BTSE stands out as a prominent crypto exchange bragging a global user base of over 1.5 million. With its 100x leverage options, the platform provides users with many opportunities to flourish in the crypto market. Notably, one of its standout features is Bot trading.

In this comprehensive guide, we look into the details of BTSE’s Bot trading, exploring its features and strategic approaches. Whether you’re a seasoned trader navigating the crypto domain or a newcomer eager to explore, this blog post serves as your comprehensive roadmap.

BTSE provides Grid and Spot DCA bots copy trading for automated trading. There are two primary types of bots available

- Futures Grid

- Spot DCA

These bots are tailored for grid and spot trading strategies, empowering users with automated tools to optimize their trading activities on the platform.

BTSE Supported Trading Bots

1: Futures Grid

The BTSE Futures Grid Trading Bot is a remarkable tool that enables users to capitalize on market trends. Offering control over trade direction, price ranges, and up to 200 grids, this automated futures trading feature facilitates strategic execution.

Implementing a buy low, sell high approach within the defined range, harnesses market volatility for optimal results. Whether markets are surging, descending, or moving laterally, the Futures Grid Trading Bot on BTSE provides a comprehensive solution for traders seeking strategic automation in futures trading.

2: Spot DCA

BTSE’s Spot DCA bot is a versatile tool empowering users to automate trades by configuring purchase amounts, buying schedules, and selling points. This strategic approach aims to accumulate profits gradually, offering both beginners and experienced traders an efficient means to handle crypto market volatility. Its customizable interface aids traders in optimizing strategies for cryptocurrency success without constant monitoring.

How to Use BTSE Trading Bot 1

Futures Grid Trading and DCA Spot Trading

Note: Both Futures Grid and DCA Spot Trading have the same steps to copy their strategies.

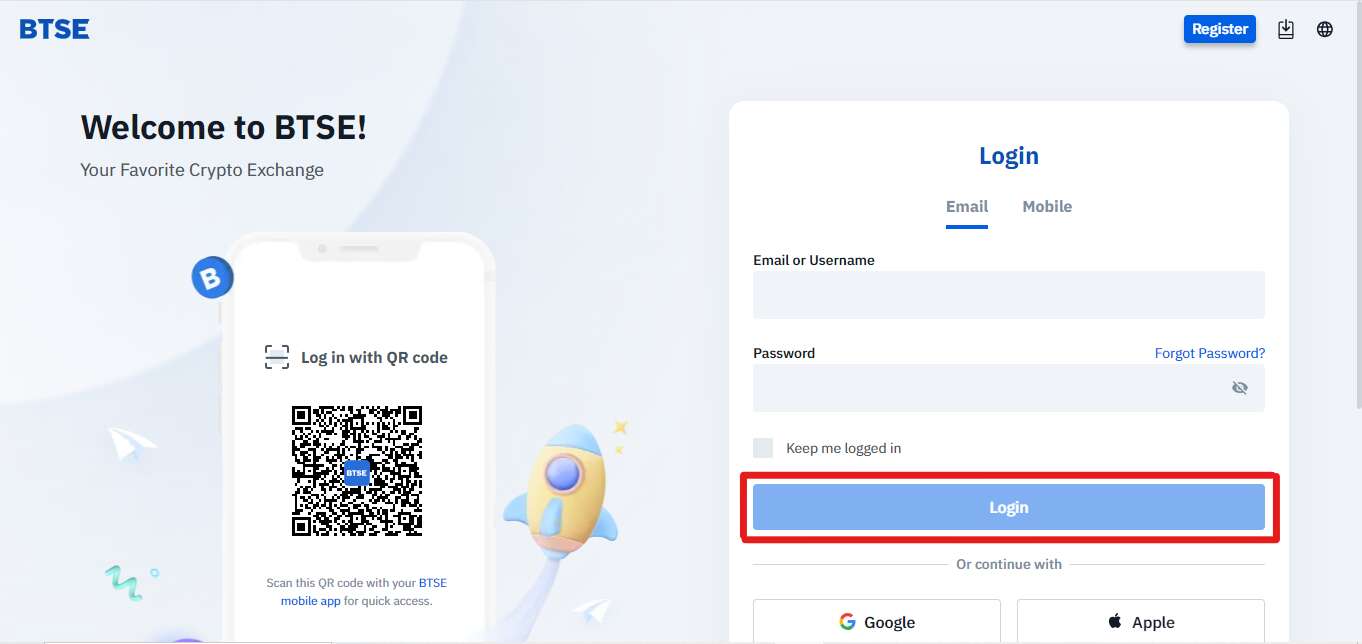

Step 1: Log into your BTSE Account

Start by logging into your BTSE account using your credentials, ensuring secure and authenticated access to the platform.

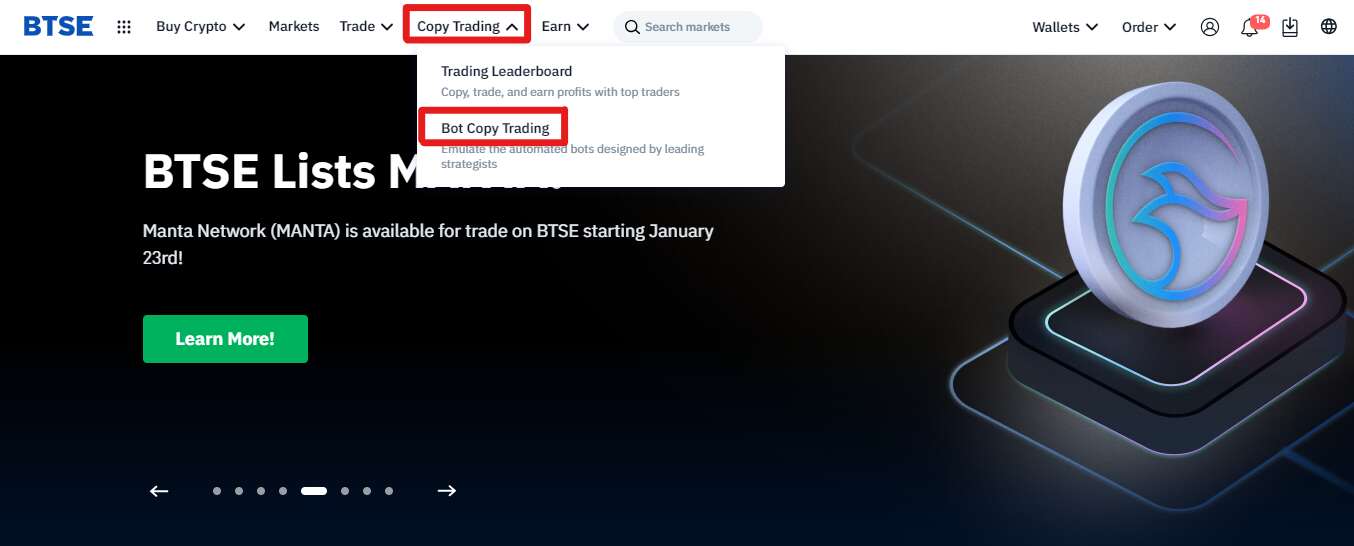

Step 2: Click on” Copy Trading”

Navigate to the Copy Trading section within the BTSE platform. This is typically found in the main menu or dashboard.

Step 3: Choose” Bot Trading” Option

Within the Copy Trading section, opt for the “Bot Copy Trading” option, indicating your preference to manually manage your trading activities.

Step 5: Scroll Down to the Middle

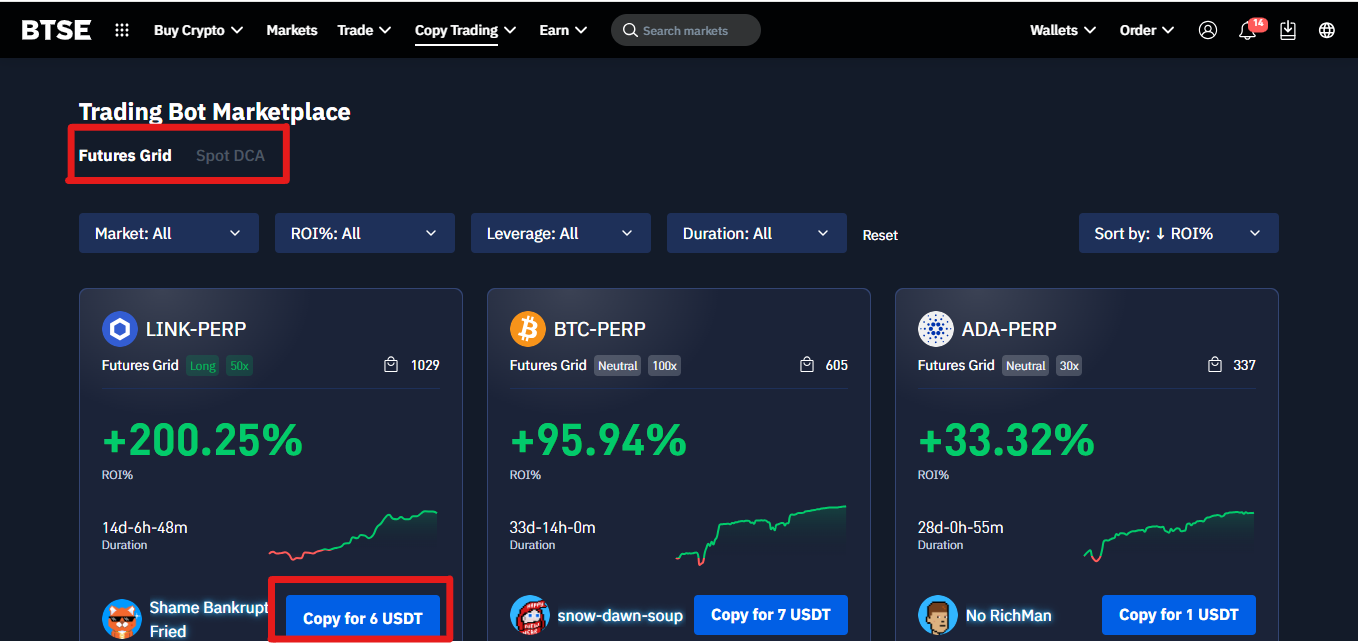

Scroll down through the Copy Trading interface until you reach the middle section where you can find options related to individual bots.

Step 5: Choose Between Futures Grid or Spot DCA

At this point, choose between Future Grid or Spot DCA, depending on your trading strategy and preferences. Each option caters to different trading styles.

Step 6: Choose a Bot and Hit Copy Button

Choose a specific bot that aligns with your trading goals. Once decided, click on the “Copy” button associated with the selected bot.

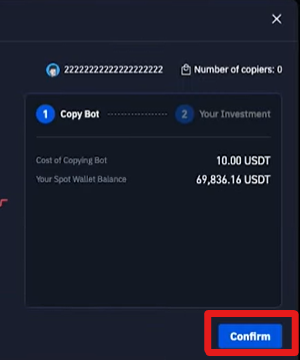

Step 7: Hot Confirm Button

After selecting the bot, confirm your decision by clicking on the “Confirm” button. This ensures that your chosen bot is now linked to your trading account.

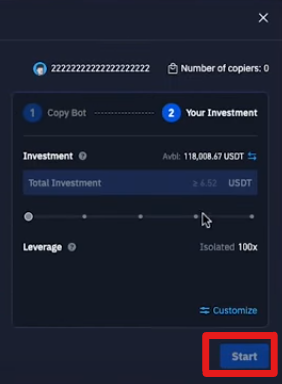

Step 8: Enter an Investment Amount

Specify the investment amount you wish to allocate to the selected bot. This step allows you to control the capital you expose to the automated trading strategy.

Step 9: Click on “Start” Button Leverage

Initiate the trading process by clicking the “Start” button. This action sets the bot in motion, executing trades based on the predefined strategy.

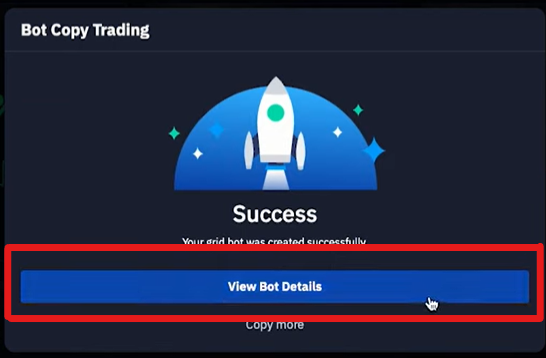

Step 10: Click on “View Details” to See Bot Details

To gain a deeper understanding of the bot’s strategy, click on the “View Details” option. This provides insights into the specific parameters and settings of the chosen bot.

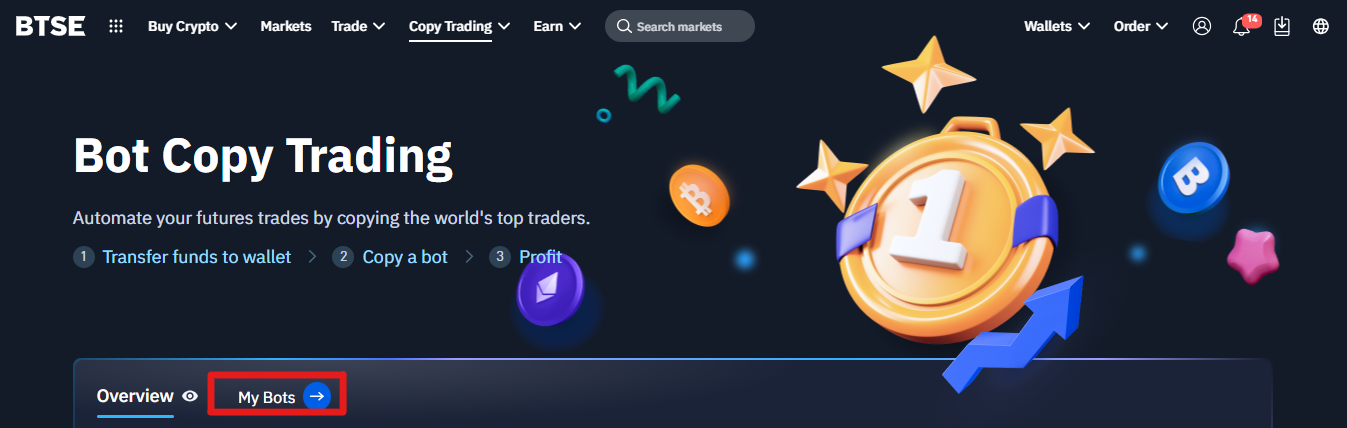

Step 11: Click on” My Bots” to See Your Bots

To monitor and manage your active bots, navigate to the “My Not” section within the platform. Here, you can track the performance and status of your linked bots.

By following these steps, you can effectively leverage BTSE’s Copy Trading features, tailoring your automated trading experience to suit your individual preferences and investment goals.

Best Third-Party Trading Bots For BTSE

Enhance your BTSE trading experience with the best third-party trading bots. Explore API integrations, notably with platforms like 3Commas, to unlock advanced features for automated trading. These external tools extend beyond BTSE’s capabilities, offering refined trading strategies and comprehensive portfolio management.

By integrating these third-party options, you can elevate your cryptocurrency trading experience, optimizing your strategies and gaining access to additional functionalities that enhance overall performance on the BTSE platform. Consider leveraging these tools for a seamless and enriched trading journey.

Summary

BTSE’s trading platform caters to cryptocurrency enthusiasts, introducing innovative features such as Futures Grid Trading and Spot DCA. These functionalities enable users, whether experienced or novice, to leverage automation and strategic customization.

By providing powerful trading tools, BTSE offers a comprehensive solution for different trading preferences and experience levels.