Do you want to own crypto tokens without spending money? How would you feel if we told you that you could mine it on your mobile? Yes, no specialized crypto-mining tool is needed!

In comes Pi, the first-ever cryptocurrency you can mine on your phone. With around 55 million miners using the Pi app, it continues to grow its community in the current bullish trend. However, you must know that if something sounds too good to be true, it probably is. This post tells you how to trade Pi and gives you an insight into its status and authenticity.

How Does Pi Network Work?

It works on the pattern of an MLM scheme. Since its launch in 2019 (Pi Day), Pi has focused on growing its miners’ community. Your mining capacity and asset security increase based on the number of people you add to the Pi network.

Remember that you can mine Pi only if someone refers you to the network. Once you receive a referral number, you can install the Pi app and start mining. This has greatly helped increase its users.

What Is Pi Worth?

The current value of Pi is in a slight decline at around $35. However, it has been growing steadily for the past 30 days. Although it is still a “phantom asset”, its rising price graph indicates that people are still interested in trading it. Or, it can be the result of the general FOMO of the bullish trend nowadays.

Why Is Pi Unique?

It is unique because you don’t need specialized equipment to mine coins from this ecosystem. You have to:

- Install the Pi app on your phone

- Register with it

- Open the app every 24 hours and tap on the lightning button to mine coins.

You must know that you are not actually “mining” by tapping the button. You are just receiving Pi token vouchers. Also, you are proving that you are not a bot. Think of it as “booking” the number of coins you will receive once the Pi mainnet launches. When people say “trading Pi”, they mean trading those vouchers.

It is also unique because it hasn’t been open to public trading even after five years since its creation. People have been predicting its launch year, but no date has been endorsed by the founders.

Also, its user interface is like a pyramid scheme. You keep seeing a “low security” network notification on your app until you add 3, 5, or more people to the Pi ecosystem. What’s more, you can join Pi only through invitation. If you don’t have an acquaintance to invite you, you can find invitation links online.

Risk of Investing in Pi

The biggest risk here is that you can not trade Pi tokens in reality. Wherever you see Pi listed for trade, it is on an IOU basis. It literally means “I Owe You”. Since this cryptocurrency is not launched, no one can predict its actual value. So, if you buy 1 Pi coin for $40 and it lists for $10 upon its launch, you lose $30 per Pi coin.

You are basically mining and trading a promise when using the Pi network. If you get a smart deal to trade Pi on an exchange, remember to keep a track record of your purchases. More so because no one knows when it will be launched.

Why Should You Use HTX Exchange?

Because you get multiple trading options here. From ETPs to spot trading, you can choose your pick. Also, this exchange supports 80+ payment options for different currencies. You can deposit money through your local cash wallet apps. Alternatively, you can add a credit or debit card for smooth transfers.

In general, it is an average crypto exchange with a satisfactory performance.

Customer Support

HTX has a long FAQ section where you can find answers to almost all your troubleshooting queries. If that doesn’t solve your problem, you can use their live chat option. You will get replies in real-time, within minutes of asking a question. It is a good option to ask urgent questions like, Why can’t I deposit USDT into my HTX account?

If your query is a non-emergency, you can send an email to the customer support section. They will get back to you with a comprehensive reply in a few days. However, we recommend you drop your questions in the live chat. The email route is sluggish at best.

Security Protocols

You get the usual two-factor authentication and SSL encryption of data transmission. Your trader funds are stored in cold wallets provided by the exchange for maximum asset protection. You can also connect your wallet to HTX for extra leverage and convenience.

HTX conducts regular security checks to enforce protective measures. They also perform penetration testing to check if:

- Your account can be hacked

- Your wallet can be accessed by scammers

- There have been any phishing attempts

You must know that HTX has a good track record of protecting its users’ assets. There has been no scandal reported with this exchange.

Fees

This exchange has a simple, flat rate fee structure:

- Maker fees: 0.02% – 0.04%

- Taker fees: 0.02% – 0.04%

- Complimentary low fees for HTX Token (HT) holders

You will have to pay different rates for withdrawing different cryptocurrencies. It depends on current rate, demand, etc. Additionally, HTX charges you for:

- Margin trading

- Depositing certain cryptos

- ETP trading

- OTC landing

Variety of Cryptocurrencies

You can find 600+ cryptocurrencies on this exchange. You can:

- See their real-time market trends

- Compare offers

- Trade via multiple channels

How to Buy and Sell Pi: Step-By-Step Process

Note: You must do the KYC verification on the Pi app to be eligible to trade it. You may have to wait for a few days because Pi is allowing verification slots quite slowly at the moment.

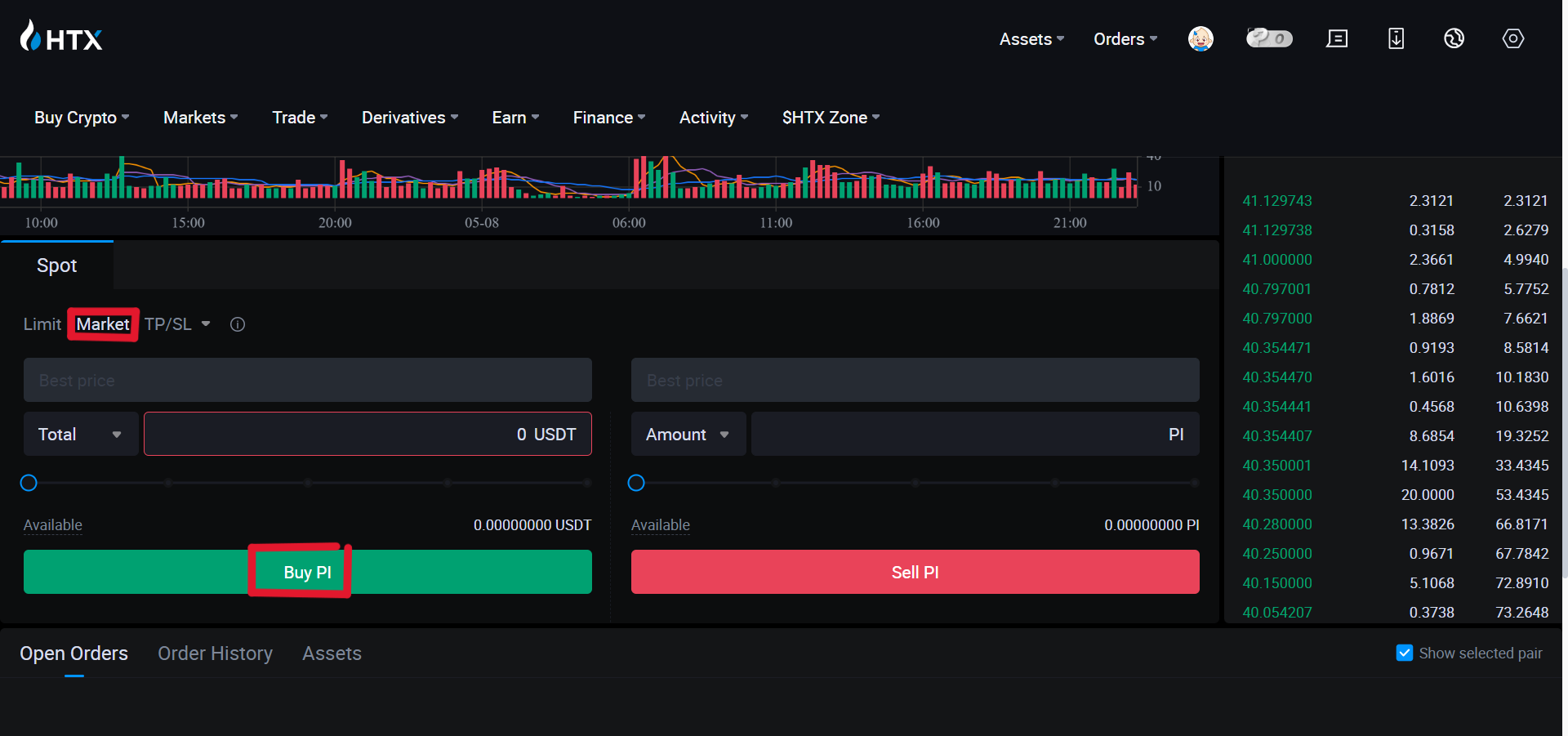

This is the fastest way to navigate the HTX exchange and buy Pi tokens. All the relevant options in the images are circled in red.

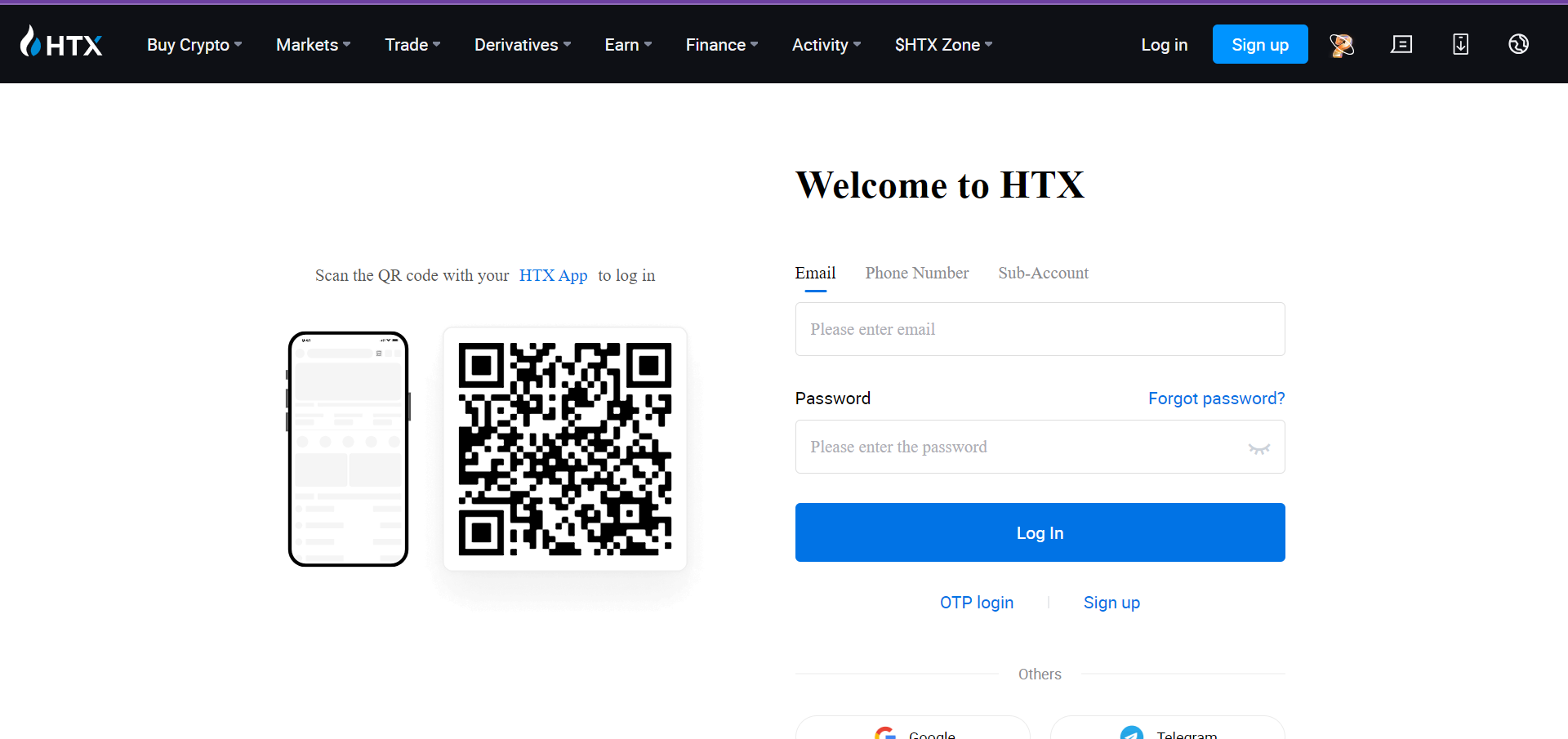

Step 1: Register & Verify

First, you have to register on HTX. You need an email or a phone number, and a strong password for this. After registration, you must verify your identity.

To finalize the KYC verification, you need a government-issued ID, Passport, or driver’s license. The HTX verification process takes up to 24 hours.

Step 2: Connect Your Pi Wallet to HTX

If you are KYC-verified, you can get permission to link your Pi wallet to HTX. Copy the wallet’s address and paste it into the HTX link address section.

Disclaimer: You may or may not be able to carry out his step. The Pi network controls whether you can link your wallet to exchanges or not.

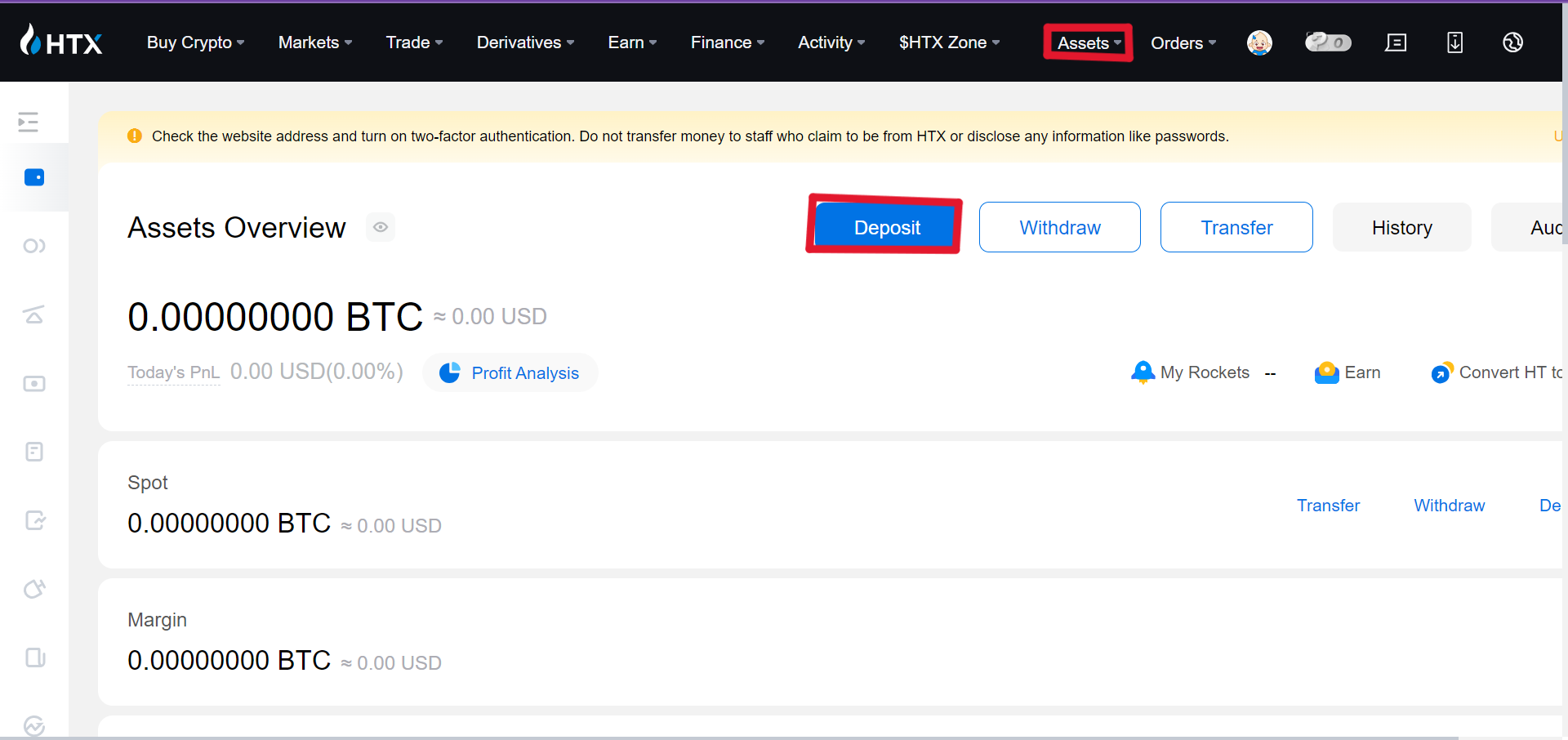

Step 2: Deposit Funds

After successfully creating and verifying your HTX account, you can deposit funds. You can either deposit crypto or fiat currency in your HTX account. Click on “Assets” at the top right corner and click “Deposit”. You can deposit cryptos like USDT here.

Alternatively, you can add your Visa or Mastercard to the Fiat for 0 extra fee. For any option, copy your deposit address and send your funds to it. You can deposit funds through 90 payment methods in available fiat currencies.

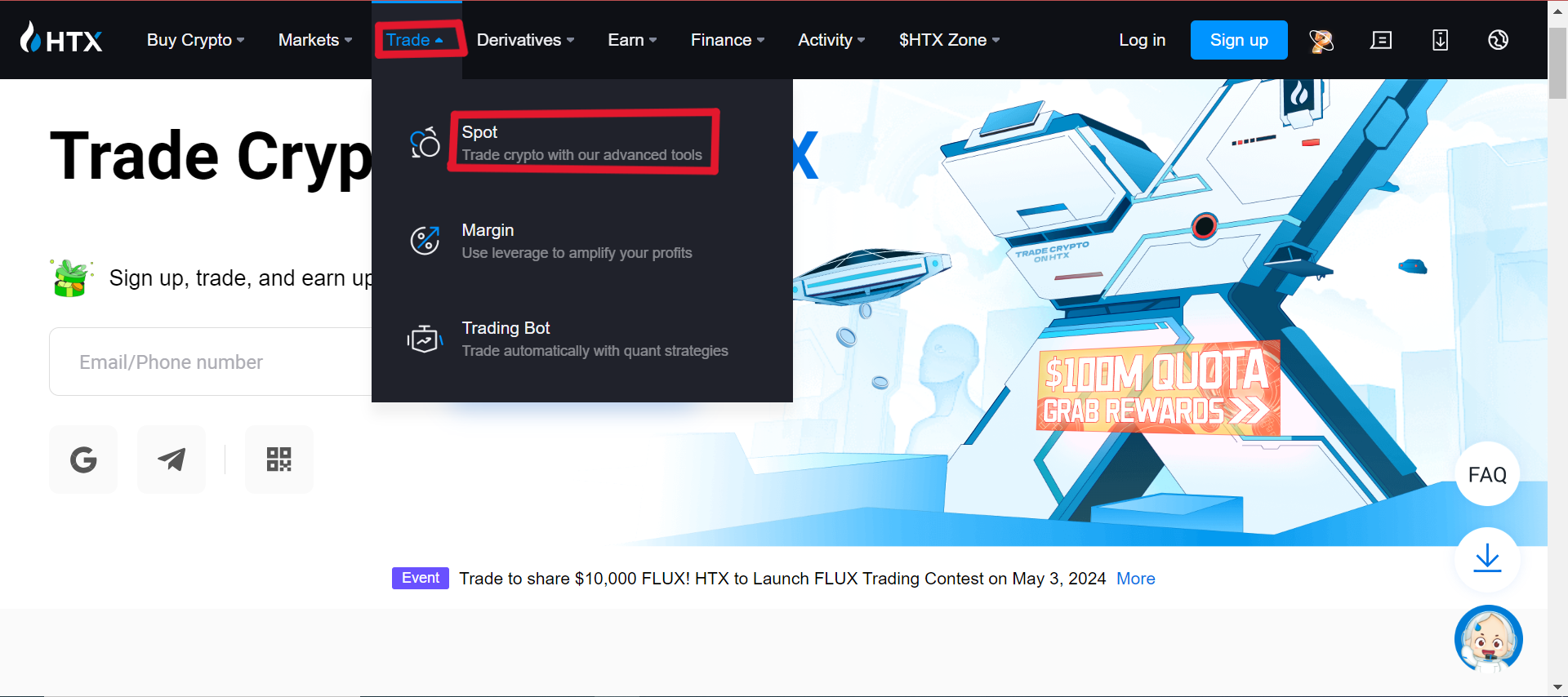

Step 3: Go to the HTX Spot Market

After successfully depositing funds into your HTX account, head to the HTX spot trading section. This is where we will buy the Pi token.

Select “Trade” in the header menu and click “Spot“.

Step 4: Search for “Pi”

Once you reach the spot market dashboard, click on the arrow beside BTC/USDT. A drop search bar will appear.

Write Pi and click “Pi/USDT”.

Step 5: Buy or Sell Pi On the HTX Spot Market

Now that we have successfully deposited funds into our account and navigated to the Pi chart, we can finally buy or sell Pi tokens.

For this, we will use a “Market” order. So make sure you select “Market” instead of “Limit” order. This ensures we buy Pi immediately at the ongoing market rate without waiting.

Choose how many Pi tokens you want to purchase and click “Buy Pi” to finalize the transaction. The same goes for selling. Click on “Sell Pi” to look at offers.

Disclaimer: You may or may not find a listing for PI immediately as it is an IOU-based currency. You must check regularly to find one.

Step 6: Store Pi In a Secure Wallet

After successfully purchasing the Pi cryptocurrency, you should decide where you want to store your digital assets. We never recommend keeping cryptos on an exchange, as these can be subject to hacks or bankruptcies.

The best place to store crypto assets such as Pi is a hard wallet like the Ledger Nano X. You can learn more about this hardware wallet in our dedicated Ledger Nano X review.

Step 7: Track Your Pi Investment Performance

If you want to keep track of your crypto portfolio, including Pi, you can use tools such as coinmarketcap or TradingView. Coinmarketcap is an extensive crypto database that tracks valuable information such as prices, volume, popularity, etc.

TradingView, on the other hand, is a professional charting tool with much more advanced features to do an in-depth analysis of cryptocurrencies, stocks, commodities, and more.

Alternative Exchanges to Buy Pi

Although HTX is the best exchange for Pi, you can buy it from other exchanges, too. Some names are:

- BitMart

- SuperEx

- Biconomy Exchange

Conclusion

Pi has been a phantom asset since its conception in 2019. Although its value is estimated at around $40 in the market nowadays, no one knows its actual value. You must be KYC-verified by the Pi network before trading it on the HTX exchange. However, remember that Pi trading is IOU-based because it has not been launched on the mainnet. So, the risks of losing money or getting scammed are real.