Does BTSE Require KYC?

No, BTSE doesn’t require KYC verification. That means you can deposit cryptos, trade, and withdraw profits from BTSE without having to verify your identity.

While users from all around the world can access BTSE without KYC verification, there are some withdrawal limitations. Unverified users can’t make credit card purchases.

Read on to learn everything you need to know about the BTSE Know Your Customer verification process.

Learn more about the platform in our comprehensive BTSE review.

Is BTSE safe to use without KYC?

BTSE appears to be a safe and secure crypto exchange to use, even without KYC verification. With a clean track record of zero hacks, BTSE remains a reliable platform for crypto enthusiasts. To safeguard customer funds, BTSE utilizes multi-signature cold storage wallets. That makes it nearly impossible to hack the assets.

With generous withdrawal limits for unverified users, BTSE is a good options for users seeking to make large transactions on a daily basis

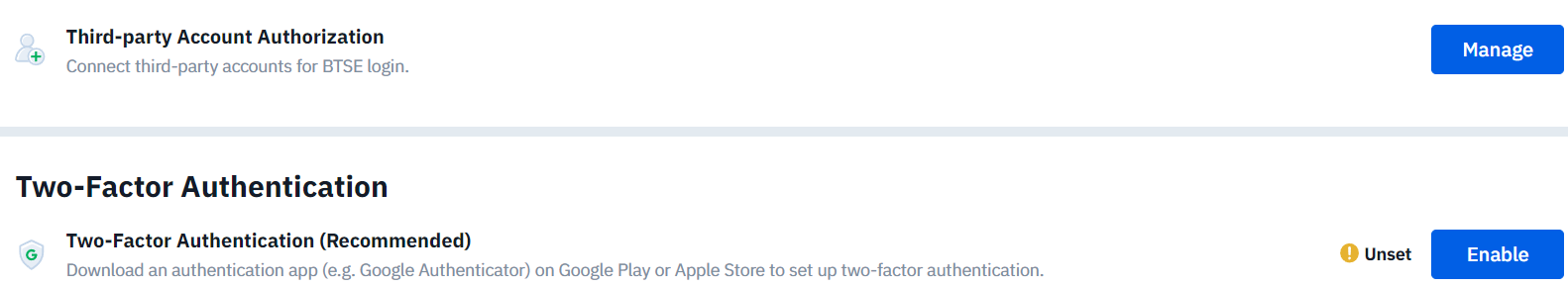

Additionally, BTSE supports typical account security protocols such as two-factor authentication via phone number and Google Authenticator.

The daily trading volume on BTSE regularly reaches over $1 billion, indicating high user trust. Additionally, BTSE offers trading for over 200 currencies with low fees.

While we consider BTSE to be a good option, we never recommend storing investments and long-term holdings on any crypto exchange. Only keep on the exchange what you are actively trading with. Other than that, all funds should be stored privately on a hard wallet such as a Trezor wallet.

BTSE Withdrawal Limits

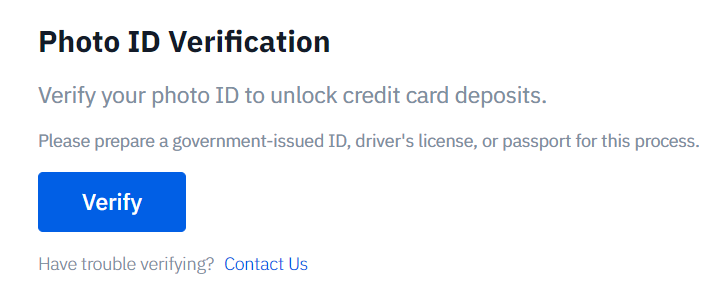

While BTSE is a no-KYC crypto exchange, one drawdown is its daily withdrawal limit for unverified users. To increase the daily withdrawal limit, you must do identity verification. Additionally, unverified users don’t have access to credit/debit card deposits and fiat transactions.

BTSE has different 24-hour withdrawal limit tiers based on the KYC verification level. Unverified BTSE users can withdraw $100,000 on a daily basis. For higher daily withdrawal limits, you must do the KYC verification. Level 1 KYC unlocks a $1,000,000 limit, and level 2 KYC unlocks $3,000,000. Refer to this article for more information.

You can see all withdrawal limits based on the respective KYC level in the table below.

| KYC Level | 24-hour Withdrawal Limit |

|---|---|

| No KYC | $100,000 |

| KYC 1 | $1,000,000 |

| KYC 2 | $3,000,000 |

BTSE KYC Requirements

If you decide to do the personal verification on BTSE, you must provide personal data such as a government-issued ID. The requirements are as follows:

- Level 1 KYC only requires an official document such as your ID, passport, or driver’s license, and a selfie

- Level 2 KYC requires proof of address with official documents such as utility bills or bank statements.

Bottom Line

BTSE is a no-KYC crypto exchange for users who want to remain anonymous while trading cryptocurrencies. The platform is well-designed and user-friendly, supports over 200 cryptocurrencies, has low fees, and has generous withdrawal limits.

Even when you are unverified, you have access to key features such as crypto deposits, withdrawals, and trading. However, to unlock everything on the platform, such as higher withdrawal limits and fiat support, you must verify your identity in the BTSE KYC process.

FAQ

Does BTSE require KYC?

No, BTSE doesn’t require KYC verification. You can deposit, trade, and withdraw without identity verification.

Is BTSE legit?

BTSE appears to be a legitimate crypto exchange. The platform was never hacked and has robust security measures in place.

What are BTSE withdrawal limits?

The daily withdrawal limit for unverified users on BTSE is $100,000. At level 1 KYC, you can withdraw $1,000,000, and at level 2 KYC, you can withdraw $3,000,000. It is safe to say that BTSE has generous withdrawal limits for no KYC users.