Trading cryptocurrencies can be highly profitable. But there are many factors that play a big role in becoming a profitable trader, like win rate, risk-to-reward ratio, position size, risk tolerance, and fees. One of these factors is heavily underlooked: Trading fees. The seemingly low cost of crypto trading fees can make a huge difference. It is also important to note that the cost of limit orders (maker orders) differs from market orders (taker orders). Limit orders are less expensive, in some cases even for free. In this article, we will present you with the best cryptocurrency trading platform for using limit orders. We only compared legitimate, licensed crypto exchanges with full proof of reserves, the highest security measurements, and of course, high liquidity and volume.

Difference between limit and market orders

First, let’s clear up what the difference between limit orders and market orders is.

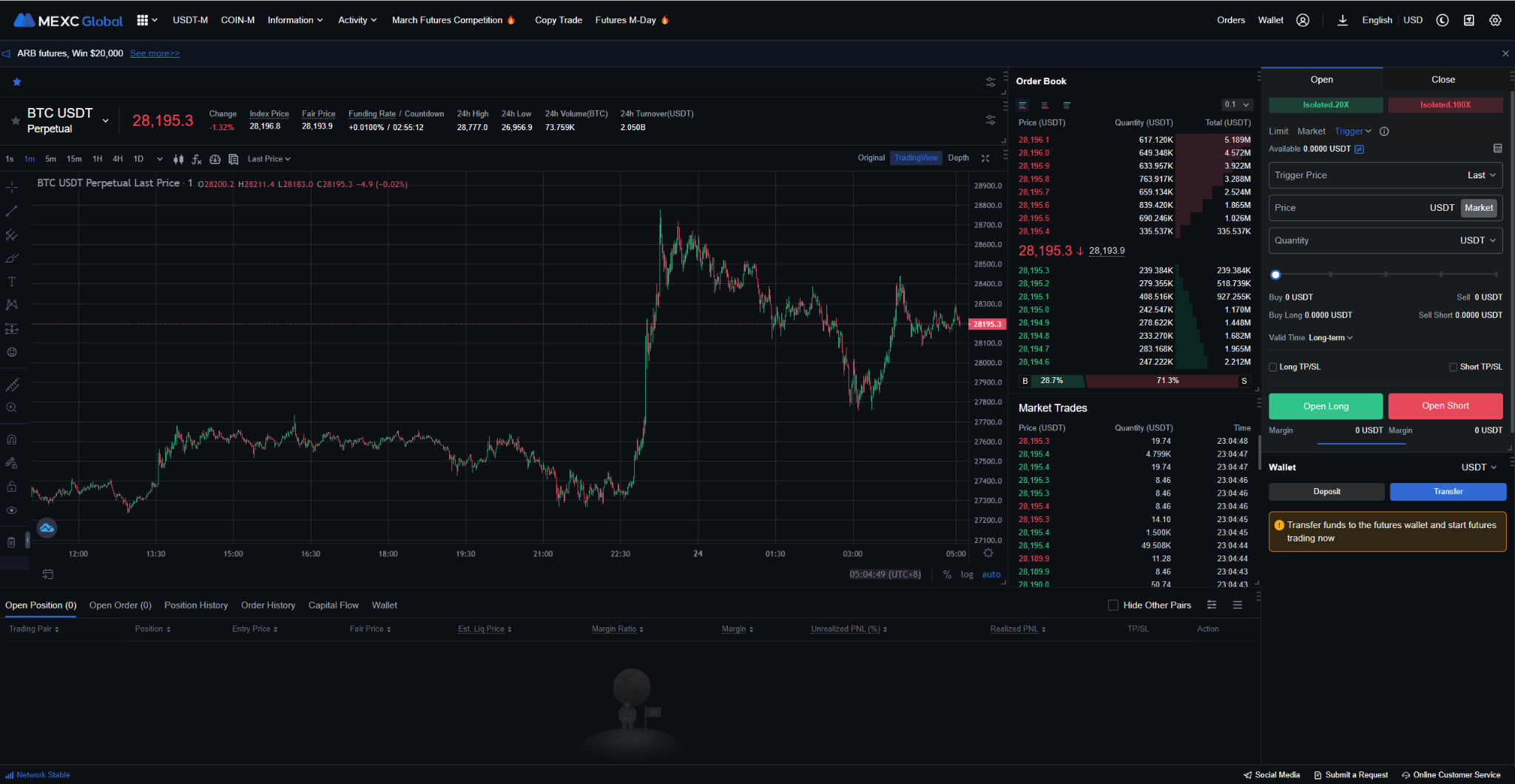

Limit orders are so-called “passive market participants” or maker orders and don’t move the price of an asset. If you place a limit order, you are placing an order into the order book at a specific price. This order will only be triggered once this price is reached. The average limit order fees are 0.02%. In the image below, you can see an order book where all limit orders are resting. Limit orders are visible to every market participant.

Market orders are so-called “active market participants” or taker orders. They immediately execute their orders at the best possible price. They “take” the orders from the order book, so to speak. Market orders fill the limit orders that rest in the order book, and by doing so, they move the price. That’s why they are referred to as active or aggressive. The average market order fees are 0.06%.

As you can see, limit orders are usually cheaper than market orders. While a difference of 0.04% might seem small, it is actually adding up to a lot of money. Especially when you are using leverage, your fees relative to your margin increase a lot. Also, some crypto exchanges have low transaction speed or low volume and liquidity, which can lead to inefficient price delivery. That’s why choosing the best exchange for limit orders is so important.

The Best Cryptocurrency Exchange for Limit Orders

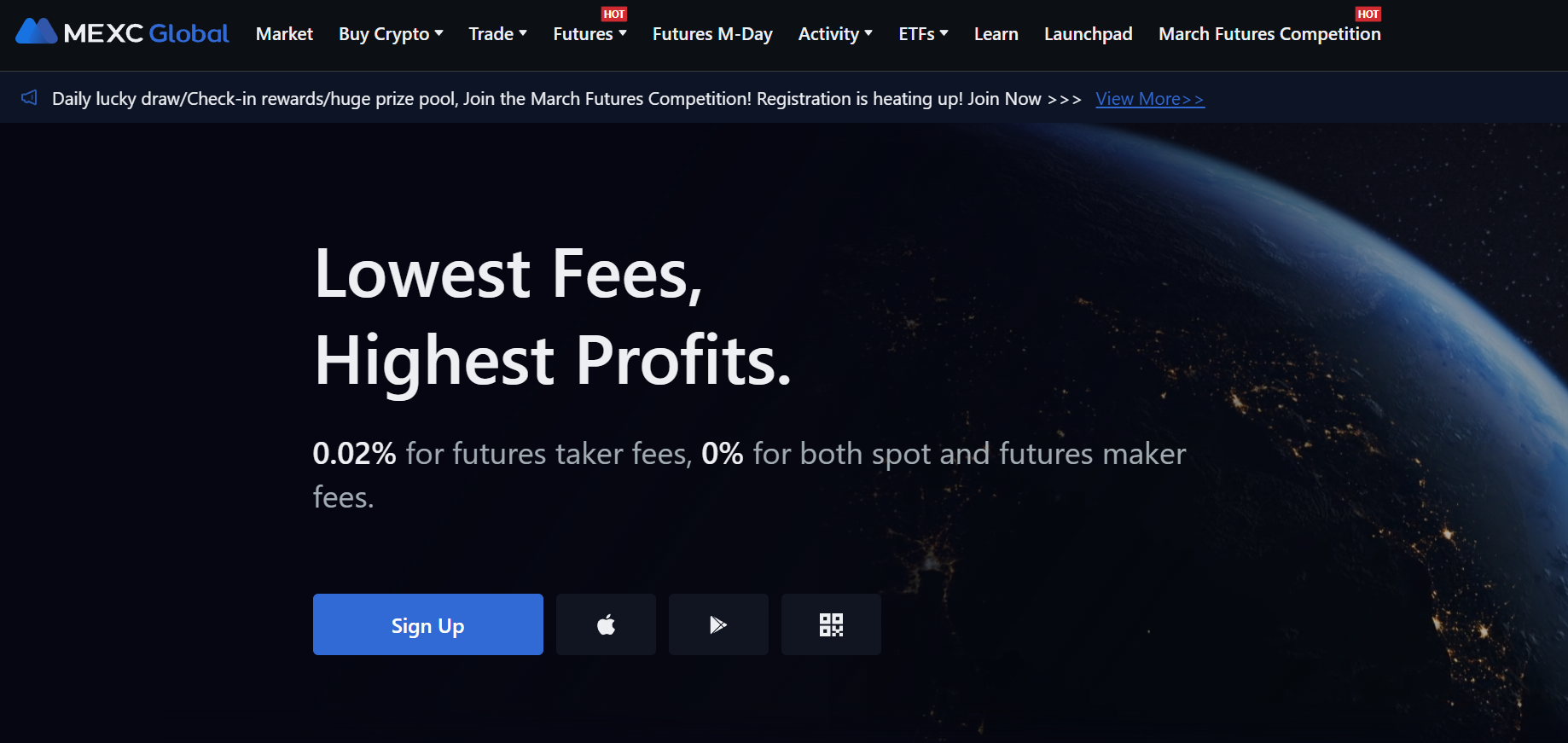

We compared all legitimate and secure major exchanges based on their limit orders and came to the conclusion that MEXC Global is the best cryptocurrency exchange for placing limit orders. MEXC Global has a unique fee structure which makes them stand out. They charge 0% taker fees on their spot and futures market, which means that limit orders are free of charge.

On MEXCs futures market, you can trade 200 pairs, and on their spot market, you can trade a whopping 1800 pairs, so it is safe to say that you will find all cryptocurrencies you are looking for.

Since MEXC is one of the top exchanges, they have all the features you need for successful crypto trading.

Aside from low trading fees, they also offer high leverage with up to 200x on their futures market. You can add take profit and stop loss orders as well as spreading multiple take profits and stop loss orders which is great in case you have multiple areas of interest. For more advanced traders, conditional order types are also available.

The user interface on MEXC Globals trading platform is one of the best, with an incredibly responsive and user-friendly design to ensure a smooth trading experience.

Looking at other factors, such as security and reliability, MEXC is at the top of the game. The crypto exchange has never been hacked and even provides full proof of reserves, which means all of your assets are backed 1:1. They are also operating in many countries, including the United States, with an MSB license (Money Service Business).

If you want to learn more about the crypto exchange, you can read our full MEXC review.

Why you should use limit orders

Use limit orders for catching perfect entries

Limit orders are not just great for saving a lot in trading fees, but you can also catch moves without having to watch 24/7. If you have identified an important point of interest where you want to enter a trade, you can create a limit order at the desired price. That way, you also know exactly which price your position will be filled at. This can give your overall trading plan more accuracy.

One thing to note here, is that in highly volatile phases, some limit orders might be skipped as the price moves too rapidly. While this does not occur often, it can definitely happen during a flash crash or very explosive moves to the upside.

Limit orders can increase profitability

With our free win rate and profit calculator, you can simulate trades and also change the order type from market order to limit order in the “advanced settings”. Definitely go over some scenarios and compare your profitability with limit orders and market orders, respectively. Fees as low as 0.02% or 0.04% can easily trick you into thinking that 0.02% does not make much of a difference. However, when trading with leverage in the cryptocurrency futures market, even a difference of 0.01% in fees will make a massive difference. Many crypto traders don’t even realize that they pay too much money in trading fees. That’s why it’s so important to choose the best crypto exchange for limit orders.

Fee Comparison

Below you can see a list of all major crypto exchanges sorted by trading fees. On the left side you can see limit order fees, and on the right side you can see market order fees (maker/taker).

|

MEXC |

0% / 0.02% |

|---|---|

|

ByBit |

0.01% / 0.06% |

|

Phemex |

0.01% / 0.06% |

|

BitMEX |

0.01% / 0.075% |

|

Binance |

0.02% / 0.04% |

|

Huobi |

0.02% / 0.4% |

|

BingX |

0.02% / 0.04% |

|

OKX |

0.02% / 0.05% |

|

BitGet |

0.02% / 0.06% |

|

KuCoin |

0.02% / 0.06% |

|

Bitfinex |

0.02% / 0.065% |

Alternative Exchanges for Limit Orders

MEXC operates in over 160 countries, but if you are one of the few people in restricted areas, you can use other options for limit orders.

ByBit is a close second when it comes to trading cryptocurrencies with limit orders. With a limit order fee of 0% on their spot market and 0.01% on their futures market, it is safe to say that ByBit offers a fair environment for crypto traders. ByBit has never been hacked and provides full proof of reserves, which means that your assets are on the safe side. Lastly, ByBit has one of the best user interfaces with a super user-friendly and easy-to-understand design. In terms of liquidity and volume, ByBit is one of the top exchanges, regularly ranking in the top 5 globally. Check out our Bybit review to learn more about the exchange.

A relatively unknown yet very powerful exchange is Phemex. They are fully licensed in many countries, including the USA, with an MSB license. Their user interface and the overall trading experience are also great. If you want to learn more about Phemex, you can read our comprehensive Phemex review.

Final verdict

Limit orders are an important instrument in the world of trading and are very underrated. Especially traders with big position size should use limit orders more often, as it gives you a much better entry price, and you will save a lot of money on fees. On average, limit orders are 66% cheaper than market orders. In some cases, limit orders are even completely free. That’s why it’s crucial to make the right choice when looking for the best crypto exchange for using limit orders.

The best cryptocurrency trading platform for using limit orders is, without a doubt, MEXC. With top-notch security standards, fully backed proof of reserves, and amazing support, MEXC ensures a flawless customer experience. With 0% maker fees, you can trade on MEXC free of charge using limit orders.

FAQ about limit orders

Why should I use limit orders?

Limit orders are usually cheaper compared to market orders, and they guarantee you the desired entry price you are looking for.

When should I use limit orders?

Limit orders are great for day trades and swing trades, where you don’t have to act as quickly as intraday trades or scalp trades. As a swing trader, you have plenty of time for your limit order to be fully filled.

Who should not use limit orders?

For high-frequency traders on smaller time frames, market orders might be better than limit orders as you need to be in and out of the market very quickly. Market orders are executed almost immediately within milliseconds, while limit orders have no guarantee of being filled.

What is the best crypto exchange for limit orders?

The best exchange for limit orders as of 2023 is MEXC Global due to their fee structure. MEXC charges 0% fees on limit orders, so they are completely free. They also have the highest security standards with full proof of reserves and high volume and liquidity.