If you are looking for a reliable crypto exchange, you probably have come across the names Binance and BitMEX. In this BitMEX vs Binance comparison, we will go over all the important factors that you need to know. We will compare features, products and services from BitMEX to those of Binance. After this in depth, side by side comparison, you will know exactly if you should go with Binance or BitMEX!

First, we will compare all key measures of BitMEX and Binance in a table so that you see all factors at a glance.

Overview

BitMEX was launched in 2014, making it one of the oldest and most reputable cryptocurrency trading platforms. Currently, 400 BitMEX employees are managing over 2 million users.

With its focus on leverage trading early on, BitMEX was even the market leader for futures trading during 2016 to 2018 and many OG crypto enthusiasts remember BitMEX as the number 1 crypto exchange.

Now, BitMEX supports 40 different cryptos and reaches a daily trading volume of $1 billion, ranking it somewhere in the middle in terms of activity.

With a high leverage of 100x, BitMEX was the number 1 crypto trading platform for a long time. When going over features of BitMEX, you will quickly notice that its number 1 focus is trading and trading only. There are hardly any products or services available aside from crypto trading.

Binance was launched in 2017 and quickly became the largest cryptocurrency exchange in the world. With now over 100 million registered users, over $30 billion in daily trading volume and 6000 employees, it is safe to say that Binance has earned its number 1 spot. With over 380 tradable assets on the spot and futures market while offering low fees and high leverage of up to 125x, Binance is a great choice for crypto traders.

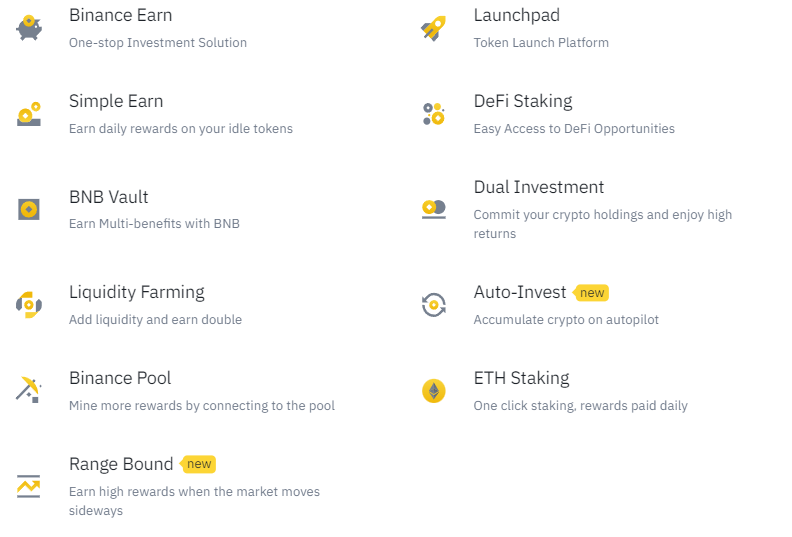

Furthermore, Binance realized how important it is to not only offer trading, but also other crypto related services. Therefore, Binance launched various products such as staking, mining, lending, NFT trading, options trading, P2P services and even a crypto debit card.

Trading on BitMEX vs Binance

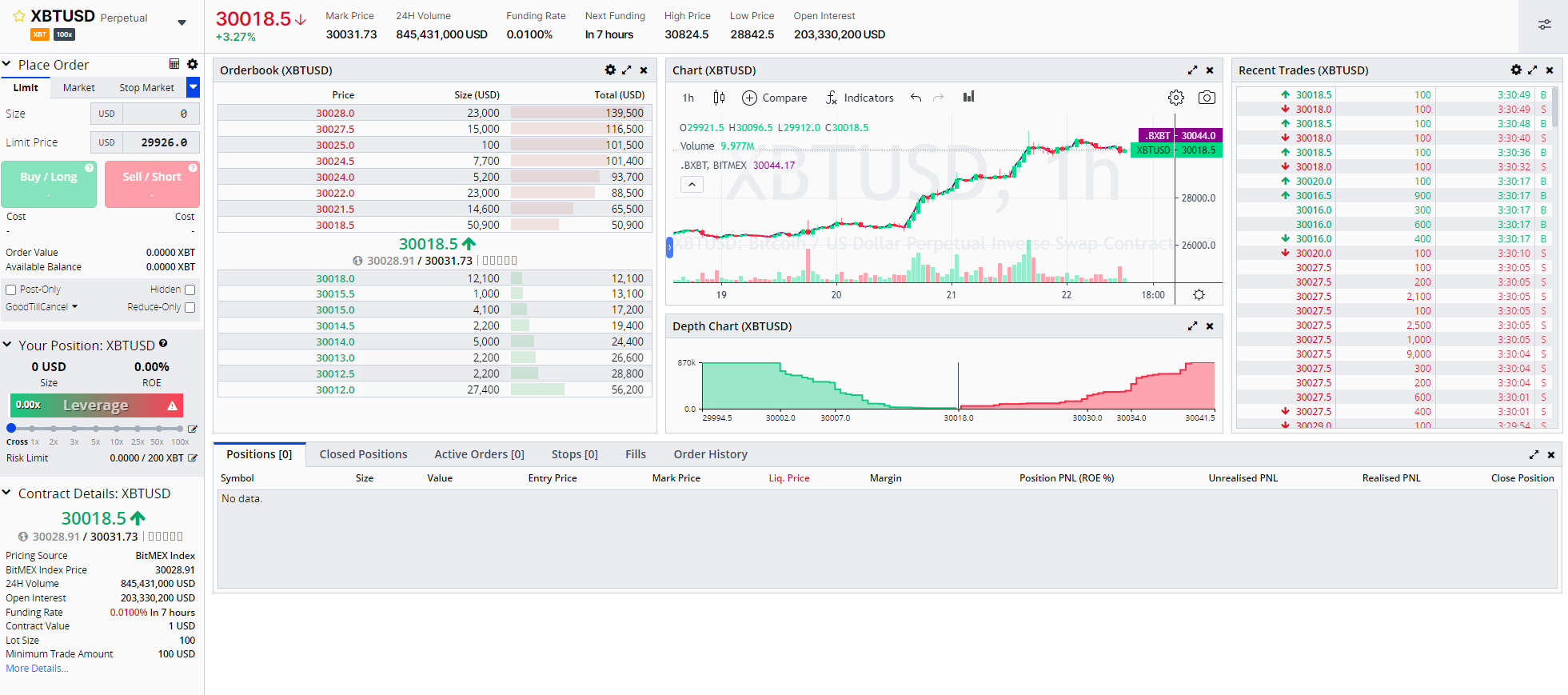

Crypto traders can access 40 digital assets on the BitMEX spot and futures market. The highest leverage on the futures market is 100x, offering futures traders a way to accelerate their gains. When comparing the liquidity, we noticed that BitMEX does not offer as much liquidity as other exchanges. Traders with large portfolios could run into issues when trying to fill their orders.

The interface of BitMEX is rather outdated and barely changed since 2016 which is very unfortunate. Back then, BitMEX was a revolutionized crypto exchange but didn’t make much progress ever since. BitMEX charges the same spot and futures fees of 0.02% maker and 0.075% taker fees. For the spot market, these fees are some of the lowest in the crypto space, however, the futures fees are some of the highest.

Binance on the other hand offers over 380 crypots on their spot and futures market. Furthermore, traders can access up to 125x leverage on major cryptos such as BTC and ETH. With some of the best liquidity in the crypto space, Binance is a top choice not only for small traders, but also for crypto whales. The interface is well designed and features the most advanced order types such as Iceberg or TWAP orders.

The spot fees on Binance are at 0.1% for makers and takers which is the industry standard. Futures traders enjoy low fees of 0.02% maker and 0.04% taker.

For trading, Binance is the clear winner. A 5 years ago, BitMEX was at the top of the game, however this has changed over the years. With more coins, lower futures fees, higher leverage and a better trading terminal, Binance is the clear winner for crypto traders.

Fees

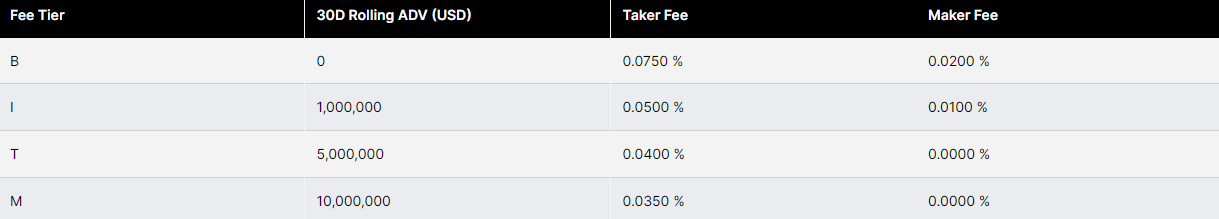

Now let’s go over fees in depth and compare the separate fee discounts based on your trading activity.

As mentioned earlier, BitMEX charges the same fees for spot and futures traders which is very unique. The default fees are 0.02% maker and 0.075% taker.

Based on your 30 day trading volume, you can climb up the BitMEX VIP ladder and lower your fees to as low as -0.01% maker and 0.0175% taker. That means you are getting paid 0.01% for limit orders. However, this requires over $1 billion in monthly trading volume.

The most interesting fee tier on BitMEX is VIP T level which only requires 5 million in monthly trading volume and lowers your fees to 0% maker and 0.04% taker. You can check out the official BitMEX fee schedule here.

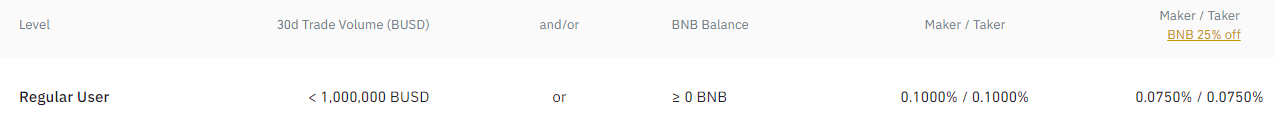

Binance charges 0.1% maker and taker fees on the spot market. When holding the BNB token, you can reduce your spot fees by 25% so that you enjoy 0.075% maker and taker fees.

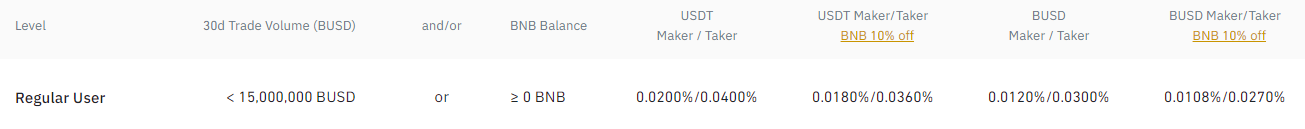

For futures traders, Binance charges 0.02% maker and 0.04% taker fees. Again, with BNB you can reduce your fees, this time by 10%, leaving you with 0.018% maker and 0.036% taker fees. The lowest fee rate is reached at a $25 billion trading volume per month and sets your fees to -0.01% maker and 0.0207% taker.

You can check out the official fee schedule of Binance here.

In terms of fees, BitMEX seems to be cheaper on the spot market. However, for futures trading, Binance is the clear winner.

Signup & KYC Process

The signup process on both platforms is very simple. On BitMEX you can only register with an email and a strong password, while Binance allows users to choose between email or phone number and of course, a strong password. After you hit enter, you must verify your email or phone number, so make sure to check out your inbox. If you can’t find any message, check out the spam folder or request another email/message to verify your details.

After verifying your email or phone number, you must complete step number 2, which is KYC. Binance and BitMEX both require customers to verify their identity so that you can deposit, trade and withdraw.

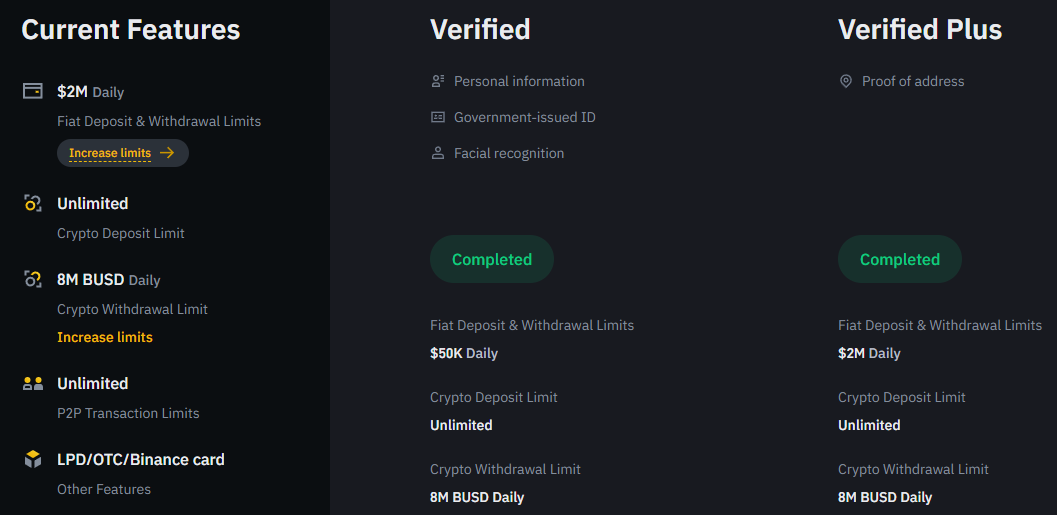

The level 1KYC process on Binance is very simple and only requires a legal document such as ID or Passport and a facial recognition device. The KYC process on Binance usually just takes 15 minutes and you will be all set. Level 2 KYC requires proof of address.

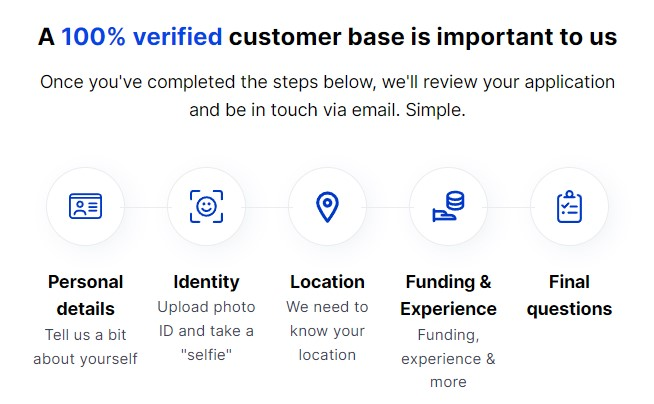

BitMEX on the other hand requires more information. You will be asked for personal details, your ID, location, origin of funds, experience and some additional questions. The KYC application on BitMEX can take 1-3 days to be approved.

Overall, there is no clear winner as both exchanges simply follow the regulations and jurisdictions. Due to AML laws, any money business must require their customers to verify their identity.

Products & Features

As mentioned earlier, BitMEX is only focused on offering crypto trading services. Other than that, all you can do is purchase cryptos via credit card or bank transfer. There is not staking, mining, copy trading or other features.

Binance on the other hand is the most comprehensive crypto exchange, offering dozens of crypto related products and services. Aside from trading, crypto enthusiasts can enjoy passive income products such as earn, staking, mining, lending, and more. You can even apply for the Binance crypto debit card which you can not only use online but even in store. On top of that you can receive up to 8% cashback on your purchases.

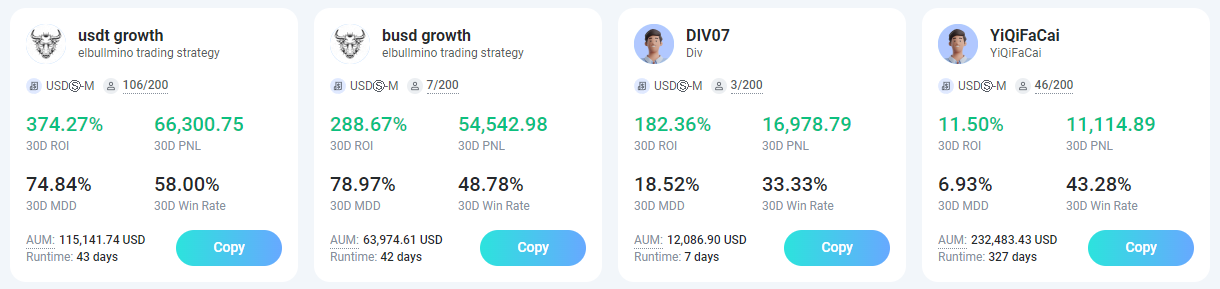

For copy trading, Binance has partnered up with TraderWagon to support the service on its platform. Simply connect your Binance account to TraderWagon and start following experienced traders.

In terms of products, services and features, Binance clearly beats BitMEX. The only exchange that could keep up with Binance in this section was Gate.io. You can check out the Gate.io vs Binance comparison here.

Deposits & Withdrawals

Bitmex and Binance offer deposits for all major cryptos free of charge. Simply activate your wallet address and start receiving your cryptos. Withdrawals on the other hand are not free of charge. You will pay the typical network fee for each respective chain. As the fees are different for each coin and network, make sure to check out which cryptos you are trying to send. One of the cheaper options is sending USDT with the TRC20 network which costs $1.

In terms of FIAT deposits and withdrawals, the two exchanges are very different. BitMEX does not support FIAT at all.

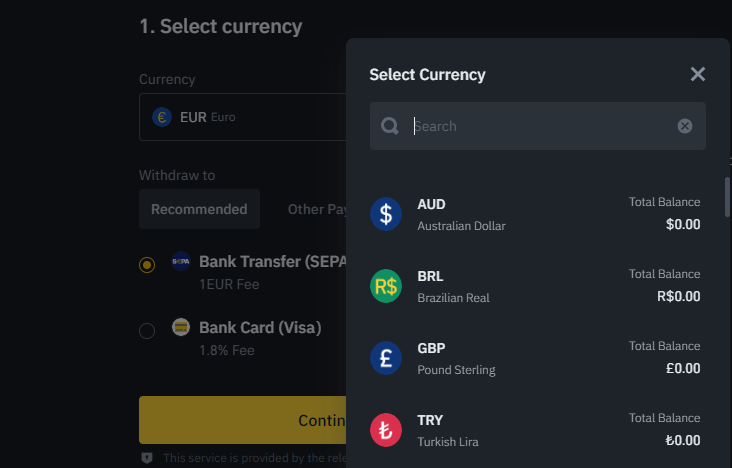

Binance on the other hand offers FIAT deposits and withdrawals for over 40 local currencies including, but not limited to, EUR, GBP, AUD, AED, CAD, TRY, BRL and much more. The fees range between $1 for bank transfers up to 4% for card payments. Note, that the fees are different for each FIAT currency and payment method. Some of the cheapest FIAT deposit and withdrawal methods are bank transfers for EUR and GBP which are fixed fees at 1€ / 1 £.

For deposits and withdrawals, Binance takes the point home again. With comprehensive FIAT support, Binance makes it easy for users to send profits back to their bank account.

Security

BitMEX and Binance both have been hacked, however, they are still considered to be relatively secure exchanges. The customers have been refunded and ever since 2018, no more incidents happened.

In terms of security funds, Binance has the upper hand with its $1 billion SAFU fund (Security Asset Fund for Users). This fund is dedicated to protect users in the case of black swan events. Luckily, Binance never had to make use of the fund so far.

Customer Support

Unfortunately, BitMEX does not offer 24/7 live chat support. If you need help on the platform, you must submit a ticket from the contact page form. The response time can be up to 24 hours.

Binance offers multilingual 24/7 live chat support with an average response time of 3 minutes. The support staff is always helpful and can resolve your queries quickly. Furthermore, Binance has a comprehensive help center where thousands of frequently asked questions are covered in depth.

BitMEX vs Binance: Who Wins?

Binance is undoubtedly the superior choice. BitMEX did not manage to beat Binance in any criteria except for having lower spot fees.

Other than that, Binance offers way more features, tradable assets, better liquidity, lower futures fees, higher leverage and an up to date trading interface with the most advanced order types.

I personally remember the glorious days on BitMEX when it was still the market leader for derivatives trading, and it is hard for me to admit that BitMEX got stuck in time. The platform did not advance over time and is pretty much the same it was back then with high futures fees, barely any assets to trade, no FIAT support and an outdated interface.