Embarking on your cryptocurrency journey can be both exciting and rewarding at the same time. However, by understanding the intricacies of buying, selling, and trading crypto, you can take calculated risks with confidence.

One great way to start is by taking advantage of peer-to-peer (P2P) services as a direct way of buying or selling crypto. The benefits of this method is there are several safety measures implemented (2FA, escrow).

For a secure P2P trading experience, I recommend that you consider the BTSE P2P trading marketplace. In this guide, we take a look at BTSE P2P, highlighting important aspects such as the pros and cons, tutorial guides, and tips to enhance your trading.

BTSE Overview

BTSE is a leading crypto exchange that was established in 2018 by a team specializing in trading technology. BTSE, an acronym for “Buy, Trade, Sell, Earn,” provides a secure and user-friendly marketplace for trading crypto.

Since then, BTSE has grown to be a crowd favorite for cryptocurrency traders thanks to the advanced features and multiple trading technologies they offer.

Some of the products and services offered by BTSE include OTC, spot, and derivatives trading, NFT marketplace, asset management, and more. Additionally, it offers advanced features for trading such as perpetual contracts and customizable leverage.

If you’d love to know more about the platform, feel free to check out our BTSE review.

Pros and Cons of BTSE P2P Trading

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Potential for profits as successful trades by experienced traders can be replicated | ❌ Investors may face losses if the selected trader's strategy performs poorly |

| ✅ Gain insights into trading strategies and market dynamics by observing seasoned traders | ❌ Reliance on the skills and decisions of the chosen trader, which may not align with personal risk tolerance |

| ✅ Allows individuals with limited trading knowledge to participate in the market | ❌ Less control over individual trades and strategy adjustments, as decisions are made by the copied trader |

| ✅ Access a variety of trading strategies and markets by copying different traders | ❌ Trading mistakes can increase losses, constraining deposit flexibility |

| ✅ Minimize the time commitment required for active trading by leveraging the expertise of others |

Understanding BTSE P2P Trading

Although getting started in cryptocurrencies can be a little daunting for beginners, BTSE P2P provides a somewhat good option for anyone who wants to buy or sell crypto.

For starters, BTSE peer-to-peer trading gives you the freedom to explore crypto ads and only select the one that aligns with your needs and strategy. Additionally, all P2P transactions have zero fees and are protected by escrow.

Unfortunately, BTSE P2P is extremely limited when it comes to the number of cryptos it offers (only USDT). Additionally, it has a strict verification process (KYC, Google Authenticator, & Address) that seems very unnecessary.

Nevertheless, if you’re determined to use the platform, below are step-by-step procedures on how to buy and sell crypto on BTSE P2P.

How to Use BTSE P2P Trading: Step-by-Step Procedure

BTSE is a stand-out, user-friendly platform that’s ideal for both beginner and seasoned traders. That said, to use BTSE’s P2P platform, you’ll need to create a BTSE account.

If you’re new, register on BTSE and create an account. Once you’re done, simply log in and follow any of the instructions below to buy or sell crypto.

How to Buy Crypto Using BTSE P2P Trading

To buy crypto using the BTSE P2P trading marketplace:

1. Join BTSE and register for an account. Make sure you complete KYC verification.

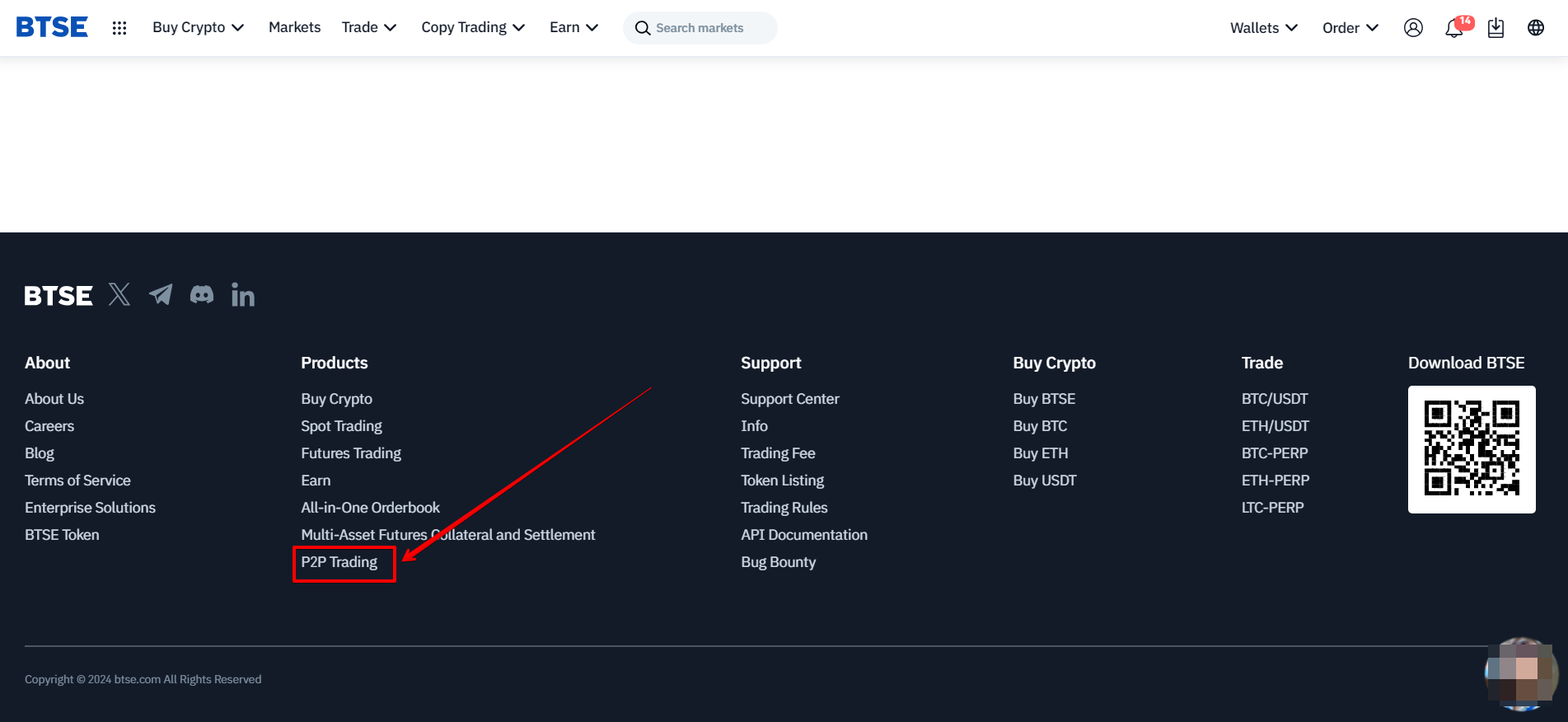

2. Scroll down to the bottom of the page and select “P2P Trading” under the Products column.

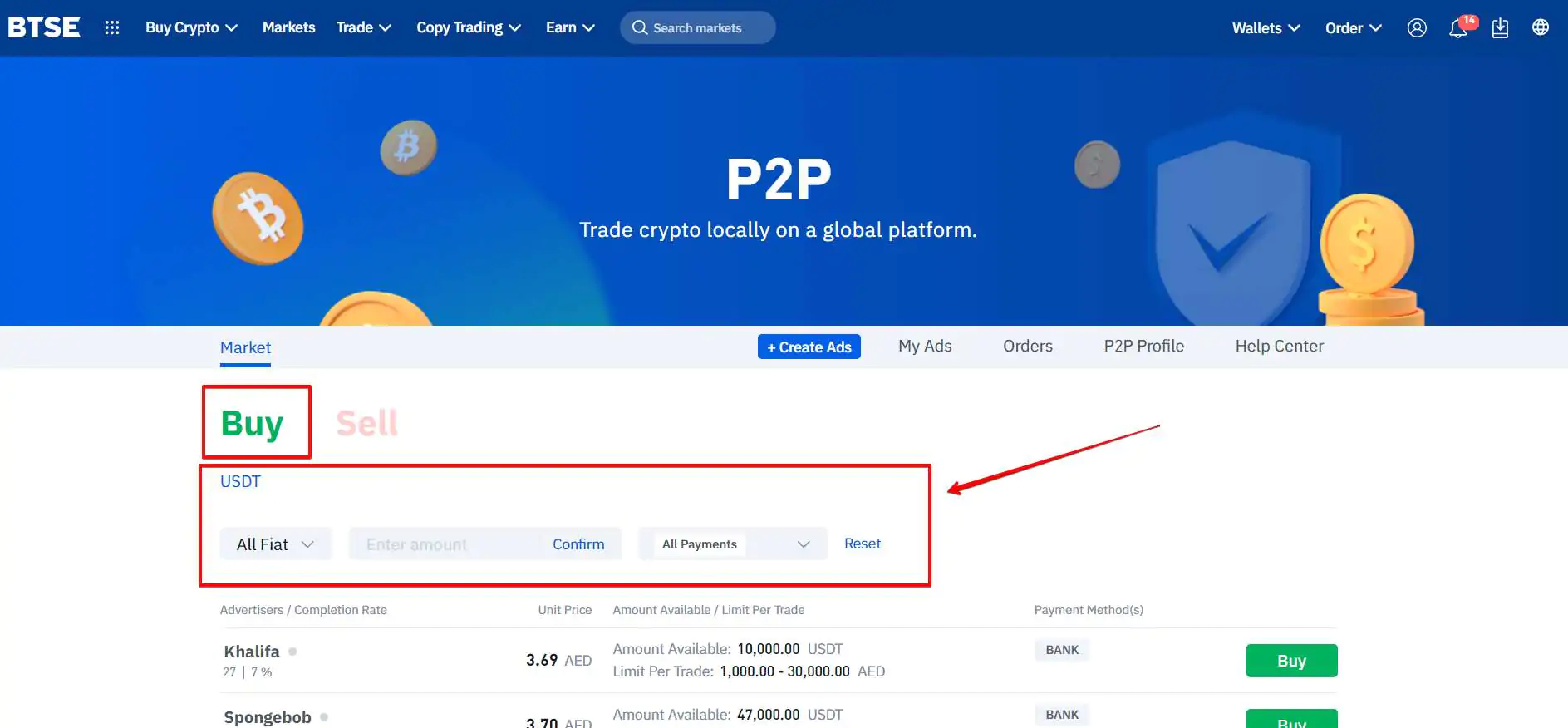

3. The “Buy” tab will be set automatically. Below this tab, select the kind of fiat you intend to use, the amount, and the payment method you plan to use. Unfortunately, you can only buy one kind of crypto; USDT.

4. Browse the available ads to select a counterparty that matches your requirements. Once you find one, click on “Buy.”

5. On the pop-up window, enter the amount of crypto that you want to buy. The system automatically calculates the amount of crypto you will receive. Enter your payment method and click “Buy USDT.”

6. In the order page, make payments to the merchant and click “I have made Payment.”

7. Wait for the merchant to verify the payments. Once verified, the merchant will confirm payment and release the crypto to you.

8. That’s it! You’ve successfully bought your first digital assets through the BTSE P2P trading marketplace.

How to Sell Crypto Using BTSE P2P Trading

To sell crypto using the BTSE P2P trading marketplace:

1. Join BTSE and register for an account. Make sure you complete KYC verification.

2. Scroll down to the bottom of the page and select “P2P Trading” under the Products column.

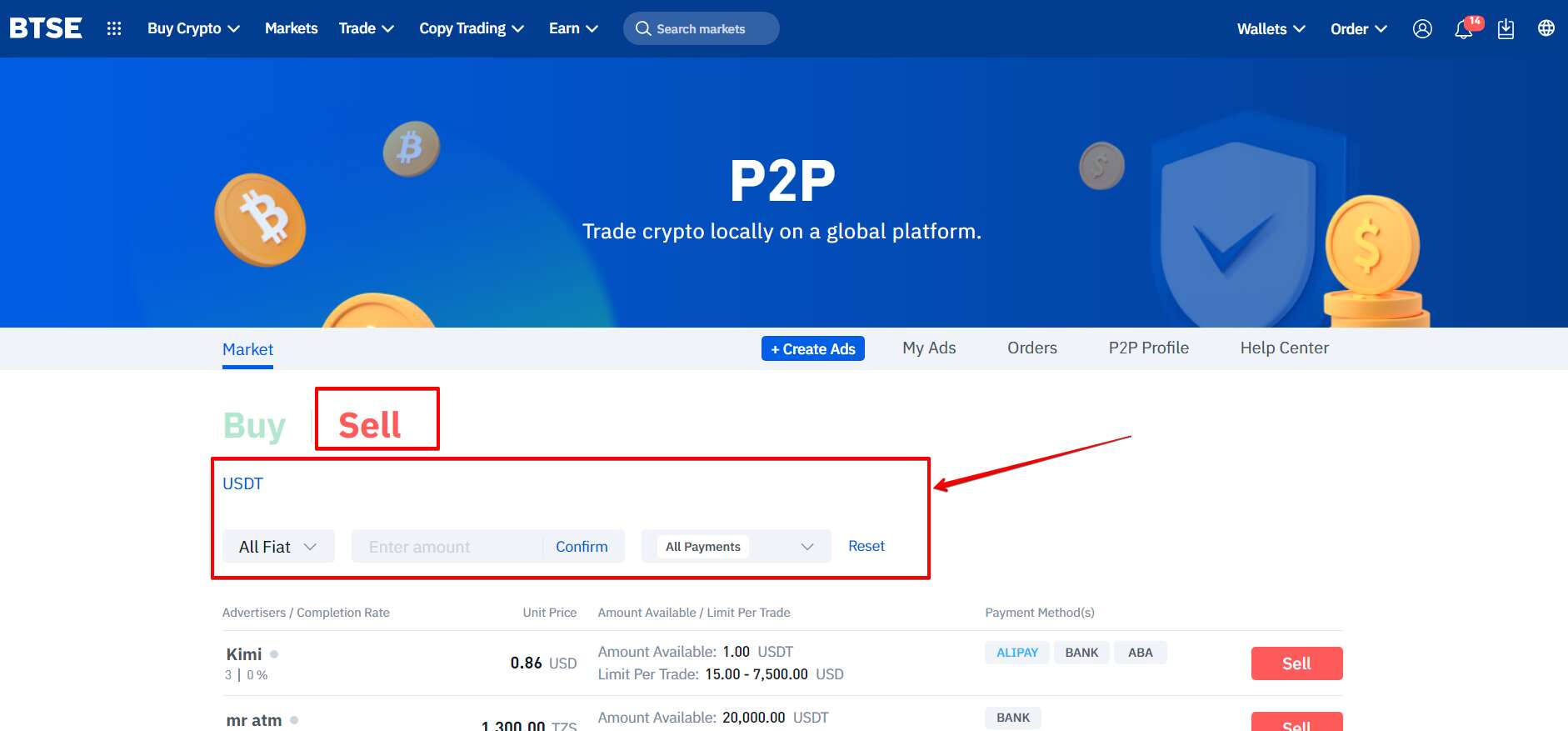

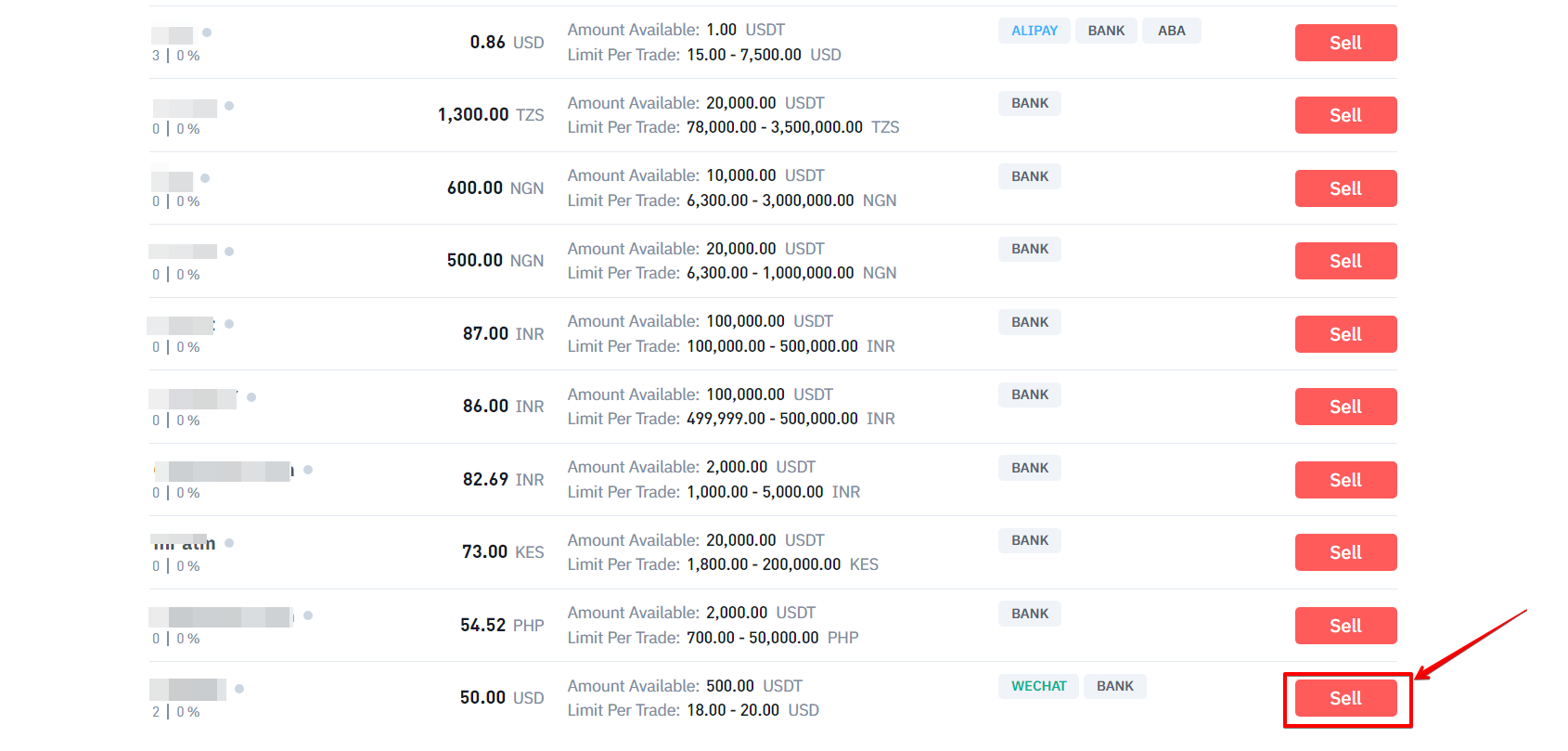

3. Select the “Sell” tab. Below it, enter the fiat currency, amount, and payment method you prefer. Unfortunately, you are only limited to selling USDT on their platform.

4. Scroll down and select the kind of buyer that best fits your requirements. Click the “Sell” button next to the seller you want to trade with.

5. In the pop-up window, enter the amount of USDT you would like to buy. The system will auto-populate the amount of fiat you will receive. Enter your payment method and click “Sell USDT.”

6. On the order page, wait for the buyer to make payments. Verify payments and click “Payment Confirmed” and “Release USDT.”

7. That’s it! You’ve successfully sold your first USDT on BTSE P2P.

BTSE P2P Trading Checklist

Here’s a comprehensive BTSE P2P trading checklist to help you as you navigate this new marketplace:

- Registration and Compliance: Registering on BTSE will require you to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. This is an essential step in P2P trading to ensure the security of all your transactions.

- Account Funding: Transferring assets to your BTSE P2P account is crucial especially if you are planning on selling crypto on the platform. Once your account is funded, you can start selling and accept payments through options such as bank wires, credit/debit cards, or SEPA transfers.

- Secure Storage: Having a secure storage/wallet is essential to your BTSE P2P journey. Different types of storage solutions offer varying levels of security and accessibility. It’s important that you get the best solution to move your assets off BTSE after completing trades.

- Investments and Risks: Cryptocurrencies are known for their extreme volatility. Therefore, before you start trading, assess your risk tolerance. Do your own research before investing in any kind of cryptocurrency.

- Safety Measures: Implement safety measures such as enabling 2FA and only handling P2P trades on BTSE. Additionally, avoid storing large amounts of crypto on BTSE. Always move them to a secure storage location. Safeguard your transactions by only using BTSE P2P.

- Irreversible Transactions: Remember that some cryptocurrency transactions, such as Ethereum, are irreversible. Therefore, it’s important that you double-check details before confirming any P2P transactions.

BTSE P2P Trading Tips

Follow these BTSE peer-to-peer trading tips to help you stay safe and improve your trading experience on BTSE:

- Abide by KYC/AML Rules: To use BTSE’s P2P trading, you’ll need to be a registered account holder. These qualifications are required in order to be eligible for P2P and all its features. Also, ensure that you are the only one using your account.

- Read the Terms of Trade: Before initiating a trade with a BTSE p2p counterparty, read the teams of trade on the ads description page. This is to help you avoid disputes once the order is initiated.

- Ensure Fiat Payment Method Matches: Make sure that the fiat payment method you use during every p2p trade matches with the fiat payment method you selected on the ad. Also, make sure that the payment information you use matches the one provided by your counterparty.

- Avoid Using Third-Party Channels: Only use the BTSE p2p facilitated channel to communicate with your counterparty. Avoid using other channels such as face-to-face trading, social media, or chat messaging apps to avoid leaking sensitive information or incurring losses.

- Don’t Use Foul/Offensive Language: Avoid using misleading, false, offensive, or foul language when communicating with your counterparty or even customer support live chat. Doing so can lead to restrictions on your account.

- Contact Customer Support for Help: BTSE has 24/7 customer support that’s willing to help you in case you run into any issues. In case of a dispute, prepare all the evidence/receipts you’ll require to get the matter settled promptly.

Summary

Although BTSE P2P offers a good option for anyone to buy or sell crypto, it has a strict verification process that requires KYC, 2FA, and address verification (documents) to allow anyone to conduct P2P trades.

Additionally, traders can access only one type of cryptocurrency; Tether. Compared to other P2P exchanges, BTSE is extremely lacking when it comes to the amount of cryptocurrency options it offers. Not to mention, the P2P option is extremely hard to find (hidden at the bottom of the page).

Fortunately, all P2P transactions have zero fees and are protected by escrow. If you’d still like to try out their P2P marketplace, join BTSE and start trading today.

FAQs

Are BTSE P2P Payments Safe?

All BTSE P2P payments are safe as long as they are executed on the platform. However, there is a risk of falling prey to P2P scams. Therefore, it’s mandatory that you familiarize yourself with the platform first.

How Does BTSE P2P Work?

A BTSE P2P user executes a direct peer-to-peer trade by placing a buy or sell order on the marketplace where another user fulfills the terms of the trade by completing the transaction without the need of an intermediary.

Can I Use BTSE P2P Trading in the US?

Unfortunately, BTSE peer-to-peer trading is restricted in the United States, Iran, and Syria. Therefore, traders from these regions can’t access any of their services, including P2P trading.