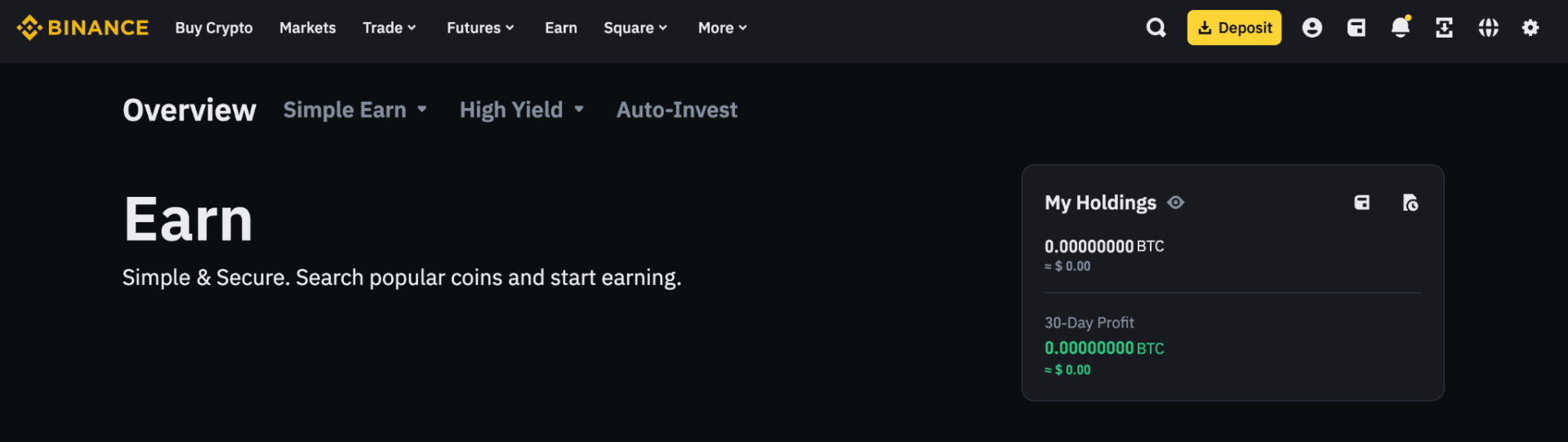

Binance Earn Overview

Binance Earn is a platform within the Binance cryptocurrency exchange that lets you earn interest on your cryptocurrency holdings. It offers a range of products where users can deposit supported cryptocurrencies and earn rewards and interest over time without having to actively trade or manage investments.

To get a comprehensive platform of the whole Binance platform, you can check out our in-depth review.

Key things to know about Binance Earn

Wide range of supported coins

Over 180 different cryptocurrencies are supported across the various Binance Earn products. Popular coins like BTC, ETH, BNB, and stablecoins can earn interest.

Flexible and locked term options

Users can choose between flexible/demand products, which allow withdrawals anytime, or locked products, which offer higher rewards for committing funds for a fixed period.

Attractive rates

Binance Earn products generally offer competitive interest rates with other CeFi and DeFi lending/staking platforms. Rates can range from 1-15% APY based on market conditions.

Easy to use

Getting started earning interest only takes a few clicks on the Binance platform. No complex wallet setups or gas fees.

Secured by Binance

Users don’t have to worry about managing private keys or smart contract risks themselves. Binance handles security and payouts.

Binance Earn Flexible vs. Fixed

Binance Earn includes both flexible and fixed-term deposit products depending on your needs:

Flexible Products

Flexible saving products allow you to deposit and withdraw your funds anytime without waiting for a locking period to end. This offers added liquidity in case you need access to your crypto assets. Some examples include:

- Simple Earn: Offers daily payouts on stablecoins and other coins. There are no lock-up periods.

- Launchpool: Stake BNB, BUSD, and other tokens to earn newly launched tokens as rewards. Withdraw deposited assets anytime.

The flexible products generally offer lower interest rates compared to fixed-term deposits but are useful for short-term earning opportunities or if you want the ability to exit your position as needed.

Fixed-Term Products

Locking up crypto for fixed terms allows Binance Earn to offer a higher yield. However, locked-term products come with more restrictions. For example:

- Simple Earn (Locked): Terms range from 7 days to 90 days, with interest paid at the end of the term. Early withdrawal loses accrued interest.

- DeFi Staking: Commit to 30, 60, or 90-day terms to earn governance tokens from DeFi projects. No early exit allowed.

- Dual Investment: Lock up crypto (ex. BTC) for a fixed period (ex. 1 month) to earn a minimum fixed yield or potentially higher returns if the locked asset increases in price over the investment term.

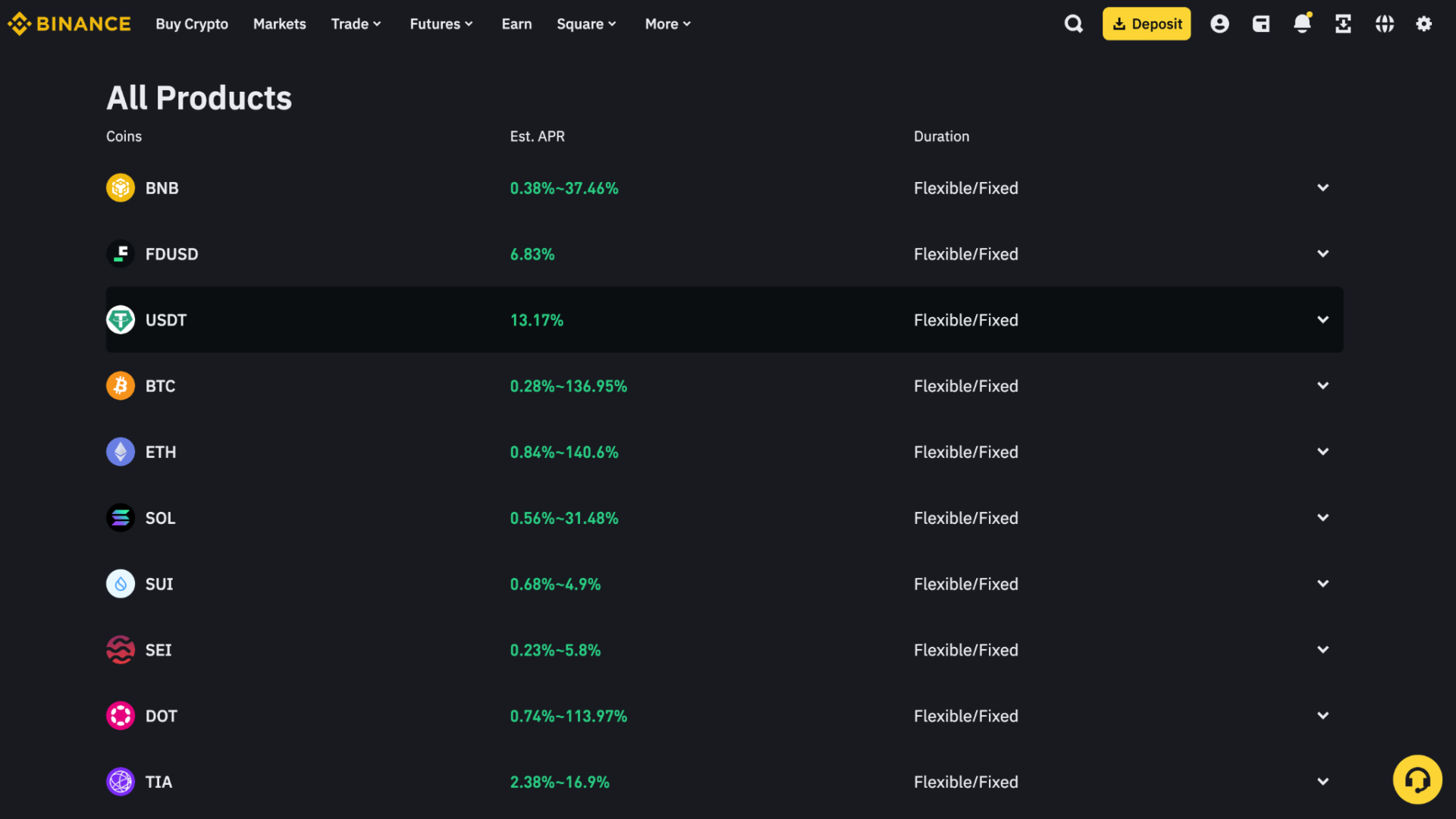

Binance Earn APY Options

The annual percentage yields (APYs) available across the various Binance Earn platforms can vary significantly based on factors like:

- Product risk: In general, “Protected” Binance Earn products offer lower yields around 1-5% APY, while “High Yield” products may offer 5-15%+ APY in exchange for a higher risk of loss. Always understand the risks before chasing high yields.

- Market conditions: Supply and demand dynamics in crypto lending/staking markets impact prevailing rates. Increased demand can drive up interest rates.

- Lock-up terms: As noted earlier, longer lock-up periods tend to offer higher yield opportunities.

- Minimum/Maximum caps: Some products implement caps on the minimum and maximum amount allowed to be deposited, which impacts potential earnings.

To give some current examples, here are sample rates offered:

- BTC Simple Earn Flexible – Up to 2% APY

- USDT Simple Earn (30-day lock) – Up to 7% APY

- DeFi Staking (CAKE token for 90 days) – Up to 25% APY

Rates can fluctuate daily based on market dynamics, so be sure to check the latest terms on each product before investing.

Generally, protected services like Simple Earn offer reliably stable, lower-risk returns, while products like DeFi Staking allow opportunities to pursue higher yields if you have a higher risk tolerance.

How to Use Binance Earn?

Getting started with Binance Earn is straightforward – just follow these steps:

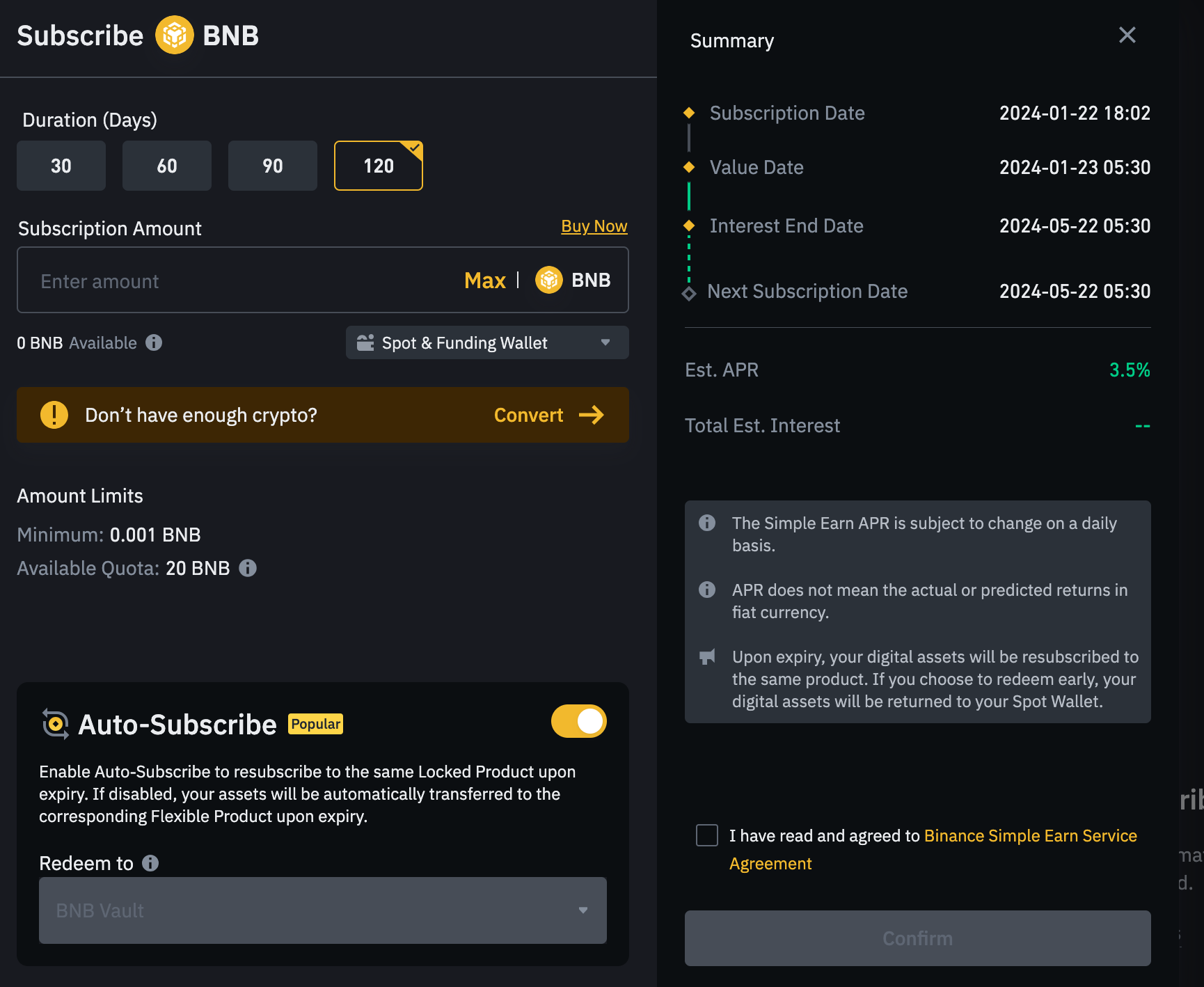

Subscribe

1. Log in to your [Binance account](https://www.binance.com/en-IN) and navigate to “Earn” at the top.

2. Scroll down to view all available Binance Earn products.

3. Click a product you’re interested in and review the details, such as supported coins, lock-up terms, minimum/maximum investment amount, projected APY, etc.

4. If ready to invest, click “Subscribe,” input the duration, and confirm the amount you wish to deposit from your Binance wallet.

Once deposited, you will immediately start earning rewards, which are paid out either flexibly or at the conclusion of the locking period, depending on the product.

Redeem

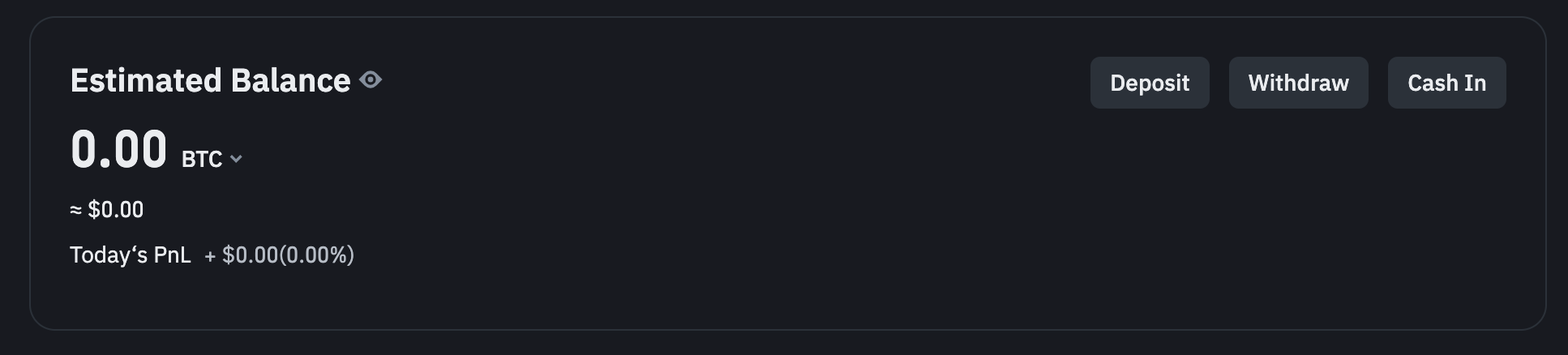

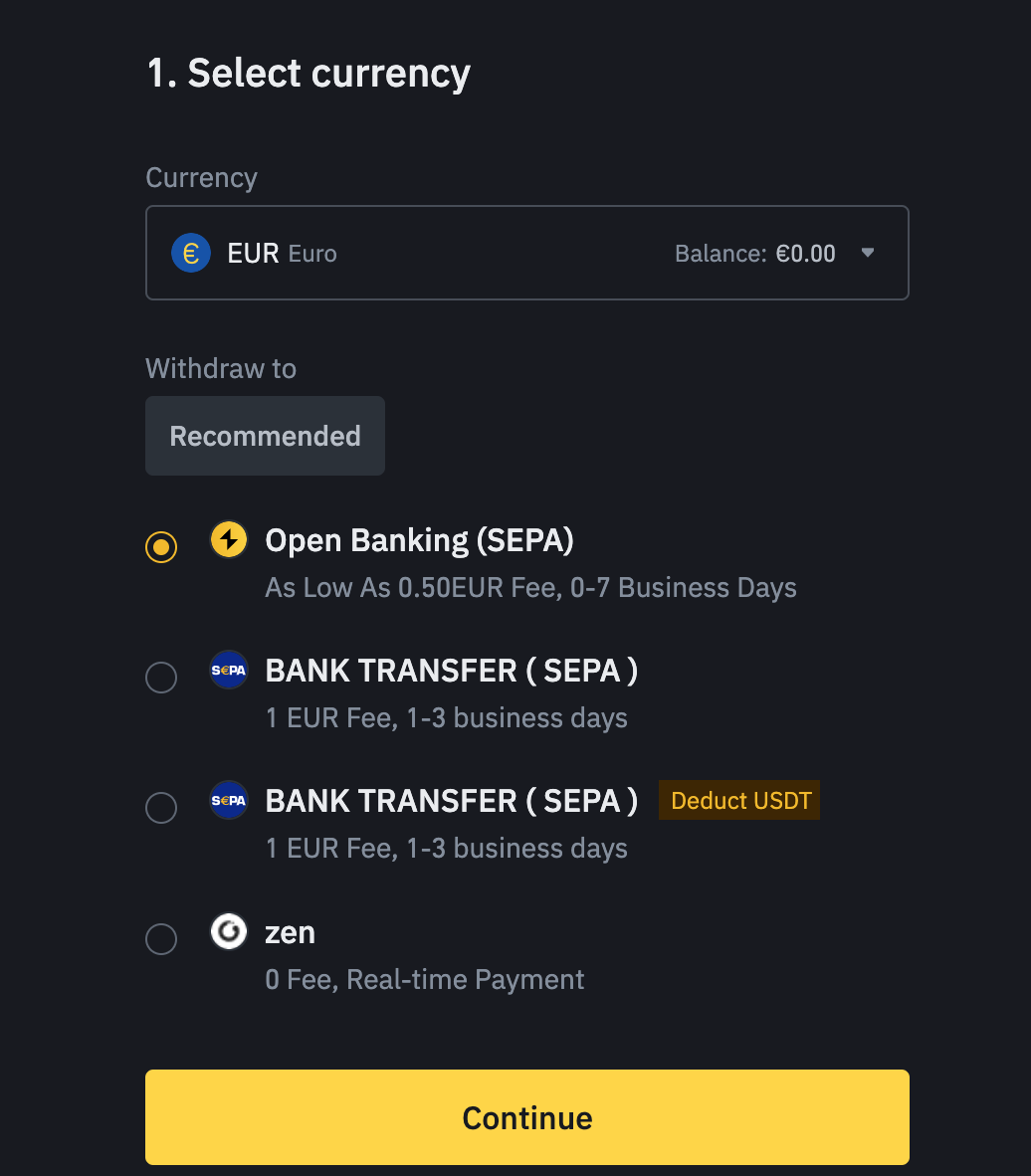

To withdraw from flexible Binance Earn products:

1. Under “Dashboard,” locate the Withdraw option.

2. Select your currency and enter the amount you wish to withdraw back to your Binance wallet.

For fixed-term products, you generally cannot redeem early without penalty. You must wait until the conclusion of the lock-up period, at which point your initial deposit plus any earned yields will automatically be credited back to your Binance account wallet.

Summary

In summary, Binance Earn offers a wide range of products for easily putting your crypto to work and generating consistent yield and interest. It handles the complexity of lending/staking protocols, allowing you to deposit assets, sit back, and collect rewards simply.

Flexible products offer the ability to withdraw anytime, while fixed-term deposit products generally offer higher rates in exchange for committing funds for set periods. Just be sure to evaluate the risk-return tradeoff and any caps and restrictions before investing.

Getting started is simple – just browse options on the Earn platform, pick a product that matches your investment goals and risk tolerance, and subscribe and fund it directly from your Binance wallet.

FAQ

Is Binance Earn safe?

Yes, Binance Earn products are backed by Binance which is a leading and trustworthy player in the crypto industry. Funds are kept secure using industry best practices.

When do I get paid interest?

Payout frequency varies – flexible products pay daily/weekly, while fixed-term products pay upon maturity. Refer to each product’s details.

What are the fees?

Binance Earn does not charge any platform fees or commissions. The APY rates already factor in any underlying third-party fees.

Can I lose money?

Protected products guarantee your deposit. High-yield products carry the risk of losing principal if underlying protocols fail. Evaluate risks accordingly.

Are there any country restrictions?

Binance Earn availability may vary across certain regions depending on local regulations. Check the Binance website for any limitations specific to your country.