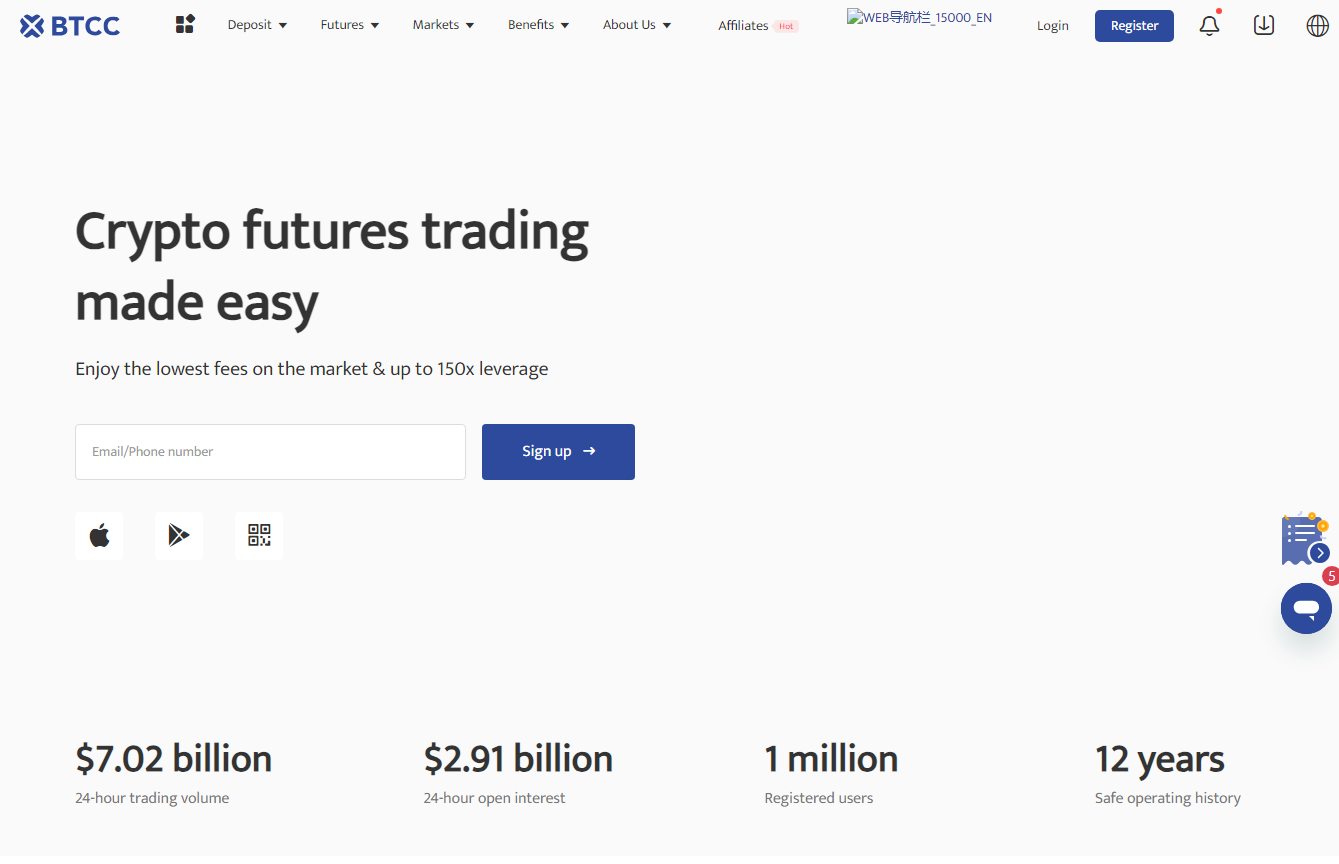

Founded in Hong Kong and now headquartered in the United Kingdom, BTCC is one of the world’s oldest cryptocurrency exchanges. Despite facing regulatory challenges in China, it has remained resilient.

But is BTCC a dependable choice for your crypto trading needs? Let’s further explore that in this comprehensive BTCC review.

To get started, you can check out all the key facts about BTCC at a glance in the comprehensive table below.

| 🚀 Founded | 2011 |

| 🌐 Website | www.btcc.com |

| 📌 Headquarters | United Kingdom |

| 🔎 Founder | Bobby Lee |

| 👤 Users | 10+ m |

| 🪙 Supported Spot Cryptos | 80+ |

| 🪙 Futures Contracts | 320+ |

| 🔁 Spot Fees (maker/taker) | 0.2% / 0.3% |

| 🔁 Futures Fees (maker/taker) | 0.025% / 0.045% |

| 📈 Max Leverage | 500x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.7/5 |

| 💰 Bonus | $11,000 (Claim Now) |

BTCC Overview

BTCC, one of the oldest cryptocurrency exchanges worldwide, has garnered a reputation for its reliability, security, and liquidity, making it a favored choice for users seeking a reliable crypto trading platform.

Founded back in 2011 by Bobby Lee, whose brother, Charlie Lee, is renowned for his role in Coinbase and Litecoin, BTCC started its journey with substantial investments from international venture capital.

Over the years, it grew to become one of the largest cryptocurrency exchanges in China. However, challenges arose as it had to suspend Yuan deposits multiple times due to uncertainties regarding China’s cryptocurrency stance.

In response to these developments, BTCC initiated significant changes in its operations. BTCC shifted its headquarters to the UK to expand its international reach while maintaining its steadfast commitment to reliability and security.

BTCC offers spot, futures (with up to 500x leverage), and copy trading. Additionally, BTCC integrated a free demo trading feature, making it a great option for beginners seeking a reliable practice environment.

What we love most about BTCC is its generous crypto signup bonus. Up to $11,000 in trading bonuses can be claimed on BTCC.

You can check out our BTCC bonus guide to get the best value for money on the exchange.

| 👍 BTCC Pros | 👎 BTCC Cons |

|---|---|

| ✅ BTTC mobile app is available for Android and iOS | ❌ Limited customer support options |

| ✅ Supports fiat currency deposits and withdrawals | ❌ Supports limited cryptocurrencies |

| ✅ Offers various order types for tailored trading scenarios | ❌ High withdrawal fees |

| ✅ Low trading fees | ❌ Priority for deposits worth > $200 |

| ✅ Proprietary multicurrency wallet for secure storage | ❌ Only offers trading products, no earn products |

| ✅ User-friendly trading interface | |

| ✅ Reliable customer service | |

| ✅ No history of hacks or scandals | |

| ✅ Free demo trading supported |

BTCC Signup & KYC

Trading on BTCC is a relatively straightforward process as KYC is not required, meaning you can stay anonymous. You can start our trading journey with this exchange by following the simple guidelines below. First of all we recommend you check if your country is supported on BTCC with out BTCC restricted country checker.

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform. Due to regulations, BTCC does not support every country. To ensure that you are eligible to register on the exchange, you can use our free BTCC country checker.🌍 Free BTCC Country Checker

Simply type in your country and see if you can use the platform or if your country is restricted.

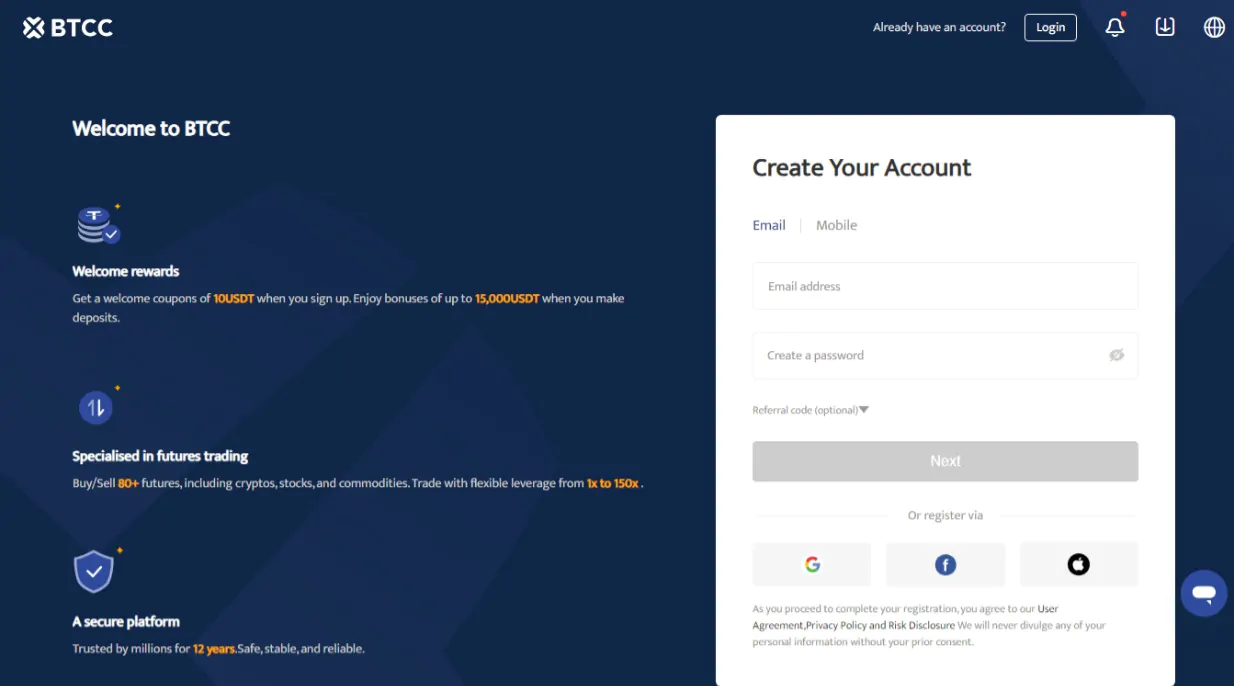

Step 1: Sign Up

BTCC currently caters to users in the United States. To begin, attempt to sign up on BTCC. While the availability of Chinese and American users may vary due to ongoing changes, it’s worth trying to create an account to see your eligibility.

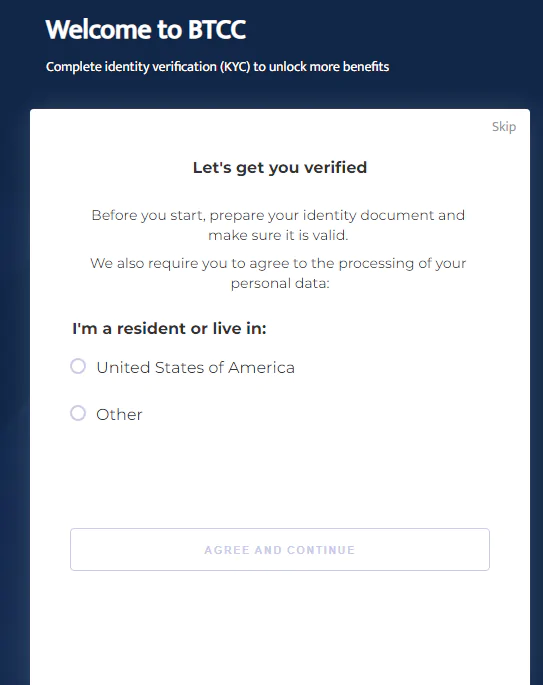

Step 2: Verification

KYC is not required if you want to trader, however, it will unlock all features of the exchange. To complete your BTCC verification, follow these steps: Verify your email, set up passwords, enable Two-Factor Authentication (2FA), and make account deposits.

Additionally, be ready to fulfill KYC (Know Your Customer) requirements, which entail submitting a photo of your face, a government-issued ID, and proof of address. Keep in mind that KYC requirements may change during BTCC’s transitional period.

You can learn more about the verification process in our BTCC KYC guide.

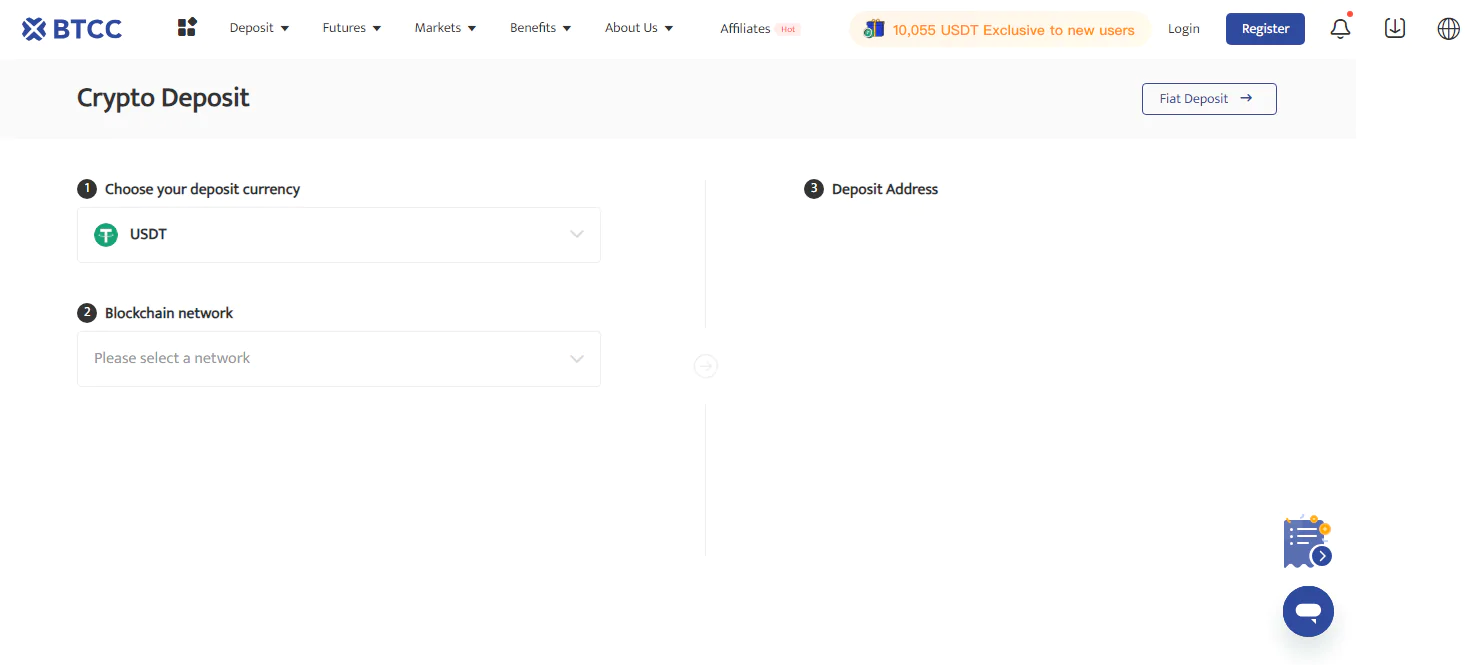

Step 3: Deposits & Withdrawals

You can perform deposits and withdrawals using credit/debit cards, bank transfers, or Bitcoin. Remember that fees vary based on the chosen action and payment method.

Step 4: Start trading

Users can easily buy or sell the four supported assets inside the primary trading interface using different order types, including Limit Orders, Market Orders, Stop Orders, and One Cancels Other Orders.

BTCC Regulation & Security

With a global user base exceeding 1.6 M, BTCC is unwavering in its commitment to security, backed by several key pillars.

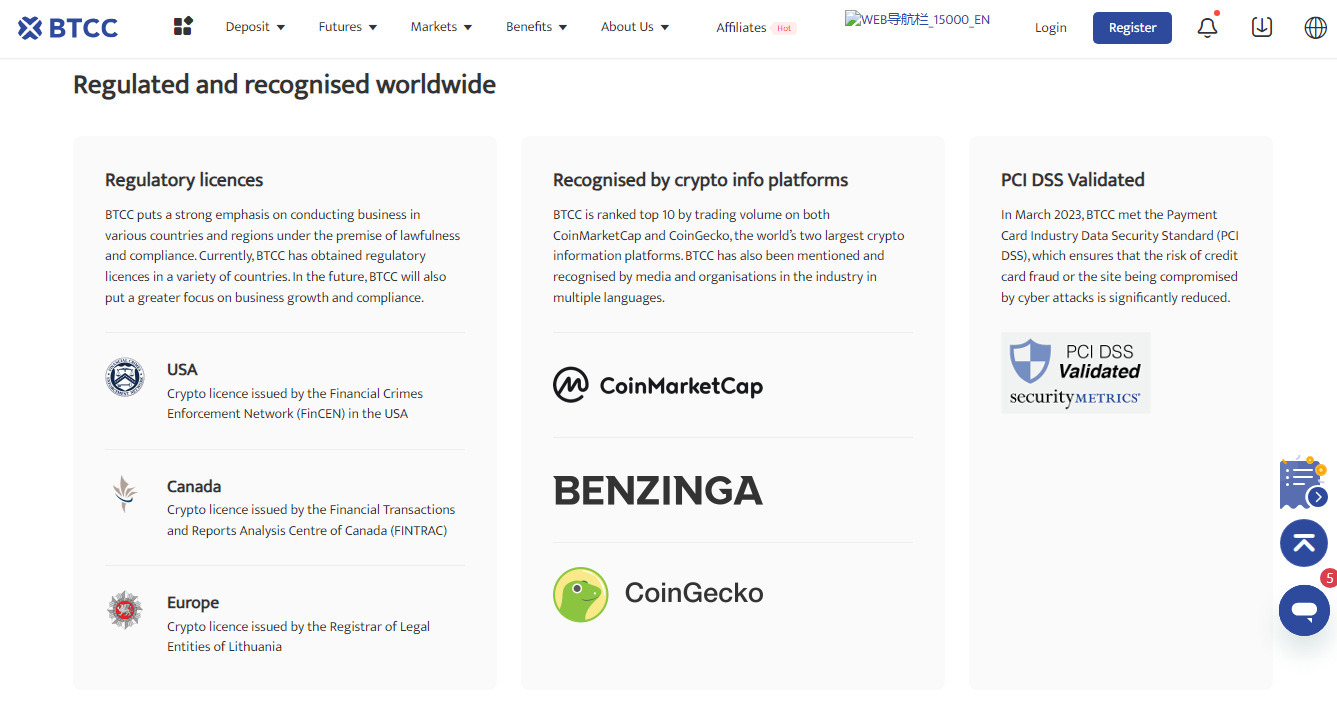

BTCC operates globally while prioritizing compliance with local regulations, holding regulatory licenses in various countries, including the USA, Canada, and Europe.

Learn more about banned countries in our BTCC restricted countries guide.

This dedication to legal and ethical cryptocurrency trading has earned industry recognition, consistently ranking among the top 40 exchanges on CoinMarketCap.

Furthermore, BTCC’s adherence to the Payment Card Industry Data Security Standard (PCI DSS) significantly mitigates the risk of credit card fraud and cyberattacks.

To ensure platform security and an optimal user experience, BTCC conducts regular maintenance and updates, promptly notifying users through various channels.

This comprehensive approach to security underlines BTCC’s reliability and commitment to providing a secure trading environment for its global user base.

Lastly, you can delete your BTCC account if you want to cut all ties.

BTCC Supported Assets

BTCC stands out with its wide variety of tradable assets, which not only include cryptocurrencies but also stocks, commodities, and indices.

One major downside of BTCC is its relatively new spot market, where only 85 cryptocurrencies are supported for buying and selling without leverage. You can trade all major cryptos, such as BTC, ETH, SOL, XRP, and more. Memecoins such as DOGE and SHIB are also supported.

The major strength of BTCC is its futures market. Here, traders can access over 320 assets with leverage of up to 500x. What makes BTCC stand out most is its support for tokenized traditional finance assets such as Stocks (including Apple, Google, NVIDIA, Amazon, and more), Indices including SPX 500 or TECH100, and even commodities such as Gold and Silver. Additionally, BTCC offers support for over 300 cryptocurrencies.

| Spot Cryptos | 80+ |

| Futures Cryptos | 300+ |

| Commodities | Gold, Silver |

| Indices | SPX500, TECH100 |

| Stocks | AAPL, AMD, AMZ, CIFR, CLS, DELL, COIN, INT, GOOGL, KOU, MARA, META, MSFT, NFLX, NVDA, TSLA, TSM, URA, VUSD, WGMI |

BTCC Trading Features

The BTCC trading platform boasts a straightforward interface suitable for novice and experienced cryptocurrency traders.

Spot Trading

In 2023, BTCC launched a new spot trading feature supporting over 80 cryptocurrencies for buying and selling without leverage. The spot market is very beginner friendly with basic order types (compared to the futures market). After buying cryptocurrencies on the BTCC spot market, you can easily withdraw them to your personal wallet.

Generally speaking, the BTCC spot trading feature is a great way to obtain your desired spot holdings in a user-friendly trading environment with moderate risk levels due to the absence of leverage.

Supported order types for spot trading are:

- Limit order

- Market order

- Trigger limit order

- Trigger market order

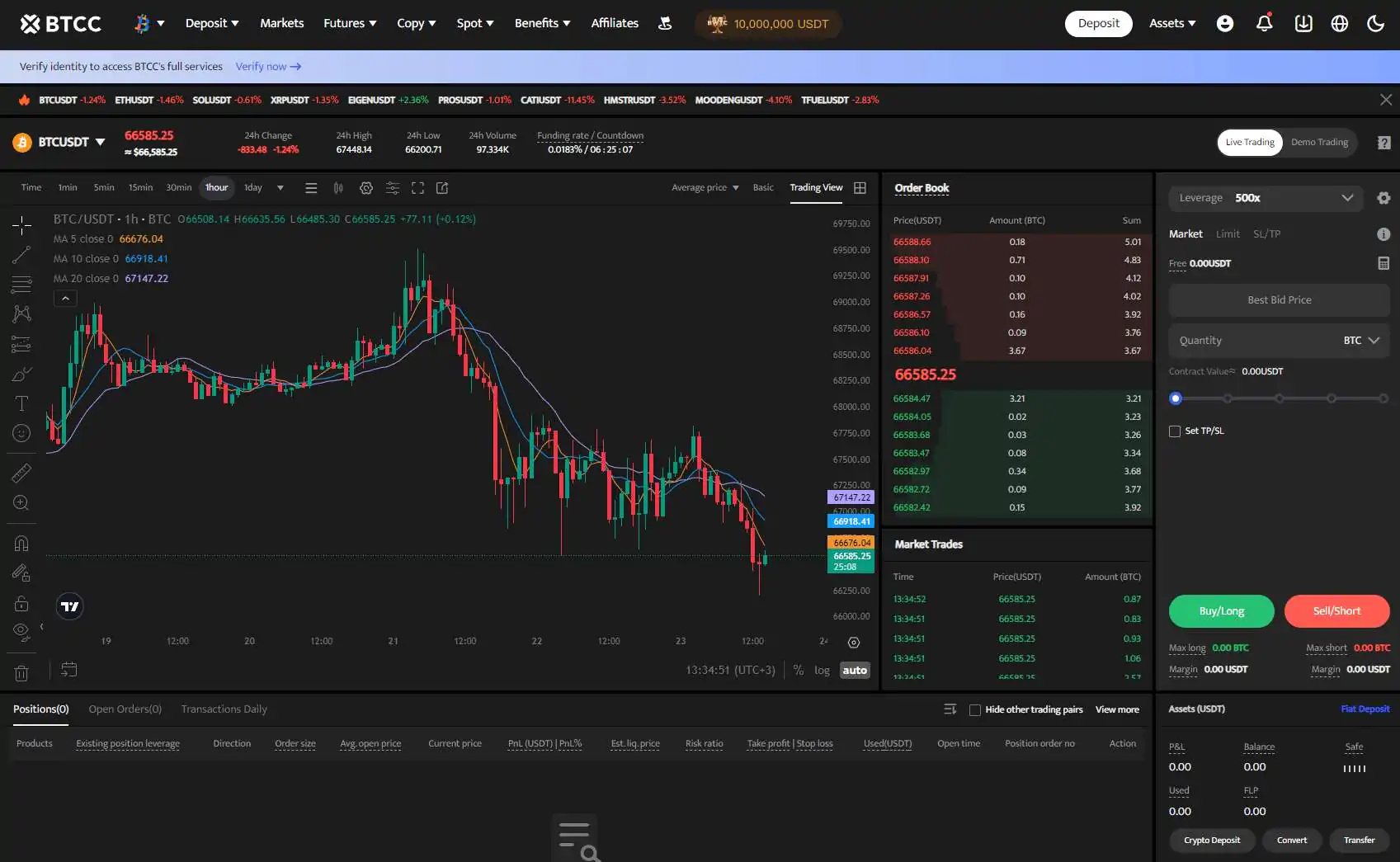

Futures Trading

BTCC specializes in providing futures trading services with low fees and deep liquidity for over 300 cryptocurrencies. What makes BTCC stand out is its support for leverage of up to 500x.

For crypto trading, BTCC offers two distinct types of crypto futures:

- USDT-Margined Futures: Settled in USDT, these futures contracts enable users to trade on 104 popular cryptocurrencies, including BTC, ETH, DOGE, XRP, SOL, and many others.

- Coin-Margined Futures: Settled in various cryptocurrencies, coin-margined futures offer traders the flexibility to diversify their portfolios across a wide array of digital assets.

You can learn more in our BTCC futures guide.

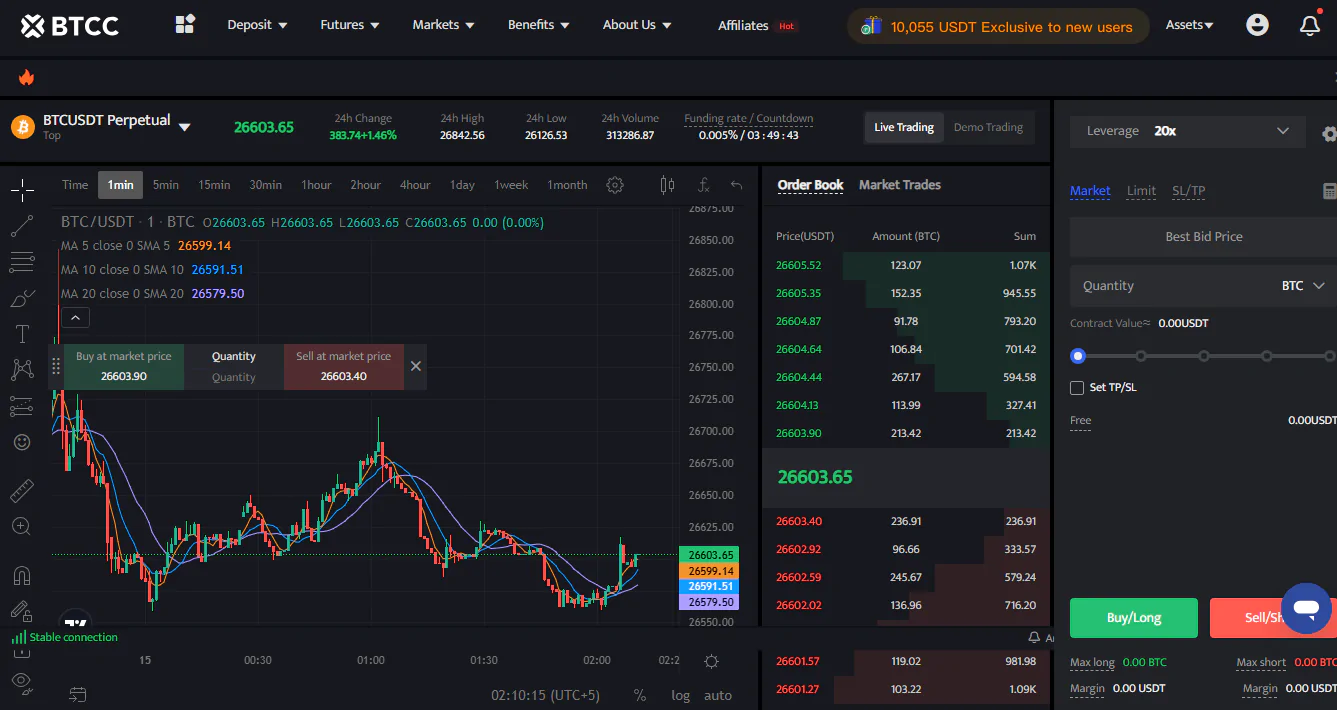

As shown in the image above, BTCC offers diverse trading types, making it accessible to a broad audience. These trading types include:

- Market Orders: Users can buy or sell cryptocurrencies at the prevailing market price, ensuring swift execution of their trades.

- Limit Orders: With limit orders, traders can set specific price points at which they wish to buy or sell cryptocurrencies. For instance, they can buy when the price reaches a predetermined low point.

- Stop Orders: Designed to limit potential losses, stop orders activate when the price of a chosen asset hits a specified low point, allowing users to sell at a predefined level.

- One Cancels Other Orders: While less common, these orders function precisely as their name suggests. When the price of an asset reaches a predetermined point, a buy or sell trade is executed, and any additional buy or trade orders with unmet price conditions are canceled.

- TP/SL: You can add automated take profit and stop loss levels to your trade so it will close automatically when reaching the specified price.

- Position Mode: Select between hedge, one-way, and order mode based on your preferred trading strategy.

All of these trading types can be conveniently executed within the user-friendly interface of the BTCC exchange.

Tokenized Futures

In 2022, BTCC introduced commodity and stock tokenized futures, expanding its offerings beyond cryptocurrencies. Users can now diversify their investment portfolios by exploring additional financial instruments.

These tokenized futures are settled in USDT, enhancing accessibility and convenience for traders. This is a unique feature that only very few platforms offer. If you are seeking traditional assets such as stocks, gold, silver, or even indices such as SNP 500, BTCC has you covered.

BTCC Demo Trading

Another noteworthy feature of the BTCC exchange is its perpetual demo trading account. Upon registration, users receive a substantial 100,000 USDT in virtual funds, providing an ideal practice environment.

This risk-free resource enables traders to refine their strategies, gain confidence, and enhance their skills without any real capital on the line. It’s a valuable feature that makes BTCC an excellent choice for traders at all experience levels.

Read our BTCC demo trading guide to learn how to get started step-by-step.

BTCC Products & Services

BTCC may offer a limited array of features that are supported by today’s standards, but its focused approach serves a purpose. The main focus of BTCC is clearly its futures trading platform with low fees, extensive liquidity, and up to 500x leverage.

This streamlined selection is not a drawback. Instead, it reflects BTCC’s commitment to providing a straightforward trading experience for cryptocurrencies with the broadest appeal, avoiding the complexities of niche markets.

BTCC offers spot, futures, demo and copy trading. Additionally, BTCC offers an affiliate program where users can earn up to 50% commissions and BTCC regularly hosts events and campaigns where users can earn bonuses and rewards.

Moreover, BTCC offers a feature-rich, multi-currency mobile app for both iOS and Android mobile devices, ensuring secure and convenient cryptocurrency trade management on the go. Financial products such as staking or mining are not supported.

Notably, BTCC sets itself apart by supporting One Cancels Other (OCO) orders, a feature that distinguishes it from many other exchanges, enhancing flexibility for traders.

BTCC Fees

Unlike many exchanges that charge high fees, especially those catering to specific national markets, BTCC offers competitive rates.

Trading Fees

The exchange employs a tiered fee system for futures trading based on users’ VIP levels, ranging from VIP0 to VIP9.

Spot trading fees start at 0.2% for taker orders and 0.2% for maker orders.

For lower fees, we recommend futures trading where BTCC charges only 0.025% maker and 0.045% taker fees. Based on your trading volume, you can lower your trading fees to 0% maker and 0.01% taker, which are some of the lowest rates in the crypto industry.

Advancing through these VIP tiers grants users access to discounts on trading, withdrawal, and cryptocurrency conversion fees and the ability to cover trading fees using coupons.

Users at VIP3 or higher enjoy exclusive benefits, including birthday gifts, BTCC-branded merchandise, and dedicated support from an account manager and customer service team.

Withdrawal Fees

While BTCC’s transaction fees are highly competitive, it’s worth noting that withdrawals are subject to relatively higher trading fees compared to some competitors. The minimum Bitcoin withdrawal fee stands at 0.0015 BTC.

Cash withdrawal fees are set at 0.30%, with this figure representing the minimum value. The platform’s fees can vary depending on the type of transaction, including swaps, daily settlements, and more.

BTCC Deposit & Withdrawal Methods

BTCC exchange also offers a user-friendly array of deposit and withdrawal methods. This means that users can conveniently transact in USD, and the platform accepts various payment options, including bank transfers, debit/credit cards, and direct cryptocurrency deposits. However, if you want to use fiat currencies via credit card or bank transfer, you must verify your identity, while crypto deposits do not require KYC.

Depositing funds onto the platform is a straightforward process. Users can choose from several payment systems, encompassing wire transfers and credit/debit cards, and select cryptocurrencies.

BTCC supports some of the most popular cryptocurrency networks for deposits including USDT (via TRC20, BEP20, and SOL), BTC (via Bitcoin network), or ETH (via ERC20 and BNB network). You can also use additional options including XRP, LTC, ADA, TRX, and many more.

Withdrawing funds from BTCC is just as seamless as depositing. Online bank withdrawals have a daily limit of 100,000 or 500 for Bitcoin withdrawals. USD serves as the primary fiat currency for both depositing and withdrawing funds.

For more information, read our BTCC withdrawal guide.

BTCC Customer Support

Along with a robust trading platform, BTCC also stands out for its customer support services. The platform offers 24/7 live chat support, email support, and an online contact form for issue reporting.

Moreover, the BTCC team values customer feedback and consistently updates the platform to meet user needs. This commitment to improvement has earned BTCC a loyal user base.

The exchange also maintains an active presence on social media, particularly Twitter, which keeps users informed about new developments and updates.

With its dedication to customer satisfaction and open communication, BTCC ensures users have a reliable partner in their cryptocurrency trading journey.

BTCC Alternatives

BTCC is a solid choice for high-leverage traders, but here are some other exchanges worth checking out:

- BYDFi: BYDFi is a great choice if you want to avoid KYC and still get high leverage and a wide selection of cryptocurrencies.

- Blofin: Blofin offers a nice balance of features with no KYC requirements, competitive fees, and support for multiple fiat currencies.

- Bybit: Bybit is a feature-rich platform with top-notch security, deep liquidity, and a wide variety of trading tools, but keep in mind it does require KYC.

| Feature | BTCC | BYDFi | Blofin | Bybit |

|---|---|---|---|---|

| Established | 2011 | 2019 | 2019 | 2018 |

| Spot Fees (Maker/Taker) | 0.10% / 0.10% | 0.00% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.045% / 0.045% | 0.020% / 0.060% | 0.020% / 0.060% | 0.020% / 0.055% |

| Max Leverage | 250x | 200x | 150x | 100x |

| KYC Required | No | No | No | Yes |

| Supported Cryptos (Spot) | 88+ | 418+ | 394+ | 660+ |

| Futures Contracts | 309+ | 187+ | 329+ | 386+ |

| No KYC Withdrawal Limit | $10,000 | 1 BTC | $20,000 | Not Allowed |

| 24h Futures Volume | $12.34B | $5.6B | $9.73B | $15.25B |

| Trading Bonus | $11,000 | $300 | $5,000 | $30,000 |

| Key Features | • Highest leverage (250x) • No KYC required • Forex/commodity trading |

• No KYC required • High leverage (200x) • Zero-fee spot trading |

• No KYC required • High leverage (150x) • $9.73B futures volume |

• Advanced features • Deep liquidity • Multiple trading bots |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

The Verdict

BTCC is a seasoned player in the cryptocurrency exchange arena with a history of reliability and trustworthiness. However, its future remains uncertain, primarily due to China’s stringent cryptocurrency regulations.

The potential reopening of the Chinese market could be a game-changer, but it also faces the challenge of adapting to friendlier markets like the United States.

Ultimately, BTCC exhibits potential for ongoing growth and enhancement, but it may not align with your trading requirements, particularly if you plan to trade using a broader range of cryptocurrencies.

In such a case, we recommend exploring Kucoin or Bitget, both esteemed and secure cryptocurrency platforms that boast an extensive array of cryptocurrencies and enhanced trading functionalities to suit your diverse trading preferences.

FAQ

Can US investors trade on BTCC?

BTCC is a highly favored exchange among users in the United States. It offers an extensive range of assets, keeps fees minimal, and provides an easy-to-use trading interface.

Is BTCC safe?

BTCC has been committed to fostering a secure user environment since 2011. It employs several safety measures to uphold this commitment, such as a rigorous verification process and a two-factor authentication (2FA) method.

BTCC stands out as one of the most secure cryptocurrency exchanges, with no recorded hacks or security breaches.