Bitunix is a reputable crypto exchange platform. It is a no-KYC platform, which makes it the best exchange for traders who want to maintain anonymity. The platform offers low fees and high leverage that help traders increase profit while trading futures.

To learn more about Bitunix, look at our detailed review of the platform.

Here is a comprehensive guide on how to start trading futures on Bitunix

Open an Account

Registration on Bitunix is straightforward. You are required to submit a valid email or phone number, enter a password, and submit. Also, you will be required to verify your email address or phone number.

How to Fund Your Futures Account

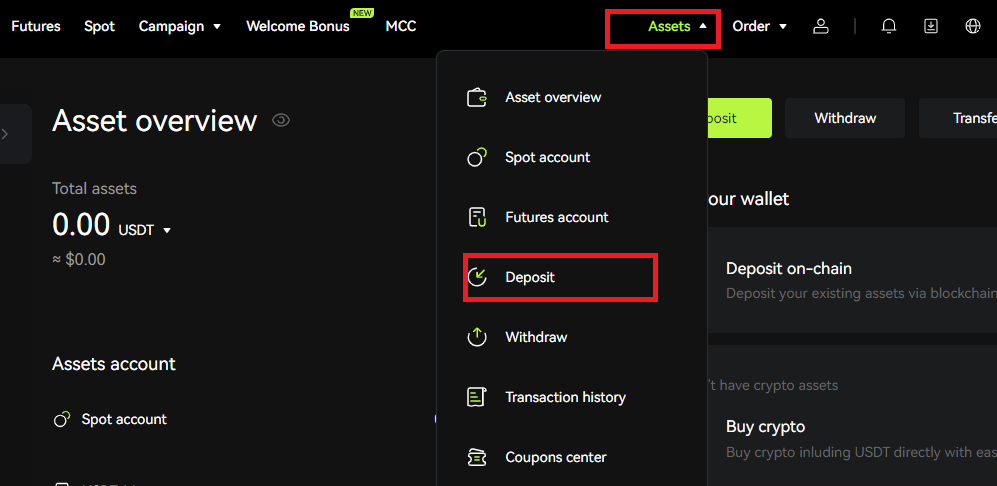

To fund your futures account, you have to deposit funds into your wallet. Access Deposit through the Assets button on the menu bar. Choose your preferred cryptocurrency and select a network type. A deposit address will be generated. Deposit the specified cryptocurrency to the right address. Crypto sent to the wrong address may not be recoverable.

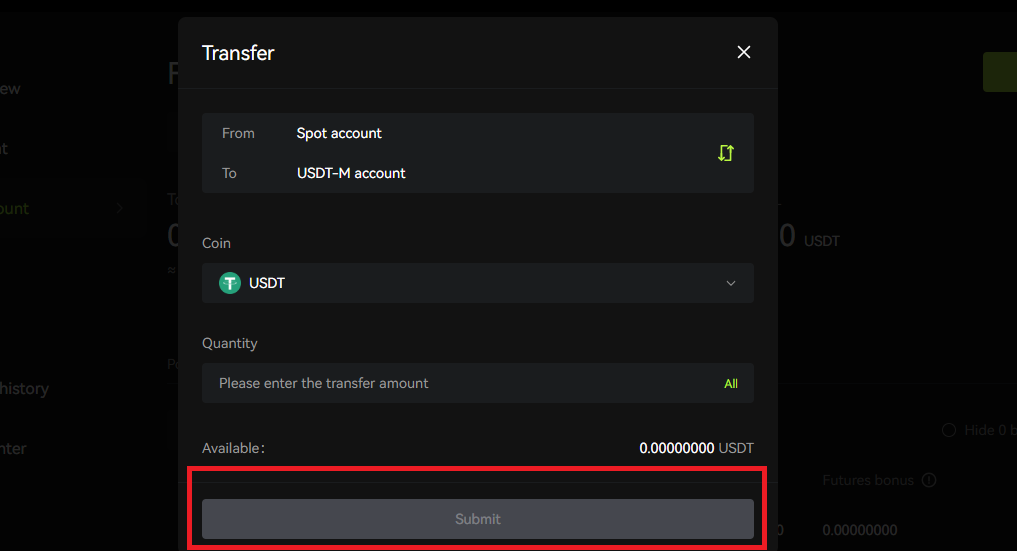

Once you have deposited, it is time to fund your futures account. Funding a futures account is simply done by transferring funds from the spot account into the futures account. Here is how to achieve this

- Click the ‘Assets’ tab on the menu bar.

- Select Futures account.

- Click the ‘Transfer’ button on the top right corner.

- Make sure you are transferring from the spot account to the USDTM account.

- Select the coin. The only available coin on Bitunix is USDT

- Enter the amount of USDT to be transferred.

- Click ‘submit’ to confirm the transfer.

Features of Bitunix Futures Trading

Here are some peculiar features of futures trading on Bitunix.

Bitunix Futures Fees

Bitunix offers fair and competitive trading fees across its trading platforms. Futures traders also benefit from these low charges. The highest you will pay in futures trading is a 0.02 percent taker fee and a maker fee of 0.06 percent. You get more discounts on fees as your trading volume increases.

Supported Leverage

Leverage offers traders the opportunity to increase their trading capital to earn more. It, however , comes with an increased risk of liquidation.

For example, if you have $100 as your futures trading capital, with a leverage of 10x, you can hold positions worth $1000. So, you earn 10x as much profit as you would when trading with the $100. In the same way, you can lose 10x as you would if the market moves unfavorably. For instance, if the market value increases by 5%, you will earn 5% of $1000, which is $50. That is a 50% profit on your trading capital. You can also lose this amount if there is a 5% decrease in the value of the crypto.

So, as leverage increases gain tremendously, it also amplifies losses. You have to be careful using this feature. Let us look at the various forms of leverage offered by Bitunix.

Cross Margin

Cross Margin uses your account balance as collateral to secure your positions. It allows for higher leverage and can tolerate large market volatility. However, you are at risk of losing all your capital from the loss of one single position. Bitunix offers up to 125 x cross leverage. Regardless of the time spent on trading futures on the platform, anyone can use the maximum leverage. However, traders without experience are usually advised to stick to lower margins to manage risk and reduce losses.

Isolated Margin

In an Isolated Margin, traders assign a specific amount as collateral to each position opened. It separates each position which offers a better risk management strategy when compared to cross margin. Bitunix also offers as much as 125x isolated leverage.

Supported Contracts on Bitunix

Currently, Bitunix offers USDT-Margined (USDT-M) perpetual futures contracts for over 45 futures cryptocurrencies. Popular among these cryptocurrencies are BTC, ETH, BNB, and many more. As of today, Bitunix does not support COIN-Margined futures where contracts are settled in crypto.

Trading Futures in Bitunix

Log in to your funded account on the Bitunix site. Click the Futures tab, and a futures trading interface will be shown. Let us take a glance at the trading interface on Bitunix.

Overview of the Futures Interface on Bitunix

- Trading Pairs: This section shows the current futures contract you are about to trade. You can select other pairs from the section.

- Trading Data: This section gives information about the current market price, 24-hour high, low, 24-hour volume, and the funding rate.

- TradingView Chart: This is a candlestick representation of the price trend of the trading pair. The panel on the left contains tools for real-time technical analysis.

- Order Information: This panel shows current positions, current orders, and order history.

- Order Book: Shows real-time orders and transactions on the trading pair.

- Operation Panel: Used to place orders. Traders can choose order type and adjust leverage in this section.

How to open a Position

Opening a position on Bitunix should not be difficult once you understand the basics of futures trading. Here is a guide on how to open a position on the platform.

- Select a futures trading pair.

- Choose a preferred leverage type and adjust to the desired size. Ensure to set leverage as low as possible because high leverage comes with a high risk of liquidation in an unfavorable market. 5x leverage is usually advised for beginners.

- Select the order type which can be limit, market, or trailing order.

- For a limit order, enter the price you are willing to buy or sell

- Enter the amount of USDT you want to use to open a position.

- Click on ‘Buy/Long’ or ‘Sell/Short’

- Your order will be executed immediately and a position opened if you used the market order. If you use the Limit order, the position will be opened once the market price hits your order price.

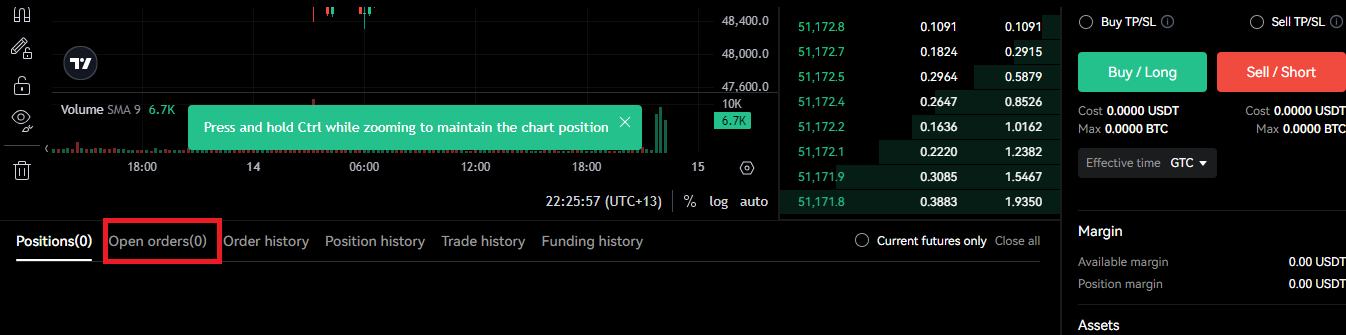

How to view Order or Position

You can view your order if it is not settled immediately. You can assess this under the open orders tab. This feature also allows you to cancel your position if you no longer want the order to be fulfilled.

You can also view your positions. You will assess this under the open positions tab. Details about each position are shown here. You can see the PnL, the open price, the liquidation price, and the margin. From here, you can easily close your position manually.

How to Close a Position

After holding a position, you can close the position to take profits or to cut losses. To do this, select the close position. Choose the order type, limit, or market order. Enter price and quantity to close.

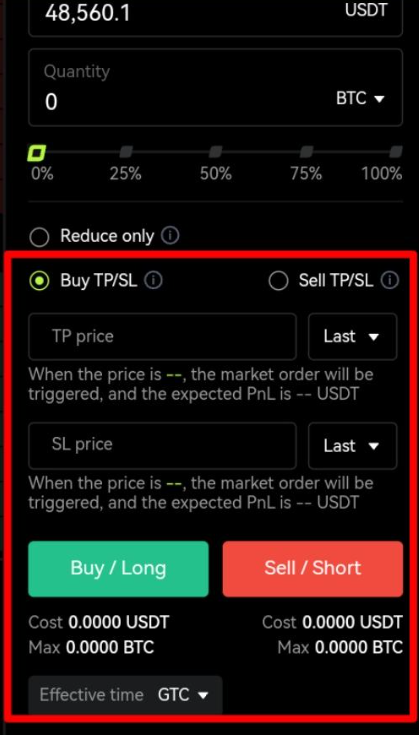

How to set up TP/SL

You can set a Take-Profit or Stop-Loss order in two ways: placing an order for a new position or on an existing position. Here are the steps involved in each scenario.

TP/SL for when opening a position

Follow the steps highlighted above on how to open a position on Bitunix. Before confirming your order, check either the Buy TP/SL or the Sell TP/SL box. Enter the TP and SL price and select an order type. After this, you can then confirm the order.

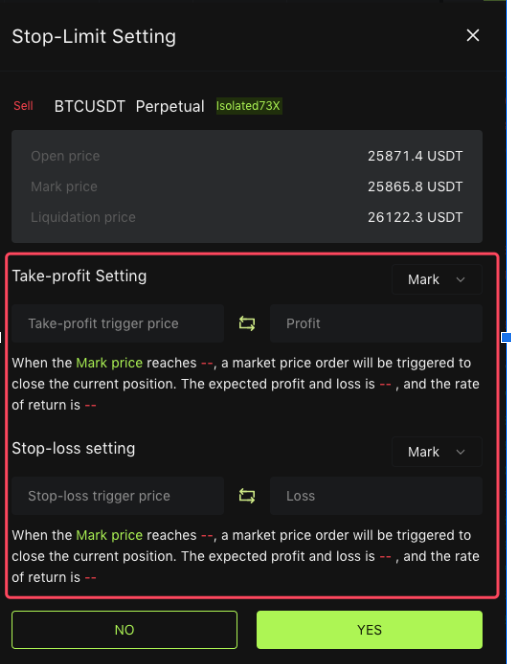

TP/SL for an existing position

Under Stop-Limit, click the edit icon for the position you want to set TP/SL. Enter the price at which you want to take profit or stop loss and choose an order type. Once placed, you can access the TP/SL order under Open Order. From here, you can cancel the order if you want.

Bottom Line

Bitunix offers a seamless trading experience. Trading futures on the platform is simple and easy. With practice, the processes become clearer and the platform gets easier to navigate. Soon, you may not need to refer to this guide to trade futures on Bitunix. For additional information about the platform, read our full review of Bitunix.

Although futures trading is rewarding, it is associated with high risk due to market volatility in crypto. Hence, it is important to stick to your trading strategies and avoid greed.

This article should not in any way be taken as financial advice. Information contained here is for educational purposes only.