Crypto futures contracts are agreements between two parties to buy or sell a specified amount of a cryptocurrency at a predetermined price at a future date. Unlike spot trading, which involves immediate ownership of assets at the current market price, futures trading allows investors to capitalize on price fluctuations without having to own the underlying asset.

You can learn more about the exchange in our comprehensive BTCC review.

BTCC Perpetual Futures Trading

BTCC Perpetual Contracts cover a range of popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), EOS, Litecoin (LTC), Bitcoin Cash (BCH), Ripple (XRP), Cardano (ADA), and DASH. Users can trade these assets with varying levels of leverage, with maximum leverage ratios of 100X, 50X, 20X, and 10X respectively.

To effectively trade Perpetual Contracts on BTCC, it’s crucial to grasp fundamental concepts such as Initial Margin, Leverage, and Liquidation Level. Understanding these concepts is essential for proper risk management and can help traders navigate the volatile cryptocurrency markets with confidence.

Perpetual Contracts on BTCC deviate from traditional futures contracts by eliminating the constraints of fixed expiration dates and holding periods. This flexibility allows traders to maintain positions for as long as desired, on the condition they meet the minimum margin requirements and ensuring that the traded crypto-asset remains above the liquidation price.

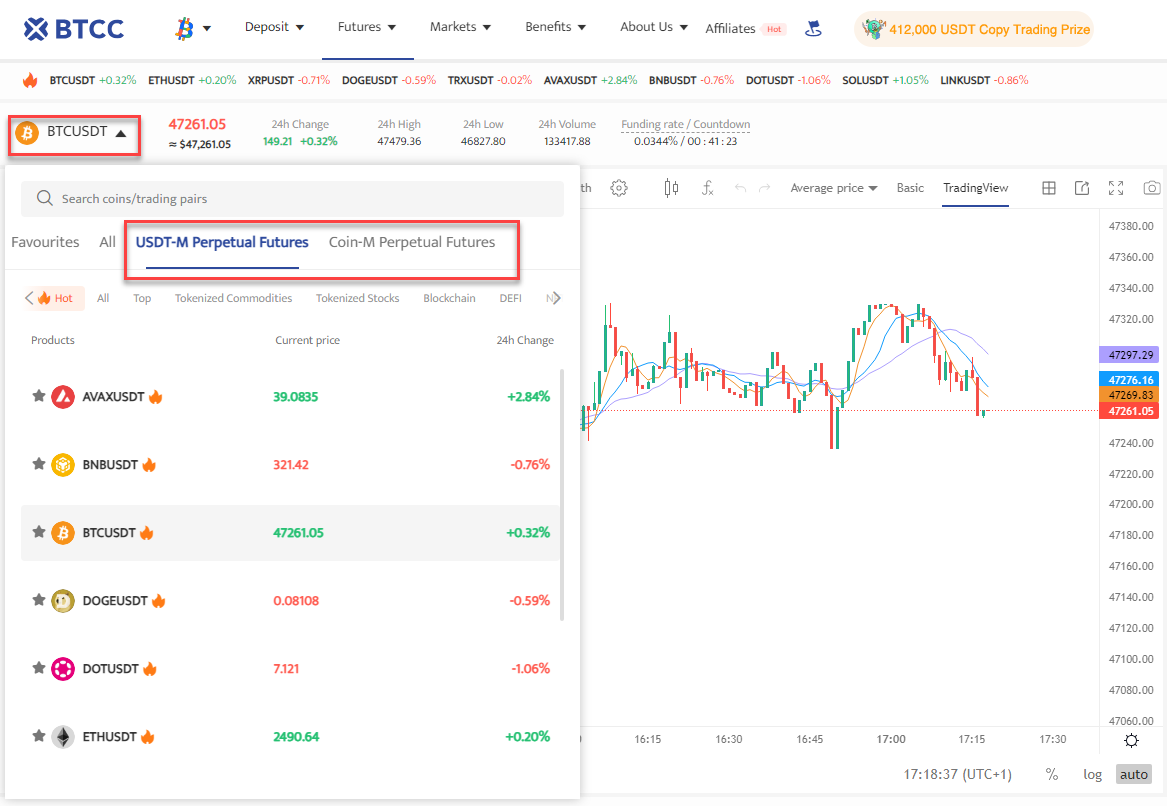

USDT-M Perpetual Futures

For traders seeking stability and convenience, BTCC presents USDT-M Perpetual Futures, providing the opportunity to engage in futures trading settled in USDT. This innovative offering opens doors to a seamless trading experience, leveraging the stability of the US Dollar Tether (USDT) to navigate the ever-changing cryptocurrency markets.

Coin-M Perpetual Futures

Besides USDT-M Perpetual Futures, BTCC introduces Coin-M Perpetual Futures, offering traders the flexibility to trade futures contracts settled in various cryptocurrencies. This allows traders to capitalize on the inherent advantages of cryptocurrencies while benefiting from the perpetual contract model.

Key Features of BTCC Perpetual Contracts

BTCC’s Perpetual Contracts cover a diverse range of popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), EOS, Litecoin (LTC), Bitcoin Cash (BCH), Ripple (XRP), Cardano (ADA), and DASH. Each of these assets can be traded with varying levels of leverage, with maximum leverage ratios tailored to suit individual trading preferences.

To navigate the intricacies of trading Perpetual Contracts effectively, it is essential for traders to grasp fundamental concepts such as Initial Margin, Leverage, and Liquidation Level. A comprehensive understanding of these principles is vital for implementing robust risk management strategies and confidently navigating the volatile cryptocurrency markets.

Advantages of Crypto Futures Trading on BTCC

Higher Leverage Opportunities

Traders can access higher leverage opportunities, allowing them to amplify their trading positions with a smaller capital outlay.

This increased leverage empowers traders to potentially magnify their profits, although it also heightens the risk of losses, which calls for careful risk management strategies .

Ability to Hedge Against Price Volatility

The ability to hedge against price volatility is another notable advantage of crypto futures trading on BTCC.

By taking short positions on futures contracts, traders can mitigate their exposure to downward price movements in the underlying cryptocurrency, thus safeguarding their portfolios against adverse market conditions.

Enhanced Liquidity and Market Depth

BTCC’s platform has sufficient liquidity and market depth, providing traders with ample opportunities to enter and exit positions with minimal slippage.

Futures Trading on BTCC: Step-by-Step Guide

Sign Up/Login and Deposit Crypto Funds

Sign Up or Log in to your account on BTCC.

Deposit funds into Your BTCC crypto Wallet. USDT for USDT-M futures or convert the USDT to a crypto-asset of your choice for Coin-M futures.

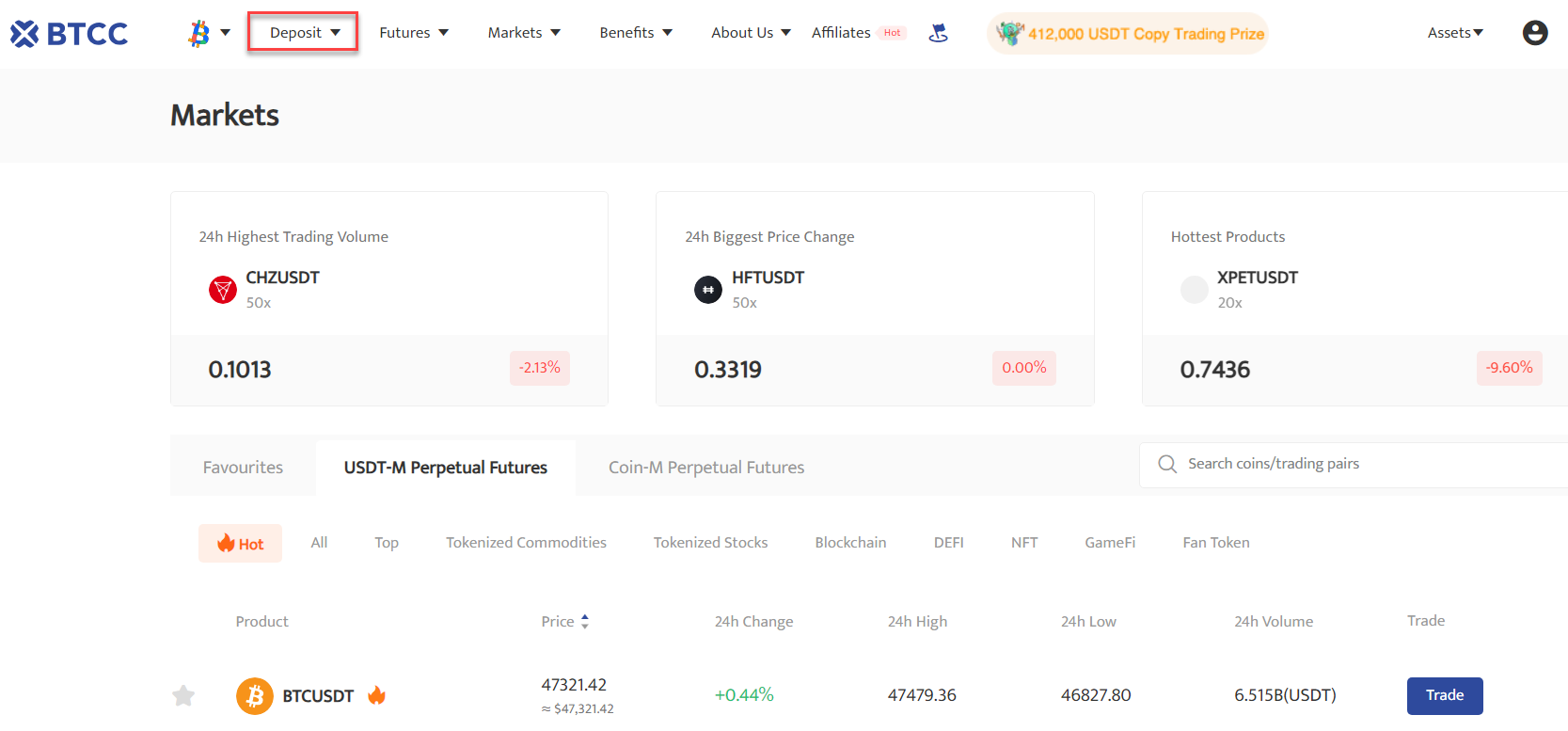

Navigate to the Trade Terminal

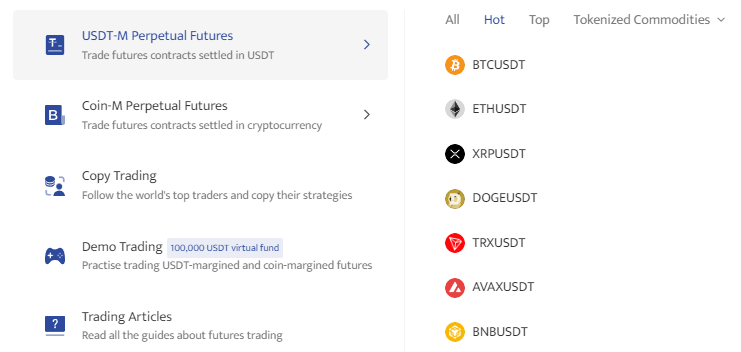

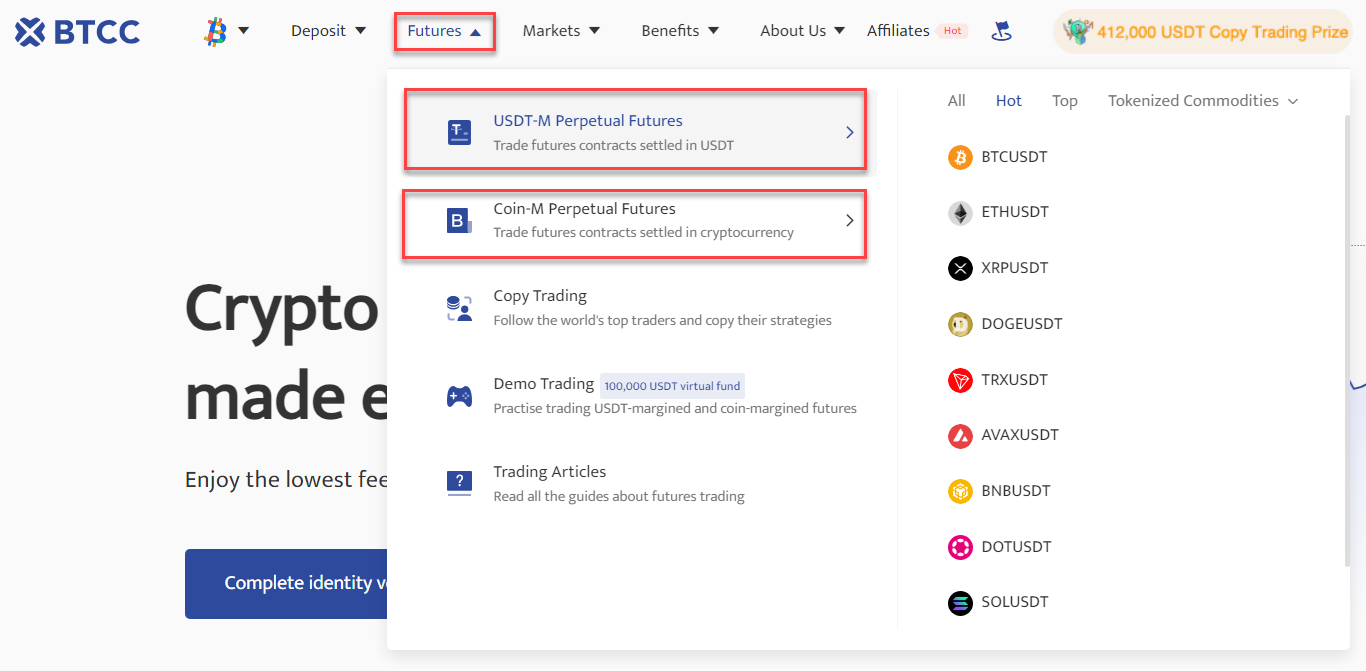

Hover on the futures tab to reveal the futures products on BTCC

Hover on USDT-M Perpetual Futures and click on any of the crypto-assets to trade futures contracts settled in USDT. Alternatively, hover on Coin-M Perpetual Futures to trade futures contracts settled in cryptocurrencies.

The BTCC Trade Terminal

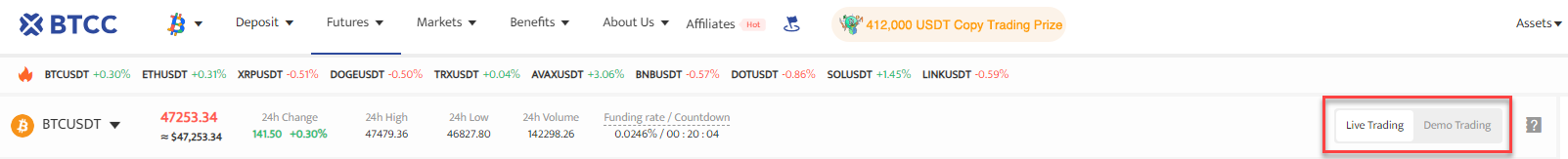

Clicking on the ‘Futures’ tab launches the BTCC trade terminal.

Toggle between ‘Live’ trading or ‘Demo’ trading.

Click on the Trading Instrument tab for an overview and to select a different trading instrument.

Managing Margin and Leverage

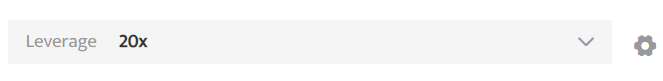

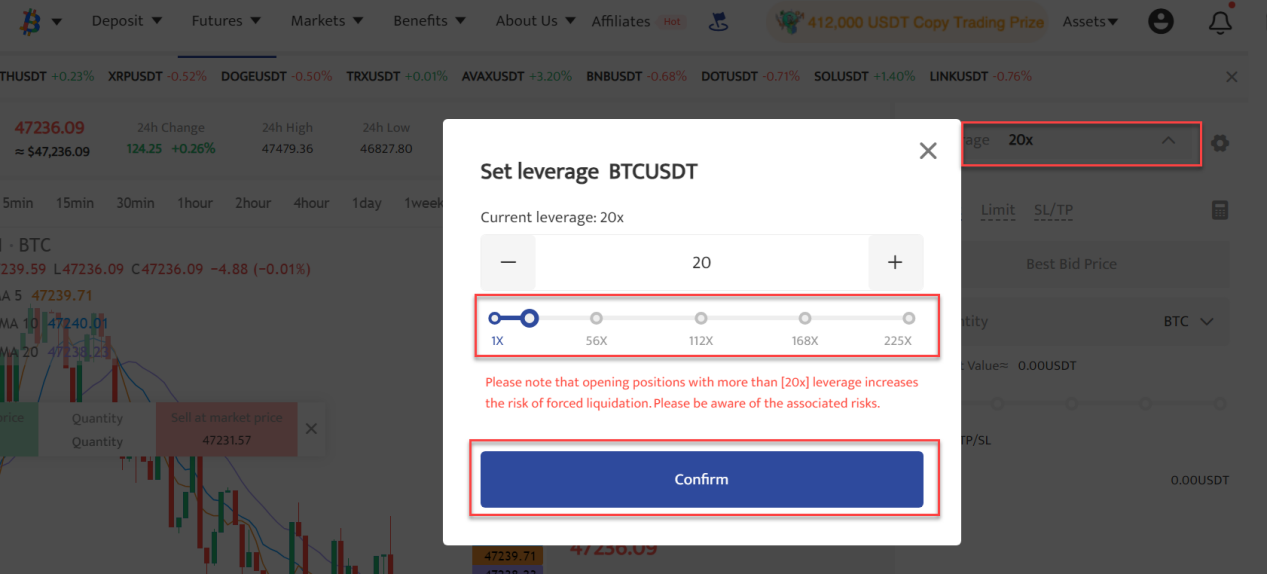

Click on the leverage tab to set leverage for your selected crypto pair, ranging from 1X to 225X leverage.

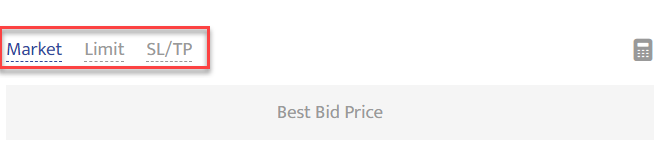

Select Order Type as ‘Market’ or ‘limit’ order

Note that you’ll get the best bid/ask price with a market order type. Select order price level for limit order type.

Input Trade Size

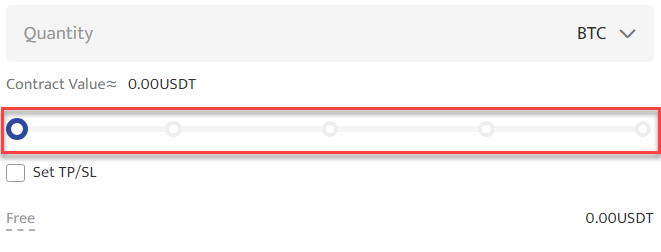

Type in the quantity of crypto-asset denominated in BTC or USDT. The slider bar is an optional way to set your trade size by percentage.

Set Stop-Loss and Take-Profit Levels

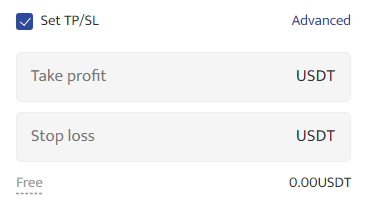

Click the check box to set the take profit and stop loss for your trade.

Validate Margin Requirements and Click ‘Buy’ or ‘Sell’

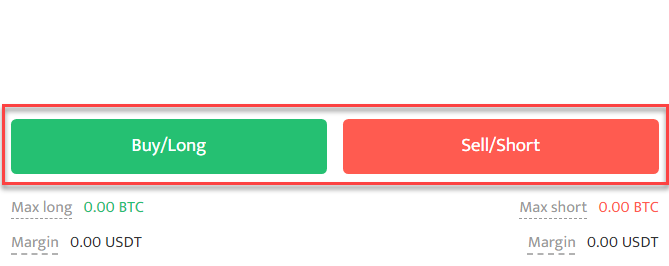

Verify the maximum long and required margin for long , as well as maximum short and required margin for short.

Click the ‘Buy/Long’ button if you believe the asset will go up from your entry level, or click ‘Sell/Short’ button if you believe the price will go down from your entry level.

Conclusion

In conclusion, trading crypto futures on BTCC offers traders a diverse range of benefits, including higher leverage opportunities, the ability to hedge against price volatility, and enhanced liquidity and market depth.

By following the step-by-step guide, traders can navigate the BTCC platform with confidence, executing trades and leverage on the potential of crypto futures trading. As traders continue to explore and engage with the platform, they should consider further expanding their knowledge and skills in futures trading.