Crypto traders from European countries should make sure to register on legitimate crypto exchanges. In this guide, we present you with the best crypto exchanges in Europe based on security, features, fees, trading options, regulations, customer support, and more. At the end of this guide, you will know exactly which crypto exchanges in Europe are the best ones for you.

We also made sure that every presented crypto exchange accepts deposit and withdrawal methods in Euro (EUR) so that you can send your profits back to your bank account.

Best Crypto Trading Platforms In Europe

There are many many European crypto exchanges available, but which one is the best? We have analyzed over 100 crypto exchanges in Europe and compiled a list of the best five cryptocurrency trading platforms for European users. They are all licensed and well-respected cryptocurrency exchanges in the European Union.

- Bitget – Overall Best Crypto Exchange in Europe

- Blofin – Most Professional Crypto Exchange in Europe

- Bitvavo – Best Native European Crypto Exchange

- Bitpanda – Basic Exchange for Beginners

- Kraken – Oldest Cryptocurrency exchange

| Exchange | Cryptos | Spot Fees | Future Fees | Max Leverage | Bonus | KYC |

|---|---|---|---|---|---|---|

| 1. Bitget | 871+ | 0.10% / 0.10% | 0.02% / 0.06% | 125x | $20,000 | Yes |

| 2. Blofin | 560+ | 0.10% / 0.10% | 0.02% / 0.06% | 150x | $10,000 | No |

| 3. Bitvavo | 200+ | 0.15% / 0.15% | N/A | None | None | Yes |

| 4. Bitpanda | 200+ | 0.15% / 0.15% | N/A | None | €10 | Yes |

| 5. Kraken | 185+ | 0.16% / 0.26% | 0.02% / 0.05% | 50x | None | Yes |

1. Bitget

Founded in 2018, Bitget is the best option for crypto traders from Europe, granting crypto enthusiasts access to over 550 different cryptocurrencies. Bitget is on rank 5 globally according to coinmarket cap with an average daily trading volume of over $2.8 billion, making it the largest crypto exchange in this guide. The crypto exchange is regulated by the FinCEN and Bitget has obtained an MSB license to operate in over 120 countries.

With a comprehensive spot and derivatives market where crypto traders can access 100x leverage and low trading fees, Bitget is a top choice for Europeans. Furthermore, Bitget has high liquidity making it a top choice for active crypto traders from Europe. Bitget offers over 300 different futures contracts for derivatives trading.

If you are looking for passive income products, Bitget offers staking, mining, and their flagship product “copy trading”. The copy trading feature is a simple way to automatically take the same trades as professional traders on the Bitget exchange.

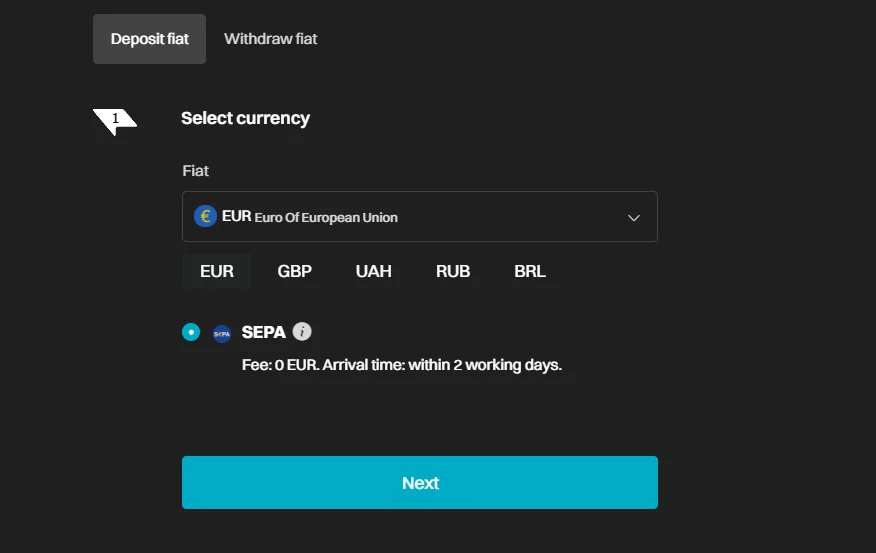

Bitget is highly recommended to European crypto enthusiasts as the exchange supports fiat deposits and withdrawals in Euro €. That means you can send EUR from your bank account to the Bitget exchange via bank transfer or credit/debit card to buy Bitcoin and 500+ other crypto assets. Once you are done with your trading and you want to cash out profits, you can easily withdraw your funds from Bitget to European bank accounts. SEPA Transfer is the supported withdrawal method for Euros without any fees. In terms of value for money, Bitget is one of the best European crypto exchanges.

Lastly, Bitget provides full proof of reserves. That means that all customer funds are stored 1:1 on the exchange.

Spot Fees: 0.1% maker / 0.1% taker

Futures Fees: 0.02% maker / 0.06% taker

Deposit Methods: EUR € deposits with SEPA bank transfers, 0% fees

Regulation & Licensing: Fully licensed as MSB (Money Service Business) by the FinCEN, Financial Crimes Enforcement Network Treasury Department

| 👍 Bitget Pros | 👎 Bitget Cons |

|---|---|

| ✅ Low trading fees | ❌ Not fully regulated |

| ✅ User-friendly Interface | ❌ Advanced tools confusing for beginners |

| ✅ Fiat deposits & withdrawals | ❌ USA not allowed |

| ✅ Passive Income Products | ❌ Requires KYC |

| ✅ 500+ cryptocurrencies | |

| ✅ Copy Trading | |

| ✅ Full Proof of reserves |

2. Blofin

Blofin is the one of the largest crypto derivative trading platforms in the world and also a top choice in terms of crypto exchanges in Europe. Founded in 2018, Blofin has quickly gained over 5 million users. With low trading fees, advanced trading tools, and a daily trading volume of over $5 billion, Blofin is a highly liquid derivatives trading platform for European investors.

Although Blofin is located in Singapore, the exchange is also regulated by the CySEC in Cyprus to offer its services in all European countries.

With over 500 available digital assets, Blofin has a lot to offer to its users. Aside from a basic spot trading market, Blofin offers a comprehensive futures market with up to 150x leverage for professional crypto trading. Blofin and Bitget are both the best cryptocurrency exchanges for European users seeking advanced trading tools with low fees, high liquidity, and high leverage.

Blofin also supports fiat deposits for Euros. The supported payment methods are Bank Transfers, Credit and Debit cards, Google Pay, and Apple Pay. The fees range between 0.30€ to 0.92% based on your payment methods. Therefore, Blofin is a great option when it comes to depositing Euros into your trading account.

Aside from crypto trading, Blofin offers passive income products such as staking with flexible and fixed terms. Additionally, Blofin has an integrated copy trading feature. These are great opportunities to let your digital currencies work for you. Blofin is without a doubt a great all-rounder crypto platform.

For full transparency, Blofin also offers full proof of reserves, meaning that all customer assets are backed 1:1 on the leading cryptocurrency exchange.

Spot Fees: 0.1% maker / 0.1% taker

Futures Fees: 0.02% maker / 0.06% taker

Deposit Methods: EUR € deposits with Bank Transfer, Credit/Debit Cards, Apple Pay, Google Pay

Regulation & Licensing: Fully licensed as MSB (Money Service Business) by the FinCEN, Financial Crimes Enforcement Network Department of the Treasury

| 👍 Bybit Pros | 👎 Bybit Cons |

|---|---|

| ✅ Low trading fees | ❌ Extremely advanced (confusing for beginners) |

| ✅ High liquidity | ❌ Not available in the United States |

| ✅ Advanced trading options | |

| ✅ Copy trading | |

| ✅ Passive income products | |

| ✅ Full proof of reserves |

3. Bitvavo

Bitvavo is one of the largest cryptocurrency exchanges with European roots. The platform is located in the Netherlands and is registered with the Dutch Central Bank (DNB) to ensure secure crypto services for Europeans. Bitvavo is fully compliant with local laws and regulations, such as Money Laundering laws. Over 200 cryptocurrencies are supported on Bitvavo.

The Bitvavo trading fees are relatively low, starting at 0.15% maker and 0.25% taker fees. This makes Bitvavo a good exchange for beginners and passive investing.

Overall, Bitvavo is famous for its simplicity, ease of use, and security features. However, experienced traders can switch to the “advanced” trading interface to enjoy Bitvavo at its full potential. You will get access to real-time candlestick charts, a limit order book, a trading history, and advanced order types such as limit and stop limit orders.

What we love most about Bitvavo is the low barrier of entry. Depositing funds as a European crypto trader is super simple as the Bitvavo currency is Euro€ €. The payment methods include PayPal, GiroPay, Credit/Debit Cards, SEPA Bank Transfers, and more. The deposit and withdrawal fees range between 1-3% based on your payment method.

If you want to learn more about Bitvavo, you can read our comprehensive Bitvavo review.

- Supported Cryptos: 200+

- Spot Fees: 0.15% maker / 0.25% taker

- Futures Fees: No futures supported

- Deposit & Withdrawal Methods: Euro € via PayPal, Klarna, Credit/Debit Card, Bank Transfer

- Regulation & Licensing: Registered with Dutch Central Bank with licenses in several European countries

| 👍 Bitvavo Pros | 👎 Bitvavo Cons |

|---|---|

| ✅ Local European Exchange | ❌ Lacks advanced features |

| ✅ Very user friendly | ❌ No futures trading |

| ✅ Live chat support | |

| ✅ Several Euro deposit methods |

4. Bitpanda

If you are a total beginner, looking for a secure and reliable crypto exchange in Europe to buy Bitcoin and other crypto assets, Bitpanda is a great option for you. Bitpanda is situated in Vienna, Austria, and has obtained a license from BaFin and other European regulators.

Bitpanda has an extensive list of supported cryptos with over 400 trading pairs. Trading crypto on Bitpanda is very simple and straight forward due to the user-friendly interface. Bitpanda caters to beginners rather than advanced traders and it is not a derivatives exchange so futures trading is not supported. However, Bitpanda offers spot margin trading with up to 3x on the Bitpanda Pro trading platform. The crypto spot trading fees are 0.1% maker and 0.15% taker.

Aside from crypto trading, Bitpanda offers traditional finance assets like metals, commodities, indices, ETFs, Stocks, and more as it is not just a Bitcoin exchange. Especially the crypto ETF option is a great choice for beginners as these are highly diversified portfolios to mitigate risk.

Furthermore, Bitpanda offers passive income products a savings plan, or staking, where you can earn 2.94% APY.

As Bitpanda is one of the best European crypto exchanges, they also offer simple deposit and withdrawal methods for EUR €. The payment methods for Euro transactions are SEPA Transfer, PayPal, Credit/Debit cards, and more. The fees range from 1€ to 3% based on your payment method.

Spot Fees: 0.15% maker / 0.1% taker

Futures Fees: No futures supported

Deposit & Withdrawal Methods: € via SEPA Transfer, PayPal, Credit/Debit Card, Klarna

License & Regulations: BaFin license

| 👍 Bitpanda Pros | 👎 Bitpanda Pros |

|---|---|

| ✅ Very beginner friendly | ❌ No futures |

| ✅ 300+ cryptos available | ❌ Low liquidity |

| ✅ Simple € on/off ramps | ❌ Lacks advanced features |

| ✅ Passive income products | ❌ No proof of reserves |

| ✅ TradFi + Crypto Assets |

5. Kraken

Kraken is one of the oldest cryptocurrency exchanges that are available in Europe. The platform offers a simple way to trade cryptocurrencies for retail and institutional investors. With over 9 million registered users and a daily trading volume of over $100 million, Kraken is a top choice for European crypto exchanges. The platform serves over 190 different countries including European areas with a license by the CySEC and FCA. Furthermore, Kraken has an MSB license from the Financial Crimes Enforcement Network in the US.

Over 230 different cryptocurrencies are available to trade on Krakens spot market with fees starting at 0.16% maker and 0.26% taker. This makes Kraken a rater expensive spot exchange. However, on the futures market via Kraken Pro, users enjoy low fees of 0.02% maker and 0.05% taker, making Kraken a great option in terms of value for money.

When it comes to Euro deposits and withdrawals, Kraken supports SEPA transfer and Credit/Debit Card payments with fees from 1€ to 3%. The process is simple and straightforward, making it easy to get started on Kraken as a European investor.

If you are looking for ways to make passive income on the side, Kraken offers staking and mining with flexible terms and APYs as high as 6%.

Spot Fees: 0.16% maker / 0.26% taker

Futures Fees: 0.02% maker / 0.05% taker

Deposit & Withdrawal Methods: € via SEPA Bank Transfer, and Credit/Debit Card

License & Regulations: Regulated by CySEC and FinCEN with MSB license

| 👍 Kraken Pros | 👎 Kraken Cons |

|---|---|

| ✅ User-friendly interface, suitable for beginners | ❌ KYC required |

| ✅ Offers competitive trading fees | ❌ Complex for beginners |

| ✅ Secure and reliable | ❌ Poor liquidity |

| ✅ Passive income products | |

| ✅ Established and regulated |

Is Crypto Trading Legal in Europe?

Yes, trading and investing in cryptos is legal in Europe. There are no laws or restrictions by the European Union to limit the trading of digital assets like Bitcoin, Ethereum, and more. However, it is important to look into each crypto exchange to see if they hold the required license to operate in Europe. The trading platforms presented are the best cryptocurrency exchanges that are licensed and fully operational in European countries.

Overall, the EU does a good job of keeping its investors safe by implementing strong regulatory frameworks for the crypto community. Therefore, any European crypto exchange has to comply with strict rules in order to offer the trading of digital currencies.

Is Crypto Trading Taxed In Europe?

As tax laws differ for each country, there is no absolute answer to that question. However, in most cases, Crypto profits are taxed just as any other profits from Stock or Forex trading. Most countries also charge capital gains tax.

We highly recommend you get in touch with a local tax advisor to clear your questions regarding cryptocurrency taxation.

Do Crypto Platforms Report To Tax Authorities?

This may differ for each platform and each tax authority. However, there are only rare cases where cryptocurrency exchanges reported personal data to authorities. Still, the possibility is there as the crypto market is an easy way to make (and also launder) money. In order to comply with anti-money laundering laws (AML), cryptocurrency exchanges might have to obey in certain cases to keep the European market safe.

How to Choose Crypto Exchanges in Europe

First and foremost, if you want to choose a crypto exchange in Europe, you should take key factors such as licensing, and regulations into consideration.

After that, you should look into the value for money. Are there cheap deposit and withdrawal methods for my fiat currencies? For this case, we have only selected crypto exchanges that support Euro € deposits and withdrawals.

If you want to trade cryptos, you also must look into the trading fees. The cheapest options for European crypto traders are Bitget and Blofin. Those are also the best crypto exchanges in terms of spread, volume, and liquidity, which makes them top crypto trading platforms.

Lastly, look into if they offer a secure crypto wallet. Things like multi-sig cold storage wallets are the best options. Also, providing proof of reserves can be a good indication of an honest and reliable crypto exchange.

How to Buy Bitcoin & Other Cryptos in Europe

Now that you know everything about the best crypto exchanges in Europe, it is time to make your first crypto purchase. Follow our simple step-by-step guide to buy Bitcoin or other cryptos quickly and securely.

- Choose the right crypto exchange. Make sure that it is a legit and regulated crypto exchange like those presented in our full guide of the best crypto exchanges in Europe.

- Register on the platform and finalize the KYC verification.

- KYC usually requires your ID or Passport and facial recognition

- Once your account is approved, select a deposit method. The top crypto exchanges from our guide support Euro deposits via Bank transfer or Credit card.

- Bank transfers are usually the cheapest option, though, they can take up to 3 days.

- Credit card payments are processed instantly but are more expensive

- Once your money arrives, select the cryptocurrency you wish to purchase

- Purchase your crypto with your available EUR balance in your crypto exchange wallet.

- If you are a long-term holder, you should send your investment to your personal crypto wallet to keep your crypto assets safe and secure.

Summary

As the crypto market is getting more and more traction, investors from all around the world join the market. Also, European crypto enthusiasts want to join the market. In order to do things right, it is important to only consider the best crypto exchanges in Europe for crypto trading.

The exchanges presented in this article are licensed and also support fiat currencies like the Euro for an easy and seamless deposit and withdrawal process. Crypto exchanges like Bitget and Blofin are great ways to join the crypto market with low trading fees, a user-friendly interface, and some of the most advanced trading features. Overall, the best crypto exchange for cryptocurrency trading is Bitget due to the great value for money and easy deposit & withdrawal process.

Register on your cryptocurrency exchange of choice to buy and sell Bitcoin or other cryptocurrencies with ease.