As a crypto trader or investor in France looking to trade or buy digital currencies, you need the most reliable and best cryptocurrency exchange that makes trading extremely smooth and safe, with strong safety measures and low trading fees. For French crypto traders and investors, it is important to look out for a crypto exchange that complies with the French Financial Markets Authority (AMF).

This article features the 7 best crypto exchanges in France and all their essential features, including supported coins, trading fees, regulatory compliance, and many more to help you make the right choice for your needs.

Top Crypto Exchanges in France Reviewed

Read on to learn everything you need to know about the 7 best crypto exchanges in France.

- Phemex – Best Crypto Exchange in France

- Bitget – Best Alternative Exchange in France

- Kraken – Oldest Crypto Exchange in France

- WhiteBit – Popular European Crypto Exchange

- Kucoin – Best Altcoin Exchange in France

- BingX – Best Social Trading Crypto Exchange in France

- Bitpanda – Great Alternative Exchange in France

| Exchange | Cryptos | Spot Fees | Future Fees | Max Leverage | Bonus | KYC |

|---|---|---|---|---|---|---|

| 1. Phemex | 346+ | 0.10% / 0.10% | 0.01% / 0.06% | 100x | $4,000 | No |

| 2. Bitget | 871+ | 0.10% / 0.10% | 0.02% / 0.06% | 125x | $20,000 | Yes |

| 3. Kraken | 185+ | 0.16% / 0.26% | 0.02% / 0.05% | 50x | None | Yes |

| 4. WhiteBit | 400+ | 0.10% / 0.10% | 0.05% / 0.05% | 25x | None | Yes |

| 5. KuCoin | 800+ | 0.10% / 0.10% | 0.02% / 0.06% | 125x | $10,500 | No |

| 6. BingX | 824+ | 0.10% / 0.10% | 0.02% / 0.05% | 200x | $5,000 | No |

| 7. Bitpanda | 200+ | 0.15% / 0.15% | N/A | None | €10 | Yes |

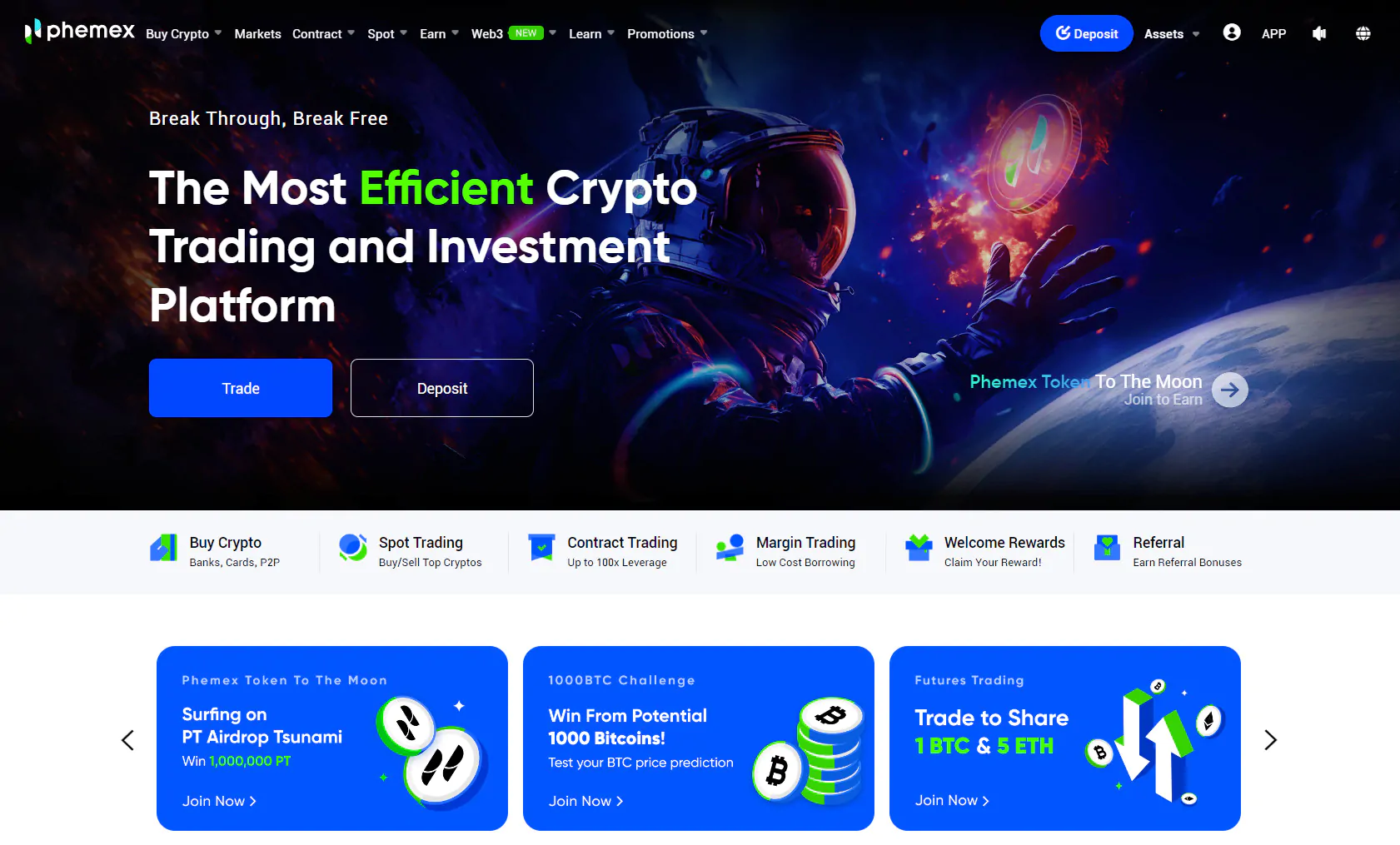

1. Phemex

Phemex is a global cryptocurrency trading platform that was launched in 2018. It has over 10 million users across over 180 countries worldwide, with its headquarters located in Dubai. Phemex is an advanced crypto trading platform, and it is compliant with all the rules and regulations of the French Financial Markets Authority, making it a reliable platform for users in France. The Phemex exchange offers over 300 cryptocurrencies for spot trading with an average daily trading volume of over $2 billion, according to Coinmarketcap.

Although Phemex offers spot and futures trading, it is best for futures trading as it offers low fees and high leverage. Phemex charges a 0.1% fee for makers and takers on the spot market, while for futures, it charges a 0.01% maker fee and a 0.066% taker fee. Phemex also offers high leverage of up to 100X on futures and derivatives. Phemex also offers bot trading and copy trading for passive income.

Currently, Phemex supports over 6 fiat currencies for deposits and withdrawals, including the Euro (EUR €) for users in France. Payment methods include Debit/credit cards, Advcash, GooglePay, Maestro, ZEN, SEPA, or through P2P trading. Fees on deposits and withdrawals range from 0% to 3%, depending on the currency and payment method. Deposits and withdrawals for EUR are free through Advcash, while there is a charge of 1.75% through SEPA.

Phemex also provides a mobile app for traders or investors in France who want to trade on their smartphones, available for Android and IOS users with a 4.7/5 star rating on the Google Play Store.

Some of Phemex key features include:

- Demo Trading: For beginners and inexperienced traders to practice trading with real-world market conditions without using real funds

- Copy Trading: This allows users to replicate the trades of High performing traders and investors on the platform

- Automated trading bot: This helps users make trades based on a range of market indicators and parameters that are pre-configured into their programming

- Low Trading Fees: 0.01% maker fee and a 0.06% taker fee for derivatives and futures trading. It offers 0.1% for both makers and takers on the spot market.

- 24/7 customer support: Offers round-the-clock access to customer support via live chat, email and social media

- Adequate security and proof of reserves to protect user assets

- Crypto debit card: This enables users to access and spend their cryptocurrencies on the go.

- New user rewards: Offers new users bonuses for performing tasks on the platform.

- Educational materials for users to understand cryptocurrencies

If you want to learn more about Phemex, you can read our full Phemex review.

Phemex Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Offers a user-friendly trading interface with advanced trading tools for experienced traders | ❌ Limited pairs for trading bots |

| ✅ Easy registration and KYC verification process | ❌ Advanced trading features might be confusing for beginners |

| ✅ It provides a wide range of payment options with low fees | |

| ✅ Offers a wide range of passive income products, including staking, savings, liquidity mining, and many more, to help users earn money | |

| ✅ Free deposits for EUR | |

| ✅ Offers an NFT marketplace for NFT traders | |

| ✅ It offers up to 100X leverage on derivatives and futures |

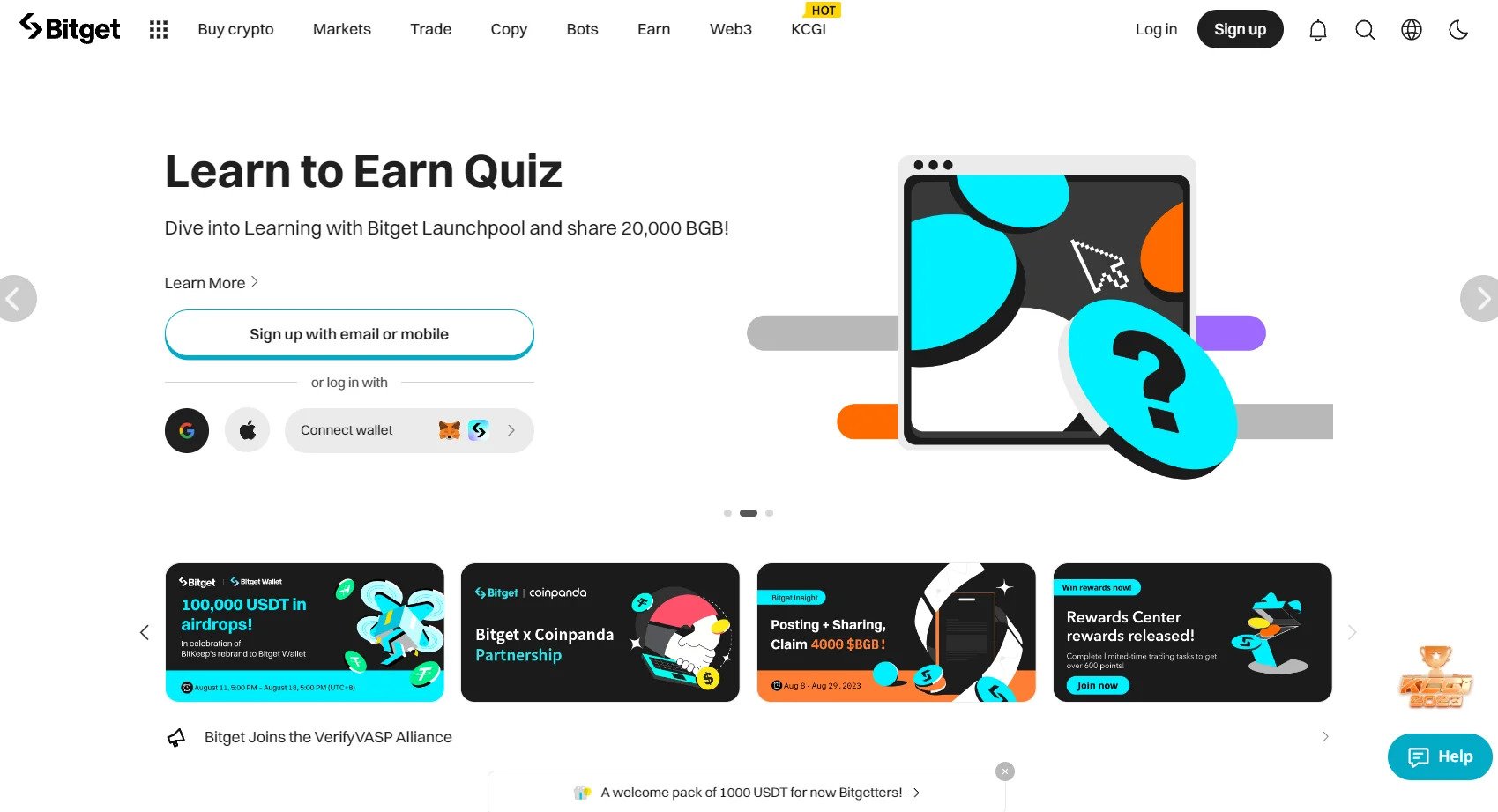

2. Bitget

Bitget is a fully licensed crypto exchange with over 20 million users across over 100 countries worldwide, including France. It was launched in 2018 and has its headquarters located in Seychelles. It supports over 400 cryptos for trading with an average daily trading volume of over $5 billion. Bitget complies with all the French Financial Markets Authority rules and regulations, making it a reliable platform for users in France. There are no fees for crypto deposits, while withdrawals depend on the coin and blockchain network used.

Bitget is best for Copy and futures trading as it offers a 0.02% maker fee and a 0.06% taker fee with high leverage of up to 125X on derivatives and perpetual contracts. Bitget provides a 0.1% charge for makers and takers on the spot market with a 20% discount when you use its native token, “BGB.” Based on your 30-day trading volume, users can reduce fees by up to 0.0125% for makers and 0.035% for takers on the spot market and up to 0.008% for makers and 0.032% for futures trading.

Bitget supports 5 fiat currencies for deposits and withdrawals, including the EURO (EUR) for users in France. Payment methods include Visa/Master card, SEPA, ApplePay, and GooglePay. Fees range from 0% to 8%, depending on the currency and payment method. Deposits are free for EUR through SEPA, while withdrawals attract a fee of 0.5 EUR per transaction.

Bitget also offers a mobile app for people who want to trade or invest using their phones, available for Android and IOS users in France with a 4.3/5 star rating on the Google Play Store.

Some of Bitget’s key features include:

- Adequate security with the use of two-factor authentication and cold storage

- Low trading fees: Offers 0.02% maker fee and 0.06% taker fee for futures and derivatives trading, while on the spot market, it offers 0.1% for both makers and takers. It also provides a 20% discount on the spot market when you use the native most giant token, “BGB.”

- Demo trading for users to practice before using real funds

- Copy trading for newbies and inexperienced traders.

- Offers spot trading with a 10X margin

- Bitget Earn offers opportunities for users to earn income on the platform.

- 24/7 customer support, including live chat and email support

If you want to learn more about Bitget, you can read our full Bitget review.

Bitget Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Offers low trading fees and generous discounts | ❌ Advanced features can be overwhelming for beginners |

| ✅ It supports a wide range of trading pairs | ❌ There are no educational materials for inexperienced traders |

| ✅ Offers NFT trading services | ❌ No crypto debit card |

| ✅ Offers a wide range of passive income products | |

| ✅ Free deposits for EUR | |

| ✅ Offers leverage of up to 125X on derivatives and futures |

3. Kraken

Kraken was launched in 2013 and has its headquarters in San Francisco, California. It has over 9 million users across over 190 countries, including France. Kraken is fully licensed for crypto trading, and it obeys all the rules and regulations of the French Financial Markets Authority, which makes it a reliable trading platform for users in France. It offers over 200 cryptos for trading with an average daily trading volume of over $500 million.

Kraken is best for adequate security of user assets as it implements sophisticated security measures and has never been hacked. There is also proof of reserves to back user funds. Kraken is one of the best platforms for futures trading. It offers a 0.02% maker fee and a 0.05% taker fee with up to 50x leverage, but the initial margin and maintenance margin differ depending on the contract and position size. Although Kraken offers low prices for futures trading, its spot trading fees are relatively high as it provides a 0.16% maker fee and a 0.26% taker fee. That makes Kraken more suitable for futures trading and less ideal for spot trading.

Kraken supports over 6 fiat currencies for deposits and withdrawals, including the Euro (EUR) for users in France. Payment methods include Credit/Debit cards, SWIFT, ACH, SEPA, and FPS. Fees range from free to about $8, depending on the currency and payment method. It offers free EUR deposits and withdrawals through Advcash.

Kraken also features a mobile trading app available for IOS and Android users in France with a 4.2/5 star rating on the Google Play Store.

Some of Kraken’s key features include:

- Copy trading: This allows users to follow the top traders and implement their trading techniques

- Demo trading account for users to practice their trading techniques without using real funds

- 24/7 customer support via email and live chat

- Trading fees: Offers a 0.02% maker fee and 0.05% taker fee for derivatives and futures. It offers a 0.16% maker fee and a 0.26% taker fee on the spot market.

- Advanced security features and proof of reserves

- Educational materials for users to understand cryptos

- Margin trading with up to 5X leverage

- Automated trading bot for newbies and veteran traders

If you want to learn more about Kraken, you can read our full Kraken anaylsis.

Kraken Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ User-friendly interface easy to navigate for beginners | ❌ High spot trading fees |

| ✅ Offers advanced trading tools for veteran traders | ❌ No native coin or token |

| ✅ Fast and easy sign-up and KYC verification | ❌ Poor liquidity |

| ✅ Free EUR deposits and withdrawals | ❌ No crypto debit card |

| ✅ Offers crypto staking for users to earn passive income | |

| ✅ It supports NFT trading services |

4. WhiteBit

WhiteBit is a relatively new crypto exchange platform. It was launched in 2018 and has its headquarters located in Lithuania. It currently ranks as one of the fastest-growing crypto exchange platforms, with over 4 million users across 190 countries worldwide, including France. WhiteBit is a fully licensed crypto exchange that obeys all the French Financial Markets Authority guidelines for crypto trading in France. It supports over 200 cryptocurrencies and over 250 trading pairs with an average daily trading volume of over $500 million.

WhieBit is best for futures trading as it offers a 0.01% maker fee and a 0.035% taker fee for futures and derivatives with leverage of up to 20X. On the spot market, it offers a charge of 0.1% for both makers and takers with up to 20% discount when payments are made with its native token “WBT.”

Its user-friendly interface and security for newbies exploring crypto trading stand out. WhiteBit offers free crypto deposits, but withdrawal fees depend on the coin and selected blockchain network. It supports over ten fiat currencies for deposits and withdrawals, including the Euro (EUR) for users in France. Payment methods include ApplePay, SEPA, and Web3 wallet. The fees range from 0.4% to 1.5%, based on the currency and payment method. It offers free EUR deposits and withdrawals through SEPA.

WhiteBit also provides a mobile trading app available for Android and IOS users in France with a 4.2/5 star rating on the Google Play Store.

Some of WhiteBit’s key features include:

- Crypto debit card

- Crypto to fiat trading

- Low trading fees: Offers a 0.01% maker fee and a 0.035% taker fee for futures and derivatives, while on the spot market, fees are 0.1% for both makers and takers. WhiteBIT also offers trading fee discounts of up to 20% on the spot market when you use the WhiteBit token “WBT.”

- WhiteBit Earn: Allows users to make passive income through staking and crypto lending.

- 24/7 customer support, including live chat and phone support

If you want to learn more about WhiteBit, you can read our full WhiteBit review.

WhiteBIT Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Adequate security with two-factor authentication and cold storage | ❌ No demo trading for users to practice trades |

| ✅ Wide range of digital assets and trading pairs | ❌ Still relatively new |

| ✅ It is beginner-friendly | |

| ✅ Free EUR deposits and withdrawals |

5. Kucoin

Kucoin is a global crypto exchange platform that was launched in 2017. It currently ranks as one of the largest crypto trading platforms in the world, with over 29 million users across over 200 countries worldwide, including France. Its headquarters is located in Seychelles. Kucoin is a fully licensed crypto exchange that obeys all the French Financial Markets Authority guidelines for crypto trading in France. It supports over 700 cryptocurrencies with a daily trading volume of over $1 billion, which makes it the right choice for users who want access to a wide range of digital assets to trade.

Kucoin offers spot and futures trading and an NFT marketplace for NFT traders in France. Charges are 0.1% for both makers and takers for spot trading with a 20% discount when you pay with Kucoin’s native token “KCS,” while for futures trading, charges are 0.02% for makers and 0.06% for takers with leverage of up to 100X.

It offers free deposits of supported crypto, but crypto withdrawal fees depend on the coin and selected blockchain network. For fiat deposits and withdrawals, Kucoin supports over 20 fiat currencies, including the Euro (EUR), for traders and investors in France. Payment methods include Visa/Master card, Paypal, Wise, Skrill, and bank transfers. Depending on the payment method, fees range from $1 to $25. The cheapest option for EUR payments is bank transfer, which has a fixed fee of 1 EUR per transaction.

Kucoin also provides a mobile trading app for IOS and Android users in France to trade on the go with a 4.2/5 star rating on the Google Play Store.

Some of kucoin’s key features include:

- Copy trading

- Demo account for users to practice before using real funds

- Automated trading bot

- Crypto debit card: offers exclusive rewards and benefits for cardholders, including cashback on purchases, making your shopping experience even more rewarding.

- 24/7 customer support via live chat and email

- Offers NFT marketplace for NFT traders

- Low trading Fees: Offers a 0.02% maker fee and a 0.06% taker fee for futures and derivatives, while on the spot market, the fee is 0.1% for both makers and takers. There is also a discount of 20% on charges if you pay with their native token, KCS.

- Passive income products include Crypto lending, stakings, and savings to help users earn income on the exchange.

If you want to learn more about Kucoin, you can read our full Kucoin review.

Kucoin Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Offers up to 100X leverage on futures and derivatives | ❌ Limited payment methods |

| ✅ Easy registration and KYC verification | ❌ Has been hacked |

| ✅ Wide range of supported coins | ❌ Limited educational resources |

| ✅ Advanced trading features, including technical indicators and multiple order types | |

| ✅ Low trading fees and generous discounts | |

| ✅ It is beginner-friendly | |

| ✅ Adequate security with the use of two-factor authentication and cold storage |

6. BingX

As one of France’s most popular crypto exchanges, BingX provides access to over 690 cryptocurrencies, including major assets like BTC and ETH, as well as traditional assets like stocks, forex, and commodities, with leverage up to 200x.

Trading fees are low—0.1% for spot trades and 0.02% and 0.05% for futures makers and takers, respectively.

The platform offers a user-friendly interface, complemented by advanced tools such as technical analysis and copy trading, catering to both beginners and experts. Anonymous trading is allowed, but KYC verification unlocks additional features and higher withdrawal limits. Plus, SEPA Euro deposits are free of charge.

Some of BingX’s key features include:

- Supported Cryptocurrencies: 824+ cryptocurrencies available for spot trading.

- Futures Contracts: 246+ futures contracts supported with diverse asset options.

- Max. Leverage: Up to 200x leverage for futures trading.

- Spot Trading Fees: Flat 0.10% fee for both makers and takers.

- Futures Trading Fees: 0.02% for makers and 0.05% for takers.

- Deposits & Withdrawals: Supports free Euro deposits via SEPA + credit/debit cards, MoonPay, and bank transfers.

If you want to learn more about BingX, you can read our full BingX review.

BingX Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Very reputable crypto exchange | ❌ Lacks fiat support |

| ✅ 800+ supported assets | ❌ Too advanced for beginners |

| ✅ Up to 150x leverage | ❌ P2P requires KYC |

| ✅ Low trading fees | |

| ✅ Verious products & Services | |

| ✅ Great copy trading |

7. Bitpanda

Bitpanda is one of the fastest-growing crypto exchanges in Europe. It was launched in 2014 and has its headquarters in Vienna, Austria. It has over 4 million users across over 100 countries worldwide, including France. Bitpanda is a fully licensed crypto exchange that complies with all the French Financial Markets Authority rules and regulations for crypto trading in France. It supports over 100 cryptocurrencies for trading with a daily trading volume of over $1.5 million.

It is important to note that Bitopanda has two variations, which are Bitpanda and Bitpanda Pro. Bitpanda stands out for its beginner-friendly trading interface and simple tools for newbies and inexperienced traders. That makes it not a good choice for experienced traders. However, Bitpanda Pro offers access to real-time candlestick charts, a trading terminal, advanced order types, and an order book for experienced traders.

Bitpanda is well known for its wide range of digital assets, which include stocks, precious metals, securities, and ETFs. It offers free crypto deposits, but withdrawals depend on the coin and blockchain network used. Over five fiat currencies are supported for deposits and withdrawals, including the Euro (EUR) for users in France. Payment methods include Visa/Mastercard, Skrill, Netller, and SEPA. The fees range between 1.8% for cards and 3.6% for Netller and Skrill. Deposits and withdrawals are free of charge through SEPA.

A mobile app for traders and investors who want to manage their portfolios on the go is available for Android and IOS users in France with a 3.5/5 star rating on the Google Play Store.

Some of Bitpanda’s key features include:

- Copy trading

- Crypto debit card

- Automated trading bots

- 24/7 customer support via email

- Adequate security with two-factor authentication and cold storage

- Trading fees: Offers a fee of 0.25% for both makers and takers on all trades

- Passive Income Products: Offers crypto savings and staking to help users earn money

If you want to learn more about Bitpanda, you can read our full Bitpanda analysis here.

Bitpanda Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Offers leverage of up to 10X for perpetual contracts | ❌ No demo trading accounts |

| ✅ Free EUR deposits and withdrawals | ❌ High trading fees |

| ✅ It is beginner-friendly | ❌ High crypto deposit fees |

| ✅ Wide range of payment options | ❌ A limited number of supported cryptos |

| ✅ High liquidity |

How to Choose a Cryptocurrency Exchange in France

To choose the best crypto exchange for your needs in France, the following factors must be considered.

- Euro (EUR) Support: The platform must support the native currency for French users as it makes payments more accessible and improves the overall trading experience.

- Adequate Regulatory Compliance: As a trader or investor in France, you must only use a fully licensed crypto exchange that complies with the guidelines of the French Financial Markets Authority. That guarantees a trusted and safe environment for trading.

- Trading Fees: Ensuring the platform offers low trading fees on Spot and futures trading is essential. Also, look for discounts on making payments with the platform’s native token. That helps users in France to maximize trading profits and improve the overall trading experience.

- Number of Supported Coins: An ideal crypto exchange should support a wide range of cryptos for trading to help French traders and investors diversify their portfolios for greater profits.

- User Interface: Consider a platform with a great user interface that is easy to navigate and has advanced trading tools to give you a smooth and seamless trading experience.

- Good Customer Service: 24/7 customer support is essential for any crypto exchange platform. As a French trader, look out for a venue with fast and reliable customer support to help you handle any issues on the forum.

- Optimum Security: You must consider a platform that has never been hacked and implements adequate security measures, including two-factor authentication and cold storage, at least to help secure user assets. Proof of reserves is also essential as it guarantees user assets are backed with the company’s funds.

- Passive Income Products: An ideal crypto exchange should offer many opportunities for users in France to earn money on the platform. That would help you maximize profit and improve your overall trading experience.

- Deposit & Withdrawal Methods and Fees: One of the most important factors to consider as a French trader or investor. Ensure the platform supports convenient payment methods for EUR and t offers low fees.

How to Buy Bitcoin and Other Cryptos in France

If you are looking to invest in crypto or trade as a beginner in France, follow the guidelines below:

- Choose a France-supported trading platform that fits your needs from the abovementioned list.

- Create an account on the Platform.

- Complete the KYC verification process to access all the features and products of the Platform.

- Deposit any supported crypto or EUR through any of the available payment methods.

- Go through the educational materials provided, then practice trading with a demo account and familiarize yourself with the trading features on the Platform.

- Start trading on your real account based on what you have learned.

- Effectively monitor your trades and implement new trading techniques to improve your trading experience and manage your portfolio efficiently.

Final Words

France provides a safe and regulated environment for crypto traders and investors. This guide has covered the best 7 crypto exchanges and everything you need to know to make a well-informed decision on the right platform.

Kucoin, Phemex, and Bitget are the best options for a wide range of supported cryptos.

Regarding optimum security, Kraken and WhiteBit are the best options as they implement advanced safety features and have never been hacked.

WhiteBit and Bitget are the best options for French traders for low trading fees and generous discounts.

For a user-friendly interface for beginners, Bitpanda and WhiteBit are the best options, while Phemex and Bitget stand out with advanced tools for experienced crypto traders.

Phemex and Bitget are the best options for many payment methods and low fees.

Bitget is the best option for high leverage as it offers up to 125X on futures and derivatives.

All except Bitpanda stand out for fast and reliable customer support.

For a wide range of passive income products, Phemex, Bitget, and WhiteBit are the best options for users in France.

FAQs

Is Cryptocurrency legal in France?

Yes, cryptocurrency is entirely legal in France, and the French Financial Markets Authority regulates it,

What is the Best Crypto Exchange in France?

The best crypto exchange in France is Phemex, which offers a smooth trading experience for beginners and experienced traders with all its features.

Is it Safe to Buy Bitcoin in France?

Yes, it is safe to buy Bitcoin in France. You can use any of the exchanges listed above to purchase Bitcoin or any other crypto you choose.

Which crypto Exchange has the Lowest Fees in France?

WhiteBit stands out as the crypto exchange with the lowest fees in France as it offers 0.1% maker and taker fees on the spot market, 0.01% and 0.035% as maker and taker fees, respectively, for derivatives and futures, and 20% discount on payments made with its native token “WBT.”

What is the Safest Crypto Exchange in France?

Kraken is the safest crypto exchange in France as it implements advanced security measures, including SSL encryption, two-factor authentication, and many more, to ensure the safety of user funds. It has never been hacked and provides proof of reserves, making it a reliable option for French traders and investors.

What is the best Crypto Exchange For Beginners in France?

The best crypto exchange for beginners in France is WhiteBit, as it offers a simple user interface with simple tools and educational materials to help newbies understand crypto trading.

Which Crypto Exchange is The Best in France?

Overall, Phemex stands out as the best crypto exchange in France with its outstanding features such as Copy trading, Demo trading, High leverage, and low fees to help French traders and investors improve their overall trading experience.