Bitunix spot trading offers a convenient and secure way to earn. Its user-friendly interface allows for easy navigation of the trading pages. It provides quick execution of trade at an up-to-date market price. Also, Bitunix spot trading allows users ownership of their assets.

For a comprehensive overview of the exchange, read our in-depth Bitunix review.

Bitunix Spot Trading Guide: Step-By-Step Instructions

Below is a comprehensive guide to how spot trading in Bitunix works

Step 1: Open an account at Bitunix

You need to open an account at Bitunix to start trading. Registration on Bitunix is quick and straightforward.

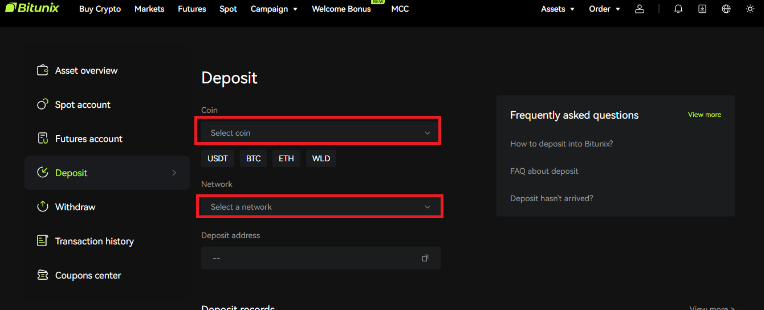

Step 2: Deposit

- Log into your account with your registration details to access the homepage.

- Click the ‘Assets’ tab on the menu bar and select ‘Deposit’

- Select the coin or cryptocurrency you want to deposit

- Choose your preferred network. A deposit address and a QR code are generated.

Note: Ensure you deposit the right coin to the right address. This precaution is to ensure the safety of your funds.

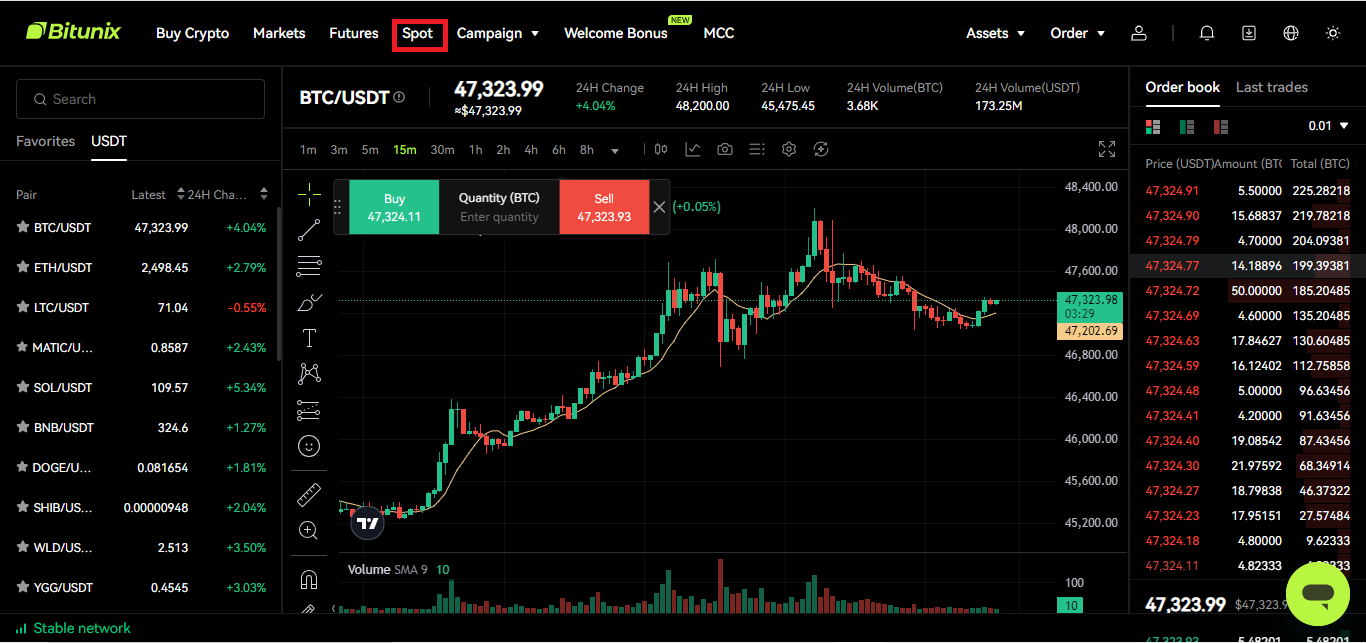

Step 3: Spot Trading

On the homepage, click the ‘Spot’ tab in the menu bar. You will be directed to the spot trading page.

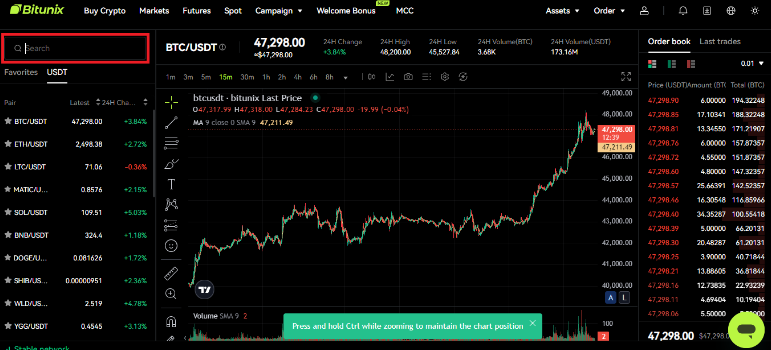

Step 4: Select trading pair

Use the search bar on the top left corner to choose a trading pair. Information on the trading pair will be seen in the spot trading section. This information includes the current market price, a 24-hour change, 24-hour volume, and more.

Step 5: Place an order

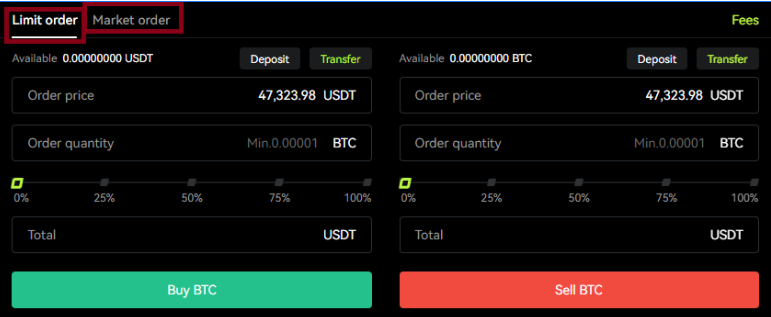

Order in spot trade can be placed through two methods. You can place a limit order or a market order.

Limit Order

Limit Order helps traders decide what price they will buy or sell an asset. For a buy order, traders place a limit order at a price below the market value. In a sell order, traders place a limit order at a price equal to or higher than the market price. The order is executed when the market price reaches the order price.

Here is an example of how Limit Order works. Let us assume to trade the BTC/USDT pair.

- Select the Limit Order option

- Enter the price you are willing to buy or sell BTC in the Order price section.

- Enter the quantity of BTC you want to trade

- Choose either ‘Buy BTC’ or ‘Sell BTC’ to complete the order.

- The trade will be executed immediately once the order price is triggered.

Market Order

Market Order offers instant execution of a trade. However, traders do not have control of the price. You cannot choose what price to buy or sell an asset. Once an order is placed, the exchange executes the trade at the current market price of the crypto.

Here is how to place a market order on Bitunix

- Select the Market Order option

- Enter the amount of UDST you want to use to buy BTC or the quantity of BTC you wish to sell.

Also, you can choose a fraction of your fund to use for purchases or a portion of crypto to sell. To do this, use the percentage bar.

- To confirm the order, click ‘Buy BTC’ or ‘Sell BTC.

- The trade is executed immediately at the current market price.

Step 6: Add funds

Make sure your account is adequately funded before trading. You can add funds to your account using the Buy Crypto or Deposit option.

Why choose Bitunix for spot trading

Spot trading on Bitunix is simple and easy to understand. The clear layout of the trading section allows traders quick navigation. The live chat and advanced analytical options offer an excellent experience.

Bitunix has over 300 spot trading pairs, including BTC, SOL, ARB, and more. It offers an affordable trading fee. The spot trading fee is 0.8 percent as a maker fee and 0.10 percent as a taker fee. Spot traders with a trading volume of about $100 million in 30 days are eligible for more discounts on trading fees.

Bottom Line

Spot trading is a quick and simple method of investing in crypto. Though the profit margin is usually small, it is a low-risk method. Unlike futures, you do not have to borrow from the exchange to raise capital. Beginners can start spot trading on Bitunix for as low as $10.

In addition, Bitunix offers a welcome bonus for new users. For more information on the exchange, take a look at our Bitunix review.