gharar).

4. Is the Bybit Islamic Account available in all countries?

The Islamic Account is accessible globally, except in regions where cryptocurrency trading is restricted or where Bybit services are unavailable due to legal limitations.

5. What happens if I switch between my regular Bybit account and the Islamic Account?

Switching between accounts is seamless; however, the Islamic Account restricts access to services that violate Shariah principles, such as futures trading. Funds and trades within each account are managed separately to maintain compliance.