Wells Fargo is one of the oldest financial institutions in the United States. Established in 1852, it has expanded to rank among the biggest national banks in the region with thousands of branches and ATMs located all across the country. Numerous checking and savings accounts, as well as numerous additional banking options for people, companies, and businesses, are offered by Wells Fargo.

In 2024, one of the easiest and most dependable ways to purchase cryptocurrency is through traditional methods of payment. The following article explains how to use a bank transfer to purchase cryptocurrency on Coinbase using a Wells Fargo account.

Is It Possible to Buy Crypto with Wells Fargo?

It is possible to purchase cryptocurrencies with US dollars using a Wells Fargo account, but you will need to use a reliable cryptocurrency exchange. Wells Fargo doesn’t offer a service that enables you to convert fiat money for cryptocurrencies directly, but you can move money from your bank account into a cryptocurrency exchange and exchange its value for any cryptocurrency of your choosing. American customers can use conventional US bank transfers to deposit money on exchanges that support them, like Coinbase.

Is Wells Fargo Crypto-friendly?

Wells Fargo takes an evolutionary position on cryptocurrencies, coordinating its products with the legal frameworks set forth by well-known financial organizations in the United States, such as the Financial Crimes Enforcement Network (FinCEN). Wells Fargo allows its customers to use their accounts for cryptocurrency-related transactions as long as they adhere to FinCEN’s stringent guidelines for the use of digital assets.

This policy presents Wells Fargo as a trustworthy and fully compliant platform for consumers to securely explore the ever-evolving world of cryptocurrency. The bank guarantees a safe path for its customers to engage in the digital asset market by permitting transactions through authorized and regulated channels like Coinbase. This allows them to integrate these cutting-edge investment choices into their all-inclusive financial strategies.

Steps to Buy Crypto with Wells Fargo on Coinbase

With the bold notion that anybody, anywhere, should be able to send and receive Bitcoin with ease and security, Coinbase launched in 2012. They now provide a reliable and user-friendly platform for getting access to the larger crypto economy.

Beginners and experienced traders can use Coinbase to trade well-known cryptocurrencies like Bitcoin and Ethereum as well as less well-known but highly sought-after ones like SUI and MAGIC, with over 10,000 assets to select from. The platform offers an easy-to-use interface that is perfect for beginners and allows users to convert cryptocurrency to cash and vice versa in a straightforward manner.

Here’s a step-by-step guide on how to buy crypto with Wells Fargo on Coinbase.

Step 1: Open a Coinbase account.

You must first create an account on Coinbase. Fortunately, it only takes a little moment. To access the signup page, visit their official website and click the “Sign Up” button in the upper-right corner. To create an account, enter your name, email address, and password. Then proceed to confirm your email address.

Take a clean photo of a government-issued document and upload it to the site to complete the registration procedure. In a few minutes, Coinbase will examine your paperwork. You can go to the next stage once your paper has been approved.

Step 2: Add a Mode of Payment

For US consumers, Coinbase accepts credit/debit card payments, wire transfers, and online bank transactions. You need to link your bank account to the site to add a bank transfer method of payment. Coinbase will often ask you to select a payment method at the time of account creation. Even if you had skipped this step, adding a payment method is still possible.

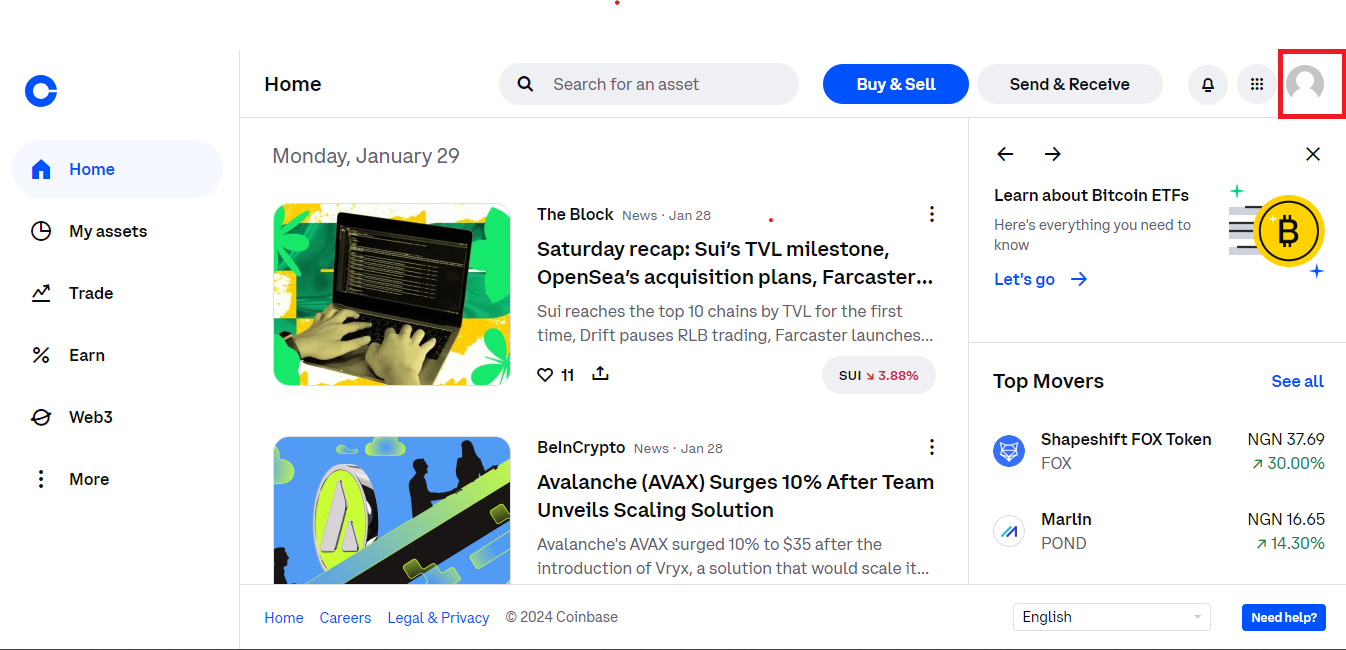

Click the avatar symbol in the upper-right corner of the screen when you’re on the homepage as shown in the image below.

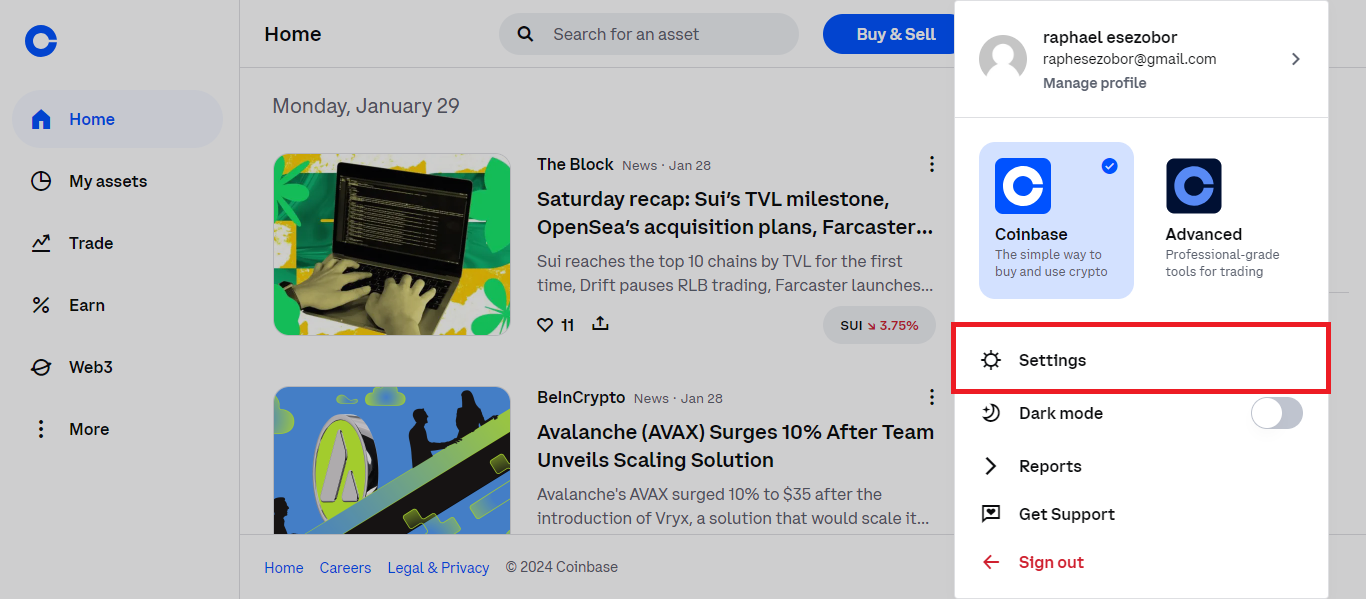

Click on “settings” in the drop-down menu.

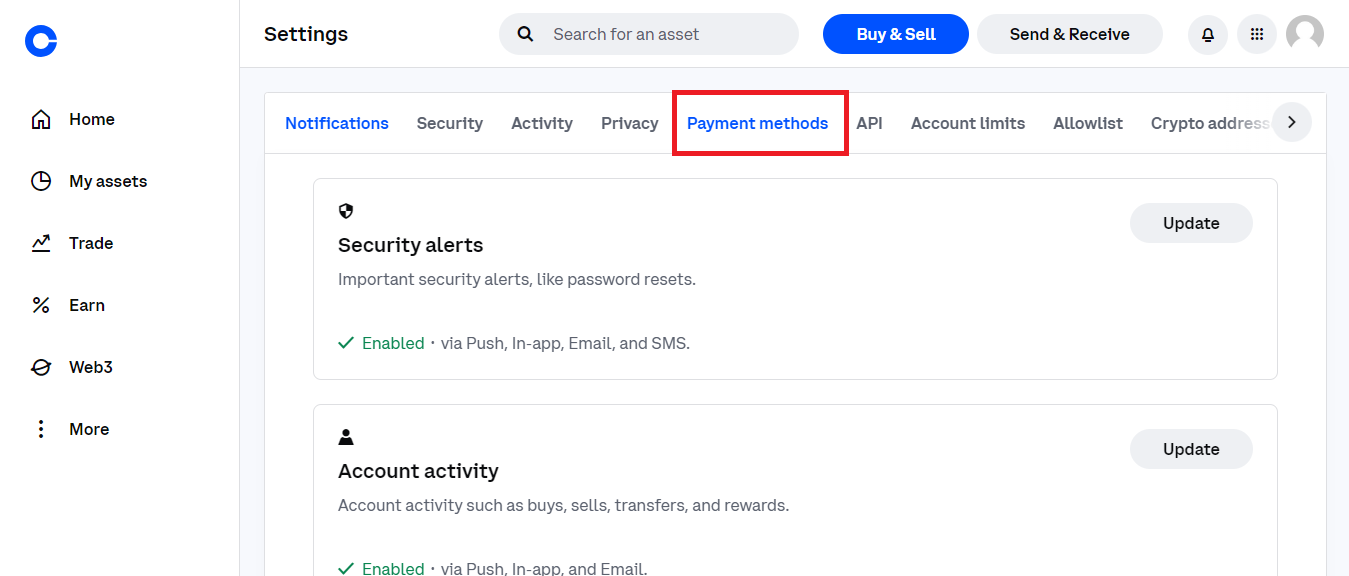

Click on “payment methods” in the available options as seen below.

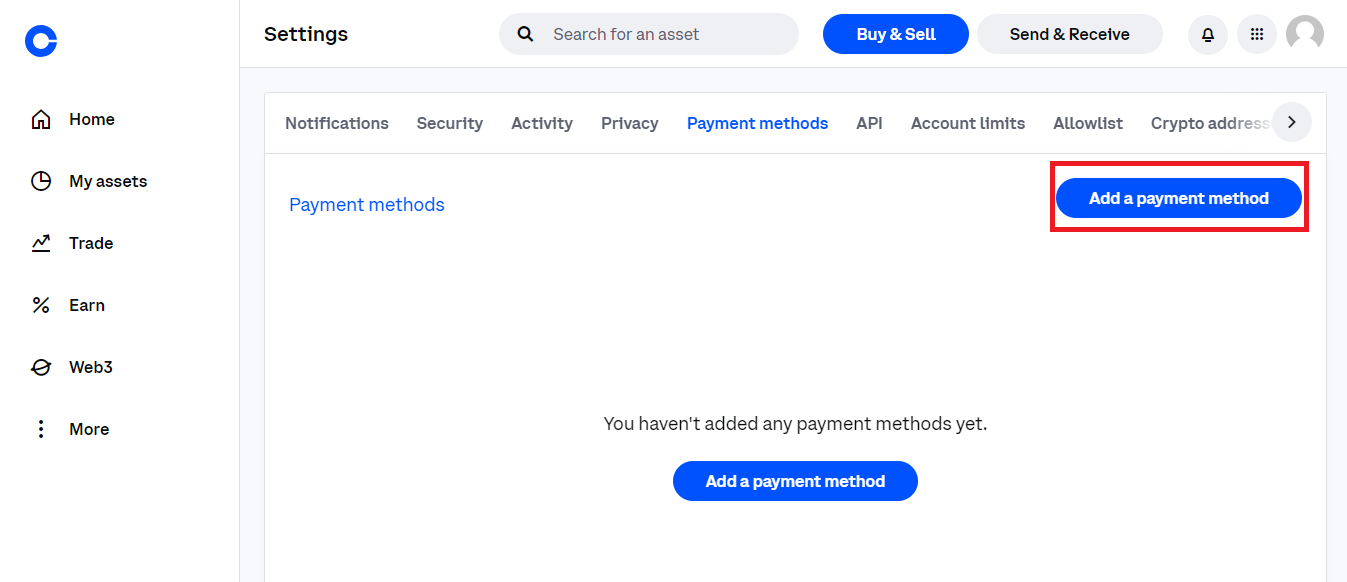

Click on “Add a payment method.”

Follow the instructions to successfully link your bank account to your Coinbase account.

Step 3: Deposit Money

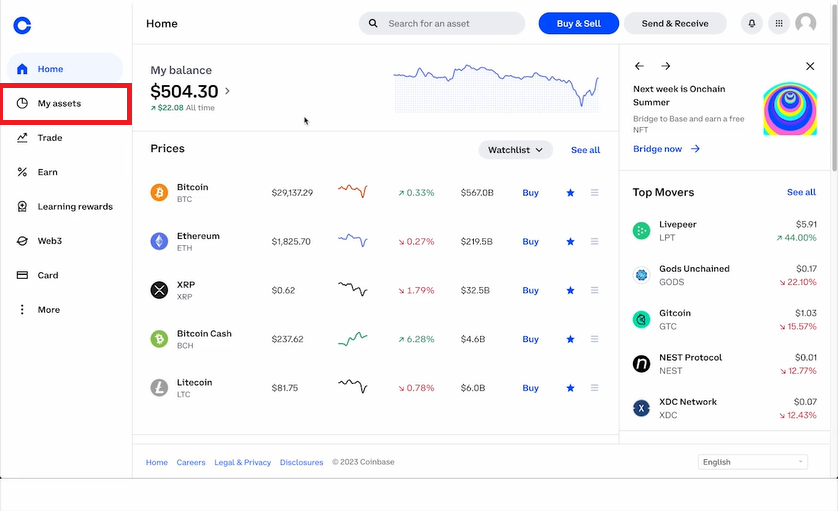

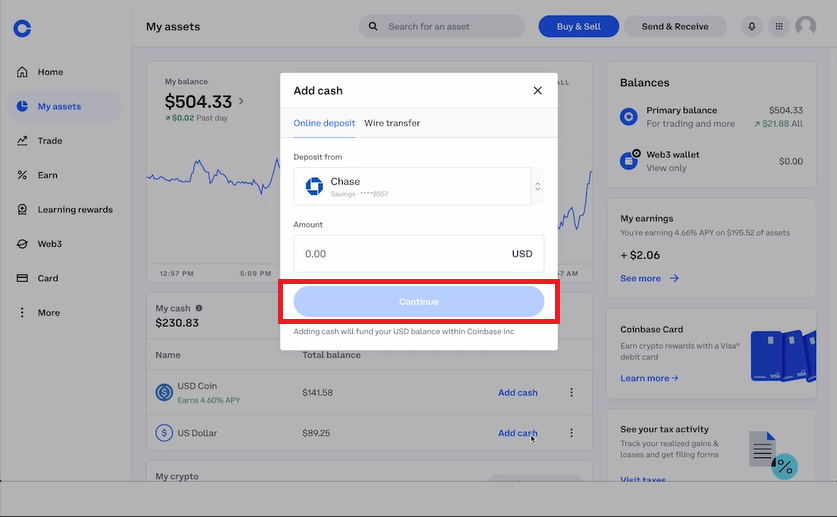

You can now add money to your USD balance after registering your bank account. Click the “My assets” link on the sidebar.

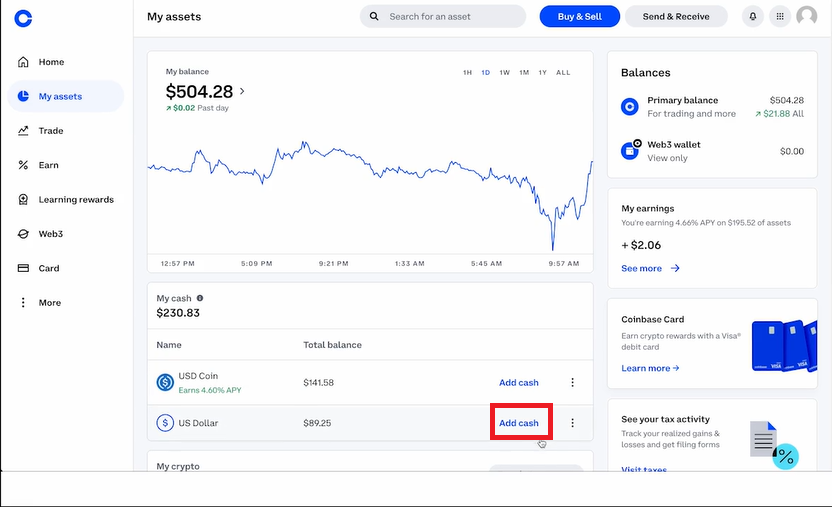

The amount that you currently have in USD will show on the screen. Click “Add cash” in the US dollar section under “My cash.”

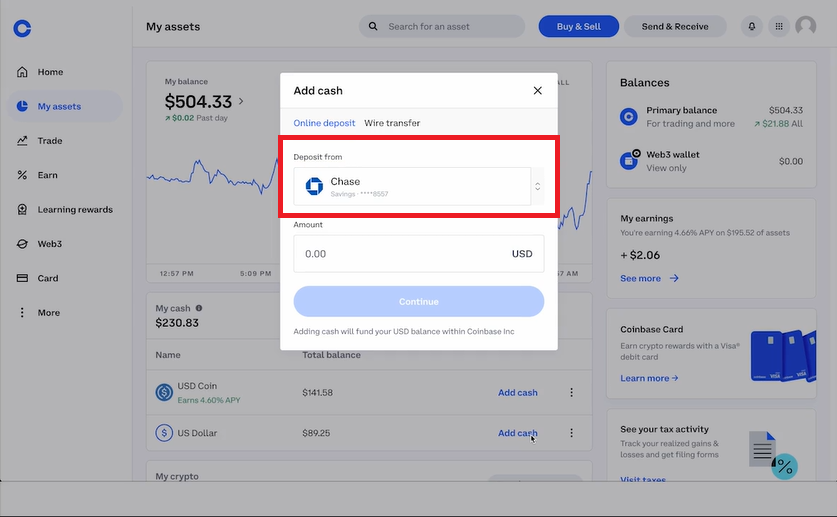

Choose “Wells Fargo” as the bank you want to use to start the transfer from the pop-up window by filling out the relevant section. You can also search for “Wells Fargo.”

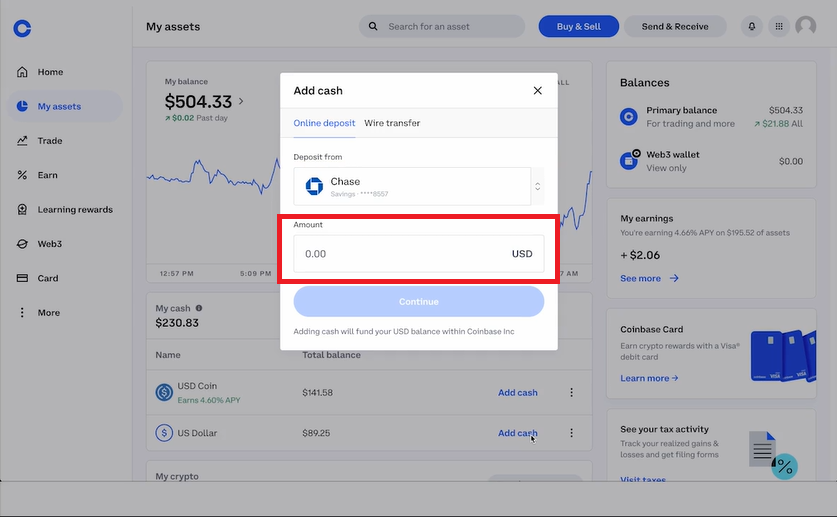

Enter the desired deposit amount in USD.

Click on the “Continue” button.

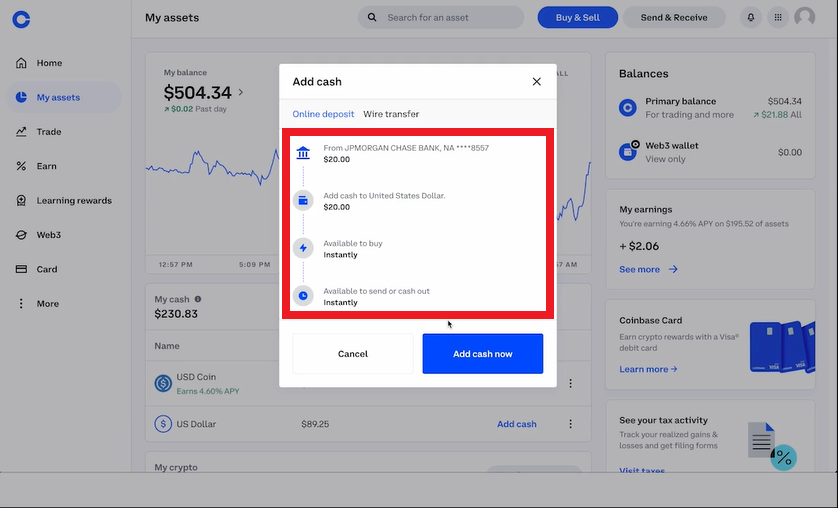

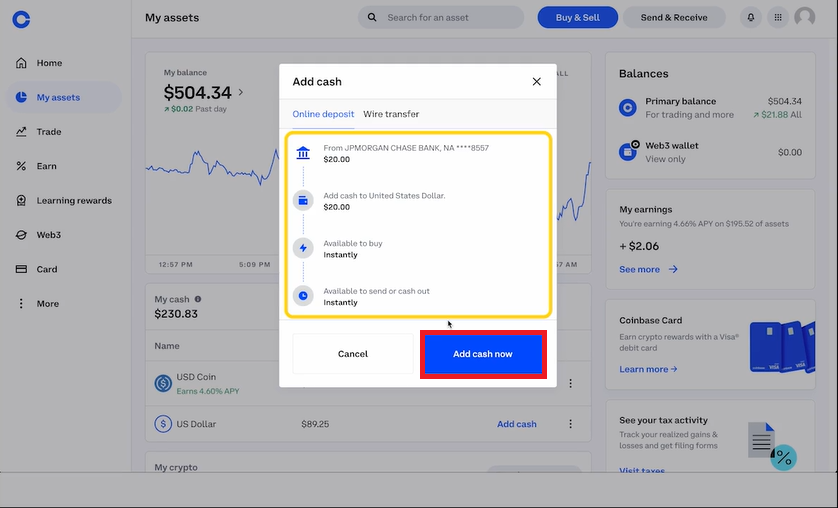

Make sure you have given accurate information by reviewing the transaction details one more time. Keep in mind that the name on your bank account and the government-issued document you provide for identity verification must match.

Click on “Add cash” to proceed with the transaction.

Congratulations! Your USD balance has been loaded successfully! You can now use the money you deposited to purchase any cryptocurrency on Coinbase.

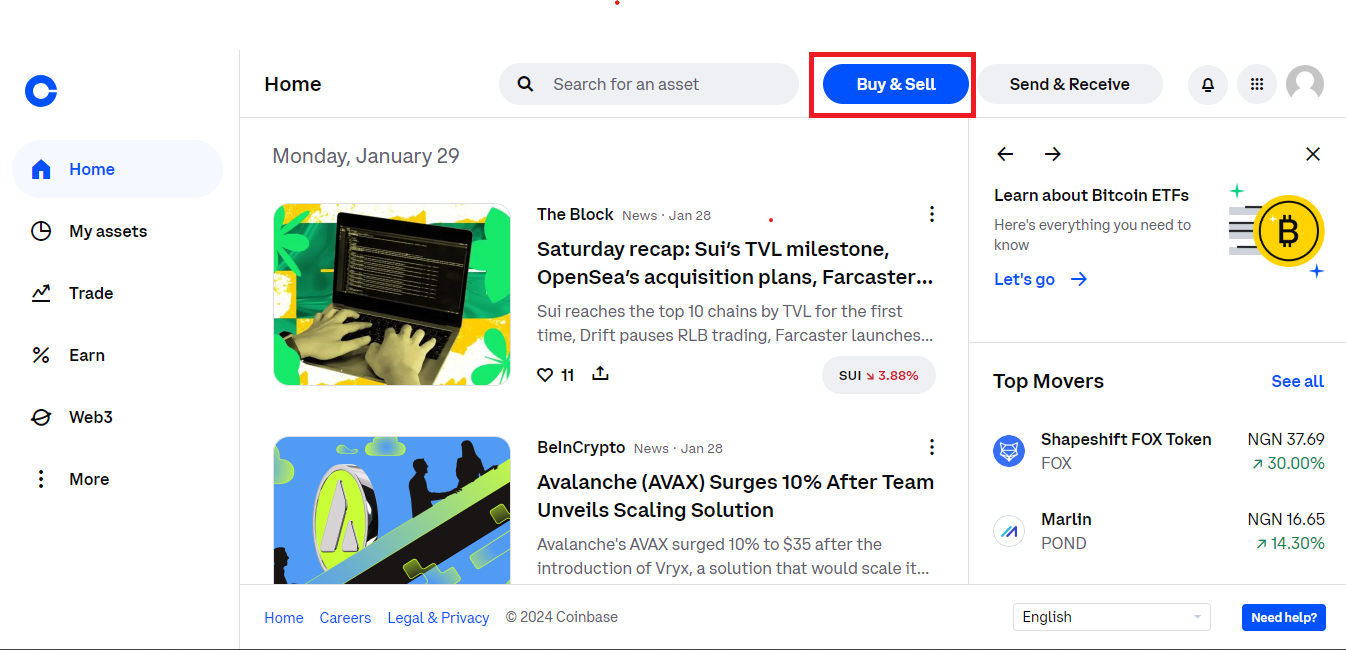

Go back to the web page and select the “Buy & Sell” button located at the top of the page as seen below.

Now, you are free to purchase any coin that is available on Coinbase. If you’re having trouble locating your favorite cryptocurrency, use the search filter to locate it easily.

About Wells Fargo

Wells Fargo is a multinational financial services company with headquarters in San Francisco, California. Having assets of almost $1.9 trillion. It is one of the top middle-market banks in the United States, serving over 10% of small businesses and one out of every three families.

Wells Fargo strives to improve the socioeconomic conditions of the communities it serves by promoting low-cost housing, the expansion of small businesses, sound financial practices, and a low-carbon economy.

In addition to mortgage banking, it also offers trust services, computer and data processing, insurance brokerage, equipment leasing, securities brokerage and investment banking, investment advising, and venture capital investment. It distributes its products globally through branches, ATMs, and mobile and online platforms.

Conclusion

In a quick summary, Wells Fargo enables its clients to transact with digital assets through regulated exchanges, even though it does not personally oversee crypto transactions. According to our analysis, Coinbase distinguishes itself as a superior choice for Wells Fargo clients by providing a large assortment of more than 200 cryptocurrencies, a friendly interface, and compliance with US regulatory requirements. Wells Fargo clients are assured a secure path in digital asset investing when they use a FinCEN-compliant platform such as Coinbase.