Berachain has been gaining attention with its latest airdrop, evolving from an NFT project into a blockchain that introduces a unique consensus mechanism. This innovation reshapes how validators and liquidity providers are rewarded, allowing tokens to remain secure while earning rewards and contributing to liquidity. In this guide, we will highlight six notable Berachain projects that leverage the network’s core features while playing a crucial role in improving usability and efficiency for users.

What Is Berachain?

Berachain is an innovative blockchain network built on Proof of Liquidity (PoL), a model that allows users to stake assets while keeping them liquid for trading and other activities. It is designed as an EVM-compatible blockchain, Berachain supports smart contracts, decentralized applications (DApps), and DeFi ecosystems while maintaining high security and scalability. Its unique approach strengthens the network, enhances liquidity, and opens up better opportunities for traders, stakers, and developers.

Unlike traditional Proof-of-Stake (PoS) systems, where users lock up tokens solely for staking, PoL allows users to provide liquidity (tokens used for trading in DeFi) while still participating in network security. This approach increases capital efficiency, ensuring more assets remain available for Decentralized Finance (DeFi) applications rather than sitting idle.

Originally, Berachain emerged from the Bong Bears NFT project before evolving into a full-fledged blockchain. Today, it leverages the Cosmos SDK and BeaconKit framework to enhance scalability, flexibility, and interoperability, making it a powerful choice for developers and users in the Web3 ecosystem.

Since the launch of its mainnet, the network has experienced significant growth, with over $1.06 billion in total value locked (TVL) and 18 DApps already live. A recent airdrop distributed 15.8% of the total $BERA supply, including 1.65% allocated to BArtio testnet participants. The network’s native token, $BERA, is now available on centralized exchanges such as Bitunix and Coinbase, serving as the primary asset for covering transaction fees on Berachain.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

Best Berachain Projects Right Now

Here are some of the most promising and impactful Berachain projects that are currently gaining traction and shaping the ecosystem.

Honey Chat

Honey Chat is a SocialFi platform built on Berachain, blending social networking with crypto innovation. It allows users to connect, create, and earn while maintaining full ownership of their data, content, and digital identity. Getting started is simple—just log in with your X (Twitter) account to access a decentralized social space where reputation matters. Badges reward achievements and deter misconduct, ensuring a trustworthy and engaging community.

Designed for creators, fans, and traders, Honey Chat offers monetization tools, enabling users to profit from interactions. It combines the ease of Web2 interfaces with the benefits of Web3 decentralization, making social engagement more rewarding. As the first major SocialFi app on Berachain, Honey Chat is reshaping digital interactions by integrating financial incentives, data sovereignty, and reputation-driven networking into one seamless experience.

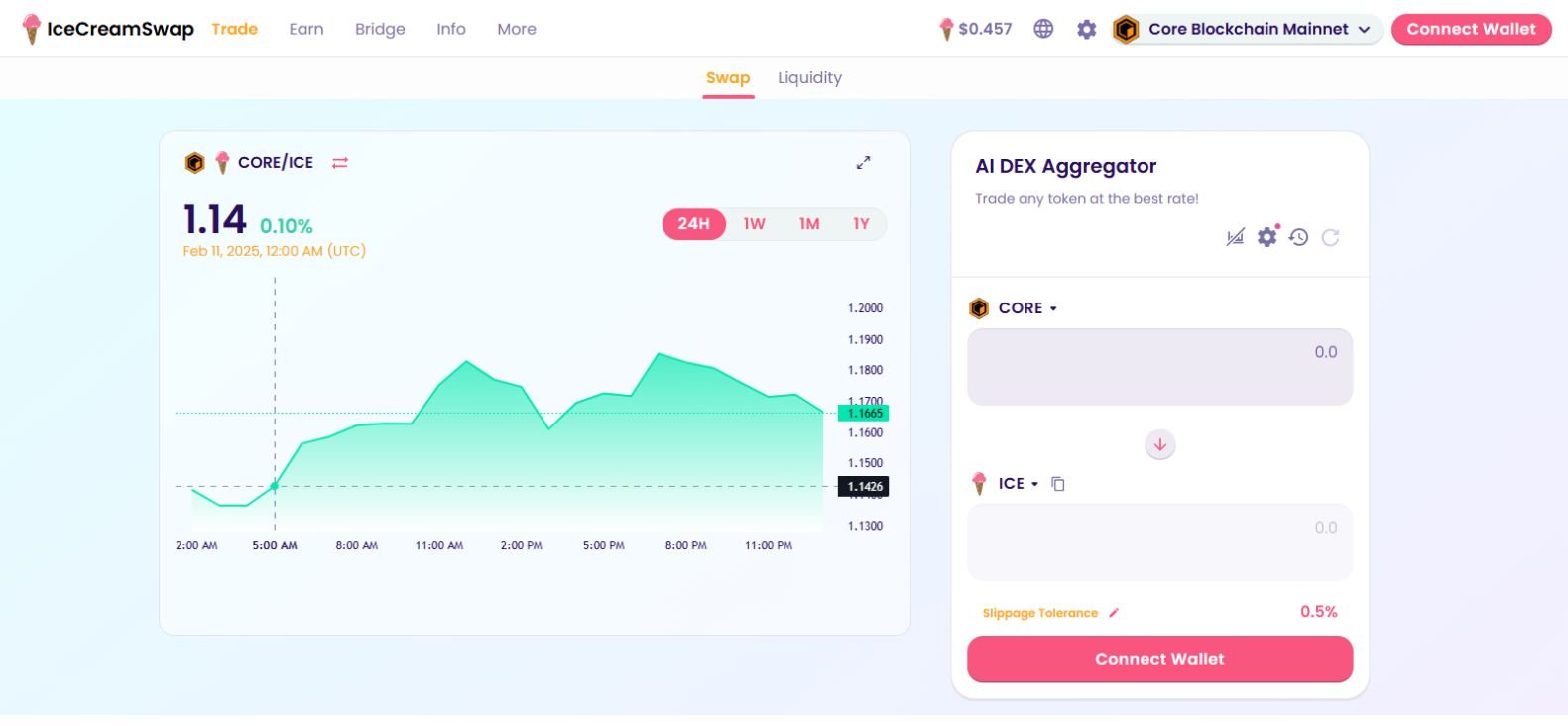

IceCreamSwap

IceCreamSwap is a next-generation AI-enhanced decentralized exchange (DEX) aggregator designed to offer the best trading rates across multiple blockchains. It leverages AI and machine learning to continuously optimize trade execution, ensuring users get the most efficient swaps.

Unlike traditional DEX aggregators, IceCreamSwap improves with every trade, learning from user activity to enhance liquidity routing and reduce slippage. This makes it the “Booking.com of DEXes,” seamlessly finding the best paths for token swaps while eliminating inefficiencies.

Beyond trading, IceCreamSwap offers a cross-chain bridge with a built-in faucet, allowing users to transfer assets between blockchains while automatically receiving native tokens for gas fees. Additionally, liquidity providers can earn ICE tokens through staking and liquidity farming, further incentivizing participation.

Origami

Origami is an automated leverage infrastructure designed to help users earn more from DeFi with minimal effort. It offers customized leverage strategies for different tokens, allowing users to boost their yields with smart automation. Whether you want maximum leverage, smart leverage, or auto-farming, Origami provides tailored solutions to suit different risk levels and investment goals.

With four types of vaults, Origami makes it easy to access advanced DeFi strategies used by experts. Its automation layer handles everything from looping and rebalancing to risk management, reducing the chances of liquidation. Plus, it seamlessly integrates with top protocols like Ethena, Morpho, Pendle, and Berachain, making it a one-stop solution for leveraged yield farming and optimized DeFi strategies.

Bulla Exchange

Bulla Exchange is a decentralized exchange (DEX) built on Berachain, leveraging Uniswap v4 technology to enhance trading efficiency. It utilizes hooks, dynamic fees, and automated liquidity management, allowing for optimized swaps and better returns for liquidity providers.

By integrating customizable trading mechanisms and automated liquidity strategies, Bulla Exchange ensures a seamless, low-cost, and efficient trading experience. As a native v4 DEX, it is designed to adapt and improve with the evolving DeFi ecosystem, making it a key player in Berachain’s growing decentralized finance landscape.

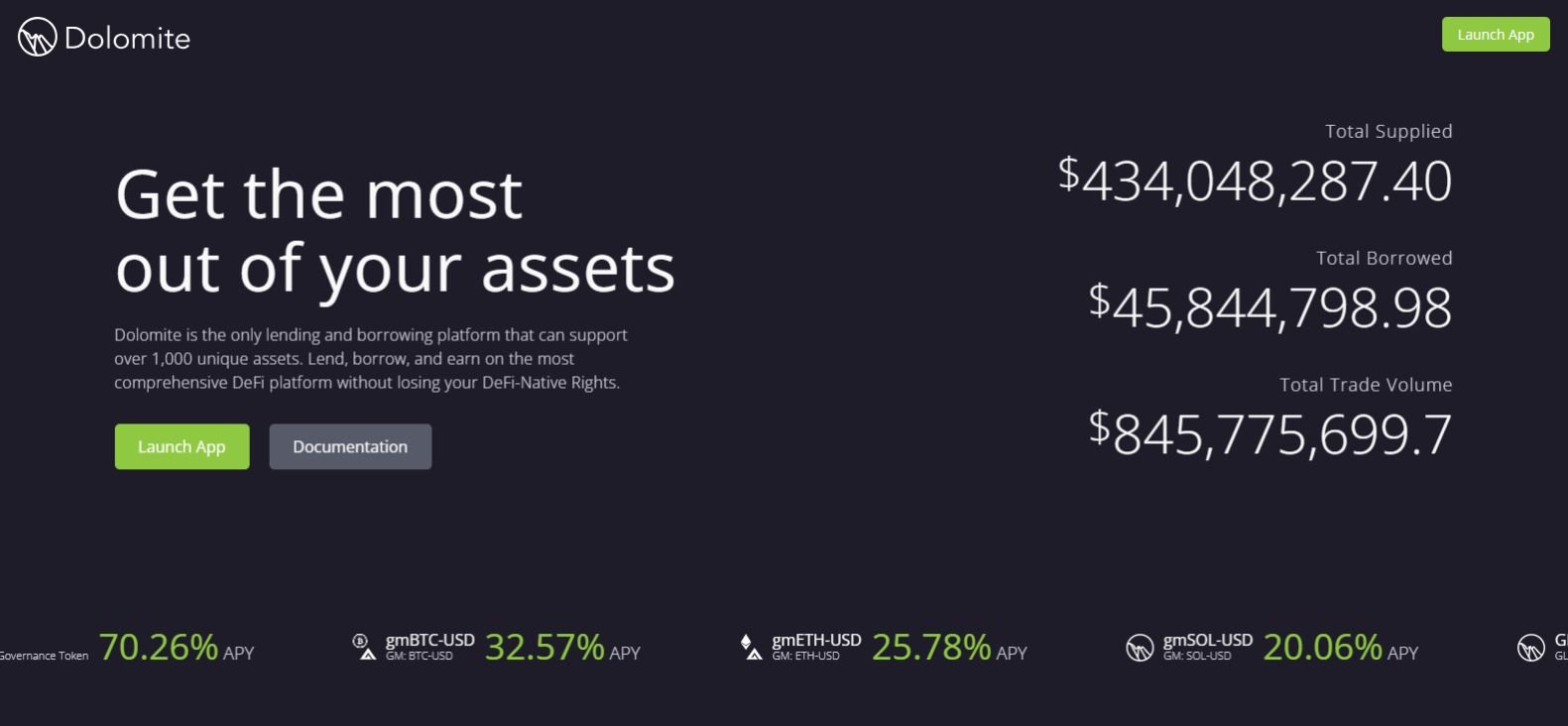

Dolomite

Dolomite is a next-generation DeFi lending and borrowing platform that supports over 1,000 unique assets, giving users unmatched flexibility in managing their portfolios. Unlike traditional DeFi platforms, Dolomite allows users to retain their governance rights, staking rewards, and yield-bearing benefits even while lending. It also offers DEX pair margin trading, enabling traders to margin trade DeFi assets against stablecoins or other tokens. With isolated loan positions, users can borrow securely without risking their entire portfolio.

Built on Arbitrum, Mantle, Polygon zkEVM, and X Layer, Dolomite ensures low-cost, high-speed transactions while maintaining top-tier security through multiple smart contract audits. The platform is also fully mobile-compatible, making it easy for users to trade, borrow, and earn on the go.

Berabot

Berabot is the first native Telegram sniping and trading bot built for Berachain, offering users seamless and automated trading directly from their Telegram app. Designed for speed and efficiency, Berabot executes trades instantly, helping users take advantage of market opportunities before anyone else.

With real-time market tracking, customizable settings, and deep integration into Berachain’s ecosystem, Berabot is a must-have tool for active traders. It simplifies DeFi trading, making it more accessible and efficient than ever.

How to Access Berachain Projects

To interact with any of the dApps within the Berachain ecosystem, you’ll need a Web3 wallet that supports Berachain. Currently, Berachain does not have an official wallet, so users must rely on EVM-compatible wallets to access its network. One of the most widely used options is MetaMask, though any other EVM-compatible wallet will work as well.

Once you’ve chosen a wallet, the next step is to add the Berachain network to it. Additionally, you’ll need to fund your wallet with $BERA to cover gas fees for transactions on the Berachain network.

Final Thoughts

As Berachain continues to expand, attracting more crypto enthusiasts to the network, the Berachain projects mentioned above are among those we believe will gain the most traction. These projects blend innovation, technical expertise, and community engagement, positioning themselves at the forefront of Berachain’s ecosystem while contributing to the broader evolution of blockchain technology. Staying ahead of the curve is essential, especially in crypto. Always conduct thorough research to identify promising projects and make informed decisions about the next opportunities in the space.

FAQs

1. How does Proof of Liquidity (PoL) benefit Berachain projects?

PoL enhances capital efficiency by allowing assets to remain liquid while securing the network. This benefits Berachain projects by ensuring deeper liquidity for DeFi applications, improving trading volume, and attracting more users.

2. Can I bridge assets from Ethereum to Berachain?

Yes, several cross-chain bridges support asset transfers to Berachain, allowing users to bring liquidity from Ethereum and other EVM-compatible chains.

3. What wallets are compatible with Berachain?

MetaMask and other EVM-compatible wallets can be used to access Berachain dApps. You need to manually add the Berachain network and hold $BERA for gas fees.

4. What is Berachain built on?

Berachain is a Layer 1 blockchain that supports EVM compatibility and is developed using the Cosmos SDK. It operates on a unique Proof-of-Liquidity (PoL) consensus model, setting it apart from conventional Proof-of-Stake (PoS) mechanisms.

5. Is Berachain EVM-compatible?

Yes, Berachain is fully EVM-compatible, meaning developers can deploy smart contracts and dApps just like they would on Ethereum, making it easy to integrate with existing Web3 applications.